Entering the European market for fresh tuna

Tuna is 1 of the most popular fish species in Europe. There are lots of origins and end markets for fresh tuna products. To get your tuna products into Europe, your tuna must have a catch certificate, and all food safety regulations must be followed. Your end market may have some further requirements, like sustainability certifications in European retail. Get your products to the market through importers and wholesalers. They will know how to transport and sell this delicate product.

Contents of this page

1. What requirements must fresh tuna comply with to be allowed on the European market?

In order to enter the European market for fresh tuna, exporters must note that Europe has strict standards for quality, packaging and labelling. Apart from the legal and safety requirements, most buyers require a sustainability seal (such as the Marine Stewardship Council certificate). Some buyers also ask for corporate social responsibility (CSR) certificates to ensure the well-being of the fishermen or workers in the factory.

What are mandatory requirements?

Since fresh tuna is wild-caught, European buyers require the fresh tuna exported products to be free from illegal, unreported or unregulated fishing (IUU). This means that exporters must ensure that their products are not caught illegally and that they meet all the food safety standards for fresh tuna. Because fresh tuna is considered a delicate product that needs proper storage and delivery, the standards for food hygiene from the moment it is caught, stored and sold must all be met.

Catch certificates to combat illegal fishing

European countries are very strict about importing tuna that is caught through IUU fishing. The European Union requires that you can prove that your tuna products do not come from IUU fisheries. Therefore, it uses a Catch Certification Scheme, which is a must for exporting to Europe. The catch certificate contains all the information specified in the example shown in Annex 1 of the European IUU legislation.

According to the European Union, IUU fishing is any fishing that is done in forbidden areas, uses illegal methods or goes unreported. IUU fishing has a negative effect on the sustainable management of global (and local) fish stocks and creates unfair competition against those that fish legally and responsibly.

Catch certificates are not only used to check if your products come from legal fisheries and that no slave labour has been used. European countries also use this document more and more to check if your products comply with the European hygiene rules. The certification is a must for all fishing vessels.

Tips:

- Learn more about the European Union’s rules to combat illegal fishing.

- Learn about the European Union CATCH system which will eventually replace the old paper-based catch certificate system. Currently, the CATCH system is not a requirement for non-European Union countries. However, we recommend that you learn and comply with the digital system in order to ensure a smooth-flowing transaction with European buyers.

Follow label and packaging standards

Standard labelling requirements for fish and seafood must be followed to export fresh tuna to Europe. You are required to pack your tuna in safe materials and list all ingredients that have gone into the product on the packaging, including additives used for treatment like colouring and stabilisers. European customs are very strict regarding labels. It is absolutely necessary to comply with all labelling requirements in order to avoid possible rejections at the airport of a destination.

Tip:

- Find the labelling requirements in the CBI Buyer Requirements study. Make sure that you understand and follow them all.

Food safety standards must be followed

In Europe, food safety standards are very important. Products that are found to be non-compliant will be registered and reported in the Rapid Alert System for Food and Feed (RASFF). If you are on that list, your tuna will be inspected thoroughly at its destination. It is possible that samples will be taken and analysed by an external laboratory. Any irregularities can result in rejections of future shipments of your goods.

For imports into the European Union, a health certificate must accompany your fresh tuna. Ask your logistic forwarding agent about this. Hygiene and health are important to buyers. Be sure that no contaminants end up in the final product. Seafood destined for the European market is generally tested before it is shipped, sometimes in the buyer’s own lab, sometimes in recognised (independent) labs.

European Union rules regarding food hygiene cover all stages of production, processing, distribution and placing on the market for all food intended for human consumption. The standard European hygiene rules can be found in the CBI buyer requirements study.

Tips:

- Check the RASFF portal to know what kinds of products are recalled and the reasons for border rejection.

- Email all mandatory transport documents and the drafts of the health and catch certificates, as well as labels, and ask your customers if they agree with the contents before making up the final original documents.

