Tips for doing business with European buyers in the fish and seafood sector

Building trust is very important in creating and maintaining successful long-term business partnerships with Europeans. Communicating transparently, behaving professionally and delivering on your promises encourage trust, and helps your business. The COVID-19 pandemic means that physical contact, traveling and visiting your European buyers has become more difficult, so we are also providing tips on how to successfully increase your visibility online. It is not a guarantee that you will have successful business relationships with European buyers, but the tips will help to make relationships go smoothly and give you a competitive advantage.

Contents of this page

- Deal with European buyers professionally, both in writing and in person

- Online meetings

- Consolidation trend in Europe

- Be transparent to build long-term partnerships

- Be clear when negotiating prices and specifications

- Organise your samples to make more successful sales

- When meeting buyer requirements, have the right certifications in place

- Add your unique selling points to sales pitches and marketing materials

- Invest in online marketing to promote company qualities

- Check out online trade fairs and webinars

- Stay up to date on European market developments

- Governmental and non-governmental agencies can help you do successful business in Europe

1. Deal with European buyers professionally, both in writing and in person

In general, the European seafood sector is a conservative sector, which appreciates formal communication. For example, they prefer to use last names rather than first names if you do not know the person yet. Most communication about offers, negotiations and purchase orders is done by email. Written communication is preferred, especially as it makes sure that terms, prices and orders are documented, protecting both parties by creating a permanent record. With everything in writing, there is also no additional negotiation once things are finalised.

To make first contact with the company, it is recommended to use a formal email directed to the purchase manager of the company, with a short introduction about your company and your reason for reaching out. As purchase managers have little time and receive a lot of emails, try to keep the email short and to the point, and mention the purpose of your email in the subject line as well as in the first paragraph of your email.

It is wise to include a short company introduction and an introduction to your product. Also include a presentation, in digital form, attached to the email to provide additional information. Keeping the email short and to the point increases the chances that the purchase manager will read it and be interested. Not every buyer will want a price list, and a quotation cannot be given until you know the specifications and quantities that your buyer requires.

If first contact is established through an email, a follow-up meeting face-to-face is always preferred by European buyers before business is finalised. These face-to-face meetings can be organised at trade fairs, company visits (you can visit them or they you), or any other location or time to which both parties can commit.

The most efficient way of having these face-to-face meetings is by organising a company visit, where you go and meet your potential buyer at their offices or factories. These visits are not usually agreed to until after first contact and the early commitment to work together have been made. Buyers may also want to visit your factories before deals are finalised.

Personal connections build trust between the parties and increases the chance for you to become a preferred supplier for that company.

If you do meet the company face-to-face, make sure to bring your business cards and printed information about your company. This way, you make sure after the meeting is over that you leave something physical behind which purchase managers can look at to be reminded of your company.

For the meeting itself, try to create a presentation about your company which is personalised for the company that you are meeting. Include their logo in the presentation and really do your research in which of your products the company might be interested. Make sure not to make the presentation too long, with a maximum of 10 slides and 15 minutes. Make sure to leave enough time during your meeting really to get to know the company, the purchase manager and the opportunities.

Where bringing gifts to business meetings is necessary in other countries, buyers in Europe will appreciate a gift but definitely will not see it as a necessity to do business with you.

Apart from the general tips of communication, it is important first to understand that the business culture can differ between Northern European countries (the Netherlands, Belgium, Germany) and Southern European countries (France, Spain, Portugal, Italy).

The main difference is that the common language in which you can communicate is English in Northern Europe, while companies in Southern Europe highly appreciate being spoken to in their own language (such as French in France and Spanish in Spain), though you can get away with English. This fact does not only hold for the written communication in the email but also for the information (brochure, presentation) that you might share with a company.

2. Online meetings

Due to the travel restrictions because of COVID-19, meeting face to face has become difficult, if not impossible. This means that it is a good idea to organise online meetings via Zoom or Skype, or to make WhatsApp calls. Consider the time difference with your client or buyer and set up a time that would work for both parties.

Building trust online may be challenging, but making a good first impression matters. In these formal online meetings, make sure to be on time for the actual meeting. Sign in or log in five to ten minutes earlier in order to check if all connections are stable and successful. Being prompt and making sure that you have a stable internet connection during the meeting is valued by European buyers.

