Entering the European market for blueberries

Blueberries are a typical retail product that require scale and professional cultivation. As a supplier, it is important to operate in close coordination with producers and establish international partnerships to reach major retailers. Over the years it has become a difficult market to enter. Good quality blueberries can still be a very profitable crop, but it takes large investments in cultivation, varieties and packing to deal with the fierce competition from Chile, Peru, Spain and Morocco.

Contents of this page

1. What requirements and certifications must blueberries comply with to be allowed on the European market?

Fresh blueberries must comply with the general requirements for fresh fruit and vegetables, which you can find on the CBI market information platform. My Trade Assistant of Access2Markets provides an overview of export requirements for blueberries and other berries of the Vaccinium genus (product code 08104000).

What are mandatory requirements?

There are specific marketing standards for different berries, but most importantly they must be clean for direct consumption and the quality must be well kept by a proper post-harvest process.

Pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetables suppliers. This is especially relevant for fresh blueberries, as they are directly consumed.

To avoid health and environmental risks, the European Union has set maximum residue levels (MRLs) for pesticides and other contaminants, such as heavy metals, in and on food products. Products exceeding the MRLs are withdrawn from the market.

Note that buyers in several EU Member States, such as Germany, the Netherlands and Austria, use even lower maximum residue levels than those established by European legislation.

Tips:

- Check the EU Pesticides database to find all MRLs and those specific for blueberries. Search by product or pesticide and the database to find the list of associated MRLs.

- Use integrated pest management (IPM) in production to reduce the use of pesticides. IPM is an agricultural pest-control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they require spray registers or if they have additional requirements on MRLs and pesticide use.

- Make sure that lead contamination in your blueberries remains below 0.10 mg/kg and cadmium below 0.030 mg/kg, according to the maximum levels for certain contaminants in foodstuffs.

Microbiological criteria

Food safety authorities can withdraw imported berries from the market or stop them from entering the European Union if salmonella, norovirus, E. coli or other bacteria are present (Regulation No 2073/2005).

These are some of the findings of a scientific opinion on risk factors that contribute to the contamination of fresh or frozen berries such as strawberries, raspberries or blueberries at different stages of the food chain. EFSA has recommended that producers use good agricultural, hygiene and manufacturing practices to reduce contamination.

The European Food Safety Authority (EFSA) has identified potential factors that cause contamination of berries with Salmonella and norovirus. These include rainfall, the use of contaminated water for irrigation or for applying pesticides, and contaminated equipment. EFSA recommends good agricultural, hygiene and manufacturing practices to reduce contamination in berries.

Tips:

- Make sure to use clean water and equipment in the cultivation and processing of blueberries. Use good hygiene practices when hand-picking your berries.

- Use the European Union guidance document on addressing microbiological risks in fresh fruits and vegetables in primary production through good hygiene.

Phytosanitary regulations

Blueberries must go through plant health checks before entering or moving within the European Union.

European regulation requires plants and fruits of the Vaccinium genus originating in Canada, Mexico and the USA to be free from Grapholita packardi Zeller, also known as cherry fruit worm, which must be established in the country of origin by the national plant protection organisation. The plant health inspection must take place in the country of origin and the shipment must be accompanied by a phytosanitary certificate, guaranteeing that they are:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Regulation (EU) 2019/2072.

Tip:

- Check which (other) fruit and vegetables require a phytosanitary certificate in the lists of Annex XI and Annex XII of Regulation (EU) 2019/2072. Learn more about the European phytosanitary rules in the Implementing Directive 2019/523 on the protective measures against the introduction of harmful organisms in the European Union.

Quality standard

For more information on quality, size, packaging and labelling requirements for berries, including blueberries, see the UNECE standards for berry fruits (2019 edition).

Blueberries must at least comply with the general quality requirements (see Table 1). Bilberries and blueberries must be practically free of agglomerated berries. Blueberries must be practically covered with bloom, according to the varietal characteristics.

