Exporting fresh exotic vegetables to Europe

Exporting exotic vegetables to Europe requires a lot of hard work and knowledge. To help you prepare CBI provides market information with trends which offer opportunities in the European market for exotic vegetables. From information about buyer requirements and certifications when exporting exotic vegetables, to main market segments and distribution channels for exporting exotic vegetables as well as information about the competition.

The market for exotic vegetables is characterised by a wide range of products as well as buyers. In this sense the market for exotic vegetables is not so different from the general fresh fruit and vegetable market, but the details are different. Wholesalers and countries with larger ethnic populations play an important role. As a supplier you must focus on freshness and pay extra attention to the quality of your products, the type of buyer and the efficiency of logistics.

COVID-19

The wholesale trade has been exceptionally hard hit by the COVID-19 pandemic. Restaurant closures have left a gap in the sales of exotic vegetables and many wholesalers have suffered great losses. At the same time, freight rates increased making imported vegetables more expensive.

Contents of this page

- Product description exotic vegetables

- Which countries offer the most opportunities for exotic vegetables

- What are the main channels for exotic vegetables?

- How to do business with buyers of exotic vegetables?

- What are the main requirements for exotic vegetables?

- How can you best organise your export of exotic vegetables?

- How can you find buyers of exotic vegetables?

1. Product description exotic vegetables

There is no clear definition for the product group ‘exotic vegetables’. Every company calls it something different, and sometimes no specific definition is used. Some companies include the country of origin when referring to the vegetables, such as Indian, Asian, Surinamese or African vegetables. Other companies use words such as exotic, tropical, oriental or, occasionally, ethnic to refer to the vegetables.

The term exotic vegetables refers to a large variety of vegetables that are marketed as exotic or ethnic products. These include, for example, okra, bitter melon, mini aubergines, chilli peppers, baby corn, niche herbs such as lemon grass, coriander, galangal or ginger, and exotic roots such as cassava, yams and taro.

The names of the individual products may vary. For example, bitter melon is also known as Karela in India or Sopropo in Surinam. Okra is also known as Lady’s finger or Gombo in French. Different varieties exist, including as Indian, Thai, American (Clemson) and Chinese okra (Teroy).

Table 1: Product definition and HS (Harmonised System) or product codes

| Product | Oriental vegetable and commercial varieties | |

| 07082000 | Fresh or chilled beans "Vigna spp., Phaseolus spp.", shelled or unshelled | Asparagus bean (Vigna unguiculata). Also known as: yardlong bean, Chinese long bean, snake bean (Kowsbanti in Surinamese, kousenband in Dutch) |

| 07093000 | Fresh or chilled aubergines "eggplants" | Mini-aubergine (Solanum melongena). Also known as: eggplant |

| 07096099 | Fresh or chilled fruits of genus Capsicum or Pimenta (excl. for manufacture of capsicin, capsicum oleoresin dyes, essential oils or resinoids) | Chilli peppers (Capsicum annuum, chinense, frutescens), for example: Bird’s eye, African bird’s eye, Scotch Bonnet etc. |

| 07099990 | Fresh or chilled vegetables not elsewhere specified

| Okra (Abelmoschus esculentus). Also known as: Lady’s finger, Gombo, Teroy. Varieties: Indian, Chinese, Thai, American |

| Bitter melon (Momordica charantia). Also known as: Bitter gourd, karela, sopropo | ||

| Chayote (Sechium edule) | ||

| Coriander leaves (Coriandrum sativum) | ||

| 07144010 | Taro "Colocasia spp.", either fresh and whole or without skin and frozen, even sliced, for human consumption, packaged <= 28 kg | Taro (Colocasia esculenta). Also known as: eddo, malanga, dasheen |

| 07143010 | Yams "Dioscorea spp.", either fresh and whole or without skin and frozen, even sliced, for human consumption, packaged <= 28 kg | Yams (Dioscorea), such as: Dioscorea rotundata / cayennensis / alata / polystachya |

| 07141091 | Cassava, either fresh and whole or without skin and frozen manioc, whether or not sliced, for human consumption, packaged <= 28 kg | Cassava (Manihot esculenta). Also known as: manioc, yuca |

