Entering the European market for squid and cuttlefish

The market for squid and cuttlefish has many different relevant species, origins and competitors. It is a mature market with many stable commercial relationships, modern processing facilities and many options for adding value to the raw material. Ensure that your product complies with all traceability and health and safety requirements to enter Europe. Once in Europe, make sure that your product goes to the right destination market and passes through the right channels. Competition is tough and markets know what they want.

Contents of this page

1. What requirements must squid and cuttlefish comply with to be allowed on the European market?

What are mandatory requirements?

Provide a catch certificate to prove sustainable fishing and hygiene

European countries are very strict when it comes to the import of squid and cuttlefish that is caught through illegal, unreported or unregulated (IUU) fishing. As with all fishery products, the European Union uses a Catch Certification Scheme, which is a must for exporting to Europe. It allows authorities to combat IUU fishing and ensures slave-free socio-economic conditions. The catch certificate contains all the information specified in the specimen shown in Annex 1 of the European IUU legislation. These catch certificates are checked against EU standards by the competent authority in your country.

According to the European Union, IUU fishing is any fishing that is done in forbidden areas, uses illegal methods or goes unreported. IUU fishing has a negative effect on the sustainable management of both global and local fish stocks and creates unfair competition against those that fish legally and responsibly. The European Union requires that you can prove that your products do not come from IUU fisheries.

Catch certificates are not only used to check if your products come from legal fisheries. European countries use them more and more to check if your products comply with the European hygiene rules. According to these rules, all squid and cuttlefish need to be frozen, processed or transported on board of authorised vessels or at authorised factories.

The competent authority is the government department in your country that the European Union finds the most capable (competent) of monitoring the seafood and fisheries products to be sent to the European Union. The European Union enters into an agreement with this department, giving them responsibility for the mandatory control measures before export.

The competent authority is a ministry department, usually one that regulates aquaculture and fisheries. In Peru, for example, the competent authority is the Organicmo Nacional de Sanidad Pesquera (SANIPES). In Costa Rica, the National Animal Health Services (SENASA). In Senegal, the Directorate of Fish Processing Industries. In Bangladesh, the Department of Fisheries in the Ministry of Agriculture, Fisheries and Rural Development.

Your competent authority is also appointed to authorise factories or vessels with on board processing facilities for trade with the European Union. These vessels will be put on the DG Santé list of establishments from developing countries authorised to trade with the European Union. If there are establishments on your catch certificate that are not registered on this DG Santé list, it is likely that your consignment will be rejected at the European Union border.

Tips:

- Learn more about the European Union’s rules to combat illegal fishing.

- Check this write up about the European Union CATCH system, which will eventually replace the old paper-based catch certificate system. Currently, the CATCH system is not a requirement for non-European Union countries. However, we recommend you learn and comply with the digital system in order to ensure a smooth-flowing transaction with European buyers.

Follow the guidelines for the management of squid and cuttlefish stock

To protect squid and cuttlefish stocks there are guidelines to which your product must adhere. The stock management approach for squid and cuttlefish is mainly focussed on limiting catching periods instead of minimum sizes.

There is usually a period (depending on the origin) when adults are largely absent, and the population is represented by eggs and larvae. During this period there is no fishing possible, nor allowed. Following this cycle, in all origins there is normally a relatively short fishing season during which growth and individual biomass increases rapidly. For example, the Falkland Islands only allows fishing Loligo Gahi squid from March to April and from August to September.

The life span of most commercially exploited squid and cuttlefish is approximately one year. This short annual lifecycle, with rapid growth that is determined by many environmental factors, means that a vessel cannot be sure of the size of the squid and cuttlefish that they are fishing, until just before they are caught.

Depending on each origin, other ways to manage the stocks of squid and cuttlefish are imposing a minimum and/or maximum size of fishing nets, setting quotas, fixing a maximum size of the vessel, prohibiting fishing in certain zones and even imposing minimum or maximum prices to manipulate offer-demand. With low prices, fishermen are less interested in going fishing for squid and cuttlefish, by which stocks increase.

Comply with labelling and packaging requirements

For all squid and cuttlefish exported to Europe, the labels on your products must comply with the standard labelling requirements for fish and seafood. You can find these requirements in the CBI Buyer Requirements study. Make sure that you understand and meet these requirements. European Customs departments are very strict regarding labels. You are required to pack your product in safe materials and include all ingredients that have gone into the product on the labels, including eventual additives used.

