Entering the European market for fresh chilli peppers

The European market for fresh chilli peppers is a specialised market, which is supplied primarily by producers in southern Europe, Morocco and Turkey. Because of the strong regional competition, you will find most opportunities in the off-season and specific chilli pepper varieties. However, you can only become successful if you fully comply with very strict phytosanitary and food safety requirements.

Contents of this page

1. What requirements must chilli peppers comply with to be allowed on the European market?

Fresh chilli peppers must comply with the general requirements for fresh fruit and vegetables. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also use My Trade Assistant, which provides an overview of export requirements (use code 07096099).

What are mandatory requirements?

Avoid pesticide residues and contaminants

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. To avoid health and environmental damage, the European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Fresh chillies containing more pesticides than allowed will be withdrawn from the market. The same goes for contaminants such as heavy metals.

Chilli peppers and many of their origins are considered high risk for pesticide residues. For several countries, there is an increased frequency for pesticide checks. European Regulation 2019/1793 states that 50% of the imported chilli peppers from the Dominican Republic and Vietnam must be checked for pesticide residues, 20% from India, Pakistan and Uganda and 10% from Thailand. These checks are costly and can drive up the final price of chilli peppers.

Note that retailers in several Member States such as the United Kingdom, Germany, the Netherlands and Austria, use MRLs that are stricter than the MRLs laid down in European legislation.

Tips:

- Find out the MRLs that are relevant for chilli peppers by consulting the EU MRL database, in which all harmonised MRLs can be found. You can search on your product or pesticide used. The database shows the list of the MRLs associated with your product or pesticide. For chilli peppers, the same MRLs apply as for ‘Sweet peppers/bell peppers’ (code 0231020).

- Reduce the amount of pesticides by applying Integrated Pest Management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

- Read more about MRLs on the website of the European Commission. Check with your buyers if they have additional requirements for MRLs and pesticide use.

- Make sure that contamination of lead in chilli peppers remains below 0.10 mg/kg and cadmium below 0,050 mg/kg, according to the maximum levels for certain contaminants in foodstuffs.

Follow phytosanitary regulations

As from December 2019, the new European regulation went into force for the trade in plants and plant products from non-EU countries. This regulation requires chilli peppers to have a phytosanitary certificate before being brought into the European Union, guaranteeing that they are:

- properly inspected;

- free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- in line with the plant health requirements of the EU, laid down in Implementing Regulation (EU) 2019/2072

There are additional requirements for different regions. The phytosanitary certificate must include an official declaration that the chilli peppers originate in a country or region that is free from the pests mentioned below, or effectively inspected and treated to ensure its absence.

Table 1: Pests from certain origins that require an additional declaration

| Origen | Pests that require an additional declaration |

| Countries of the African continent, Cape Verde, Saint Helena, Madagascar, La Reunion, Mauritius and Israel | Thaumatotibia leucotreta (Meyrick)

|

| Australia, the Americas and New Zealand | Bactericera cockerelli (Sulc.) |

| Third countries | Neoleucinodes elegantalis (Guenée) |

| Belize, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Jamaica, Mexico, Nicaragua, Panama, Puerto Rico, United States and French Polynesia where Anthonomus eugenii Cano is known to occur | Anthonomus eugenii Cano |

To avoid exclusion in the trade with the European Union, several countries have taken measures at different moments in time. For example, in 2019, the Ugandan Ministry of Agriculture imposed a restriction on the export of chilli peppers, allowing only a few traders to export that meet a tight set of requirements. Only months later, over 90 percent of the Kenyan suppliers stopped their export to Europe due to the strict phytosanitary restrictions and the presence of the Codling Moth.

Tips:

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate on time.

- Read which additional declaration is needed on the phytosanitary certificate for chilli peppers (capsicum) in the document of the Dutch food safety authority NVWA.

Maintain high quality standards

For marketing fresh chilli peppers in Europe, the General Marketing Standards of Regulation (EC) No. 543/2011 apply. A more specific marketing standard for fresh chilli peppers is described in:

- Codex Alimentarius standard for chilli peppers (‘food code’ of WHO and FAO).

- UNECE Marketing Standard on Chilli Peppers.

