Entering the European market for tuna bycatch species

When exporting tuna bycatch species (in this study: swordfish, mahi-mahi, Patagonian tooth fish and butterfish) to Europe, these must meet a number of more specialised requirements (beyond the general ones for fish and seafood products), due to the nature of the species, and their route to and their place on the European market. By ensuring that your product matches the market requirements and then connecting it to the right market, using the right channels, you could gain access to the European market with your tuna bycatch product.

Contents of this page

- What requirements must tuna bycatch species comply with to be allowed on the European market?

- Through what channels can you get tuna bycatch species on the European market?

- What competition do you face on the European tuna bycatch market?

- What are the prices for tuna bycatch products on the European market?

1. What requirements must tuna bycatch species comply with to be allowed on the European market?

We recommend that you first read our fish and seafood buyer requirement study, in order to gain a fuller understanding of the general requirements for fish and seafood, before learning about the requirements unique to tuna bycatch species. In this section, we give all the information you need about specific mandatory, additional buyer and niche markets requirements you must comply with when exporting tuna bycatch species to Europe.

What are mandatory requirements?

The majority of the mandatory requirements related to exporting fish and seafood products to Europe apply at the fish and seafood level, rather than focusing on specific species or products. Below, you will find the most relevant requirements specific to exporting tuna bycatch species to Europe. It is also important that you read our Buyer’s Requirements study, for an understanding of the general requirements for exporting fish and seafood (and therefore your products) to Europe.

Stay low in heavy metals

If you want to export tuna bycatch products to Europe, it is important that these are low in heavy metal levels. Tuna bycatch species – like swordfish, mahi-mahi, Patagonian tooth fish and butterfish – are predatory fish and therefore may have high levels of mercury and other heavy metals like lead and cadmium. Excessively high levels of heavy metals in fish products can harm vulnerable population groups like children and elderly people.

The mercury content in tuna bycatch species varies widely, and in general is higher in larger predatory fish such as swordfish. The maximum level of mercury content for swordfish, set by the European Union, is 1.00 mg per kg. The maximum level of mercury content for mahi-mahi, Patagonian tooth fish and butterfish is 0.50 mg per kg.

It is important that only tuna bycatch products that comply with European law are sent to Europe. To comply with this legislation, you need to have a sampling plan regarding heavy metals that includes testing every batch for these contaminants. Having a good sampling plan is not only a mandatory requirement, but will also help you to earn trust from European importers and reduce the potential risk of product rejection at the European border.

If your tuna bycatch products are rejected at the European border or recalled from the market due to overly high amounts of heavy metals, you will be placed on the Rapid Alert System for Food and Feed (RASFF). Your consignments will then have additional controls (and thereby costs) at the European border until ten shipments in a row have been checked and have passed through customs without any issues. Your company will then be able to resume normal trade. In 2018, over 70 notifications of (heavy) metals in fish products landed on the RASFF list.

When sending products to the European Union, accompany them with the results of laboratory tests performed by labs with ISO 17025:2005 certification; the competent authority in your country will prefer tests performed by such laboratories, since they always use the newest and most accepted lab tests that promote international trade.

The ISO is the International Organization for Standardization, a non-governmental organisation that sets internationally recognised standards for different products. Although these standards may not be mandatory, the ISO is a well-trusted body in Europe, and meeting ISO standards acts as a licence to do business.

The ‘competent authority’ is the government department in your country that the European Union finds the most capable (competent) of monitoring the seafood and fisheries products supplied to the European Union. The European Union enters into an agreement with this department, giving them responsibility for the mandatory control measures before export.

In India, the competent authority is the Export Inspection Council, which delegates part of the responsibility to the Marine Products Export Development Authority (MPEDA), both under the Ministry of Commerce. In Bangladesh, this is the Department of Fisheries under the Ministry of Agriculture, Fisheries and Rural Development. In Vietnam it is NAVIQAD, the Quality Department of the Department of Fisheries under the Ministry of Agriculture. In general, the competent authority is a department in the ministry under which aquaculture and fisheries are regulated.

Tips:

- Check the maximum level of contaminants allowed for your tuna bycatch products in Commission Regulation (EC) No 1881/2006.

- The size (age) of the fish plays an important role in the level of contaminants in the fish. Keep this in mind when selecting your tuna bycatch products for export to Europe.

