Tips for organising your fish and seafood export to Europe

This article can help you to organise your fish and seafood export to Europe. It explains the most important factors and shows you the organisations that can support you. Although following the tips will minimise your risks and maximise your opportunities, it will not guarantee your business will be successful. The COVID-19 crisis has made logistics more difficult, due to changing measures in the countries of origin and destination. This is why it is always a good idea to keep updated about the most recent regulations when arranging your exports to Europe.

Contents of this page

- Negotiate for a win-win payment structure

- Get your documents and labels in order

- Invest in your packaging: it protects your product and represents your company

- Make sure that you are using the best freezing techniques possible: innovation is key

- Employ a broker for your transport needs

- If possible, invest in global freight insurance

- Seek support from both private and public organisations, both in Europe and at home

1. Negotiate for a win-win payment structure

In the fish and seafood sector, there are lots of payment conditions on which you can agree with your customer. You must understand that an importer wants to pay you as late as possible and with as little paperwork as possible. On the other hand, you as an exporter want to get paid as soon as possible and with a guarantee that the customer is going to pay you the full amount of the invoice. Consequently, payment is one of the most important conditions to agree on at an early stage of the negotiation – and one of the most difficult conditions.

An overview from the best to the worst international payment terms (in the eyes of an exporter, as opposed to an importer):

- Full prepayment;

- Partly prepayment with the rest of the payment made on producing a copy of the original documents by mail;

- Partly prepayment with the rest of the payment made in Cash Against Documents on sight (immediately), after 30-60-90 days, via the importer’s bank;

- Full payment in Cash Against Documents at sight (immediately), after 30-60-90 days, via the importer’s bank;

- Letter of Credit via exporter’s and importer’s bank;

- Line of credit after 7-15-30-60-90 days.

Full prepayment

The easiest way to receive your money is asking your customer to pay the total value of your fish and seafood product in advance. You can be sure that no importer will agree to these terms. Some importers may be willing to prepay for a small shipment of fresh fish (a trial order). Most European importers do not send money to a foreign company before receiving the product. They want guarantees that the goods are of excellent quality and are being shipped directly. There are too many examples of receiving low- quality products (or nothing at all) after a full prepayment.

Partial prepayment

Most importers know that you as an exporter need to catch, farm or buy raw materials, process them and keep them in stock for several weeks at times to fill a container. They also know that exporters in most developing countries have to pay their suppliers directly in cash. In other words, there is a time period between your expenses and the moment of receiving money from the customer. You need to pre-finance that period and, if you are lucky, a business partner will take that period into account during negotiations.

If your product is good and stable, importers want your product and they will also want it in the future. It is in their best interest that you survive financially-difficult times. In these cases, some importers are willing to agree on payment terms with a partial prepayment. It depends on the name, history and status of your company, and the willingness of the importer, but it might be 25–30% of the value of the goods.

Please understand that this option means a financial risk for these importers. They trust you and rely on you. They are doing it to make your business a bit easier and to develop a long-term relationship with you. Nevertheless, the other 70–75% of the value of the goods which is not pre-paid must be paid through a documentary interchange.

Whether there is a partial prepayment or not, there are several payment terms with a documentary interchange. It can be that an importer wants such an agreement for 100% of the value of the goods, especially for first-time businesses with unknown exporters. The most secure option for both parties, exporter and importer, is the confirmed and guaranteed Letter of Credit (L/C).

