Entering the European market for fresh cassava

The export of fresh cassava is a specialisation that mainly Costa Rican suppliers have learned to master. Selecting the right variety and post-harvest process is a must if you want to compete in the European market, which is often served by specialised importers and ethnic wholesalers.

Contents of this page

1. What requirements must cassava comply with to be allowed on the European market?

Fresh cassava must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My Trade Assistant for an overview of export requirements for cassava (code 07141000).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental damage, the European Union (EU) has set maximum residue levels (MRLs) for pesticides in and on food products. Fresh cassava containing more pesticides than allowed will be withdrawn from the market. The same goes if it contains contaminants such as heavy metals.

Note that retailers in several EU Member States such as Germany, the Netherlands and Austria, as well as the United Kingdom, use MRLs that are stricter than the MRLs laid down in European legislation.

Avoid GMO cassava for export

There have been initiatives in Africa to genetically modify cassava (GMO) to improve pest resistance. Although this could solve local issues with food security, in the European market GMO food crops need to be authorized before putting them on the market. When you plan on exporting cassava to Europe, it is important to select high quality non-GMO cassava varieties.

Tips:

- Find out the MRLs that are relevant for cassava by consulting the EU MRL database in which all harmonised MRLs can be found. You can search on your product (“cassava roots/manioc”) or pesticide used. The database shows the list of the MRLs associated to your product or pesticide.

- Read about pests and diseases on the FAO website and reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers whether they require additional requirements on MRLs and pesticide use.

- Make sure that the levels of lead contamination in your cassava remain below 0.10 mg/kg and cadmium below 0,10 mg/kg, in accordance with the maximum levels for certain contaminants in foodstuffs.

Follow phytosanitary regulations

As from December 2019, new European regulation came into force for the trade in plants and plant products from non-EU countries. This regulation requires cassava to have a phytosanitary certificate before being brought into the European Union, guaranteeing that it is:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Implementing Regulation (EU) 2019/2072

For roots and tubers such as cassava, an official statement is required that the consignment or lot does not contain more than 1% by net weight of soil and growing medium.

Tip:

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate on time.

Maintain high quality standards

For cassava the general marketing standards of the European Union as defined by EU regulation 543/2011 (see table 1) also apply. For more specific standards you can also use the Codex Alimentarius (‘Food code’ of the Food and Agriculture Organisation) that contains marketing standards for Sweet Cassava and Bitter Cassava.

The European demand consists almost exclusively of the sweet cassava varieties and Class I as a minimum. Cassava in this class must be of good quality and within the permissible tolerances. The defects must not affect the pulp.

The cut at the distal (narrow) end of the cassava should not exceed 2 cm in diameter. The stalk end of the root should have a clean cut between 1cm and 2.5cm in length.

The development and condition must be such as to enable them to withstand transportation and handling and to arrive in satisfactory condition at the place of destination.

Table 1: General quality requirements

| General quality requirements (all classes) |

|

|

|

|

|

|

|

Table 2: Permissible tolerances for class I cassava

| permissible tolerances for class I cassava |

|

|

|

|

Tip:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to file claims on quality issues.

Check on product size uniformity

Size is determined by the diameter at the thickest cross-section. For all classes, up to 10% by number or weight of cassava is allowed to correspond to the size immediately above and/or below the size indicated on the package.

Table 3: Size codes for fresh cassava roots

| Size code | Diameter in centimetres | |

| Sweet cassava | Bitter cassava | |

| A | 3.5-6.0 | 3.5-7.5 |

| B | 6.1-8.0 | 7.6-10.0 |

| C | >8.0 | >10.0 |

Perfect your post-harvest and product handling

Cassava is highly perishable after harvest, especially when kept too warm. Like other root and tuber crops cassava continues to respire after harvest and as a result has a limited shelf life. This limited shelf life is a major challenge in commercial production.

Cooled storage, proper packaging and cooled transportation are crucial to maintain product quality and avoid product deterioration. Fresh cassava can best be stored at 3 degrees Celsius. Lower temperatures may cause chilling injury and internal browning, making them unfit for consumption.

Advanced methods to preserve fresh cassava include waxing with paraffin wax – in Europe food grade wax is also known as microcrystalline wax (E905). This process will allow cassava to travel longer distances and make them better suitable for export.