Search for information in the database of the Rapid Alert System for Food and Foodstuff (RASFF) to learn which tuna bycatch products have been withdrawn from the market and why. Catch certificates do more than deter IUU fisheries. Illegal, Unreported and Unregulated (IUU) fishing, according to the European Union, is any fishing that is in forbidden areas, uses illegal methods or goes unreported. IUU fishing has a negative effect on the sustainable management of global (and local) fish stocks, and creates unfair competition for anyone that fishes legally and responsibly. The EU requires that you can prove that your tuna bycatch products are not from IUU fisheries.

Your wild fish products must be accompanied by a catch certificate approved by your competent authority. It must contain all the information specified in the specimen shown in Annex II of the European IUU legislation.

Catch certificates are not only used to check if your products come from legal fisheries. European countries are increasingly using them to check whether your products comply with the European hygiene rules. According to these, all tuna bycatch species need to be frozen, processed or transported on board of authorised vessels, and/or be frozen and processed by authorised factories.

Your competent authority is appointed to authorise processing factories, as well as vessels with onboard processing facilities, for trade with the European Union. These factories will be put on the DG Santé list of establishments from developing countries authorised to trade with the European Union. If there are establishments on your catch certificate that are not registered on the DG Santé list, your consignment is likely to be rejected at the EU border.

Tips:

- Check the DG Santé list of non-European Union countries’ authorised establishments to see whether your vessels/factories are registered for the European Union.

- Ask your buyer to double-check the catch certificate on authorised establishments to prevent potential rejection at the European Union border.

Be careful with parasites

Even though European law does not require fish to be parasite-free, it does require producers to take measures to reduce their prevalence and control any potential health risks. Although European law does not set a limit for parasites in fish products, CODEX international food standards do. Although CODEX is not legislation, striving for a maximum of two parasites per kilogram of edible fish flesh is recommended to prevent discussions about food safety in Europe.

According to European Union law, before placing your tuna bycatch products on the market, it must have been subjected to a visual examination process for the presence of parasites, such as Opisthorchiidae and Anisakidae, that can cause intestinal infections in humans. Freezing or cooking will kill the relevant parasites, which are then no longer harmful.

If your tuna bycatch products will be consumed raw (for instance in the case of sashimi butterfish), there are legal requirements to use freezing techniques to kill the parasites before putting the fish on the market. Commission Regulation (EC) No 1276/2011 states that all fish and seafood products which are to be eaten raw need to have had a freezing treatment, reaching at least −20°C for at least 24 hours, or −35°C for at least 15 hours.

Your tuna bycatch species are exempt from freezing if there is proof that the fishing grounds of origin do not present a health hazard with regard to the presence of parasites. Your competent authority needs to approve this.

The increasing ocean water temperatures are beneficial to parasites. It is expected that the frequency and amount of parasites will increase in future, due to global warming.

Tips:

- Check with your competent authority if there is approved data available that shows that your fishing grounds do not present a health hazard with regard to the presence of parasites, so that your tuna bycatch species can be exempt from freezing. This avoids having to perform an unnecessary processing step.

- Consistently deliver parasite-free products, to become a preferred partner for your clients.

Add warning on oilfish label

An additional point with regard to labelling oilfish is that it can only be marketed in wrapped and/or packaged form. It must also be appropriately labelled to inform the consumer about its preparation and cooking methods, and the risks related to the presence of substances with adverse gastrointestinal effects.

What additional requirements do buyers often have?

There is no standard way of determining terms of payment and delivery, with each party negotiating for the terms that best suit them. In these negotiations, the size of the company and volume of its purchases, as well as how much competition the buyer or seller faces, can determine the bargaining power of each party. In our tips for organising your exports with Europe, we go into more detail on what terms buyers might prefer, and what terms might be better for you.

For tuna bycatch species, just as for all other fish and seafood, your establishment will need to be accredited for food safety, depending on the specific requirements of your buyer. The most commonly requested food safety certification schemes for seafood products are IFS (International Featured Standards) and/or BRC (British Retail Consortium). You will mostly come across these schemes in northern and western Europe.

By having food safety accreditation, you can show your buyer you have good working procedures to which controls can be applied, and through which food safety hazards can be prevented, eliminated or reduced to acceptable (critical) levels. It also shows that you are able to trace your raw materials and packing materials.

Tips:

- Invest in the IFS and BRC food safety schemes, as they are not only a must for the European market, but also for other markets around the world.

- Get your fisheries and factory audited by an accredited certification body. Check the list of accredited certification bodies to see which one could assist you.

