9 tips on how to do business with European buyers of fresh fruit and vegetables

The European fresh fruit and vegetables sector is a dynamic world full of opportunities and pitfalls. The sector feels informal yet is highly professional. Excellent product quality, consistency and efficient communication are a must when doing business. These tips can help you prepare to negotiate with European buyers and create long-term partnerships.

Contents of this page

- Learn to understand European buyers

- Be professional and follow the rules

- Put quality above all the rest

- Offer continuity and consistency

- Use proactive communication

- Create an attractive selling proposition

- Prepare yourself for tough purchase conditions

- Find collaborations with support agencies

- Look for long-term synergy

1. Learn to understand European buyers

To do business in Europe, you must understand how buyers operate. Know what type of buyer they are and familiarise yourself with their habits. The key interest in the fresh trade always comes down to volume, compliance, quality and efficiency.

Keep basic interest in mind

The main interest of your buyer is to fulfil the demand of their clients. To do this they need to secure sufficient fresh, quality products in the most efficient way. Buyers are not there to solve your problems as a supplier. They expect you to know the business and be able to deliver quality products without issues.

In summary, you must:

- Show professionalism, complying with all necessary standards and preferences;

- Make quality your most important objective;

- Guarantee a consistent and reliable supply;

- Maintain a proactive attitude and communication.

The tips below identify what this means for you as a supplier.

Adjust to different types of end clients

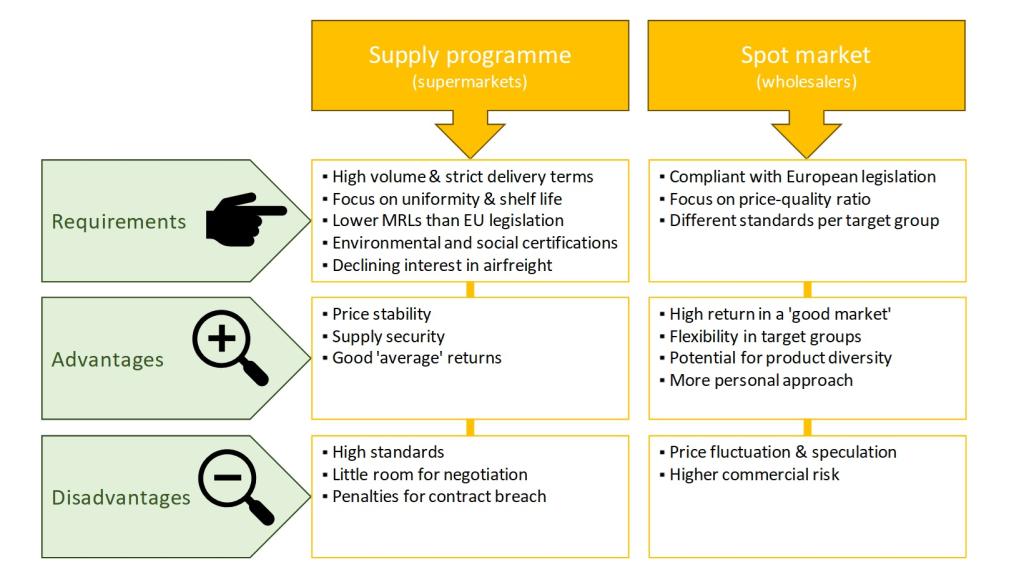

Understanding your buyer also means understanding your end market. Each end market has its own characteristics, preferences and product requirements. One of the main differences you will find is between the programmed supply and the ‘spot market’. These markets sustain each other and regulate supply and demand. Both have their advantages and disadvantages (see Figure 1).

Becoming part of a supermarket supply programme is easily underestimated. Large supermarkets want to be unburdened. They often work with service providers that arrange everything from sourcing and planning to local distribution.

Supermarkets demand uniform quality fruit and their delivery terms can be rigorous. Volume and supply reliability are key. Failing to comply with their needs can result in fines. Large retail chains are also most demanding in environmental and social standards: GLOBALG.A.P. is a standard requirement for supermarkets, but most also demand standards such as SMETA or Rainforest Alliance. Depending on the specific supermarket you may need to adopt additional, private standards such as the Nurture Module (originally Tesco Nurture), WWF/Edeka or Rewe Pro Planet. All of this makes it a difficult segment to enter for small suppliers. Having an experienced importer in-between could help get your product into the main supermarkets.

Selling to the ‘spot market’ is easier, but also provides less price stability and supply security. In times of high demand it can be very profitable, but in a ‘bad market’ prices can become extremely low and companies stop buying. A great number of importers and wholesalers do spot sales, including companies that are part of supply programmes. Among this group you will find a number of companies that are open for new suppliers.

Wholesalers have a diverse clientele, from food service clients to street markets and ethnic food shops. As a supplier you must know where you best fit in. Some buyers will be very price-focused, while specialised importers may have other priorities. For example, buyers of ethnic fruit and vegetables typically prioritise freshness and specific varieties or origins. For importers of organic produce, organic integrity will be one of the key focus points.

