Entering the European market for wild-caught warm-water shrimp

In order for your wild-caught warm-water shrimp to enter the European market, you must be able trace its origin, and ensure your supply chain is safe to consume according to European law and a range of other mandatory requirements your product must meet. Once in Europe, your buyers and the European (niche) market will have other requirements, like sustainability certification, which if not met could make doing business difficult. Knowing your product, the different requirements and your competitors can give you the advantage.

Contents of this page

- What requirements must wild-caught warm-water shrimp comply with to be allowed on the European market?

- Through what channels does a product reach the end market?

- What competition do you face on the European wild-caught warm-water shrimp market?

- What are the prices for wild-caught warm-water shrimp on the European market?

1. What requirements must wild-caught warm-water shrimp comply with to be allowed on the European market?

Before you dive into this part of the study, we recommend first reading our fish and seafood buyer requirement study, which provides a general overview of the requirements you must comply with when exporting fish and seafood products to Europe. In this study we provide you with all the necessary information about specific mandatory requirements, additional buyer requirements and requirements for niche markets that you need to comply with when exporting wild-caught shrimp to Europe.

What are mandatory requirements?

When looking at the requirements necessary to export fish and seafood product to Europe, the majority apply at the fish and seafood level, rather than focusing on specific species or products. Below, you will find the most relevant requirements specific to exporting wild warm-water shrimp to Europe. It is also important that you read our Buyer’s Requirements study, for an understanding of the general requirements for exporting fish and seafood (and therefore your products) to Europe.

One part of the European Union’s requirements for imported wild-caught shrimp products from countries outside Europe relates to food safety and hygiene. Another part relates to ‘Illegal, Unreported and Unregulated’ (IUU) fishing. In order to get approval to export wild-caught shrimp to Europe, the competent authority in your country needs to develop a plan on how to ensure that products exported to Europe are safe for human consumption and caught in line with IUU regulations.

The ‘competent authority’ is the government department in your country that the European Union finds the most capable (competent) of monitoring the seafood and fisheries products intended for the European Union. The European Union enters into an agreement with this department, giving them responsibility for the mandatory control measures before export.

In India, the competent authority is the Export Inspection Council which delegates part of the responsibility to the Marine Products Export Development Authority (MPEDA), both under the Ministry of Commerce. In Bangladesh this is the Department of Fisheries under the Ministry of Agriculture, Fisheries and Rural Development. In Vietnam it is NAVIQAD, the Quality Department of the Department of Fisheries under the Ministry of Agriculture. In general, the competent authority is a department in the ministry under which aquaculture and fisheries are regulated.

This plan and its implementation will be audited by European Union authorities on a regular basis.

Tips:

- How your government can get approval to export wild-caught shrimp products to Europe is explained in more detail in our fish and seafood buyer requirements study. Check it out and you will understand that it is crucial for you to cooperate with your government to ensure European requirements are met.

- Read this study for a more in-depth understanding of European Union regulations and their implementation with regard to imports of fish and seafood products.

Compliance with food safety and hygiene regulations

The wild-caught shrimp that you export to Europe will have to be accompanied by a health certificate provided by the competent authority in your country. The health certificate proves that your wild-caught shrimp products have been tested for and are free from microbiological contamination and other contaminants (such as heavy metals), as in accordance with the various European Union regulations.

For wild-caught warm-water shrimp, Regulation (EC) No 1881/2006 lays down maximum levels (MLs) for heavy metals (0.5 mg/kg wet weight for lead, cadmium and mercury) and dioxins (sum of dioxins 4.0 pg/g wet weight, sum of dioxins and dioxin like PCBs 8.0 pg/g wet weight). Regulation No 2073/2005 outlines maximum levels for microbiological contaminants such as histamine and salmonella.

Tip:

- Have a look at an example of a model health certificate on page five of regulation (EC) No. 1250/2008.

Compliance with IUU regulations

The European Union Regulation to prevent, deter and eliminate illegal, unreported and unregulated (IUU) fishing entered into force in 2010. According to this regulation, only marine fisheries products validated as legal by the competent flag state or exporting state can be imported into Europe. The IUU Regulation can take steps against states that ignore illegal fishing activities: first it issues a warning, then it can identify and blacklist them for not fighting IUU fishing.

