Exporting frozen organic seafood to Europe

Consumption of organic seafood continues to increase year on year, as consumers are increasingly aware about what they eat. Most organic seafood consumed in Europe comes from European farms, from outside Europe it is mainly organic shrimp. New product launches, supportive strategies of the large food retailers, and an on-going trend of increasing awareness among consumers will continue to support market growth in the next years.

Contents of this page

- Product description

- What makes Europe an interesting market for frozen organic seafood?

- What trends offer opportunities on the European market for organic seafood

- What requirements should frozen organic seafood comply with to be allowed on the European market?

- Through what channels can you get frozen organic seafood on the European market?

- What are the end market prices for frozen organic seafood?

1. Product description

This fact sheet on organic seafood in Europe covers all seafood imported in Europe as organic. Only farmed seafood that comes from organic farming is eligible for an organic certification label.

Cold water seafood species like salmon, trout, and carp are farmed and certified as organic within Europe. Imported farmed seafood from outside Europe, and from the Developing Countries in particular, includes tropical species.

The focus for this factsheet will therefore be on the products that are included in the latter group. These are certified and labelled as organic shrimp (giant tiger prawn and whiteleg shrimp), organic tilapia or organic pangasius.

Although there are trade data available for fish and seafood products, these data give not details about organic and any other origins. This means that there are no data on trade of organic fish and seafood presented in this product factsheet.

For more information about the fish and seafood market in Europe, see our studies about specific fish and seafood, for example about the European market for octopus or the European market for frozen white fish products.

Product specification

This section provides you with basic information about specifications for organic seafood products in the European Union. The basis for organic food products is organic farming, which means farming under natural circumstances with a minimum of human impact on the environment. For seafood this means, among other things:

- animal friendly aquaculture practices (for example limited stock density),

- Genetically Modified Organisms (GMO's) are not allowed,

- restricted use of chemical pesticides, fertilizers and antibiotics,

- restrictions on preservative additives, etc.

- control of fish feed (which means that the organic label can only apply to aquaculture, and not wild fish).

The organic certification is different from ASC (Aquaculture Stewardship Council) certification. ASC has a strong focus on environmental sustainability and social responsibility across the chain, and organic certification is all about natural and animal friendly production.

One example of a different requirement is the use of GMO-free fish feed. While GMO-free fish feed is a must for organic certification, this is not required for ASC certification.

Important legislations for organic seafood are the following:

- Council Regulation 834/2007 on organic production and labelling of organic products.

- Council Regulation 710/2009 with rules about the organic production of aquaculture products and seaweed.

Other relevant legislation is the renewed Common Organisation of the Market, and legislation about how to inform European consumers about seafood products.

Labelling

The contents of labelling must be provided in the language of the country your products are exported to. For organic frozen seafood that will be sold on the European market, it is obligatory to carry the European Union recognised label for organic production. The label must also include 1) a code that shows the certification body a company is licensed by and 2) the origin of ingredients (European origin /non‑European origin).

You can find more information about the European Union legislation on organic production and labelling in this implementation appraisal from the European Parliament.

Packaging

In general, packaging of organic products is not different than for conventional products. However, consumer packages, especially in the specialised organic shops, are more often made from bio-degradable products or reused paper.

In general, packaging requirements differ widely between customers and market segments. It is crucial that you discuss your customers’ preferred packaging requirements. Some general characteristics are:

- Frozen fish imported by wholesalers for further distribution to smaller traders or food service companies are mostly delivered in 10 x 1 kg bags packed in master cartons. Smaller bags are sometimes requested for smaller-size fillets. Frozen shrimps are often imported as 5 to 25 kg bulk, and also 1-5 kg block.

