Exporting certified sustainable seafood to Europe

To gain market access to the European seafood sector and expand your business, consider offering sustainable products. Although it is not a mandatory requirement in all markets yet, many retailers demand sustainability certifications for seafood products on their shelves – especially in Northwestern Europe. Offering certified sustainable products is key if you want your seafood products to stand out and compete on the European market.

Contents of this page

1. What is sustainable seafood?

Sustainable seafood is caught or farmed in a way that ensures that future generations can still benefit from the world’s marine resources. To understand the trend of sustainable seafood in Europe, let’s first take a look at how the sustainable seafood movement started and what sustainability certification means. We also clarify the difference between sustainable and organic seafood.

The sustainable seafood movement

The sustainable seafood movement began in the mid-1990s and encourages the consumption of sustainable seafood. This is seafood that is caught or farmed using methods that do not harm single species or ecosystems. The movement encourages consumers to ask for sustainable seafood products and in this way involves them to be part of the solution to environmental problems.

Seafood consumers are becoming more conscious of the environmental and social impact associated with seafood production. For example, key production inputs like water and energy are scarce resources. Fishing vessels or farms emit gases into the atmosphere, leading to air pollution. Furthermore, seafood producers may discharge water and sediment into the surrounding environment, leading to water and soil pollution. Unsustainable fishing and aquaculture practices can also have a negative impact on biodiversity.

At the same time, the sector can have a negative social impact, by for instance failing to provide fishermen or farmers with decent wages and working conditions. Consumers are becoming more aware of these challenges and a growing number of them are paying more attention to how food is produced, where it comes from and whether it is good for their health, for the people and for the planet.

NGOs, governments and buyers all contribute to the sustainable seafood movement in different ways. NGOs and governments have encouraged social action toward sustainable seafood through informational campaigns, which have informed consumers about the environmental issues around seafood production like overfishing and bycatch.

At the same time, organisations have developed guides that help consumers make informed decisions when purchasing seafood. For example, the UK’s Marine Conservation Society created the Good Fish Guide, which rates the sustainability of different seafood species. In the Netherlands the Good Fish Foundation created the VISwijzer which quickly and easily shows consumers how sustainable the fish they buy is.

European buyers, particularly some retailers, have contributed to this movement by making commitments to sell only sustainable seafood.

An introduction to seafood certification

Sustainability certification communicates to the consumer that your seafood has been produced in a sustainable way. Certified seafood receives an ecolabel on the end-product, which you see in the supermarket. Through this ecolabel consumers can recognise the difference between conventional seafood and sustainable seafood. The label also evokes trust as it demonstrates that an independent organisation has checked whether the seafood has been produced in a sustainable and responsible way.

In this section we give you some general information, in section 4 we take you through the process of certification.

Figure 1: Certified seafood with MSC and ASC ecolabel for sale in mainstream retail shop Spar (the Netherlands)

Source: Seafood TIP (2021)

Europe is home to the biggest concentration of certified seafood products. According to a global benchmark made by the Seafood Certification and Ratings Collaboration, 20,701 different seafood products were certified and labelled in Europe in 2019. According to GLOBALG.A.P, one of the biggest sustainability certification standards, “The assurances that certification provides will become increasingly important for access to the European market, due to ever higher expectations from government regulations and non-governmental organisations.”

Certification standards first and foremost provide assurance about sustainability at the fisheries and farm level. Fisheries standards certify fisheries (which can entail a single fisheries company with several vessels or a group of companies working together). Aquaculture standards certify farms or groups of farms.

By far the largest global certification standard for wild-caught fisheries is the Marine Stewardship Council (MSC). The Best Seafood Practices (BSP) is a recently established certification programme that assures the marketplace that wild seafood has been harvested and processed in an ethical manner. The largest 3 standards for aquaculture are the Aquaculture Stewardship Council (ASC), Best Aquaculture Practices (BAP) and GLOBALG.A.P.

Currently, the Marine Stewardship Council and Aquaculture Stewardship Council are still the 2 largest certifications for sustainable seafood in Europe. According to the Certification and Ratings Collaboration, 4.6% of global seafood production is currently MSC-certified and 0.9% is ASC-certified. However, other standards like Best Aquaculture Practices are gaining popularity in European markets. Data from BAP-certified farmers shows that about 25% of their products are sold in Europe.

The Global Sustainable Seafood Initiative (GSSI) is a public-private partnership on seafood sustainability. They developed a tool that benchmarks seafood certification schemes using the FAO Code of Conduct for Responsible Fisheries. GSSI-benchmarked certification standards are recognised by many retailers as being credible and trustworthy.

There is a gradual shift from retailers committing to selling seafood with specific ecolabels to committing to selling seafood that is certified by any GSSI-benchmarked certification standards. This provides an opportunity for other standards to increase their presence in Europe. For you, it broadens the selection of standards to consider for the certification of your facility. Though there are other seafood sustainability labels such as Friend of the Sea and various Dolphin Friendly or Dolphin Safe labels, in the remainder of this study we will focus on GSSI-benchmarked standards that are relevant to exporters from developing countries.

There are also many sustainability initiatives that are invisible to the consumer. For example, in Fisheries Improvement Projects (FIPs) different actors in the supply chain work together to improve specific fisheries. Other examples are pre-competitive collaborations between seafood companies like the Seafood Business for Ocean Stewardship. This is a collaboration between leading seafood companies seeking to lead a global transformation towards sustainable seafood production through time-bound commitments.

The difference between sustainable and organic seafood

Sometimes the word ‘sustainable’ is confused with the word ‘organic’, but they do not have the same meaning. Sustainable seafood is farmed or caught using methods that do not harm single species or ecosystems. Organic seafood is always farmed (and never caught) and the rules for producing organic seafood are more stringent than for sustainable seafood. The market for sustainable seafood in Europe is much larger than for organic seafood. On the other hand, producers tend to receive significant price premiums for organic seafood, whilst producers rarely receive price premiums for sustainable seafood. If you want to learn more about organic seafood, take a look at the CBI factsheet on exporting organic seafood to Europe.

Tips:

- Ask your customers about their sustainability certification requirements. When possible, partner with the importer and gain their support in becoming certified.

- Look at the Global Sustainable Seafood Initiative’s website to see which certification standards are currently GSSI recognised.

- If your aquaculture products are not already certified, familiarise yourself with the different certification standards for farmed seafood. For example, Aquaculture Stewardship Council shares information about the ASC standards, group certification and the ASC improver programmes and publishes a monthly ASC certification update. GLOBALG.A.P provides 5 steps to get certified, National Interpretation Guidelines and specific guidelines for if you are a smallholder producer. Best Aquaculture Practices certifies every step in the value chain and provides information on these different standards, posts testimonials so you can read about the experiences about other producers that received BAP certification and describes a timeline for the certification process.

