The European market potential for pacific white shrimp

Suppliers of Pacific white shrimp (Penaeus vannamei) have taken over the European shrimp market. Supermarkets and wholesalers throughout Europe sell a variety of frozen and chilled refreshed Pacific white shrimp products. The global rise in production of Pacific white shrimp has brought prices down. To reach your market and be able to gain a market share, you need to be competitive. This can be on price, but it can be easier if you can stand out on quality or certification.

Contents of this page

1. Product description

Pacific white shrimp (Penaeus vannamei) is part of the Penaediae family and is also commonly referred to as whiteleg shrimp or vannamei shrimp. While the species is originally native to Southern America, from the 1990s onward, they have been cultivated more and more in Asia. At the moment, it is the predominantly cultivated shrimp species around the world.

Pacific white shrimp enter the European market in various forms, as final products but also as bulk products. Most of the pacific white shrimp enters as frozen products.

When Pacific white shrimp is imported as a final product for the Northwestern market, it can enter raw or cooked and have a wide range of forms such as head-on shell-on (HOSO), headless shell-on (HLSO) and peeled products. Sometimes, it is repacked by importers and ends up in the frozen segments of supermarkets or food service wholesale stores. Final products imported into Southern Europe are usually imported as boxes consisting of raw or cooked products in the head-on shell-on form (HOSO) or in bags with headless shell-on (HLSO), peeled or cooked products.

Pacific white shrimp can also be imported as a bulk product destined for Europe’s domestic processing industry. In Southern Europe, bulk imports of raw HOSO products serve cookeries, which thaw the products, cook them and sell them on the market as chilled refreshed HOSO products. In Northwestern Europe, processors import blocks of a variety of raw and cooked peeled products. Blocks are thawed, sometimes cooked, and then repacked for sales through retail and food service channels.

The Pacific white shrimp sizes available in the market range from 20 to 100 pieces per kilo, but the majority is 40 to 100 pieces per kilo. In the larger sizes (20 to 40 pieces per kilo), Pacific white shrimp competes with black tiger shrimp, Argentinian red shrimp and African sea tiger. Even though the other species are often regarded as being higher quality, if Pacific white shrimp is sold at a lower price, customers are likely to buy Pacific white shrimp. Usually, the best margins can be made on these bigger sizes.

Where cultivated Pacific white shrimp is mentioned in this study, it means the following Harmonised System codes, unless stated otherwise:

- HS 03061792 – Frozen shrimp of the genus Penaeus;

- HS 160521 – Shrimps and prawns not in airtight containers;

- HS 160529 – Shrimps and prawns in airtight containers.

The definitions of products under these HS codes are not straightforward. The general rule is that products having undergone only 1 processing step, such as raw peeled and deveined products (PD) or head-on shell-on (HOSO) cooked products, are declared as HS03061792. Products that have undergone at least 2 processing steps, such as peeled and cooked or peeled and battered, are declared under HS160521 or HS160529. Contrary to cooking, blanching is not officially regarded as a processing step. Peeled and blanched products are still declared under HS03061792. For Europe, HS030361792 is largely accounted for by Pacific white shrimp, both wild-caught and farmed. However, the HS codes also include Black tiger shrimp (P. monodon). You can read this study to learn more about the market for black tiger shrimp.

- Access the freely available Trade Map data. Play around with the data from the relevant HS codes for Pacific white shrimp mentioned above to help you better understand the market dynamics.

2. What makes Europe an interesting market for Pacific white shrimp?

Europe is the world’s third largest market for Pacific white shrimp, after the United States and China. In 2019, Europe imported an estimated EUR 1.9 billion of raw or blanched peeled and raw and cooked HOSO and EUR 998 million of cooked and peeled and value-added Pacific white shrimp. In volume, Europe’s Pacific white shrimp imports in 2019 totalled approximately 370,000 tonnes, 7.5% less than in 2018. The biggest European importers are France, Spain, the United Kingdom, Italy, the Netherlands, Germany and Belgium, accounting for about 80% of the total European Pacific white shrimp imports.

