Exporting certified organic seafood to Europe

The demand for organic seafood in Europe is expected to grow as consumers are getting more and more interested in their health and in the origin of their food. If you want to export organic seafood, be aware that all products must comply with the EU Organic Regulation. Although getting organic certification for your products is not a simple task, the benefits can be substantial as prices for organic seafood are much higher than for non-organic products.

Contents of this page

1. What is organic seafood?

Organic seafood falls under organic agriculture: farming food using natural substances and processes. IFOAM Organics International, the global umbrella organisation for the organic sector, defines organic agriculture as: “a production system that sustains the health of soils, ecosystems, and people. It relies on ecological processes, biodiversity and cycles adapted to local conditions, rather than the use of inputs with adverse effects.”

Organic farming encourages:

- responsible use of energy and natural resources

- preservation of biodiversity

- improvement of soil fertility

- maintenance of water quality

- high standards of animal welfare

Organic farming is a concept that has been around for many years. In fact, the concepts of organic agriculture were already developed in the early 1900s by people who believed that the use of animal manures, cover crops, crop rotation, and biologically based pest controls resulted in a better farming system.

The demand for organic farming started gaining more traction in the 1960s when the environmental damage caused by pesticides became public knowledge. Organic food sales increased steadily throughout the rest of the 20th century and beyond. Greater environmental awareness, coupled with concerns over the health impacts of pesticide residues and consumption of genetically modified (GMO) crops, fostered the growth of the organic sector.

Only farmed seafood can be labelled organic

Organic seafood is always farmed. This means that organic seafood products are always aquaculture products, and never wild-caught seafood products. Only farmed seafood can be labelled as organic. Though sometimes wild-caught species are marketed as organic, this is incorrect. Technically, wild-caught seafood cannot be organic. This is because organic is a farming method, and amongst other things requires close control of what animals are fed. When it comes to wild-caught seafood, we cannot control what they eat. Organic seafood covers a full spectrum of aquatic species, including micro and macroalgae, zooplankton and aquatic animals like shrimp and tilapia.

Reasons consumers buy organic seafood

It is important to understand that organic seafood is a niche market. Producing it is costly, and thus it is expensive for the end-consumer. However, a small group of consumers finds it essential that the food they eat has been produced organically. Their main reasons are:

- Health: there are claims of improved nutritional value in organic products and no pesticides are used.

- Animal welfare: consumers find it important that farmed animals have enough space and are slaughtered using more humane methods than are used in conventional farming methods.

- Environment: water quality, soil quality and biodiversity are kept intact, therefore reducing the environmental impact of farming.

The difference between organic and sustainable

Sometimes ‘organic’ is confused with ‘sustainable’, but these words do not have the same meaning. Sustainable seafood is farmed or caught using methods that do not harm single species or ecosystem. Organic seafood, on the other hand, is always farmed and the rules for producing organic seafood are more stringent than for sustainable seafood. The market for sustainable seafood in Europe is much larger than for organic seafood. On the other hand, producers tend to receive significant price premiums for organic seafood, whilst producers rarely receive price premiums for sustainable seafood. If you want to learn more about sustainable seafood, take a look at the CBI factsheet on exporting sustainable seafood to Europe.

Tips:

- Browse the EU’s website on organic farming for more information on the aims, the logo and the rules behind it.

- Take a look at the IFOAM website to learn what they are doing to further develop organic aquaculture and support related activities.

2. Organic regulation and certification

All organic seafood entering the EU must comply with the EU Organic Regulation. These rules prohibit the use of synthetic pesticides, fertilisers, ionising radiation, sewage sludge, and genetically engineered plants or products. They are the legal basis for the control of organic farming, food processing and organic labelling within the EU. After Brexit, these EU rules have been retained in the UK for implementation in the UK.

Food that is certified organic by the EU carries the organic logo (Figure 1). This helps consumers to recognise organic food and producers to market their products.

Figure 1: EU organic logo

Source: European Union (2021)

In addition to the EU regulations, private organic certifications also exist. In fact, private organic standard Naturland was the first organisation to develop a standard for organic aquaculture. A few years later, the EU organic regulation came into force. Other private organic certification schemes with standards applicable to aquaculture farms are:

- Soil Association (UK);

- Bioland (Germany);

- Bio Suisse (Switzerland);

- KRAV (Sweden).

To see an example of how private organic certification standards differ from the EU regulations, take a look at a comparison between Naturland standards and EU organic regulation.

Keep in mind that these private organic certifications in some cases go beyond EU regulations for organic seafood and impose more requirements than the EU regulations do. The main reason for considering these private certifications is that they are popular in specific markets. For example, Naturland is popular in the German market, so if you are already supplying organic seafood products, then getting Naturland certification on top of the EU certification may be relatively easy and give you access to the German market.