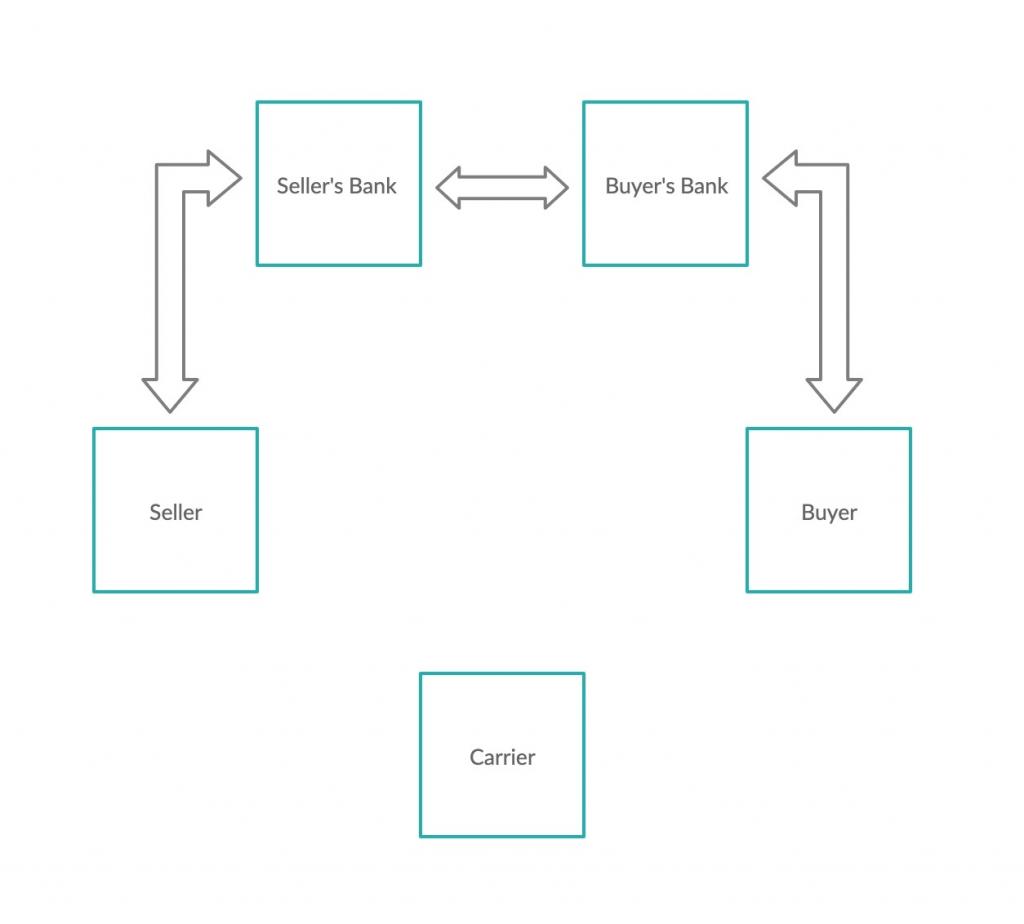

Figure 1: Document and/or money flows in financial transactions in case of a Letter of Credit

Source: Seafood TIP 2021

Letter of Credit

A Letter of Credit is a guarantee that the seller receives the payment and that the buyer receives the goods. Before loading the container, both parties assign a bank, through which all documents are exchanged. The buyer releases their payment when the buyer’s bank has the official transport documentation such as the Bill of Lading, Health Certificates, Form A, invoices, packing lists and so on (see the tip below on getting your documentation in order).

On the other hand, the exporter releases the documents when the seller’s bank confirms that the amount of the invoice has been reserved for payment to the importer. In short, the banks do a mutual interchange between documents and payments: documents = payment and no documents = no payment.

However, banks are not cheap. A Letter of Credit can easily cost about $800. Moreover, it takes time, as banks can be very particular about deciding on and following the smallest details in a contract. Therefore, many importers and exporters avoid L/Cs. They prefer more flexible payment terms such as Cash Against Documents (CAD).

Cash Against Documents

There are 2 types of CAD. One is without the use of a bank. The exporter must send a copy of all original sales documents, including the Bill of Lading, and the importer makes the payment by wire transfer. Email is preferred when sending the document copies to be checked, as it is the fastest and most convenient option. After receiving the money, the exporter sends the original documents directly to the importer by DHL, FedEx or another secure mailing service. The importer uses those documents to collect the goods at the border.

In this case, the importer pays the exporter directly and has no 100% guarantee that the original documents are really being sent. Without these documents, they will not be able to collect their purchase, so this method takes some trust.

The other CAD type is to send the original documents to a bank assigned by the importer. The exporter sends the documents to the bank and the bank reserves the amount of the invoice from the bank account of the importer. When the importer comes to collect the documents, the bank pays the exporter immediately or after 30-60-90 days, depending on what both parties agreed to in the contract. It is important to include any interest that you paid for the pre-financing of the goods in your cost price calculation.

In this case, the exporter has no 100% guarantee that the importer is going to collect the documents. Unless they have prepaid, if they do not collect the original documents, the money will not be released to you and it will be your loss. You may have to try and find a replacement buyer or, if it is not possible, have the products returned to you. For this reason, until trust is built up, it is important to make sure that the buyers to which you sell are professional businesses that seem to be reliable customers. Our Tips for finding European fish and seafood buyers will give you more information.