What are the requirements for niche markets?

Sashimi and smoking fish

Depending on how your product will be used in Europe, there could be strict requirements regarding structure, taste, colour and smell (organoleptic requirements). If products are used for smoking (like butterfish and swordfish), the texture needs to be extra firm. For products intended for sushi markets (like butterfish), the colour of the product is also very important. If products are intended for baking and grilling, standard organoleptic requirements are usually enough.

Table 1: Strict organoleptic requirements tuna bycatch products

|

Culinary use |

Tuna bycatch products |

Strict organoleptic requirements |

|

Sashimi |

oilfish |

firm, white colour, no smell and rich flavour |

|

Smoking |

oilfish, swordfish, marlin |

firm |

|

Grilling |

oilfish, swordfish, marlin, mahi-mahi |

- |

|

Baking |

oilfish, swordfish, marlin, mahi-mahi |

- |

Source: Seafood Trade Intelligence Portal, 2019

Northern European supermarkets

If you want to do business with northern European supermarkets, you will need to invest in getting your products certified by the Marine Stewardship Council (MSC) standard and your processing establishment certified with MSC’s Chain of Custody standard. For tuna bycatch species, this can be challenging, as often not much information is available about the relevant fish stocks and the stocks are not managed properly. However, if it is possible to obtain this certification for your products, it will make it easier to enter this market.

Tips:

- Check the MSC supply chain certification guide for an overview of what to expect from the Chain of Custody certification process.

- Study the websites of retailers in southern Europe (like Eroski in Spain) and north-western Europe (like Albert Heijn in the Netherlands) for a better understanding of product assortments.

- Ask your buyer the purpose of tuna bycatch products and match your product to the right market segment to prevent any problems.

- Use Google Translate if you are trying to access a company website linked in this study and the website is not available in a language you are familiar with. Companies that you might be interested in may only have their websites translated into the languages that they use most often.

2. Through what channels can you get tuna bycatch species on the European market?

Most of the bycatch products reach the European market together with tuna products, in mixed consignments. Your tuna bycatch products will mainly be imported to Europe by specialised importers, either by air (fresh products) or container vessel (frozen products), who sell the fish to the relevant segments. The most relevant European end-market segments for tuna bycatch species are wholesale and food service. Other important market segments, particularly in southern Europe, are specialised fishmongers and street markets.

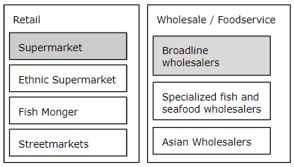

How is the end market segmented?

The importance of one segment over the other can vary significantly from one part of Europe to the other. While street markets and specialised fish shops have quite a strong position in the market in southern Europe, a much larger part of tuna bycatch purchases goes to wholesale in north-western Europe in comparison.

The tuna bycatch species are less interesting for supermarkets in northern Europe, where sustainability is very important. Tuna bycatch species are consumed more frequently in southern Europe, where per capita consumption of fish and seafood is generally much higher than the average European consumption.

In the end market, swordfish is often sold chilled (refreshed) in bigger loins or chunks, but also frozen in steaks or fillets. Butterfish used for the sushi market is sold chilled, while frozen products go to wholesale and fish smokers.

Europeans are not as familiar with mahi-mahi as Americans. A major portion of the imported mahi-mahi is used to supply cruise ships.

In the section below, we will focus on the wholesale market in Europe and the specialised fish markets in southern Europe.

Figure 1: End-market segmentation

Source: Seafood Trade Intelligence Portal, 2019

Figure 1 shows the main retail and wholesale/food service end-market segments in Europe. The darker segments are the ones that are most interesting for you, as a producer of tuna bycatch species, as these are the segments where there is the most demand for your products.

Tip:

- Learn more about regional fish and seafood consumption differences in our study on the demand for fish and seafood on the European market. It will give you insights into what might be the best markets for your product.

Wholesale

There are two types of wholesalers relevant to you. The first are the broadline wholesalers who sell a full range of products to chefs.

Broadline wholesalers often have a relatively limited range of seafood products, which often includes swordfish, but certainly also other tuna bycatch species. The volumes of these broadline wholesalers are often relatively large, as some will operate many shops throughout a country. Some even do business across borders, although this can be challenging because chefs’ preferences can vary widely from one country to another. Examples of international wholesalers active in Europe are Metro, Kühne & Heitz and Bidfood.