According to Naturland: “Through social media, documentaries and movements like ‘Friday for future’, people become more aware and interested in organic food and sustainability in general. Consequently, organic certification is attracting more and more consumers and we see high potential for producers and exporters to invest in a niche sector in order to highlight and stand out with their product from other conventional products.”

Tips:

- If you have questions about EU rules for organic production, take a look at the EU’s Frequently asked questions on organic rules.

- Consult ITC Sustainability Standards Map for the different organic labels and standards.

- Familiarize yourself with the private organic certification schemes that are popular in the markets you cater to, and learn how they define standards for organic aquaculture. In some cases, these will be equal to the EU regulations for organic aquaculture. However, in other cases, such as with Naturland, standards are more stringent than EU regulations.

3. What makes Europe an interesting market for organic aquatic products?

Though it is still a niche market, the market for organic food is growing in Europe and this growth has in some ways actually been fuelled by the global pandemic. Though the market for organic seafood is still dominated by Northwestern Europe, Southern Europe is also clearly developing a taste for organic seafood.

Europe has a taste for organic food

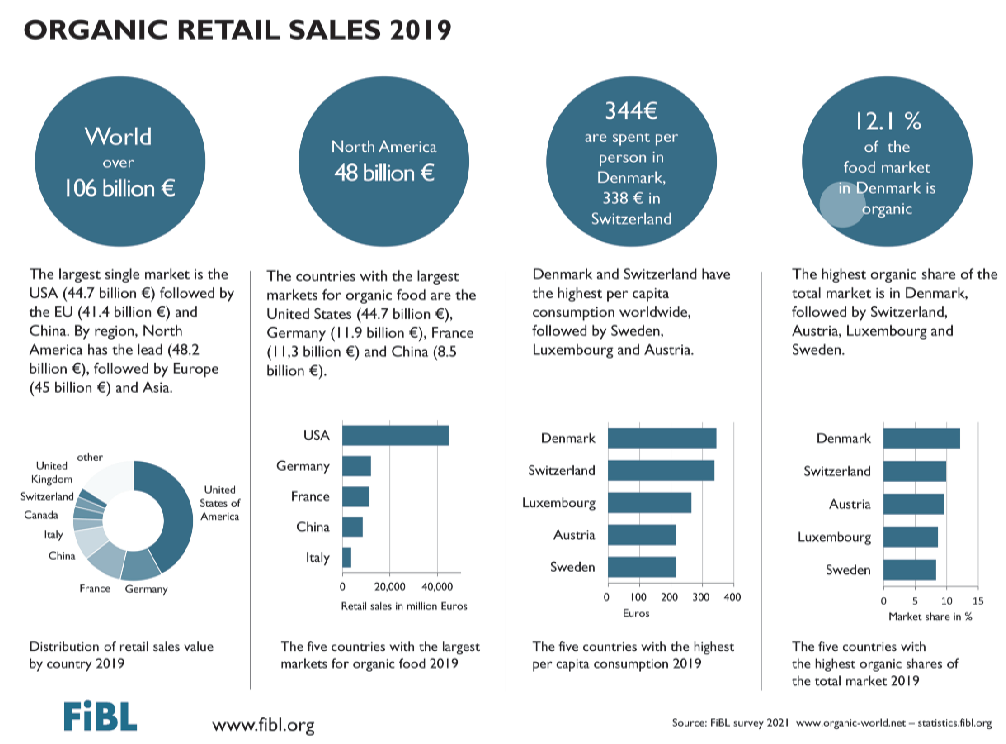

According to a 2021 survey conducted by the Research Institute of Organic Agriculture (FiBL), the European market is the second-largest market for organic food and worth €45 billion, which is 43% of the total global market for organic food (Figure 2). In 2019, the European market recorded a growth rate of 8% and imported 3.2 million tonnes of organic agri-food products. After the US, Germany (€11.9 billion euro) and France (€11.3 billion) are the countries with the largest markets for organic food.

This means that if you are involved in the production or export of organic seafood, there is already an existing and growing market in Europe. Let us look at which countries offer the most opportunities.