- If your wild-caught products are not already certified, browse the Marine Stewardship Council website to help you to understand the requirements and potential for support for certification. Take a look at the MSC fishery certification guide and MSC’s capacity building programme.

2. What makes Europe an interesting market for certified sustainable seafood?

The number of certified sustainable seafood products is growing and this is no longer limited to Northwestern European markets. Consumers are increasingly interested in where their food comes from and retailers are making sustainable sourcing commitments for seafood.

The demand for certified seafood products is growing

The demand for certified seafood is growing. This was even the case in 2020 when the world was hit by the COVID-19 pandemic. Around 887,000 tonnes of MSC-certified seafood were sold on the European market, 13% more than the year before. If we look at the total products available on the market, the offer grew by 11% to reach 14,640 products. If we look at farmed fish, roughly 9,750 ASC-certified seafood products were available in Europe, which was 32% more than in 2019 (Figure 2). The offer of ASC-certified Pacific white shrimp products sold in Europe increased by 27% in 2020. The offer of ASC-certified black tiger shrimp products also increased by 19%.

Disclaimer: Please note that ASC data has been corrected for double-counting products that are sold in multiple countries. The MSC uses a different approach to product counting and a product sold in more than one market is counted once for each market.

The 2020 growth in certified products can to a certain extent be explained by the pandemic. Consumers that normally eat seafood in restaurants started cooking it at home during the lockdowns. People spent money on seafood in the retail sector, which is the main end-market for sustainable seafood. Though the foodservice sector has since re-opened, retail sales remain high, so it is likely that the demand for certified products in Europe will continue to grow.

Tip:

- Take a look at the Seafood Certification and Rating Collaboration’s Sustainable Seafood Data Tool, which provides businesses with a snapshot of how much of global seafood production is rated and certified by its members, how much is in a public Fishery Improvement Project (FIP), and how much is not yet on a path to sustainability.

European consumers are increasingly concerned about the origin of their food

Europeans are becoming more aware of the environmental and social issues associated with food production. They are getting more interested in where their food comes from. As consumers are ultimately those who buy your seafood products, it is important to track consumption trends and patterns. Let’s look at some numbers.

According to the Aquaculture Stewardship Index “Consumers are becoming more and more aware of the pressures that our food production places on the environment”. This was confirmed in a survey on consumer attitudes towards sustainable food carried out by the European Consumer Organisation in 2019, across 11 EU countries. The survey demonstrated that 47% of consumers say they pay some attention and 17% say they pay a lot of attention to the environmental impact of their food choices. Consumers most spontaneously associate “sustainable food” with “low environmental impact” (48.6%), “use of GMOs and pesticides to be avoided” (42.6%) and “local supply chains” (34.4%).

According to the 2020 European Barometer poll – carried out between 3 August and 15 September 2020 in the 27 EU Member States – Europeans primarily associate sustainable food and diets with nutrition and health. For Europeans, food is “sustainable” when it is nutritious and healthy (41%), when it has been produced with little or no use of pesticides (32%) and when it is affordable for all (29%). Nearly a quarter consider local or short supply chains (24%) as an important characteristic of sustainable food and over 1 in 5 cite the low environmental and climate impact of food (22%). Two-thirds of Europeans say that they eat a healthy and sustainable diet most of the time (56%) or always (10%).

If we zoom in on seafood, we also see that consumers are more and more interested in sustainability. To understand consumer attitudes toward sustainable seafood more specifically, in 2020, the MSC partnered with GlobeScan to conduct the third wave of a global study into consumer trends in sustainable diets and seafood consumption. In Europe, climate change was considered the most concerning environmental issue and the health of oceans and decline in fish populations ranked number 6.

However, in Spain, Sweden and France the perceived importance of ocean health was second to climate change, suggesting that this issue is particularly important for consumers in those countries. Two-thirds of consumers agree that in order to save the ocean, we have to consume fish only from sustainable sources and 30% of seafood consumers in Europe think that their favourite fish species will not be available to eat 20 years from now.

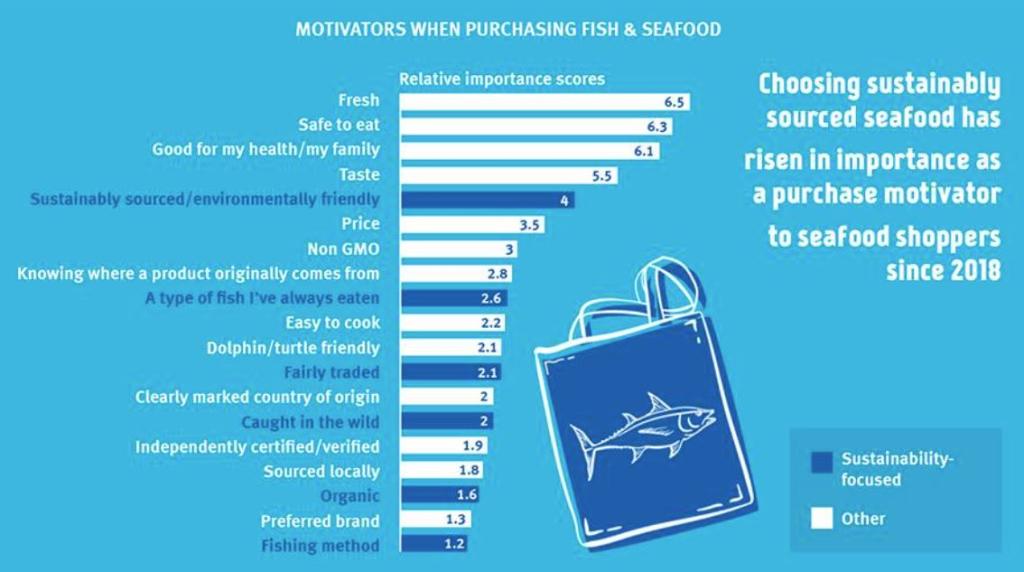

A quarter of surveyed consumers switched to a brand or product that says it helps protect the oceans/fish, and 16% changed the species of fish they bought. Nearly three-quarters of consumers agree that claims about sustainability should be labelled by an independent organisation while just under half say they notice ecolabels. When asked what the most important drivers are for buying seafood, whether or not seafood is sustainably sourced was more important to consumers than the price of seafood (Figure 3). In 2020, 70% of consumers said they want to reduce their environmental impact, which is 8% more than in 2019.

Figure 3: Top drivers of purchasing seafood for consumers

Source: Marine Stewardship Council

The more European citizens become aware of the environmental issues associated with their seafood, the more likely they will require the seafood they consume to be sustainably produced. However, it is important to know that the 2020 European Barometer poll also showed that EU citizens consider that they themselves only have a secondary role in making our food systems sustainable and place greater reliance on other actors to do so.