- Frozen fish fillets for further distribution to retail are mostly imported in polybags ranging from 500g to 1 kg. Smaller volumes are also distributed skin packed and sold at a higher price. Frozen fish fillets that go directly to retail are mostly already packed in country of origin and are imported in consumer packages. Frozen shrimps are mostly imported in cartons containing a certain amount of shrimp depending on size or weight in pieces/kg)

- In retail, fresh fish is sometimes sold over the counter. To safeguard the organic chain of custody, retail will not offer organic and non-organic products at the same time without packaging. But mostly the product is sold defrosted for self-service in a tray and plastic filter. In this case, the product is re-packed by European processing companies.

Tip:

- Each European Member State has appointed a competent authority who is responsible for labelling and packaging. You can use the: EU Trade Helpdesk to find out who the competent authorities for each European Member State are.

Quality

Buyers expect organic seafood to be at least of equal quality compared to conventional seafood products. Requirements with regard to the shell life, colour, taste, and structure are therefore similar to the requirements for conventional seafood products. Information on quality requirements for frozen fish (and fillets) and shrimps is given in the in the Codex Alimentarius (‘Food code’ of the World Health Organisation (WHO) and Food and Agricultural Organization of the United Nations (FAO)).

2. What makes Europe an interesting market for frozen organic seafood?

This section provides you with information about the import, export, production, and consumption of organic seafood in Europe. Detailed trade statistics about organic seafood on product level are not available.

Consumption

The largest organic food markets in Europe are Germany, France, the United Kingdom and Italy. In addition, Spanish consumers are also showing increasing interest in organic products.

For organic fish and seafood, the list of leading markets is a little bit different. In the main European fish and seafood markets, only 1% of consumption of fish and seafood is organic. United Kingdom (15 thousand tons, or 2% of the total consumption) and Germany (12.5 thousand tons) are the largest markets for organic fish by volume, at large distance followed by Spain, Italy and France (each 2-3 thousand tons). From a global perspective, Europe continues to be the largest market for organic seafood.

Although the consumption of organic seafood products is still relatively small, it is expected that it will grow strongly in the near future. This is because consumers are becoming more environmentally and socially conscious. Leading food retail companies and fish and seafood traders (brands) are becoming aware of this trend and commit themselves to sell more organic fish and seafood every year.

Tip:

- The 2016 EU Market Report of IFOAM (the European umbrella organisation for organic food and farming) provides information about the organic market in Europe.

Production

Organic aquaculture production is increasing worldwide. Global organic aquaculture production was estimated by IFOAM at 50,000 tons in 2009 and at over 150,000 tons in 2013. The turnover even quadrupled from an estimate of €300 million in 2010 to a turnover of more than €1.2 billion in 2015.

In 2012, the volume of organic shrimp production (which takes place outside Europe) reached 25,000 tons. Every year since 2012 the production volume increased, by an estimated 3-5% per year.

Zooming in on Europe shows that certified organic production accounts for about 4% (or 50,000 tonnes) of total European aquaculture output. Aquaculture production is mostly concentrated in Spain, the UK, France, Italy, and Greece, while Ireland is the leading organic aquaculture producer (44% share of EU total), followed by Italy (17%), UK (7%), and France (6%).

In terms of species, the figures for 2015 are as follows.

- Salmon: production of over 16,000 tonnes, equal to 9% of total EU salmon production. Production led by Ireland and the UK.

- Mussels: 20,000 tonnes, 4% of total mussel production in EU. Ireland, Italy and Denmark dominate production.

- Carp: 6,000 tonnes produced, equal to 8% of total carp production in EU. Leading producers are Hungary, Romania and Lithuania.

- Trout: 5,000 tonnes produced, 3% of EU total trout production. The main producers are France and Denmark.

- Seabass and seabream: 2,000 tonnes produced, good for 1% of EU total production. France, Greece and Spain are the top-three producers.

While organic (rainbow) trout production doubled in the period 2012–2015, while seabass/seabream (+25%) and salmon (+24%) also experienced relatively strong growth, followed at quite some distance by mussels and oysters.

For other species (oysters, sturgeon, perch), the volumes farmed under organic standards are rather low.