Figure 1: Differences between supply programmes and spot trade

Figure by ICI Business

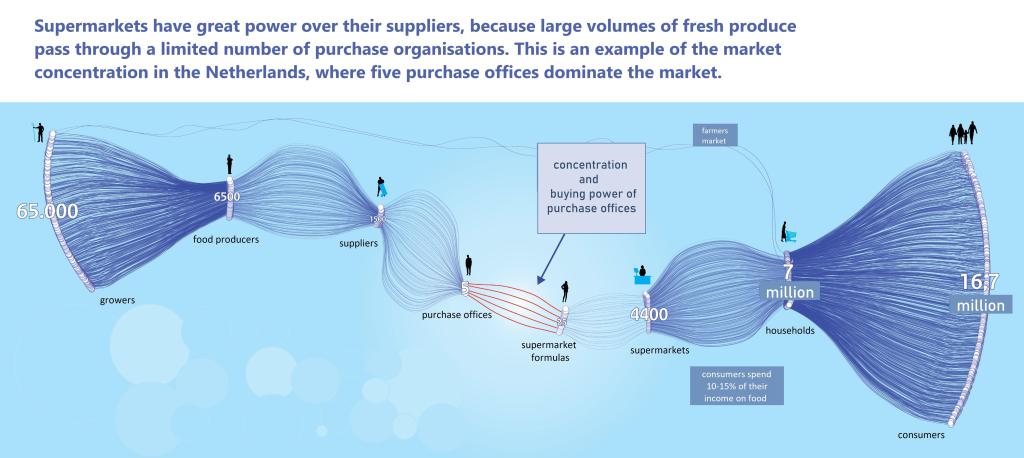

Figure 2: Example of buyer concentration in the Netherlands

Source: PBL Netherlands Environmental Assessment Agency

Prepare for cultural differences

Europe enjoys a wide cultural diversity. Every region has its own customs and preferences when it comes to consumption of fresh fruit and vegetables. Fulfilling specific market demand and dealing with different nationalities will take some experience.

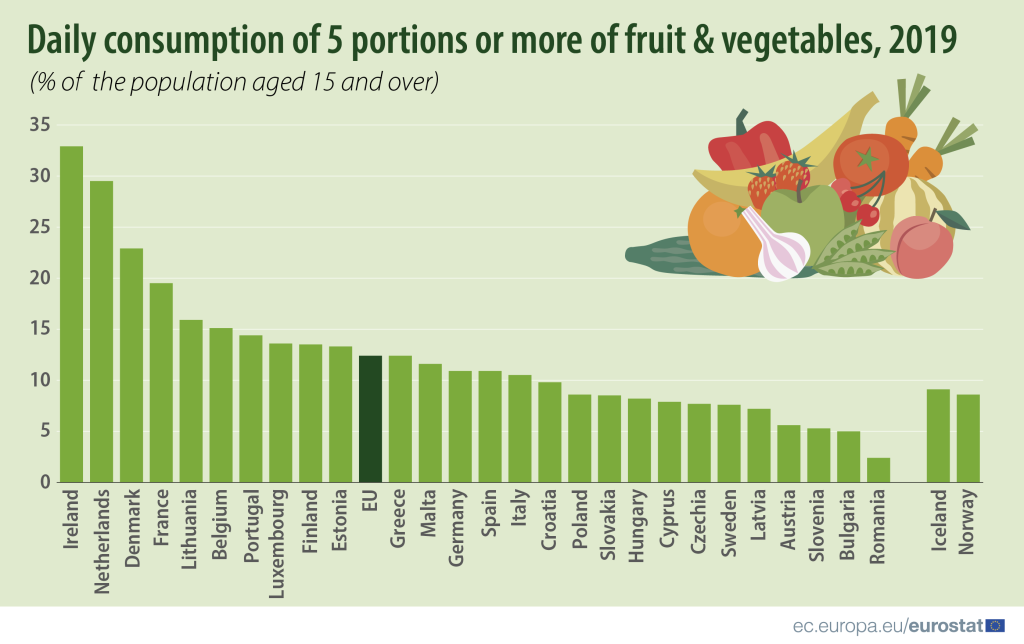

Consumption

The countries with the largest markets for fresh fruit and vegetables are Italy, Germany and France. Consumers in Portugal, Belgium and Romania eat most fruit or vegetables per capita, according to consumption data of Freshfel. But in a survey by Eurostat consumers in Ireland, the Netherlands and Denmark claimed the highest percentage of daily consumption at five portions or more. In Belgium, Spain and Italy, 65-68% of consumers claim to eat 1-4 portions of fruit and vegetables a day. The high consumption in Belgium and Italy can also be explained by the presence of a strong processing industry.