Other definitions in this study:

Traditional food: foods that are consumed based on cultural tradition (local or foreign)

Ethnic food: foods that are related or belong to a tradition of a foreign population or ethnic minority

Exotic food: foods that are not originally part of a local food culture

Oriental food: foods that are related to Asian food cultures

2. Which countries offer the most opportunities for exotic vegetables

A large part of the demand of exotic vegetables is related to traditional or ethnic consumption. In other words, consumers purchase these vegetables because they are part of their traditional diets or their cultural food heritage.

The most promising markets for exotic vegetables are Germany due to its large non-European population, the United Kingdom and France with large imports of niche vegetables, and north-western Europe in general because of the open attitude towards new cuisines.

Germany, the UK and France have the largest non-EU born populations

The ‘ethnic’ target groups for exotic vegetables (depending on the product and variety) include Asian, African, Indian, Arab and Latin American consumers. Some exporters claim that 80% of the exotic vegetables are destined for the ethnic market and 20% for the non-ethnic market. It is therefore important to look at the population diversity and statistics to estimate the potential size of the market for your product.

In 2020 Europe had 43 million citizens that were born outside the EU, 7.5 million more than in 2015. The group of second generation citizens is nearly as large as the number of first generation immigrants. The largest number of inhabitants with a non-European background are found in the countries with the largest overall populations. In terms of percentages, smaller countries such as the Netherlands, Belgium and Sweden also have significant non-EU born populations.

Germany boasts the largest non-EU born population, consisting of 8.6 million people, but specific data is lacking. Historical ties make the United Kingdom attractive to immigrants from the Indian sub-continent, while the foreign population in France is mainly of Northern African origin and in Spain, the majority of non-EU born foreigners come from Latin America. Immigrants in Italy are mainly from Albania and Morocco. The non-EU populations in the Netherlands consist mainly of Turkish and Moroccan immigrants, and descendants from former colonies such as Surinam, Indonesia and several Caribbean Islands.

Table 2: Countries with the largest non-EU born populations, in 2020

| Total non-EU population | Largest ethnic groups | |

| Germany | 8,604,207 | No data |

| France | 6,384,234 |

|

| UK | 5,808,999 |

|

| Spain | 5,029,446 |

|

| Italy | 4,430,954 |

|

| Netherlands | 1,710,531 |

|

Source: Eurostat (UK data from 2019)

The UK, France, Spain and the Netherlands import the most niche vegetables

The import value of niche vegetables with HS code 07099990, which includes okra, bitter melon, chayote, coriander leaves, reached €120 million in 2019 (and €91 million in 2020, not including imports to the UK). This is €10 million more than 5 years earlier.

The United Kingdom and France import the most niche vegetables from non-European sources. Together, these countries are responsible for 45% of the import value, while Spain, the Netherlands and Italy are responsible for 29%. Importers in the Netherlands have indicated that a portion of the imported vegetables are re-exported to Germany, Belgium, Switzerland and the Scandinavian markets.

North-western Europe is most open to ethnic cuisines

The consumption of international cuisines and establishment of restaurants are important for the expansion of imports of exotic vegetables and offer clues as to ethnic consumption, but also the potential cultural influence on other types of consumers. The cultural influence of international cuisines is strongest in north-western Europe.

Consumers in north-western Europe seem to have the most interest in trying new foods. In these countries, people seem less attached to their own local food cultures and have a greater interest in trying new things.

Asian cuisines are the most popular in the UK (Chinese, Indian and Thai) and France (Chinese, Vietnamese, Japanese and Thai). Chinese and Thai are among the most widely accepted cuisines in Europe; Thai food is also very popular in the Nordic countries. Arab food is the most popular in France, UK and Sweden. Countries with a taste for Latin and Caribbean food include the Nordics countries (Mexican), the UK (Caribbean) and Spain (Peruvian). Figure 3 provides a general overview of the popularity of different cuisines. Although relevant for exotic vegetables, the Netherlands and Belgium are not included, nor are African cuisines.