Selling on credit

Particularly in the fresh fish business, it is quite common to sell “on credit”. The goods are shipped to the importer and the importer pays the exporter directly or after a prearranged period. The most common payment periods are 7, 15, 30, 60 or 90 days. Credit-based payment plans that avoid documentary interchange, especially longer-term payment periods, are often reserved for longer-term relationships and are often built on regular business.

This condition, however, gives no guarantees on payment. Therefore, if you are choosing exports on a credit basis, try to get insurance on sales to a specific customer. Depending on the financial situation of a customer, an insurance company such as Coface or Crédito y Caución can be willing to “guarantee” payments up to a certain amount.

For example, if an insurance company guarantees $250,000 on sales to company X, the insurance company will pay you the pending invoices up to $250,000 if something goes wrong with company X. However, if the outstanding balance is $300,000 and company X goes broke, the difference of $50,000 is your loss.

Such insurance companies, like Coface and Crédito y Caución, want to minimise their risks. This means that they regularly check the financial accounts of the companies asking to be insured. At the start of the COVID-19 crisis, they cut or lowered lots of guarantees for precautionary reasons. For example, if before the pandemic a company had taken out $250,000 worth of insurance, when the virus breakout took place, this guarantee was lowered to just $50,000, and sometimes even cancelled. This resulted in an increasing risk for the exporter, as their sales were no longer covered by the insurance, or no longer fully covered by it.

Insurance companies are still reluctant to grant guarantees or to increase these. They want to know the financial outcome of the crisis first. So until then, sales on credit will be rather restricted due to the low guarantee amounts.

In short, the most interesting payment term for an exporter is prepayment. The most interesting payment term for an importer is credit after 90 days. The most secure but most expensive guarantee for both parties is the Letter of Credit. You now understand that payment is an important part of negotiating a contract.

Tips:

- Consider the payment terms as an essential part of negotiating a contract.

- Make your cost price calculations, as some payment terms will force you to prefinance your export (time difference between paying your suppliers and the moment of receiving payment from the customer).

- Payment terms go together with risks. The more insecure you feel about a new customer, the quicker and more securely you will want your money. However, longstanding customers should also be held strictly to payments.

- Remember that a deal is a deal when the deal has been paid.

- Ensure that you have all the documentation in place, as the documents equal payment; without documentation, you can risk late payment and demurrage in the port.

2. Get your documents and labels in order

There are some basic export documents that an importer always needs to present to European customs when receiving a shipment:

- Bill of Lading (the document of the shipper, stating details about the shipment such as volume, number of boxes, container number and vessel name);

- Health Certificate (the document of the local authorities in the country of origin, stating that the goods are in the right condition for consumption);

- Packing list (the document of the exporter, stating things such as the number of kilos, boxes and sizes);

- Commercial invoice (the document stating things such as the volumes per size, prices, end prices and payment conditions);

- Certificate of Origin (the document of local authorities in the country of origin, stating the origin of the products);

- Form A, if available (the document in case of ‘0’ import duties for the importer);

- Catch Certificate, in case of wild catch (the document of the local authorities in the country of origin, stating all the details about the number of kilos caught by a specific vessel, including the European Union vessel licence number).

All these documents must have been stamped and signed by the competent authority in your country. In case of any doubts, hire a professional broker or forwarding agent to make sure that all of your documents are in order. Incorrect documents can be expensive due to border rejections or delays.

The “competent authority” is the government department in your country which the European Union finds the most capable (competent) of monitoring the seafood and fisheries products to be sent to the European Union. The European Union concludes an agreement with this department, giving them responsibility for the mandatory control measures before export.

Usually, the competent authority is a department in the ministry in which aquaculture and fisheries are regulated. For example, the competent authority in Peru is the Organismo Nacional de Sanidad Pesquera (SANIPES), in Costa Rica the National Animal Health Services (SENASA), in Senegal the Directorate of Fish Processing Industries, in Bangladesh the Department of Fisheries in the Ministry of Agriculture, Fisheries and Rural Development, in Vietnam NAVIQAD, the Quality Department of the Department of Fisheries in the Ministry of Agriculture.

Brokers or forwarding agents can be found in any international port or via a search on the internet. They all offer the same services and tariffs are normally equal. The Trade Helpdesk of the European Commission also gives lots of information about actual custom requirements.