Tip:

- Use the CGIAR Manual: Fresh cassava roots handling for waxing and relative humidity storage to learn about shelf-life extension techniques and make your crop suitable for export to Europe.

Use quality and protective packaging

Make sure to use quality packaging for cassava. Cardboard boxes with cassava destined to Europe usually carry about 18kg, but this may vary depending on your buyer’s requirements.

When your product is sold with consumer presentation, you must add the preparation instructions on the labelling:

- Cassava must not be eaten raw (bitter cassava);

- Cassava should be peeled, depithed, cut into pieces, rinsed and fully cooked before consumption (bitter/sweet cassava);

- Cooking or rinsing water must not be consumed or used for other food preparation purposes (bitter cassava).

Tip:

- Always discuss the specific requirements for size and packaging with you buyer.

What additional requirements do buyers often have?

Obtain commonly used certifications

Common certifications for fresh vegetables are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. Management systems recognised by the Global Food Safety Initiative (GFSI) are also recommended.

In the coming years the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe in becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal aiming to make food systems fair, healthy and environmentally-friendly. It will ensure a sustainable food production and address for example packaging and food waste. EU trade agreements with cassava-supplying countries such as Costa Rica (Central America) already include rules on trade and sustainable development. For suppliers of fresh fruit and vegetables, it is important to look ahead of the increasing standards and try to be in the frontline of the developments.

Although ethnic channels may be able to market uncertified cassava, it is strongly recommended to have at least a GlobalG.A.P. certification if you want to successfully enter the European market. Costa Rica is the leader in fresh cassava export to Europe and likely the only country with GlobalG.A.P. certified producers – currently around 10 certified producers.

Apply additional sustainability and social standards

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) or Grasp (a GlobalG.A.P. add-on) is highly recommended to get your product up to retail standards.

Retailers can also impose their individual standards, such as Tesco Nurture and Marks & Spencer Field to Fork. Especially larger retail chains in northern Europe are more prepared to buy your product if your compliance to social and sustainability standards is in order.

Tips:

- Implement at least one environmental and one social standard. See the Basket of standards of SIFAV Sustainability Initiative for Fruit and Vegetables.

- For other additional requirements such as payment and delivery terms, see CBI Buyer Requirements for fresh fruit and vegetables and the Tips for doing business with European buyers.

What are the requirements for niche markets?

Keep monitoring the potential for social and sustainable labels

Niche markets may sometimes require more specific social or sustainability labels. For a niche product such as cassava these are not usually required, but you can use them to differentiate your product.

Organic certification and label may be a utopia, considering the fast deterioration of fresh cassava and the use of wax. Therefore there is practically no fresh organic cassava on the European market. If you do manage to export organic cassava while maintaining product quality, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Note that starting January 2021 a new legislation, Regulation (EU) 2018/848, will come into force.

Cassava is a typical smallholder crop and therefore suitable for social labels. Adding a social label such as Fair Trade or Rainforest Alliance could trigger social-conscious consumers. At the moment these labels are rare for fresh cassava but it can be worthwhile to monitor their market development in the future. Until then, it is best to adopt common social standards such as Grasp or SMETA (as described above).

Tip:

- Explore social and sustainable labels only once you manage a quality export product that is low on pesticide residues. Without quality and food safety, additional labels will have no added value.

2. Through what channels can you get fresh cassava on the European market?

Cassava still depends largely on ethnic or traditional consumers. To reach this target public, wholesalers have a bigger role than usual. As an exporter you can best focus on importers or importing wholesalers that specialise in exotics and vegetables for the ethnic market.

How is the end-market segmented?

For fresh cassava there are only two main segments; the conventional vegetable segment and the ‘ethnic’ market segment.

Conventional consumption

Like all fresh vegetables, cassava can be marketed by conventional retailers (or food service). With an expanding interest in exotic vegetables, several retailers in the conventional fresh market have started to include cassava in their assortment. Supermarkets such as Tesco (UK), Grand Frais (France) and Albert Heijn (Netherlands) offer fresh cassava as one of their niche root vegetables. This development is partly influenced by the introduction of new foods by traditional or ethnic consumers.