Shrimp accounts for 6% of seafood consumption in Europe

According to a recent study of the European Commission, shrimp accounts for 6% or about 1.5 kg per person of total European fish and seafood consumption. The European Union estimates that 62% of that shrimp comes from the wild and 38% from aquaculture, of which approximately 85% to 90% consists of Pacific white shrimp and about 10% of black tiger shrimp. Most shrimp imported into Europe is consumed in Southern Europe. The annual per capita consumption of shrimp is almost 3 kg in Spain, 2 kg in Portugal and 1.5 kg in France.

- To understand the position of Pacific white shrimp in the European seafood market, read the CBI Fish and Seafood Market Statistics and Outlook Study. You will learn more about the consumption, demand and imports of the European market.

- To understand the long-lasting relationships European importers foster, read the study Tips to do business.

- For data about the EU seafood market and consumption, it is also possible to make use of the free accessible database EUMOFA.

Various market opportunities in Europe

When we talk about the European Pacific white shrimp market, it is important to understand that there is no such thing as a single European shrimp market. Each country in Europe has its own food culture, based on historical developments and cuisine. In terms of fish and seafood consumption, it is safe to single out Southern European countries and regions in comparison with the rest of Europe. The different product demand could provide you, as an exporter, with a clear focus on your market strategy.

The main shrimp product consumed in Southern Europe is in HOSO form, mostly imported from South America. Much more so than in the north of Europe, people in countries around the Mediterranean Sea prepare a large number of elaborate recipes, many of them based on HOSO shrimp. Most shrimp in Southern Europe is sold cooked or blanched as a cosmetic treatment.

The rest of Europe has developed into a convenience market, as far as shrimp is concerned. Here, the demand for products that are ready to eat or quick and easy to prepare has been growing steadily. In these northern countries, various types of peeled shrimp imported from Asia dominate the market. Peeled shrimp can be sold either raw for cooking at home or fully cooked. In some parts of Europe, there is even a growing market for more value-added products, such as peeled and ready to be stir-fried, sometimes accompanied by a sauce or breaded for deep frying at home or in restaurants.

Pacific white shrimp is known as an imported product

Europe does not produce any significant volumes of Pacific white shrimp itself. Therefore, most Pacific white shrimp is imported. The shrimp comes in either as a final product ready for the consumer or as a product to be reprocessed in Europe before it is sold to the end consumer.

Europe mainly imports raw and cooked HOSO shrimp from South America. Raw and cooked peeled and further value-added products are imported from Asia. Europe’s key suppliers of HOSO shrimp are Ecuador, Nicaragua, Venezuela, Peru and Honduras. The main suppliers of peeled and value-added Pacific white shrimp are Vietnam, India and Indonesia. Vietnam is expected to expand its market share, at the expense of India and Indonesia, thanks to the upcoming free-trade agreement with the European Union and the withdrawal of import tariffs.

The main reason for the differentiation of suppliers of HOSO products and peeled products is that South American suppliers can generally not compete with the prices of Asian suppliers on peeled or further value-added products, because labour costs are too low in Asia. South American suppliers, however, have traditional strong ties with the Spanish and broader Southern European market, where importers have been selling Pacific white shrimp for much longer than in the rest of Europe, which was previously dominated by black tiger shrimp (P. monodon).

Although there are some developments in terms of producing Pacific white shrimp in closed recirculation systems in Europe and the United States, it is not likely that this production will grow rapidly. Domestic production in any case will consist of small production units with small production volumes targeted to supply freshly harvested shrimp to premium local markets. For the bulk product, to supply its mainstream market, Europe will remain dependent on imports from non-EU origins.

Tips:

- If you want to stay up to date on the European shrimp market, follow the ShrimpTails magazine or the GLOBEFISH’s global seafood market reports. Both publications can be read online for free.

- Other daily news sites that publish regular news on the European shrimp market are Undercurrent News, Intrafish and SeafoodSource, which have freemium models and unlimited access subscriptions.