You can see that European authorities are serious from the list of countries that have been warned and banned from exports to Europe. Several of these countries, such as Vietnam, which is now confronted with a yellow card, are involved in exports of wild-caught shrimp to Europe. If these countries do not take the necessary steps to convince European authorities that they are able to comply with IUU regulations, they might eventually be confronted with a red card, which means that the European market would be closed to them.

For every consignment of wild-caught shrimp you send to Europe, you need to have catch certificates, provided by your country’s competent authority, of all the boats (including those who supplied to transhipment boats at sea) that supplied the shrimp in your container. Although this might be difficult to achieve, it is crucial that you do everything you can to comply with this requirement and do not try to cheat the system. If you do not meet these requirements, in the long run this may put your country’s access to the European market at risk.

So far, catch certificates have been paper based. However, in May 2019 the European Commission launched CATCH, an IT system that aims to digitise the currently paper-based European Union catch certification scheme. Although this new system will initially be voluntary to use, it is expected that by 2020, once new regulations come into force, it will become compulsory, including for authorities and exporters from developing countries.

- Consult this overview for a full overview of publications by the European authorities about IUU requirements for developing countries.

Specific labelling requirements for wild-caught shrimp

Wild-caught shrimp products need to be labelled according to the European labelling requirements for fishery products. The complete overview of labelling requirements is provided in our buyer requirement study. The following requirements are relevant, especially if you export wild-caught shrimp to Europe.

- For wild-caught seafood products you need to state the specific catch method for your wild-caught shrimp – this will usually be bottom trawl.

- For wild-caught seafood products you are required to include the FAO zone where the seafood was caught.

- As mentioned in our trend study, how added water must be labelled is receiving increased attention. Added water must be shown in the list of ingredients. For value-added products, added water must also be shown in the name of the product if it makes up more than 5% of the weight of the finished product.

- For a few years now, the label must include the product’s net weight. Stating the gross weight on the package is no longer allowed, as this is considered to be misleading to consumers.

Tips:

- Check the European Union’s pocket guide for labelling wild-caught and aquaculture products for a full overview of how to label your wild-caught warm-water shrimp products.

- Be sure that you and your client are aligned on how the product should be labelled. The buyer should be able to provide you with all required input.

What additional requirements do buyers often have?

There is no standard way of determining terms of payment and delivery, with each party negotiating for the terms that best suit them. In these negotiations, the size of the company and volume of its purchases, as well as how much competition the buyer or seller faces, can determine the bargaining power of each party. In our tips for organising your exports with Europe, we go into more detail on what terms buyers might prefer, and what terms might be better for you.

For wild-caught warm-water shrimp, just as for all other fish and seafood, you will need to be accredited for food safety in your establishments by IFS (International Featured Standards) and/or the BRC (British Retail Consortium), depending on the specific requirements of your buyer. Making this investment is clearly a good idea as it is not only a must for the European market, but also for other markets around the world.

MSC certification becoming mainstream

As mentioned in our trend study, throughout Europe, sustainability of fish and seafood is becoming more important. For your wild-caught shrimp products, this means that you will be confronted with customers requesting certified products, especially in retail but increasingly also so in wholesale, and particularly in north-western Europe but increasingly also elsewhere in Europe. In the case of wild-caught shrimp, European buyers will require Marine Stewardship Council (MSC) certification.

Unfortunately, although most coldwater shrimp fisheries have been MSC certified, currently no tropical warm-water shrimp fisheries are. This threatens market access in Europe, as in due time most of the market will require your shrimp to be certified. The stakeholders in the fishery that you are involved in should consider looking into MSC certification and the possibility of investing together in getting the fishery certified to maintain long-term access to the European market.

If it is not possible for you to certify immediately, some market players may also accept your products if you are involved in a fishery improvement project (FIP), which aims to eventually get its shrimp fishery MSC certified. Several African shrimp fisheries, in Madagascar and Mozambique for example, have been involved in FIPs.