Fresh squid and cuttlefish are usually packed in polystyrene boxes with ice or gel packs. The boxes must be strong, clean and labelled according to the necessary requirements. Frozen squid and cuttlefish can be packed many different kinds of things, like boxes, bags or trays for example. Ask your client for their packing specifications before producing.

Food safety standards must be met

Food safety standards are important for Europe. Products that are found to be non-compliant will be registered and reported in the Rapid Alert System for Food and Feed (RASFF). If you are on that list, your containers will be inspected thoroughly at port of destination. These checks can easily take two to three weeks after arrival. Extra expenses like demurrage will be passed to you by the importer.

Hygiene and health are important to buyers. Make sure that no contaminants end up in the final product. Seafood destined for the European market is generally tested before it is shipped, sometimes in the buyer’s own lab, sometimes in recognised (independent) labs. European Union Rules regarding Food Hygiene cover all stages of production, processing, distribution and placing on the market for all food intended for human consumption. The standard European hygiene rules can be found here.

The maximum residue level (MRL) is also a detail that exporters should pay attention to. All traces of substances must be declared since they may be harmful to people with sensitivities to these substances. The MRL indicates the maximum amount that is allowed in the product as established by Commission Regulation (EC) No 1881/2006 (see Section 3.3 of the Annex).

Tips:

- Check the RASFF portal to learn about the kinds of products that are recalled and the reasons for border rejection.

- Have all mandatory transport documents be checked and confirmed by the client first, before making up the final original documents. Send them an email with the models of the health and catch certificates, as well as labels, and ask them if they agree with the contents. Upon approval, start up the documentary process with your authorities.

What additional requirements do buyers often have?

Buyers want extra guarantees on food safety and on the wellbeing of people

Many European buyers want products that are processed under quality standards that exceed the standard European hygiene rules. There are certificates that guarantee these stricter standards.

Some of those additional requirements include temperature control during processing, hygiene, traceability, condition of the cold store and safety protocols. Several internationally known quality certifications give buyers those guarantees. The most requested food safety certifications are International Food Standard (IFS) and/or British Retail Consortium (BRC).

European buyers are also concerned about the wellbeing and safety of your workers and suppliers (fisherfolk). Slowly, European retail chains are beginning to ask about Corporate Social Responsibility (CSR) certifications in their supply chain. For now, it is not an additional requirement set by importers, but within a couple of years it surely will be. It is better to be prepared beforehand, as implementing standards always takes a lot of time and some financial investment.

Tips:

Follow the grading guidelines

In the following tables you will find the gradings of some commercially popular squid and cuttlefish species. Only the gradings of the whole squid and cuttlefish are mentioned as there are too many specifications available for processed products. In order to find more details, please visit the websites of the companies mentioned in our ‘competition’ analysis below.

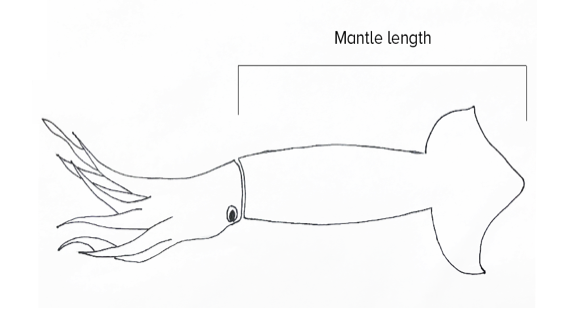

Figure 1: Mantle length of Squid

Table 1: Grading whole Patagonian squid Loligo Gahi (Falkland Islands)

|

No. 1 |

> 22 centimetres mantle length |

|

No. 2 |

19-22 cm |

|

No. 3 |

16-19 cm |

|

No. 4 |

12-16 cm |

|

No. C |

10-12 cm |

|

No. 5L |

7-10 cm |

Source: Open Europa Import & Export Consultancy 2020

Table 2: Grading whole Argentine squid Illex Argentinus (Argentina)

|

No. 0 |

14-18 centimetres mantle length |

|

No. 1 |

18-22 cm |

|

No. 2 |

22-25 cm |

|

No. 3 |

25-30 cm |

Source: Open Europa Import & Export Consultancy 2020

Table 3: Grading whole cuttlefish Sepia Officinalis (Morocco)