Table 1: Quality requirements and permissible tolerances for fresh avocados

| General quality requirements (all classes) |

| 1. Intact; |

2. sound – produce affected due to rotting or deterioration, making it unfit for consumption, is excluded; |

| 3. clean, practically free of any visible foreign matter; |

| 4. practically free from pests; |

| 5. practically free from damage caused by pests; |

| 6. fresh in appearance; |

| 7. free of abnormal external moisture; |

| 8. free of any foreign smell and taste, including bitter taste in case of bilberries; |

9. he development and condition of the berry fruits must be such as to enable them: • to withstand transportation and handling. • to arrive in satisfactory condition at the place of destination. |

Europe almost exclusively requires Class I blueberries as a minimum. Blueberries in this class must be of good quality and within the following permissible tolerances:

- very slight leakage of juice;

- very slight bruising;

- a tolerance of 10% is allowed for fruit that meets Class II standards.

In no case may the defects affect the fruit flesh, the general appearance of the produce, the quality, the keeping quality and the presentation in the package.

Tip:

- Maintain strict compliance with quality, delivering it as agreed with your buyer. Being careless with your standards will lead buyers to raise issues with quality.

Post-harvest

Berries must be cooled directly after harvest, which lowers the field heat from the berry and extends shelf life. A perfect cold chain is a must to maintain fruit quality and successfully export your blueberries to Europe.

Tip:

- Consider using a controlled atmosphere for temporary storage in addition to your cold rooms, so as to further improve the quality and shelf life of your product.

Size and packaging

There is no specific standard for blueberry sizes in Europe. Buyers may have specific requirements for fruit grading, so it is best to discuss it beforehand.

The type of packaging also depends on your buyer. The contents of each package must be uniform and contain only berry fruits of the same origin, variety and quality.

Common packaging includes:

- Bag-in-box for bulk packaging (3–4 kg);

- Clamshells or punnets of various sizes, such as 12x125 g, for direct marketing. Larger packaging than the usual 125 g is growing more popular;

- Shakers or buckets often in 250 g or 500 g sizes done by packing companies in destination countries.

European retailers increasingly push for more sustainable packaging. As a supplier, you are expected to use recyclable or biodegradable packaging. The Italian brand Sant’Orsola has introduced zero-waste and zero-residue blueberries in plastic-free packaging.

Tips:

- Always discuss specific packaging requirements and preferences with your customers. Make sure you can offer different types of wholesale and retail packaging.

- See the buyer requirements for fresh fruit and vegetables on the CBI market information platform for the legal labelling requirements.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Pre-packaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

What additional requirements do buyers often have?

Good agricultural practices, certifications and sustainability are most important, but future requirements may also become more specific in relation to varieties and taste.

Variety

Buyers in the end market often do not have preferences for specific blueberry varieties. The main reason for it is to optimise productivity, quality and extend supply seasons. However, choosing the right variety is important to obtain the best product for your client in terms of flavour, firmness, colour and shelf life. Large blueberries with a high brix value (sweet taste) are most likely to fetch higher prices. In the future, as the market for blueberries further matures and end-clients become more knowledgeable, specific variety preferences may also develop.

Tips:

- Learn more about different blueberries by looking at the available varieties of large nurseries, such as Fall Creek Nursery. Try not to become completely dependent on a single variety, but experiment with different ones.

- Choose the right blueberry varieties by learning from other companies, such as the Peruvian suppliers in the United Kingdom. Close cooperation with market players in Europe is essential.

Certification

Common certifications for blueberries include GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are most recommended.

Sustainability and social responsibility

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards.

Retailers can also impose their individual standards, such as Tesco Nurture or M&S Field to Fork. Especially larger retail chains in northern Europe are more prepared to buy your product if you comply with social and sustainability standards.

In the near future you can expect new standards and buyer requirements to be introduced. For example, the Sustainable Trade Initiative for Fruit and Vegetables (SIFAV), a private covenant between European importers and retailers, is formulating new goals towards 2025 that include reducing the carbon footprint and sustainable water use.