Food producers and manufacturers are seen as key actors in making the food system sustainable, ranking above public authorities. When respondents were asked which actors they think have a role to play in making our food system sustainable, two-thirds say they think producers (65%) have this role, and nearly 6 in 10 say they believe food manufacturers (58%) have this role. Almost half of the respondents say they think national governments (47%) have a role to play in making our food system sustainable, and more than 4 in 10 say they think consumers (43%) play a role too. This indicates that perhaps European consumers do not see themselves as driving change toward sustainable food. It is no coincidence that it is often said that it is the retail sector that has driven the sustainable seafood movement and not necessarily consumers.

Tips:

- Watch the webinar on the rise of the conscious consumer in Europe on MSC’s website to learn more about consumer trends in sustainable diets and seafood consumption and how the COVID pandemic affected the public sustainability agenda in Europe.

- Read the EU’s Barometer report ‘Making our food fit for the future – Citizens’ expectations’ to better understand what factors influence European consumers’ food buying and eating habits, what they believe constitutes ‘sustainability’ and assesses what would help them adopt a healthy, sustainable diet. Keep in mind this Barometer does not just focus on seafood, so outcomes would likely have been different if the focus of the questions had been seafood.

European retailers drive sustainable seafood

Although consumer awareness played a role, the growth of certified seafood is mainly due to the commitment of international retail groups. According to BAP: “Certification is used by many retailers, foodservice and seafood companies in Europe to evidence that sourcing is conducted in a responsible fashion.” As sustainability is becoming a more and more important requirement for European retailers when sourcing seafood, you need to start thinking about how you can meet this requirement with your product portfolio. Offering certified sustainable certified products ensures that you meet buyer requirements and more importantly, it gives you a competitive advantage over other suppliers that only offer conventional, uncertified products.

The sustainable sourcing commitments that specific retailers make are expected to have a knock-on effect and increase the overall demand for certified products. Other retailers that do not yet offer sustainable seafood, processors that supply to retailers and companies that prepare seafood for sale in supermarkets will be forced to offer certified products to remain competitive. This means that if you wish to sell your products to these buyers in the long run, you need to be able to offer sustainably produced seafood. Since every retailer has distinct sourcing commitments, it is important you find out the specific requirements of your buyer before you invest in sustainability.

There are many examples of sustainable seafood sourcing commitments amongst European retailers, all with slightly different approaches. Waitrose & Partners, a brand of British supermarkets, claims that all their seafood is responsibly farmed and caught according to seafood certification standards and RSPCA. Tesco PLC’s approach to responsible sourcing means working with the Sustainable Fisheries Partnership to work with suppliers on any improvements that are needed, often through Fishery Improvement Projects.

Some European retailers like Colruyt Group still make commitments to sourcing only ASC and MSC-certified seafood. However, there is a shift toward sourcing seafood with GSSI-benchmarked certification. Ahold Delhaize, Europe’s fourth-biggest retailer, has made a sourcing commitment to buy seafood with certifications benchmarked by the GSSI. Similarly, major British multinational retailer Marks & Spencer (M&S) claims that 90% of wild-caught fish and shellfish for M&S products comes from a GSSI-recognised third party certified source.

Tips:

- Read more about how retailers make commitments for selling sustainable seafood in the CBI study on what trends pose opportunities or threats to the European seafood market.

- Since every retailer has distinct sourcing commitments, it is important you find out the specific requirements of your buyer before you invest in sustainability. Familiarise yourself with the specific commitments European retailers make in terms of sustainable seafood, based on where your buyers are located.

Which European regions offer the most opportunities for sustainable seafood?

For a long time, the trend of retailers making commitments to sustainable seafood was limited to Northwestern Europe and the Nordic countries. Now sustainable seafood is also on the rise in Southern and Eastern Europe. According to ASC, “Europe is a large and diverse market, of course. Some countries like the Netherlands already have a very high awareness and availability of certified products, but other markets, in Southern Europe especially, are just starting to grow in this regard and represent a real opportunity for responsible producers.”

Northwestern Europe

Northwestern Europe is still your biggest market for sustainable seafood. Most retailers demand sustainability certification, so your target market for sustainable seafood in this region is the retail sector.

Results from the 2020 European Barometer poll demonstrate that consumers from Northwestern Europe find low environmental impact an important characteristic of sustainable food. When asked what they consider to be the most important characteristics of ‘sustainable’ food, ‘Low environmental or climate impact’ is the most mentioned answer in 3 countries – the Netherlands (51%), Ireland (34%) and Denmark (33%), and the second-most common response in Sweden (42%) and Belgium (27%). High animal welfare standards is the most popular answer among respondents in Germany (36%), and the second or third-most mentioned answer in another 3 EU countries – Sweden (34%), Denmark (32%) and Austria (30%). Minimal packaging, little or no plastic (35%) is the most mentioned characteristic by respondents in Luxembourg (35%) and the second-most common answer in the Netherlands (31%) and Belgium (27%).

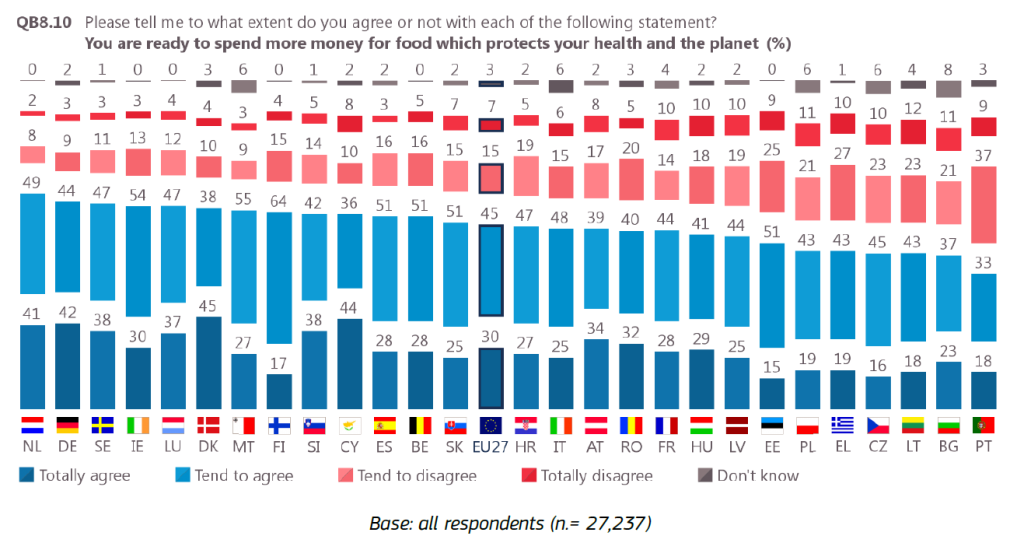

Overall, Northwestern Europeans are more willing to spend money on sustainably produced food than other European consumers (Figure 4). When asked whether they agreed with the statement ‘You are ready to spend more money for food which protects your health and the planet’, 90% of respondents in the Netherlands agreed, and 85% in Germany and Sweden agreed.