Tuna colouring is illegal in Europe

In recent years, fraudsters have been trying to enter the European market for fresh tuna by adding red colour to the loins. In Europe, it is illegal to use any colouring in tuna, so to stay in business, you should never engage in such practices. Tuna colouring means adding red colour to mask the deterioration of freshness of the tuna. In its natural state, fresh yellowfin tuna (the most commonly consumed fresh tuna in Europe) is reddish or brownish in colour once caught, cut and prepared for distribution.

As an exporter, you should be aware that the European Commission is very concerned and active in detecting the use of colouring in tuna. Make sure to not engage in these illegal practices, no matter how tempting the financial gain may be.

In a report by the European Commission, it states that, “Not only does this fraudulent practice mislead the consumer, who is led to believe that he is buying fresh tuna, but it can also lead to serious food poisoning, since illegally treated products may contain high amounts of histamine which can cause serious allergic reactions. In the spring of 2017 more than 150 people in Spain were affected after consuming illegally treated tuna.”

Tip:

- Read this report by the European Commission on the current regulations and impact of tuna colouring in Europe.

What are additional requirements?

Consumers and buyers want proof of your sustainability standards

Consumers are becoming increasingly aware of sustainability issues and want to be sure that, in the future, their children can still eat fish and seafood. Consumers want to buy products that are sustainably produced from companies that can show that they protect the environment and the people involved with production. Sustainability certifications are the best way to show consumers that your product is sustainably sourced.

In Europe, the most widely accepted sustainability certification for wild-caught species, like tuna, is the Marine Stewardship Council (MSC) certification. Getting an MSC seal helps secure your reputation as a reliable and trustworthy exporter, making it easier to enter Europe. It is a good investment at this stage when sustainability plays an essential role in trade.

First, your country must be involved in a Fisheries Improvement Project (FIP). A FIP is the preliminary phase of obtaining MSC certification. During a FIP, which can take 6 to 7 years, the organisations involved study the actual stock of tuna, their migration flows, their maturity status and other biological parameters. The ultimate goal is to chart the exact point of fishing possibilities (catching periods and quota) without interrupting the natural habitat or lifecycle of the tuna species.

Lots of countries are currently working on a FIP: Sri Lanka, Japan, Indonesia, India, Ghana, Panamá, the Philippines, etc.

Several FIP projects are executing these studies. Some measurements which have been implemented already in many countries are the use of hand lines and purse seines instead of trawling catching systems. These ways of fishing maintain the stock and limit the impact on the ecosystem and other animals. The by-catch of dolphins and turtles, for example, decreases considerably using hand lines.

Tips:

- Read this list to find out which tuna fisheries already have MSC certification.

- Read our CBI study on opportunities and threats in the European market in order to learn more about the importance of sustainability.

- Get an audit by an accredited certification body. It can be an advantage in the business. Check the list of accredited certification bodies to see which of these could assist you.

- Check out the Sustainability Standards Map which helps small and medium-sized enterprises in developing countries develop their value chain with a focus on sustainability.

Grading

There are 5 ways of grading fresh tuna: freshness, size, colour, texture and fat content. There are some theoretical standards of grading, but in practice, each individual buyer interprets the standards in their own way. As Mr Remco Willigenburg of Dutch importer Open Seas states: ”for the best tuna, some exporters handle ‘grade A’, others ‘grade 1’, others ‘grade AAA’, others ‘grade A++++’, I prefer to see the fresh tuna myself….”

For an exporter who wants to enter the European market, it is very common to have to send the customer a sample first. In this way, the buyer can examine the fresh tuna, compare it with other suppliers, grade it according to their standards and estimate the value of the fish. Future deliveries should have the same quality as the sample, of course. All grades have their corresponding value and end markets. The higher the grade according to the marketplace, the higher the price.

Make sure you comply with your buyers’ packaging needs

Whole fresh tuna is usually packaged in polystyrene boxes. The size of the box can vary depending on the size of the tuna. Fresh tuna loins are normally packed in polystyrene boxes of 10 or 20 kilos, depending on the wishes of the customer. Moreover, tuna loins are usually packed individually and in vacuum packs. Your buyer will tell you if they prefer ice or gel packs in the boxes. Also, continuous temperature control (close to 0 ºC) is recommended.