Preferences

Variety and taste properties are very important in southern Europe, while many northern European consumers buy fresh produce with their eyes. Northern Europe and in particular Germany can be very strict on pesticide residues. Price usually plays a bigger role in countries with a lower purchasing power such as Romania or Bulgaria.

Market channels

In some countries such as the UK and the Netherlands, the supermarket channel is very dominant. In southern Europe, street markets and independent shops tend to have a more important position than in northern countries.

Trade

Throughout Europe you will find different business cultures, but the basic business etiquette in this sector remains the same. Companies in Western Europe are most familiar with intercontinental trade.

The business culture in Germany can be more formal and hierarchical. It requires you to focus on the facts and use rational arguments. Rationality is also present in Scandinavia, although their style of doing business is much more informal and done with consensus.

In the UK, indirect communication is considered to be most polite. This contrasts with the Netherlands, where a direct communication style is appreciated. Dutch importers are known for their distribution activities throughout Europe. They have extensive knowledge about the requirements of different European markets.

In the Mediterranean countries, business partners value their relationships and spend more time maintaining them. Spain is well connected with producers in Latin America and Morocco. France is a good market for French-speaking countries in Africa. Italy and Eastern European countries are traditionally rather focused on local and seasonal produce, although their interest in imported fruits is rising.

Source: Freshfel

Figure 4: Consumption of fruit and vegetables in Europe

Source: Eurostat

Tips:

- Use CBI’s tips for finding European buyers for ways to connect with experienced importers in Europe.

- Read the CBI study Exporting fresh exotic vegetables to Europe to see how you can find opportunities in the ethnic niche market and what buyers of ethnic vegetables are looking for.

- To gain an understanding of how to do business in Europe, read about the different European business cultures in Passport to Trade 2.0.

2. Be professional and follow the rules

Show you understand the rules of doing business and are familiar with common practices. You can do this by keeping certifications up to date, maintaining flawless documentation and addressing every detail in your supply chain.

Understand terminology and common practices

The European market has no room for inexperienced suppliers. You must familiarise yourself with the most common practices and terms and know what they entail for you as a supplier.

Doing business in Europe starts with learning about the European regulation for food safety and phytosanitary measures. It is your obligation as an exporter to take legal requirements seriously. Structural issues with supply from your country can lead to stricter controls and additional inspections.

Buyers expect you to know how to produce, grade and pack your product. They may also ask you for spraying records, MRL analyses, as well as brix level or dry matter content to indicate the maturity of the fruit. Use common and quality packaging to ship your fresh products. You can try to differentiate in your presentation, but avoid being original with packaging that does not work for your buyer. If you do not have your own packing facility, use one that has experience and the necessary certifications.

Table 1: Common terminology in the fresh trade

| Food safety | MRLs | Maximum residue levels for pesticides and chemical traces |

| HACCP | Hazard Analysis Critical Control Point, a food safety risk assessment for foodstuffs | |

| BRC(GS) | Food safety certification (British Retail Consortium) | |

| IFS | Food safety certification (International Featured Standard) | |

| Quality | Class I, II, ‘Extra’ | The common way to indicate the quality of the product |

| GMS / SMS | General Marketing Standard / Specific Marketing Standard refer to the minimum quality requirements for marketing fresh fruit and vegetables | |

| Dry matter | The percentage of solids in fruit, indicating maturity | |

| Brix level | Measurement of the dissolved solids in the fruit’s liquid, indicating sweetness and maturity | |

| Ready-to-eat | Common term for ripened fruit ready for consumption | |

| Agriculture | GGAP | GLOBALG.A.P., certification for global good agricultural practices |

| IPM | Integrated Pest Management, a sustainable approach to pest management that relies on a combination of integrated practices | |

| Hybrid | Cross-breed that creates a new variety or improves the properties of an existing fruit | |

| Club variety | A registered and branded type of fruit that earns a premium price (e.g. Pink Lady apples) | |

| Logistics | Incoterms | International commercial terms, specify who is responsible for paying and managing the logistical activities, e.g. Free On Board (FOB) or Cost Insurance Freight (CIF) |

| FCL / LCL | Full Container Load / Less than Container Load (consolidated shipment) | |

| TEU | 20-foot equivalent unit, e.g. 1 TEU = 20-foot container and 2 TEU = 40-foot container | |

| Cold Chain | A continuous temperature-controlled supply chain involving storage, transportation and distribution | |

| Reefer container | Refrigerated container | |

| CA / MAP | Controlled atmosphere / Modified Atmosphere Packaging | |

| P.O.L. / P.O.D. | Port of loading / Port of discharge | |

| Documents | COO | Certificate of Origin, indicating product provenance to determine import duties or additional inspections |

| COA | Certificate of Analysis, a laboratory analysis listing the presence of contaminants and chemical or microbiological residues | |

| COI | Certification of Inspection, ensuring that the inspected goods meet the necessary quality criteria | |

| Commerce | MGP | Minimum guaranteed price |

Keep certifications up to date

Meeting European quality and food safety standards is a must. Proof can be shown through different documents and certifications. Make sure to keep your certifications up to date and regularly discuss new developments with your buyers. Look ahead for new requirements rather than downgrading your current level.