Specialised wholesalers are those who only sell seafood (sometimes in combination with meat). In general, they will have a broader and perhaps more exclusive product range. Other tuna bycatch species than swordfish, like butterfish and mahi-mahi, are more common in the sales portfolio of specialised wholesalers. Examples of specialised wholesalers are Bullmeat in the Netherlands and Rari in Germany.

If the wholesaler works with volumes that are big enough, they may aim to source directly from you, the exporter. However, most wholesalers use an importer. Importers are often more experienced in sourcing tuna bycatch products and are specialised in importing the fish products into Europe. For both broadline wholesalers and specialised wholesalers, tuna bycatch species are just one out of many products.

Specialised fish market

In Europe, you can find food markets where people can buy all kinds of products, including fish. However, there are also specialised fish markets. Most of these fish markets are located near the coast or in the bigger European cities. An example of a specialised fish market is Mercamadrid.

Specialised fish markets, despite being accessible to the general public and selling mainstream products, also cater to the restaurant industry and ethnic groups. They often have a wider range of seafood options, sourced from direct European landings or from imported fish. By engaging with companies that have a presence on the specialised fish market, your more niche products can find a way onto your desired markets.

Most of the imported fish is imported frozen and defrosted in Europe. Swordfish is also the most popular of the bycatch species at fish markets, although all types of tuna bycatch products are available.

Tips:

- Check the website Dutchfish.nl to find specialised importers/wholesalers for tuna bycatch species.

- Check the Conxemar website to find fish importers and/or wholesalers in Spain.

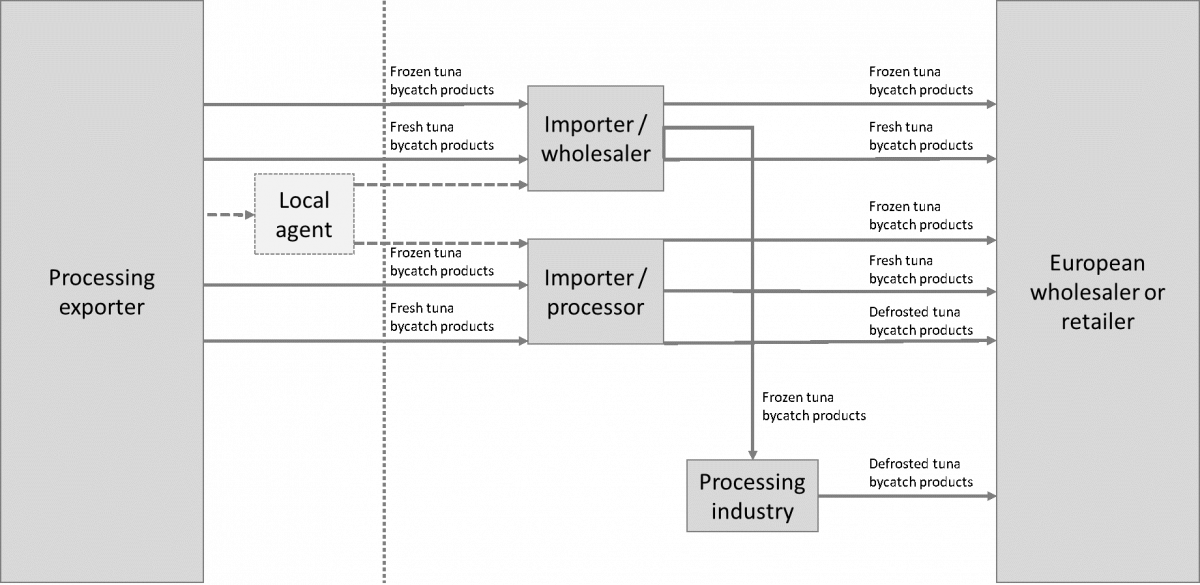

Through what channels does a product reach the end market?

Although there are many channels through which tuna bycatch species reach the end market, the most important ones are those that supply wholesalers. Let us take a closer look at these in Figure 2, which shows how products move along the supply chain from an exporter in a developing country to the wholesale sector in Europe. Below the figure, the role of each actor in the supply chain is explained.

Figure 2: Main trade flows for fresh and frozen tuna bycatch products

Source: Seafood Trade Intelligence Portal, 2019

In Figure 2, the actors in the lighter boxes only function as service providers and never take ownership of the product. They are often not involved in making financial transactions but only provide a service to a buyer or seller. The actors in the darker boxes are those who actually buy and sell the product.