Buyers want additional guarantees on food safety

Many European buyers want to have the guarantee that the products have been processed under controllable quality standards. Issues to keep in mind are temperature control during processing, hygiene, traceability, condition of the cold store and safety protocols, to name a few.

Usually, European importers require the exporter to have internationally known quality certifications. The most commonly requested food safety certification schemes for seafood products are International Food Standard (IFS) and British Retail Consortium (BRC).

The requirements mentioned above are not the same for all importers and wholesalers. Some might need more standards, other less. It fully depends on each specific buyer which requirements you need to comply with. It is best to speak with your customer or potential customer and try to find out every standard they need.

Tips:

- Make sure that you can provide high-quality certifications (BRC and/or IFS).

- Read CBI’s study on requirements for more details on food safety requirements of buyers.

What are the requirements for niche markets?

At the moment, only a few huge supermarkets in the Netherlands and France are asking for standards on Corporate Social Responsibility (CSR). CSR activities are worth undertaking when you export to Europe. European consumers do not only care about the environmental impact of your product, but also about its social attributes, such as workers’ rights, gender equality and human rights. Although those huge supermarkets demanding CSR certificates can still be considered a niche market for fresh tuna, it is foreseen that CSR will get more and more important in the near future.

2. Through what channels can you get fresh tuna on the European market?

Importers and wholesalers are usually the main channels to get your fresh tuna to the food service and retail segments in Europe. There are no European retailers importing fresh tuna directly from origin. Food service buyers prefer to work with local suppliers for financial or practical reasons, like the lack of knowledge of importing or dealing with relatively small volumes.

How is the end market segmented?

Fresh tuna is an important fish product for the food service segment in Europe. Lots of Asian restaurants, especially Japanese, offer tuna-based menus. To a lesser extent, fresh tuna is found in retail, as this segment principally uses defrosted tuna on their fresh counters. Fresh tuna may also be sold by fish mongers, although they also prefer defrosted tuna. The processing industry takes a small part of the fresh tuna imports, mainly for fresh ready-to-eat sushi plates.

According to a major importer of fresh tuna from overseas countries, Open Seas from Holland, about 80% of fresh tuna ends up in Japanese and other Asian restaurants. The other 20% is equally divided between other restaurants, retail and processors. The main cause of this considerable difference is the increase of the use of defrosted (‘refreshed’) tuna in these segments.

Figure 1: End-market segmentation for fresh tuna

Source: Seafood TIP (2020)

Food service

A report published by Nippon.com, a Japanese news website, stated that the number of Japanese restaurants in Europe has been expanding over the years, and an estimated 14,800 Japanese restaurants were present in Europe in 2019, an increase of more than 2,000 since 2017. Adding Korean, Chinese and Taiwanese restaurants, for example, you can imagine the importance of Asian restaurants in Europe. Fresh tuna is an important product on their menus. In Southern European countries like Italy and Spain, grilled tuna is a highly demanded fish plate in specialised fish and seafood restaurants.

Restaurants prefer good-quality red fresh tuna. Usually, they buy fresh tuna vacuum packed and cut in loins without skin and without bloodline (which turns brown even faster). It depends on the wishes of the restaurants, but each loin weighs about 2 to 4 kilogrammes, which can be cut into slices for 10 to 20 portions, or enough sushi according to the restaurant’s needs.

For food service, the ideal situation is to open and sell a fresh tuna loin in 1 day, in order to avoid the loin quickly turning brown and losing its attractiveness. Restaurants buy fresh tuna about 2 times a week to limit exposure time to 3 or 4 days. Consequently, their suppliers, importers and wholesalers buy raw material twice a week, or even more frequently.

Retail

In Southern European countries, it is normal to have open-air fresh fish counters. Fresh tuna turns brown fast in such an environment. Therefore, lots of supermarkets prefer to sell fresh tuna steaks of about 150-200 grammes in MAP packed trays with a nice attractive design. Companies like Scanfisk Seafood from Spain are specialised in this processing with sales to the retail chains. Higher-level restaurants, however, are their main customers.

