Entering the European market for rock lobster

The European demand for rock lobster is always higher than the supply. Rock lobster is a wild caught product that is considered to be a high-value luxury item. Therefore, despite its popularity, there are few European importers that can afford to buy rock lobster. Because of the high demand and the high price, exporters can find good opportunity in entering the rock lobster market, although new exporters will face serious competition from Caribbean producers (who are the main exporters to Europe). Rock lobster is mostly sold fresh in exclusive restaurants, and mostly frozen in supermarkets. Importers and wholesalers can help you to get it there.

Contents of this page

1. What requirements must rock lobster comply with to be allowed on the European market?

Apart from ensuring you meet quality and food safety requirements, sustainability is a key issue for European buyers in importing rock lobsters. Therefore, exporters should ensure their products have the necessary catch certificates and management measures in place to ensure the future stock of rock lobsters. As this is a high-value product, it is best to contact your buyer regarding their preferred grading or packaging.

What are mandatory requirements?

Provide a catch certificate to prove sustainable fishing and hygiene

European countries are very strict about the import of rock lobster that is caught through illegal, unreported or unregulated (IUU) fishing. Like with all other fishery products, the European Union uses a Catch Certification Scheme, which is a must for exporting to Europe and allows authorities to combat IUU fishing.

The catch certificate contains all the information specified in the specimen shown in Annex 1 of the European IUU legislation. Catch certificates are not only used to check if your products come from legal fisheries and that no slave labour has been used. European countries also use them more and more to check if your products comply with the European hygiene rules. The certification is a must for all fishing vessels.

Tips:

- Learn more about the European Union’s rules to combat illegal fishing

- Learn about the European Union CATCH system which will eventually replace the old paper-based catch certificate system. Currently, the CATCH system is not a requirement for non-European Union countries. However, we recommend you learn about and comply with the digital system in order to ensure a smooth transaction with European buyers.

Management of rock lobster stock

As an exporter, you must coordinate with rock lobster producers on how they manage their fisheries in accordance with their respective government regulations. Knowing how your rock lobster is caught or how to guarantee stock for future purchases, is a selling point to European importers who want to ensure the supply of rock lobster.

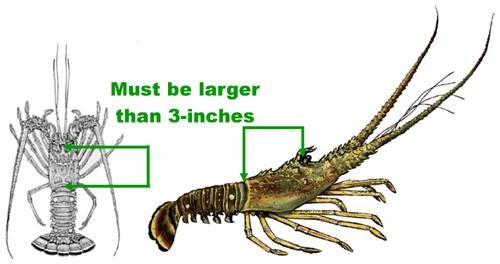

An important way to avoid the IUU fishing of rock lobster is managing the fishing methods. Rock lobster stocks are primarily managed through fishing effort limitation and technical conservation measures. For example, the Caribbean area is working to ban diving (with oxygen) and to only allow the use of baited traps. However, the key technical measure is the minimum landing size (MLS) which is designed to ensure that animals can grow to maturity and sustain breading stocks.

Image 1: Measurement of rock lobster’s Carapace Length

Source: the Florida Keys Fishing Directory

In the majority of countries in the Caribbean Sea, it is illegal to land lobsters below the minimum size of 76.3 mm carapace length. Some countries, like Jamaica, want to increase this limit to 83 mm in order to give the stock more possibilities to recover from fishing pressure. Smaller rock lobsters and female rock lobsters with eggs have to be returned to sea.

Another key effort limitation method to aid stock management is to maintain a 1 March to 30 June fishing ban. Also, countries are imposing quotas, allowing a limited number of vessels (or traps), regulating permissions (like entry and gear restriction, only licensed vessels, just some appointed fishing spots) all trying to guarantee sustainability. However, some organisations like the Monterey Bay Aquarium think that more has to be done to protect the rock lobster.

Tip:

- Read the Monterey Bay Aquarium’s report on rock lobster and try to guarantee your customer that you are doing all you can to protect rock lobster stocks.