European quota for raw materials for domestic cookeries

The European Commission announced the new autonomous tariff quotas (ATQs) for 2019-2020 on 11 December 2018, providing reduced or duty-free import rates for certain products from outside the European Union. 1 of the quotas is for Pacific white and black tiger shrimp. Between 1 January 2019 and 31 December 2019, European Union buyers can import 40,000 tonnes of raw materials for reprocessing. Countries that already have a free-trade agreement with the European Union do not benefit from this quota and their exports do not use any of the ATQ-assigned 40,000 tonnes.

Europe’s most important exporter of cooking quality HOSO Pacific white shrimp, Ecuador, does not have to trade under the quota as it is already benefitting from 0% import duties. Vietnam, which has recently signed a free-trade agreement with the European Union will also soon benefit from 0% import duties. This means that, if you are an exporter from another country like India, Indonesia or Central America, you have an improved chance of benefitting from trading under ATQ quotas at 0% duties when supplying raw materials to Europe’s shrimp re-processors.

Tip:

- Read the CBI study on how to find buyers to get in contact with importers working with these ATQs.

3. Which European countries offer most opportunities for Pacific white shrimp?

The top 5 European countries importing raw peeled and raw or cooked HOSO Pacific white shrimp are in Southern Europe. The top 5 European countries importing cooked peeled and further value-added products are in Northwestern Europe. In these regions, the markets in Spain, France, the Netherlands, Belgium, Germany and the United Kingdom are leading. Together, these markets represent approximately 80% to 90% of the total European Pacific white shrimp imports.

France’s large and diverse market

In 2019, France imported 103,000 tonnes of shrimp worth €700 million. Raw or blanched peeled products and raw or cooked HOSO products account for 90% of the warm water shrimp imported by France, while cooked peeled or further value-added products made up only 10%. Pacific white shrimp accounts for approximately 69,000 tonnes of all raw or blanched peeled and raw or cooked HOSO products. It is by far the most consumed shrimp in France.

In terms of culinary culture, France is a large, diverse powerhouse of cuisine, with diverse eating habits and various cooking cultures in different parts of the country, in and out of home. It also, in varying degrees, mixes in the habits of consumers in Southern Europe and the rest of Europe. This means that the French shrimp market is quite diverse. France is a large market for peeled products as well as for HOSO products, where prices for the different products from different origins vary widely. This infographic in ShrimpTails magazine offers a brief overview of the variety of products in French supermarkets.

Much like consumers in Northwestern Europe, consumers in France are also very concerned with sustainability. Most French retailers and institutional food service companies have committed to only selling sustainable seafood. This means that they have committed to selling ASC-certified products. In some cases, these companies also accept other labels such as Label Rouge or Friends of the Sea.

France is also Europe’s biggest market for organic shrimp. French importers source organic-certified black tiger shrimp mostly from Madagascar and Pacific white shrimp from Ecuador.

Organic shrimp consumption is still relatively small, but is expected to grow strongly in the near future. This is because consumers are becoming more environmentally and socially conscious. The leading food retail companies, shrimp traders and brands are aware of this trend and consistently commit to selling more organic fish and seafood every year. It is important to note that organic-certified Pacific white shrimp can only be farmed in South and Central America.

A sector report by Agrimer shows that household purchases in France amounted to about 5,700 tonnes worth €111 million of frozen shrimp, as well as 9,200 tonnes worth €169 million of chilled shrimp, in 2018. As in Spain, cookeries play an important role in importing in bulk and reprocessing it into chilled products in France. Major cookeries in France include Krustanord (Pescanova) and Delpierre (Labeyrie Fine Foods).

Just like in Spain, it is very common for French retailers to sell chilled shrimp in bulk at counters where consumers can handpick the shrimp they want to buy. Contrary to Spain though, a lot of chilled shrimp is also packaged in modified atmosphere packaging (MAP) and offered to consumers in the same way as in Northwestern Europe, prepacked and weighed.

Besides the cookeries, key buyers of frozen shrimp for the French market include Argis, Escal, Gelazur and Crustamar.

Spanish consumers love shrimp

Spain imported approximately 162,000 tonnes of warmwater shrimp at a value just under €1 billion in 2019. The vast majority of it (around 90%) consisted of raw and blanched HOSO, HLSO and peeled products or cooked HOSO shrimp. Approximately 70,000 tonnes comprised Pacific white shrimp, of which 68,000 tonnes consisted of HOSO and a small portion of HLSO shrimp from South and Central America. The remaining 1,500 tonnes were peeled products from Asia.