While it is not a must to wear formal clothing, make sure you look presentable with a neat background. Try to minimise the noise during the meeting.

If you have an online presentation, make sure that the file is ready for sharing, and that it is clear and easy to follow. Practise giving the presentation before the meeting takes place, to make sure that you know all about the slides. To increase the success rate of communication with a company, it might be worthwhile to invest in a good translation of your promotional material and to increase outreach and marketing efforts so that your company gets more visible. It is also a good idea to take notes during the presentation in case your buyer gives additional information or has any requests.

Before the meeting ends, try to summarise what has been discussed. If possible and necessary, discuss when the next online meeting will take place.

3. Consolidation trend in Europe

It is also important to realise that there has been a general trend of consolidation in the European seafood sector over the past years. This consolidation means that smaller importers are being taken over by larger companies in the sector.

In the past, a smaller supplier would have dealt with smaller importers which specialise in a few specific products and which are generally easier to approach. Now, especially in the Northern European countries, a small supplier may deal with larger companies with a broad assortment. These companies are generally harder to approach than a small company. Our trends study goes into more detail on what this trend means for you and your business.

Examples of these larger companies are Seafood Connection and Heiploeg in Northern Europe, and Brasmar in Southern Europe. Targeting the larger companies, you might need to make some extra efforts in order to stand out, while you might get easier contact if you start with a smaller importer.

Tips:

- Keep your written communication short and to the point; make sure that the purpose for which you are reaching out becomes clear in the first paragraph.

- Especially for companies in Southern Europe, try to communicate in the native language of the company/person to which you are reaching out, if possible.

- Try to personalise the communication wherever you can: rather than sending an email to the general info@... email address on the website of the company, try to do some research to find out the name of the purchase manager of the company and direct your first email to them personally. You could search on the company website, search for the company name with the title “Purchase manager” in an internet search engine or search on LinkedIn.

- See the tip about selling points to include in sales pitches and marketing materials, later in this module, for more specific tips on what to focus on for your marketing materials.

- Whenever possible, use mutual connections, references and recommendations to create trust at the beginning of your dealings with European buyers, and encourage them to enter into negotiations with you.

4. Be transparent to build long-term partnerships

While a good first impression and high-quality samples are key to a successful sales process, it is actually how you follow up on this first phase that will determine whether you will work with a European buyer in the long term. It is important to realise that European buyers highly value trust in a business relationship. Part of this trust is established by high-quality products and professional facilities, but it is important to realise that one thing is of the utmost importance in gaining and keeping this trust: open and honest communication.

Many of your buyers will resell your product to other companies, especially in retail. Delays in product delivery will mean possible penalties for your buyer from their customers for failures in their supply chains and wrong labelling can cause recalls from the retail stores. Your buyer will be responsible for covering this cost. If the issue is caused by something that you can control, they may require you to pay. If the issue is caused by something that you cannot control but you are not upfront, you risk losing their trust and your continued business partnership.

Communicating early and honestly (which means right at the moment that you become aware of a problem or delay), and discussing alternatives with your buyer will be highly valued and seen as professional, as it leaves them time to look for a possible solution. Good communication at all times will show your buyer that they can depend on you when problems arise and makes you a reliable long-term partner.

Tips:

- Communicate early and clearly on delays and problems (delay in production, different sizes, smaller catch, delay in loading the container and so on).

- Do not make promises that you cannot keep.

- Deliver the product as agreed in your written contracts with your buyer.

5. Be clear when negotiating prices and specifications

The most important when making an offer to European buyers is asking how they would like to receive the quotation. They might want you to deliver them a weekly price list, if it concerns more commodity products, or they might prefer to receive personalised offers on specific specifications. Getting that information clear in the first conversations makes it easier to work with them.