Comply with standard labelling and packaging requirements

To export rock lobster to Europe, you must comply with the standard labelling requirements for fish and seafood. You are required to pack your rock lobster in safe materials and list all ingredients that have gone into the product on the packaging, including additives used for treatment like polyphosphates or sulphites. European customs are very strict when it comes to labels. It is absolutely necessary to comply with all labelling requirements in order to avoid possible rejections at the destination border.

Live lobster is usually packaged in cartons of ten kilos, but this can vary, depending on the wishes of the customer. Also, cooked and raw head-on shell-on lobster are packed in ten kilo boxes. However, lobster tails are almost always packed in ten-pound (4.54kg) boxes with each tail individually wrapped or packed in plastic or plastic bag. The tails are layered side to side in the box.

Image 2: Individually packed lobster tails in ten-pound box

Source: Open Europa Import & Export Consultancy, 2020

Tip:

- Find the labelling requirements in the CBI Buyer Requirements study. Make sure that you understand and follow them all.

Food safety standards must be met

Europe is very demanding when it comes to food safety standards. Products that are found to be non-compliant will be registered and reported in the Rapid Alert System for Food and Feed (RASFF). If you are on that list, your containers will be inspected thoroughly at port of destination. These checks can easily take two to three weeks after arrival. Any extra costs will be addressed to you as the exporter. Also, continuous temperature control is recommended.

A health certificate accompanying the product is obligatory for import into the European Union. Ask your logistics forwarding agent for a health certificate. This is for all fish and seafood products, including your rock lobster. Hygiene and health are important to buyers. Be sure that no contaminants end up in the final product. Seafood destined for the European market is generally tested before it is shipped, sometimes in the buyer’s own lab, sometimes in recognised (independent) labs.

European Union rules regarding food hygiene cover all stages of production, processing, distribution and placing on the market for all food intended for human consumption. The standard European hygiene rules can be found in the CBI buyer requirement study.

Tips:

- Check the RASFF portal to learn about the kinds of products that are recalled and the reasons for border rejection.

- Email all mandatory transport documents and the models of the health and catch certificates, as well as labels, and ask the customer if he agrees with the contents before making up the final original documents.

What additional requirements do buyers often have?

Grading

In tables 1 and 2, you will find the size gradings for whole raw/cooked rock lobster and rock lobster tails. Each box only has one size, do not mix them. It is best to ask your buyer about their size and packaging needs ahead of time. Bigger sizes are rarer to find and therefore cost a bit more. Demand for larger sizes is higher. Count on about a three percent price increase per size upgrade, but this depends on actual supply and demand.

Table 1: Grading whole raw/cooked rock lobster

|

575-630 grams per piece |

|

630-690 grams per piece |

|

690-785 grams per piece |

|

785-900 grams per piece |

|

900-1200 grams per piece |

|

1200-1350 grams per piece |

|

1350-up grams per piece |

Source: Open Europa Import & Export Consultancy 2020

Table 2: Grading rock lobster tails

|

Weight class |

Average weight |

|

4oz |

abt. 110 grams per piece |

|

5oz |

abt. 140 grams per piece |

|

6oz |

abt. 170 grams per piece |

|

7oz |

abt. 200 grams per piece |

|

8oz |

|

|

9oz |

abt. 255 grams per piece |

|

10-12oz |

between abt. 285 and 340 grams per piece |

|

12-14oz |

between abt. 340 and 400 grams per piece |

|

14-16oz |

between abt. 400 and 450 grams per piece |

|

16-20oz |

between abt. 450 and 565 grams per piece |

|

20oz+ |

bigger than abt. 565 grams per piece |

Source: Open Europa Import & Export Consultancy 2020

Please note that importers prefer it when products fall on the heavier side of the grading scale. For example, in a 14-16oz packaging, an average weight of 440 grams is preferable than just 410 grams, although this would still fall in the same grading.)