Tips:

- Check out MSC’s website to see which shrimp fisheries around the world are already MSC certified. Also check the MSC fisheries standard to better understand the MSC certification requirements.

- Check the FIP database to see which fisheries are involved in a FIP and the progress they are making. The FIP profiles will also give you a better understanding what types of interventions you need to make to work towards a sustainable fishery.

What are the requirements for niche markets?

Other ecolabels may do the job as well

Although buyers in the mainstream market may require MSC-certified products, there are some niches where buyers may accept other ecolabels as well. The best example in shrimp is the Friends of the Sea (FoS) certificate. Although accepted in fewer markets than MSC certification, there are a number of buyers throughout Europe that accept FoS as a good alternative. Nigeria-based Atlantic Shrimpers is the only company in the world that has its wild-caught Asian tiger shrimp (Penaeus monodon) FoS certified; its products can be found in niche markets throughout Europe.

Which channels can you use to put your wild-caught warm-water shrimp on the European market?

In terms of market position, in the case of wild-caught warm-water shrimp, we are dealing with two completely different products. In the European warm-water shrimp market, wild-caught head-on shell-on Asian tiger shrimp (and other head-on shell-on products) is an extremely high-end product, while other wild-caught warm-water species, sold as peeled products, are low-end ones. It is important to understand this difference and what that means for your products’ route to market.

In order to understand how the market channels of the European market are structured, in this section of the study we will draw a distinction between the market segments and channels for those products that end up on the market head-on shell-on (mainly Asian tiger shrimp from both Africa and Asia) and those products that end up on the market as peeled blocks (mainly pinks from Asia, and some other species from Africa).

How is the end market segmented?

In this study, we maintain the same segmentation as in the Pacific white shrimp and black tiger shrimp studies. Almost all wild-caught warm-water shrimp species are sold primarily in the wholesale market, or otherwise in the ethnic retail market, and only to a limited extent in the mainstream retail market. The reasons for this are different for the head-on shell-on products than for the peeled blocks, but in both cases these relate to the nature of the fisheries involved and the absence of MSC certification.

In order for your wild-caught warm-water shrimp to enter the European market, you must be able trace its origin, and ensure your supply chain is safe to consume according to European law and a range of other mandatory requirements your product must meet. Once in Europe, your buyers and the European (niche) market will have other requirements, like sustainability certification, which if not met could make doing business difficult. Knowing your product, the different requirements and your competitors can give you the advantage.

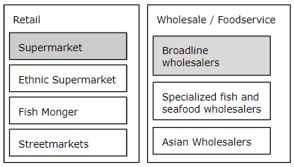

Figure 1: End-market segmentation for wild-caught warm-water shrimp

Source: Seafood Trade Intelligence Portal, 2019

Figure 1 shows the main retail and wholesale/food service end-market segments in the Europe. The segments that are darker are those that should be most interesting for you, as a producer of wild-caught warm-water shrimp, since these are the segments in which there is the highest demand for your products.

IQF and semi-IQF head-on shell-on Asian tiger shrimp and other species

In the case of IQF and semi-IQF head-on shell-on products, it has often to do with the consistency of supply. The mainstream retail market requires products to be available year-round at a consistent volume and at a consistent price. This is not the case for Asian tiger shrimp and other head-on shell-on products. As a result, Asian tiger shrimp – whether from Africa and sold in southern Europe, or from Asia and sold in north-western Europe – is mostly destined for the wholesale market and to a certain extent for the ethnic retail market.

Within the wholesale market, head-on shell-on Asian tiger shrimp (and other species) is mostly sold by specialised fish and seafood wholesalers with a wide product assortment and a clientele interested in premium products. Ethnic wholesalers catering to the Asian and African markets may also have some of these products on offer, as their clientele is accustomed to them. Broadline wholesalers are less likely to have these products on offer, since fish and seafood is just one of their many types of product, and (like mainstream retail) they often require larger volumes.

Blocks of Asian pinks and African wild-caught warm-water shrimp

Peeled blocks of Asian pinks and blocks of head-on shell-on and peeled African wild-caught shrimp used to be supplied to mainstream retail. They were used as an ingredient in ready-eat meals in supermarkets and sometimes sold as refreshed products. However, since many retailers now require MSC or ASC certification, suppliers of wild-caught species from Africa and Asia have limited market access. In most cases, retailers switched to Pacific white shrimp or coldwater shrimp species that are available with ASC or MSC certification.