3. What are the main channels for exotic vegetables?

Exotic vegetables can be sold through a variety of market channels. The ones that are often mentioned by traders of exotic vegetables are wholesalers and secondary channels such as street merchants, specialised retailers and restaurants. For certain exotic vegetables, non-specialised retailers, including conventional supermarkets, are also part of the supply chain. One thing is clear, the wholesaler plays an important role in both import and distribution.

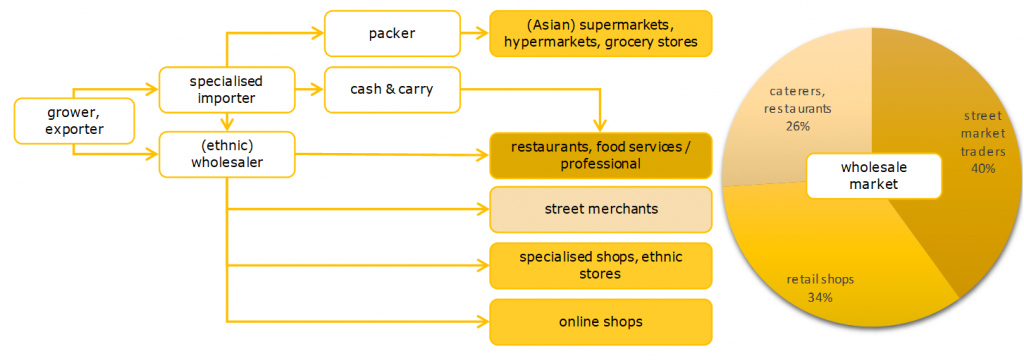

Figure 4: Market channels for exotic vegetables

Figure by ICI Business (wholesale market shares on the left are based on the German wholesale market data grossmaerkte.org)

Wholesale channel is key

The wholesale channel is relatively important for the sale of fresh exotic vegetables. Wholesale and import activities often go hand in hand. A large share of these products are air-freighted, so wholesalers can comfortably import smaller batches. Wholesalers that manage volumes that are too small to import can also buy with other importing wholesalers. The largest concentrations of wholesalers can be found at wholesale markets.

Germany:

Germany has 17 wholesale markets with 2,600 registered companies, of which 66% are wholesalers or importers. These markets attract a total of 53,000 buyers such as street market traders (40%), retail shops (34%) and restaurants or caterers (26%). The turnover of fresh fruits and vegetables is €7.2 billion. The biggest wholesale markets are Hamburg (472 companies and €2 billion in sales), Munich (400 companies and €2 billion in sales) and Stuttgart (370 companies and €530 million in sales). The Berlin wholesale market (300 companies and €1 billion in sales) may also be interesting to visit due to the mix of cultures represented and the high turnover. Grossmaerkte.org and its GFI Guide wholesale markets in Germany provide a complete overview of the German wholesale markets.

The United Kingdom:

The largest wholesale markets for fresh fruits and vegetables can be found in London: The New Covent Garden Market (175 businesses) and New Spitalfields Market (115 businesses). Several smaller wholesale markets exist, which are spread out over the country.

France:

France has over 22 wholesale markets, with Rungis in Paris being the most famous one. In total the French wholesale markets represent 2,500 wholesalers. An overview of these markets can be found via the Fédération Les marches de gros de France.

Spain:

The wholesale segment in Spain is dominated by two large wholesale markets: Mercamadrid (Madrid) and Marcabarna (Barcelona), each with a market share of approximately 32% in sold volumes. Mercavalencia holds the number three position, with a share of 4.3%.

Italy:

According to The National Association of Wholesale Market Directors (ANDMI) Italy has over 200 wholesale markets and food and agricultural centres involving thousands of companies. These markets are responsible for a turnover of between €7 to €8 billion. The Wholesale Fruit and Vegetable Market of Milan (SOGEMI) is the largest wholesale market in Italy with over €1 billion in sales.