The most important certifications to keep updated relate to agricultural practices (GLOBALG.A.P.) and food safety management such as BRCGS or IFS. Most buyers will ask for additional environmental and social standards like amfori BSCI, Sedex SMETA, GLOBALG.A.P., GRASP, Fair for Life or Rainforest Alliance. Organic or Fairtrade certification will open the door to specific niche markets.

Pay attention to details

Everything in the fresh supply chain must be organised to the greatest detail. Mistakes are easily made but can be very expensive to solve.

Make sure that products are uniform and well-packaged. Paperwork for export must be complete, accurate and without mistakes to avoid border rejections. Besides these technicalities, also follow the client’s preferences in terms of packaging and presentation. For example, some buyers need fruit to be neatly packed to make it look more attractive or exclusive. Figure 5 shows different sorting of mandarins, loose and arranged.

Figure 5: Different packing preferences for the same fruit

Source: Picture by ICI Business

Tips:

- Find out which types of certifications are the most relevant for you and your target markets. Check out the CBI study on buyer requirements for fresh fruit and vegetables and explore the ITC Standards Map. Always discuss your clients’ preferences with them. Be honest as to what you can offer and keep your production and certification records up to date.

- Learn to speak the language of your buyer. Read the 50 fruit-industry terms to know on FreshFruitPortal. The best way to make a professional impression is by showing that you understand your client.

- Show that you care about the environment by implementing good farming practices. Promote initiatives at your farms related to crop rotation, integrated pest management (IPM), water and waste management, and reduction of your carbon footprint.

3. Put quality above all the rest

Quality is your top priority in the fresh fruit and vegetable sector. This means you must take care of your product throughout the entire supply chain, from production to arrival at your client. Quality requirements are not open for discussion.

Marketing standards

The Marketing Standards in EU Regulation 543/2011 (version 24-10-2022) lay down detailed rules for the fruit and vegetable sector. These standards are your guidance for quality. Besides the official marketing standards you will find specific marketing standards through UNECE, OECD and the Codex Alimentarius.

Class I produce is the most common quality level for imported products. The market for imported Class II products is narrow.

Individual buyers may also have their own specific quality requirements and expectations. For example, many supermarkets demand lower MRL levels than required by European legislation.

How can you manage quality?

Fresh fruit and vegetables are perishable products that involve extensive handling. The route from field to packing house and beyond can be long and difficult. Every step in the supply chain can affect the quality of your product. Still, your product must arrive in good shape and with sufficient shelf life. This takes expertise and planning.

There are several points of attention on how you can maintain your fruit fresh and in a good shape:

- Knowledge: Work with agronomists that can help you produce a strong and quality product at the farm level. This will reduce damage and help your product withstand the journey when being shipped overseas.

- Measurement: Keep your chemical use low. Measure and register everything. European buyers and authorities are very strict on MRLs. Some buyers will ask for laboratory analyses and spray records.

- Training: Use skilled workers for the harvest and post-harvest. Provide regular training. Much of the physical damage takes place during harvest.

- Quality inputs: Use quality packaging material. Do not try to save a few cents per box when you risk losing 5 euros per box due to problems with inferior packaging.

- Keep control: Know what you are exporting; analyse aspects like maturity and residue levels. Take pictures before exporting your product.

- Cold chain: Organise your cold chain without interruptions. If necessary, use pre-cooling for products from the field. Study the perfect conditions for your particular product, such as temperature or controlled atmosphere (CA).

- Planning: Look for direct and efficient shipping routes to reduce transit time.

Solve problems together

Quality issues are often a reason for buyers to file a claim, which can hurt your profit. In case of a claim, ask your buyer for conclusive visual proof. Always try to solve issues together regardless of the origin of the problem.

Quality claims are also common when it is a difficult market and prices can be renegotiated. Remember, in a good market (high demand, low offer) anything is possible. Even poor-looking fruit can be accepted, just to fulfil the demand. But the other way around is also true: in a difficult market, any slight quality issue becomes a reason to claim to cut losses. A shipping company can also be responsible for the poor handling of your product. In this case it is easier for your client to hold you accountable rather than the logistics provider.

If you doubt your buyer’s findings, hire an independent party such as SGS, Bureau Veritas or Intertek to do a quality inspection.

Tips:

- Collect proof of quality before shipping your product. Collect sample test data, take pictures of the load and the product, register temperatures and climate conditions, and (if needed) have an independent pre-shipment inspection done. The more data you have, the better you can defend your responsibility and obligations as a supplier.

- Make quality throughout the supply chain a team effort. Work closely with your buyer, and understand the game of giving and taking. Remember that your buyer is just a link in a larger chain and they also may face penalties from their clients (especially from large retailers).

