What requirements must coffee meet to be allowed on the European market?

To enter the European market, your coffee must meet legal and non-legal regulations, particularly regarding food safety. In addition, consumers across Europe have high expectations, especially when it comes to safety and sustainability. Sticking to specific voluntary requirements associated with high quality and/or sustainability could improve your opportunities to enter niche markets that command higher prices.

Contents of this page

1. What are the mandatory requirements for the coffee sector?

Growing sustainability concerns are prompting consumers to demand more sustainable coffees, urging industry players to act. This has led to mandatory requirements covering all 3 pillars of sustainability, which are environmental, social and economic. These 3 pillars are interrelated in a way that if one pillar is weak, the others are affected.

In terms of social sustainability within the coffee sector, gender inequality and child labour are significant issues. Economic sustainability covers challenges such as low prices, price volatility, meeting market demands, and ensuring a living income. Read our tips on how to be a more socially responsible supplier in the coffee sector for more information on social and economic sustainability. On the environmental front, attention to climate change and biodiversity issues is increasing, with projections showing a substantial reduction in suitable coffee cultivation areas by 2050.

To reduce these sustainability concerns, the European Green Deal (EGD) aims to make Europe climate neutral by 2050, impacting trade and imports by enforcing stricter sustainability standards, particularly for export companies from developing countries. One focus area is the From Farm to Fork strategy. Additionally, the EGD includes the Biodiversity Strategy for 2030, which includes measures such as the EU Regulation on deforestation-free regulation (EUDR). Another social and economic sustainability strategy is the Corporate sustainability due diligence Directive (CS3D), recently approved by the European Council.

Below, we have outlined the details of the main regulations for entering the EU27 coffee market, covering both legal and non-legal requirements. Detailed information is available on the Access2Markets website of the European Commission. To find specific requirements for coffee on this website, including decaffeinated variants, please refer to Product HS Code 0901 for coffee.

European Union Deforestation Regulation (EUDR)

On 29 June 2023, the EU parliament passed the European Union Deforestation Regulation (EUDR) - Regulation (EU) 2023/1115 - the Regulation on deforestation-free products. The regulation bans imports into the European Union (EU) of coffee products from land that was deforested after 31 December 2020. The EUDR has 3 main goals:

- Stop products linked to deforestation from being sold, both in the EU and worldwide.

- Cut down on greenhouse gas emissions caused by deforestation by promoting deforestation-free products, aiming for a yearly reduction of at least 32 million metric tons of carbon.

- Prevent global biodiversity loss.

EUDR also restricts importation of coffee products from lands acquired forcibly from local and/or indigenous communities, or whose cultivation involves labour and human rights abuses. Importers that fail to comply with EUDR could face fines of up to 4% of their net profit in any EU Member State.

Some coffee-producing countries have already started taking steps to comply with this regulation. For instance, Solidaridad, in collaboration with partner organisations and the Peruvian government, is helping farmers to geo-reference their farms. Solidaridad carried out a pilot initiative utilising satellite images from Sentinel-2 to monitor both primary and secondary forests on coffee farms. With a spatial resolution of up to 10 metres, these images enable the assessment of whether small-scale producers are effectively preserving their forested areas. The project received validation from Peru's National Forest Programme.

Apart from national level interventions, adherence to the EUDR can feel like an extra burden for many cooperatives, but it is actually very straightforward. The first step is to have a traceability plan, documenting the source of your coffee. Specifically, for each batch of coffee, give unique identifiers: 1) farmers and farms including GPS locations, 2) for the community or village from which coffee is produced, and 3) for each batch of coffee sent to the wet and dry milling stations. Record movement or transportation information manually, on paper, or automated through an electronic, digitalised system. Once these are well documented you can share them with your buyer who will then be willing to pay for verifying that there is no deforestation, since legal liability falls on them.

If establishing traceability is difficult for you as an exporter or cooperative, you can link up with companies with blockchain-based operating systems such as Dimitra. This company has become one of the first firms to certify a coffee shipment compliant with the new EU Deforestation Regulation (EUDR) standards. For instance, they collaborated with CACI Satinaki, a Peru-based farming cooperative of smallholder farmers and facilitated a fully certified shipment of coffee to Germany under the EUDR, with a full traceability record from bean to cup.

Tips:

- To show that you follow EUDR rules, cooperatives and exporters must provide detailed information about their products, including their origin. You must also ensure that your coffee is not associated with deforestation and things like forests and land rights issues, and conflicts.

- Improve traceability to farm level and stick to open data transparency protocols and make your data sharable with buyers.

- Read our tips to go green in the coffee sector for more information on how to become an environmentally friendly coffee supplier.

The Corporate Sustainability Due Diligence Directive (CS3D)

On 24 April 2024, the European Parliament adopted the CS3D. The CS3D sets common goals for all EU Member States to achieve. The directive is binding for EU companies and non-EU companies who do business in the EU. EU Member States have a period of 2 years to implement the directive into their respective national legislations. The CS3D will be phased in over a longer period. Companies with 5,000 employees and €1,500 million turnover will be impacted in 3 years. Companies with 3,000 employees and €900 million turnover will be impacted in 4 years. Companies with 1,000 employees and €450 million turnover will be impacted in 5 years.

The CS3D is compulsory for all companies in the EU, and companies outside Europe that sell products or services in EU countries. It tackles mainly the social and economic concerns of sustainability. Companies must take steps to find and prevent any harmful impacts that their businesses and supply chains may have on people and the environment.

Even before final confirmation of the CS3D, pilot programmes were being co-financed by the Organisation of African, Caribbean and Pacific States (OACPS), the EU and the Dutch Ministry of Foreign Affairs and implemented in partnership with the International Coffee Organization (ICO). The piloting aims for actionable measures to implement mandatory human rights and environmental due diligence sustainably for all.

Exporters to the EU must therefore establish codes of conduct that focus on:

- Business ethics;

- Social responsibility, such as the welfare of farmers and processing facility workers and living income; and

- Environmental responsibility, such as carbon neutrality, impact on local biodiversity and deforestation.