To sell tuna on the fresh fish counters or in prepacked trays, there are 2 possibilities: real fresh tuna or defrosted tuna (‘refreshed’). It depends on the supermarket, but the last method is increasing quickly in acceptance. It is difficult to see the difference between a fresh and a defrosted tuna loin. Nowadays, there are several ways to keep a frozen tuna loin as red as fresh tuna. Due to logistical and commercial reasons, it is easier for supermarkets to defrost a frozen product and to sell it as ‘refreshed’.

Tips:

- Check out large retailers in your target country, for example: Carrefour in France, El Corte Inglés/Supercor in Spain, Metro in Germany or Hanos in the Netherlands.

- Go to events and exhibitions such as the Seafood Expo Global, which will be held in Barcelona, Spain (formerly in Brussels, Belgium). There, you can meet with lots of possible importers. Take advantage and visit nearby supermarkets to see their way of selling fish and seafood in general.

Through what channels can you get fresh tuna on the European market?

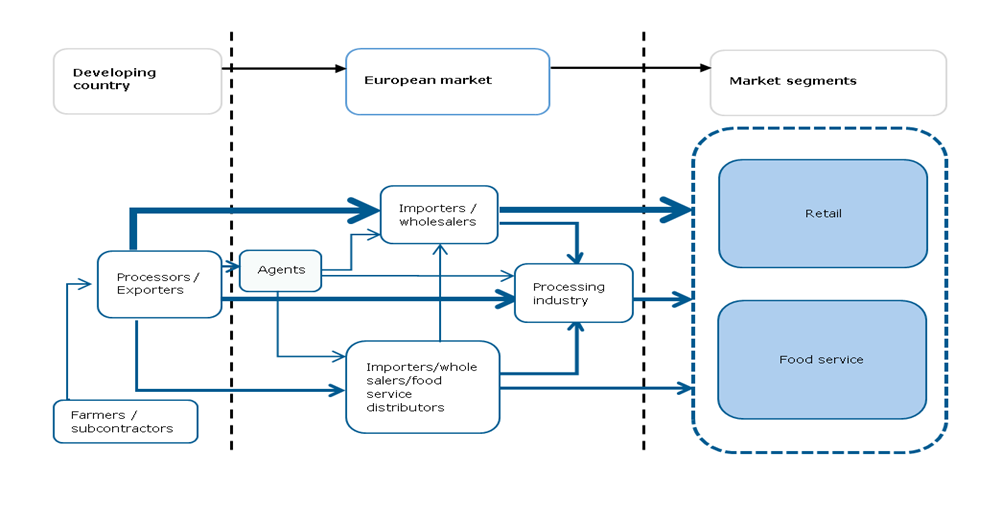

The main channels that fresh tuna goes through are importers or wholesalers. These are the most interesting channels for you, as you can also see in Figure 2. These importers and wholesalers should be able to provide access to the retail and food service sectors. A local agent could help you by giving you insights into the European market and helping you to build up your connections.

Local restaurants buy fresh tuna from local or regional suppliers. They buy the product from bigger wholesalers and importers like Open Seas. You have to focus on these regional suppliers, as they have the necessary knowledge and experience of the import of fresh fish and the daily market. Moreover, logistically, a minimum import volume per delivery of about 500 kilos (an airfreight container) is recommended.

The retail markets are usually supplied by strong suppliers with a longstanding business relationship. Retail needs just-in-time logistics (ordering today, delivery tomorrow), and commercial risks tend to be much more limited when buying from suppliers nearby instead of overseas suppliers. There are no supermarket chains that directly import fresh tuna from origin.

Figure 2: European market channels for fresh tuna

Source: Open Europa Import & Export Consultancy, 2020

What is the most interesting channel for you?

For you as an exporter, the most interesting channel is importers/wholesalers. These companies are used to importing fresh tuna, know how logistics work and have reliable customers in different segments. As they are used to working with several suppliers, they are well aware of actual market conditions, market prices and worldwide availability.