Ethnic consumption

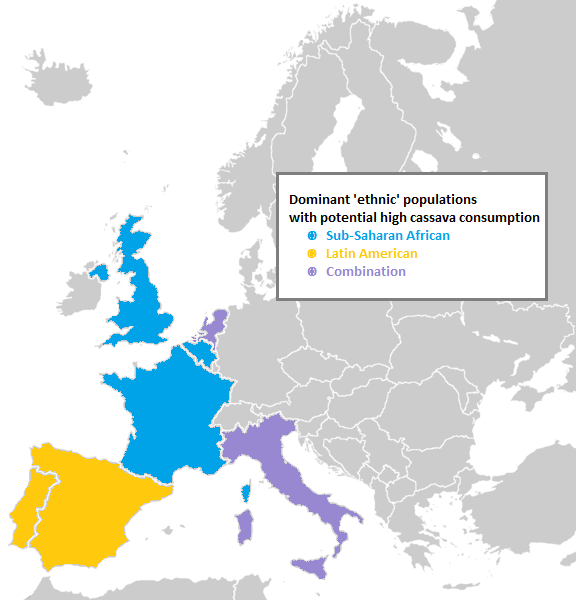

Traditional or ethnic consumers can be found all over Europe. The most significant consumers of fresh cassava are probably of Latin American or Sub-Saharan descendance. There is a population of approximately 4 million Latin Americans in Europe and over 4 million from the Sub-Saharan African region. Each country in Europe has a different composition of ethnic consumers (see figure 1). These consumers are served by street markets and a large number of small stores that specialise in non-European food.

Emerging foreign cuisines in Europe also contribute to the consumption of fresh cassava and form an ideal link between traditional and ‘new’ consumers. According to Mintel analysts the West-African cuisine could be the next big food trend. The unexplored cuisine of West Africa offers numerous opportunities for innovation. Cassava is mentioned as one of the key ingredients that could be highlighted in product innovation.

Figure 1: Mapping ethnic cassava consumption in the main European markets

Source: ICI Business

Tips:

- Always strive for the best quality for export, but also adjust your focus to the specific segment you are supplying. For example, taste, freshness and size can be most important for ethnic consumers. Conventional supermarkets first of all require a clean and certified product.

- Read the study entitled Market opportunities and entry strategies for cassava and cassava related products in the United Kingdom as an example in the ITC report and learn what it means to enter the market of oriental vegetables on the CBI market information platform.

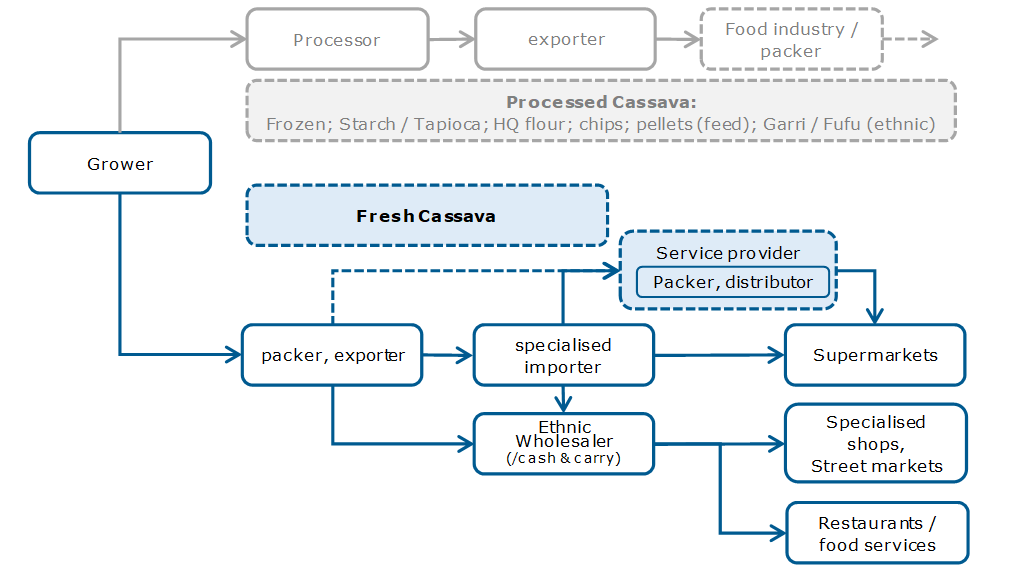

Through what channels does a product end up on the end-market?