The Netherlands:

There are 9 locations or areas in the Netherlands where wholesalers are typically located, including Rotterdam Spaanse Polder, The Hague Forepark and the Food Center Amsterdam. The different wholesale markets are shown on a map at AGF.nl.

Figure 5: Rungis wholesale market in Paris

Photo by ICI Business

Profile of wholesalers

The wholesalers are very diverse and many of them keep a low profile. A great many of them are small companies, sometimes employing only 1 to 5 people, and in many cases they do not even have a website. Their reach is mostly local or regional.

Many importing wholesalers market their products as exotic fruit and vegetables, for example Exofi Exotic Fruit Export in Belgium, Drevin Exotics in France or Exotic Roots in the Netherlands.

Some importing wholesalers have a specific target group, or focus on specific origins because of their own background or specific product characteristics unique to the product’s origin. For example Grassfields Trading in Germany focuses on African food, while Tropifruit in the UK presents itself as a specialist importer and distributor of Afro-Caribbean fruit and vegetables and Sunnyfield Veg as one of the leading importers of Chinese and Thai vegetables.

Larger importers provide access to non-specialised retailers

Larger importers with wider ranges of products seem to be best placed to enter the conventional and non-specialised retail market. They usually already have close ties with large supermarket chains and offer additional services such as re-packing and branding. These companies are sometimes less specialised in the ethnic markets, but their market reach can be more extensive with international distribution throughout Europe.

The conventional grocery stores and supermarkets are not the best outlets for most exotic and niche vegetables because they serve a limited number of ethnic consumers. When a vegetable outgrows the ethnic market and is adopted by other consumers, it becomes interesting for supermarkets to add it to their range. This occurs regularly in Northern Europe, where supermarkets have a strong market presence and consumers are generally open to trying new foods.

Exotic vegetables that are normally sold by supermarkets and non-specialised grocers include common chilli peppers, lemon grass, ginger and sometimes cassava. Okra is more exotic, but can still be found in Ocado and Waitrose in the UK. Grand Frais, a French fresh concept based on the traditional market place, offers okra (“gombo” in French) and chayote. The Dutch supermarket Jumbo has diversified its exotic range by adding Taro (eddo), galanga and turmeric to it. A product such as bitter melon and chayote are niche products, and are more difficult to find in regular supermarkets.

Because of its favourable logistical position, the Netherlands boasts a relatively large number of international traders and importers of exotic (fruits and) vegetables. These include Nature’s Pride, BUD Holland, Roveg and TFC, for example. This logistical hub is also used by other importers, such as the Spanish CMR, which has an office in the Netherlands.

The gastronomic segment is important for new consumer experiences

The gastronomic channel is an important segment for exotic vegetables. Ethnic restaurants, pioneering chefs and food bloggers help introduce new flavours and exotic vegetables to larger consumer groups.

Europe has a wide variety of Asian restaurants (Chinese, Indian and Thai), but there are many cuisines such as Ethiopian, Lebanese and Peruvian which are gaining popularity. According to Dutch restaurant guide The Fork, there are 123 Asian, 38 South American, 29 Arab and 7 African restaurants in the capital city of Amsterdam alone (which has 880,000 inhabitants).

Restaurant buyers purchase their fresh vegetables from specialised wholesalers or non-specialised cash & carry outlets such as Bidfood (United Kingdom), Metro (Germany) and Sligro (the Netherlands).

Specialised retailers cater to traditional consumers

Specialised retailers, which include both street markets and physical shops, are responsible for a large portion of the sales of exotic vegetables. They can specialise in selling fresh fruit and vegetables or in selling ethnic foods. Many of these outlets are managed by foreign entrepreneurs that have immigrated from Asian and Arab countries. Asian supermarkets such as Asian Market in France and Amazing Oriental in the Netherlands often sell both fresh and processed vegetables. Some of these ethnic channels use the services of specialised importing distributors such as Asia Express Food.

There are more small fresh fruit and vegetable shops in southern European countries compared to the north where supermarkets tend to dominate (see Figures 6, 7 and 8).