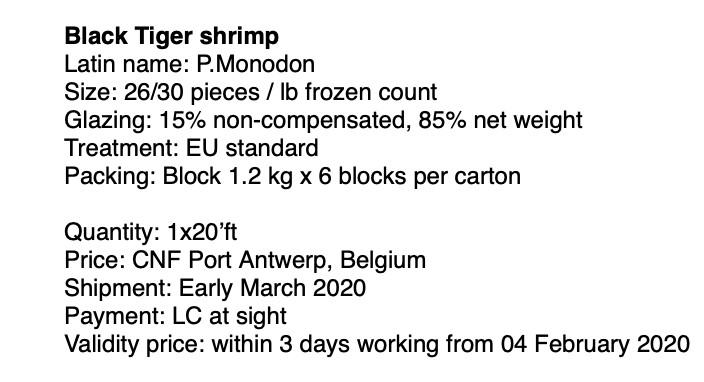

In general, European buyers like clean, clear and well-structured offers in dollars and kilograms. It is important to describe the product that you are offering in as much detail as possible, so both you and the buyer are clear about the exact product in the negotiation phase that will come after the offer, and no discussion or misinterpretation will interfere later in the process. As mentioned earlier, having these discussions in writing protects both parties.

Of course, it depends on the type of product that you are offering, but it is generally recommended that you include the following details in an offer:

- Latin/scientific name of the product;

- Size of the product;

- Specification (for example, freezing technique, % of glazing (check whether it is compensated or non-compensated glazing), % of added water, treatment, specific trim of a fillet or specific peeling if it is a shrimp);

- Type of packaging (bulk boxes, blocks, retail bags).

Figure 1: Offer of Black Tiger shrimp

Figure 2: Offer of frozen Red Tilapia fillets

If possible, include a picture of a reference product so it is clear what the product looks like.

In order to avoid miscommunication on the calculation of the glazing, it is important to ask your customer how they would like to receive the offer. If they say that they want to get the offer based on compensated glazing, they mean that they want to receive an offer for 100% net weight of the product and the glazing is not calculated in the price. An offer based on non-compensated glazing means that the percentage of glazing is calculated in the price. For example, if the product carries 10% non-compensated glazing, the price that you offer will be for 90% net weight.

The prices with which most European buyers work are net weight prices. However, as this procedure might of course be different per buyer, it is also very important to discuss with each individual buyer. If you are working with a general price list that you send to more than 1 individual buyer, it is recommended to use net weight prices.

What is included in the price-setting depends on which Incoterms you agree with the buyer. For example, a Free on Board (FOB) price will not include the shipping and insurance cost, which will be paid for by the buyer. With cost, insurance and freight (CIF), which is often preferred by the buyer, the shipment and insurance costs will be on you and therefore will be reflected in the price. More details on the different Incoterm options and insurance can be found in our report on Tips for organising your fish and seafood export to Europe.

As for margins, it is important to take into account that the margin of a product depends on the product which you are offering. Are you offering a commodity product that is widely available in the market? If so, the margins that you can expect will be lower than if you are dealing with a niche product or a product of much higher quality than commonly available. Generally speaking, exporters can expect no more than a 10% profit margin on their products, with lower-value species at times getting much less.

As for discounts, it is important to realise that giving a discount is generally not to be taken lightly and you should go about giving discounts carefully. The same as with margins, how much discount you give depends on the type of products that you are selling. Immediately giving a buyer a discount or giving too much discount devalues your product offering and gives you a certain “low-quality” image, which is not something for which you should aim. Discounts can, however, be a good tool to encourage buyers to commit.

For example, if you have a certain size that you would like to sell to a buyer but the buyer is actually looking for a slightly different size, giving a discount might be a good incentive for them to take your product. In general, when looking for a win-win promotion that benefits both you and the European buyer, giving them a discount when they commit to several orders over a period of time often works.

Tips:

- Determine at an early stage of contact with the buyer how they would like to receive an offer and on which Incoterms.

- Give as many details as possible on the product in the quotation to avoid miscommunication later in the negotiation.

- Be careful with giving discounts, as it might devalue your product.

- Professional service and communication are highly valued by European buyers, and can give you an advantage over your competitors.

6. Organise your samples to make more successful sales

In doing business with European buyers, it is a common practice for them to request samples of the products that they are interested in buying from you. The quality and presentation of these samples are key for them to check whether you can meet their quality requirements and product specifications. Investing time in making good samples, and in their presentation, can therefore really make or break a deal with a European buyer.