European Green Deal

In the coming years the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe for becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal aiming to make food systems fair, healthy and environmentally-friendly. It will ensure sustainable food production and address things like packaging and food waste. For suppliers of fresh fruit and vegetables, it is important to look beyond more and higher standards and to try to be ahead of the developments.

Tips:

- Implement at least one environmental and one social standard. See the Basket of Standards of the Sustainability Initiative of Fruit and Vegetables (SIFAV).

- For other additional requirements, such as payment and delivery terms, see the CBI’s reports on buyer requirements for fresh fruit and vegetables and tips for doing business with European buyers.

What are the requirements for niche markets?

Organic matches the healthy profile of blueberries

Organic certification can be an interesting way of setting your blueberries apart and marketing them at higher prices. Blueberries are very popular because of their health benefits and are directly consumed, which leads to increased consumer interest in clean and certified organic blueberries.

Specialised buyers such as SpecialFruit (Belgium) and Eosta (Netherlands) often work with organic blueberries. For a large part, organic blueberries are sourced locally and are sometimes from the bilberry or wild blueberry varieties. In France, retailer Carrefour sells zero-residue blueberries, blueberries without detectable pesticide residues, as an alternative to organic. In Germany, low or zero residue is already a standard and organic is one step up from it.

To market organic products in Europe, you must use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. In January 2022 the new Regulation (EU) 2018/848 came into force. This legislation includes new rules for group certifications, new approaches for dealing with suspected non-compliance and residues, and new rules at the EU borders for imported products. Inspection of organic products will become stricter to prevent fraud, and producers in third countries will have to comply with the same set of rules as those producing in the European Union.

Tip:

- Strive for residue-free blueberries and certify your production as organic, if possible, to broaden your market opportunities. But remember that implementing organic production and becoming certified can be expensive; you must be prepared to comply with the entire organic certification process.

Through what channels can you get blueberries on the European market?

Blueberries are a premium fruit, which you can market through specialised soft fruit importers to supermarkets. Offering different packaging options can increase your market chances.

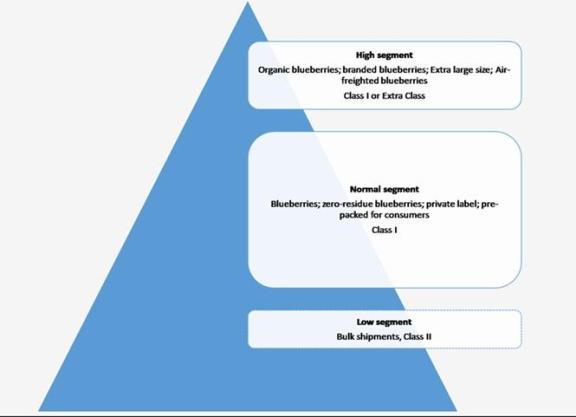

How is the end-market segmented?

The market segmentation for blueberries is straightforward. Certified organic blueberries and those branded as premium fetch the highest prices. Several supermarkets in large consuming countries have premium brands, such as Waitrose’s DUCHY blueberries (premium organic blueberries), Family Tree Farms Jumbo Ultra-Premium Blueberries or Driscoll’s ‘Sweetest Batch’ premium blueberries.

The most common segment is Class I blueberries, which are geared to average consumers. Retailers offer these blueberries in different sized consumer packages and often private label. They can be sourced from any origin. When market demand is very high, occasional airfreight may raise blueberry prices.

Class II blueberries are not common, but can be marketed for fresh processing or by individual shops and street markets for quick sales. Blueberries that fail to meet the normal specifications are thrown away or, if possible, sold for any acceptable price.

The segmentation for blueberries is likely to diversify with more varieties, flavours, qualities and brands. The United Kingdom is farther ahead on these developments in Europe. Over the next few years, you will see a growing demand for premium blueberries, but also much more price competition from the medium segment.

Figure 1: Market segments for blueberries in Europe

Source: ICI Business

Tips:

- Be honest about quality and back up your product. Document your cold chain and product appearance with photos before shipping to help you in case the buyer rejects the quality and wants to renegotiate value and price.