These codes of conduct guide how you do your business and enhance adherence to the CS3D. For cooperatives, it is also important to keep track of your carbon footprint. Companies such as Carbon Roots can help you estimate your carbon footprint. Even if you cannot calculate the exact footprint, you should keep track of the type and amount of energy you use at your hulling, washing or drying stations, the capacity of your machines and the amount of chemical fertiliser used by the cooperative for each season. Buyers may request this information to have an idea of your environmental friendliness.

Tips:

- Read more about the European Due Diligence Act on the CBI website.

- Ensure that your suppliers also have responsible business practices in place. Many social and environmental issues take place at farm level, which may not be a part of direct handling and processing activities.

- Cooperatives must reduce their carbon footprint by replacing chemical fertilisers with organic waste and practising organic farming, using green energy if possible or vehicles and machines (for example, at hulling, washing and drying stations) that are fuel-efficient. Read CBI’s Tips to go green in the coffee sector to learn more about carbon footprint.

Food safety

The General Food Law ensures both food safety and food hygiene, guaranteeing quality across the supply chain. Coffee products that do not meet food safety standards are prohibited from entering the EU. Additionally, when further processing coffee, adherence to hygienic standards based on Hazard Analysis and Critical Control Points HACCP principles is required. This practice is essential beyond primary coffee production, as identifying critical control points is crucial for food safety.

While HACCP is not typically necessary for coffee beans, it may be needed for processed coffee products. Coffee originating from countries not meeting safety standards may encounter import difficulties. These countries and their products are listed in the Annex of European Commission Implementing Regulation (EU) 2019/1793. The list is regularly updated, so staying informed is vital, although extra checks for coffee are minimal.

Tips:

- Be ready for inquiries from buyers, as they ask about your coffee’s cultivation and processing methods. Anticipate questions such as where your coffee is dried and how you maintain cleanliness throughout the process.

- Develop your own food safety rules that guide your coffee production or processing. This framework can help you in maintaining food safety standards and also attracting customers. Read this publication to understand the food safety practices adopted by coffee trader Trabocca.

- Check the EU’s Rapid Alert System for Food and Feed (RASFF) Window database to find coffee withdrawals from the market and reasons behind them. Select 'cacao and cacao preparations, coffee and tea' under 'Product'. Additionally, you can specify your country under 'Country' to view instances of non-compliance. This practice aids in developing your risk management system and decreases the likelihood of future notifications or border rejections.

- Remember that food safety regulations are continually evolving, so staying informed about any updates or changes is crucial for ensuring that you stay in business.

Food contaminants

Food can get contaminated during production because of the environment, farming methods, or how it is processed or transported. However, since many contaminants are natural, banning them completely is not possible. European laws make sure that contaminant levels are kept very low to avoid health risks and keep food quality high. These levels are decided based on advice from the European Food Safety Authority (EFSA).

As of 25 April 2023, the European Union has updated food safety regulations to guarantee high standards of food safety and consumer protection. The regulation on maximum levels for certain contaminants in food, (EU) 2023/915 has replaced regulation (EC) 1881/2006.

In the next sub-sections, we will talk about the main contaminants likely to be found in coffee products. These include:

- Pesticides;

- Mycotoxins / mould;

- Pathogens;

- Extraction solvents;

- Hydrocarbons; and

- Other: Acrylamide.

Tips:

- Check the European Commission's website for more details on controlling food contamination in the EU. On this webpage you will also find a publication titled 'Ensuring food is safe'.

- Support your cooperatives and farmers to concentrate on using good agricultural practices to decrease contaminants.

- For information on safe storage and transport of coffee, refer to the website of the Transport Information Service.

- Read this article on Perfect Daily Grind to better understand how green coffee can become contaminated.

Pesticides

Pesticides are a common reason for border authorities to reject coffee from producing countries. One key goal of the Farm to Fork strategy as part of the European Green Deal is to reduce pesticide use by 50% by 2030. To achieve this, the EU has legally-binding targets for maximum residue levels (MRLs) for pesticides in food, including coffee.

Coffee farmers usually use pesticides to control pests such as Coffee Twin borer (BCTB), Coffee Berry Borer (CBB), Coffee Mealybug, Coffee Leaf Miner, Coffee Leaf Skeletonizer, Caterpillars and Ants. However, they need to apply caution in the use of pesticides to protect the crop. While pesticides are allowed, they must stay within these limits. They must know the recommended timing and frequency of applying pesticides. Products with high levels of pesticides will be taken off the EU market. Buyers may test batches of organic green coffee for residues at accredited labs.

One pesticide that has been under debate in recent years was glyphosate. On 28 November 2023, the disagreements about this pesticide were resolved. The EU passed Regulation 2023/2660, extending glyphosate's use until 15 December 15 2033. Glyphosate, found in many herbicides, has faced criticism for health and environmental risks. Recent scientific assessments by the European Chemicals Agency (ECHA) and the European Food Safety Authority (EFSA) found that glyphosate is not carcinogenic and poses no significant risk to humans, animals or the environment.

Tips:

- Check the legislation on pesticide residues (Regulation EC 396/2005, Document 02005R0396-20240226) for further information on pesticides.

- Consult the EU Pesticide Database for an overview of the maximum residue levels (MRLs) for each pesticide. You can search for coffee under product or search the active ingredient of your pesticide if you know it. This will show the MRLs of the active ingredients accepted in the EU. Always check with your buyers if they require additional adherence to MRL limits and pesticide use.

- Focus on reducing the amount of pesticides in your products. A good way to do this is applying Integrated Pest Management (IPM), an agricultural pest control approach that uses complementary crop management strategies and practices to help minimise the use of pesticides.

- If in doubt or to avoid any doubt from your potential buyer, get your coffee analysed by a (preferably EU-accredited) laboratory to test for presence of MRLs. This should not cost more than a few hundred euros.