The fresh cassava trade is a specialised market. Experienced importers of exotic and ethnic vegetables fulfil the European demand. Typical companies in this channel vary from wholesalers that maintain their own import relations and provide access to a large ethnic market, to larger exotic importers that also coordinate or re-pack for regular supermarkets.

Figure 2: European market channels for fresh cassava

Source: ICI Business

Specialised importers form the main channel for cassava

Your main points of entry into Europe are importers that specialise in exotic or ethnic vegetables. They have an important responsibility in fulfilling the ethnic demand as well as introducing cassava and other exotic root vegetables to the European market.

Some of these importers are medium to large companies that add cassava to their larger assortment of tropical and exotic fruit and vegetables. Their wide assortments, often in combination with packing services and brands, are most likely to attract supermarket buyers and other conventional clients. Among these companies you will find, for example, Bel Impex, BUD Holland and Nature’s Pride in the Netherlands, Neta in France and Cultivar and CMR Group in Spain. Other importers have a stronger link with the ethnic market and mainly supply smaller wholesalers, street merchants and independent ethnic shops, such as Sunnyfield in the UK and Fresh Tropical in Italy.

Service providers provide access to supermarkets

In general, supermarkets want to buy as close to the source as possible, but they also want to be unburdened. The companies that have a direct relation with large supermarket chains, often present themselves as service providers. They organise the supply chain according to the needs of their clients, from sourcing to (re-)packing and branding. These service providers either source directly from the origin or select specialised importers to find niche products such as cassava. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider requires.

Wholesalers (spot market)

The wholesale channels are crucial for the distribution of cassava. Wholesalers often supply smaller quantities of fresh cassava to hospitality and food services, specialised fruit retailers and street markets. Ethnic wholesalers often have their own import and international contacts. Other wholesalers depend on a network of experienced importers. Typical wholesale markets are for example Rungis in Paris, New Spitalfields Market in London and Marcabarna in Barcelona,

Tip:

- Combine your cassava export with other vegetables. There is a relatively large number of small buyers in the cassava market. By combining different products you can easier fill a container and save costs. Alternatively you could also use airfreight and supply high-demanding clients that focus on ultimate freshness.

What is the most interesting channel for you?

Although cassava is a niche product in the fresh market, there is a wide choice of companies you can approach. When starting up your export of cassava it is best to start with smaller, specialised importers and importing wholesalers. This way you can build a track record before reaching out to larger clients.

Ethnic buyers and foreign-owned wholesalers may have the advantage of a cultural link with your country and perhaps even operate in your language. Larger exotic importers may provide better access to larger retail channels, but will also be more demanding with formalities and certifications. See some of the importers listed above.

Tip:

- Visit trade fairs to find buyers. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and Fruit Attraction in Madrid. You can also find potential clients at the previously mentioned wholesale markets and their member lists.

3. What competition do you face on the European cassava market?

Competitors in the fresh cassava trade understand what it takes to keep products fresh and suitable for export. Costa Rican exporters dominate the trade with the right export varieties and control over the post-harvest process, using wax to preserve shelf life. Other competitors are mostly exporters of other cassava products that are either frozen or dried.

Which countries are you competing with?

Costa Rica is the biggest competitor in the export of fresh cassava to Europe. Cassava production is many times larger in Central Africa and Southeast Asia, but it is much more focused on ethnic cassava preparations (Africa) and frozen cassava or processed cassava for industrial applications (Asia).

Latin America

Cassava production in Latin America is not as extensive as in Asia or Africa. But with much experience in the export of fresh fruit and vegetables, the potential level of competition from Latin American countries could be significant.

Table 4: Cassava production of potential exporters in Latin America in 2019, in 1,000 tonnes

| Brazil | 17,497 |

| Peru | 1,286 |

| Colombia | 1,027 |

| Nicaragua | 221 |

| Dominican Republic | 175 |

| Costa Rica (market leader in fresh export) | 160 |

| Ecuador | 70 |

Source: Faostat

Costa Rica

Costa Rica dominates the fresh cassava supply to Europe. Costa Rican suppliers have built a solid reputation exporting quality, fibreless cassava roots. They can supply fresh cassava year-round.

Exporters have managed to make their cassava roots suitable for export through an excellent post-harvest process and by using paraffin wax to preserve shelf life. Their supply is reliable year-round and competitive. With a yield of 16 tonnes per hectare – compared to 6 to 12 tonnes in Ecuador, Colombia and Peru – Costa Rican cassava farms are among the top producers.