Next to these documents, it might be possible that an importer requires other documents such as an insurance policy (under CIF Incoterms), a bacteriological analysis or an anti-drugs certificate. Fish destined for the European market can be tested (mostly for heavy metals and histamines) before it is shipped or on arrival in Europe. When and where products are tested, whether through an independent recognised lab or through the labs of one of the companies, depends on the agreement made and the contract signed between the importer and exporter.

The exporter is obliged to send these documents by international couriers such as DHL or UPS to the bank of the importer (under Letter of Credit or Cash Against Documents payment conditions) or to the importer themselves before the arrival of the shipment.

If the documents arrive too late, customs will not release the container, which will cause demurrage. Demurrage means that the container is put “on hold” until the documents arrive. Nobody can touch the goods. Each day on hold costs about €350, depending on the port of arrival. The importer will claim this demurrage from the exporter.

A single mistake in the export documents can also cause demurrage. Just forgetting to complete 1 data field or 1 typo is a reason for customs to put the container on hold until the mistake has been resolved. Therefore, a tip is to revise all documents thoroughly and send a draft/example of the documents to the importer in order to have a second opinion, and ensure that they are all correct.

On the arrival of the shipment, European customs will check the labelling of the goods, both the master carton and (or other situations where there are smaller packages within the master carton), the retail packing, in the case of retail. The labelling must be exactly according to the Regulations EU 1169/2011 and EU 1379/2013. In short, each box must have a label or data printed somewhere on the box. Read the CBI buyer requirements study to learn what must be included on the label.

As with the documents, a wrong label can be a reason to put the container on hold, causing demurrage costs. Before labelling the goods, send a draft to the importer to doublecheck that everything is correct. Be sure that the importer confirms by mail. In the case of mislabelling, it is better to cover your bases, as relabelling the whole container in Europe under customs supervision can be very expensive. Customs can even decide to send the container back to the exporter.

In theory, all European ports and airports have the same rules and conditions. In practice, there are differences between the ports of arrival. Customs in some ports will be much more demanding and alert to minor details than customs in other ports; your customer will know the best ports. If buying CFR or CIF, they will do so in their favourite port.

Nowadays, several European companies insisting on customs checking not just documents and labels, but also chemical treatments and glazing. The label has to mention the net weight of the goods, but there is little control over the real glazing used. With chemical treatments, which are often used to influence the net weight, all ingredients and chemicals used must be mentioned on the label.

For now, European ports and customs lack the capacity and necessary expertise to address these issues fully, but it might be in future that controls on glazing and chemical treatments in relation to the labels may increase.

Trade tariffs for most developing countries that export to Europe are 0%, if you have a certificate of origin. An importer therefore does not have to pay tariffs when importing the goods, which could give you an advantage over countries which do have trade tariffs. The CBI European buyer requirements study will give you more details about the certificate of origin and other required documents. If you want to know the trade tariffs worldwide, look at https://trade.ec.europa.eu/tradehelp/ or https://madb.europa.eu/madb/euTariffs.htm.

Remember that the EU has changed the Form A by introducing an electronic system called Registered Exporter System (REX). This new system is being implemented according to EU Regulation 2015/2447. If you want to know more about the implementation process and its progress, you can check the specific EU website about the REX system. This website also provides a list of countries indicating when the REX system will be in place (or when it should be).

When applying for the REX system, exporters are issued a REX identification number. This number must be mentioned on the invoice and packing list of each delivery. This means that a Form A is no longer necessary. Ask your authorities in case of doubts or questions.

Tips:

- Arrange all necessary export documents on time; the buyer needs them at least 2 days before the arrival of the vessel.

- Send the original documents with an internationally recognised courier such as DHL or UPS.

- Send an example of the label to be used to the customer, and insist that they to check and confirm the label by mail.

- Use glazing and treatments as declared on the label.

- Check https://trade.ec.europa.eu/tradehelp/ regularly for labels and documents. Regulations can change.

3. Invest in your packaging: it protects your product and represents your company

Packaging is an important aspect of your product, especially during the pandemic, when frozen seafood products are said to be able to carry the virus on their outer packaging. Chinese customs, for example, has already ramped up the requirements for imports to be sterilised, disinfected and checked for traces of COVID-19. While this is not (yet) the case in Europe, make sure to invest in good packaging, and ensure that your products are – of course – free from any possible contaminants. Currently, European importers do not require or demand any additional testing (i.e. a nucleic acid test) to prove your product is free from any contamination.