Local agents play a crucial role in the trade of tuna bycatch species. Although buyers will visit potential suppliers regularly, they need someone there who can ensure that quality requirements are met, the best suppliers selected, and the best prices secured. Although there is a tendency among certain importers to want to do business more directly, quality control often remains outsourced.

Fresh fish consignments are exported by air on ice, in polystyrene boxes. The product temperature must be kept close to zero degrees Celsius to maintain high quality and ensure longer shelf life for your tuna bycatch species.

For frozen consignments, it is much cheaper to send your products in reefer containers to Europe. Together with your buyer, you can decide what shipping line and what reefer container you want to use. It is important to load your container in the right way to prevent freezing problems. Your frozen products require free-flowing air to circulate, so it is important not to stow your cartons above the red line marking the maximum height in the reefer container. Incorrect airflow could mean that your products will not stay cold enough.

At the European border, the competent authority checks all product groups in the shipping container. Most of the time this will be an administrative check, but products are also regularly checked for organoleptic aspects (colour, smell, taste and structure) or (in lesser amount) sent to a laboratory for biological or chemical tests. If no abnormal results are found, the container can enter European territory for further distribution.

The most common importers in Europe are ones that import finished frozen tuna bycatch products for retail and wholesale. Such companies usually also specialise in importing tuna; there are dozens in the European Union.

In wholesale there are importers who sell full container loads, and those who even sell on master carton basis. The importers take care of all logistics from the moment that the container arrives in Europe until the container or master carton reaches the customer. Some importers thaw the frozen fish products (mainly swordfish) and distribute the fish products as defrosted.

There is also a significant group of importers who sell fresh and/or defrosted tuna and tuna bycatch products to wholesalers (and retailers). Fish are sold whole or in loins/chunks on ice. The trade is very dynamic due to the relatively short shelf life.

Examples of importers who supply frozen tuna bycatch species to European wholesalers (and retailers) are Seafood Connection, DaySeaDay and Amacore in the Netherlands, and Pescanova in Spain. Importers of fresh tuna and tuna bycatch species are DaySeaDay and Open Seas in the Netherlands, and Comptoirs Océaniques in France.

Tips:

- If you export a mixed container of fish to the European Union, do not forget to list all of the different fish products at the opening or doors of the container. In this way competent authorities in Europe can easily check the different products in the container without completely emptying it (and thereby negatively influencing the cold chain).

- Put enough cold packs or ice in the fish boxes to guarantee the cold chain when in transit to Europe. Although fresh fishery products are transported in refrigerated trucks and aircraft, extra cooling is desirable for tuna bycatch species to maintain their quality.

What is the most interesting channel for you?

The wholesale market is the most interesting one for tuna bycatch species products. In these channels there are enough opportunities to sell your tuna bycatch products and it is easier to meet the certification requirements of this market. The supermarket channel in Europe is only interesting for you if it certifying your fishery and processing establishment with MSC (or another sustainability certification) is a realistic option.

In the Netherlands, potential end buyers of your products are broadline wholesalers Makro, Sligro and Hanos. Your client would normally be an importer who takes care of all logistics and customer service for the wholesaler. You will only be responsible for placing you consignment on a container vessel/airplane. Examples of important Dutch importers are Seafood Connection, Dayseaday, Amacore and Open Seas.

Tip:

- Visit websites of sector associations in Europe in which tuna bycatch importers have organised themselves. There you can find member lists for a quick overview of the relevant buyers. Examples of sector associations are the Dutch Fish Importers Association and the Danish Seafood Association. Be sure to study the companies in detail before you approach them. You only have one chance for a first impression.

3. What competition do you face on the European tuna bycatch market?

The tuna bycatch market is relatively small, but there are many countries – and companies – that have the potential to supply tuna bycatch, through their tuna fisheries. Your products will be competing with the European Union (Spain, Italy and Portugal), a big producer of tuna bycatch itself, as well as countries like Indonesia and Vietnam, with a range of companies in each country. Since tuna bycatch products are all relatively unique, they face competition from few other products.

Which countries are you competing with?

There are many countries offering tuna bycatch species for the European market. Below we will highlight three.

The European Union

The European Union has its own tuna fishing fleets that produce their own bycatch species (the same applies to swordfish to a lesser degree). These fleets are managed by southern European countries. While most of the tuna is sold to the Spanish canning industry, tuna bycatch species find other ways to the end consumer.