Some blocks of wild-caught warm-water shrimp may still end up in mainstream retail in southern and Eastern Europe where retailers have not yet committed to only selling MSC-certified products. Often, they are still used as a cheap ingredient in ready-made meals, as blocks of wild-caught warm-water shrimp often sell for prices below those of Pacific white shrimp for the larger sizes, and below the price of coldwater shrimp for the smaller sizes.

In the wholesale market and in the ethnic retail market, blocks or bags of wild-caught warm-water shrimp are often still on offer. In the wholesale market, it still serves as an ingredient and is used as raw material for industrial processors who supply it as cooked products to the food service industry. In the ethnic retail segment, it is sometimes sold as a finished product as well. While there are only a limited number of importers for reprocessing, the number of importers of finished products for wholesale is endless.

Tip:

- If you can have the fishery you are involved in engaged in a fishery improvement project (FIP), this might give you lucrative access to Europe’s mainstream retail market. To learn about the possibilities, contact non-governmental organisations like the World Wildlife Fund, which support FIPs across Asia and Africa.

2. Through what channels does a product reach the end market?

We will now look at which market channels supply the European market with wild-caught warm-water shrimp. Just like in the previous section, we will look at IQF and semi-IQF head-on shell-on and block frozen head-on shell-on and peeled products separately.

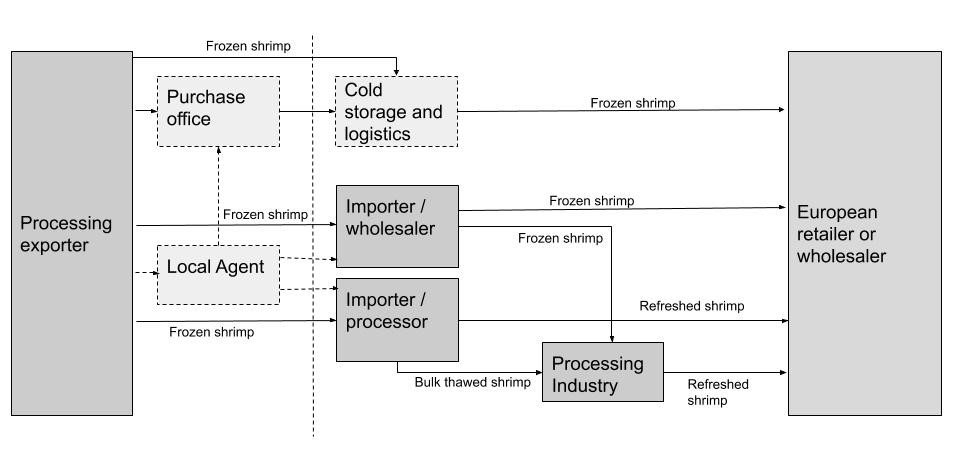

Figure 2: Market channels in the European shrimp market

Source: Seafood Trade Intelligence Portal (2019)

In the figure above, the actors in lighter boxes are those who only act as a service provider to a buyer or seller. These actors never actually own the shrimp and are often not involved in making financial transactions to do with the ownership of the shrimp. Examples of these actors are the local agents who support buyers in sourcing products or quality control, and logistics providers who ensure the cold-chain during transportation but never own the product. The actors in the darker boxes in the figure are those who actually buy and sell the product.

IQF and semi-IQF head-on shell-on Asian tiger shrimp and other species

In terms of market channels, there is an interesting distinction between how Asian products are sold to this market in comparison to how African products are sold to it.

Asian suppliers of head-on shell-on or headless shell-on Asian tiger shrimp often sell their products in mixed containers to their regular customers in Europe. Asian suppliers often lack the volumes to supply full container loads of this product and therefore the buyer needs to be interested in buying other products from the supplier as well. As most European buyers interested in this product will buy other shrimp products as well, this is often not a problem. European importers will include this product as a service product for their end customers.