- Try to come up with a unique selling point for your product, such as organic certified blueberries or a superior variety. This could help you differentiate from other suppliers and reach a higher segment. Branding your own blueberries can be an option if you are able to differentiate and invest in marketing. The best way to do this is with a partner in Europe.

2. Through what channels does a product end up on the end market?

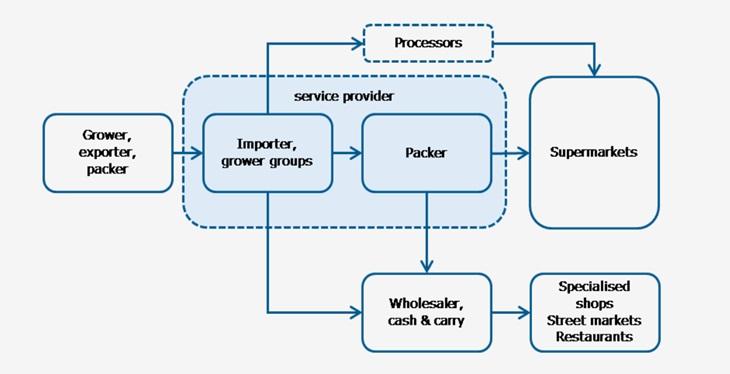

Importers and service providers

Importers and traders play a central role in the distribution of blueberries. They are familiar with all the different requirements of end clients and are able to distribute to different markets. By sourcing blueberries from different regions, traders can assure their clients with year-round supply.

Blueberry and soft fruit specialists supply most of the market, forming a link between growers and retailers. Specialists such as Yex (formally known as Fruit World) and Growers Packers in the Netherlands, and Chambers and S&A Group in the United Kingdom, are closely involved in or integrated with primary production to offer a wide range of packing and mixing solutions. Packing is an important activity in the blueberry supply chain and consumer packing is a must for supermarkets.

Working closely with a company specialised in soft fruit is important to get your product to large retail chains. Specialists with global import activities are also very useful to indirectly reach wholesale, foodservice and processing channels. To reach industrial processors, it is a good idea to add frozen or preserved blueberries to your offer.

Supermarket supply programmes

Blueberries are a typical retail product. Large retail organisations want to source blueberries close to production, so they have more control and transparency in their supply chain. The demand for more transparency has led fresh fruit traders to get more involved in production. Several of these companies have merged their businesses with farmers and nurseries. For example, Berryworld is a highly specialised company that has managed to organise a group of international growers to supply to supermarkets, such as ICA (Sweden), Coop Denmark and Albert Heijn in the Netherlands.

Wholesalers (spot market)

Wholesalers often supply smaller quantities of blueberries to secondary channels such as specialised fruit retailers and food services.

Smaller, traditional wholesalers reach fruit shops, street merchants, restaurants and hotel chains. They may also do importing, but they are not equipped to organise a global network of blueberry growers. Instead, they prefer to buy from local growers and international blueberry specialists. Without a retail programme, they only cover the spot market and are most subject to market fluctuations.

Global growing and sourcing companies have covered the large wholesale business and supply major food service chains or non-specialised (cash & carry) wholesalers, such as Metro.

Figure 2: Market channels for blueberries

Source: ICI Business

Tips:

- Combine fresh exports with processed blueberries, for example, frozen, dried, syrups, purees and juices. Some buyers may have demand for both, but more importantly, processed blueberries provide you with a secondary channel for fruit that is not fit for fresh export.

- Read our studies about exporting processed fruit to Europe such as frozen berries on the CBI market information platform.

- Make sure you have access to a reliable and certified packing station when dealing with large retailers. You have the option of packing your blueberries directly in consumer packages after harvest or outsource repacking in the destination country.

What is the most interesting channel for you?

Taking part in retail supply programmes can provide the security of stable demand and average margins, which are often most profitable in the end. However, the requirements are high and the room for negotiation is minimal.