- Always show professionalism as a supplier. When your products are not up to standard – for whatever reason – do not send the products to market. Instead, communicate actual or potential issues proactively with your buyer throughout the time of production and harvest.

4. Offer continuity and consistency

Competition in fresh fruit and vegetables is fierce. Every buyer wants the best quality for the lowest price, but a good partner will always look for a reliable supplier that provides continuity. As an exporter you must respect your agreements, but make sure the reliability is mutual.

Ensure a consistent quality and stable supply

European buyers look for steady volumes of quality products. They secure their supply by working with different origins.

So not price, but stability is the best-selling strategy. You need to have an attractive supply window and sufficient volumes available. Prices will be determined by the market. The best way to stay in business is by performing well and consistently.

For the main products such as citrus, avocado or grapes, expect to ship larger and more regular volumes. You can make yourself an attractive supplier if you can arrange weekly shipments of export quality produce during your season. For less common products or smaller exotics such as chilli peppers, passion fruit or pomegranate you need to be able to supply a minimum workable volume per week. Smaller volumes can also be air-freighted.

Larger volumes and better guarantees come with greater responsibilities. If you cannot comply with the volumes or quality requirements of a major buyer, e.g. for a supply programme, it makes no sense to approach these types of buyers.

Create trust

In a sector where perishable products and price fluctuations carry many risks, trust is a valuable trait. Give the buyer a reason to stay in business with you. Build confidence by respecting agreements and deliver what you promise.

It is best to be honest about what you can offer. Always discuss any changes before deviating from your contract. Poor planning or other management errors are unacceptable. If your supply has a different quality, size or timeline than agreed, your buyer will likely have to sell your product for a lower price. The client will hold you accountable for the financial loss.

The only acceptable reason for not fulfilling a contract is ‘force majeure’. Force majeure are events that are outside of your control, such as the outbreak of a war, a pandemic and natural disasters (floods, drought, hailstorms, etc.).

All the conditions should be part of the agreement with your buyer. Make sure that everything is in writing and confirmed. Do not leave any room for interpretation or doubt.

Evaluate your client

Trust and reliability work both ways. Knowing your buyer is essential for doing business. You need to know what kind of trade buyers are offering, but also if they are able to fulfil their obligations. Evaluating your client is about understanding the benefits and risks for your company.

Importers help with matching supply and demand. Ideally, you would select your buyer according to their network, the type of product and the scale of their operation. What type of end clients do they supply? Do they work in supply programmes? Do they specialise in your product?

When selling in consignment of a minimum price guarantee, you need to know if your buyer will defend your product well in the market. See our tips on purchase conditions below. Look for experienced importers with a strong reputation and network.

Tips:

- Never promise more than you can deliver. Keeping your word is key to gaining trust with European buyers. A promise is therefore worth as much as a contract.

- Leave nothing to chance when doing business with European buyers of fresh fruit and vegetables. Plan your production and supply thoroughly. Contract farmers in time, stock sufficient packaging material, plan your logistics and calculate your lead time. Proactively inform your clients about the crop forecast.

- Do a credit check of your buyer or consider an export credit insurance via an insurance company such as Atradius, Coface and Allianz Trade.

5. Use proactive communication

Fresh fruit and vegetables are perishable products and typical for day trading. Their fast rotation in trade requires a proactive attitude and straightforward communication. Because of this, people in the fresh sector are direct and prefer efficient communication.

During first-time contact make yourself an attractive company to talk with. Try to respond to the specific need of the buyer. Buyers have little time for unnecessary communication, so you need to be clear and to-the-point. You can keep your contacts warm by updating them with relevant information. Update buyers on the forecast of your season in terms of fruit sizes, expected yield, etc.

Once in business, your buyer will expect good and prompt communication skills. Respond to emails and any other types of messages the same day or at least within 24 hours. This period allows for time differences, but make sure you are available at some point during your buyer’s business hours. You need to be disciplined to maintain this level of communication, plus ensure you have good internet connectivity.

Communicate in good times and in bad times. Do not avoid or delay delivering bad news. If something goes wrong, communicate this with the buyer directly. Be proactive in solving the problem and discuss the consequences openly.

Tips:

- Keep your communication short and informative. Notify your client of important aspects of production planning and shipment. Help your buyer with freight rates, transit times and arrival schedules, so they can calculate the costs and plan further trade.

- Make it a habit to reply quickly and consistently to emails, phone calls or any other means of communication. If you are unable to respond yourself, make sure you have colleagues who can respond for you. Not getting back within one business day shows a lack of interest or poor organisation skills.

- Be reachable for your business relations. Use available communication tools such as a mobile phone number, personal email address and WhatsApp. WhatsApp has become common in trade communication. Whatever tool you use, make sure to save important messages and confirmations.

6. Create an attractive selling proposition

When approaching potential buyers, you need to be well-prepared. Know your strengths and weaknesses, and create added value as a supplier. Buyers get regular offers from suppliers all over the world. If you want to get into business, you must stand out.