Mycotoxins / mould

Mould can lead to coffee being rejected at borders. One concern is Ochratoxin A (OTA) levels found in green coffee beans. OTA contamination can occur during production, post-harvest practices, or transportation in humid containers. Therefore, OTA risk management in coffee production spans from tree to finished product. Essential practices involve meticulous harvesting, eliminating potential defects, ensuring rapid drying with moisture content between 8% and 12.5%, and maintaining clean, dry storage and transportation to prevent coffee from becoming rewet. In August 2022, the EU set new limits for OTA (Regulation (EU) 2022/1370). The maximum OTA level for roasted and ground coffee has been lowered to 3 μg/kg, and for instant coffee it is 5 μg/kg. OTA levels may decrease during roasting, but it is important to check levels in green coffee.

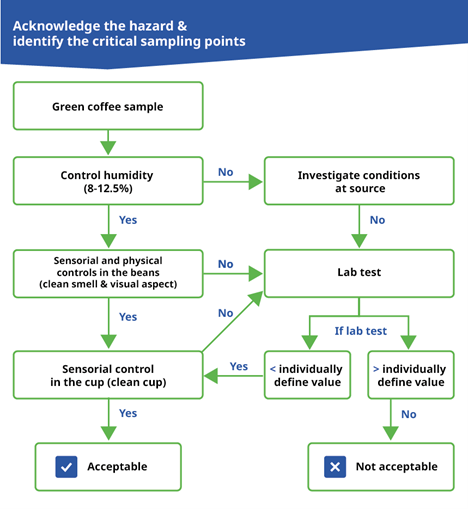

There is no specific limit for green coffee beans, but the European Coffee Federation (ECF) provides maximum moisture content allowed for green coffee to prevent risk of OTA. The moisture content for both Arabica and Robusta coffee should not exceed 12.5%. In addition, the ECF provides a decision tree (see Figure 1) that buyers can use to assess OTA risk which can lead to accepting or rejecting your coffee after testing your samples.

Figure 1: A decision tree to check green coffee

Source: European Coffee Federation, 2022. Redesigned by Bart Wortel

Tips:

- Focus on using proper farming, drying, processing, and storage methods. For instance, follow Good Agricultural Practices (GAP) and/or Good Manufacturing Practices. These actions greatly limit the growth of mycotoxins.

- Read and follow the Codex Alimentarius’ Code of Practice for the Prevention and Reduction of Ochratoxin A Contamination in Coffee (CXC 69-2009). Search for coffee using the search box and / or click on last modified to access latest document.

- If in doubt, get your coffee analysed by a (preferably EU-accredited) laboratory to test for presence of Mycotoxins. One such laboratory is Eurofins.

- Always test your green coffee for moisture content. Buyers will reject green coffee with moisture levels of >12.5%.

Pathogens: Salmonella

Salmonella is a type of germ or microbe contamination. It is sometimes found in coffee if harvesting and drying are not done properly. Coffee beans do not usually have much risk of salmonella because roasting kills any germs. European rules do not therefore have specific germ limits for coffee. But if authorities find this type of germ during checks, they can stop coffee imports or take them off the market.

Tips:

- Check the legislation regarding the microbiological criteria for foodstuffs (Regulation EC 2073/2005) for further information on micro-organisms.

- Use the Codex Alimentarius Principles and Guidelines for the Establishment and Application of Microbiological Criteria Related to Foods, which was last modified in 2013 as a guideline to avoid microbiological contamination. Check Codex Alimentarius for reports updates.

Extraction solvents

Solvents can be used for decaffeination of coffee. Directive 2009/32/EC of the European Parliament about extraction solvents used in making food and food ingredients has been updated. But the updates did not affect the maximum residue limits for the extraction solvents such as methyl acetate (20 mg/kg in the coffee), dichloromethane (2 mg/kg in the roasted coffee) and methylethylketone (20 mg/kg in the coffee).

Hydrocarbons: Polycyclic Aromatic Hydrocarbons (PAHs) and Mineral Oil Aromatic Hydrocarbons (MOAHs)

There is also a growing worry about a group of contaminants called Polycyclic Aromatic Hydrocarbons (PAHs) in Europe. These contaminants come from drying and roasting coffee beans. Examples include Benzo(a)pyrene and Anthracene.

During drying, PAHs contamination often happens because of smoke from fuel in machines. Pollution from the air, such as near roads, can also be a factor. The EU has rules (Commission Regulation (EU) No 835/2011) for PAHs limits in certain foods. Specific limit for coffee beans is not explicitly stated. But it is still important to try and prevent PAHs contamination.

Figure 2: Drying coffee in a safe manner to prevent pollution from harmful gases

Source: Ethos Agriculture

Mineral Oil Aromatic Hydrocarbons (MOAHs) are also mineral oils that might cause cancer. Green coffee can get contaminated with MOAHs during many stages, from production and drying to processing, packaging, storage, and transport. However, there are no official limits set specifically for coffee in Europe. The EU Commission introduced a Draft Regulation by the end of 2023 to establish maximum levels for Mineral Oil Aromatic Hydrocarbons (MOAH) as part of the European Contaminants Regulation. Even though the specific food groups are still under discussion, it is important to know the proposed maximum levels for MOAH to ensure that levels in your green coffee or coffee products do not exceed these limits:

- Products with a fat content ≤ 4 % fat/oil: 0.50 mg/kg

- Products with a fat content > 4 % fat/oil and ≤ 50 % fat/oil: 1.0 mg/kg

- Products with a fat content > 50 % fat/oil: 2.0 mg/kg

Some countries such as Germany and Switzerland have their specific guidelines. Germany is already implementing these thresholds proposed by the EU, while Switzerland has banned the use of recycled paper in food contact materials due to concerns about MOAH contamination.

Figure 3: Coffee storage in a warehouse

Source: Ethos Agriculture

Figure 4: Coffee ready for transportation

Source: Ethos Agriculture

Tips:

- Ensure coffee is dried in a clean and professional way, away from potential contaminants such as fossil fuels, traffic, kitchens or open fires to prevent PAHs contamination. Also, communicate to buyers that the coffee was dried in a clean manner, away from potential contaminants.