Spanish consumers love shrimp. They eat shrimp in a variety of tapas, in traditional paella and rice recipes and several other ways. Like in many other parts of the world, consumers in Spain like to prepare their dishes with HOSO shrimp, not necessarily serving it directly on the plate, but often taking the heads off or peeling the shrimp only when preparing it.

Figure 3: Refreshed cooked shrimp sold in La Boqueria Market, Barcelona

Source: Librarygroover, 2019, no changes applied, this work is licensed under the Creative Commons Attribution 2.0 License

Spanish importers traditionally purchase shrimp from South and Central America. In the case of Pacific white shrimp, imports mainly originate from Ecuador and various countries in Central America, including Honduras, Nicaragua and Guatemala. There are 2 reasons for this. The first reason is language. Spanish importers prefer to do business in Spanish. The second reason is that suppliers in South and Central America, with their high-quality and large-sized extensively farmed shrimp, are better positioned to supply high-quality HOSO shrimp.

We estimate that 80% to 90% of Spain’s Pacific white shrimp imports consist of HOSO products, of which 50% to 60% consists of raw materials for the domestic cooking industry and 40% to 50% consists of finished frozen products for retail and food service. The remaining 10% to 20% of the imported volume will consist of a mix of peeled products frozen as finished product ready to be distributed to retail, wholesale and food service.

To supply cooking quality shrimp to Spain, your company must be well set up. The right quality of shrimp — in terms of colour (A2 to A4), sizes (20–60 pc/kg), texture and freshness — requires you to have control over the supply chain from farm to factory. You must be able to freeze the raw materials within a couple of hours of harvesting and be very precise about storage and transportation from farm to factory. Increasingly, cookeries may request that you brine freeze the shrimp instead of blast freezing to improve quality further.

The advantage of exporting HOSO shrimp is that HOSO products, whether packaged in bulk or in final packages, do not require much labour to produce. So, in countries where labour is not as cheap, it is a good way to be competitively priced in the market. If you have your farms well managed and your factory located close to the farms you source from, you should be able to deliver the right quality of raw materials and develop solid business with Southern Europe’s cookeries, not only in Spain but also in France and Italy.

Tips:

- Get in contact with key buyers of frozen shrimp, like Compesca and Gambafresh. These buyers hold the highest potential for introducing your products to the Spanish market.

- Be sure to speak the language of your buyers or hire a translator to do business in Southern Europe. Making contact and gaining trust of potential buyers in Southern Europe will be much easier if you speak their language. Of course, business can be done in English as well, but speaking their language will give you a step ahead. In North Western Europe, English is a must but there is no need to speak other local languages.

- Study the product portfolios of Labeyrie Fine Foods, Krustanord and Nueva Pescanova if you intend to sell shrimp to Southern European processors interested in purchasing HOSO bulk products.

Netherlands, Belgium and Germany: an interconnected group of markets

The Netherlands, Belgium and Germany are interconnected markets, as the ports of Rotterdam, Antwerp and Hamburg are strategically located for all 3 markets. An importer from the Netherlands may import through Antwerp, an importer from Germany might import through Rotterdam. It all depends on logistical preferences. In terms of consumption, Germany is the biggest shrimp market, followed by the Netherlands and Belgium. However, in terms of imports, the Netherlands is the biggest, followed by Germany then Belgium.

The Netherlands imported just over 45,000 tonnes of Pacific white shrimp in 2019, Germany 15,000 tonnes and Belgium 18,500 tonnes. Contrary to imports in Southern Europe, imports in these 3 markets largely consist of raw, blanched and cooked peeled products and further value-added products. Consumers in North Western Europe are less likely to use whole shrimp in their dishes. They favour the convenience of a product that is easy to peel and ready or almost ready to eat.