For swordfish, the European Union is the leading producer, providing over 25% of world production. Within the European Union, Spain (74% of the swordfish landings in 2016) is the main producer, and, to a lesser extent, Italy (10% in 2016) and Portugal (9% in 2016).

European Union fishing fleets landed around 38,000 tonnes of swordfish, 1,000 tonnes of butterfish and 1,700 tonnes of common mahi-mahi in 2016.

The fresh or frozen tuna bycatch species are processed (mainly in southern Europe) by the domestic processing industry into fresh or frozen steak and loins/chunks, and exported both within the European Union and to the rest of the world.

One of the advantages of European Union tuna bycatch species is that they are not burdened with import tariffs. The fish are already in the European Union and so also avoid extra transportation costs. On the other hand, labour is very expensive in the European Union.

Vietnam

Vietnam is one of the traditional developing countries exporting tuna and tuna bycatch products to Europe. Existing Vietnamese suppliers and European importers have built up relationships with each other. Labour is affordable and factories are set up to process raw materials into the preferred products of European consumers. Tuna bycatch products are usually exported to Europe, single frozen, in combined containers together with tuna products.

Vietnam benefits from a preferential tariff system, which provides lower tariffs on various products. This General System of Preference (GSP) helps the least developed countries to use trade to grow their economy and reduce poverty. Tuna bycatch species originating from Vietnam have reduced import tariffs if combined with a General System of Preference Certificate of Origin Form-A, which serves to prove where the tuna was imported from.

The European Union and Vietnam signed a free trade agreement (FTA) in June 2019. It is expected to take effect in early 2020. This agreement will eliminate around 99% of the import tariffs. Vietnam will become more competitive when tuna bycatch species are exported to the European Union with a 0% tariff.

The European Union gave Vietnam a ‘yellow card’ warning on seafood in October 2017 for failing to fight Illegal, Unreported and Unregulated (IUU) fisheries at the time. Since then, Vietnam has been working on fisheries management and imposes harsh punishments on those vessels conducting IUU fishing practices. In November 2019, inspectors from the European Union were sent to Vietnam to review the yellow card.

Although the yellow card was still in place in December 2019, industry media sources reported that the EU representatives were impressed with the progress being made by the Vietnamese government and industry. Other media outlets, however, have reported on further sustainability challenges in the Vietnamese fish and seafood industry.

Indonesia

Indonesian tuna fisheries are among the largest and most productive in the world. This makes Indonesia another important developing country producing tuna and tuna bycatch species for the European market. As in Vietnam, good relationships between suppliers and importers are very significant, with factories being set up to process raw materials into European preferred products.

Butterfish from Indonesia is very important, with the country known for the good quality of this tuna bycatch species. The firm white meat and minimum amount of bloodspots ensure its desirability on the European market.

Indonesia benefits from a General System of Preference of tariff reductions. Tuna bycatch species from Indonesia have reduced import tariffs if combined with a General System of Preference Certificate of Origin Form-A.

In July 2016, negotiations started for a free trade agreement between Indonesia and the European Union. The EU and Indonesia are currently still in negotiation and no agreement is expected in the short term.

Tips:

- Build up a good relationship with your buyers. Do not focus on quick wins, but go for long-term benefits.

- Read our Market Analysis for tuna bycatch to learn the difference between single-frozen and double-frozen fish, and about other trends and preferences of European buyers.

- Use the European Union trade helpdesk to check the tariffs that you would have to pay when exporting tuna bycatch species to the EU. Compare your tariffs with your competitors’ from other origins to understand how competitive your product is.

- Compare the price of your tuna bycatch product with prices from other origins to understand how competitive your prices are.

Which companies are you competing with?

There are hundreds of exporters of tuna bycatch species around the world. Here, we will discuss the examples of Hai Vuong Group from Vietnam, PT. Inti Samudra Hasilindo from Indonesia and WOFCO from Spain. Each of these companies is a major player in their respective countries and exports tuna bycatch products to Europe.

Hai Vuong Group

Hai Vuong Group is one of the largest processors and traders of tuna and tuna bycatch species in Vietnam. The Hai Vuong Group uses raw materials directly frozen on fishing vessels equipped with deep-freezing facilities. In this way, the company tries to eliminate any possible decomposition.