These marketing standards describe the minimum requirements for chilli peppers (see table 1) and provide information on the quality requirements for each class. Chilli peppers can be divided into three classes according to quality: Extra Class, Class I and Class II. Europe almost exclusively requires class I chilli peppers as a minimum. Products in this class must be of good quality and within the permissible tolerances.

In the Annex “Pungency” to the same UNECE Marketing Standard on Chilli Peppers, categories of ‘mild’, ‘medium’, ‘hot’ and ‘extra hot’ chilli pepper varieties are distinguished, depending upon the total amount of capsaicinoids per microgram of dry weight.

The development and condition of the chilli peppers must be such as to enable them to withstand transportation and handling and to arrive in satisfactory condition at the place of destination.

Table 2: General quality requirements and permissible tolerances for chilli peppers

| Minimum quality requirements (all classes) |

|

|

|

|

|

|

|

|

|

|

Table 3: Quality requirements and permissible tolerances for Class I chilli peppers

| permissible tolerances for class I chilli peppers |

|

|

|

|

|

|

Tip:

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to claim on quality issues.

Check on product size uniformity

The size of chilli peppers is determined by either length or diameter (see table 4). Chilli peppers in a package must be uniform and packages should contain only chilli peppers of the same origin, variety or commercial type, quality and size (if sized). Nevertheless, a mixture of chilli peppers of distinctly different colours and/or commercial types may be packed together in a sales package, provided they are uniform in quality and of the same origin.

For chilli peppers sized by diameter, the difference between the diameters in the same package may not exceed 2 cm.

Table 4: Provisions on product size

| Size code | Length in centimeters |

| 1 | <4 |

| 2 | 4<8 |

| 3 | 8<12 |

| 4 | 12<16 |

| 5 | >16 |

Use protective packaging

Chilli peppers should be packed in a way that ensures proper protection for the product. Boxes must be new and of good quality. The visible part of the contents of the package must be representative of the entire contents.

Packages must be free of all foreign matter. The materials used inside the package must be clean and of such a quality that it prevents any external or internal damage to the produce.

Common package sizes are 2, 4 or 5kg. Small chilli peppers are often packed in 2 or 4kg cardboard boxes. In retail, the chilli peppers are often sold loose, but in some cases retailers require additional packaging in trays or punnets. Retail packaging is often used for exclusive varieties or chilli pepper mixes.

Figure 1: Example of chilli peppers presented in a Dutch supermarket

Photo by ICI Business

Maintain temperature during product handling

After the harvest, it is important to cool the peppers down as soon as possible so as to reduce water losses. The ideal temperatures during transport should be around 7-8 degrees Celsius.

Tips:

- Always discuss the specific requirements for size and packaging with your buyer.

- Study the proper post-harvest practices and handling for fresh chilli peppers on Frutas-hortilizas.com and cargohandbook.com, or the vegetable produce facts of the post-harvest centre of the University of California.

- Make sure your chilli peppers are well preserved to ensure optimal freshness and taste. Supply chain logistics should not affect the product taste in any significant way.

- For other additional requirements such as labelling, see CBI Buyer Requirements for fresh fruit and vegetables.

What additional requirements do buyers often have?

Obtain commonly used certifications

Common certifications for fresh chilli peppers are GlobalG.A.P. for good agricultural practices and BRCGS, IFS or similar HACCP-based food safety management systems for packing and processing facilities. It is recommended to use management systems recognised by the Global Food Safety Initiative (GFSI).

Apply additional sustainability and social standards

Complying with sustainable and social standards has become common for all fresh fruit and vegetables. Besides GlobalG.A.P. to ensure good agricultural practices, a social certificate such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards.

In the coming years, the European Green Deal will influence how resources are used and greenhouse gas emissions are reduced. The new EU policies on sustainability will prepare Europe in becoming the first climate-neutral continent by 2050.

The Farm to Fork Strategy is at the heart of the European Green Deal aiming to make food systems fair, healthy and environmentally friendly. It will ensure sustainable food production and address, for example, packaging and food waste. EU trade agreements with Mexico, Peru and Vietnam, all chilli pepper producers, already include rules on trade and sustainable development, and other countries are expected to follow. For suppliers of fresh fruit and vegetables, it is important to get ahead of the increasing standards and try to be in the frontline of the developments.