After you have established the specifications for which the European buyer would like to see samples, make sure to dedicate time ensuring that the product is not only produced in the right way but also packaged in the right way. Arrange high-quality samples, as the samples will determine the buyers’ final decision of whether to go into business with you or not. Use high-quality packaging to transport the samples to the buyer to ensure that the samples arrive in the best condition in Europe.

Once you have prepared the sample, it is important not to take arranging transport lightly, as it might be the most difficult part of arranging the delivery of your samples. Sending samples requires you to arrange the correct labelling of the box, as well as the accompanying documents which ensure that the sample is cleared at European customs when it arrives. Due to the logistical difficulties because of the COVID-19 pandemic, remember that you might have to deal with delays in shipping and border checks, and with security measures in the country of destination.

Tips:

- Ask both your transport company and the receiving buyer about the documents and correct labelling (as well as the amounts of dry ice and other considerations) which need to be arranged in sending the samples and ensuring a smooth clearance at customs. A delay at customs will easily take a few hours, which could influence the quality of the samples.

- Focus on packing each sample in an individual transparent sealed bag with header cards that are labelled with all the information which you would normally put on the label of the product itself.

- If the specification that the buyer requires is a retail bag, it might be a good idea already to pack the product in a sample bag which you would like to use for sale in supermarkets. This approach will show them that you are willing to go the extra mile.

- Make sure that you pack enough pieces of each specification which they would like to see.

- Polystyrene boxes with dry ice, to keep products in good condition until they arrive, are commonly used and the dry ice often needs to be labelled with special pictograms on the box.

7. When meeting buyer requirements, have the right certifications in place

It is important to take into account the requirements that buyers will expect you to meet before you can start supplying them. European buyers will require certifications for all of their sustainability, origin and food safety requirements, as well as other certifiable claims that you might make. Food safety certifications (such as HACCP), compliance (IFS), sustainability (MSC and ASC) and social (BSCI) certificates are a hard requirement for doing business, and having them in line will be essential to reaching some markets.

At the time of writing, European buyers have not added requirements related to COVID-19 (such as nucleic acid testing of seafood imports by China). Unlike China, which imposed strict biosecurity on seafood imports, generally speaking, Europe does not associate COVID-19 with food safety issues.

Even though the buyer will conduct their own checks on the quality of your products and the requested specification, third-party certifications will be essential. Remember, certifications serve to provide the end-consumer with confidence that someone is watching, checking and agreeing that the product is made in the way that the company says. If the end-user will not buy the product, the buyer will not need it.

The certifications are particularly important to the retail sector of Northwestern Europe, but more companies are now demanding more certifications.

Tips:

- Read the CBI buyer requirements study to find out more about certification – you need to understand this aspect to be successful doing business in Europe.

- Find out early in the contact with your customer if they require certifications before you can supply products to them and, if so, which.

- If you are working with more than 1 target client, try to choose the most commonly requested certifications. Be sure that you invest in the right certifications to avoid having to invest in another certification at a later stage.

- Once you have figured out which certifications you need, consult with a local certification body in your country to find out the requirements with which you need to comply to pass the audit. Most international accredited certification bodies such as Société Générale de Surveillance (SGS), Control Union and Bureau Veritas have local offices that you can contact for help.

- For some certifications, it is possible to start off with a “gap” analysis, which will give you insight into what you need to improve to be able to pass an audit for that certain certification. This insight will give you a clear picture of where to invest and will also give you a timeline to communicate with your potential buyer how long it will take you to start delivering to them.

8. Add your unique selling points to sales pitches and marketing materials

To be successful selling to European buyers, it is important to think about which unique selling points (USP) of your product or company will appeal to them. Use those USPs in your sales pitches and marketing materials.

The way that you manage your company, unique features of your product (such as colour or texture), the fact that your company is family-run, or the way in which you farm or catch your seafood product are all examples of USPs that can attract European buyers. Other examples of unique selling points are experience, transparency and traceability, sustainability and storytelling about the origin of your product. Below, we share some examples that generally appeal to European buyers and some examples of things not to do.

Note that using the cheapest/lowest price as a unique selling point will not be a strong selling point for your product. While a competitive price is of course one of the features that a European buyer or any buyer will consider, it is unwise to use it as your only USP. While you might not realise it, using the cheapest price as your only USP might tell the buyer that your product is of lower quality. It is smarter to focus on price later in the negotiations.