Figure 2: Organic retail sales in 2019

Source: FiBL and IFOAM, 2021

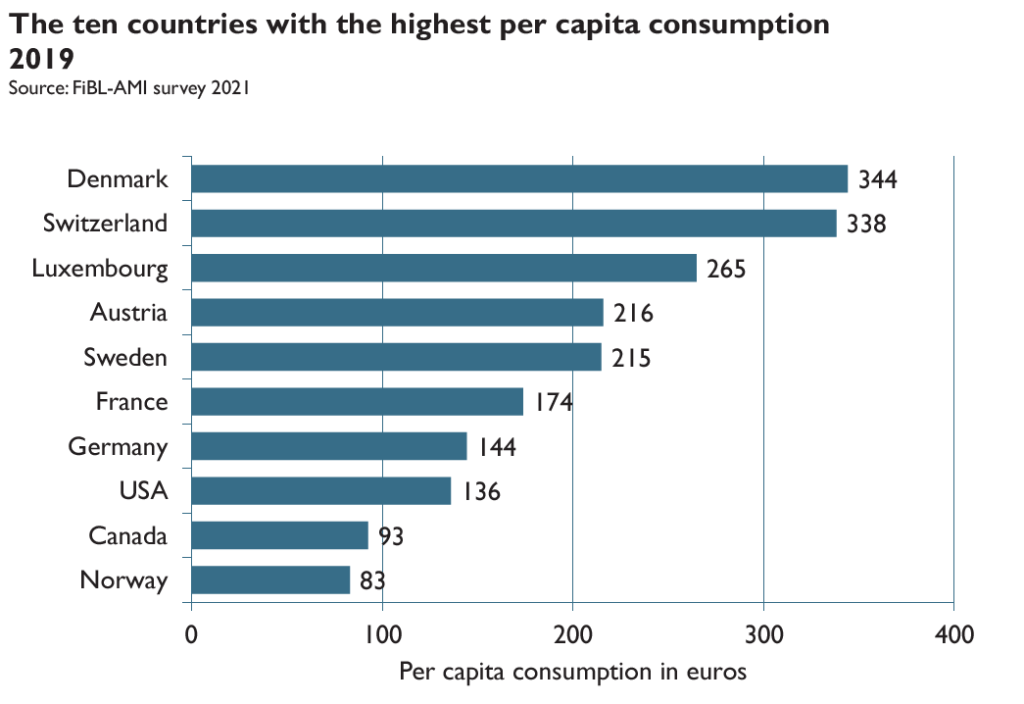

Among the key markets, the highest growth was observed in France (13%). In the decade 2010-2019 the European markets’ value has more than doubled. Though the US may represent a larger market for organic food, European countries have higher per capita consumption of organic food (Figure 3). Denmark and Switzerland have the highest per capita consumption of organic food worldwide, followed by Sweden, Luxembourg and Austria.

Figure 3: Per capita consumption for organic food

Source: FiBL and IFOAM, 2021

Although North America and Europe generate the most sales for organic food, their share of the total market is shrinking. In fact, the share of developing countries such as China, India, Brazil and India is likely to grow at a fast rate in the coming years. This means that perhaps there is also a growing market for organic seafood in your own country.

If we zoom in on seafood, organic aquaculture products represent a growing niche market in the EU. In the main EU countries surveyed by the European Market Observatory for Fisheries and Aquaculture (EUMOFA) in the EU Fish Market 2020, Germany, Spain, France, Italy and the UK, 46.500 tonnes of unprocessed fishery and aquaculture products consumed in 2019 originated from organic production. This was 3% more than in 2018, and 20% higher than consumption in 2015, indicating an increase in the share of organic seafood products.

According to a 2020 EU Agricultural Market Brief on EU imports of organic agri-food products 7,098 tonnes of organic fish were imported into the EU in 2019. This represented 0.2% of all imported organic commodities, a 22% increase from 2018. Imports of organic seafood from developing countries consist mainly of shrimp, but also include small volumes of organic tilapia and pangasius. Organic vannamei shrimp is mostly sourced from Ecuador and organic monodon is farmed in several countries (e.g. Bangladesh, Madagascar, India, Indonesia and Vietnam). Imports of organic tilapia come from Central America and imports of pangasius from Vietnam.

This means that there is already an existing organic market for species like shrimp, tilapia and pangasius. If you are already exporting these seafood species, this could be an advantage for you as you can add organic to your product portfolio. However, you may also look into other farmed species that are in demand in the European organic market.

According to a EUMOFA report on EU Organic Aquaculture, some large-scale retailers who buy organic fish indicated that they do not source it in the EU, because of the absence of a guarantee on availability. They prefer to buy a limited number of products from suppliers outside the EU that are more likely to provide regular supply at competitive prices. For example, one interviewed retailer preferred to buy shrimp from South America. This means that as an exporter from outside of Europe, you have an opportunity to supply to this niche market, provided you can offer a regular supply of organic products at competitive prices.

Tips:

- For retail sales of organic food, the organic share of total retail sales, and per capita consumption of organic food for different countries, take a look at The World of Organic Agriculture 2021.

- Read EUMOFA’s The EU Fish Market 2020 to better understand the European fisheries and aquaculture industry from an economic perspective. This report answers questions such as: what is produced/exported/imported, when and where, what is consumed, by whom and what are the main trends?