Many African suppliers of head-on shell-on and headless shell-on Asian tiger shrimp (and other species) sell more directly to the European market. Some products will also be sold to traditional importers who then sell to the wholesale or ethnic retail market. Often, they either have agents in Europe who sell their products on a commission basis directly to the wholesale segment or they are part of a joint venture company in Europe that takes responsibility for sales and distribution to the European and other global markets.

With its partner or buyer, the African supplier would normally ship a container to the European port, from where it would be sold onwards on a pallet basis (importers also sell onwards on a pallet basis). If the supplier works with an agent, the advantage is that the margins for the supplier can be bigger, as the agent would work on a smaller commission than the margin an importer would take. The disadvantage is that the logistical efforts needed are a bit higher and a trusted agent is required.

Where a joint venture company is concerned, the costs for the supplier are much lower since the joint venture partner will take care of all activities related to imports, sales and distribution of the entire company catch. This means that the joint venture partner in Africa is certain of a market and revenues. In this case, it is important that mutually beneficial agreements are made about the division and allocation of turnover and profits, and that both partners have maximum benefit from the cooperation.

An example of a company working with an agent is Nigerian shrimp supplier Benarli, which works with an agent in Spain who sells on its products to the market. An examples of a joint venture between an African supplier and a European importer is Atlantic Shrimpers from Nigeria, which collaborates with Primstar in the Netherlands. These kinds of partnerships are rarely seen in Asia. Examples of European importers of Asian tiger shrimp from Asia are DKSH in Switzerland, Dayseaday in the Netherlands and AquaMarine in Belgium.

Tip:

- Use Google Translate if you are trying to access a company website linked in this study and the website is not available in a language you are familiar with. Companies that you might be interested in may only have their websites translated into the languages that they use most often.

Blocks of Asian pinks and African wild-caught warm-water shrimp

Block frozen products are mostly destined for reprocessing. These products are mainly imported from Asia by importers in north-western Europe who reprocess imported blocks into final products for industrial players in the ready-meal industry or who sell it directly to retail as refreshed products. For African products, these will be importers in France, Spain, Italy and Portugal, who reprocess the shrimp for the ready-meal industry and retailers, who will be mostly importing these products.

Normally, the buyers in this segment are much larger than those who buy IQF and semi-IQF head-on shell-on products, with products being traded on a container basis instead of on a pallet basis. Especially for Asian block frozen pinks, it is rare to see suppliers work with agents to sell directly to wholesalers and retailers. Usually an importer will supply the reprocessing industry, or reprocess the blocks in their own facilities. The small volume of Asian pinks that are traded as cooked peeled products and packed as finished products are an exception. These shrimp are traded by the larger group of importers supplying frozen finished products to the wholesale market.

In the United Kingdom, the Netherlands and Belgium – the key markets for the Asian block frozen products – key buyers are companies like Heiploeg, the Dutch Seafood Company (Klaas Puul), Mooijer and Shore (Morubel). Although hard to determine precisely who these are, southern European importers of African block frozen products include the traditional cookeries of Nueva Pescanova and Gambafresh, and possibly also smaller players specialising in these products.

What is the most interesting channel for you?

In general, the more directly you sell your products, the larger your potential margin. However, to sell directly, you need to invest in finding buyers by attending trade shows, visiting companies all over Europe, and maintaining the relationships in your network. You will also have a bigger responsibility in terms of logistics and distribution, and potentially also in financing the trade of your goods.

If you work with an agent or with a joint venture partner, you will lose some margin, yet will also be able to profit from the markets and networks that these players already have.

In the end, the right market channel for you really depends on your company’s specific situation, the volumes of products that you can offer and your ability to invest time and money in sales and distribution.

Tips:

- If you have made up your mind about which market in Europe you want to enter or expand in, hire an agent or consultant who can help you to identify buyers in that market who might match your profile.

- If you are a supplier of Asian tiger shrimp from Asia, and you have good access to the raw materials but lack the finances to invest in upgrading the fishing fleet on your own, look at which European companies have investments in African fisheries and try to connect with them to discuss potential cooperation in Asia.