|

M1 |

> 8 kilograms per piece |

|

M2 |

5-8 kilograms |

|

M3 |

3-5 kilograms |

|

M4 |

2-3 kilograms |

|

M5 |

1.3-2 kilograms |

|

M6 |

0.9-1.3 kilograms |

|

M7 |

0.6-0.9 kilograms |

|

M8 |

0.4-0.6 kilograms |

Source: Open Europa Import & Export Consultancy 2020

Table 4: Grading whole squid Loligo Duvaceli (India)

|

U2 |

1-2 pieces per kilogram |

|

U3 |

2-3 pieces per kilogram |

|

3/6 |

3-6 pieces per kilogram |

|

6/10 |

6-10 pieces per kilogram |

|

10/20 |

10-20 pieces per kilogram |

|

20/40 |

20-40 pieces per kilogram |

|

40/60 |

40-60 pieces per kilogram |

|

60up |

60 or more pieces per kilogram |

Source: Open Europa Import & Export Consultancy 2020

What are the requirements for niche markets?

Meet buyers sustainability standards

Buyers want to know that their fish is produced in a responsible way. The market segment requiring these sustainability standards can still be considered niche, but it has great future potential. Often, suppliers cannot guarantee the sustainability of their products. At the same time, Europe is becoming increasingly demanding about the sustainability of their squid and cuttlefish products.

The most commonly accepted sustainability certification scheme for wild-caught seafood in Europe is from the Marine Stewardship Council (MSC). MSC works with the seafood industry to promote sustainability in the sourcing of wild caught fish and seafood. MSC certification helps you secure your reputation as a reliable and trustworthy exporter among European importers.

As MSC-certified squid and cuttlefish is not available yet, it is a big advantage to have it as soon as possible. Consumers in the northern part of Europe are more likely to require this certification. It is a worthwhile investment at this stage, when sustainability plays an essential role in trade.

For a fishery to achieve MSC certification, it must first conduct a Fisheries Improvement Project (FIP), which can take six to seven years. The FIP project requires a study of the actual stock of squid and cuttlefish, their migration flows, their maturity status and other biological parameters. The ultimate goal is to chart the exact point of fishing possibilities (catching periods and quota) without interrupting the natural habitat or lifecycle of the squid and cuttlefish species. In other words: guaranteeing sustainability.

Of the squid and cuttlefish producing countries, Peru, India and China are already involved in an FIP. If you are from another country, please check the FIP website in order to know how to start a project. It will definitely be easier to enter the European market with such a standard.

Tips:

- Read our CBI study on opportunities and threats on the European market in order to learn more about the importance of sustainability.

- Check the list of accredited certification bodies to see which one could assist you. An audit by an accredited certification body can be an advantage in the business

- Check out the Sustainability Standards Map which helps small and medium-sized enterprises in developing countries develop their value chain with a focus on sustainability.

2. Through what channels can you get squid and cuttlefish on the European market?

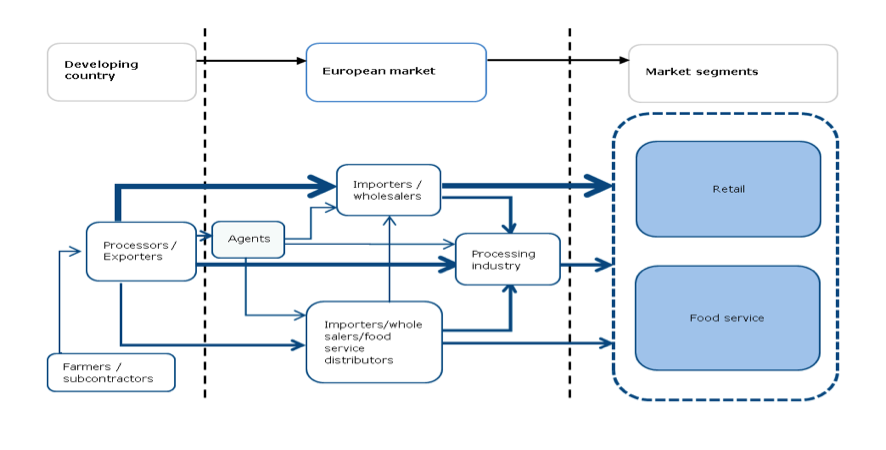

Importers and wholesalers are the main channels through which you can enter the European market. Sometimes, having agents facilitate the connection between you and the importers/wholesalers can be useful. These agents know exactly which requirements you need as product competition is heavy, especially in the food service sector. Retailers are not importing directly, instead, they buy from re-processors in Europe. Therefore, to enter the retail market, it is a good idea to communicate first to re-processors who are already have the necessary connections.