Which European regions offer the most opportunities for organic seafood?

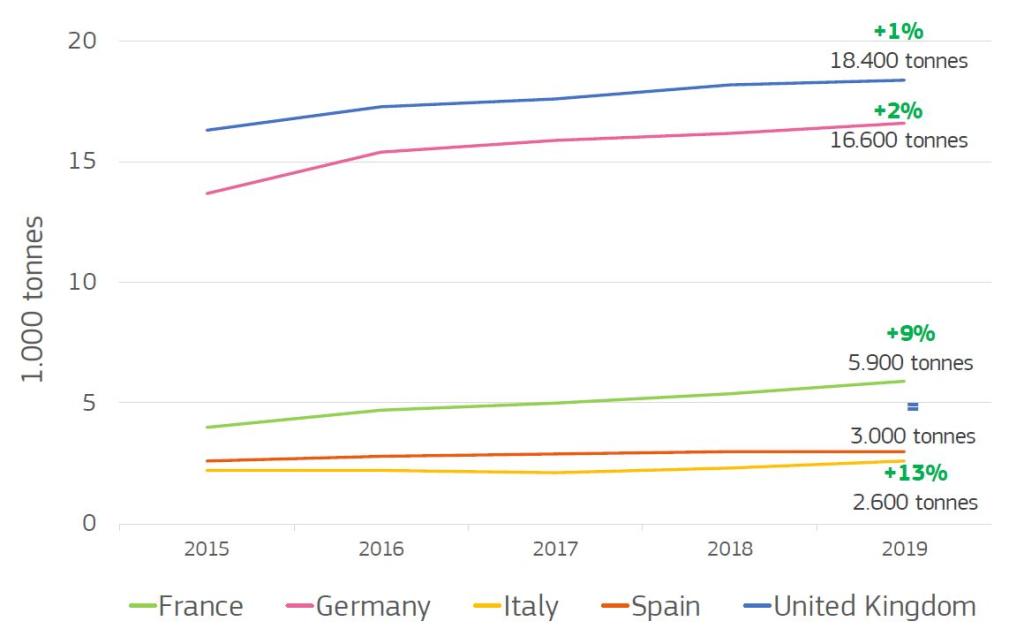

The UK and Germany are Europe’s largest markets for organic aquaculture products. That was the conclusion of a study by the European Market Observatory for Fisheries and Aquaculture (EUMOFA) (Figure 4). In 2019, the UK consumed 18,400 tonnes of organic aquaculture products and Germany consumed 16,600 tonnes. Compared with 2015, consumption increased by 13% in the UK and by 21% in Germany.

Figure 4: the 5-year trend of consumption of organic fishery and aquaculture products in top 5 countries, 2019 volume and % variation 2019/2018

Southern European countries are also developing a taste for organic aquaculture products. In 2019, France consumed 5,900 tonnes, Spain consumed 3,000 tonnes and Italy consumed 2,600 tonnes. The most significant increase between 2015 and 2019 was in France, consuming 48% more in 2019 than in 2015. During this period, consumption in Italy grew 18% and consumption in Spain grew 15%.

4. What are the trends in the market for organic seafood products?

As consumers become more concerned with personal health, wellness and nutrition, they increasingly turn to organic food and the EU is putting serious efforts into promoting the consumption of organic seafood. At the same time, rules for organic production are changing. As the sector grows, the EU is developing new legislation for organic farming, which means that imported organic seafood will also be subject to different rules.

Consumers are more and more interested in healthy food

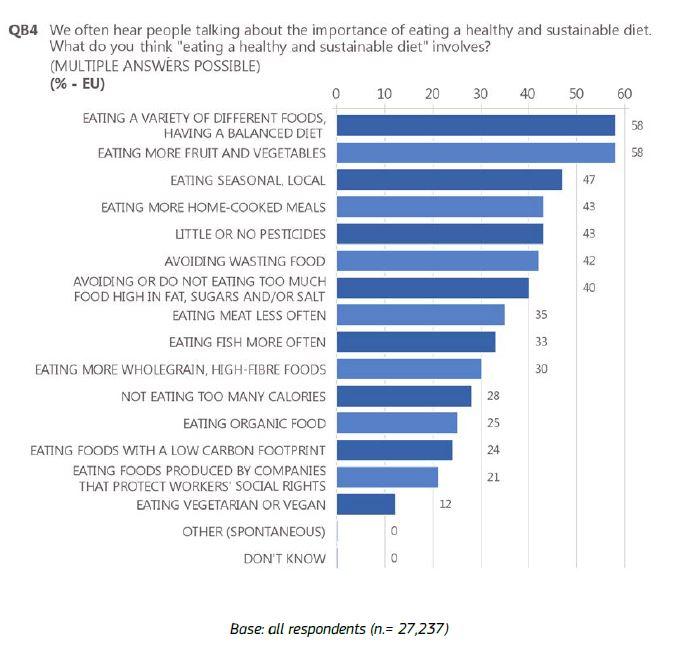

European consumers are increasingly concerned about eating healthy food and they tend to associate healthy diets with organic food. According to the 2020 European Barometer poll, consumers believe that eating healthy and sustainable includes eating organic food (Figure 5). This study was carried out between 3 August and 15 September 2020 in the 27 EU Member States.