Analyse thoroughly what makes your company different from other suppliers. What are your unique selling points? Highlight them and try to link your proposition to the needs of your potential buyer.

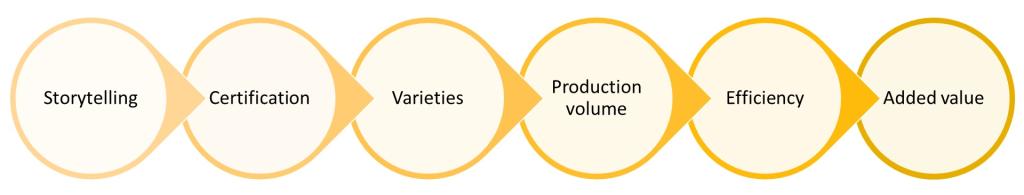

Figure 6: Ways to differentiate your company in the fresh fruit and vegetable sector

Source: ICI Business

- Differentiate with a sustainable or social impact. Use storytelling to attract buyers that value transparency or want to show their social engagement. Some importers like presenting the story behind the growers and their products, like Nature’s Pride’s supplier Dominus (see video below).

- Switch to organic farming to work with importers that are specialised in organic fruit and vegetables. Or get a fairtrade certification and show your work with small farmers to engage with companies that deal with fairtrade products.

- Promote unique or superior varieties and approach specialised buyers that know the product well. Extend your supply season with different cultivars or explore licensed varieties to get premium prices. Companies like Green Marketing International in South Africa cover wide seasons with different varieties of grapes and stone fruits, including several licenced varieties.

- Show your production volume and farmer integration to guarantee large buyers with supply security.

- Shorten your supply chain and look for logistical efficiency to guarantee the best freshness and shelf life.

- Add value with basic processing such as freshly cut fruit or special packaging to reach retail channels. Be innovative to stay ahead of the crowd. The company Frutireyes in Colombia has diversified their offer of exotics into fresh, dried and frozen fruits.

Figure 7: Video presentation of Nature’s Pride’s supplier Dominus

Tips:

- Research the market for your specific product and analyse how you can use the trends to your advantage. Read the CBI studies on promising export products in fresh fruit and vegetables.

- Specialise yourself in specific products or varieties and try to add value to your proposition. Make use of your strengths as a company. Focus and experience will distinguish your company from generic suppliers.

- Use your website to create a company identity. Include information about your assortment, certifications, good agricultural practices, social engagement and international service. Make sure your website is attractive and up-to-date. For example, communicate about your latest achievements in social projects for the community.

7. Prepare yourself for tough purchase conditions

The fresh fruit and vegetable industry can be relatively informal and commercial results are difficult to predict. As a result, purchase conditions can be tough. Prepare yourself for these conditions and always make sure the supply terms are clearly defined.

Purchase conditions or sales conditions?

Most European buyers will enforce their purchase conditions. It is important to read those and check your obligations as supplier. If the purchase conditions do not cover your buyer’s responsibilities sufficiently, you can also propose your sales conditions. When both parties have their own conditions, agree on which ones are leading. Purchase conditions will generally include:

- Supplier obligations

- Supplier liability

- Consequences for agreement non-compliance

- Terms of delivery

- Confidentiality statement

- Payment terms for supplier invoices

- Laws that apply in case of conflict

Quotation and negotiation

New clients will often ask you for a quotation. This doesn’t mean they are directly interested in doing business. But this way they have your contact details and also get up-to-date market information of what is on offer.

Before making a quotation, first calculate your costs of production, packing and shipping. You can only make a profit when you keep control over your spendings. In your quotation you can mention all the product characteristics such as volume, size, packaging and palletisation. Also include the Incoterms, destination and date of expiry of your quotation.