Figure 4: Results from the poll on whether respondents are ready to spend more money on food that protects their health and planet

Source: 2020 European Barometer poll

Northwestern Europe accounts for the largest share of the European sales of MSC-certified and ASC-certified fish and seafood. In 2019/2020 there were 6,260 MSC-labelled products available on the Northwestern European market, a 6% increase from the previous year (Figure 5). The biggest selection of MSC-labelled products is available in Germany, with 2,961 products on the shelves in 2019/2020. Looking at total ASC-certified products available in December 2020 per country, the total number of different products available in Northwestern Europe was 7,720, 27% more than in 2019 (Figure 6). In Northwestern Europe, the biggest selection of ASC-certified products is available in the Netherlands with 2,719 certified products on Dutch shelves in December 2020.

Disclaimer: Please note that in MSC data, a product sold in more than one market is counted once for each market.

Disclaimer: Please note that ASC data has been corrected for double-counting products that are sold in multiple countries.

Southern Europe

Southern Europeans are increasingly demanding sustainable seafood. You should monitor this trend because Southern Europe is the largest market for seafood in Europe. If more companies from the retail, foodservice and processing sectors in Southern Europe demand sustainable seafood, this could significantly increase the demand for sustainable seafood in all of Europe. Currently, only a few retailers in this region buy sustainable seafood, but their number is expected to grow. However, this region processes a lot of seafood which is re-exported for sale in the retail sector. Thus, if you sell raw material to the Southern European processing sector, be prepared for demands for sustainable seafood.

Results from the 2020 European Barometer poll indicate that Southern Europeans also pay attention to the sustainability of their food. When respondents were asked what they consider to be the most important characteristics of a sustainable diet the second most frequent response in France is: ‘What you eat is good for the planet’ (47%). In Greece, this is the third-most given answer (55%). A majority of respondents in all EU Member States agreed with the statement ‘Information on food sustainability should be compulsory on food labels’, with the highest levels of agreement found in Cyprus (98%) and Greece (97%). When asked what would help them adopt a healthy and sustainable diet, ‘Clear information on food labelling regarding a product’s environmental, health and social impacts’ is the top answer in Spain (54%).

Though Northwestern Europe is still the biggest market for sustainable seafood, the growth of MSC-certified and ASC-certified seafood sold was mainly accounted for by Southern Europe. In 2019/2020 Southern Europe had 2,890 MSC-certified products on the market, a 31% increase from the previous year (Figure 5). The number of MSC products available in France grew by 27% and the number of products available in Spain grew by 25%. Italy made the greatest strides with 49% more products on the market in 2019/2020 when compared to the previous year. The amount of ASC-certified products on offer in Southern Europe increased the most, growing 46% and reaching 2,577 products (Figure 6). The biggest Southern European market is France with 1,428 products available in December 2020.

Eastern Europe

Eastern Europe is still the smallest market for sustainable seafood as they have a preference for low-cost seafood. Results from the 2020 European Barometer poll indicate that the cost of sustainable food is an important factor limiting the demand for sustainable food in Eastern European countries. When respondents were asked what would help them adopt a healthy and sustainable diet, making healthy and sustainable food affordable was the most chosen option in Estonia (72%) and Bulgaria (66%). When asked whether respondents were ready to spend more money on food that protects their health and the planet, more than one-third in Lithuania (35%) and Estonia (34%) disagreed with this statement (Figure 4).

Although still a small market, Eastern European also expanded their offer of MSC-certified products available with 673 products on the market in 2019/2020, 13% more than the previous year (Figure 5). Meanwhile, the total number of different ASC-certified products available in Eastern Europe was 1,646, an increase of 32% when compared to 2019. This region’s biggest market for ASC products is Poland.

Tip:

- Read the CBI Market Statistics and Outlook study for a greater understanding of regional differences in their consumption and import patterns.

3. What are the trends in the market for sustainable seafood products?

The main trends in the sustainable seafood market are being able to provide traceability of your products and demonstrating the social impact and carbon footprint of your organisation. Over time these may even become basic requirements as the EU increases their focus on seafood sustainability. As consumer awareness of seafood sustainability increases, so does the demand for sustainable seafood in the foodservice sector, which means the wholesale market is a new potential market for you.

Buyers are asking for traceability

More and more European buyers are looking for suppliers that can provide traceability of their products. Traceability means being able to follow the movement of seafood along the supply chain. That way buyers can show their customers and regulatory bodies where their seafood is coming from. This is essential in Europe; the EU is making a big effort to improve seafood traceability as part of the fight against illegal fishing and irresponsible production practices.

Seafood businesses use a variety of digital technologies for traceability. Blockchain and DNA technology are 2 of the most used in the seafood sector. These technologies can be used to monitor your supply chain and digitise all this information.

If you are considering selling certified seafood, it is important to realise that providing traceability is essential. You will not find credible sustainability certification standards that do not include traceability requirements. In most sustainability certification standards, traceability is a key requirement through a Chain of Custody standard. This is a traceability and segregation standard that is applicable to the full supply chain, from a certified farm to the product carrying the logo. So, if you want to sell certified sustainable seafood, start with exploring whether your business is able to provide documentation on all steps in the supply chain.

Tips:

- Read CBI’s study on Digitalisation in the Seafood sector and the CBI Trends study to learn how other businesses use technologies like blockchain for traceability.

- To learn about how global seafood companies work on traceability together, take a look at the Global Dialogue on Seafood Traceability. This is a business-to-business platform established to develop a common framework for seafood traceability practices.

- Whether you choose to sell certified products or not, use traceability to compete with businesses that are unable to do so.

Your social impact is an essential part of seafood sustainability

The social impact of your company can be an important Unique Selling Point if you are selling to a European buyer. Making sure that your company empowers employees and takes care of the community is not only something that your buyers appreciate, it is ultimately the right thing to do.

The reason that buyers are increasingly concerned about your social impact is that concerns regarding the abuse of workers engaged in the seafood industry have recently attracted more attention from the media and civil society advocacy groups. It is also increasingly important to European consumers. Concerns range from slavery and human trafficking to fair wages. Thus, as an exporter, you should look into improving the social impact of your company. There are many ways how.