Particularly larger retail chains in northern Europe (including Asian supermarkets) are more prepared to buy your product if your compliance with social and sustainability standards is in order. When your products are mainly marketed in smaller ethnic channels, taste and quality may be more important than having a social standard. Despite these different requirements, expect social compliance to become more important.

Tips:

- Implement at least one environmental and one social standard. See the Basket of standards of SIFAV Sustainability Initiative for Fruit and Vegetables.

- For other additional requirements such as payment and delivery terms, see CBI Buyer Requirements for fresh fruit and vegetables and the Tips for doing business with European buyers.

What are the requirements for niche markets?

Use organic certification to increase product value

Organic certification can be an interesting way to set your chilli peppers apart and market them at a higher value. The demand for organic vegetables is growing, although it is mainly fulfilled by European growers. For suppliers in tropical countries it is very challenging to produce organically due to a variety of pests common for chilli peppers.

In order to market organic products in Europe, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Note that, starting January 2021, the new legislation Regulation (EU) 2018/848 has come into force. You must use sustainable and organic production methods and apply for an organic certificate with an accredited certifier.

Tips:

- Strive for residue-free chilli peppers, and certify your production as organic if possible. It will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive and difficult in certain environments. You must be prepared to comply with the whole organic process.

- Download the actual list of control bodies and authorities to see which certifiers are active in your region.

2. Through what channels can you get chilli peppers on the European market?

Europe has a regular channel for common chilli peppers and a wide variety of exotic chillies that are marketed by a large group of specialised importers and wholesalers. The requirement and characteristics of these chillies are as diverse as the companies that trade them.

How is the end-market segmented?

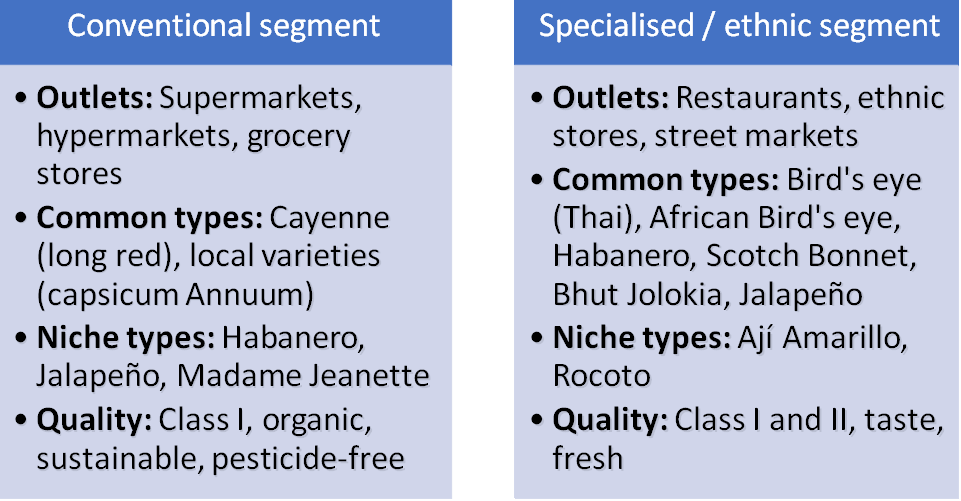

The European chilli pepper market is diverse with different consumer groups, but it can roughly be divided in conventional segments and specialised or ethnic segments.

The conventional channel, mainly consisting of supermarkets, mainly focuses on the consumption of red cayenne chilli peppers of the Capsicum Annuum species. In some countries local varieties are added such as the Hungarian wax pepper in Eastern Europe, the Pepperoncino in southern Italy, the Piment d'Espelette in French Basque region, and the Padron and Ñora in Spain. Other varieties such as the Habanero, Jalapeño or Madame Jeanette are niche varieties for retailers that want to offer a wider assortment. The priority for supermarkets is product appearance, low pesticide residues and sustainable standards.

The specialised or ethnic segment is most diverse. Restaurants, Asian supermarkets, specialised web-shops, ethnic shops or street merchants caters to a wider public of consumers with different backgrounds and food preferences. Exotic chilli peppers are more common in this segment, but over time move to conventional retail when other consumers become familiar with them as well. The quality requirement in the ethnic segment mainly focuses on taste and freshness, while product certifications and physical appearance are less important. Origin may also play a role when it affects the flavour of a specific chilli pepper.