Supplying supermarkets directly is challenging for non-European suppliers. Their demand is programmed and the local seasonal production weighs heavily in retailers’ preferences. As a foreign supplier, you must be prepared to integrate your business with European berry growers or service providers, offering full service and reliable volumes. Supermarkets require a year-round supply, which you must provide by way of international cultivation or partnerships.

The most likely route to become part of a retail programme is to cooperate with a service provider that has a local infrastructure and already established supply contracts with retailers.

If you cannot comply with the high service level or guaranteed supply contracts that are required by large retailers, it is best to work with an importer that has a diverse network of wholesale clients.

Tip:

- Go to trade fairs to find buyers. The main trade fairs for fresh fruit are Fruit Logistica in Berlin and Fruit Attraction in Madrid.

3. What competition do you face on the European blueberry market?

The scale of your operation and your professional performance determine your competitive advantage in the blueberry market. Over the years the offer has diversified with new players, improved varieties and cultivation technologies. The entry costs to start your own production are high. Seasonality is the other main factor that defines your competition. It is important to monitor the increasing competition and the fast-planting rates worldwide in relation to demand.

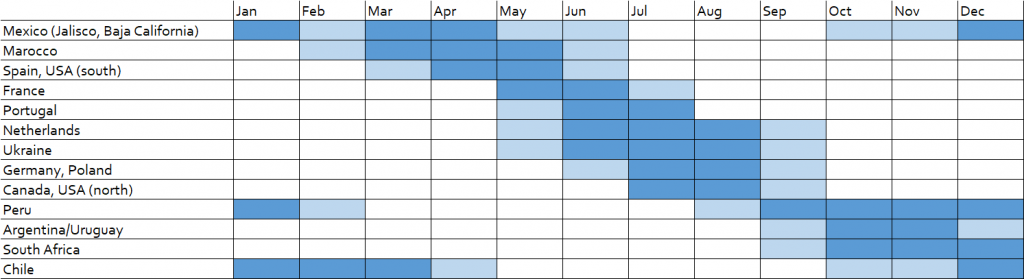

Which countries are you competing with?

In the southern hemisphere, Peru, Chile and South Africa are strong suppliers with increasing volumes. In the north, your principal competitors are European producers, such as those in Spain and Poland. Morocco is the strongest non-European competitor that competes within the European season. These supply seasons change quickly (see supply calendar in Figure 5).

Europe: Local is preferred

When local production is abundantly available, it is difficult for long-distance suppliers to sell on the European market. This is why volumes from the United States, Canada and Mexico are much smaller than from counter-seasonal producers Chile, Peru and South Africa. Recent logistical challenges and increasing attention to carbon footprints have further tipped the scales in favour of local blueberries.

Spain and Poland are the strongest European suppliers and growing fast in production volume, but you will find blueberry production all over Europe. In fact, blueberry production is on the rise in most European countries.

Figure 5: Indicative blueberry supply calendar to Europe

Source: ICI Business

Peru: booming in blueberries

In less than a decade, Peruvian producers have built up a new blueberry sector and gained lots of experience from its Chilean neighbours. Peru has had exponential growth in blueberry cultivation in the last five years, most of which was exported. In 2022, the country expects another 25% growth in export volume, bringing its total volume up to 277,000 tonnes. Around 18% of the volume is exported to Europe.

Although most Peruvian blueberries are shipped to the United States, in Europe, Peru has become the largest non-European supplier. Europe imported a value of €378 million in 2021 (see figure 4). Keep in mind that Peru and Chile have an overlapping harvest season at the end of the year, with volumes and competition increasing as a result.

Peruvian growers mostly rely on the Ventura and Biloxi cultivars, but new genetics and more blueberry varieties are being introduced. Experts are projecting that 120,000 tonnes will be of new varieties of the more than 300,000 tonnes that Peru could export in 2025.

There are several large blueberry producers in Peru and a relatively large share of small growers: 20% of all Peruvian producers have 10 hectares or less. This large presence of small producers is both a strength and a weakness for Peru. The scattered production over different areas makes the sector less vulnerable to adverse weather and gives Peruvian producers the advantage of prolonging their harvest season. On the other hand, consistency in quality and agricultural practices may vary among small growers.