Figure 5: Results from a poll on what eating a healthy and sustainable diet involves

Source: 2020 European Barometer poll

When asked what eating a healthy and sustainable diet actually involves, 43% said eating food with little or no pesticides, 33% said eating fish more often and around a quarter of respondents think it involves eating organic food (26%) or eating foods with a low carbon footprint (24%).

Organic food is still a niche market and primarily caters to the upper or middle class. Results from the poll suggest that upper class or upper-middle-class consumers care most about a food’s impact on animal welfare and whether food is organic. Thus, before investing in organic aquaculture you should ask yourself if this is the consumer group you want to target.

The pandemic has had a profound effect on daily lives and on the organic food industry. According to Naturland, “Due to COVID, the consumer consciousness for healthy, sustainable food has grown significantly, which also resulted in a significant growth of the organic market.” This means the market for organic food is likely to continue growing in the coming years.

Tips:

- To read about trends in organic food take a look at The World of Organic Agriculture 2021.

- Read the EU’s Barometer report ‘Making our food fit for the future – Citizens’ expectations’ to understand what factors influence European consumers’ food buying and eating habits, what they believe constitutes ‘sustainability’ and what would help them adopt a healthy, sustainable diet. Keep in mind this Barometer does not only focus on seafood.

New organic farming legislation in Europe

The growth of organic agriculture has led to the development of new legislation for organic farming, which will enter into force in January 2022.

The most important part of this legislation for producers from developing countries is that you will have to comply with the same set of rules as those producers in the EU, to ensure that all organic products sold in the EU are of the same standard.

Examples of other changes that will be made under the new organic legislation include:

- a strengthening of the control system, helping to build further consumer confidence;

- a new system of group certification will make it easier for smaller farmers to convert to organic production;

- a greater range of products that can be marketed as organic;

- a more uniform approach to reducing the risk of accidental contamination from pesticides.

Action plan to boost organic consumption in Europe

The growth in consumer awareness and the development of the organic sector have led to more government support for organic food in Europe. In March 2021 the European Commission presented an Action Plan for the development of organic production. Its overall aim is to boost the production and consumption of organic products. One of the goals is to increase organic aquaculture significantly. It is important to keep track of this action plan and see how your company can benefit from European efforts to promote organic consumption.

The Action Plan is in line with the European Green Deal and the Farm to Fork and Biodiversity Strategies. It is designed to provide the (already fast-growing) organic sector with the right tools to grow.

Particularly interesting for you is what they are doing to promote consumption. Increasing consumption will motivate farmers to change to organic farming. The Action Plan puts forward concrete actions to boost demand, maintain consumer trust and bring organic food closer to citizens. This includes:

- informing and communicating about organic production;

- promoting the consumption of organic products;

- stimulating greater use of organics in public canteens through public procurement;

- increasing the distribution of organic products under the EU school scheme.

Actions also aim at preventing fraud, increasing consumers' trust and improving traceability of organic products.

Tip:

- Read more about the Action plan for organic production in the EU

Organic feed

It is important to be aware of the debate around organic feed. Questions have been raised as to what actually constitutes organic feed, notably when feed contains wild-caught components. Experts argue that feed containing anything that has not been produced organically cannot by definition be referred to as organic feed. However, since the organic market is still so small, the availability of purely organic feed is very limited.

Since any food imported and sold in Europe as organic must adhere to the EU regulations, we will take a look at what the EU says on this matter in Regulation 710/2009. This states that raw materials for feeding organic fish and crustaceans should preferably be derived from sustainable fisheries as defined in Article 3(e) of Regulation 2371/2002 or from organic aquaculture sources.

However, it also says that given the early stage of organic aquaculture and sustainable fisheries, shortages of organic feed or feed from sustainable fisheries may occur, and provisions should be made for the use of non-organic feed. These should be based on Regulation 1774/2002, which sets the health rules for the material of fish origin that may be used in aquaculture. It also provides a ban on the feeding of certain materials derived from farmed fish to farmed fish of the same species. If you do decide to invest in organic aquaculture, it is important to stay up to date on any changes in these rules as it is possible that the EU will develop new provisions on organic feed.