- Avoid overusing grease in coffee processing machinery, as this can lead to MOAH contamination during processing. Also, take measures to prevent contamination during packaging, storage, and transport, as green coffee can become contaminated with MOAHs at various stages of the supply chain.

- If in doubt, get your coffee analysed by a (preferably EU-accredited) laboratory to test for presence of PAHs. Eurofins and Tüv Rheinland are examples of EU-accredited laboratories.

- Refer to the “Effect of mild roasting on Arabica and Robusta coffee beans contamination with polycyclic aromatic hydrocarbons” to learn more about PAH contamination in coffee and what steps of the production cycle should be controlled for.

- Refer to “Microbial Contamination in the Coffee Industry: An Occupational Menace besides a Food Safety Concern” for further insights into the risks posed by microbial contamination, which not only endanger consumers but also threaten the health of workers at coffee milling centres. Learn about proactive measures you can implement to reduce these risks and safeguard the wellbeing of your employees.

Other: Acrylamide

Acrylamide is a carcinogenic substance that forms naturally when coffee is roasted at temperatures above 120°C. Recently, there has been a discussion in the European Union regarding the levels of acrylamide in roasted coffee. Changes are expected to be made on Regulation (EU) 2017/2158 which stipulates measures and benchmark levels for reducing acrylamide levels in foods. Commission Regulation (EU) 2017/2158 establishes that the benchmark level for roasted coffee is 400 μg/kg. As an exporter of green coffee beans, you will not be directly affected by this legislative development, but it is important to note the increasing food safety controls for coffee in Europe.

Tips:

- Refer to European Union Directive 2009/32/EC for more information about the restriction of extraction solvents. Refer to Annex 1 of the webpage for the amended sections.

- See Food Drink Europe’s Acrylamide Toolbox (2019) to learn more about this contaminant and its occurrence in roasted coffee. Also, refer to the EU Food safety page to learn more about EU Acrylamide regulations.

General requirements on packaging and labelling

There are rules for labelling to help identify products and trace their origins. Follow the EU regulations on food labelling and packaging. Compliance enhances transparency of your products and helps to build buyers’ trust and confidence in your product. This will ultimately enhance your market access and uphold your reputation with European buyers. It is important to give buyers clear information so they can make good choices. When selling coffee in the EU, make sure the details on the label are accurate, easy to read, and not misleading. Also, ensure the information stays on the packaging and cannot be changed easily. Green coffee labels should be in English and include specific details:

- Product name;

- International Coffee Organization (ICO) identification code;

- Country of origin;

- Grade;

- Net weight in kilogrammes; and

- Supplier’s name.

For certified coffee: name/code of the inspection body and certification number.

Additional labelling information for when your export includes prepacked coffee products:

- Ingredient list;

- Allergen information ;

- Date marking (best before/use by);

- Special storage conditions;

- Instructions for use;

- Alcohol level (if applicable); and

- Nutrition declaration.

Also, due to the EUDR, labelling should help efforts to check and reduce deforestation in the coffee supply chain. This might mean putting ways to monitor for deforestation on packages or giving buyers information about where the coffee comes from.

Figure 5: Examples of green coffee labelling

Source: Ethos Agriculture

When packaging green coffee, it is important to pick the right packaging to keep it fresh from the farm to the roaster. Green coffee is usually stored in big bags made of different materials. For example, Burlap bags, Plastic bags, High-barrier bags and Vacuum-sealed bags. Each has pros and cons.

Burlap bags have been popular for green coffee storage among farmers. They are strong, cheap, and eco-friendly because they are made from jute plant fibres. But they let in liquids and gases, so they are prone to oxygen and moisture, which can lead to mould and spoil the coffee.

Plastic bags come in various sizes and are more affordable and more durable than burlap. They offer better protection against oxygen and moisture but still allow some permeability.

High-barrier bags, often lined with burlap, are widely used for green coffee storage. They are waterproof and create a shield against oxygen and moisture, preserving coffee quality. Brands such as GrainPro, Videplast and Savor Brands offer these bags with advanced layers such as nylon and EVOH for better protection and recyclability.

Vacuum-sealed bags are the most protective but costly option. They remove all oxygen and are ideal for storing and shipping small batches of premium specialty coffees.

When shipping delicate specialty coffees, using impermeable bags can prevent them from deteriorating quickly. Large amounts of commercial coffee are often transported in simple plastic container liners because they are permeable and cost-effective. However, smaller quantities of both speciality and commercial coffee are always stored and shipped in traditional burlap coffee bags.

Figure 6: Examples of coffee packing: jute bag packaging and simple plastic liners and containers for smaller quantities of specialty and commercial coffee

Source: Ethos Agriculture

The EU is, however, getting ready to approve new green packaging rules. Even though the article is not directly related to the coffee industry, it points to the EU’s plan to deal with the increasing waste problem and change how people in the EU use, buy and recycle things. The goal is to ensure all packaging can be recycled by 2030. The EU targets that by 31 December 2025, at least 65% by weight of all packaging must be recycled. By the end of 31 December 2030, the EU wants to recycle at least 70% of packaging. By 1 January 1 2035, recyclable packaging should be recycled on a large scale. Also, the EU plans to stop using very light plastic bags. Some companies are already taking action. For example, Nestlé's Nespresso brand started testing home-compostable coffee capsules in France and Switzerland in Spring 2023.

The European Coffee Federation (ECF) supports the European Commission's plan to update the EU Packaging and Packaging Waste Directive (PPWD) 94/62/EC. They expressed concern, however, over the proposed regulations' impact on Single Serve Units (SSUs) in the coffee industry. They said that it has potential conflicts with circular economy goals. They have therefore asked for changes to compostability requirements. This is because they want to help member countries and businesses meet waste reduction targets to reduce the environmental impact of packaging.

Even though the regulation does not directly relate to green coffee, it is important to stay up to date with issues regarding packaging in consumer countries if you export to the EU. Also, if you plan to export roasted coffee to the EU, you must consider adhering to this regulation.