Not only retail packaging must be attractive with all details mentioned, the master carton must also be clean, with all necessary data (for a tip on customs for labelling, which holds for both retail and master packaging, see EU 1169/2011 and EU 1379/2013) and with a nice logo of the exporting or importing company.

The master carton is the first thing that an importer sees when opening the container. Give them a good first impression! Later in the value chain, when your product is always stable and consistent in quality, the customer does not need to open the master box to see whether the product is in order; just seeing your master box is enough to trust you. Moreover, an exporter should try to limit handwriting on the boxes. Instead, try to have as much information as possible pre-printed on the packaging. Using a pen is not to be advised since the ink can easily smudge when it comes into contact with humidity and condensation.

Some exporters want to save money on the quality of the packaging. They may save $0.01/kg per kilo using mediocre packaging material that can break easily before reaching the customer. The money that they save during production can be lost afterwards due to damages. Do not do it. The packaging material should be strong, clean and undamaged when it arrives.

Sometimes, an importer has certain criteria for the boxes, such as the thickness of the carton. In some developing countries, high-quality packaging material can be difficult to find and/or very expensive. However, the same material may cost less in a neighbouring country. There are even companies in developing countries importing packaging material from European countries such as Spain.

The San Cayetano company in Valladolid, Spain is a strong player in exporting packaging material to developing countries. If you are unsure about what quality of packaging to use, ask your buyer. Sometimes, an importer even sends the packaging material to the exporter in order to be sure of its quality and attractiveness.

If the product is sent in bulk packaging (for example, 10 or 20 kilos) without smaller inner packaging, the product should first be packed in a plastic bag before using the master carton; this step is mandatory for hygiene and quality preservation. If sent in bulk, the attractiveness is normally less important, as the product will be used for reprocessing. Still, the carton must be strong in order to avoid damage during transport.

Sometimes, if used for reprocessing, it is possible to send the product in a large pallet box. Block-frozen products are especially suitable for transport in this kind of box. The large carton pallet box fits the size of a pallet, which needs to be either wood or plastic and which needs to be of high quality to carry the load of the box so it does not arrive broken or damaged in any way.

Pallet boxes can come in very large sizes, but most importers will generally have restrictions on what sizes they can store in their warehouse. The exporter will need to check the maximum sizes of a pallet box with the importer.

The frozen blocks are put in 5 to 6 layers, then a carton layer, 5 to 6 layers of product, a carton layer, and so on until the top of the box. The advantages of such packaging are less handling during production (such as unpacking individually wrapped bags during the defrosting process) and easy transport handling (about 33 pallets ready to load or unload in a container, with less wasted space than packing individual bags or IQF products in a carton). Less carton also means more net weight and therefore lower transport costs per net kilo of product.

For the importer, extra advantages are less handling and less waste of packaging material during processing. The pallet box must be stapled securely, wrapped in plastic (to protect the contents and avoid slipping during transit) and of course be strong. Moreover, the box needs to have the correct labelling.

Picture 1: Palletisation (the way that a pallet is packed)

Source: John van Herwijnen (2021)

For fresh products, polystyrene boxes are the norm. The size of the box depends on whether the customer wants 3-, 5- or 10-kilo boxes, or even larger ones.

Ask the customer and your forwarding agent for the packaging conditions, as some airlines only transport fresh fish under specific standards; for example, a special type of polystyrene box or a master carton to cover the polystyrene box. There can also be specific customer or airliner requirements for the use of ice or gel packs.

Picture 2: Example of a polystyrene cooler box

Source: Davpack (2019)

Tips:

- Do not underspend on packaging to save money. Calculated per kilo of product, the costs of packaging are limited and you reduce your risks by using high-quality packaging.

- Send an example of the master label to the customer for approval by email. Remember, the master box is an advertisement for your company. It must be strong, clean and attractive, and have all necessary data.

- If the product is for final processing purposes, try to minimise the use of packaging material.

- Make sure to wrap/seal the final pallet with boxes to prevent the boxes from moving during transport and therefore reduce the risk of damaged cartons.

- If you export a container with mixed fish to the European Union, do not forget to put all different fish products at the top of this container. In this way, the competent authorities in Europe can easily check the different products in the container without completely emptying the container (and thereby negatively influencing the cold chain).