Figure 2: Segments and characteristics for fresh chilli peppers

Tips:

- Try to maintain flexibility in your product offer in terms of quality and compliance with different requirements. A large part of the chilli peppers finds their way into the ethnic channels, but you need to keep the option open to sell in more conventional markets where demand for niche products is increasing as well.

- Find out how the ethnic market functions and what it means to enter the European market for oriental vegetables on the CBI market information platform.

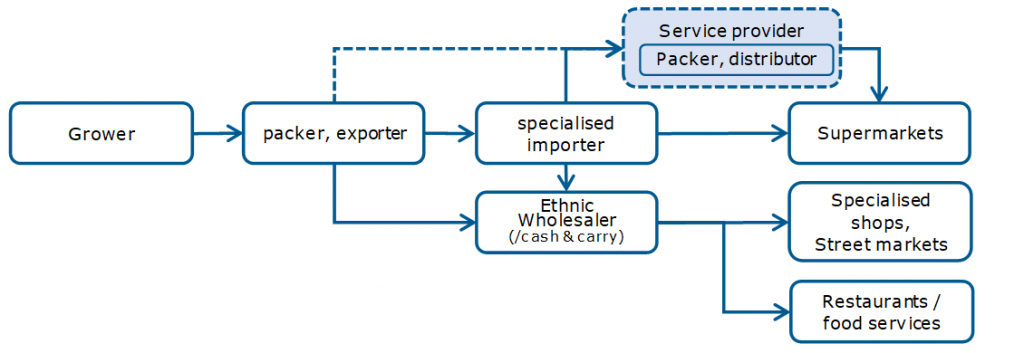

Through what channels does a product end up on the end-market?

A large part of the chilli pepper demand is fulfilled by grower groups and service providers. For the more exotic varieties, the market depends on specialised importers and importing wholesalers.

Figure 3: European market channels for fresh chilli peppers

Source: ICI Business

Specialised importers form the main channel for chilli peppers

The main entrance to Europe is importers that specialise in exotic or ethnic vegetables. They have an important responsibility in fulfilling the demand for different types of chilli peppers, from common off-season chillies to the most exotic chilli peppers.

Importers manage supply chains from different origins and perform quality control. They are familiar with all the requirements of end clients and distribute to different European markets.

There is a wide variety of chilli pepper importers, in size, segment and product assortment. There are exotic specialists with chilli peppers such as BUD Holland and Roveg in the Netherlands, CMR Group in Spain, and Neta in France. Other importers have a stronger ethnic focus such as Tropifruit in the UK or Belimpex in the Netherlands.

Grower cooperation and grower groups are important for common chilli pepper varieties

An important channel for common chilli peppers (Capsicum Annuum) are grower groups and cooperatives, such as Hortamar in Spain, that produce and supply a great part of the EU demand. These cooperatives often have a commercial extension that is responsible for the marketing and sales. Sometimes part of the production is outsourced to nearby countries such as Morocco to ensure a year-round supply.

There are also growers and cooperatives that produce exotic varieties. Among these are, for example, the Unica Group in Spain, and Westland Peppers in the Netherlands (also with production in Spain, Morocco and Israel).

Tip:

- Activate the “Translation” function of your browser to make foreign websites available in your own language or change them to an English version.

Service providers provide access to supermarkets

In general, supermarkets want to buy as close to the source as possible, but they also want to be unburdened. The companies that have a direct relation with large supermarket chains, often present themselves as service providers. They organise the supply chain according to the needs of their clients, from sourcing to (re-)packing and branding. These service providers either source directly from the origin, or select specialised importers to find specific chilli pepper varieties. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider requires.

Wholesalers (spot market)

The wholesale channels are crucial for the distribution of different chilli pepper varieties. Wholesalers often supply smaller quantities of exotic chillies to hospitality and food services, specialised fruit retailers and street markets. Ethnic wholesalers can have their own import and international contacts, such as Punjab Exotic Foods and Sunnyfield Veg. Other wholesalers depend on a network of experienced importers. Typical wholesale markets include Rungis in Paris, New Spitalfields Market in London and Marcabarna in Barcelona.