Tips:

- Always use food-grade quality packaging. Packaging materials can consist of fibres that have been softened by mineral oils or have been written on with mineral oil-based ink – these could lead to potential MOAH contamination of your green beans. Read more about food grade packaging on this blog by the Australian Food Authority and read here how Germany is planning to restrict the use of MOAHs in food contact materials.

- Refer to the Green Coffee Association contract terms and conditions with regards to Quantity, Packaging, Marking and Quality of green coffee for export.

Payment and delivery terms

Payment and delivery terms refer to the conditions agreed upon for the transfer of funds in exchange for purchasing coffee beans. These terms dictate when and how payment will be made, influencing cash flow, risk management, and relationships with suppliers. Common payment terms include Letter of Credit (LC), Cash in Advance, Open Account and Documentary Collection (DC). Each method offers different levels of security and flexibility, allowing buyers to tailor their payment arrangements according to their preferences and circumstances.

You need to negotiate to set up mutually beneficial payment terms. Effective negotiation involves clear communication, understanding each party's needs and constraints, and seeking solutions that accommodate both parties' preferences and circumstances. The way you receive payment and deliver your goods might change, depending on where you are sending them from and where they are going. Bank accounts are the main mediums through which you receive your payment from a buyer. The main bank account-based payment methods include credit transfers, cheques, direct debits, and card payments. These methods all involve moving funds from the buyer's account to the seller's account.

Sometimes you can receive late payments. The EU Late Payment Directive required Member States to establish laws governing payment schedules. The payment terms should not be more than 60 days unless both parties agree. If no terms are set, it defaults to 30 days. However, some countries had laws more favourable to suppliers. Consequently, the EU passed a directive in 2019 addressing unfair trading practices in food chains. As a result, payment terms are now limited to 30 days for perishable goods and 60 days for other food items.

On 12 September 2023, the EU proposed a new and more stringent rule, suggesting a maximum payment term of 30 days for all food products. Member States need to agree. While the proposed regulation has not yet been finalised or enacted, it highlights the EU's commitment to addressing late payment issues and protecting suppliers. It is crucial to stay informed about the developments and potential changes to payment term regulations. This knowledge can guide you in negotiating favourable terms when signing supply or trade contracts within the EU market.

The EU's Access2Markets website has the information you need about taxes, rules and other things that might affect your trade. You can look up the taxes and rules for exporting coffee (HS code 0901) from your country to any European destination on this website.

Tips:

- Visit the UN Economic Commission for Europe’s website to learn more about payment methods.

- Learn about INCOTERMS, which provide rules and guidance for global trade. INCOTERMS divide responsibilities between exporters and importers regarding shipment coordination, insurance, duties, customs clearance, and documentation. For instance, agreeing on who pays for insurance during transport is crucial in case of mishaps.

Intellectual property (IP) rights

In the coffee industry, intellectual property issues are common. Companies invest a lot in branding and innovation to stay competitive. Protecting intellectual property rights is crucial. Patents are important for products and ingredients used in coffee. They cover things such as flavoured syrups and packaging solutions. Unique designs, sealing methods, and materials can extend the shelf life of coffee. Accessories such as grinders can also be patented, as they impact coffee quality and preparation. Examples of patented technologies and coffee extraction methods include pressure coffee maker for preparing coffee infusions, Maitake mushroom coffee and Maca coffee.

The EU is a signatory of IP rights agreements such as the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS)

The IP rights in the TRIPS agreement include:

- Copyright and related rights;

- Trademarks including service marks;

- Geographical indications including appellations of origin;

- Industrial designs;

- Patents including the protection of new varieties of cocoa with desirable traits such as flavour profiles;

- Layout designs of integrated circuits; and

- Undisclosed information including trade secrets and test data.

Tips:

- Learn more about EU policies regarding intellectual property (IP) rights and agreements with other nations and details on how to uphold your rights. Also learn about geographical indicators in relation to IP rights.

- Learn more about IPR rules in EU trade agreements from the European Commission’s Guide to IP in Europe and the Guide to IP and Contracts.

- Visit the EU IP Helpdesk to learn more about EU IP Landscape which is intended for non-EU companies from Africa, China, India, Latin America, and South-East Asia, willing to know more about the Intellectual Property environment in the EU.

2. What additional requirements and certifications do buyers ask for in the coffee sector?

Some buyers have requirements that go beyond existing legislation, in particular regarding food safety, quality, and environmental impact and social responsibility.

Additional food safety requirements

In coffee-producing countries, processing systems for green beans are not always required because they are often roasted elsewhere. However, some buyers may ask for food safety systems such as ISO 9001, ISO 22000, or HACCP. HACCP is a starting point for more rigorous schemes such as FSSC 22000 or BRCGS. Consultants can help develop HACCP schemes.

Tip:

- Carry out an HACCP scheme to reflect on critical points (potential hazards) in your supply chain that you need to control. Your scheme needs to be based on the 7 basic principles of the HACCP system. Read more about how to manage HACCP for coffee in the Coffee Guide published by the International Trade Centre.

Quality criteria

If you want to export coffee to Europe, you will have to meet your buyer’s quality standards. These are particularly high within the specialty segment. Coffee quality is assessed by examining green and roasted coffee physically and by sensory evaluation of the roasted coffee.

Green coffee assessment

First, the quality of green coffee is graded and classified before export. There is no universal grading and classification system for coffee, but the Specialty Coffee Association’s standards for green coffee grading are often used as a reference. However, most producing countries have and use their own grading and classification systems. Article 50(2)(a) of Regulation (EU) No 1151/2012 also explains the preferred quality of green coffee in the EU. This includes factors such as moisture, odour, wet/dry process, and so on.

The Organisation for Standardisation (ISO) also provides specific standards on coffee quality, such as ISO 10470:2004 (Green coffee - Defect reference chart). Also, standards such as ISO 24114:2011 define criteria for the authenticity of soluble (instant) coffee. This standard was last reviewed in 2018 and is still in effect.