Tips:

- Consider diversifying your production sources, for example, by teaming up with growers from different regions.

- See who are the leading suppliers and competitors in Peru on Agrodataperu.com.

Chile: leading in experience

Chilean companies are highly experienced in breeding and cultivating some of the best blueberries in the world. Today, they are exploring production growth in other countries such as Peru and Mexico. Chile has been the leader in blueberry export in the southern hemisphere for a long time, but in 2019 they were overtaken by Peru’s booming export. With a large north to south stretch, these two countries together are able to fulfil the whole off-season blueberry period in Europe.

European imports of Chilean blueberries were valued at €215 million in 2021. Most blueberries exported to Europe are shipped to the Netherlands and the United Kingdom, but Germany and Spain are also increasing their imports from Chile.

Due to increasing competition from Peru and Morocco, the Chilean blueberry sector has seen the need to keep improving quality to maintain its leading role. You can expect growers in Chile to be innovative in production. They increase organic production and replace older blueberry varieties with new ones with longer shelf life , obtaining a better varietal mix. Varieties that have interesting volumes and growth are Blue Ribbon, Top Shelf, Suzie Blue, Cargo, Rocio, and Stella Blue. According to the Chilean Fruit Exporters association (ASOEX), 17% of blueberry area under cultivation is organic.

The experience and the advanced production knowledge in Chile raise the bar for new exporters. To compete with Chilean blueberry companies, you must be able to provide an equal quality level or distinguish yourself in another way, such as being closer to the European market.

Tip:

- Keep up with the developments in the leading blueberry producing countries. Look at developments in countries with similar climates and try to understand the growers’ choices of blueberry varieties. Ask for advice from breeding companies about the benefits of specific varieties.

Morocco: the advanage of proximity

Morocco is an up-and-coming producer of blueberries. There is no reliable data on the current Moroccan production to allow for projections, but most of the Moroccan production goes to the European market. European import levels reached a value of nearly €300 million in 2021. This is almost double the value of only two years prior and there is nothing stopping the growth yet.

Morocco offers a good climate for blueberries and the harvest starts before Spain’s. With relatively low labour costs and close proximity to the European market, Moroccan producers can compete well with producers in Southern Europe.

The Moroccan government has made agricultural development a priority, encouraging private investment and exports. Several companies have recently invested in Moroccan blueberries: Australia’s Costa Group became a majority stakeholder in African Blue in 2017. Several Spanish companies have invested in cultivation in Morocco, such as the Spanish company Fresh Royal with its own blueberry plantations and Atlantic Blue, which was recently acquired by Hortifrut. To a certain extent, Morocco’s production relies on foreign investment, but it has a strong advantage in the early season and direct connection with the European and Spanish market.

South Africa: putting itself on the blueberry map

Unlike South American suppliers, South Africa mainly directs its blueberry export to Europe. The Netherlands and the United Kingdom are the main importing markets. The European import of South African blueberries passed the value of €100 million for the first time in 2021.

South Africa has become one of the main suppliers to Europe thanks to a rising production. The blueberry industry is the fastest-growing horticultural industry in South Africa. According to Farmers Weekly, South Africa’s 2021/22 blueberry crop was up 60% from that of the previous season. The total marketable output was over 31,500 tons, but export prices were down 14% from those of 2020.

Like other blueberry export countries, South Africa has had to deal with lower prices, higher market requirements and logistical issues. But large merged companies are better equipped to handle these challenges.

The blueberry sector is dominated by a few large companies. Deep integration of South African businesses with British companies secures a market in Europe for South African blueberries. This is the case for Driscolls’s partnership with Haygrove’s blueberry production in South Africa and BerryWorld’s joint venture with South African grower Trevor McKenzie. BerryWorld also operates in Zimbabwe. The recent opening of a large Fall Creek nursery and the partnership between blueberry breeder Planasa and TopFruit South Africa, will contribute to diversity and new genetics for growers.