3. What competition do you face on the European wild-caught warm-water shrimp market?

A risk for every country involved in warm-water shrimp fisheries is compliance with Europe’s IUU regulations. Europe has increased its efforts to end IUU fishing. Countries that cannot convince the European authorities that they comply with its IUU regulations will be confronted with interventions, which eventually may result in a total ban of exports of their fishery products to Europe. One country involved in exporting wild-caught shrimp to the European Union which has currently been given an IUU-related yellow card is Vietnam.

Which countries are you competing with?

In general, countries with a wild-caught shrimp fishery will find it difficult to distinguish themselves from other such countries. However, unique selling points may exist that are related to the small-scale versus large-scale characteristics of the shrimp fisheries. These can result in differences in a fishery’s ability to maintain the quality of products post-harvest and to maintain traceability of products from the sea to the plate. If your country has a consolidated fishery with short supply chains, you might be able to turn this into a competitive advantage.

Competition from Africa – Madagascar, Mozambique, Senegal, Nigeria and many others

The African shrimp fisheries are much less dominated by small-scale fisheries than the ones in Asia. This can be considered a competitive advantage, as the smaller fleets of larger vessels mean that the companies attached to these fisheries can often provide higher quality products and better product traceability. One of the best examples of a consolidated shrimp fishery is in Nigeria, where only four or five companies own the entire fishery.

The larger vessels operating in African waters often have on-board freezing facilities where they can freeze the shrimp in its final product specifications, right after it is caught. This results in a larger portion of catches having the quality to be frozen and sold as head-on shell-on products, which are the most desired and highest priced products in the market. The portion of shrimp landed by small-scale fishermen in Africa is often absorbed by the same companies that operate their own trawler fleets, a risk when chain of custody is not maintained.

Competition from Asia – India, Bangladesh, Myanmar, Pakistan, Vietnam, Indonesia and others

With regard to the peeled blocks of pinks imported from Asia, the main suppliers are India and Bangladesh, and – to a lesser extent – other suppliers in the region, like Myanmar, Indonesia, Pakistan and Vietnam. However, buyers will rarely distinguish between the different origins. For them, pinks are a price-driven product. The markets that the products are sold into are not really interested in quality or sustainability. As such, it will be difficult to distinguish yourself in any other way than by being competitive on price.

Asian tiger shrimp from Asia is always in demand and buyers are willing to pay a high price if they can secure the products for their customers. A challenge many Asian suppliers face is that they can only supply limited volumes. They often can only supply it as a service product in a mixed container with other wild-caught peeled shrimp products. The problem is that while the suppliers of peeled blocks of pinks and head-on shell-on Asian tiger shrimp are often the same party, the buyers are often different ones and may not be interested in mixed containers.

The problem described above is related to the nature of fisheries in Asia. Compared to the African shrimp fisheries, a considerable part of wild-caught warm-water shrimp in Asia is supplied by small-scale fishermen. The involvement of small-scale fishermen results in various challenges related to product quality (freezing on board is often not possible) and to the traceability of products. A considerable portion of wild-caught shrimp in Asia, once landed, will not have the quality to be sold as head-on shell-on products.

Tip:

- Compare the tariffs that you would have to pay when exporting shrimp to Europe with what your competitors from other origins pay.

Which companies are you competing with?

Atlantic Shrimpers

Primstar, the shrimp division of Dutch fisheries giant Cornelis Vrolijk, is the joint venture partner of Nigeria-based Atlantic Shrimpers. Through a series of mergers, Atlantic Shrimpers operates the largest fleet of shrimp trawlers in West Africa, with more than 70 vessels operational. Atlantic Shrimpers is fully concentrated on the fishing and processing of products on board of its vessels and in its land-based factory. Primstar is the sole distributor of its products in Europe and in other global markets, such as China and the United States.

Atlantic Shrimpers’ fleet is the only warm-water shrimp fishery in the world that has been able to achieve Friends of the Sea (FoS) certification. With this certification, Atlantic Shrimpers has been able to access markets that other suppliers of Asian tiger shrimp have not, such as certain mainstream retailers in the United Kingdom. Primstar, through its parent company Cornelis Vrolijk, also provides Atlantic Shrimpers with access to the capital, technology and knowledge required to continuously upgrade its fishing fleet to the latest standards.