Experience

If your company has already been in business for a long time, you have a family-run business that has been in the family for many generations or you have a management team with a long history and a strong reputation in the industry, they are definitely unique selling points that you could use. They point out your experience and proven track record in the business, encouraging trust among potential European buyers.

Also point out the countries to which you are already exporting, emphasising the companies with which you have already been doing business. Even if these companies are not European, they provide evidence proving your experience. In the end, proven experience and/or a proven track record increase the trust which a buyer has that you can deliver the products as agreed. This way, they will be more easily convinced to go into business with you.

Transparency and traceability

A unique selling point for which European buyers are definitely looking in a supplier is the transparency in the supply chain and the complete traceability of your product from the farm/catch level to the final product. If you are able to provide this information, you should definitely emphasise it in your sales pitch and marketing materials. For European buyers, full traceability and transparency mean that documentation on all the steps of the supply chain is available, and that you are open and transparent in your communication about your company.

Traceability has become a unique selling point for some seafood products, as it allows buyers to check the supply chain of your product from ‘sea to table’ (for wild-caught products) or from ‘farm to fork’ (for aquaculture products). An example of these traceability efforts is John West’s Trace Your Plate initiative. This allows consumers to discover where their fish came from. These tracking methods are available online, which allows consumers around the globe to easily check the history and origin of their seafood products.

Sustainability

In the European market, proven sustainable fishing or farming and processing practices with regard to the environment and society will certainly be a good selling point that improves your chances with European buyers. It is, however, not enough only to tell them that you are engaging in sustainable practices and how. European buyers, especially in the north-western European markets, will prefer and even require you to have sustainability certification. They prefer you to have MSC certification for wild catch or ASC certification for farmed products.

Even if you cannot yet obtain sustainability certification, but you are engaging in sustainable practices, it is always worthwhile to mention them as a unique selling point. Sustainable practices will make clear to potential buyers that you are working towards being certified. An example of a sustainable practice could be the replanting of mangroves around your farm for aquaculture or engaging in stock management practices for wild catch.

In the retail market, particularly in north-western Europe but increasingly elsewhere, a sustainability certification is no longer a unique selling point but rather a market entry requirement.

Storytelling for your product using origin or production method

Related to the unique selling points, a trend of which to be aware in the European market is the trend of storytelling. Storytelling can be explained as increasing the value of a product by using and telling the unique story behind the origin or production of the product.

European buyers, especially those in Northern Europe, are increasingly looking for ways to increase the value of the product in the market. If your country has a good reputation in producing your product, use it. Underline the sustainability and quality of the product by telling the story about how or where it is produced.

By using images such as the beautiful nature of the country, or smiling people working in your company or on your farms, you can encourage the consumers to relate the positive features to your product. Making people aware of the origin of your product and telling the story can positively contribute to the image of a high-quality product with a good natural and sustainable image, particularly if your product is in its final form in the retail market.

Figure 3: New retail product line for shrimp from Klaas Puul (now part of Sykes UK)

Source: Undercurrent (2019)

An example is Dutch importer Klaas Puul, who worked with its Guatemalan supplier of shrimp in telling the story of the origin of the shrimp by using pictures of nature and iconic images, such as a volcano in Guatemala. On the packaging, they communicate where the shrimps come from and how they were farmed.

Though this partnership was initiated by Klaas Puul, having a good story behind your product which you are ready to communicate will be an advantage for you as a producer. It will allow you to approach European buyers with an offer that appeals to their customers, making it easier to do business with you.

Another example is Acuamaya’s marketing campaign that uses a ninja icon to represent their products. Shrimp Ninjette is an icon created by the Guatemalan producer to communicate the origin of their products and to promote gender equality, not just in the company, but also in the shrimp industry in general.