Buyers want guarantees on food safety and wellbeing of people

Exporters must apply for food safety certifications required by their buyers on top of other certificates mentioned in the mandatory requirements. Meeting these requirements allows you to set yourself apart from other exporters. Below you will find some suggestions on which certificates to apply for. However, not all importers and wholesalers have those additional requirements. Some have more wishes, others have fewer. The exact requirements that you must comply with may vary from buyer to buyer depending on their needs. The best is to speak with your client or potential client and try to find out exactly what their needs are.

If you are not sure about which certificate to apply for, it is best to ask your buyer about it. Otherwise, there are some internationally known quality certifications, which are usually required by European importers. The most commonly requested food safety certification schemes for seafood products are International Food Standard (IFS) and/or British Retail Consortium (BRC). Hazards Analysis and Critical Points (HACCP) certification is no longer enough. Moreover, some European customers will ask for a bacteriological analysis performed by an external laboratory.

Many European buyers also want the guarantee that the products have been processed under certain quality standards. Issues to keep in mind are temperature control during processing, hygiene, traceability, condition of the cold store, and safety protocols, to name a few.

In addition to food safety, European buyers are also concerned about the wellbeing and safety of your workers and suppliers (fishermen), as part of their “Corporate Social Responsibility” (CSR). Slowly, European retail chains are beginning to ask about CSR certifications in their supply chain. For now, it is not an additional requirement set by importers, but within a couple of years it surely will be.. It is better to be prepared as implementing standards take much time and some financial investment.

In the Bahamas, for example, the catch of lobster by free divers is restricted to touristic purposes. Free diving is considered a dangerous fishing method and not in line with CSR principles.

Tips:

- Start looking for possibilities for acquiring CSR certification. Some internationally known certifications are Sedex and ISO 28000.

- Learn more about CIF and other Inco Terms in the CBI Tips for organising your exports to Europe.

- Read the CBI’s study on buyer requirements. It will give you an understanding of the general seafood industry requirements.

What are the requirements for niche markets?

Compared to products like Pacific white shrimp or farmed black tiger shrimp, rock lobster is already a niche market. Availability is limited and so is the number of exporters and importers. As long as sustainable lobster is not the industry standard, the market segment that requires sustainability can still be considered niche. Below, find out what buyers in this niche segment may require of you.

Buyers sustainability standards

On the European market, sustainability is becoming increasingly important for end consumers, and the certifications are becoming an essential way of proving the sustainability of a supply chain. The most commonly accepted sustainability certification scheme for wild-caught seafood in Europe is from the Marine Stewardship Council (MSC).

There is just one country in the world that has MSC certification for rock lobster, and that is the Bahamas. You can check the MSC announcement here. As the availability of MSC-certified rock lobster is limited, this certification could be a big advantage, especially if you are willing to export to the northern part of Europe, which is more likely to require this certification.

Consequently, other countries are also trying to obtain this MSC standard for their rock lobster fishery. First, they have to engage in a Fisheries Improvement Project (FIP). Five countries are currently involved in an FIP: Belize, Brazil, Honduras, Mexico and Nicaragua. FIPs work with the seafood industry to promote sustainability in the sourcing of wild caught seafood. An FIP is the preliminary phase of obtaining MSC certification.

During this project, which can take 6-7 years, they study the actual stock of rock lobster, their migration flows, their maturity status and other biological parameters. The ultimate goal is to chart the exact point of fishing possibilities (quota) without disturbing the natural habitat of the rock lobster. In other words: guaranteeing sustainability.

If you are from another country than mentioned above, please check the FIP website to learn how to start.

Getting an MSC seal helps secure your reputation as a reliable and trustworthy exporter among European importers, making it easier to enter the market. It is a good investment at this stage when sustainability plays an essential role in trade.

Tips:

- Read our CBI study on opportunities and threats in the European market in order to learn more about the importance of sustainability.

- Get an audit by an accredited certification body, as this can be an advantage in the business. Check the list of accredited certification bodies to see which one could assist you.

- Check out the Sustainability Standards Map, which helps small and medium-sized enterprises in developing countries develop their value chain with a focus on sustainability.