Despite its strong proposition, Atlantic Shrimpers is also confronted with challenges related to the sustainability of its fishery. The company has recently received negative attention for fishing in waters where it lacked the appropriate licences, while some civil society organisations have argued that Friends of the Sea certification does not match the same standards as MSC. For a company like Atlantic Shrimpers, it will be crucial to continuously invest in the sustainability of its fishery and to convince its stakeholders of its efforts.

Afritex Ventures

Afritex Ventures is a multinational fishing group with fishing fleets in Mozambique and Mauritius. Its fleets consist of longliners in Mozambique and Mauritius, and a separate trawler fleet owned by the Mozambican company Kalipesca. Kalipesca owns three deep-sea trawlers, which primarily target Haliporoides triarthus, referred to by Kalipesca as deep-sea pink shrimp. They also fish in shallow waters and catch other shrimp species too.

The big advantage of Afritex is that it owns a variety of longline, trawler and demersal vessels, and as such is able to trade in a large variety of species. The trading operation of Afritex is a crucial part of its business. Headed by former investment bankers, the company is financially strong and able to trade larger volumes of seafood with clients around the world. The company is also involved in fishery improvement projects with the Sustainable Fisheries Partnership to ensure the sustainability of its fleet and market access to higher-end markets.

Abad Fisheries India Private Limited

Abad Fisheries is one of India’s oldest seafood exporters. The group is headquartered in India’s old seafood capital Kochin in Kerala state. Based out of Kerala, the company has good access to the fishing ports in the southern states of Kerala and Tamil Nadu, where a lot of India’s wild-caught warm-water shrimp is landed. Contrary to Atlantic Shrimpers in Nigeria, Abad Fisheries is not involved in fishing itself. Instead, it operates a network of agents and collection centres along the coast, through which it sources wild-caught shrimp for its factories.

Although wild-caught shrimp previously was the core of Abad Fisheries’ business, now it is merely a side activity. Catches have been shrinking and farmed shrimp production has increased in India. Despite this, Abad is still one of the leading exporters of wild-caught shrimp and is able to freeze shrimp with the most modern technologies. Abad Fisheries is joint venture partner of the Spanish company Nueva Pescanova, which invested in Abad Fisheries through one of its former subsidiaries, providing Abad with good access to the global market.

Tips:

- Look at your management team. Do you have any highly educated team members who can support you in making your company future-proof and taking it to the next level?

- At trade shows, besides looking for buyers, also try to engage with your competitors and ask them about the challenges and opportunities they face, and see what you can learn from that.

Which products are you competing with?

Before we look at competition with other shrimp species, it is first necessary to acknowledge that possibly the most important competitive disadvantage of wild-caught warm-water shrimp from Asia and Africa is that none of their fisheries are certified by the Marine Stewardship Council. MSC certification is rapidly becoming a market access requirement throughout Europe, and without certification your European market for warm-water shrimp will shrink.

Other shrimp species – whether they are coldwater species from fisheries in the Arctic, Europe or South America, or warm-water species from aquaculture in Asia and South America – are now widely available as MSC or ASC certified products. If the warm-water shrimp fisheries in Africa and Asia do not follow, they will be pushed out of the European market by their certified competitors. A major challenge is that while in aquaculture you can certify a single farm, in fisheries you need to certify an entire fleet. This requires wider collaboration between stakeholders.

Cultivated Pacific white shrimp

Pacific white shrimp is currently the price fighter of the exotic shrimp species offered on the European market. For the middle sizes (30 to 100 HOSO pieces per kilogram), Pacific white shrimp is cheaper than every other species. In addition, ASC-certified Pacific white shrimp is widely available to any market players who require it. With European consumers in most of north-western Europe being very focused on price and sustainability, it is unsurprising that most retailers choose to mainly offer Pacific white shrimp in their supermarkets.