A relatively new channel is the online retail, which includes many initiatives of wholesalers. The development of online sales is especially strong in countries such as the United Kingdom and the Netherlands with shops such as Fine Food Specialist, Wosiwosi (UK), Groentebroer and Versbestellen.nl (Netherlands). But the online food market is also growing significantly in Germany as a result of the COVID-19 pandemic. In Germany AsiaShopOnline.de, My-Asia-Shop and Get Grocery offer a range of fresh exotic vegetables.

Figures 6, 7 and 8: Examples of local fruit and vegetable shops in Barcelona

Photos by ICI Business

Tips:

- Start your market entry in the wholesale channels to gain experience. Depending on your specific product you can gradually expand your business to larger importers and non-specialised retail.

- Offer different options for consumer packaging if you are interested in supplying supermarkets.

4. How to do business with buyers of exotic vegetables?

Trust is an important part of doing business in exotic vegetables, especially because of the informal nature of the trade and the risks of shipping a perishable product. Doing business is a trade-off between a potential profit and the risk you are willing to take. To avoid disappointment, it is best to build long-lasting relationships and negotiate conditions that are acceptable for both parties.

Relationships matter when doing business

The trade of exotic vegetables requires a high level of trust. Many companies are small business operators and do not have the same resources or certainties as the leading fresh produce companies.

Most importers maintain long-lasting trade relations and some would even argue this is worth more than a written contract. Much of the business is done on a personal level. Contact can initially be established in person (at trade fairs), by phone and by sending information by e-mail. Then, the relationship can be built over time with experience.

With the focus on day-trading and keeping products fresh, not everybody spends the same amount of time and attention on formalising their business. Smaller trade partners and individual entrepreneurs seem to focus on different aspects of the business at the same time, without having personnel specifically for purchasing, logistics, wholesaling and administration.

Buyers prefer suppliers with experience in Europe

Suppliers of exotic vegetables face the same challenges as their counterparts when it comes to checking the trustworthiness of a trade partner. Each company has its own way of doing due diligence.

Buyers of exotic vegetables will often check your company details and ask for photos of the product. Sometimes they will check your reputation with other importers, using your previous activities in Europe as a point of reference. So if you have experience on the European market, that will work in your favour. As a supplier you can also check different criteria and do your due diligence:

- Check if the company is registered, for example at a chamber of commerce. You can find an overview of registers in the EU on the website of the Dutch Chamber of Commerce (kvk.nl).

- Find out how many years the company has been operating. If it has been in operation for multiple years, you will at least know that it is not a ‘pop-up’ or temporary company.

- Find the company’s financial data through the registers mentioned above.

- Check the company’s creditworthiness, for example through your insurance agency or a credit rating agency.

- Check the physical location and website of the company. Does it have an office or is there only a home address?

If you do not trust your potential buyer:

- Ask for references and check their reputation (if possible).

- Ask for financial proof such as a financial report.

- Work with a bank guarantee or have the buyer pay up front.

Purchase and payment conditions vary

Purchase and payment conditions vary in the import of exotic vegetables. Orders can be paid for before shipment, after arrival or both in partial payments.

The conditions depend on the company’s policies, their negotiation power and which party is more eager to do business. There are importing wholesalers that refuse to pay up front, while others have difficulties obtaining the products without making an advance payment. Buyers are most concerned about receiving products that are not suitable for the European market in terms of pesticide residues or marketable quality. A lot can go wrong with fresh tropical vegetables, such as okra. For some companies this can be a reason to prefer paying for a shipment after arrival. Documentary credits such as cash against documents (CAD) or letters of credit (LCs) are not common because they take time and are expensive.

Purchase and payment conditions also change over time. Some importers will start with pre-paid shipments and negotiate better payment conditions (for themselves) as they build a relationship with their suppliers.

Because of the speed of trading exotic vegetables, the price is often fixed. Rarely is there a minimum price guarantee (MPG) or account of sales with these niche products. Bank transfers can be slow in some countries, and buyers may use other types of money transfers such as Western Union.