How is the end market segmented?

Squid and cuttlefish are mostly sold to the retail and food service market segments. There are many types of products at different prices and qualities. Each product has its segment where it has a high demand. Knowing your product will determine if you are targeting high-end expensive squid and cuttlefish products or the low-end cheap varieties, which is essential for success.

Fresh squid and cuttlefish are normally sold to food service clients (high end restaurants), largely from France, Spain and Italy. These countries have a developed affinity for fresh seafood. This market is particularly busy during the second half of the year with a peak in December. Fresh squid and cuttlefish are considered attractive for their freshness, taste and quality.

On the other hand, frozen squid and cuttlefish are considered more price orientated. Demand and supply are high and there are lots of alternatives. Spain and France are the biggest markets for these products, and you can find frozen squid and cuttlefish in major supermarkets across these countries. Carrefour in Spain and Auchan in France are just some examples. Frozen squid and cuttlefish are also in high demand in the food service sector, so they are also found in cash and carries and at wholesalers.

In addition to fresh and frozen squid and cuttlefish, there is another segment: re-freshed products. The ‘fresh’ squid and cuttlefish you can find in the larger supermarket chains are usually defrosted. It is too expensive to have actual fresh squid or cuttlefish on the fresh counter. You can find some locally caught products (along the Mediterranean Sea for example) but they are three times more expensive than defrosted products.

Some processors in Spain and France are specialised in importing frozen raw material, defrosting it in their installations and selling it to retail and food service as ‘refreshed’. This process is fully accepted by the European Union.

Tips:

- Think about trading with the Netherlands, Belgium and Germany. Companies in these countries may buy smaller quantities, but they are willing to pay more for excellent quality (certifications!), good service, customer made specifications and value-added products. Dutch and German traders often supply mixed containerloads to other rather unknown markets, like the Middle-East and cruise liners.

- Read the CBI Market Analysis for squid and cuttlefish to learn more about Spain and France, who are the main importers of squid and cuttlefish in the European market.

Through what channels does squid and cuttlefish end up in the end market?

There are two end markets for your squid and cuttlefish: retail and food service. Your product reaches these markets though importers and wholesalers.

Figure 2: European market channels for fresh, processed and frozen squid and cuttlefish.

Source: Open Europa Import & Export Consultancy, 2020

Retail

Being an overseas exporter, it is almost impossible to sell directly to the retail market. These clients are usually supplied by strong suppliers with a longstanding business relation. Supermarkets need to be sure that yearly contracts are being met. Also, retail needs just-in-time logistics (ordering today, delivery tomorrow) and commercial risks tend to be more limited if they buy from a supplier nearby instead of an overseas exporter.

Some retailers do import some fish and seafood products directly from origin, but only products with a very high rotation (like farmed Pacific white or black tiger shrimp). Turnover of these products is so high that retailers do not mind putting a container load in their own cold store, because they will sell it quickly anyway.

Squid and cuttlefish do not count among the retailers’ quick-selling items yet. Consequently, to get your squid or cuttlefish into the retail market, it is best to search for European importers with a stable supply to the retail market. Grupo Profand SA from Spain is such an importer. More than 80% of their turnover is based on sales to European retail chains like El Corte Inglés, Carrefour, Auchan, Casino.

Normally, the retail chains look for suppliers that can offer them a range of products. Supermarkets have lots of references and each reference has a supplier. For example, it is easier for them to speak with one supplier about ten references than with ten different suppliers. It is true that squid and cuttlefish are relatively important references for their sales but retailers tend to contract suppliers that can offer both squid and cuttlefish on all specifications together with octopus products for example.

Retail needs nice retail packaging under a private label or the importer’s label, not ten-kilogramme bulk boxes. Companies like Delfin Ultracongelados import squid and cuttlefish in the normal ten-kilo boxes but their processing plant repacks or processes the squid and cuttlefish in small boxes, bags or even skin pack trays of about 500 grams (consumer weights).

A company like Scanfisk Seafood from Spain receives the frozen squid and cuttlefish from origin, defrosts the product in their installations and packs it in Modified Atmosphere Packaging (MAP) of 400-500 grams. They sell the squid and cuttlefish ‘refreshed’ to the fresh fish counters of all major Spanish retail chains.