In terms of economic performance, the organic trout and mussel farming sector in Europe do quite well because of good price premiums. The same (but to a lesser extent) goes for salmon. Organic farming sectors that are not profitable are carp and also seabass and seabream. The leading challenge for organic farming is the relatively low scale of production.

Tropical species are mostly farmed outside Europe, and in particular in Developing Countries, and therefore have to be imported.

Tips:

- Stay up-to-date with the latest developments in the organic (aquaculture) sector. The European Market Observatory for Fisheries and Aquaculture Products is a good source to use. One of their publications is “EU Organic Aquaculture”.

- For inspiration, you can check the following link about the organic certification project through the 2010 European Union regulation for pangasius in Vietnam. Furthermore, you can also check the websites of an organic shrimp company certified by Agriculture Biologique in Madagascar, a producer of organic shrimp in Thailand who is accredited by International Federation of Organic Agriculture Movements (IFOAM) in Ecuador.

- Read for example this article “Thailand looking to organic shrimp farming”.

Imports

The European import value of fish and seafood is huge: in 2016 the total value was more than €38 billion. Every year, organic fish and seafood takes a larger share of imports. However, the share is still relatively low, estimated at about 0.5%. This means that the market has an approximate value of €150-200 million.

Imports of organic seafood from outside Europe consist mainly of shrimps, but also include small volumes of organic tilapia and pangasius. While organic vannamei shrimps are mostly sourced from Ecuador, organic monodon is farmed in several countries (e.g. Bangladesh, Madagascar, India, Indonesia and Vietnam). Imports of organic tilapia come from Central America and imports of pangasius from Vietnam.

For most organic fish, the Netherlands and Belgium are among the largest importers. Also the UK and Germany could offer opportunities. For organic shrimp, the largest importer is France.

Exports

Exports of organic fish and seafood basically concerns trade within Europe. The dominant trading hubs for seafood are the Netherlands and Belgium, from where considerable volumes of seafood are re-directed to other European countries.

3. What trends offer opportunities on the European market for organic seafood

Expansion within the European aquaculture sector

The organic aquaculture sector in Europe will continue to expand as demand for organic fish and seafood is expected to show an upward trend in the next years. There are also several initiatives in Europe that focus on helping the sector to expand. One example is OrAqua, which was established in order to support the economic growth of the sector. Within OrAqua there is, among other things, a focus on the development of new regulations about organic aquaculture products.

MSC and ASC market growth is impressive

European organic seafood traders continually expand their product lines of MSC (Marine Stewardship Council, the sustainability label for catched seafood) and ASC (the sustainability label for aquaculture) certified seafood products.

For example, in June 2015, there were more than 15,000 fish and seafood products in the European market carrying the MSC label, while in March 2017, this number has grown to over 21,000. Also in the next few years this number is expected to grow further, by more than 10% per year.

ASC certified production also experienced sharp growth. By the end of 2015, worldwide almost 200 farms in 21 countries were ASC-certified thanks to a growth of 55% in one year. In December 2016 the total number of farms reached 370 (and 38 countries), while another 119 farms were in assessment. In terms of volume, growth was also impressive: from 674 thousand tonnes ASC-certified seafood in December 2015 to 1.08 million tonnes one year later (of which most was destined for the European market).

While for organic seafood there are no data on product launches available, the expectation is that also in organic new product launches will continue to support market growth. They will include newer and luxury varieties, such as a premium organic smoked salmon product or a premium pangasius fillet wrapped in bacon (which are already available in a few European countries).

Food retailers strongly support certified seafood products

Several large retailers across Europe have declared their strong commitment for selling more sustainable seafood. While this mostly includes ASC and MSC certified products, definitely also the organic seafood market benefits from this trend.

Examples of retailers that support the sales of sustainable seafood are:

- Edeka from Germany, working towards 100% sustainable seafood

- Lidl (several markets) will only sell MSC in frozen and fresh own range.

- Sainsbury’s (UK) will source only sustainable seafood by 2020

- Carrefour (Southern Europe) has a focus on selling more MSC products in France and Italy.