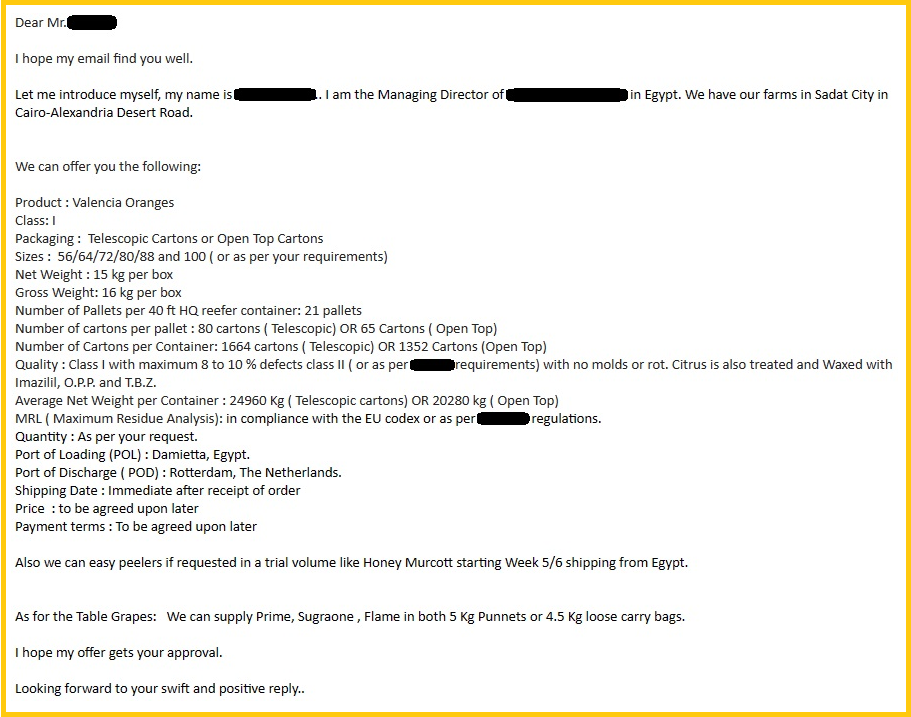

Prices can either be quoted or left up to the market. When the market determines the price, expect to pay at least 8% plus handling costs to the importer that represents your product. Figure 8 illustrates a marketing mailing showing information of an Egyptian offer.

You can also wait with your quotation and negotiate when a buyer is interested. This way you can use different variables to negotiate: price or minimum price, terms of delivery and payment.

Make sure to have a written acceptance from the buyer. It is best to have a sales contract, but agreements confirmed by email are also common. Read any additional purchase conditions of your buyer before confirming or signing anything on your part. The duration for a contract or agreement can be per shipment but also per season.

Figure 8: Mailing with an offer of Egyptian oranges

Source: Industry sources

Payment terms

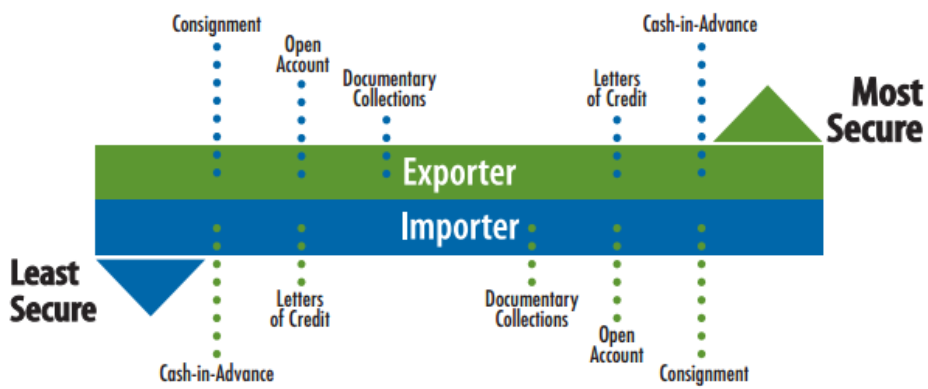

Payment terms are an essential part of the purchase conditions. In the fresh trade, price and payment agreements vary from fixed price to minimum guaranteed price (MGP) and open account.

Ideally, you look for buyers that offer optimal purchase conditions for you as a seller. However, as a new or small supplier you will have to be open to working with different terms. The more flexible you are as a supplier, the more interest you can get from buyers. But flexibility also comes with risks. In the end, it depends on which conditions you accept.

Advance payment and fixed-price contracts provide the most security. In case of an MGP or open account contract, ask your buyer to share the account of sales, which shows their selling price and costs. Remember that a buyer may renegotiate a minimum price if your product did not meet the quality requirements or if the market gave poor results. Selling with open account or in consignment provides the least security. It is only recommendable in partnerships with trusted and reputable companies.

Figure 9: Payment Risk Diagram

Source: International Trade Administration

Table 2: Explanation or different payment terms

Fixed price | A fixed-price contract is clear to both parties and offers the most security to you as an exporter. Fixed-price contracts used to be difficult to get, but thanks to the stability of supply programmes their preference is gradually gaining over other purchase conditions. |

| Minimum guaranteed price | A minimum guaranteed price (MGP) is common in the fresh fruit and vegetable trade. It guarantees a minimum return for the seller. The rest will depend on the market and the skills of your buyer. |

| Advance payment | Payment in advance gives you more security and better cashflow as an exporter. It is common to ask for a partial payment when the product is being shipped, and for the rest on arrival or after sales in the destination market. Smaller, air-freighted lots can be paid in full before or after arrival. |

| Open account | An open account transaction is a sale where the goods are shipped and delivered before payment is due. You would be providing a line of credit to the importer. As a supplier you can cover the risks of non-payment with export credit insurance. |

Free consignment | A consignment is not a sale. Your client acts as a sales agent, and you as a seller continue to own and be responsible for the product until it is sold. The advantage is that you are always entitled to a detailed account of sales, and your partner cannot deduct more than the expenses and commission related to the sale. |

Account of sales | An account of sales will be proof of the expenses and sales made by your trade partner. The final payment after a MGP or consignment is calculated after deducting commission and expenses. The average commission for fresh fruit traders is at least 8% excluding handling costs, but you can also choose to split the profit (or loss!). |

Tips:

- Get information from European buyers on their market expectations. Watch out for empty promises. The market determines the final price, not your buyer.