4. Make sure that you are using the best freezing techniques possible: innovation is key

Your product is only as good as the final product which arrives. An important part of the quality of the product is of course the production process. The freezing process at the end of the entire production cycle, however, is very important and greatly influences the quality of the product that arrives at its destination in Europe.

More and more European buyers are looking to buy products with low glazing levels. Products imported as individually quick frozen (IQF) and brine frozen are increasing. Block-frozen products are still being used in the foodservice industry, but IQF and brine-frozen products are increasingly appealing to buyers.

It depends on the product that you sell, but it might be worthwhile to look for ways to offer more than only block-frozen products, which might mean partnering with a production plant that already has those freezing machines in place.

Tips:

- Ask your buyer about their preferred freezing techniques.

- Visit the machinery part of the large seafood expos and inform yourself of the latest trends in production/freezing techniques.

- If investing in a new freezing machine in your factory is impossible, check the options to partner with a plant that does have those facilities in place.

- Read our market analysis for Pacific white shrimp for more information about brine freezing as a growing trend.

- Read our news report on glazing to learn more about the risks and reputation of glazing.

5. Employ a broker for your transport needs

If an importer wants to buy FOB, they take care of the freight between the country of origin and the country of destination. They tell the exporter where and when to load the goods, and onto which vessel. If an importer wants to buy Cost and Freight (CFR) or Cost, Insurance and Freight (CIF), the exporter must arrange and pay for the freight.

The costs depend on the country of origin and the country of destination. Prices of petrol, political circumstances, the international demand for freight, and the availability of vessels and empty containers are just some factors which influence the price of bringing goods from one place to the other. Your forwarding agent or broker (see our previous tip on customs) can give you an indication of the current prices. Alternatively, if you want to figure them out yourself, direct contact with internationally known shipping companies such as Maersk, CMA or MSC can be made quickly.

If you need an empty container to load the goods, you would normally contact your forwarding agent to find a reefer (cooling) container of 20 feet (about 12 tonnes of loading capacity) or 40 feet (24 tonnes). A 20-foot container is more difficult to find and is relatively more expensive than 40-foot containers. The forwarding agent will contact internationally known shipping companies.

You could do it by yourself, but letting a reliable forwarding agent arrange transport is easier, more secure and relatively cheap. They can also take care of the necessary documents. As an exporter, you are responsible for the accurate completion of the documents. However, a broker or forwarding agent can check your documents, make sure that they are in order and help you to fix them.

For fresh fish shipments by air, it is certainly advisable to use a professional forwarding agency to take care of the cargo and the documents. Here as well, costs depend on the distance, availability, weight of the goods (it is cheaper to ship a lighter product than a heavier one) and volume. Prioritise getting a direct flight. An extra stop increases the risks of damage, higher temperatures and delays.

In the case of international transport by road, when your country is relatively close to Europe, it is quite easy to find empty trucks. International transport companies such as Girteka or Kotra have a wide European network of transporting chilled and frozen goods, but there are hundreds of smaller companies that can offer transport services by full truck load or per pallet. A quick search on the internet with key words such as “international transport company fresh frozen foods” in combination with your country will give lots of results.

Be sure that the truck is in the right condition, with temperature control during the trip, and reliable drivers who comply with European laws and traffic standards. Try to avoid transport companies that subcontract other transporters. A direct line towards the customer is more secure and easier in communication. Costs depend on the distance, petrol prices, reliability (an old truck is cheaper than a new truck), availability of empty trucks, toll roads and salary of the driver(s).

Tips:

- Find a good and reliable forwarding agent which is proactive and helpful.

- Use internationally recognised shipping companies such as Maersk, CMA and MSC.

- Take care that the container or truck is in good condition and complies with the latest standards.

- For fresh transport, use direct flights without stopovers.

- Make your cost price calculation include all costs of freight, forwarding services, administration and insurance if necessary.

- Remain in constant communication with your broker/shipping company regarding possible delays or changes in shipping period due to logistical difficulties caused by changing COVID-19 measures. Since there is constant uncertainty regarding the measures related to COVID-19, it is a good idea to always keep up to date on the latest measures in the country of destination.