In some cases, buyers require specific standards that focus on social issues in supply chains. Find out from your buyers which standards they require. The SA8000 Standard is the world’s leading social certification programme. The BSCI provides companies with a social auditing methodology that helps them improve working conditions in their supply chain.

It is also good to know that some sustainability certification standards, like the ones discussed in this factsheet, actually include rules about social issues. For example, the ASC and Fair Trade USA include social content within their standards. The MSC requires all MSC-certified fisheries to report on the measures they have in place to mitigate the presence of forced or child labour. Seafish, the public body supporting the seafood industry in the UK, with the Global Seafood Assurances launched the Responsible Fishing Vessel Standard. This enables fishing operations to prove that they operate with decent working conditions. Be aware, however, that sustainability certifications do not necessarily replace social certifications, so always check with your buyer what they require in terms of social certification.

Your carbon footprint is becoming a priority in sustainability

As concerns about climate change grow, it will become more important to prove that you have a low carbon footprint. In a global study about consumer trends in sustainable diets and seafood consumption conducted by MSC and GlobeScan in 2020, climate change was considered the most important environmental issue.

What this trend means for you is that sustainability certification standards increasingly include rules about carbon emissions. For example, standards like ASC require farms to monitor their energy use and emissions. Therefore, if you are considering certification for your own company, take a close look at what they require in terms of carbon footprint and find out if this is feasible for you.

Being able to monitor your carbon emissions may provide your company with a competitive advantage that goes beyond requirements in certifications. European buyers are making commitments to minimise their carbon emissions and communicate about this. For example, Walmart, the world’s largest retailer with stores in the UK, targets zero emissions across all global operations by 2040 and aims to protect, manage or restore at least 50 million acres of land and one million square miles of ocean by 2030. Dutch retailer Albert Heijn announced that they have reduced their CO2 emissions by 50% per shop and they are working with suppliers and farmers to reduce carbon emissions in the supply chain.

With buyers making such commitments, this could mean increasing buyer requirements for the reduction of carbon footprints from suppliers such as yourself. As such, in the future, exporters that are able to keep track of their carbon emissions and offer clear communication on the topic might have a competitive advantage.

European Farm-to-Fork strategy increases focus on sustainable seafood

At EU level, there are serious efforts toward promoting sustainable food consumption. This might mean increasing requirements for your products and stricter controls upon entering Europe. The Farm to Fork Strategy is at the heart of the European Green Deal, which aims to make food systems fair, healthy and environmentally-friendly. The strategy focusses on sustainable food production, sustainable processing and distribution, food loss and waste prevention and sustainable food consumption.

In terms of production, this means that over time there will be more stringent rules around the way that your products are fished or farmed, the way they are processed and the way they are distributed in Europe. In terms of sustainable consumption there are already concrete plans to require origin information for certain products, setting minimum mandatory criteria for sustainable food procurement and a proposal for a sustainable food labelling framework.

Tips:

- Browse the EU’s Farm-to-Fork webpage if you are interested in reading more about the plans the EU has for the coming years.

- The EU also provides information sessions on what Farm-to-Fork means for different commodities. Keep track on the website to see whether there are any upcoming information sessions for seafood.

Demand for sustainable seafood is rising in the food service sector

The food service sector is showing more and more interest in sustainable seafood. In Northwestern Europe, restaurant chefs are increasingly becoming aware that consumers want to know where their food comes from, and that they want to make sure it is sustainable. There are even restaurants that market themselves as only selling sustainable seafood. This trend means that the wholesale market is a potential future market for sustainable products as it supplies the food service sector.

The demand for sustainable products in the food service sector is also greatly supported by the European Union through campaigns like Taste the Ocean, so it is likely to be a long-term trend.

NGOs also stimulate this trend. For example, the Netherlands-based Good Fish Foundation encourages restaurants to work exclusively with sustainable seafood. The idea is that once chefs are convinced and ask for sustainable fish and seafood, wholesalers will start to expand their offer of sustainable seafood.

A growing number of smaller fish and seafood wholesalers, like the Netherlands-based Ecoseafood and Jan van As are specialised in selling sustainable seafood.

Tips:

- Take a look at Jan van As’s Fish&Season initiative, which helps chefs adjust their menus based on which seafood is in season and offer a partner programme in which partners receive monthly procurement statistics that show how much sustainable seafood was purchased and receive personalised advice.

- Check whether your product is recommended as a responsible choice in the Good Fish Foundation’s Good Fish Guide in the Netherlands or the Marine Conservation’s Good Fish guide in the United Kingdom.

- Check out the European Commission’s Taste the Ocean social media campaign and how 9 European chefs became Sustainable Seafood Ambassadors and promote the consumption of sustainable seafood.

- Read the CBI Trends study to learn more about how the ‘Out-of-home market’ in Europe is becoming more committed to sustainable certified fish and seafood.

4. Sustainability throughout your supply chain

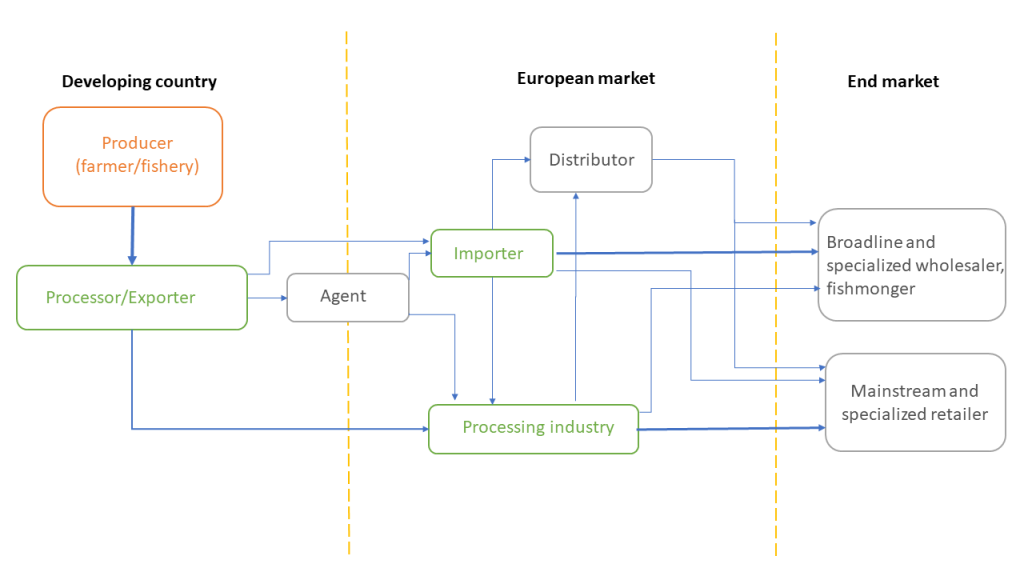

Organising sustainability throughout the seafood supply chain is not an easy task. This section explains how the certification process works. It also highlights the main end-markets for sustainable seafood and points out through which distribution channels you can bring your sustainable products to Europe.