Being very flexible in their processing, both Brasmar and Scanfisk are able to change their retail packing easily and at short term, according to the customers’ wishes. You, as an overseas exporter, would have difficulties doing the same when you take into account even just the additional travel time.

Tips:

- Check out large retailers in your target country, for example: Auchan in France, Mercadona in Spain, Lidl in Germany, Tesco in the United Kingdom and MAKRO (Cash & Carry) in the Netherlands.

- Go to events and exhibitions such as the Seafood Expo Global, which will be held in Barcelona, Spain (formerly in Brussels, Belgium). There you can meet with lots of possible importers. Moreover, as there are many international suppliers of squid and cuttlefish, you can also see how your competition works. When in Barcelona, take advantage and visit nearby supermarkets to see their way of selling fish and seafood in general. You will notice that the demanded standards are high.

Food service

Especially in major import markets like Spain and France, squid and cuttlefish are generally accepted by all kinds of fish and seafood consumers. As there are so many varieties and price levels, squid and cuttlefish can be found in most restaurants of all standards. From high-end specialised fish restaurants, which usually use fresh squid and cuttlefish, to low-budget restaurants that use pre-fried and battered squid rings.

Schools, universities and hospitals are also important parts of the food service channels. There is a lot of consumption of squid and cuttlefish in these institutions, although normally only the cheapest varieties. School menus for small children must be easy to prepare and according to strict (= low) budget rules. This channel usually buys the squid and cuttlefish from local or regional wholesalers, in bulk boxes of five or ten kilogrammes.

Local and regional wholesalers usually buy their raw material from big importers. Sometimes they import some containers per year themselves. Instead of aiming at the bigger importers, some smaller wholesalers can be of interest for you as an overseas exporter. It takes more time to find these smaller importers, but you might get a better price for your product.

The large variety makes the food service channel a bit difficult to understand at wholesale level. There are so many different qualities and price levels involved that a restaurant needs to find out in detail what exactly is being offered. There is normally a lot of confusion about exact glazing, treatments and sizes – as well as their corresponding prices.

Furthermore, it is advisable to produce the squid and cuttlefish as declared on the label, even if an importer asks you to add extra glazing or a longer treatment. European Customs are intensifying quality controls in the ports of arrival. If your product contains more water than declared on the label, you take the risk of having the container sent back to origin, at your expense. Price is crucial in the squid and cuttlefish markets, but you have to play according to the rules.

A specific segment of the food service industry are all-inclusive hotels, in which all meals are included during the guests’ stay. Especially in the touristy coastal areas of Portugal, Spain, France, Italy and Greece, lots of hotels aim at this type of tourism, which normally attract low(er) budget travellers. These buffets offer all kinds of low-value squid and cuttlefish. Importers and wholesalers in these areas make their major sales during Europe’s summer, while inland business is bigger at the Christmas season.

As you can see from figure 2, you should go through a local agent or an importer or wholesaler to enter the European market. Local agents can be individual consultants that have further connections with importers or work under an importer. They allow the exporter to gain insight into the European market from someone in the industry.

Traders or importers can also provide you with connections in markets like retail or food service that would otherwise be difficult to reach. They can give you updates on changes in the market and competition.

What is the most interesting channel for you?

The most interesting channels for you are the importers and wholesalers. Retailers will not buy directly from origin. Food service has tough competition and is sometimes hard to understand. Each product has a specific market and there are specialised companies that cater to these markets. They know the competition and know how to tackle it.

Importers and wholesalers who deal with your product know exactly where it needs to go. Southern European countries and trading nations like Germany and the Netherlands are your best bet. While your product may end up in the retail and food service segment, its route to that end market is likely to be through companies like Seafood Connection and Profand.

Tips:

- It is important to know your target market and realise that nothing is guaranteed. The COVID-19 pandemic made this extra clear, as the food service sector (restaurants) struggled a lot during this period, while supermarkets could survive quite easily. You always need alternatives, do not focus on just one market. Therefore, it is best to deal with importers and wholesalers who can give access to both the retail and food service sectors. Search for importers who get at least 50% of their turnover from supermarkets. The retail sector is much more stable and less influenced by economically sensitive situations than the tourism and leisure sector.

- Make an Export Marketing Plan, which includes the strategies for reaching different end markets. If one market goes down (like high-end restaurants), you focus on the other ones. There is a lot of competition in the squid and cuttlefish market, so you should have well-thought strategies to stay in business. Strategies on product, price, promotion, place, planet and people must be the lead to gain your place in the European squid and cuttlefish sector. Be creative and transparent in presenting these key points to stand out from the competition.