In the last ten years, Costa Rica has doubled its cassava export value to Europe. In 2020, the value reached 31 million euros. Costa Rica will continue to use its superior position and experience in the export of fresh cassava.

Figure 4: Fresh cassava from Costa Rica for sale in Kerava, Finland

Source: Anneli Salo, CC BY-SA 3.0, via Wikimedia Commons

Ecuador

Ecuador is not among the largest suppliers according to trade statistics, but the value of its exports to Europe is growing. In 2020 Europe imported €579,000 of cassava, 3.5 times the value of five years earlier. With this value, Ecuador is the second-largest Latin American supplier to Europe after Costa Rica. However, trade data does not provide a clear picture how much of this value is fresh cassava, or dried or frozen cassava products.

Ecuador already has a reputation in exporting tropical fruit (bananas) and some exotics. Cassava could be another product added to these existing exports. Still, it is unlikely that Ecuador will become the next market leader in cassava export. In terms of production Ecuador does not have the same volumes as Brazil, Colombia and Peru, let alone Costa Rica, the current market leader in fresh cassava export.

Africa

Africa has the highest production volume in the world, but also the lowest yields. Cassava is a staple crop in Africa, important for food security. Therefore there is less focus on international trade. Most of the cassava export concerns typical cassava preparations such as cassava dough or cassava bread.

According to the FAO, West-African countries have potential in supplying Europe due to lower shipping costs and different cassava varieties. But the African cassava is less suitable for fresh export and exporters are still far behind the efficient and effective marketing methods of Costa Rican suppliers.

Cameroon

Cassava is one of the main foods in Cameroon. The country also became the second-largest supplier to Europe (in terms of value), after a sudden growth in 2020. While Europe imported €1.7 million worth of cassava in 2019, the import in 2020 reached a value of almost €4.1 million. This value is still far away from the €30+ million from Costa Rica, but there is also a difference in the type of cassava products. The trade statistics are not clear about the type of cassava that is shipped to Europe with the export HS code 071410.

The export of fresh cassava roots from Cameroon is likely to be minimal. Cameroon competes with cassava preparations that are typical for the regions. Exporters supply an ethnic demand of ‘bobolo’ (cassava bread or sticks also known or sold as ‘batton de manioc’, ‘chikwangue’, ‘kwanga’ or ‘miondo’) and ‘water fufu’ (a cassava dough or porridge, known in Cameroon as ‘couscous'). Frozen cassava may also be among the exported products. The market channels for these products are often not the same as those for fresh cassava roots, although there can be some overlap in the ethnic wholesale channel.

If Cameroon succeeds in developing efficient supply chains to export fresh cassava by selecting the right varieties and upgrading the post-harvest and logistical processes, the country could potentially become a competitor for Costa Rica. Cameroon is closer to Europe than Costa Rica and could cater to the African community in Europe. The same goes for other cassava producing and exporting countries in Africa such as Nigeria, Ivory Coast, Togo or the Democratic Republic of the Congo.

Ghana

According to statistics Ghana is the second-largest African supplier of cassava to Europe. In 2020 European countries purchased €244,000 of cassava from Ghana. This trade value probably consists of both fresh cassava and typical African cassava products such as water fufu and gari (grated cassava).

Ghana is already the main supplier of yams to the European market. This experience can help Ghanese exporters in finding a market for fresh cassava as well. However, there is a great difference in shelf life between yams and cassava. This means that yam exporters will have to adapt their supply chain and optimise their post-harvest to the same efficiency and quality-level as their Costa Rican counterparts.

Asia

Asia has a well-developed cassava industry and the export is highly focused on processed cassava such as cassava starch, cassava chips or frozen cassava.

Thailand

Thailand used to be a major supplier of cassava pellets for the feed industry in Europe. But this market has almost entirely disappeared. Today, Thai exports mainly consist of cassava chips and starch. The processing industry is well-developed and the export of fresh cassava roots is minimal.

Thailand’s main destination market is China, Europe is less important. The two million euro value of cassava (excluding starch) imported by mainly the Netherlands and Spain, consists of grated cassava and cassava chips, and possibly some frozen cassava. A similar supply of dried (or frozen) cassava products comes from China, India and Vietnam.