- For a full overview of certification schemes in the sector consult ITC Sustainability Map. Enter your sector or product, the producing region or country and the target destination region or country to see the relevant schemes.

Different countries often want their tails differently

Commercially speaking, there are some typical differences in the most popular sizes of rock lobster tail in between European countries. While this is not exactly a “niche market requirement”, it is an advantage to know the desires of the different regions. It will help you to understand which markets best match your products.

Consumers in France usually prefer small sizes (4oz to 6oz). The United Kingdom prefers small to mid-size (5-9oz). In Spain, consumers prefers mid-size (8-10-12oz) and Germany prefers big sizes (10-12oz and much bigger). These are just a few examples of the regional differences in the preferred size of lobster.

2. Through what channels can you get rock lobster on the European market?

The main channels to get your lobster to the retail and food service segments are importers and wholesalers. There are no European retailers importing lobster directly from origin, and food service buyers prefer to work with local suppliers for financial reasons (expensive products) or practical reasons (lack of knowledge of importing).

How is the end market segmented?

In Europe, rock lobster is mostly sold in retail such as in higher-level supermarkets (about 70%) and the specialised fish & seafood restaurants (around 30%).

Depending on seasonality (Christmas for example, when demand is high for special meal items) and availability, rock lobster may also be sold by low-level supermarkets, fish mongers and street markets, as well as other less expensive restaurants.

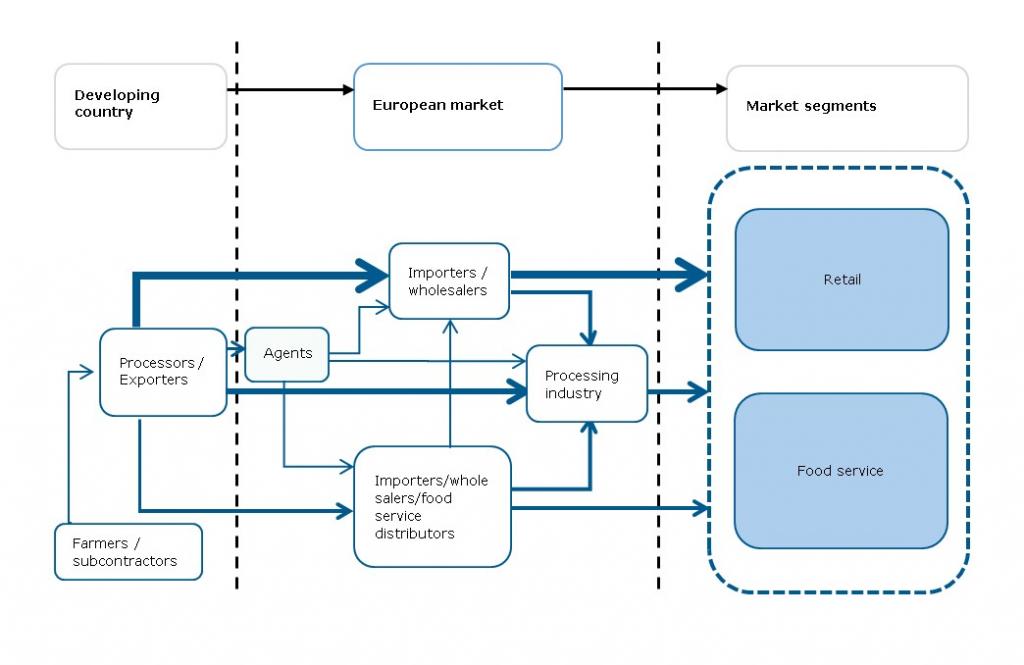

Figure 1: End-market segmentation for lobster

Source: Open Europa Import & Export Consultancy 2020

Retail

Retail needs just-in-time logistics (ordering today, delivery tomorrow). Furthermore, the commercial risks tend to be much more limited when making purchases from suppliers nearby instead of overseas suppliers. Consequently, it is best to search for European importers with a stable supply to the high-level supermarkets.