How does the sustainability certification process work?

As there are many different seafood certification standards that all work differently, we cannot provide a step-by-step guide for your products to get certified. However, we can offer you information about the different aspects of the certification process. This way you know what to expect.

Choose a certification standard

Before applying for certification, start with assessing which certification is most relevant and beneficial to you. Then ask yourself if you will be able to meet the requirements and if you can pay the costs of certification by doing a cost-benefit analysis. Please be aware that the process of certification is time-consuming and costly and that it will take commitment.

To understand the characteristics of the GSSI-benchmarked certification standards relevant to you, we have conducted a survey amongst these standards. A compilation of responses is given in Table 1. For more details on the process of certification for the Marine Stewardship Council, Aquaculture Stewardship Council, Best Aquaculture Practices, Best Seafood Practices and GLOBALG.A.P., take a look at this overview.

Table 1: Characteristics of GSSI-benchmarked certification standards relevant to developing country exporters

|

Standard |

Do you have standards for specific species or is there a generic standard that covers multiple species? |

Is there a tool that potential applicants can use to do a gap-analysis before deciding to apply for certification? |

What are the types of costs associated with applying for certification? |

Are there fees involved in placing and using the logo on the end-product? |

How long is the process from applying to becoming certified (on average)? |

|

Marine Stewardship Council |

The MSC sets one standard for sustainable fishing. |

For fisheries, there are benchmarking and improvement tools available on the MSC website. For supply chain companies, the MSC Chain of Custody - Get Certified Guide gives a good indication of what is needed in order to go through an audit. |

Use of the MSC Standards is free, but there are audit costs as charged by independent certifiers. |

If you are using the MSC ecolabel on consumer facing products, you will also need to pay royalties based on turnover of the products. |

Fishery assessments take on average 18 months, Chain of Custody certification can often be arranged in a matter of weeks. |

|

Best Aquaculture Practices |

BAP has standards for each part of the aquaculture supply chain, |

BAP provides an online application system which has a self-assessment process. |

There is an application fee, an audit fee and a programme fee specific to each type of standard. |

There are no extra logo licensing fees for use of relevant logo on pack as these are included in the programme fees paid by each relevant facility. |

From completing an application to receiving the certificate usually takes anywhere from 5-9 |

|

Global G.A.P |

We have gathered all species specific standards to harmonise criteria and facilitate the market to have one single document that is applicable for finfish, crustaceans, molluscs and seaweed. |

All standards are free to download where applicants can perform a self-assessment on the checklist format to evaluate their status compared to the requirements. |

Use of the GGN standard is free, but there are audit costs as charged by independent certifiers. |

There is a one-time registration fee for companies using the logo and topped by a volume based fee. |

By the time that the producer has implemented all the criteria, there needs to be a minimum of 3 months of records showing GLOBALG.A.P. implementation to be ready for an audit for certification purposes. |

|

ASC |

ASC has standards for specific species. There are currently 11 farm standards covering 23 species groups, as well as a joint ASC-MSC standard for seaweed. |

ASC publishes an audit preparation checklist for each Farm Standard on the ASC website. Farmers can use the checklist to identify levels of compliance against the Standards. |

The cost (and time) of the certification audit will vary depending on the complexity and size of the company as well as the certifier’s rates and travel expenses. |

Any company applying the ASC logo on consumer-facing products is liable to pay royalties, which start at 0.5% of the net wholesale value of the ASC labelled seafood sales. During the whole supply chain of a product, royalties are only collected once. |

There are around 4 to 6 months from application to a certification decision. |

When choosing which standard is most suitable, it is important to understand that some certification programmes define one standard for multiple species, and other standards define species-specific standards. The MSC sets one standard for sustainable fishing and has some specific modifications for certain species. Similarly, GLOBALG.A.P. has defined one standard that is applicable to multiple species. BAP has a farm standard that is applicable to multiple species, but also has some species-specific farm standards. ASC has species-specific standards.

Assess the capacity of your supply chain partners

Certification standards also provide assurance about sustainable conduct in other parts of the supply chain, which means some of your supply chain partners need to be certified as well. Therefore it is important to assess whether these partners have the capacity to become certified.

To do this, it is important to understand that certification standards provide assurance in the supply chain in different ways. For example, MSC and ASC work with Chain of Custody certification. All supply chain partners that manipulate fish need to be certified against the Chain of Custody Standard to make sure no substitution is taking place. The same Chain of Custody standard is used for the MSC and ASC. Similarly, GLOBALG.A.P has a separate Chain of Custody standard. BAP, on the other hand, has standards for each part of the supply chain and therefore has a processing plant standard. They work with a star-system which indicates how many parts of the supply-chain are certified.

Prepare yourself for audits

The audit is one of the costly components of the certification process and it is important to find out whether you are able to cover these costs. One of the primary characteristics that makes people trust certification standards is that they are audited by external and therefore independent auditors referred to as the Certification Body.

The cost of the audit is always paid by the producer to the Certification Body, and this payment is made regardless of the outcome of the audit or the final certification decision. Some aquaculture standards offer options for Group Certification, so that farmers can share the costs for certification. Keep in mind that sometimes processors are willing to sponsor the certification of producers if this leads to stable supply of sustainable products.

Understand the rules for using logos

As you see in the supermarket, certified products available to the end-consumer carry a logo or a label. Some standards charge a fee for using this logo, whilst others do not. For the MSC and ASC, the companies that use the label on consumer-facing products or the license holder (generally the processor since they apply the logo to the package) must pay annual fees and royalties. For BAP there are no logo licensing fees. For GLOBALG.A.P., there are registration fees and volume-based fees for those using the label, and there are different rules for different actors along the supply chain.

Tip:

- Read a shrimp farmers guide to certification to understand the practicalities around aquaculture certification.

What are the benefits and costs associated with sustainability certification?

The main benefit of offering certified sustainable certified seafood is that you gain market access to the European retail market, while making a contribution to sustainability. At the same time, the costs of certification are high and some question the environmental impact of these certification schemes.

Let’s first take a look at some potential benefits associated with getting your supplier or your own operation certified:

- It can provide market access to European retailers.

- It leads to the production of high-quality products and differentiates your products.

- It improves the producer’s capacities and technical know-how to address production risks.

- It provides standardised products and processes across the industry.

- Some certification standards include social equity indicators such as fair labour practices and the inclusion of marginalised groups and therefore contribute to improved social practices and labour conditions throughout the industry.