Figure 4: Wok-ready chilled and garlic marinated shrimp, MAP packaged for Albert Heijn, the Netherlands’ biggest supermarket chain

Source: Seafood TIP 2020

Pacific white shrimp is imported into Northwestern Europe through different companies, depending on the product. Examples are re-processors like Heiploeg (Parlevliet van de Plas), Klaas Puul (Dutch Seafood Company) and Morubel (Shore). These re-processors thaw the blocks, process them into the desired product and package them for distribution in retail or sale to other industry players.

The number of buyers for finished products is huge, while the number of buyers of bulk products is rather limited. That segment is rapidly consolidating because scale is required to remain competitive. This means that buyers for these companies look for increasingly big quantities for which they negotiate strongly on prices. The buyers of finished products often deal with smaller volumes, although it depends on whether they supply wholesale or retail markets. Suppliers of finished products for retail generally buy bigger volumes than those that buy for wholesale.

In the Netherlands, Belgium and Germany, other key buyers of frozen shrimp in addition to the bulk buyers mentioned above include Seafood Connection, Fisherman’s Choice, W. G, den Heijer, Hottlet Frozen Foods, Thalassa, Anduronda, Hafro and Rassau.

United Kingdom: Europe’s third largest Pacific white shrimp importer in 2019

The British market operates in a similar way as the markets in continental North Western Europe except that there is not a lot of trade in terms of imports or exports of Pacific white shrimp from the European mainland. Most Pacific white shrimp is imported directly from Asia or South America and consumed within the United Kingdom. In 2018, Pacific white shrimp imports into the United Kingdom totalled approximately 53,000 tonnes, making it Europe’s third largest Pacific white shrimp market.

Raw and blanched peeled shrimp accounts for 50% of the United Kingdom’s imports, at approximately 27,000 tonnes. The remainder consists of cooked peeled and further processed Pacific white shrimp. Much like in North Western Europe, shrimp is sold in retail as frozen, chilled or refreshed. The refreshed product is not sold in bulk but most often in MAP packages.

A few players with their own processing facilities dominate the United Kingdom’s refreshed market. The frozen retail market and the wholesale market are managed by a larger number of importers.

Some of the key importers that supply the refreshed segment are Lyon Seafoods, J. Sykes and Sons and North Coast Seafoods. Some key players in the frozen segment in retail not active in the refreshed segment are the Big Prawn Company, Pacific West and CP Foods. Some examples of suppliers to the food service market that are not very active in retail include Yearsly, Seamark and Dockside. Companies active in retail are often also active in wholesale, but not the other way around.

In 2019, the United Kingdom stepped out of the European Union, the so-called ‘Brexit’. This means trade between the European mainland and the United Kingdom is not open anymore. During 2020, the United Kingdom and the EU were discussing the conditions on how to continue doing trade and business. However, an agreement still seems difficult to reach. To understand the impact of Brexit, keep monitoring news sites. For seafood, we advise you to look at Seafish – the special bulletins.

Tips:

- Be sure to check the websites of Klaas Puul, Shore and Heiploeg and study their product portfolios if you are more interested in selling peeled products in bulk to markets in North Western Europe. It will help you to better understand what these companies are looking for.

- You need to be at the Seafood Expo Global if you are serious about doing business in the European Pacific white shrimp market. As a visitor you can meet new potential clients, and if your budget allows, you can participate as an exhibitor, which normally attracts business partners to you.

4. Which trends offer opportunities in the European Pacific white shrimp market?

European end users, and therefore your clients, are changing what they demand from their supplier in terms of sustainability and certifications. There is also a general shift towards convenience happening. At the same time, increasing global production of Pacific white shrimp, industry consolidation and negative trends, like mislabelling, put pressure on the bottom line of producers. Being aware of how these trends affect your business is an important ingredient to success in Europe.

Growing demand for convenience and value-added products

European demand for more convenience and value-added products is growing. For Pacific white shrimp, this is most visible in the retail segment in Northwestern Europe, where supermarkets are increasing their range of such convenient products. COVID-19 has pushed this trend forward, as consumers were hoarding products which were easy to cook or with a long shelf life. This trend is also present in Southern Europe, as people are hesitant to buy fresh or refreshed products because they want to limit the possibility of getting infected. If you are able to invest in the knowledge, technology and capacity to produce value-added products, you might be able to gain from this trend.