Fresh cassava is not yet a specialisation of Southeast-Asian suppliers. It remains unclear to what extent they can actually become a competitor in fresh cassava. Thailand and Vietnam are suppliers of several fresh herbs and exotic fruit and vegetables, often air-freighted. As such, they can potentially compete when it comes to the freshness of their cassava, but maybe not in price due to higher logistical costs.

India

Most of India’s cassava export to Europe consists of chips, not fresh roots. But there is extensive research and development in the cassava sector, for example by ICAR – Central Tuber Crops Research Institute, which has developed several cassava varieties. This results in high yields, making India competitive in the cassava sector. Although the Indian sector is mainly focused on processing cassava, there is a strong basis to compete in the fresh trade. However, until now India has not managed build the same experience and reputation in exporting fresh cassava to Europe as Costa Rica.

Tips:

- Adopt a cassava variety with a competitive yield that is suitable for export. This will be a first step to competing with Costa Rica, the current leading exporter of fresh cassava to Europe.

- Focus on short-term opportunities first. You can gain a reputation as an exporter of processed cassava, while working on realising your supply of fresh cassava. Review the assortment on Afro Cameroon to see what kind of traditional cassava products are offered from Africa.

Which companies are you competing with?

Most competitors are Costa Rican exporters such as Tropifoods and Riberas Sol. These companies understand the post-harvest process that is needed for exporting fresh cassava. But they also combine cassava export with other crops to have a competitive supply.

Tropifoods

Tropifoods is one of the Costa Rican cassava suppliers competing on the European market. Countries such as Spain, Portugal, the Netherlands and Italy are among their main export destinations. With a GlobalG.A.P. and Grasp certification, the company is prepared to deal with the most demanding clients such as supermarket chains.

Tropifoods is also one of the partners in the CLAYUCA consortium, a cooperation dedicated to cassava research, based in Cali, Colombia. This provides them with first-hand knowledge and technical information to continue improving the cassava production process.

Riberas Sol

The Costa Rican company Riberas Sol is a major exporter of fresh cassava. The company has a lot of experience with the cleaning process and paraffin waxing. They can also ship smaller volumes in combination with other crops such as pineapple, eddoes, malanga, chayote and sweet potato.

Understanding the post-harvest process and logistics is crucial to export fresh cassava. The combination with other crops can be a competitive advantage.

Tip:

- Follow the example set by Costa Rican companies. Find technical partners and invest in similar post-harvest techniques.

Which products are you competing with?

For traditional consumers, cassava is a common root vegetable that is not easily replaced by another crop. Consumers with specific Latin American or African backgrounds will look specifically for cassava to use in their traditional cooking. For other consumers, cassava is an addition to their diet and competes with other starchy foods. Potatoes are the best known starchy vegetable in Europe and are produced on a large scale. Sweet potatoes are on the rise as well, both in import and cultivation. Cassava is a good third, before other niche roots and tubers such as yams and eddoes (taro). However, it is unlikely that cassava will reach similar volumes as sweet potatoes as it is still a niche product and much more perishable and difficult to trade.

Tip:

- See if you can combine several exotic root vegetables and think about a promotional strategy to put these roots on the map. A strong sector organisation would help in the promotion of such products.

4. What are the prices for fresh cassava?

High logistical costs drive up the price for cassava in Europe. For this reason it will be difficult for cassava to compete with other starchy vegetables such as potatoes.

Cassava prices have been relatively stable over the past years. According to trade data, the prices in 2019 were slightly higher. Fluctuations in availability are the main reason prices change. In general, fresh cassava is exported for 12 to 13 euros per 18kg box, which comes down to an average of €0.70 per kilo. Expect your importer to take a profit margin of at least 8% over their selling price, excluding handling costs.

At Rungis wholesale market cassava is sold for around €1.40 a kilo. But wholesale prices depend much on the sold volume. In many cases cassava is imported and wholesaled by the same company.

Retail prices are around €3 per kilo. Street markets and local ethnic shops may be more price competitive and sell for less. However, the selling prices in the ethnic channel are not lower by default. Ethnic buyers are usually more knowledgeable about the product and are prepared to pay a good price for quality and freshness. For conventional supermarkets cassava is more of an exotic vegetable, which requires a higher margin than ‘bulk’ vegetables.

Tip:

- Find a price history in France on the Market News Network of FranceAgriMer. Search for “manioc”.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research