- It provides a way for fishers or farmers to gain or maintain social license (or social acceptability) within the (fishing) community.

- The process of certification can lead to improvements in communication between stakeholders. For example, there are examples in which stakeholder collaboration on solving issues arising in their fishery improved thanks to the process of certification.

- It decreases the environmental impact of fishing and farming.

At the same time, it is important to note that there are some costs associated with certification and that there is some criticism the process of certification:

- The cost of certification can be high.

- There are many different certification standards and there is confusion about the difference between them.

- Many producers, particularly smallholder farmers and small-scale fisheries, struggle to comply with certification standards due to the financial, organisational, and administrative burden of getting their operation certified. As a result, they are not able to obtain certification and are thus excluded.

- Some standards are not adapted to local context, making it more difficult for producers in some regions to comply.

- Enforcing certification standards is difficult, and auditing processes have been questioned in terms of legitimacy, accountability and independence.

- Certification standards have had limited success in addressing production risks like disease or cumulative environmental risks.

Certification standards are making efforts to address some of these criticisms. For example, certification standards try to ensure legitimacy, accountability, and independence of their process by including the perspective of multiple stakeholders in the definition of their standards, by ensuring that auditing bodies remain independent and by being transparent about both their operational processes and outcomes of assessments.

Furthermore, to address one of the main criticisms – that certification standards are not accessible to smallholder farmers – certification standards have developed options for group certification. Group and cluster certification programmes were established by ASC, BAP and GLOBALG.A.P to increase the overall accessibility, compliance and impact of certification standards. If you are a smallholder farmer, then group certification with other small-scale producers could be an option for you.

Group certification enables smaller-scale producers to collectively implement requirements of standards. This allows you to share the costs and resources involved in meeting these requirements and auditing them. While the methodology allows smaller producers to collectively apply for certification, the applicable standard requirements remain the same, and every member of the group must meet these requirements to achieve certification. Note that sometimes processing plants are interested in supporting the certification of groups as this facilitates access to larger volumes of certified seafood for them.

To address cumulative environmental risks, BAP has developed the Biosecurity Area Management Standard. These are guidelines that apply to groups of cooperating farms that nurture a collective, biosecurity risk-mitigating model of good governance across a defined aquaculture area. Applicants typically comprise a group of producers or a farmer association.

Tips:

- Do not look at certifications as a means to get a premium price for your product, look at it as a market access requirement for Europe’s retail market.

- Since the cost of certification is high, the return on investment may not be high enough due to operational costs, costs associated with certification like audits, and other investments you need to make. Therefore, talk to your buyers, find out what the market is for sustainable products and do a cost-benefit analysis before you apply for sustainability certification.

- Be aware that the way group certification works, differs per certification standard. Take a good look at the group certification guidelines of the different standards (ASC, BAP and GLOBALG.A.P) to understand how their group certification programmes work.

Improvement projects as an alternative source for sustainable seafood

When talking about certification, we often see the terms Fisheries Improvement Projects (FIPs) and Aquaculture Improvement Projects (AIPs) used. These are multi-stakeholder initiatives that aim to help fisheries and aquaculture farms work toward sustainability. In general, the goal of FIPs and AIPs is to work toward getting fisheries and farms certified. They exist because in some areas the fishers and farmers are not yet able to be certified, but they are working on improving their practices. As a producer, getting involved in an FIP or AIP can help you in getting your operation certified. Being in an established FIP or AIP demonstrates progress and commitment to potential funders, supporters of credible improvement projects and to buyers.

If you are an exporter, find out from your buyers whether they demand sustainable seafood and if so, whether they only source from certified fisheries and farms, or also from FIPs and AIPs. It is important to understand what FIPs and AIPs are, because when retailers make commitments for sourcing only sustainable seafood, for some species no certified fisheries or farmers exist yet. In those cases, retailers commit to buying only from credible FIPs and AIPs. For example, in their seafood sourcing commitment, Ahold Delhaize set a target that their private label seafood product sales would be certified against an acceptable standard, from sustainable sources assessed by a credible third party, or from credible FIPs and AIPs. This means that your buyers may require the seafood they purchase from you to be either certified or in a credible FIP or AIP.

Fishery Progress is an organisation that gives you a range of information about global FIPs, from a quick snapshot of progress to detailed evidence for improvements. It is managed by FishChoice and makes tracking progress more efficient, consistent, and reliable for businesses that support FIPs. They provide an online searching tool, the FIP Directory, to search for FIPs for different species all over the world. In a similar way, the AIP Directory is a website that serves as an independent, online platform to showcase active AIPs. It was developed by Sustainable Fisheries Partnership as an open platform for information sharing for anyone active or interested in AIPs.

Certification standards also implement improvement projects to help fishers and farmers work toward certification. For example, MSC supports credible FIPs in their In-Transition to MSC programme. This programme offers fisheries independent verification of their progress and supports the progress of fisheries towards MSC certification with their fishery improvement tools. The ASC has developed the ASC Improver Programme to make their programme more accessible and to ensure that their standards are better understood by producers. Their goal is to leverage market forces by attracting producers to drive improvements in those areas where the biggest change can be achieved. BAP designed the BAP Improvers Programme (iBAP) to provide technical assistance and encouragement to aquaculture facilities interested in pursuing responsible aquaculture practices. Facilities that enrol in iBAP agree to a step-by-step, deadline-driven improvement plan, incentivising facilities to make the improvements necessary to apply for BAP certification.

Tips:

- If you are a producer and are thinking about becoming involved in an FIP, take a look at the Fishery Progress website to learn more about how FIPs work. If you are an exporter, browse their FIP Directory to locate potentially interesting fisheries to source your fish.

- Surf the AIP Directory website to understand what AIPs are and to find potential projects that produce farmed fish in AIPs.

- If you are interested in enrolling in an improvement programme led by certification standards, take a look at the various improvement programmes offered by various standards: the In-Transition to MSC, the ASC Improver Programme and the BAP Improvers Programme.

Through what channels can you get your certified seafood on the European market?

The most relevant European end market segment for sustainability certified seafood is retail. The food service sector is expected to also become a more relevant end market in the coming years. Like with conventional products, you can access the market through partnerships with retailers or importers or by going through an agent.

End markets

The largest market for sustainable seafood in Europe is the retail market (Figure 7). Sustainability certified seafood is sold in mainstream supermarkets, specialised ‘eco-friendly’ retailers such as Marqt or organic retailers such as Ekoplaza, and is even available at some discount supermarkets in Northwestern Europe.