Retail needs nice retail packaging under a private label or the importer’s label. Companies like Delfin Ultracongelados import the rock lobster in ten-pound boxes but their processing plant repacks the lobster in small boxes or even skin pack trays of about 500 grams (consumer weights). Being very flexible in their processing, Delfin can pack three lobster tails of 6oz each (about 170 grams per piece) in a 500-gram skin pack tray under private label.

High-level supermarkets are very demanding when it comes to quality and certifications. They continuously ask for technical sheets, BRC or IFS quality certifications, CSR standards and guarantees of sustainability (like MSC). Consequently, the importer selling to these retail channels will also ask you for these standards. Make sure you comply with all mandatory and additional requirements (refer to section above).

Fresh lobster, in retail, is considered particularly niche. Some European importers like Fiorital from Italy, have special modern storage tanks with clean and chilled water, under strict and continuous temperature control. Their aim is to limit mortality and deliver just-in-time.

Because of the complicated and expensive storage necessities, frozen rock lobster HOSO (head on, shell on) and tails are good alternatives to live rock lobster. They are found in the frozen section of major retailers and specialised wholesalers. Spain and France are the biggest markets for these products, and you can find frozen rock lobster in major supermarkets across these countries. However, for other European countries the best chance to find frozen rock lobster is in high-end restaurants (food service).

Tips:

- Check out large retailers in your target country, for example: Carrefour in France, El Corte Inglés / Supercor in Spain, Tesco in the United Kingdom and Hanos (Cash & Carry) in the Netherlands.

- Go to events and exhibitions such as the Seafood Expo Global, which will be held in Barcelona Spain (formerly in Brussels Belgium). There you can meet with lots of possible importers. A tip for finding rock lobster buyers: they usually also deal with other related crustaceans such as crab or wild catch shrimp. When in Barcelona, take advantage and visit nearby supermarkets to see their way of selling fish and seafood in general.

Food service

For live lobster, the market is limited and focused around specialised and high-end restaurants in France, Spain and Italy. These countries have a lot of experience with and appetite for fresh and live seafood. Northern Europe, however, is easier to reach with frozen lobster.

The food service sector for live rock lobster is strongly based on appearance and quality because those are the characteristics that consumers are looking for and willing to pay for. Key aspects for live rock lobster are luxury and status. Price is less important, but quality must be excellent regarding smell, date of capture, origin, assurance of wild product, size (as a guarantee of meat content) and appearance (colour, hardness of carapace, liveliness of the lobster).

Frozen lobster is convenient for restaurants that do not have an aquarium to keep live lobster in. They have the choice to buy frozen pre-cooked or raw HOSO lobster or frozen raw rock lobster tails. In frozen condition, rock lobster is easy to store and lasts for at least 24 months after the freezing date.

A specific segment of the food service are cruise liners. Frozen lobster tails are a product with potential for this sector, they are easy to prepare, easy to store, perceived as being luxurious and directed to consumers with a relatively high economic power. Some companies like B&S and Schmidt Zeevis (the Netherlands) are specialised in these segments. However, even these companies are used to buying the raw material from European importers.

Tips:

- Consider trading with the Netherlands, Belgium and Germany. Dutch and German traders often supply mixed container loads to Middle-Eastern countries (high purchase power) and cruise liners (relatively expensive and luxurious tourism).

- Make an export marketing plan (EMP) before stepping into the European markets. Consider offering nice luxurious packaging.

- Be imaginative in presenting your product to the food service sector. Think in terms of how the sector can use rock lobster on their menus or their range of dishes.

Through what channels does rock lobster end up in the end market?

As you can see from Figure 2, to enter the European market, you should go through an importer or wholesaler or local agent. Specialised traders and agents are market experts who know the market requirements, competition and reliable customers.

Regardless of whether your rock lobster products will end up in the retail or food service sector and whether it is frozen or fresh, they will use the same channels to get to the market. Logistics for live or frozen products, however, are of course different. Importers and wholesalers are the main channels to reach the European markets.