5. Organic certification throughout your supply chain

Organising organic certification throughout the supply chain is not a simple procedure. Here we explain how the certification process works. We also provide a snapshot of what the main end markets are for organic seafood in Europe and through which distribution channels you can bring your organic products to Europe.

How does organic certification work?

The process of organic certification includes a number of steps, which are outlined below.

Understand the rules

The very first step that you should take is to familiarise yourself with the actual rules for the production of organic aquaculture, as these are stringent. One specific regulation to be aware of is EU regulation 710/2009 on the implementation of EU regulation 834/2007 on organic aquaculture animals and seaweed. Determine whether producing seafood according to these regulations is feasible for your operation and/or suppliers.

Assess the capacity of your supply chain partners

A very important thing to realise when considering organic certification is that for a food product to be labelled as organic, every organisation working up and down its supply chain has to meet organic standards and prove that they do so to an organic certification body. This means that every player in your supply chain is subject to checks, from farmers to packers to food processors and organic retailers.

The EU maintains a strict system of control and enforcement to guarantee that organic rules and regulations are being followed properly. This means that not only your facility must be able and willing to comply with these rules, but all the companies in your supply chain as well.

Find a certification body

If you are confident that your own facility and the companies you trade with are on board, it is time to take a look at the organic certification body. The organic certification body is a key player in the process of organic certification as it is the institute that will be auditing your facility. Every country appoints a competent authority that is ultimately responsible for making sure that EU organics rules are followed. This competent authority can delegate its role to certification bodies.

Take a look at Regulation 1235/2008 to find the competent authorities and certification bodies that are recognised and authorised to certify organic operators in your country. Keep in mind that there have been 3 recent amendments or updates to this regulation, which may include new approved certification bodies that have been added to the list.

Prepare yourself for audits

All organic farms and food companies are thoroughly inspected at least once a year by a certification body. They need robust systems in place and paperwork that shows that the standards are being met the rest of the time. The farms and companies inspected must pay for the certification process. Once organic farms and food companies are audited and found to meet the strict organic standards, they are issued with a certificate and a trading schedule. This lists all the products they are certified to trade as organic. This certificate acts as a passport and is necessary to prove the organic status of the goods when they are sold.

Understand the rules that your buyer must follow

It is also good to be aware of the rules that your buyer must follow. Imported organic food is also subject to control procedures to guarantee that they have been produced and shipped in accordance with organic principles. Regulation 1235/2008 describes the rules concerning the import of organic products from third countries. These are the rules that your buyer has to comply with when importing your products.

When products are imported from countries outside of the EU, not only do they need an organic certificate, but they also need a certificate of inspection. This verifies that the product is produced to organic standards equivalent to those in the EU. The certificate can be initiated by the importer, the exporter or the certification body/authority of the exporter.

However, it needs to be issued by the certification body of the exporter, recognised by the EU and authorised by a country recognised by the EU (see European Commission Regulation 2016/1842). The original certificate of inspection must be presented together with the imported organic products to the relevant Member State's authority. Usually, it will be the authority at the point of entry into the EU.

Tips:

- The process of organic certification is a complicated process to understand. The Soil Association gives a clear explanation of how organic certification works.

- For a better understanding of the rules around certification and labelling, take a closer look at EU regulation 834/2007.

- To understand how to deal with the certification of inspection, take a look at the EU’s User Manual to take you through this process.

- Browse the EU Trade Helpdesk if you would like to understand what rules importers must comply with. Even though this does not necessarily apply to you as an exporter, it can be helpful to understand what your customers are dealing with. Find out who the competent authorities for each European Member State are.

What are the benefits and costs associated with organic certification?

Organic seafood sells for higher prices than conventional products. However, the process of obtaining organic certification also has some potential downfalls to consider before investing in organic seafood.

Let us first take a look at some potential benefits associated with obtaining organic certification for your supplier or own operation:

- It can provide market access to niche markets.

- It leads to high-quality products and differentiates your offer.

- It improves a producer’s capacities and technical know-how to farm organically.

- It contributes to improved animal welfare.

- It decreases the environmental impact of farming.

At the same time, it is important to note that there are some costs associated with organic certification and that there are some critiques of the process of certification in general:

- The costs of organic farming and certification are high.

- There are many different organic standards in addition to the EU’s own standards, and there is confusion about the difference between them.

- Many producers, particularly smallholder farmers and small-scale fisheries, struggle to comply with certification standards due to the financial, organisational, and administrative burden of getting their operation certified. As a result, they are excluded.

- EU organic certification standards are not adapted to the local context, making it more difficult for producers in some regions to comply.

- Enforcing certification standards is difficult, and auditing processes have been questioned in terms of legitimacy, accountability and independence.

- There is confusion amongst some consumers about the difference between sustainable and organic seafood.