Figure 7: End market segmentation for sustainable seafood

Source: Seafood TIP (2021)

As more and more retailers demand certified products and at the same time offer more convenient, value-added seafood products, industries that prepare dishes or portions for supermarkets also are forced to source certified seafood. As a result, more processors are demanding certified seafood to process for retail consumption.

At the same time, increasing broadline wholesales are offering sustainable seafood. In the 2018 price slump of Pacific white shrimp, Sligro, one of the largest Dutch wholesalers, requested that their shrimp supplier start supplying ASC-certified Pacific white shrimp only. This is likely to be because the prices of certified-sustainable fish and seafood came down to more or less the same level as their conventional competitors. Furthermore, restaurants sourcing only sustainable seafood are emerging, as mentioned before. So demand for certified products is also increasing amongst specialised wholesalers such as Netherlands-based Ecoseafood and Jan van As.

Finally, it is important to note that an increasing number of European fish mongers are getting sustainability certification. The Marine Stewardship Council has been working to improve their cooperation with fish mongers and in April 2021 the 24sth ASC and MSC-certified fish monger was announced (linked article is only available in Dutch).

As mentioned above, the types of end markets for sustainable certified seafood are expanding in Europe. This offers an opportunity for exporters from developing countries to offer their certified products to different end markets and expand their market reach. Thus, connecting and dealing with a European importer that has connections with various end market segments could be a good way to grow you market reach.

Figure 8: Fish specialty shop Koning in Amstelveen is the 24th ASC- and MSC-certified fishmonger in the Netherlands

Source: Marine Stewardship Council

Distribution channels

We will now look at the distribution channels of sustainable seafood. In general, those market channels are the same as for conventional products, as illustrated in the diagram below.

Figure 9: Market channels in the European sustainable seafood market

Source: Seafood TIP (2021)

Note: The thickness of the lines in the figure correlates with the amount of product moved via that route.

For all certification standards the producers (orange) must be certified. The supply chain actors that manipulate the product must obtain Chain of Custody certification (MSC, ASC, GLOBALG.A.P.) or a separate processor certification in the case of BAP (green). The supply chain actors in grey often do not need Chain of Custody certification as they usually do not have legal ownership over the products, or because the company buys pre-packed, labelled certified products that will be sold to the end consumer without being opened, re-packed or re-labelled.

However, when trading sustainable seafood, the main thing you must keep in mind are the rules that different standards define about providing assurance along the value chain. Most standards require every supply chain actor that manipulates the seafood to have a Chain of Custody certification. Alternatively, BAP has separate standards for processors. Either way, remember that if you want to trade certified seafood, your suppliers must be certified. If your facility processes the seafood, you are also generally required to obtain certification.

Mainstream importers may source their certified and non-certified products from the same supplier, if that supplier happens to produce both certified and non-certified products. However, more often they have different suppliers, in different countries, for certified and non-certified products. For example, Vietnam supplies a lot of certified shrimp to the European market.

Specialised importers and retailers are sometimes willing to invest in long-term relationships with suppliers and producers in developing countries. These companies often look for partners to make joint investments in sustainable production and are committed to make projects successful. For example, Marks & Spencer sells 2 species of tuna from the Indian Ocean; skipjack and yellowfin tuna. These are sourced from small scale fishing communities in the Maldives and Sri Lanka, with whom M&S have worked for over 2 decades. Their approved suppliers only use line-caught tuna and are committed to improving the sustainability of the fisheries. M&S has supported a collaborative Fishery Improvement Project in Sri Lanka since its inception and has also co-funded other social projects to continually support the livelihoods of fishing communities in the Maldives.

5. What are the prices for certified sustainable seafood in the European market?

In general, the prices of certified seafood are considerably higher than the prices of comparable conventional products. This is basically the result of the (initial) higher production costs of sustainable seafood and higher costs of sales and distribution, as volumes are relatively low compared to conventional seafood. Consumer prices of both certified and non-certified canned tuna in olive oil are presented below to illustrate the difference in price level between certified and non-certified seafood. As you can see, there is a difference between certified and conventional canned tuna. There is an even larger gap between conventional tuna and pole-and-line caught tuna.

Table 2: Consumer prices of certified and non-certified tuna at Dutch retailer Albert Heijn

|

Product |

Price (€/kg) |

Certification |

|

John West MSC certified canned tuna pieces in olive oil, 145g |

26.37 |

Yes |

|

John West canned tuna pieces in olive oil, 145g |

25.00 |

No |

|

Princes MSC certified canned tuna in olive oil, 145g |

14.41 |

Yes |

|

Statesman tuna pieces in olive oil, 160g |

9.94 |

No |

|

Fish Tales MSC certified Skipjack canned tuna in olive oil, 142g |

30.20 |

Yes |

Source: Seafood TIP (2021)

Consumer prices of certified sustainable frozen seafood products in a few different European online retail shops are presented below to give you an impression of the price levels in several European countries.

Table 3: Consumer prices of sustainable seafood in European retailers

|

Country |

Online retailer |

Product |

Price (€/kg) |

|

Netherlands |

Albert Heijn |

ASC certified frozen peeled shrimp, 100g in a plastic container |

26.90 |

|

Albert Heijn |

ASC certified defrosted pangasius fillets, 175g in a plastic container |

14.29 |

|

|

Switzerland |

Coop |

ASC certified cooked shrimp, 800g in a plastic bag |

30.60 |

|

Coop |

ASC certified frozen Pangasius Fillets, 900g in a plastic bag |

11.10 |

|

|

Germany |

Billa |

ASC certified frozen shrimp, 600g in a plastic bag |

16.65 |

|

Billa |

ASC certified frozen pangasius fillets, 900g in a plastic bag |

6.66 |

|

|

United Kingdom |

Waitrose & Partners |

ASC certified raw peeled king prawns, 180g in a plastic container |

28.50 |

|

Waitrose & Partners |

MSC certified defrosted yellowfin tuna steaks, 240g in a plastic container |

34.18 |

|

|

Spain |

Dia |

MSC certified frozen cooked peeled shrimp, 200g in a plastic bag |

21.45 |

|

Carrefour |

MSC certified cod fillet, 400g in a plastic bag |

11.47 |

Source: Seafood TIP (2021)

The idea behind certification is that it incentivises supplier upgrading by providing increased profits when food production standards are met. Receiving a premium price used to be cited as an opportunity associated with certification. However, producers rarely receive a price premium and if they exist at all, premiums tend to be captured at different levels in the supply chain. As such, market access seems to be a more commonly realised and identifiable economic driver for producers to seek certification.

As a producer, do not see selling sustainable seafood as a way to receive a price premium for your products, as there is no guarantee that farmers actually receive a premium price for certified products. Instead, look at it as a way to enter new and more lucrative markets.

The study was carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Search

Enter search terms to find market research