Figure 4: Acuamaya’s Shrimp Ninjette Campaign to represent gender equality

Source: Aquamaya 2021

In the case of canned tuna brand ‘Fish Tales’, it highlights the story of sustainability of using pole-and-line tuna fishing sourced in Maldives. After its success in Europe, the brand has also debuted in the US under the brand name ‘Sea Tales’. Fish Tales packaging already includes the words ‘100% Pole and Line’. On the website, you are directed to the story of the fishermen behind the product, and will find tips and recipes for a delicious seafood meal. Highlighting the people and the story behind your product is not only a good marketing tool, it also promotes positive values which are seen as related to your product.

Figure 5: Banner on the website of Fish Tales

Tips:

- Use the unique story of your company and your country of origin in marketing your company.

- Invest in a good basic website with all the necessary information about your company. It increases not only your visibility but also the trust in your company, as you can be found online.

- Invest in good visuals on your website and marketing materials, as they represent the image of your company and the quality of your products.

- See our trends study and learn more about the importance of sustainability and certification, storytelling in marketing, and transparency and traceability. All these trends are important in the European seafood industry.

- Read the Shrimptails magazine edition on the unified marketing approach to gain insights on storytelling and how to market your products (in particular shrimp).

9. Invest in online marketing to promote company qualities

No matter how your buyer finds you, whether you meet at a trade fair, through a mutual connection or if you cold-call their offices, your buyers will search for your company online. A buyer may do so to get a better feeling for your company or to see whether your business looks professional. Make sure that you can be found, and that everything which you put online works to highlight and promote the best qualities of your company. This approach will give you an advantage over your competitors by creating trust among potential buyers and making business easier.

An online marketing presence has become even more important during the COVID-19 pandemic. It increases your visibility and helps you to communicate with your customers. Many European retailers as well as players in the food service sector have already increased their online presence. Their goal is to target not only their customers, but also their business counterparts. Use this opportunity to check out the companies that you are dealing with, as well as their customer base, in order to tailor your online marketing efforts to them.

Your online presence will be the first impression that many potential buyers will have, so make it a good one. Think about and know your company’s USPs (your unique selling points), and make sure that they are at the forefront of your online presence. These things, such as the sustainability of your supply chain or the experience of your management team, can give you an advantage over your competitors. Your team’s ability to communicate in several European languages is a strong USP, as it tells your buyer that it will be easy to communicate with you.

Invest in developing a company website and use free social media sites, such as LinkedIn, to maximise your exposure and communicate your message. Make sure that images and texts are of high quality, as they might be the first impression that you get to make on a potential buyer. Be careful to ensure that you are consistent (in terms of logo, colour, tone and message, for example) across your online platforms, which will help the company to identify you quickly, and which builds trust in the consistency and quality of your products.

Also cover information on your company, information on your sales team, information on your products and contact information. If you use pictures, make sure that they are of good quality and look professional, which will all support a professional image of your company. Try to avoid using pictures that are blurry or pictures in a production area. If you use pictures of your production area, make sure that the production area is clean and that the product looks clean.

Encourage your potential buyers to trust you by making sure that you bring the best parts of your business to their attention, which makes it easier to do business with them.

Tip:

- Read the CBI Tips on finding European fish and seafood buyers to learn more about how your online presence can support your business efforts.

10. Check out online trade fairs and webinars

Seafood shows and trade fairs are usually the meeting point of many businesses; however, since 2020, many of these were cancelled due to the global impact of the COVID-19 pandemic. Big events were banned or limited due to health risks and safety issues. Despite the cancellations, the fish and seafood industry is now finding new ways to connect and communicate through online web conferencing platforms and webinars.

To replace cancelled fish and seafood shows and conferences, many organisations are hosting webinars or virtual shows. This way, they can still provide insights into the current trends in the fish and seafood sector. CBI also held a European Fish Market webinar for developing country exporters.

The networking aspect of the fish and seafood shows is harder to reproduce. Virtual trade shows with webinars and networking features are limited. They are usually only accessible to members, or through paid access. These webinars or virtual conferences are usually announced via social media, news websites or newsletters. Examples of news websites are Intrafish, Seafood Source and Undercurrent News. As an exporter, make sure you are on social media so that you can receive notifications about announcements.

Tips:

- If you are going to participate in a webinar or a virtual trade show, consider the difference in time zones. Check if you can view the presentations later on, if you cannot be present at the live presentations.