The Hai Vuong Group consists of four factories and office buildings and has a total staff of 3,000, including 2,500 factory workers. This group exports over 60,000 tonnes of finished fish products per year (mainly tuna).

Factories of the Hai Vuong Group are HACCP, BRC, IFS, Dolphin Safe and HALAL certified. One of the laboratories in the Hai Vuong Group is ISO 17025:2005 certified. Its working according to these standards makes the Hai Vuong Group interesting to compete with, given its ability to access the market for tuna bycatch species in Europe.

On the website of the Hai Vuong Group, you can find out what kind of products they produce and export throughout the world.

PT. Inti Samudra Hasilindo

PT. Inti Samudra Hasilindo is one of the bigger processors and exporters of tuna bycatch species in Indonesia. This company was established in Jakarta in 2008. This company processes in compliance with HACCP.

Take a look at the PT. Inti Samudra Hasilindo website to learn more about the tuna bycatch products they sell.

WOFCO

WOFCO was born from the experience of its five partners, covering the entire production chain, from capture to commercialisation, in more than thirty countries across five continents. The company covers the entire value chain, so its products are very competitive with other products on the European market.

The WOFCO factory is located in Vigo, Spain. One of the important WOFCO products is swordfish. You can find the kinds of swordfish products WOFCO sells on their website.

Tips:

- Look at your management team. Are there any highly educated team members who can support you in making your company future-proof and taking it to the next level?

- Look at the websites of some of the major bycatch tuna exporters in different origins to better understand how they present themselves and who is managing the companies. Think about how you can present your unique selling points to your potential buyers.

- At trade shows, besides looking for buyers, also try to engage with your competitors and ask them about the challenges and opportunities they face. See what you can learn from them.

Which products are you competing with?

Tuna bycatch species are quite unique and have no competition from other products.

4. What are the prices for tuna bycatch products on the European market?

The consumer prices of different tuna bycatch products in various European countries will give you an impression of the price levels in Europe. The price of tuna bycatch species differs a lot between species and presentation form. Butterfish wholesale prices (€10-30/kg) and swordfish wholesale prices (€10-30/kg) are relatively high, whereas mahi-mahi wholesale prices (€7‑15/kg) are relatively low.

Table 2: Examples of consumer prices for fresh and frozen tuna bycatch products in 2019

|

Country |

Supermarket |

Chilled, smoked or frozen |

Product description |

Price per kilogram (euros) |

|

Netherlands |

Makro |

Chilled |

Swordfish fillet |

28.87 |

|

Makro |

Frozen |

Oilfish portions 180-220 grams |

15.74 |

|

|

Germany |

Metro |

Smoked |

Oilfish portions 250-450 g |

32.62 |

|

Metro |

Chilled |

Filled swordfish rolls |

25.13 |

|

|

Metro |

Chilled |

Swordfish steaks |

27.27 |

|

|

Metro |

Chilled |

Swordfish loin 2-4 kg |

28.88 |

|

|

Metro |

Frozen |

Swordfish steaks 150-250 g |

18.18 |

|

|

Spain |

Carrefour |

Frozen |

Swordfish fillets 500 g/piece |

12.80 |

|

|

Carrefour |

Frozen |

Swordfish fillets 700 g |

12.79 |

|

|

Carrefour |

Chilled |

Swordfish fillets 1000 g/piece |

14.95 |

|

Alcampo |

Chilled |

Swordfish fillet 300 g |

12.80 |

|

|

|

DIA |

Chilled |

Swordfish fillet 400 g |

11.38 |

Source: Seafood Trade Intelligence Portal, 2019

Processed tuna bycatch products command higher wholesale prices. For example, smoked butterfish portions can be found in wholesale for twice the price of frozen butterfish portions. This high price is the result of a combination of prime material use and relatively high processing costs.

Although there was a slight price decrease for swordfish last year, prices are expected to stabilise in the next few years. For many years now, butterfish prices have increased, and should stay high as long as the supply is smaller than the demand. It is likely that prices will increase even further in the longer term.

The margins in the value chain vary a lot depending on product quality. For low-end products, margins can be as low as 5% for each company, with a wholesale margin as low as 10%. For high-end products, these margins can be as high as 20-25% for fishermen and processors, and up to 50% for importers and wholesalers.

The figure below shows the value distribution of frozen swordfish loins across the value chain:

The study has been carried out on behalf of CBI by Seafood Trade Intelligence Portal.

Please review our market information disclaimer.

Search

Enter search terms to find market research