Tips:

- Consider working with a commercial agent. They will want to earn 1-2% of the turnover, but will know the market in depth and the major players for daily contacts.

- Try to reach importers which sell to both retail and food service. The COVID-19 virus made it clear that selling to multiple markets is important: the food service segment was highly impacted while retail managed well.

- Make an export marketing plan (EMP) before stepping into the European markets.

3. What competition do you face on the European fresh tuna market?

Maldives, Sri Lanka and European countries are strong competitors for export to the European fresh tuna market. Factors for exporting successfully are the necessary quality standards as mentioned in the requirements section of this study, longstanding relationships and, most of all, stable quality and availability over the years. The countries mentioned above have these factors under control.

However, according to Mr Remco Willigenburg of Dutch importer Open Seas, there is space for more suppliers to the European market. There is always demand for good, stable-quality fresh tuna with a continuous availability. The quality of your fresh tuna is usually more important than its price.

Which countries are you competing with?

Sri Lanka and Maldives are the main exporters of yellowfin tuna, as this species is very common in their waters. European producers like Spain, France and Portugal focus on bluefin, skipjack and albacore tuna, abundant in the nearby Atlantic Ocean and Mediterranean Sea.

Maldives

Maldives is the number 1 non-European exporter of fresh yellowfin tuna to Europe, with 1,203 tonnes in 2019. This country is blessed with many natural resources, which form the basis of its economic development. Fishing and tourism are the main sectors of the country. The tuna business is highly important. Unfortunately, as with lots of islands, Maldives encounters various challenges and threats, such as environmental disasters and communication and service delivery problems. Consequently, exports of fresh tuna from Maldives can sometimes be complicated.

Europe mainly imports fresh yellowfin tuna from Maldives. The companies there have reasonable processing plants with experience in cutting fresh tuna and longstanding relationships with European customers. The logistics by air to Europe have a stopover in Arab transport hubs, like Dubai (United Arab Emirates) and Doha (Qatar). These hubs have professional perishable centres that can manage fresh fish despite the extreme temperatures outside.

Sri Lanka

Sri Lanka is the number 2 supplier of fresh yellowfin tuna to Europe, with 1,038 tonnes in 2019. It is a competitor to watch out for, as its exports steadily grew from 172 tonnes in 2016 to 1,038 tonnes in 2019. The waters of the Indian Ocean (FAO 51 and 57) are clean and of good ecological health. Due to a European Union import ban on Sri Lanka’s seafood in 2015, the country saw the necessity in 2017 to secure the ecosystem and to promote sustainability of longline tuna fishing for the future. For this purpose, it started a Fishery Improvement Project (FIP), which will take until 2023. After the FIP, Sri Lanka exporters can obtain the MSC standards.

Exporters from Sri Lanka are experienced, own modern and adequate processing plants and have the necessary quality certifications. Their logistics are well prepared for fresh fish exports, and they have longstanding relationships with European importers.

European countries

The Atlantic Ocean and the Mediterranean Sea are well-known fishing grounds for companies from Spain, France, Portugal and Italy. Modern vessels with all necessary technological monitoring systems catch daily albacore and skipjack tunas. A big part of these catches is destined for the frozen and canned markets, but these countries have good outlets for fresh tuna as well, in both the retail and food service segments.

Spain has some companies on the Mediterranean coast which are specialised in (farmed) bluefin tuna. This species is relatively expensive and exported only to the most demanding markets willing to pay the price for it. Japan is a major importer of fresh bluefin tuna from Spain. Due to the nearby availability, the market for albacore and bluefin tuna is dominated by European fishing companies. As a non-European company, it will be difficult to compete on these species.

Tips:

- Read the Market Analysis for fresh tuna to know the dynamics in Europe’s imports of fresh tuna from European countries versus non-European countries.

- Check MSC’s website to learn more about the MSC certification for tuna.

- If you want to know how competitors from Sri Lanka, Maldives or European countries work, look for websites of those companies or visit them during a business fair.

Which companies are you competing with?

The following companies have been successful in exporting fresh yellowfin tuna from overseas countries to the European market by air. The availability of necessary quality certifications, longstanding relationships with European customers and a stable quality throughout the years are important factors of their success.