Since the cost of certification is high, the return on investment may not be high enough. Therefore, talk to your buyers, find out what the market is for organic products and do a cost-benefit analysis before you apply for organic certification.

To address some of the difficulties that smallholders encounter, the EU is introducing a system of group certification. If you source from small-scale producers, you might want to consider encouraging them to enter into a group certification scheme as it enables smaller-scale producers to collectively implement requirements of standards. This allows producers to share the costs and resources involved in meeting these requirements and auditing them. While the methodology allows smaller producers to collectively apply for certification, the applicable standard requirements remain the same, and every member of the group must meet these requirements to achieve certification.

Tip:

- Keep an eye out for the new legislation due in 2022, which will introduce a system of group certification for organic farmers.

Through what channels can you get your organic seafood on the European market?

The most relevant European end-market segment for certified organic seafood is retail. Like with conventional products, you can access the market through partnerships with retailers or importers or by going through an agent.

End markets

Organic seafood used to be sold in specialised organic retail shops, such as Marqt or organic retailers such as Ekoplaza. However, over the last couple of years, the largest end-market for organic seafood in Europe has shifted to the mainstream retail market: supermarkets (Figure 6).

Figure 6: End market segmentation for organic seafood

Source: Seafood TIP (2021)

These days, organic seafood is even available at some discount supermarkets in Northwestern Europe. Most of these mainstream retailers have developed private label brands for their organic products (Figure 7).

Figure 7: Organic shrimp with the private organic label of Dutch retailer Albert Heijn

Source: Albert Heijn (2021)

Similar to mainstream retail, some broadline wholesalers also offer organic products. For example, Dutch wholesaler Sligro sells products with a variety of private organic standards under their “Eerlijk and Heerlijk” product range.

Tips:

- Organic Market Info offers a list of several distributors of organic food in Europe.

- Visit the websites of major retailers and use search words such as “Bio” and “Organic” to look at their product portfolio and private label brands.

Distribution channels

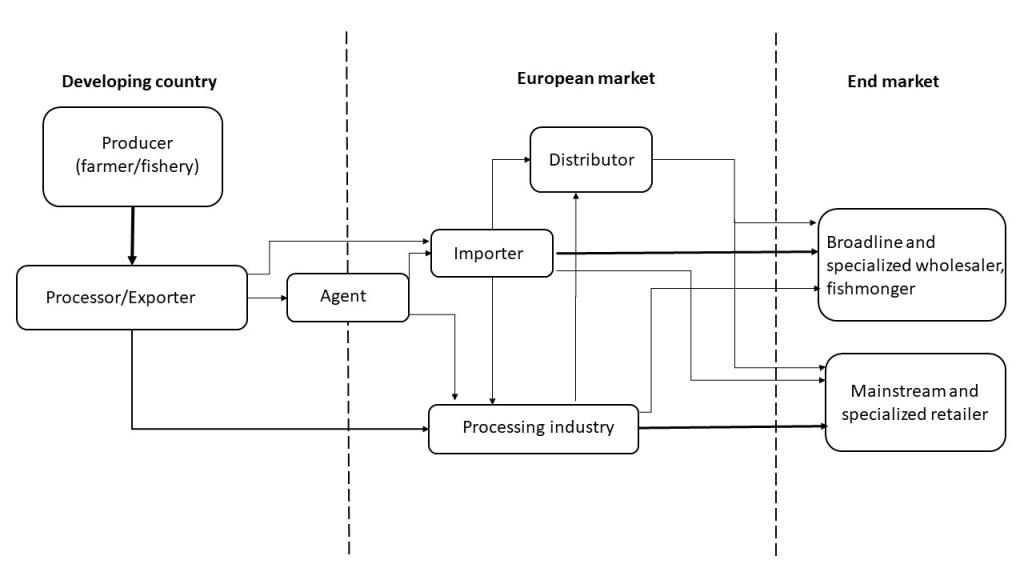

We will now look at through which market channels sustainable seafood is supplied to the European market. In general, the market channels are the same as for conventional products, as illustrated in the diagram below.

Figure 8: Market channels in the European organic seafood market

According to EU regulation 834/2007 any operator who produces, prepares, stores, or imports from a third country, or who places such products on the market, shall notify their activities to competent authorities and get inspected by a certification body. For example, Minh Phu, a large Vietnamese seafood processor, obtained EU organic certification in 2017.

Mainstream importers may source their organic and non-organic from the same supplier if that supplier happens to produce both organic and conventional products. However, more often they have different suppliers, in different countries, for certified and non-certified products. For example, Ecuador supplies a lot of certified shrimp to the European market. However, as volumes are low and to save costs, mainstream importers also buy organic products from specialised importers and supply them to their specific end market.