Tips:

- Offer several chilli pepper varieties to get interest from larger buyers. Importers in Europe usually import several types of chilli peppers. For buyers, combining shipments can be cost-effective and reduces the number of suppliers to deal with.

- Browse on the websites of wholesale markets to find wholesalers that import chilli peppers. When you decide to visit a wholesale market, make sure to go early, as most of these markets operate in the (early) morning.

What is the most interesting channel for you?

There is a wide choice of companies you can approach. It makes sense to look what kind of chilli peppers a company has in its assortment when selecting potential buyers.

When starting up your export of chilli peppers you should start with smaller, specialised importers and importing wholesalers. This way, you can build a track record before reaching out to larger clients. Ethnic buyers and foreign-owned wholesalers may have the advantage of a cultural link with your country, and potentially operate in your language.

Larger exotic importers may provide better access to larger retail channels, but will also be more demanding with formalities and certifications. If you are able to join a larger group of growers in and around Europe, you can become part of a year-round supply programme.

Tip:

- Visit trade fairs to find buyers. The most important trade fairs in Europe for fresh fruit and vegetables are Fruit Logistica in Berlin and the Fruit Attraction in Madrid. You can also find potential clients at the previously mentioned wholesale markets and their member lists.

3. What competition do you face on the European chilli pepper market?

Chilli peppers can be sourced in different regions. Each of the supply countries has its own strength in production costs, season or specific chilli type or flavour. Competition is not only about the origin, but also how exporters are organised and comply to the European standard in plant health and food safety.

Which countries are you competing with?

Turkey and North Macedonia are well positioned to supply eastern Europe. Morocco is more oriented towards France and Spain. Competitors for exotic chilli peppers such as India, Uganda and Kenya compete mainly in the UK and other northern European countries.

Morocco

Morocco leads the supply of chilli pepper to Europe, and volumes are increasing every year. In 2020, the European Union (excluding UK) imported almost 22,000 tonnes.

France and Spain are Morocco’s main destinations. For Spain, Morocco is an attractive production region with a slightly different climate. Spain and Morocco complement each other in the large-scale production of commonly used chilli peppers in Europe. Several French companies, such as Marquillanes and FausDura, specifically focus on sourcing chilli peppers in Spain and Morocco.

The proximity to the European market, a favourable climate and solid agricultural policies make Morocco a strong competitor in chilli peppers.

Turkey

Turkey is one of the largest chilli pepper producing countries in the world, and is gradually becoming a larger supplier of chilli peppers to Europe.

Turkish exporters are mainly focused on the Eastern part of Europe and Germany, where there is a significant Turkish population. Romania imported 5,500 tonnes in 2020, followed by Germany (2,600 tonnes), Bulgaria (2,100 tonnes) and Austria (1,800 tonnes). Note: These volumes are in contrast with the Turkish export data, which did not exceed 1,000 tonnes.

With increasing greenhouse production and different growing regions, Turkey is able to supply chilli peppers all year round. The presence of Turkish chilli peppers on the European market is mainly price based. With affordable production, Turkey competes with European producers as well as long distance sources of chilli specialties such as Mexico. As long as Turkey remains price competitive, they will continue to compete.

North Macedonia

Sweet and hot peppers are a common product in the Balkans, such as in North Macedonia. They are used in a typical traditional relish called Ajvar. At the same time, North Macedonia is strengthening its relations with the European Union.

The European Union has extended the duty-free import of fruits and vegetables from the Western Balkan countries, including North Macedonia, until the end of 2025. According to Eurostat, the Macedonian export to Europe was 2,400 tonnes in 2020.

Currently, North Macedonia mainly supplies the Balkans, but has the potential to increase exports to Eastern Europe and Germany.

India

Chilli peppers are an important crop in India. India has the world’s largest production of dried chilli peppers. In the fresh export to Europe it particularly serves the UK market, which has close ties to India and a large Indian population. In 2020, the UK imported 1340 tonnes of fresh chillies from India, a volume that has been relatively stable over the years.

India is a competitor in hotter chilli varieties and ideally supplies Europe in the off-season from the month of October. India has similar difficulties as other distant suppliers in tropical regions in terms of pests and rising airfreight rates. New pest-resistant chilli varieties developed by the Indian Institute of Horticultural Research could help maintain a positive export.