Another important consideration when doing business in Europe is Brexit. This could impact transporting your products, especially if they are destined for the United Kingdom. The UK left the European Union on 31 January 2020. Therefore, if you are an exporter doing business in the UK, you must know that there will be border checks to ensure that imported products meet the protocols. If your seafood product must transit through the EU in order to get to the UK, they must enter the EU territory via a Border Control Post and each consignment will need a Common Health Entry Document. Importers will need to notify the UK authorities using the new import notification system (IPAFFS: Import of Products, Animals, Food and Feed System), which will replace TRACES, the EU’s online platform. While the UK and EU will not apply tariffs for products of origin traded between their territories, exporters must check within their respective governments which trade deals were put in place with regard to the UK leaving the EU. The trade tariffs that will apply from 1 January 2021 can be checked via the UK Global Tariff Website.

6. If possible, invest in global freight insurance

Important international regulations on import-export liabilities and costs between exporter and importer are the Incoterms. These regulations are recognised under international law and are vital terms in a contract. According to Incoterms, the liability or risk of the loaded container is always for the importer. When the vessel sinks or when the container falls off the vessel during a storm, the buyer will have to pay for the costs if the goods are not covered by insurance.

The 3 Incoterms that are the most relevant for you as an exporter of fish and seafood products are Free on Board (FOB), Cost and Freight (CFR, sometimes written as C&F), and Cost, Insurance and Freight (CIF). Selling FOB or CFR, the importer is responsible for the container when loaded. Furthermore, they are the party that has to arrange and pay for the insurance. Some buyers do not want to spend this time, or they do not know where to arrange freight insurance, so they want to buy from an exporter CIF. This situation is, however, unusual.

If bought under CIF, the liability or risk for the container is still for the importer, but you as an exporter have the obligation to take care and pay for the freight insurance. If you fail to do so and something happens to the container, an importer will surely start a lawsuit against the exporter for not having complied with their obligations. In case of CIF, the insurance policy is one of the documents to be presented to customs on the arrival of the vessel.

It is very important for you to understand the responsibilities that you have for transport and insurance according to the Incoterms under which you export. It is also an important part of pricing. Selling FOB will be less work and expense for you (compared with CIF or CFR) and your product will have to be priced accordingly. Read the CBI tips for doing business with European fish and seafood buyers to learn more about the differences between the Incoterms, and the advantages and disadvantages of operating under them.

Nowadays, many importers and exporters consider freight insurance a simple condition with which they must comply; however, it is very common that insurance is arranged after the vessel has left the port of origin. This attitude is very dangerous.

There are lots of examples of vessels sinking just after leaving the port, reef containers (frozen goods) not being connected correctly to power (no cooling), defective reef containers or containers falling off the vessel during a storm. This situation can happen just minutes after sailing away. Without insurance, the total value of the container can be reduced to zero. Although nothing happens 99.9% of the time and the insurance expires without having been used, you do not want to have that 0.1% occur.

Some importers, especially the larger ones, have global insurance for all containers that they import. It is contracted insurance, for which they pay an annual fee and receive coverage for all of the company’s shipments. In this case, the importer does not need freight insurance for each specific container. Consequently, they will buy FOB or CFR.

Such a global insurance can also be an option for exporters. The most important things that a policy must cover are damages during loading, transport and unloading, the loss of containers and the failure of the freezing installation of the container. This policy could make you a preferred exporter for those companies who are unable or unwilling to deal with insurance, as it would allow you to offer to sell under CIF.

Normally, the costs of freight insurance for an individual container depends on the total value of the goods. Moreover, it depends on the insurance company and the origin of the container. A shipment from Senegal will be cheaper than one from Chile due to the distance and the transport time. An insurance company which is not used to issuing freight insurance will also be more expensive than a company specialised in exports.

If sold CIF, it is the task of the exporter to find out the best insurance at the lowest price and the highest coverage. Ask your insurance company in your country. Mapfre, Aegon, Nationale Nederlanden, Generali and AXA are just some examples of international insurance companies with a department for business insurances, including freight insurances. However, a search on the internet will give you other alternatives. Sometimes, an importer has a specific insurance company with which they require the exporter to work.

Just as an indication, freight insurance can cost about $250 per container. If you as the exporter sell under CIF conditions, you have to add these costs to your cost price and consequently the sale price. Even if you sell FOB or CFR, remind the importer by mail that they are responsible for the freight insurance.

For exports of fresh fish and seafood (which are almost always transported by plane and by truck over short distances), there is normally no insurance involved. Shipments of 500–1,000 kilograms do not cover the costs of such insurance. Nevertheless, if it concerns full charter flights of 20,000 kilograms of fresh fish or a very expensive load, it might be useful to insure the shipment.