- If you are interested in putting a container load in Europe for direct sales, make use of the available logistic facilities of the European ports. From here, products are further distributed into Europe. Important distribution hubs in Europe are Rotterdam (the Netherlands), Antwerp (Belgium) and Hamburg (Germany).

- Learn more about CIF and other Inco Terms in the CBI Tips for organising your exports to Europe.

3. What competition do you face on the European squid and cuttlefish market?

Your biggest competition in entering the European market for squid and cuttlefish are Asian countries (mainly India and China), Argentina/Falkland Islands, Peru and African countries (mainly Morocco and Mauritania). Additionally, there is some local European catch from the Atlantic and the Mediterranean Sea.

Which countries are you competing with?

Falkland Islands and Argentina

In 2019 the Falkland Islands were the top exporting nation toward Europe, volume-wise, by exporting 81,117 tonnes of frozen products with a value of €250 million. The major share went to Spain, which imported 80,026 tonnes of squid and cuttlefish. The products are sold frozen and refreshed and re-exported to other European countries. The second most important market was Germany, which imported 692 tonnes. The third European country importing from the Falkland Islands was Austria with just 81 tonnes.

Illex Argentinus, commonly known as Argentine shortfin squid, and Loligo Gahi, known as Patagonian squid, are the main products of Argentina and especially the nearby Falkland Islands. A strong feature of these species is that they are easy to process into strips, tentacles, rings, tubes, chopped pieces or any form, including of course the well-known battered squid rings ‘calamares a la romana’. This makes the Falklands islands a strong competitor on the European market, especially in supplying the re-processing sector.

Peru

In 2019, about 76,000 tonnes reached Europe from Peru, with a total value of €208 million. About 90% was exported to Spain, which has the bigger importers and processors of battered squid rings.

Dosidicus Gigas is Peru’s main squid for export purposes. This jumbo squid, or pota, can easily be processed into whatever shape: rings, stripes, balls, rectangular fillets, even Disney figures. There are many modern and certified processing plants in northern Peru. This variety of possibilities makes it ideal for lots of markets like Japan, Taiwan, China and Europe.

But there is another big advantage: its price. Under $2.00/kg, you can find jumbo squid rings in every Spanish supermarket. It is not considered to be of the highest quality in terms of taste, but that depends on the wishes and acceptance of the customer.

Sometimes there is a strong taste of chemicals (necessary to bleach the product during the processing) and the texture can easily end up being either too soft or too chewy. You cannot compare pota with a Patagonian squid for quality or price.

Jumbo squid stocks are secure, they grow and reproduce quickly. However, some years ago, due to the effects of ‘El Niño’, there was no jumbo squid at all for almost two years. A change in water temperature made the pota move hundreds of kilometres away, further in the Pacific Ocean. For each El Niño cycle, other origins might have an advantage.

India and China

India is the leading country of squid and cuttlefish exports towards Europe based on value. In 2019, India exported a total value of €284 million with a volume of 71,215 tonnes. For India, Spain is the leading importer, importing 28,476 tonnes in 2019. The next European importers are Italy with 17,286 tonnes, followed by Portugal with 6,731 tonnes.

Together with India, China is an important exporter of Loligo Duvaceli (squid) and Sepia Pharaonis (cuttlefish). China exported €237 million of frozen squid and cuttlefish to Europe. 23,123 tonnes went to Spain, making it the fifth most important country for China’s frozen squid exports (China’s total export volume of squid and cuttlefish is 345,060 tonnes globally).

Portugal and Italy are important importers too, and China also targets the United Kingdom. China sent 7,514 tonnes to the United Kingdom in 2019. This is most likely because the large ethnic group present in the United Kingdom requests different products than Italy and Spain. To learn more about the consumer preferences of ethnic consumers, read the CBI study Exporting fish and seafood to the European ethnic retail channels.

Normally, the squid and cuttlefish from India and China come in IQF or block frozen packaging. However, some of India’s processing plants are starting to take further steps in trying to add value to the product. Apart from cleaning and cutting, they started to produce squid and cuttlefish filled with vegetables and spices. Lots of India’s processing plants have quality certifications like BRC and IFS and also meet CSR standards. It is clear that India is a mature exporter of squid and cuttlefish to Europe.