Uganda

Uganda is a supplier of several exotic chilli peppers such as the African Bird’s eye peppers, Habanero and Scotch Bonnet, and these are known to be very pungent/hot in this region. The growing conditions in Uganda give the product a specific taste and spiciness that is preferred by certain buyers in Europe.

The supply from Uganda to Europe has been increasing, but since the phytosanitary requirements have become stricter, it has become more difficult for Uganda to export chilli peppers free of pests and pesticide residue. In April 2019, the government of Uganda announced a ‘self-imposed export ban’ after numerous interceptions of chilli peppers with the ‘false codling moth’ (FCM). Since then, the country has been working to improve the phytosanitary control and inspections.

In 2020, the United Kingdom imported 800 tonnes from Uganda and the rest of Europe 900 tonnes. The demand runs mainly in the off-season from October to July, but some clients require a year-round supply of Ugandan chilli peppers.

Kenya / Senegal

Kenia has similar advantages as Uganda, but also faces some of the same problems. The country has a good climate for growing hot chilli peppers, while pests are a major issue for companies that want to export to Europe.

Although the chilli export was ‘only’ 1,150 tonnes to the European Union and the UK, Kenya can count itself among the main competitors in Europe. However, in the UK, the Kenyan volumes have had to deal with high pesticide residues and more competition and was recently surpassed by Senegal. Companies such as Barfoots are responsible for a greater supply from Senegal.

Kenya still has a good position in the chilli pepper trade, simply due to the fact that it is already a big supplier of horticultural products, such as sugar snaps and beans, exotic aubergines and fresh herbs.

Europe

Fresh chilli peppers are available between June and September. In the off-season, chilli peppers are imported or grown on a smaller scale in greenhouses. In the winter, there is a lower availability and greenhouse chillies become less competitive in price, which creates opportunities for supply countries with better climates. December to February are the best months for off-season supply.

Europe producers mainly grow chilli peppers of the Capsicum Annuum species, but more and more growers have started to cultivate other exotic varieties as well. This means there is more supply from local production, but traditional consumers sometimes still prefer the varieties grown in more tropical climates because of their specific taste and spiciness.

Spain, the Netherlands and Italy are the largest producers in Europe.

Tips:

- Focus on the winter months to supply Europe with chilli peppers. This is the best period to be competitive in volumes and in price.

- Target experienced buyers that understand the differences between chilli peppers from various regions. Especially for ethnic or traditional consumers, taste and spiciness are important features.

Which companies are you competing with?

Suppliers that successfully compete on the European market understand the importance of food safety and phytosanitary requirements. Your production and compliance have to be excellent to compete with companies that have integrated their supply with EU-based companies.

Nature Growers – Morocco / Spain

Producing companies in Morocco often have a strong link with growers and traders in Europe, such as Spain. This is also the case for Nature Growers in Agadir, Morocco. Nature Growers is a production company linked to Agroatlas in Spain. With over 200 ha of greenhouse and open field production in different parts of Morocco, they produce the whole year. Although their main products are beans, the company is also active in peppers and chillies. The integrated supply chain and compliance with high standards allow them to sell their vegetables to supermarkets in the UK, the Netherlands, Germany, Scandinavia, Switzerland, Belgium and Spain.

SM Impex

SM Impex, a young company in Uganda, grows and exports Habanero, Scotch Bonnet, red and green chilli peppers, in addition to a range of other products. The produce is grown in the tropics in fertile volcanic soils, which gives the chilli peppers a premium taste. Products are exported by air to the UK and the Mediterranean region. Health and safety is one of the five values defined by the company.

Only part of the growers and exporters pay sufficient attention to food and plant safety, and have a presentable website in English. These should be considered basic points for successful export to Europe.

Tips:

- Comply first with the strict health and phytosanitary requirements before organising your export to Europe. If you export a product that is not suitable for the EU market, it will not only cost you money, but you will jeopardise the export position of your country as well.

- Define well your strengths as a company and your competitive advantage before entering the European market. You can differentiate on different levels, such as distance to the market, services, varieties, price and quality.

Which products are you competing with?

Chilli peppers are used for cooking and spicing up food dishes. The main competing product for fresh chilli peppers are dried chilli peppers or processed products such as chilli powder or ready-made sauces and curry pastes to spice up foods.