For live lobsters, which mostly go to France, Spain and Italy’s specialised supermarkets, it is best to find a specialised importer to deal with. For frozen lobsters, which mainly go to restaurants and cruise liners, it’s best to contact importers, wholesales or food service distributors.

Figure 2: European market channels for live and frozen rock lobster

Source: Open Europa Import & Export Consultancy, 2020

Tips:

- If you are interested in putting a container load in Europe for direct sales of bulk boxes to wholesalers, make use of the available logistic facilities of the European ports. From here products are further distributed into Europe. Important distribution hubs in Europe are Rotterdam (the Netherlands), Antwerp (Belgium) and Hamburg (Germany).

- Try to reach importers which both sell to retail and food service. The COVID-19 virus made it clear that selling to multiple markets is important: the food service segment was highly impacted while retail managed well.

What is the most interesting channel for you?

As indicated in the previous section, the most interesting channel is going through specialised traders and importers, as they can provide the best knowledge and expertise in the European market. They can be individual consultants or working for an importer. These agents can provide you with valuable connections into markets, like retail or food service, which would otherwise be difficult to reach. Retail outlets seldom import directly from origin. Specialised fish and seafood restaurants are, also, mostly served by European importers and wholesalers.

Tips:

- The rock lobster sector is a market with a limited number of exporters and a limited number of importers (only few importers can afford it). Importers usually work with local agents, so it would be good to find an agent that specialises in these types of products.

- To find local agents, be wary of randomly surfing the websites as you can end up with bogus agents. Check out some websites to connect you with importers such as eurofoodlink.com or personal agents like cb8global.com.

3. What competition do you face on the European rock lobster market?

Which countries are you competing with?

In this section, we will focus on the six main countries that export rock lobster to the European market. There are rock lobster fishing activities all around the equator, but we will highlight only the countries which are indeed exporting the product, not only using it for national consumption.

See Figure 3 below for a better understanding of how much lobster Europe imported from the Caribbean, Africa and Asia in 2017, 2018 and 2019.

The Bahamas

The Bahamas is one of Europe’s most important suppliers of rock lobster. They have an MSC certified fishery and a professional fishing fleet according to international quality standards. There are 12 licensed exporters and most of them have good, modern, sometimes BRC-certified processing plants. The Bahamas has longstanding experience on the European market and they know the necessary requirements and standards.

As explained before, sustainability is a key issue for rock lobster. Rock lobster has always been considered an endangered species. By engaging in Fishery Improvement Projects (FIP’s), Nicaragua, Belize, Brazil, Mexico and Honduras are tackling this issue. They have some projects running, which will end in the coming years. This FIP study will be the basis for the decision to grant the internationally known MSC sustainability certification. The Bahamas has already successfully completed this FIP study and has been rewarded MSC certification in 2018.

Nicaragua and Cuba

Apart from the Bahamas, your biggest competition in the region comes from Nicaragua and Cuba. These are two of the main exporters to Europe with a professional fishery industry and modern, even BRC certified, processing plants. Currently, however, Nicaragua cannot export to Europe due to some pending licensing issues, which offers opportunities for other exporters.

Other Caribbean countries

There are several other Caribbean countries that occasionally export their rock lobster to Europe that used to be strong exporters to the US. Historically, countries like Colombia, Jamaica, Brazil, Mexico and Honduras would sell to the US market. However, as the US is getting more and more demanding on health and sustainability issues (like the Seafood Import Monitoring Program ‘SIMP’) and prices can be better in Europe (depending on the dollar), they now regularly look for alternatives like the European Union.

Many Caribbean countries only sell the lobster they produce to local markets for now, but this could change in the future. Countries like Barbados, Saint Lucia and Dominica have some artisanal fishery but due to the limited quantities and lack of modern processing plants, these countries are not competitors.

African countries

Some African countries export live rock lobster to the European Union. Morocco, Madagascar and Mauritania have some artisanal fishery but do not have the necessary processing plants to freeze the product. Therefore, they prefer to send the live lobster to Europe by truck or by plane. In this region, there is not a lot of control on the sustainability of rock lobster.