As an exporter of fish and seafood, it is best to get insurance on time, before the goods are loaded. While it might not be necessary, insurance is relatively low-cost and will save you a lot of issues in the long run. If something goes wrong and the source of the problem is traced back to you, the importer’s insurance may not cover it. In this case, the loss would be yours.

Tips:

- If sold CIF, arrange the insurance before the container is loaded. If covering the insurance, include it in your cost price calculation. It will be just some USD cents, but you have to add it.

- Ask internationally known insurance companies in your country or search on the internet for “freight insurance”. Look for basic coverage of damages during loading, transport and unloading, the loss of containers and the failure of the freezing installation of the container. The more coverage, the better it is. If you have any doubts, ask your customer.

- Remember that a full container load is worth more than the costs of insurance.

- If possible, get global insurance for all of your exports.

- Use Google Translate if you are trying to access a company website linked to in this study and the website is not available in a language with which you are familiar. Companies in which you might be interested may only have their websites translated into the languages that they use the most often.

7. Seek support from both private and public organisations, both in Europe and at home

There are many governmental and private agencies which offer assistance and services to companies wanting to start or expand exports. Most countries have a chamber of commerce or a commercial delegation at their embassy in a European country. If you want to export to a certain European country, check whether your country has an embassy in that particular country and try to check whether they have programmes or funding to support you.

In general, most of these institutions have information about sectors and individual importers in a specific country. They sometimes even organise commercial events connecting exporters and importers. Embassies can also assist you in case of real problems such as considerable damage claims or lawsuits. A good way to start exploring a market is to ask your embassy or chamber of commerce to send you a list of actual importers of your products in a country.

Some developing countries have a business support organisation (BSO) and might also have subsidiaries in a specific country. Some of these BSOs are governmental and some are private or semi-private. ProEcuador, Vasep Vietnam and UPAMES in Senegal are examples of BSOs. If your country does not have a BSO, try to convince your government to start one. These organisations are usually focused on a specific sector, such as fish and seafood, and often organise national and international business events to promote the country’s exports.

These organisations are normally better informed than embassies, as they are more focused on and specialised in specific sectors, including fish and seafood. They are used to organising national and international business events to promote their country, and boost exports.

Some organisations are specialised in exports from developing countries. The Centre for the Promotion of Imports from developing countries (CBI) is one of them, and works closely with other agencies such as the Swiss Import Promotion Programme (SIPPO) in Switzerland, the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) in Germany and the Belgian development agency (Enabel) in Belgium. These organisations can teach you how to professionalise your company in order to boost exports.

Apart from information (and sometimes guidance) about product, place (distribution), price, promotion, planet and people, they have a detailed website about sectors and markets. Moreover, agencies such as CBI can help you to set up an export marketing plan, and can put you in contact with reliable importers and financing opportunities.

There are some private consultancy firms which can offer you services to increase exports to a certain market. A company such as the Seafood TIP from the Netherlands, for example, is a private agency that has lots of data and contacts worldwide. These private consultants work based on an annual membership or an hourly consultancy fee. Seafood TIP reports on price trends, trade and market demands that could help exporters make sound business decisions. Due to their detailed knowledge, they can be a good, reliable and personalised source for exporters and importers.

With the billions of websites on search engines nowadays, you can find whatever information you need online. For example, type “how to make a business plan” or “exporting to Europe” in a search engine such as Google or Bing and you will find countless sites that can help. We are in the “information age”: it is all there; you only have to search for it and learn.

Tips:

- Check the Seafood Importers & Processors Alliance and scan their members for companies with which you may be able to work as well as information on developments in the seafood industry.

- Check the European Market Observatory for Fish and Aquaculture Products (EUMOFA) website and scan their members for companies with which you may be able to work as well as information on developments in the seafood industry.

- Check the Conxemar website, which is a good source of information for contacts in and information on the Spanish (and Southern European) market.

Read the CBI tips for finding European fish and seafood buyers to learn more about one of the most important steps in exporting your product to Europe. Get tips on the importance of being found, where to look for European buyers and organisations that can help.

Read the CBI tips for doing business with European fish and seafood buyers to learn more about the way that buyers in Europe typically operate. The tips will give you practical advice on how to conduct business with your European buyer in a way that will impress them, giving you an advantage over competitors.

The study has been carried out on behalf of CBI by Seafood TIP.

Please review our market information disclaimer.

Search

Enter search terms to find market research