In terms of competition with Asian and African wild-caught warm-water shrimp, Pacific white shrimp mainly competes with the block frozen head-on shell-on and peeled products. Although, with regard to overlapping sizes, African and Asian wild-caught shrimp might be cheaper, sustainability requirements are increasingly outweighing the price difference. Pacific white shrimp is not available in the smaller sizes (< 100 HOSO pieces per kilogram).

Wild-caught South American seabob shrimp

The seabob (Xiphopenaeus kroyeri) fishery is small but consolidated, and dominated by only a few buyers and a few suppliers. The seabob fishery in Suriname has been MSC certified for a long time, while the seabob fishery in Guyana being MSC certified since September 2019. Blocks of cooked peeled seabob shrimp are imported by importers in north-western Europe (especially by Dutch-based Heiploeg Group) to supply refreshed products to the ready-meal industry and to mainstream retailers.

Most seabob shrimp is caught in the smaller sizes, competing more with Asian pinks than with Pacific white shrimp.

Cultivated black tiger shrimp

While Pacific white shrimp mainly competes with the block frozen products from Asia and Africa, black tiger shrimp mainly competes with the IQF and semi-IQF head-on shell-on frozen products. Larger sizes of cultivated black tiger shrimp (> 4 up to 16/21 HOSO pieces per kilogram) compete with wild-caught Asian tiger shrimp and other species. Cultivated black tiger shrimp will often sell at a lower price than its wild-caught competitors. That said, there is a shortage of large sizes in the market, so you will easily find a good market for your products.

Wild-caught Argentine red shrimp

Argentine red shrimp has a consolidated position on the southern European market, with supply volumes increasing rapidly over the past couple of years, including on the north-western European market. It is sold in larger and smaller sizes and is available as land-frozen or sea-frozen, and as head-on shell-on and headless shell-on products as well as peeled products. Just like the African and Asian IQF and semi-IQF head-on shell-on Asian tiger shrimp and other species, it is promoted as a shrimp for grilling.

With the increased supplies of Argentine red shrimp, prices have come down. In general, it will be difficult for suppliers of Asian and African Asian tiger shrimp and other species to compete, but when the price gap is relatively small, there is a group of suppliers that might switch species in favour of the Asian tiger shrimp.

Parts of the Argentine shrimp fishery are about to become MSC certified. With this achievement, it is likely that larger volumes of Argentine red shrimp will be sold into the mainstream retail market. This might increase space for other species in the wholesale segment.

Tip:

- To understand price differences between all these species, check Undercurrent News price portal and compare the prices.

4. What are the prices for wild-caught warm-water shrimp on the European market?

The table below give you an impression of the wholesale price level in Europe for different species of warm-water wild-caught shrimp. The prices are an indication of prices in December 2019.

Table 1: Wholesale price of different species of warm-water wild-caught shrimp in Spain and Portugal

|

Species |

Price per kilogram (euros) |

|

Striped prawn (M. kerathurus) |

|

|

10-20 |

20.00 |

|

30-40 |

16.40 |

|

60-80 |

11.50 |

|

100-120 |

8.30 |

|

Browns (P. atlantica) |

|

|

60-80 |

6.60 |

|

100-120 |

5.00 |

|

Black tiger shrimp (P. monodon) |

|

|

4-6 |

31.60 |

|

8-10 |

28.30 |

|

16-20 |

23.40 |

*ex works

Source: Seafood Trade Intelligence Portal 2019

Although the exact distribution of margins differs significantly from one product to another, we can give a rough estimation up to the wholesale level, since wild-caught warm-water shrimp is more dominant in various wholesale market segments. Due to the generally longer supply chains of Asian wild-caught warm-water shrimp, margins are harder to estimate.

Many African suppliers of head-on shell-on and headless shell-on Asian tiger shrimp (and other species) sell more directly to the European market and therefore avoid agent fees. Although some products will also be sold to traditional importers who sell onwards to the wholesale or ethnic retail market, many suppliers have agents in Europe who sell their products directly into the wholesale segment on a commission basis.

The commission of an agent as well as the margin of the wholesaler is around 10%. The vast majority (over 70%) of the value comes from the raw material itself.

The study has been carried out on behalf of CBI by Seafood Trade Intelligence Portal.

Please review our market information disclaimer.

Search

Enter search terms to find market research