In most countries in this region, availability is limited and stockage of live rock lobster is not up to European buyers’ standards. The water basins do not have temperature-controlled system and hygiene often does not match European requirements.

Exporters in African countries are very focused on the Asian market where importers are much less demanding than in Europe. However, the level of standards are increasing and in the mid to long term, it is expected that these African countries will target Europe more.

Asian countries

There are some Asian countries like Japan, South Korea and Taiwan which are willing to pay a lot of money for good quality live rock lobster. Consequently, due to the proximity, producing countries like India, Indonesia and Sri Lanka are focused on these end markets. It is easier to transport live rock lobster during a direct flight of five hours instead of a 14-hour flight with stopovers. Risks are limited.

While these countries do not currently export to Europe, that might change. Rock lobster is a high-demand wild-caught seafood product with high market prices and many uncertain factors influencing availability (like climate change or governmental upheavals). As countries in this region begin to match European product expectations, like they are in Africa, in the mid to long term Asian countries will be prepared to enter the European market if production from other destinations drop.

Which companies are you competing with?

As the rock lobster is unique, there are only a few main players involved in the export and import of this product. The following companies have been successful in exporting lobster to the European market. Visit their websites in order to find out how they present their products to the global market.

Central American Fisheries Nicaragua (CAF)

CAF is one of the three most important rock lobster exporters in Nicaragua. In order to maintain high levels of quality and sustainability, they only use their own vessels to catch the rock lobsters in Caribbean waters. They use baited traps and the first quality-control is being done when the lobsters are taken out of the water. Lobsters that are too small are released immediately. The rock lobsters are transferred from the small boats to larger ‘stock vessels’ that take them to a Corn Island processing plant.

Due to the lack of stable and reliable logistics from Nicaragua, live rock lobster is rarely exported to Europe. There are no direct flights between Managua and Europe and a stopover would increase the risk of mortality. Therefore, rock lobsters are being frozen HOSO (Head-on Shell-on) or HLSO (Headless, Shell-on).

Marazul Nicaragua

This company is based in Puerto Cabeza and is comparable with Central American Fisheries in terms of production volumes. In fact, they sometimes work together on production level. They do not have modern cooking facilities and prefer to export only raw head-on shell-on and lobster tails. Marazul is selling mostly to Europe but sometimes, when there is a really big difference in price, they prefer to sell some quantities to Asian countries like Taiwan and Japan.

They own about 36 vessels, all equipped with baited traps. In fact, Marazul is one of the most active companies in the fight against the catching method of diving with compressed air. Moreover, Marazul is one of the initiators of the FIP project to guarantee sustainability and to reach MSC certification in 2021. Nicaragua is a difficult country to do business in, for political reasons, especially for private companies. Catching quotas can be limited or extended with very little notice.

Caribex Cuba

This company is one of the pioneers of exporting rock lobster to Europe. Caribex used to have Pescanova/Pescafina Spain as sole distributor for the European market. All companies willing to import lobster from Cuba had to contact Pescanova/Pescafina. Nowadays, after the company faced some financial challenges a few years ago, Caribex exports to other European companies but in close communication with Pescanova/Pescafina.

Though Cuba’s historical relationship with Spain gives Caribex Cuba a competitive advantage over lobster from other origins, this relationship is important to highlight as it means that the exporter, Caribex Cuba, is tied to Pescanova/Pescafina.

There are no FIP programs running in Cuba. However, when it comes to the quality of the product, the brand name ‘Caribbean Queen’ (Caribex’s label) itself is already considered a guarantee for quality, and has the company built and maintained that reputation for more than 25 years. Every European lobster importer knows the product. There are some serious doubts about the sustainability but seeing the stable catch and export figures of Cuba, it seems that the industry has its sustainability under control.

Which products are you competing with?