As explained before, sustainability is a key issue for lots of fish and seafood products. With the enormous quantities of squid and cuttlefish caught each year around the world, there have always been serious doubts about the sustainability of these products. For this reason, India’s authorities began the process of a Fishery Improvement Project (FIP) to tackle this issue. This project is planned to finish in February 2024.

Morocco

In 2019, the turnover of exports from Morocco to Europe was about €235 million and 38,111 tonnes. Spain sourced a volume of 27,676 tonnes from Morocco, giving it a market share of 62% of all Moroccan frozen squid and cuttlefish exports. Spain imported almost 100% of the fresh exported squid, reaching a volume of 1,972 tonnes. France absorbed a volume of 8,170 tonnes of frozen product from Morocco.

The main products are Loligo Vulgaris (squid) and Sepia Officinalis (cuttlefish). Caught by both semi-industrial and artisanal fisheries, processing plants clean the squid and cuttlefish, pack and freeze them. Some companies are specialized in fresh squid and cuttlefish, which is exported by land or air to Europe.

However, the major part of Morocco’s catch is done by Spanish, Portuguese and Chinese industrial vessels. These boats never make port in Morocco. They are equipped with the most modern navigation and tracking systems and have their own freezing installations on board. The squid and cuttlefish are caught, packed in ten or twelve-kilogramme boxes and frozen. When they are full, the vessels go to the southern part of Spain for unloading.

Tips:

- If you are aiming to export squid or cuttlefish to Europe, you should speak to European importers about the standards they require. Especially quick, stable and reliable logistics are key in this sector.

- Learn how competitors in other continents work, look for websites of those companies or visit them during a business fair.

- If you are new in the business, it might advisable to forget Spain (as there is too much competition) and focus on the Northern European markets where you might find value-added possibilities. Take note that they need cleaned products that take little work to make customer-ready.

Which companies are you competing with?

The squid and cuttlefish sector has a high number of exporters and a high number of importers. The following companies have been successful in exporting squid and cuttlefish to the European market. Use these examples to learn what it takes to be successful in Europe.

Pescapuerta

Spanish fishing company Pescapuerta is one of the oldest companies catching Patagonian squid, Loligo Gahi. They have five trawling vessels with their own freezing installations onboard. Their main catching areas are the waters surrounding the Falkland Islands. The catching season for Loligo Gahi is March to April and August to September. Outside these periods, Pescapuerta’s vessels capture other fish and seafood species.

The squid is frozen and packed onboard and shipped to Spain via Argentina. From here, Pescapuerta supplies wholesalers and processors in Spain and exports this raw material to other countries like Germany, the Netherlands and Belgium. Pescapuerta’s sister company Elmar commercialises the squid to Spanish retailers and food service. With 80 lorries and 15 delegations in Spain, Elmar reaches a big part of the Spanish squid and cuttlefish market.

Proanco / Comex Andina

Comex Andina is a Spanish company based in Valencia. From here, all Dosidicus Gigas, or jumbo squid or pota, is sold to the European market. It is a company with a modern organisation and a high level of experience in the squid market. They only do Peruvian jumbo squid but they offer all imageable specifications. Rings, stripes or balls, they can do whatever their clients want. Therefore, they are the main supplier of jumbo squid to all Spanish retailers and big part of the food service, including processors.

The processing plant of Proanco, the sister company of Comex Andina, is based in Paita in the northern part of Peru. Here, all major jumbo squid companies have their processing plants. Paita even has its own international harbour for container ships. Proanco does not have fishing vessels of its own, but buys the raw material from a select number of reliable suppliers, which deliver the jumbo squid to Proanco’s private landing next to the processing plant.

Proanco is BRC certified and equipped with a lot of technology and digitised processes. They easily produce about 30 containers of jumbo squid per day. Due to this advantage of scale, it is easier and cheaper for lots of European importers to buy directly from Comex Andina than from other smaller Peruvian exporters.

Nuova Ondamar

Nuova Ondamar is one of many fish and seafood companies in Morocco. It is a typical trading company with no vessels, specialised in just three products (squid, cuttlefish and octopus). It deals with fresh and frozen products and has no internationally recognised certifications. In Morocco, and also Mauritania, there are hundreds of companies like this. And all of them are your competition.

Each day, Nuova Ondamar’s raw material comes from the many small industrial, semi-industrial and artisanal fisher boats in Morocco waters. They sometimes buy directly from the boats but most of the time from middlemen at the landing places. From here, the raw material is transported to the processing plant where Quality Control decides which products are suitable for the fresh market and which have to be frozen.