As a result, in 2015 in many food retail stores there is a good availability of certified seafood. For example, for the MSC label the food retail market penetration is about 50% in the Netherlands, Germany and Switzerland. In terms of volume, it is also Germany that dominates the MSC labelled fish and seafood market in Europe. In the range of 10-40% market penetration are Denmark, Austria, Sweden, the United Kingdom and Belgium. France is growing strongly in terms of penetration, but penetration is still low (5%). Italy and Spain are still very premature markets, with penetration below 1%.

The previous years 2016 and 2017 have also been strong years for MSC-labelled fish sales in Europe. This trend was supported by commitments of 1) leading European retailers, such as Lidl, that also started with MSC labels in premature markets such as Portugal and Spain, and 2) frozen food companies introducing the MSC label for fish products, such as the Italian frozen food market leader Findus.

While the retailers’ strategies towards more sustainable fish on the shelves is definitely driving the market in Europe, it is also considered as a threat for pure organic fish and seafood. Sustainable (labelled) fish does not need to be organic, and the growing attention for sustainable fish also confuses consumers when confronted by a variety of sustainability labels and organic logos.

Tip:

- Many important European buyers of seafood products are attending the annual European Seafood Exposition in Brussels. A visit to this exhibition provides you with relevant information about trends in the seafood market and interesting contacts with potential buyers.

4. What requirements should frozen organic seafood comply with to be allowed on the European market?

See our study EU buyer requirements for fish and seafood for a general overview of requirements, below are the requirements that specifically apply to organic seafood.

Organic certification

Organic production is on a voluntary basis. If a product is marketed as organic, it must comply with European Union legislation on organic production, the labelling of organic products and organic production. Most important aspects of the regulation are:

- The sources of inputs; organic seed, feed, and fingerlings are required

- Stocking density

- Location of the production system.

Although there is a European-wide system for the regulation of organic farming, well-established national and private logos can also be used on labels of organic products. However, these logos need to be checked for application possibilities on products from outside Europe. Examples of such national organic certifications are Soil Association in the United Kingdom, Naturland and Bioland in Germany.

Note that the United States has still not implemented a specific regulation for organic aquaculture. And therefore aquaculture products cannot yet be sold as organic on the US market.

Tips:

- Implementing organic production and becoming certified can be expensive. Probably the return on investment may not be high enough due to for instance increasing feed prices for organic production. On the other hand, it can increase yields and improve quality. Therefore, you should make an analysis of the cost and benefits before implementation.

- You can find more information about organic certification on the website of the European Commission.

- You can check the Soil Association standard for food and drink to get an idea of the requirements of organic production.

- Consult ITC Sustainability Standards Map for the different organic labels and standards.

5. Through what channels can you get frozen organic seafood on the European market?

In general, organic seafood is imported through the same market channels as conventional seafood products.