In the Mediterranean countries, such as Spain, dried chillies are extremely common and handy due to their longer shelf life. Processed products combine shelf life and convenience and are especially popular in Northern Europe. Convenience may be one of the biggest threats for fresh chilli peppers, but it will not replace the taste and experience of a fresh chilli pepper.

Tips:

- Make sure your fresh chilli pepper offers the consumer a unique taste and experience. Lots of consumers prefer a fresh product over a processed product, but you must be able to guarantee freshness.

- Read the CBI study on entering the market with dried chilli peppers, if you want to diversify your market.

4. What are the prices for fresh chilli peppers?

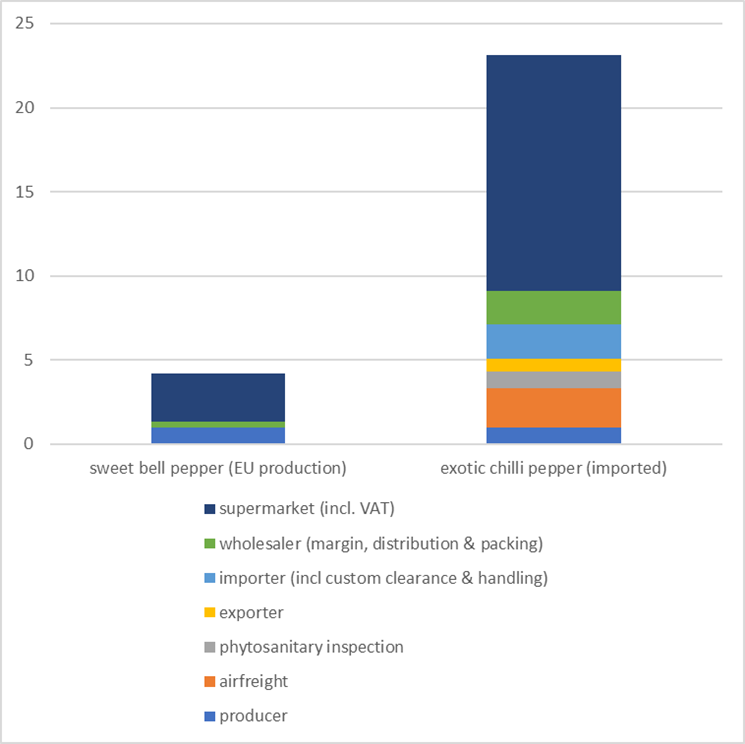

The prices for chilli peppers vary a lot, according to availability, variety and origin. In general, the more niche the chilli pepper, the higher the price. Temporary shortfalls in supply or demand can have a major impact on prices.

Chilli peppers can give a good return. But only fresh and clean chilli peppers have a market value. There are also specific factors that can easily increase the price for imported chilli peppers. For example, airfreight costs are usually around 2 to 2.5 euros per kilo, and much higher in recent times due to the COVID-19 pandemic. Physical inspections at the destination country in Europe can be as high as several hundred euros (for example in the Netherlands).

The margin of importers is usually 8% over the selling price plus handling costs. Because exotic chilli peppers are sold in minor volumes, importers often have a double role as wholesaler. Therefore, costs and margins are generally higher than for other regular vegetables.

The wholesale price for a Cayenne or Jalapeño pepper from Spain can be between 2.5 and 4 euros per kilo, while a Bird’s eye chilli or Habanero from Eastern Africa can be between 6 and 10 euros per kilo. There is also a big difference between a bulk product such as a sweet bell pepper and a much more exotic Bird’s eye chilli pepper.

Consumer prices in Europe are generally between €0.20 and €0.80 per pepper (or €10–30 per kilo), but it depends heavily on the specific variety and retail outlet. Locally produced and common peppers may be sold for well below €10 per kilo. The price of a rare variety can be as much as €75 per kilo, such as the extremely hot, British grown ‘Armageddon’ chilli pepper introduced by Tesco in 2019.

Figure 6: Example of indicative price breakdown, in euro per kilo

Tip:

- Find a price history in France on the Market News Network of FranceAgriMer from producers, importers, wholesalers (“gros”) and retail (“détail”).

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research