The types of convenience products vary between Northwestern and Southern Europe. In Northwestern Europe, this mainly results in increased assortments of peeled Pacific white shrimp products that have a marinade in the package, such as in Image 2. In Southern Europe, the demand for convenience products results in a broader range of peeled products. European importers and processors increasingly outsource the production of convenient products to producers in developing countries, due to the high associated labour costs in Europe. If you cannot make the investment, partnering with processors that produce these products can offer you market access.

Tips:

- Check the web shop of Sainsbury’s, a major supermarket chain in the United Kingdom, to see what value-added shrimp products they are selling. Look into the chilled and frozen products to get an understanding of the types of products you could try to produce.

- Read the ShrimpTails article on COVID-19 and its impact and future on the European market.

Brine freezing

Brine freezing is rapidly becoming the preferred freezing method for HOSO Pacific white shrimp destined for the high-end processing market in Southern Europe. If you want to access this market, you might want to invest in brine-freezing equipment.

Brine freezing is a very quick method to freeze your product, as the crystals formed inside the shrimp tissues are very small and only cause very small ruptures of cell membranes. Consequently, there is no leakage of liquid left after defrosting and therefore a significantly lower loss of weight than is observed in the traditional freezing techniques, like air blast tunnels or contact plate freezers.

Tips:

- Learn more about the process and the advantages and disadvantages of brine freezing in this detailed article by the Global Aquaculture Advocate.

- Check this factsheet about a brine freezer to learn the specifics of an actual brine freezing line.

Increased attention to labelling of glazing and soaking

Our trends study warns that problems with glazing and treatment of fish and seafood products are moving up the agenda of authorities and sector associations in Northwestern Europe. Although glazing and soaking both have their roles in moisture retention during processing and storage, both practices are also used to manipulate the price of the product. It is important to be transparent about the water used in or around the product to prevent misleading the end consumer. Adding water is legal. Mislabelling is fraud.

European authorities have been slow to address these issues, aware of the economic and health risks involved, but they are not expected to sit idle much longer. Enforcing regulations is one thing, but whether or not the market starts correcting itself is another. Within the European shrimp market, tackling the mislabelling of shrimp products, especially peeled, has been increasingly debated as importers that claim to be ‘clean’ complain that they are outcompeted by competitors that break the rules.

It is important to emphasise, once more, that although in the short term it may have benefits in terms of market share and margins, in the long term, if you apply malpractices yourself, this will have a negative impact on your reputation. It may even have economic consequences, such as fines imposed on you or your country of origin.

Tips:

- Read our study on trends in the European fish and seafood market to better understand the risks that mislabelling creates.

- Read our news item about the European Union’s position on the issue of glazing and soaking.

- If water accounts for less than 5% of the product’s weight, you only need to mention water in your list of ingredients, without highlighting it in the title of the shrimp product.

- If water is more than 5% of the product’s weight, you need to include water in the title of the product with a minimal size of 75% of the product name itself. More information about this rule can be found in EU Regulation (EU) 1169/2011.

Sustainability certification is required in most retail markets

Ecolabels, like the Marine Stewardship Council (MSC) for wild-caught seafood and the Aquaculture Stewardship Council (ASC) for aquaculture seafood, are dominant in Northwestern Europe and are growing elsewhere. These labels prove that seafood products come from sustainable sources. Since ASC implemented its shrimp standard in 2014, the number of ASC-certified shrimp products on the market expanded from only 500 products in 2014 to 7,500 products in 2018.

While commitments to sell ASC-certified shrimp started with retailers in North Western Europe, the deals soon extended to France, Spain and Italy. In the last 2 years, the number of ASC products on the Eastern European market has also expanded.