Grading and classification are usually based on the following criteria:

- Altitude and region;

- Botanical variety;

- Processing method: wet/washed, dry/natural, honey, pulped naturals;

- Screen size: important to ensure uniform roasting, which improves final product quality;

- Classification of defects or imperfections;

- Number of defects or imperfections;

- Bean density; and

- Cup quality.

European buyers typically do a green coffee assessment. This includes a screen-size evaluation, defect count and an assessment of bean colour, appearance and smell. This is followed by a moisture check and water activity analysis. Sample roasting is then done to evaluate green coffee quality and uniformity.

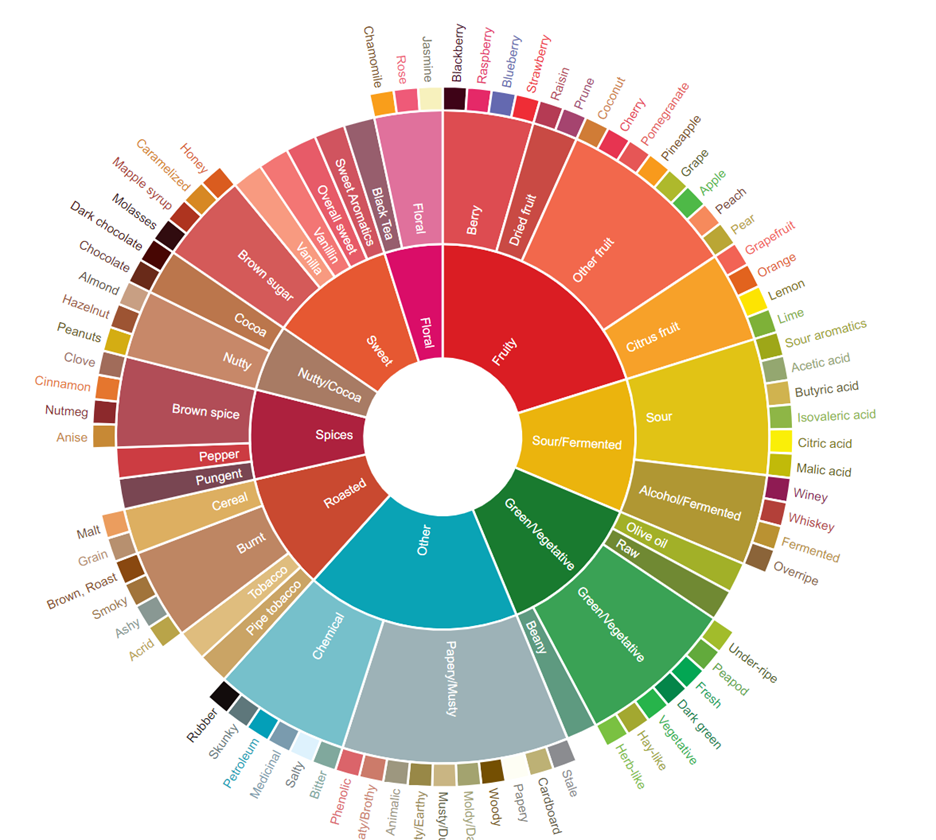

Sensory assessment: coffee cupping

Coffee is also assessed and scored by a method called cupping. Buyers use different protocols and standards to conduct a sensory assessment. However, the SCA recommends specific guidelines and protocols for cupping coffee. The most widely used cupping tool is the SCA’s Coffee Taster's Flavour Wheel. Some of the quality attributes assessed are flavour, fragrance/aroma, aftertaste, acidity, body, uniformity, balance, cleanliness, sweetness and off-notes. Overall ratings provide a summary assessment based on a scale of 50 to 10 – the higher the score, the better the quality.

Note that there is no exact definition of specialty coffee within the coffee industry. The Coffee Quality Institute and the cupping protocols of the Specialty Coffee Association consider coffees graded and cupped with scores below 80 to be standard quality and not specialty. Nevertheless, the exact minimum scores defining specialty coffee differ per country and per buyer. Most buyers consider 80 too low and demand a cupping score of 85 or higher for it to be considered specialty.

If you sell specialty coffee, it is important for buyers to know the cupping score of your coffee. Although not mandatory, it is highly relevant to add this information to the documentation of the coffee you are exporting – this may add value to your product. Therefore, it is very important to be aware of the quality of your coffee, either through local cupping experts or by becoming a cupping expert yourself. Note, however, that your coffee will most likely be cupped again at the destination market by your buyer. Most coffee will be approved based on the cupping results of the pre-shipment sample.

Figure 7: SCA Coffee Taster’s Flavour Wheel

Source: Not bad coffee

Figure 8: Panel conducting sensory evaluation of coffee

Source: Ethos Agriculture

Tips:

- Read more about the quality requirements of the coffee industry at the website of the Coffee Quality Institute and follow its recommendations on how to improve quality along the value chain.

- Refer to Trabocca’s article on how to recognise and distinguish green coffee defects for an overview of all coffee defects. Also, refer to this article on Perfect Daily Grind to learn more about coffee bean density.

- Learn more about coffee cupping and cupping scores on the website of the Specialty Coffee Association. Consider obtaining a Q-grader certificate, either for Q Arabica or Q Robusta, to be able to cup and score your coffee according to international standards of aroma and taste.

- Promote the quality of your coffee. Start by giving an accurate description of the physical properties of the coffee, such as screen sizes, which and the number of defects, at what altitude the coffee was grown, how the cherries have been processed, and so on. Additionally, if possible, cup your coffee, give a rating and mention the cupping protocol of the rating.

- Learn more about maintaining the quality of your coffee during transportation on the website of the Transportation Information Service (TIS).

Supplier Code of Conduct

European buyers are increasingly addressing social and environmental issues in the coffee supply chain, and it is becoming common for them to develop Corporate Social Responsibility (CSR) policies and codes of conduct that suppliers must follow. The CSRD (Corporate Sustainability Reporting Directive) entered into force in the EU in early 2023. Companies in the EU have to disclose information on what they see as risks and opportunities arising from social and environmental issues, in other words, mandatory reporting.