- Assess your risks when agreeing on the purchase and payment conditions. Check your options for payment terms in CBI’s Tips for organising your export of fresh fruit and vegetables and read more about payment methods on the website of the International Trade Administration.

- The (paid) examples of contracts and trade documents in GlobalNegotiator or the International Chamber of Commerce (ICC) can help you prepare. Find a sample calculation of an account of sale in the CBI presentation Doing Business in Fresh Fruit and Vegetables on SlideShare.

8. Find collaborations with support agencies

There are European organisations supporting exporters in developing countries with trade development as well as advocacy and trade policy. You can also check for support organisations in your own country.

Being part of an export support programme means you will have access to export training, trade assistance and trade fair participation. These activities increase your chances with potential buyers.

Trade development

Centre for the Promotion of Imports from developing countries (CBI) provides small and medium-sized enterprises with market intelligence and trade support in export coaching programmes. Their tailored programmes also include training in doing business in Europe. On the CBI website you can find relevant projects in fresh fruit and vegetables, for example in Lebanon, Ethiopia and Kenya.

Import Promotion Desk (IPD) establishes contacts in the European Union for exporters from partner countries. They also provide them with market information and capacity-building. Fresh fruit and vegetables is included as one of their key sectors.

International Trade Centre (ITC) is a development agency for sustainable trade. They offer publications about products and markets and an SME Trade Academy. The academy provides online courses, some free of charge.

Open Trade Gate Sweden (OTGS) is a facility and one-stop information centre for exporters interested in the Swedish market. OTGS aims to strengthen the capacity and ability of developing countries to export to Sweden. Their input can also be helpful to you when doing business with other European markets.

Swisscontact is an independent non-profit development organisation offering customised consultancy and capacity-development services. They focus on sustainable economic development of the private sector in developing and emerging countries.

Trade policy

The Institute for Agriculture and Trade Policy (IATP) has as its mission to ensure fair and sustainable food, farming and trading systems. IATP advocates for a just and green transition by pushing for policy reforms internationally. They support agroecology and promote a fair exchange of goods and services.

TradeMark Africa (TMA) is an Aid-for-Trade organisation. TMA strives for growing prosperity through increased trade. They help remove trade barriers and increase sustainable and inclusive intra-African trade and exports to the rest of the world.

Tips:

- Check the current and upcoming projects of CBI. See if any of these might be interesting for your company.

- Contact IPD if you think their services match your needs for increasing your knowledge on doing business in Europe.

- Subscribe for free or paid online courses with the ITC SME Trade Academy.

- Find Business Support Offices (BSOs) in your country and see what they can do for you. Many export or government agencies also offer space in country pavilions at major trade fairs in Europe.

9. Look for long-term synergy

Building strong and long-lasting relationships is critical to maintaining your position in the market. To realise this, you must have an attractive offer and good networking skills. Look for partners with a similar vision and complement each other.

Be selective

Focus on the right target group. As a small supplier or as a specialist in exotics, it is no use to target large retail channels. Think of what you have to offer and target the right client that could be interested in your offer. Be critical as to who you work with. Buyers that are not committed will have little interest in developing a steady commercial relationship.

Take your time

Try to meet buyers at trade fairs and keep yourself visible. Be patient. Do not expect to get orders on the first meeting; this process can take a couple of months or even longer. Important buyers often have seasonal contracts and steady relations. Be aware that buyers can sometimes be opportunistic too – they will only buy your product if it is convenient for them.

Build on your relationship

Once you have established your first buyer relations, make sure that you maintain a healthy relationship and effective communication. Keep your promises and be honest. Build trust over a period of time. If you show reliability and consistency over time, your buyer will be more confident about you as a supplier.

Develop partnerships

Exclusive partnerships can have several advantages. You can secure your market and strengthen your financial position. Think together about how to benefit from market opportunities. Explore joint ventures to further integrate the supply chain. Companies like Cartama have chosen to market their avocados through a joint venture with the Fresca Group.

Tips:

- Invite your potential buyers to your farm and production facilities. This way you give your buyer a good impression of your company and its capacity. Spending quality time together also helps to get to know each other better.

- Become a regular visitor to the main trade fairs in Europe. Being a regular face at events is part of building relationships. The most important fairs are Fruit Logistica in Berlin and Fruit Attraction in Madrid. By presenting yourself in person, you will already have an advantage over many other suppliers that do not invest in trade fair visits.

Read our Tips for Finding Buyers and Tips for Organising your Export. These tips can help you further understand how to do business with European buyers of fresh fruit and vegetables, and what it takes to become a successful exporter to Europe.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research