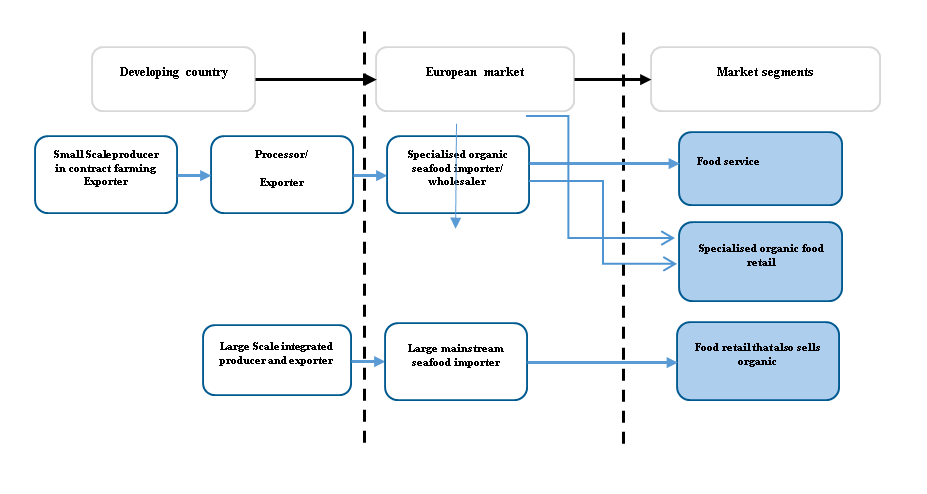

Figure 1: Market segments and channels of organic seafood in Europe

Organic products used to be mainly sold in specialised organic retail shops. Nowadays this is different, as almost all mainstream retailers and even several discounters also offer an organic product range.

In many cases, large retailers source their organic aquaculture products from their standard suppliers. For example, one of the leading shrimp importers in Europe, located in the Netherlands, imports organic shrimp from Ecuador to supply it to its regular customers as well.

Mainstream importers often source from large integrated organic aquaculture producers and processors. They are not keen to invest financially in these suppliers. In other cases, to save costs, mainstream importers also buy organic products from specialised importers. In addition, specialised importers supply directly to mainstream retailers.

The specialised organic retail chains mostly source their organic aquaculture products from specialised importers. These supply chains are often built on long term trust relationships with a high degree of transparency about value-adding, costs, and price fixing.

Specialised traders and sometimes also retailers are often willing to invest in long-term relationships with suppliers and producers in third countries. These companies often look for partners to make joint investments in organic production and are committed to make projects successful. One recent example is of the Swiss/European retailer COOP that partners in an organic shrimp project in India.

Tips:

- If you are connected to producers or production areas that are suitable for organic certification, visit a trade show in Europe such as BioFach in Germany or Natural & Organic Products in the United Kingdom and visit specialised organic seafood traders. Discuss with these companies whether they are interested in visiting your area and company to scope for cooperation and joint investments.

- Organic Market Info offers a list with several distributors of organic food in Europe.

- See our 10 tips for doing business with European buyers of fish and seafood and our 10 tips for finding buyers in the fish and seafood sector. These tips also offer more information on which topics are decisive for European buyers when searching for (new) suppliers.

6. What are the end market prices for frozen organic seafood?

Consumer prices of organic frozen seafood products in the different European countries are presented below to give you an impression of the price level in Europe.

In general, prices of organic seafood are considerably higher than prices of comparable conventional products. This is basically the result of the (initial) higher production costs of organic seafood, and higher costs of sales and distribution, as volumes are relatively low as compared to conventional seafood.

Table 1: Examples of consumer prices for organic frozen seafood products in 2018

| Product | Price (€/kg) | Country |

|

One piece of organic Pangasius fish fillet in a 350g plastic box |

12.86 |

|

|

Four pieces of organic Pangasius fish fillets in a 400g cardboard box |

22.75 |

|

|

Organic shrimps in a 225g plastic bag |

24.90 |

|

|

Organic shrimps in a 150g plastic box |

37.45 |

|

|

Two pieces of organic salmon fillets without skin in a 200g cardboard box |

34.95 |

When comparing the prices of organic and conventional seafood, one can see that price premiums for organic seafood are certainly there. While the import price of organic fish and seafood products is about 15-20% more than that of conventional products, for the European consumer this difference can be more than 20%.

For instance, in the United Kingdom a premium price of 25% is paid for organic salmon. Another example are shrimps; the import price of organic shrimps in France imported from Madagascar is about 10-20% above the average price level of French shrimp imports, while the consumer price is 30-40% higher.

In general, the price premiums for organic products are larger than the range of 10-14% for sustainability labels such as Aquaculture Stewardship Council ‘ASC’, Best Aquaculture Practices ‘BAP’, or Marine Stewardship Council (MSC). For instance, consumers pay 13% price premium for salmon with an MSC label.

The price premium is partly required for financing standard requirements such as the implementation of an internal control system. This is particularly the case when working with smallholders.

Please review our market information disclaimer.

Search

Enter search terms to find market research