Have a look at the websites of these small and mid-sized coffee importers for examples of sustainability codes of conduct and/or projects they have set up at origin:

- GEPA (Germany), Ethiquable (France) and Altromercato (Italy): these are all importers that work on the basis of fair trade principles.

- This Side Up (the Netherlands): specialty coffee importer that empowers farmers by helping them become fully independent agro entrepreneurs.

- Nordic Approach (Norway): specialty coffee importer that focuses solely on sourcing traceable green coffees. For instance, they work on the ground at origin to contribute to product development.

Efico (Belgium): this coffee importer created the private Efico Foundation, which promotes sustainable coffee production through certification, training and education programmes.

Examples of sustainability codes of conduct and/or projects from large importers and roasters are:

- Neumann Kaffee Gruppe: Corporate Responsibility. The group also founded the independent NGO Hanns R. Neumann Stiftung, with which it implements several coffee-based projects to promote a sustainable coffee economy.

- Lavazza: Blend for Better. The company founded the Lavazza Foundation, which implements and reports on sustainability projects to support coffee producing communities worldwide.

- Nestlé: Sourcing coffee responsibly, which they do through their own programmes Nescafé Plan and Nespresso AAA Sustainable Quality Program.

- Louis Dreyfus Company: Sustainable Coffee, which is focused on the expansion of certified/verified coffee and the implementation of projects at origin to support coffee farming communities.

Starbucks: Ethically Sourced Coffee. Starbucks sources its coffee through its own developed sustainability standard, the C.A.F.E. Practices. The company also has 6 farmer support centres around the world, providing training to farmers.

Some examples of sustainability codes of conducts from retailers are:

- Ahold Delhaize (Netherlands/Belgium)

- Marks and Spencer (United Kingdom)

Lidl (Germany): coffee products either Rainforest Alliance/UTZ, Fairtrade and/or organic certified

These codes of conduct may also affect you as a supplier. They may, for instance, require you to sign a suppliers’ code of conduct in which you declare that you do your business in a responsible way, meaning that you (and your suppliers) respect local environmental and labour laws, do not engage in corruption, and so on. These aspects are also investigated further in company audits carried out by your (potential) buyer.

Tips:

- Explore the sustainability standards set by retailers and roasters by visiting their sustainable sourcing pages online or reaching out to them directly. See if you can meet the guidelines they have set. These standards are a great place to begin if you are aiming to supply coffee to these companies.

- Consider participating in or visiting roundtable meetings (via conference call) or seminars to meet industry players and other interesting stakeholders. Check out the website of the International Coffee Organization (ICO), Global Coffee Platform (GCP) and Sustainable Coffee Challenge to keep up to date on these discussions.

- Think about creating and putting into action your own CSR policy or code of conduct. While it might not be mandatory for buyers, it can demonstrate your commitment to social responsibility. Plus, it could make you more noticeable when buyers are deciding between different suppliers.

- Make sure your suppliers follow responsible business practices too. Social and environmental issues often occur at the farm level, which might not be directly related to your handling and processing activities. To test to what extent your farmers are sustainable, you could ask them to fill out this Excel form by the Sustainable Agriculture Initiative (SAI) Platform.

Sustainability certification

Certification used to be the main way companies show they follow Corporate Social Responsibility (CSR) rules. However, many European companies, especially in Northern and Western Europe, still follow sustainability certification schemes. These certifications focus on different issues and are popular in different countries or areas. Knowing these standards is crucial for entering the EU market.

The main certification schemes in coffee include Fairtrade, organic, Rainforest Alliance, and 4C. Having at least one of these certifications has almost become essential for working with European importers.

Rainforest Alliance operates on a large scale and is well-known in European markets. You can consult the guide for farmers on how to get Rainforest Alliance certified here. If you are an exporting company, refer to this guide for companies on how to get supply chain certification. In June 2020, the Rainforest Alliance published its new certification programme for farmers and companies. Audits under this new standard began in July 2021.

4C, which stands for Common Code for the Coffee Community, also serves the mainstream market. Access their website to find out how to obtain a 4C certificate.

Table 1: Most important third-party Voluntary Sustainability Standards requested by European coffee buyers

| Name | Certification body | How to get certified? | Cost for companies |

| Rainforest Alliance | Access the list of authorised certification bodies of the Rainforest Alliance standard. | Consult the guide for farmers on how to get certified if you are a farmer. Companies can also consult the guide for companies to get certified. Operators usually undergo a full recertification audit process every 2-3 years. | The cost of Rainforest Alliance certification depends on the implementation of the standard, such as training, human resources, input and equipment and the audit costs. Refer to this post by Rainforest Alliance to read more about the costs of getting certified. |

| Fairtrade | FLOCERT | Consult this link to learn how to become a Fairtrade producer. Operators usually undergo a full recertification audit process every 1-2 years. | Access the cost calculator of FLOCERT to get an estimation about your costs for getting Fairtrade certified. If you are a farmer, choose the “I grow, farm pr produce Fairtrade products” option. If you process cocoa into semi-finished products, choose the “I buy, sell or manufacture Fairtrade products” option. |

| 4C | Access the list of certification bodies recognised by 4C. | Refer to the 4C certification process to learn more about getting certified. Operators usually undergo a full recertification audit process every 2-3 years. | The costs for getting certified are available upon request by 4C and depend on the size of your operations, among other things. |

| EU Organic | Access the list of recognised control bodies and control authorities for EU Organic, issued by the EU. | Refer to Regulation (EU) 2018/848 to learn more about the legislative requirements. | Costs vary and depend on set-up, scale, location, and non-conformities. |

| Fair for Life | ECOCERT | Access the Fair for Life certification process to learn about the steps that must be followed to become certified. Operators usually undergo a full certification audit process every year. | Certification costs vary depending on the size and complexity of operation, location of your operation and of producers. |

| Small Producers Symbol (SPP) | Refer to this list for an overview of authorised certification entities. | Consult this guide for an overview of the general certification procedure for small producers’ organisations | Access this link for an overview of the costs for SPP certification. |

| Demeter | Consult this list to see which organisations are authorised as certification body by Demeter in your country. | Access this page for an overview of the International Demeter Biodynamic Standard, and refer to the section on biodynamics to gain insights into the principles that form the foundation of Demeter certification. | Fees vary to a certain extent from country to country. The fees for licensees of the Federation are available upon request. |

| SMBC Bird Friendly | Access this list of certification bodies approved to inspect for Bird Friendly standards. | Access this page to get acquainted with the Bird Friendly farm criteria you need to comply with to be certified. | Certification costs vary and are available upon request by contacting the Bird Friendly coffee team. |