- Your internet connection, speed and accessibility are also factors to consider when participating in a webinar. Log in 5 to 10 minutes earlier than the start of the webinar to make sure that everything is working.

- For more tips, check out the CBI news article on online seafood shows, as well as this article from ShrimpTails regarding the ‘new normal’ in seafood shows.

11. Stay up to date on European market developments

It is important to stay on top of developments in the European market for several reasons. Knowing what is going on with your potential buyer will give you an advantage, because you will know what they are looking for and in which situation they are. This information will allow you to cater your offers to current market realities. By keeping up to date with market realities, you also show your potential buyer that you are professional and serious, and that you can engage with them on the topics which they consider important.

There is a range of different sources of information that can help you to keep up to date with the European market. Industry news sources, such as Seafood Source and Undercurrent, track and report on news, trade and trends in the industry. If you are focused on shrimp, check out Seafood TIP and subscribe to the ShrimpTails magazine’s mailing list in order to get information on European and global shrimp markets, production and trends. Seafood TIP’s other products provide intelligence on the wider seafood industry.

Other sources of insight into developments in the European market:

- Seafood Importers & Processors Alliance (SIPA) – an international alliance of seafood companies focused on food safety issues and legislation. In the news section of their website, you can find valuable information on the current food safety and legislation issues on which they are working. This information is important for you to know while doing business in Europe;

- EU Fish Processors and Traders Association (AIPCE-CEP) – a joint organisation consisting of the AIPCE (EU Fish Processors and Traders Association) and the CEP (European Federation of National Organisations of Importers and Exporters of Fish). They represent the fish sector in the European Union. On their website, they publish an European Union’s Finfish study each year, which you can download for free;

- Read our market analysis for a more complete breakdown of regional consumption differences. It will help you to decide what market and country will offer you the most opportunities;

- Check our trends study to learn about the trends that will be important to your business with Europe, now and in the future.

- Read the CBI article about the impact of the COVID-19 pandemic on the European consumption pattern.

12. Governmental and non-governmental agencies can help you do successful business in Europe

In Europe, various countries have their own governmental organisation with which you can connect for support in understanding what requirements you need to start exporting to Europe. Most European countries have governmental organisations that support SMEs from developing countries.

Some examples of organisations to which you can go for support:

The European Trade Helpdesk: this organisation and their website will support you with all the need-to-know information on the European market, such as requirements with which imported goods have to comply, including label regulations, import duties, taxes and statistics on imported goods.

Centre for the Promotion of Imports from developing countries (CBI): CBI is one of the best organisations with which to connect. They have lot of market intelligence available online on a broad scope of seafood products and tips to take into account when you want to enter the EU market. They also have export coaching programmes especially focused on helping SMEs in developing countries and making them export-ready.

Make Trade Sweden: if you consider Sweden and the other Nordic countries your target market, it is wise to consult Make Trade Sweden. They support exporters from developing countries with market intelligence reports on Sweden and the Nordic markets.

Other governmental organisations in specific European countries which all have support programmes for SME companies from developing countries are the Swiss Import Promotion Programme (SIPPO), Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) and Enabel – the Belgian development agency.

Seafood TIP is a social enterprise from the Netherlands which has lots of data and contacts worldwide. These private consultants work based on an annual membership or an hourly consultancy fee. Due to their detailed knowledge, they can be a good, reliable and personalised source for exporters and importers. Seafood TIP is part of Kontali, the leading business intelligence provider in the seafood industry.

Tips:

- Before taking action, do market research on the potential of your product on the EU market and the requirements that you need to meet to export to the EU. Based on this research, you can define what support you need from the aforementioned organisations to start exporting.

- If you are a shrimp exporter, review the free online magazine ShrimpTails and subscribe to its mailing list for free in order to get timely and relevant stories related to the shrimp industry.

Read the CBI Tips for finding European fish and seafood buyers to learn more about one of the most important steps in exporting your product to Europe. Get tips on the importance of being found, where to look for European buyers and organisations that can help.

Read the CBI Tips for organising your fish and seafood exports to Europe to get useful advice on how to make exporting your products to Europe as easy as possible. Learn how best to navigate European customs and buyer requirements, as well as tips on dealing with transport and insurance.

The study has been carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Search

Enter search terms to find market research