Rock lobster is a rather expensive product destined for high-end markets. As with most expensive products, availability is limited so competition is not directly based on price but more on exclusiveness. In this section, we will limit ourselves to the shellfish and crustacean category as these species are the most direct competition, and we will not mention expensive fish or even meat species. As demand is always higher than supply, however, there is little real competition apart from other rock lobster.

Live and frozen Canadian/American lobster

This type of lobster is different than the rock lobster. The taste of rock lobster is a bit sweeter. Both lobsters are sold in high-end restaurants and, to a lesser extent, in retail. The biggest difference is its price. While a live rock lobster can easily reach wholesale prices of about Euro €24/kg, live Canadian/American lobster is just about €8/kg. The reason for this price difference lays in the fact that lobster from the United States and Canada is much more abundant and available than rock lobster.

Canadian/American lobster is mainly sold live. Shipping by air is much easier for these countries than it is for Caribbean companies. Lots of chartered air carriers from the US and Canadian coasts are even equipped with special tanks to transport live lobster. There is also a small market for European lobsters from the United Kingdom and France, similar to the Canadian/American lobster. This European lobster can also be seen as a competitive product, but availability is very limited.

Crab

Being in the same shellfish and crustacean category, crab is competition for lobster on the European market. There are a large variety of crab species that come from different European and non-European origins. Some of these species, particularly the larger crab like the king and snow crab, share the luxury and high-end image of lobster. Crab can be found live, fresh and frozen, depending on the end market.

There are several MSC certified crab species, and the king and snow crab are mostly imported from Norwegian fisheries, reducing travel distances.

Tip:

- Read the CBI Product Fact Sheet for crab to learn more about this competitor.

Frozen wild catch Penaeus Monodon

Countries like Nigeria, Mozambique and Senegal export frozen wild-caught Penaeus Monodon (black tiger shrimp) to European markets. The size per shrimp can be big, up to 500 grams per piece. Furthermore, prices are high, around €25/kg for a 6-8 pieces per kilogramme of shrimp. The taste of a wild monodon shrimp can be compared with rock lobster. The end markets are also similar. As with rock lobster, availability is limited and supply quite irregular. The demand is higher than the offer.

Tips:

- Read the CBI market study on black tiger shrimps to better understand this competitor.

- Visit the websites of companies like Primstar, Gambastar and Unima. This will give you an idea of how they manage rather expensive seafood products.

4. What are the prices for rock lobster?

The price of a product depends on many aspects. There are several factors to keep in mind. Prices can vary due to the seasonality of rock lobster (existing stocks tend to be very expensive in June, before the new season starts), quality, origin, shelf life, certifications, air and sea freight tariffs and especially the actual USD–Euro exchange. In general, live rock lobster is more expensive than frozen lobster due to the costs of logistics, storage and the commercial risk.

Because lobster is both niche and high-end, the price paid by the end user does little to illustrate what the producer might receive. What the end consumer pays is often more to do with the name and reputation of the store or restaurant or the fame of the chef cooking it rather than the value of the product. To give an idea of actual import prices, please have a look at the following schedule (prices per kilo delivered in Europe):

Live lobster $23.00

Frozen raw lobster HOSO $16.00

Frozen cooked lobster HOSO $19.00

Frozen raw lobster tails HLSO $38.00

Frozen lobster meat $62.00

Source: Open Europa Import & Export Consultancy 2020

Looking at this table, you will notice that there is quite a big price difference between live and frozen raw rock lobster HOSO. This is partly due to the difference in transport costs (air freight against sea freight). Moreover, profit margins are usually higher for a live product than for frozen product but so are the risks.

Tips:

- Try to promote your possibilities of value added (cooked, other packing, halves, etc). More value-added use to give higher profit margins.

- Decide what is the smartest (not the cheapest) way to transport your rock lobster without risking the quality. Transportation, handling and processing are important parts of the supply chain because this will determine the quality of your lobster from origin to destination

The study has been carried out on behalf of CBI by Seafood Trade Intelligence Portal.

Please review our market information disclaimer.

Search

Enter search terms to find market research