Source: Amonarmah Consults (information retrieved from ITC Standards Map and specific standards’ websites)

Read more about Fairtrade and organic in the section below.

Tips:

- For a full overview of Voluntary Sustainability Standards, please consult the ITC Standards Map App.

- Consider applying for certification. Certification can provide your company with opportunities such as training on more efficient agricultural practices and becoming independent of synthetic chemicals for fertilisation. In addition, certification can lead to access to new markets for exporters and cooperatives. Most certification schemes have training programmes, tools or other types of assistance to help you understand the criteria and educate you on how to become certified.

- When opting for certification, consider multiple certification schemes. For example, investigate the accessibility of certification programmes in your country or region, the credibility and recognition of the available certification programmes, the costs of certification and the type of certification preferred by buyers in your main European target markets.

- Look into the different operators worldwide which handle Rainforest Alliance certification. This will provide you with insight into the countries where these certifications are most demanded, and the players which can be your potential buyers.

3. What are the requirements and requested certifications in the niche markets for coffee?

To enter a niche market, meet specific niche requirements set by buyers, which may vary. These standards often relate to sustainability and may include certifications such as organic or fair trade. By meeting these extra requirements, you can significantly improve your market opportunities and add value to your product.

EU Organic and biodiversity-focused certification schemes

European authorities and buyers do not consider "organic by default" as valid. For coffee to be labelled as organic in Europe, it must meet EU legislation 2028/848 on organic production and labelling. The new EU organic regulation, effective since January 1, 2022, means stricter inspections for producers outside the EU to prevent fraud.

To market green coffee as organic, accredited certifiers must audit your facilities annually. In countries outside the EU, organic inspection and certification are overseen by independent control bodies or authorities appointed by the Commission. To market a product as organic within the EU, one must engage with the relevant national control body of the exporting country. Certain non-EU imports may face additional controls or requirements. Following a thorough review, the Commission and EU countries have implemented additional controls on products from specific third countries from 1 January 2024, to 31 December 2024, to ensure organic production integrity. These controls involve commitments from EU countries and obligations for recognised control bodies in third countries under Commission supervision, outlined in documents by the Directorate General for Agriculture and Rural Development.

You will also need an electronic Certificate of Inspection (COI) issued by control authorities before shipping to the EU. Without it, your product cannot be sold as organic. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES), where you will also have to register as an organic exporter. Some countries require specific COIs. Switzerland and the UK, for example, have their own organic laws. It is important to check the destination country's regulations.

Tips:

- Consult the International Trade Centre’s Standards Map App database for a full overview of different organic labels and standards.

- Familiarise yourself with the requirements of organic certification, for example the standard of the International Federation of Organic Agriculture Movements (IFOAM).

- Only use a certifier accredited by the EU. Otherwise, you will risk your certificate not being recognised by European buyers. Periodically, changes are made in the area of accredited inspection bodies. This is incorporated in TRACES.

- Read our study on Exporting organic coffee to Europe to learn more about the market for organic coffee in Europe.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Start your search at the organic movement in your own country and ask if they have their own support programmes or know about existing initiatives. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

Fairtrade certification

In Europe, the main fair-trade standard is Fairtrade International (FLO), certified by FLOCERT. Fairtrade has introduced new requirements for certification. Coffee cooperatives, traders and other operators have to get commitments in place for new Fairtrade sales volumes. This must be validated by the end buyer and national Fairtrade organisations.

Fairtrade producers receive a Fairtrade Minimum Price. The current rates are listed in the Fairtrade Minimum Price and Fairtrade Premium Table. Check the guide to become a Fairtrade producer for more details.

Other fair-trade standards in Europe include Fair for Life (by Ecocert IMO) and Control Union Fair Choice. These may offer cost-saving opportunities by combining audits with organic or Rainforest Alliance audits. Ensure buyer interest and demand for specific certifications. With Fair Choice and Fair for Life, confirm premium details, such as Fairtrade's minimum price, as they are not regulated.

Another option is the Small Producers' Symbol (SPP), emphasising social impact through community-based sustainability principles. SPP certification highlights collaboration among small producers, enhancing market value and cultural contributions. Joining this network is possible for producers.

Tip:

- Before engaging in any sustainability certification programme, make sure to check (in consultation with your potential buyer) that this label has sufficient demand in your target market and is cost-beneficial for your product.

High-end specialty coffee

The high-end specialty coffee segment is characterised by a very high cupping score (around 87 and above), innovative processes (such as natural and honey-processing), direct trade relations, and high transparency and traceability from source to consumer. This means that buyers of these coffees ask for requirements that go beyond the requirements for certification.

Besides high quality, these buyers are interested in your origin stories, for instance, information about your coffee farm, the coffee growers and your processing facilities. This implies that you should know the specifics of your coffee, from soil management to the cup, from variety to processing, from external suppliers to farmers, and must be willing to share these honestly. Other than that, direct trade may result in more frequent coffee farm visits and product assessments by your buyers, as well as long-term business relations.

Tip:

- Read our study on Exporting specialty coffee to Europe to learn more about specialty coffee buyer expectations.

Amonarmah Consults carried out this study in partnership with Molgo Research and Ethos Agriculture on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research