Argentina: targeting niche markets

Argentina used to be one of the principal counter-seasonal blueberry suppliers to Europe. However, since 2016 their export has only decreased due to lack of competitiveness. Whereas Peru and Chile have become very competitive suppliers, Argentina has fallen out of favour. Despite its challenges, Argentina remains a top-five supplier of quality berries to Europe.

Europe recorded an import value of €26 million. Reasons for buyers to purchase Argentinian blueberries are quality and taste. According to Fall Creek, a main blueberry breeder, Argentina has some of the best places to grow Southern Highbush blueberry varieties. The soil and water conditions are near perfect and weather issues can be managed. Most blueberry production is protected by plastic greenhouse tunnels. But there are many challenges that have affected Argentina’s power to compete.

Argentina’s producers suffered from the low prices in their supply window, mainly due to the large supply from Peru and Chile. Argentina’s agricultural sector needs investment but economic instability in the country has not worked in its favour. There are fewer containers available due to the reduced trade flow. The long-distance logistics are expensive and unreliable. A large part of the supply to Europe is transported by air.

Future blueberry production in Argentina will likely target niche markets, focusing on quality and organic fruit. This will be an attempt to differentiate itself from the massive and productive supply from Peru. According to the Argentinean Blueberry Committee (ABC) organic production accounted for 35% of the total production in 2020.

The recent opening of the Chinese market for Argentinian blueberries and the re-opening of the Israeli market may offer better opportunities for Argentine producers. New markets in the Middle East are also being explored. But exporters will continue to feel the pressure from other competitive suppliers.

Tip:

- Lobby with blueberry producer organisations and authorities to open new markets for blueberries. Your national government can establish phytosanitary agreements and negotiate favourable import tariffs with other countries.

Serbia: a new blueberry generation

The Serbian blueberry is a newcomer on the European markets. Labour costs are lower than in Western Europe, but production is very closely located to the European market. Trade promotion and a strong focus on quality are other success factors.

The supply to Europe was less than €2 million in 2017, but has grown rapidly to almost €23 million in 2021. Serbia is conveniently positioned and starts its season when Spanish supply starts to slow down, but Northern Europe is not yet in full production.

Until today, the Netherlands has been the main target market for distribution. Dutch blueberry specialists such as abbGrowers, are cooperating with Serbian growers who understand the importance of blueberry quality. Other markets such as Germany, the United Kingdom and Poland have also increased their import from Serbia over the past three years.

Serbia has a new generation of blueberry producers who use technology to their advantage, improving calibration, sorting, packaging and storing of blueberries. One company, DzodanBerry, has even become Europe’s first “Digital Plantation”. The blueberry sector and its advancements are promoted through the new export platform named Serbia Does Fruit.

Tips:

- Use digital technology to stay ahead of the competition. Technology can help increase your yield and product quality so you can position yourself against competitors. Read our tips on going digital on the CBI market information platform.

- Find horticultural experts to get advice on the best production techniques for your region. These may include anything from new fertilisation practices or netting to protect the crop up to high-tech greenhouse technology.

Which companies are you competing with?

There are several successful blueberry suppliers in various parts of the world and what they all have in common is a direct link with cultivation, often of different varieties. They have the ability and financial means to scale up and find strategic alliances. Successful companies are able to reinvest their profits in new genetics and foreign acquisitions, a necessity to remain competitive.

Camposol: leading in volume and marketing

Camposol exported almost US$189 million worth of blueberries in 2021, which makes them the leading Peruvian exporter of blueberries.

Camposol’s production season does not last the whole year, but their huge volumes and strong marketing allow them to trade with many large supermarket chains worldwide. In Europe, large retailers prefer larger suppliers because of supply consistency and compliance with quality and social requirements. Within Camposol’s marketing strategy, they incorporated environmental and social commitments. The agro-industrial company has 2,670 hectares, of which 30% is organically certified. Their production is being expanded with cultivation in Mexico to meet a year-round demand.