The fresh squid and cuttlefish are packed in polystyrene boxes with ice bags and sold to customers in Spain, France and Italy. Depending on the logistical possibilities at that moment and the destination, the fresh squid and cuttlefish is transported to the customer by truck or air. The frozen squid and cuttlefish is packed in bulk boxes of five or ten kilogrammes and transported by truck to European customers.

Profand Vayalat

Fish and seafood company Profand is one of Spain’s leaders in the sector with retailer Mercadona as its most important customer. Profand has several sister companies in the world like in USA, Peru, Argentina, Senegal and Morocco. In India, Profand has a joint venture with Vayalat Exports that was set up in 2012. This joint venture, Profand Vayalat Marine Exports, is one of India’s biggest exporters of squid, cuttlefish and octopus.

Profand Vayalat does not own fishing boats. They buy their raw material from middlemen that gather the squid and cuttlefish from several suppliers. Upon arrival at the processing plant, the Quality Control Manager decides which raw material will be processed for which market. They have the possibility to sell fresh and frozen squid and cuttlefish according to customer’s specifications. IQF, block freezing, cleaning and cutting are just some production possibilities they have.

The ultramodern processing plant of Profand Vayalat is IFS and ISO 14001 certified and is quite involved in the protection of the environment and in social responsibility. They run projects in waste and fresh water management, rainwater harvesting and solar power energy. Even an inhouse laundry facility for the workers’ uniforms is onsite. As mentioned in the buyer requirements, European consumers are very sensitive to such aspects.

Which products are you competing with?

In a certain way all fish and seafood products can be competition for squid and cuttlefish, but we will only mention their biggest competitor: octopus.

Octopus

Squid and cuttlefish belong to the family of the cephalopods. Another member of this family is octopus. Some kind of octopus is generally available in many parts of the world. China, India, Indonesia and Mexico are just some examples of octopus producing countries that export different octopus to Europe. We will highlight one species, which is very important for the European market: Octopus Vulgaris. This product usually comes from Morocco, although there is some catching activity in Mauritania and Senegal as well.

Octopus Vulgaris is sold IQF (flower shape), in blocks or pre-cooked. Spain is an important market for this product, but the rest of Europe is also slowly showing more interest in cooked octopus tentacles. The wholesale price of cooked Octopus Vulgaris tentacles packed in retail packaging is about €22/kg.

Tips:

- Visit our CBI market study on octopus to learn more about the octopus market.

- Visit the websites of companies like Fesba, Bormarket and EGuillem. It will give you an idea of how they commercialise squid, cuttlefish and octopus products.

4. What are the prices for squid and cuttlefish?

The price of a product depends on lots of aspects. And for squid and cuttlefish even more. There are so many factors to keep in mind that it is nearly impossible to mention standard prices for so many different types and origins of squid and cuttlefish. Prices can vary due to seasonality, quality, origin, shelf life, certifications, air, land and sea freight tariffs and, especially, the actual US dollar to euro exchange rate.

Next to these general aspects, it depends on the product itself. Squid and cuttlefish, as mentioned earlier, are products with lots of processing possibilities. The different specifications have different prices. Moreover, squid and cuttlefish can be packed in industrial boxes but also in retail packing, which makes a big difference in price. To give an idea of actual export prices, please have a look at the following schedule (prices per kilogramme delivered in Europe).

Table 5: Squid export prices

|

Fresh cleaned whole Sepia Officinalis Morocco |

€6.65 |

|

Frozen cleaned whole Loligo Duvaceli India |

$1.70 |

|

Frozen raw whole Loligo Gahi Falkland Islands |

$4.80 |

|

Frozen raw dirty whole Illex Argentinus Argentina |

$5.35 |

|

Frozen raw Dosidicus Giga rings Peru |

$2.20 |

Source: Open Europa Import & Export Consultancy 2020

Tips:

- Talk to your clients to better understand their specific needs, including treatments. Try to promote your possibilities of value added (rings, tubes, other packing or seafood mixes). Value-added products usually give higher profit margins.

- Decide what is the smartest (not the cheapest) way to transport your cuttlefish and squid without risking the quality. Transportation, handling and processing are important parts of the supply chain because this will determine the quality of your product from country of origin to destination.

This study has been carried out on behalf of CBI by Seafood Trade Intelligence Portal.

Please review our market information disclaimer.

Please review our market information disclaimer.

Search

Enter search terms to find market research