Global Seafoods Ltd (GSF)

Since 1999, GSF has been 1 of the most important fresh tuna exporters of Sri Lanka. Its modern processing facility has a capacity of about 100,000 tonnes of fish per week. It has several internationally known certifications like BRC, IFS, Friend of the Sea and SA8000. GSF is committed to CSR and sustainability. It tries to reach maximum efficiency of production and reduce waste and water resources.

GSF does not have its own boats but buys the raw material on a daily basis and only from reliable fisherfolk who have proven to have the right fresh tuna at European standards. After quality control, including histamine tests, the fresh tuna is transported to the nearby airport for shipment to Europe.

Big Fish Ltd

Big Fish is a company from Maldives that is comparable with Global Seafoods from Sri Lanka in terms of production volumes. It also has international quality standards like BRC, IFS and ISO 22000. Big Fish has even the BSCi certification proving its commitment to CSR. This company has its own landing places just a few meters from the processing plant. This shortens the time of handling the fresh tuna considerably, so it stays fresh and temperature controlled.

Big Fish does not own vessels, but it only works with reliable fisherfolk who are aware of the European standards and the corresponding handling of fresh tuna.

Oman Fisheries Company SAOG

Oman Fisheries Company SAOG (OFC) is 1 of the oldest exporters of tuna of Oman. Established in 1989, it gathered lots of longstanding business relations based on experience and knowledge. It does not have BRC or IFS but is working on HACCP. OFC encourages sustainable fishing practises and CSR. Contrary to most tuna exporters from Sri Lanka and Maldives, this company does have its own fleet of 13 fishing vessels.

Which products are you competing with?

In a wide sense, all fish and seafood products are competition of fresh tuna. In this section, we will limit ourselves to swordfish, which is the most direct competitor.

Fresh swordfish

Usually, a company offering fresh tuna also has fresh swordfish (Xiphias gladius). It can be found in the same fishing areas as yellowfin tuna. Although the colour, taste and structure are not the same as tuna, it is an important ingredient in Asian kitchens. Swordfish is also a popular fish species for the grill.

The processing of swordfish is the same as for fresh tuna. European importers prefer clean vacuum-packed loins of 2-5 kilos or even steaks of 150-250 grammes with as small a blood line as possible.

While the preference is for swordfish loins to be clean, swordfish has had issues of mislabelling. In order to distinguish swordfish from other similar species like shark and marlin, some importers want to have a part of the skin left on. With only a visual inspection, this proves that the importer is not handling endangered or illegal shark or marlin species.

4. What are the prices for fresh tuna on the European market?

The price of a product depends on many aspects. There are several factors to keep in mind. Prices can vary due to the seasonality of tuna, quality, origin, shelf life, certifications, air freight tariffs and especially the actual USD – EURO exchange. To give an idea of actual import prices, please have a look at the following schedule (prices per kilo delivered in Europe):

| Fresh tuna HG (headed and gutted) grade 1 | US$9.90 |

| Fresh tuna HG (headed and gutted) grade 2 | US$8.90 |

| Fresh tuna loins skinless bloodless grade 1 | US$14.50 |

| Fresh tuna loins skinless bloodless grade 2 | US$13.25 |

Source: Open Europa Import & Export Consultancy 2020

The price of fresh tuna can fluctuate considerably. It is a daily market matching offer and demand. You must keep the European high and low seasons in mind. During the summer (July-August) and Christmas periods, prices usually rise. Outside of these months, prices could be quite a bit lower. Also, availability of air freight can have an impact on prices.

Tips:

- Before contacting an importer, investigate the possibility of sending samples. The importer will definitely ask for these to verify grades and quality.

- Decide what is the smartest (not the cheapest) way to transport your fresh tuna without risking the quality. Transportation, handling and processing are important parts of the supply chain because they will determine the quality of your fresh tuna from origin to destination.

The price of fresh swordfish is comparable with fresh tuna.

Please review our market information disclaimer.

Search

Enter search terms to find market research