Hortifrut: integrated from breeding to trade

Hortifrut is a global player in the blueberry sector headquartered in Chile. It is a highly integrated company, both vertically and in production. The company has genetic breeding and cultivation alliances throughout the world. In Europe, Hortifrut and Spanish company Atlantic Blue founded Euroberry together to commercialise blueberries throughout Europe. In 2021, Hortifrut acquired the Spanish company Atlantic Blue. The acquisition has not only given them access to new genetics such as the Rocio blueberry, but it also greatly increased their presence on the European market.

Hortifrut’s combination of breeding technology with year-round production offers them a strong competitive advantage. Having easy access to different varieties of blueberries and an integrated supply chain make it easier to negotiate bigger contracts with large buyers.

United Exports: using different origins

The international cultivation and breeding company United Exports is one of the largest producers in South Africa and has cultivation in key origins such as the United States, Peru, Chile, Australia, Mexico, Spain and Zambia. They prove the importance of combining different growing seasons. They have developed their own unique breeding programme with OzBlu blueberries. Europe is one of their main targets, servicing supermarkets such as Marks & Spencer, Waitrose, Lidl and Albert Heijn.

Tips:

- Try to find funding to upgrade your company or establish strategic alliances. Size and integration matter in the blueberry sector. If you lack financial resources, you can explore credit options with development banks and investment organisations, such as FMO and Oiko Credit.

- Focus on varieties and increase your knowledge of blueberry production. Knowledge will help you cultivate and export the best quality berry. Start with webinars and studies on the Blueberry consulting website.

- Read up on consolidation in the blueberry sector and why these developments are taking place.

Which products are you competing with?

The biggest advantage of blueberries over other berries and soft fruit, is that they have a longer shelf life and are relatively easier to transport. Because it is a less traditional fruit, consumers have become used to the year-round availability of blueberries. This means the supply period is much longer and stable than traditionally consumed soft fruit, such as strawberries, or stone fruit. Blueberry professionals are convinced that good quality throughout the year is responsible for the success of the blueberry category.

Because it is strongly promoted as a healthy product, blueberries have gained popularity over other soft fruit. However, price can be an issue. When prices for blueberries go up too much, it can be a reason for consumers to switch to other fruit as well as frozen blueberries. Frozen and processed blueberries are generally cheaper and just as easy to use. Fresh fruit is still the main product form of global blueberry production. In 2020, fresh blueberries accounted for 69% of the total output.

Tip:

- Try to be competitive in price and quality in relation to other soft fruit on the market, although it is not something you can always control.

4. What are the prices for blueberries on the European market?

Blueberries can be a very profitable crop. That is why many growers started to plant blueberries, which led to a decline in price after 2016. Supply seasons are short and product availability is a main influence on price developments during the year. Be aware that weather can dramatically influence prices in certain periods.

Until 2016, the demand was large enough for prices to rise, but after 2017 production volumes pushed prices back to the level of 2014. Prices in 2020/2021 remained low as forecast by professional sources. Price levels in the future will depend on developing production worldwide. Rising production costs and the continuous need to innovate may slow down exponential growth. If that happens, it will be easier to get good prices. Expensive inputs, labour and freight will eventually push up consumer price as well.

Price lists of importing companies calculate bulk wholesale prices of €6 to €7 euros on the low side, up to €11 to €15 euros in a good market for 12 x 125 g packages (1.5 kg). In reality, the actual prices may be lower when supply is very high. If you work with an importing company or trader, expect to pay them around 8% commission plus handling costs.

Retail prices are usually between €12 and €24 per kilo. Small packages with premium blueberries are the most expensive. Organic blueberries are sometimes sold for more than €24/kg. Supermarket margins and costs are the highest in the supply chain (see figure 6). Be aware that retail prices have no relation with trade prices. When availability is very high, supermarkets tend to have additional promotions to help sell the extra volumes.

Tip:

- Look at indicative wholesale prices on Freshplaza and France Agrimer (search for ‘myrtille’ in French), which will provide a rough indication of the market value of blueberries.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research