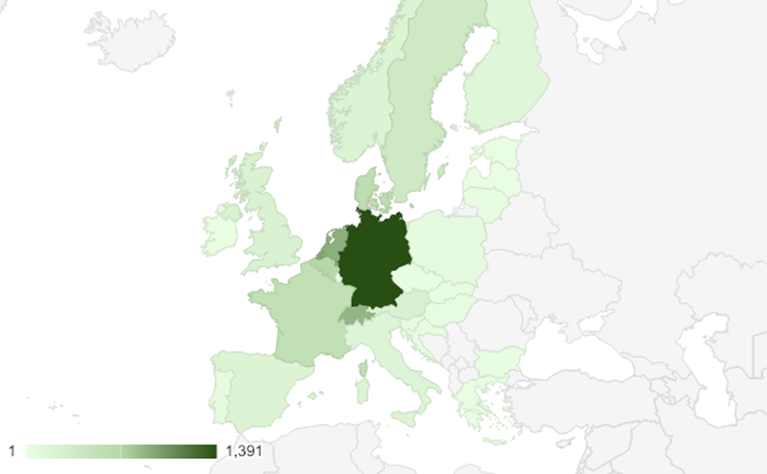

Figure 5: Geographical distribution of ASC-certified products on the market on May 2019

Source: Aquaculture Stewardship Council (2020)

The biggest market for certified products is still in Northwestern Europe, but it is clear that within a few years, for all of Europe, at retail level and partly at wholesale level, sustainability certification will become a hard market access requirement.

Over the last years, the Global Sustainable Seafood Initiative (GSSI) has worked on a benchmark system for sustainability certifications. Through this, they ensure all GSSI-approved certifications are aligned with the FAO standard and are therefore the best to use. As more standards are included now, a lot of retailers (and other seafood companies) align themselves with GSSI. This provides an opportunity for you as an exporter, as more seafood certification schemes will enter the market, such as Best Aquaculture Practise (BAP) of the Global Aquaculture Alliance. However, most consumers are not yet familiar with these other standards, and retailers might therefore keep their focus on ASC for the time to come. These sustainability standards will be a license to produce in a couple of years.

Tips:

- Check the ASC’s database to see which of your competitors have already been ASC certified.

- See our study on trends in the European fish and seafood market to learn more about the growth of certified seafood in Europe.

- Learn more about the GSSI benchmark system and approved certifications by visiting its website.

Branding and storytelling growing importance

European consumers want to know more about the products they consume. They take interest in the background of sustainability and origin of the products they buy. This is also the case in shrimp, possibly more so than other seafood. The reason is that the shrimp market has commodified. With an oversupply situation, Pacific white shrimp is no longer a specialty product.

In a commodity market, if you want to set yourself apart, you need to show your customers and the consumers in the market that it is worth paying a higher price for a comparable product. The Ecuadorian shrimp sector, which claims to sell the best shrimp in the world, is trying to do this at the moment. They have developed the Sustainable Shrimp Partnership (SSP), which has committed to only sell ASC-certified shrimp. In addition, all shrimp approved by SSP will be antibiotics-free and fully traceable back to the pond.

By investing in marketing your shrimp as more sustainable or higher quality than the shrimp of your competitor you can realise better margins in the market. Think about the unique selling point of your product and your production and how you can better promote it in the market.

Tips:

- Take a look at the website of the Sustainable Shrimp Partnership to see how they try to tell a story about their Pacific white shrimp and how they position it as a premium product.

- Read our study on trends in the European fish and seafood market to better understand the effects of branding and storytelling on consumer choices.

Consolidation and specialisation

Private equity firms have invested in some of the larger shrimp processors, while global fishing giants have acquired others. In general, big European importers are becoming bigger and smaller European importers are becoming more specialised to maintain their positions in the market. Read our trends report to make sure that you are aware of the way that consolidation and specialisation could affect your industry. Producers that do not adapt often lose market share to producers with either lower prices or a higher degree of specialisation.

This means that you should be aware that some buyers might be connected to other buyers through ownership. The bigger groups might be focusing more on trading big volumes and might be uninterested in trading niche products. Some of the smaller companies specialising in niche products, however, try to stay away from the commodity business.

Tips:

- Read Undercurrent News’ recent report for a detailed overview of mergers and acquisitions in seafood in the European market.

- Read our trends report to learn more about the effects of consolidation on the European seafood market.

The study has been carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Search

Enter search terms to find market research