For you as an exporter, it is best to contact your importer and ask them whether they already have experience with importing organic certified products. As the organic market is niche, hiring an agent who has connections in the organic market could also be a beneficial route for you to access the European market.

While hiring a middleman such as an importer or agent may be useful when making introductions and helping you navigate the organic market, sometimes a direct connection towards specialised importers and retailers can be made. They are sometimes willing to invest in long-term relationships with suppliers and producers in developing countries. If you are able to forge this kind of business relationship or connection with importers or retailers, this could be a good opportunity for you to enter the European market while developing your organic product range. Often these companies look for partners to make joint investments in organic production and are committed to making projects successful.

For example, COOP, one of Switzerland's biggest retail and wholesale companies, is partnering with the Government of India's Marine Products Export Development Authority (MPEDA) in developing export-oriented organic aqua farming in India to cater to the growing demand for organic seafood products across the EU. Under the project, MPEDA will assist in identifying entrepreneurs and providing them with technical advice on the production of high-quality organic shrimp that meet international certification protocols. COOP has offered to procure the processed organic shrimp at a premium of up to 15% and with an additional 5% through financing for development activities, including training.

Tips:

- If you are connected to producers or production areas that are suitable for organic certification and you are interested in breaking into the organic market, visit European trade shows specialised in organic products. Examples are Natexpo in France, BioFach in Germany or Natural & Organic Products in the United Kingdom. This will give you an opportunity to meet organic buyers and specialised organic seafood traders. Discuss with these companies whether they are interested in visiting your area and company to scope for cooperation and joint investments.

- See our 10 tips for doing business with European buyers of fish and seafood and our 10 tips for finding buyers in the fish and seafood sector. These tips also offer more information on which topics are decisive for European buyers when searching for suppliers.

6. End market prices for organic certified seafood

In general, organic seafood is more expensive than conventional seafood products. This is basically the result of the higher production costs of organic seafood, and higher costs of sales and distribution, as volumes are relatively low compared to conventional seafood.

Consumer prices of certified sustainable frozen seafood products in a few different European online retail shops are presented below to give you an impression of the price levels.

Table 1: Consumer prices of sustainable seafood in European retailers

|

Country |

Online retailer |

Product |

Price (€/kg) |

|

Netherlands |

Albert Heijn |

Raw peeled shrimp, 225 gr |

31.96 |

|

|

Albert Heijn |

Cooked peeled shrimp, 100 gr |

35.90 |

|

Switzerland |

Coop |

Naturaplan Organic Sea Bream |

36.00 |

|

Switzerland |

Coop |

Naturaplan Organic Salmon Fillet with Skin, 150 gr. |

49.50 |

|

Germany |

REWE |

Followfish Bio-Lachs-Filets, 200g. |

45.00 |

|

|

REWE |

Followfish Organic Black Tiger Prawns peeled, 256g |

39.02 |

|

France |

Intermarche |

Frozen cooked peeled shrimp, 200 gr |

34.90 |

|

|

Intermarche |

Fresh cooked peeled shrimp, 100 gr |

37.40 |

Source: Seafood TIP (2021)

Prices in the end market for organic products are always higher than for conventional seafood items or for sustainably certified products (Table 2). The main drivers behind these higher prices are the extra costs involved in the production process. Since competition in the market is lower, there is less focus on offering the lowest prices. As an exporter, this means that if you are able to enter the organic seafood market in Europe successfully, you are able to sell your products at a premium price.

On the market side, costs are also higher. As the volumes are relatively low, there are higher costs involved for distribution and sales. On the consumer side, the willingness of consumers to pay price premiums for organic seafood mainly depends on consumer preferences, availability of substitutes, consumer knowledge, and the ability of consumers to distinguish between organic and non-organic seafood.

Table 2: Consumer prices of certified and non-certified organic seafood

|

Product |

Price (€/kg) |

Organic certification? |

|

Cooked peeled shrimp, 100 gr |

35.90 |

Yes |

|

Cooked peeled shrimp, 100 gr (ASC) |

26.90 |

No |

|

Frozen Pangasius Fillets, 400 gr |

23.30 |

Yes |

|

Frozen Pangasius Fillets, 900 gr |

11.10 |

No |

Source: Seafood TIP (2021)

The table above illustrates the price differences between organic and non-organic products in retail. For shrimp, the price difference is 33% while for pangasius the difference is 110%. While the difference seems very large, it should be noted that package sizes usually ‘hide’ some of these large price differences. For example, the frozen organic pangasius fillets are offered in a 400-gram box, while the non-organic pangasius is sold in a 900-gram box. Both have a consumer price of €9.95 so the actual price difference becomes less obvious.

The study has been carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Search

Enter search terms to find market research