Agreements and contracts can be informal

Informality can be an additional risk in the trade of exotic vegetables. Sending invoices and confirmation by e-mail is a common practice. But there are also companies that prefer to work with contracts.

Smaller companies, in particular, will often be willing to do business without formal contracts. But as a supplier it is always wise to have the specifics and the conditions of an agreement written down, especially when payment is to be made following shipment. A contract provides clarity in case of a claim or non-compliance.

When you start doing business with a new client, it is best to begin with small shipments to reduce the risk. You can also choose to do business exclusively with clients that pre-pay their order. But this will also reduce your potential market.

Whatsapp is the new communication tool

Whatsapp has become a preferred communication tool. Buyers say it is easier to read and respond on a message when it suits them. It is also ideal for sending photos of the product prior to shipment. E-mail is often preferred over the communication by phone – this is usually because of lack of time or time differences. When you are working on client acquisition you can send an e-mail and follow up by phone.

Tips:

- Have your insurance agency check the creditworthiness of your buyer. Insurance companies usually have access to information on the financial situation of companies.

- Always do due diligence and determine your negotiating position with new clients. Make your decision to do business by balancing risks against what each party has to gain from the trade.

- Work with contracts and clear conditions – if necessary, define your own supply terms. The risk of a low-quality product that performs poorly in conformity checks is high due to the fact that exotic vegetables are often grown in tropical climates by small farmers. A contract can clarify how trade parties deal with a quality claim. Have clients confirm acceptance of the shipment as soon as products arrive. You can compare your agreement with examples of contracts used by companies in Europe, such as the purchase conditions of Hagé (part of the Greenery) or the general sales conditions of FairFruit or TotalExotics.

- Read the CBI Tips for doing business and Tips for organising your export of fresh fruit and vegetables to more about building relationships and making contracts.

5. What are the main requirements for exotic vegetables?

The general requirements for exotic vegetables are the same as for other fresh fruits and vegetables, but the inspections for several exotic products and origins are more rigorous. The more issues authorities find with certain products or origins, the higher the inspection rate will become. Products must be free of pests and pesticide residues. Individual buyers also put a lot of emphasis on freshness and price.

Pests and pesticide residues are a main concern

Residue testing and phytosanitary compliance are a key concern for European importers. Only suppliers that can comply with effective pest control and low pesticide residues have a chance on the European market.

Exotic vegetables and their origins are often considered high risk in terms of plant and food safety. Practically all fresh vegetables require a phytosanitary certificate. There are specific phytosanitary regulations for certain pests and origins of aubergine, chilli peppers, root vegetables and bitter melon. Products from several origins are subject to increased control when entering the European Union (see Table 3). These phytosanitary and product inspections are strict and expensive.

Table 3: Inspection rate for pesticide residues

| Fresh product | Country of origin | Inspection rate |

| Okra | India | 10% |

| Vietnam | 50% | |

| Chilli peppers | Turkey | 10% |

| Thailand, Uganda, Pakistan, Egypt | 20% | |

| Vietnam, Dominican Republic | 50% | |

| Yardlong beans | Cambodia, Dominican Republic | 50% |

| Chinese celery | Cambodia | 50% |

Source: European regulation 2019/1793

Freshness is the most important quality requirement

Freshness is top of mind for both consumers and professional buyers. Ethnic consumers prefer buying more often to guarantee the product’s freshness. Therefore, importers also prefer to buy smaller loads which they can sell in a short amount of time.

Freshness is also important in the regular vegetable business, but there is much more focus on convenience and extending product shelf life. This is in contrast to the ethnic market, where freshness and flavour must not be compromised. For this reason, many of the vegetables for the ethnic market are air-freighted.

Ethnic consumers are price conscious

Exotic vegetables are relatively expensive due to their small trading size, often in combination with high air-freight costs. Still, price is a key consideration for consumers. The traditional consumers are willing to pay for quality, but most of these consumers are not particularly wealthy. As a result, European buyers are also price-focused and compare different origins to find the best deal.

For example, Spain is able to produce okra, but personnel costs there are high. One buyer mentioned that it is cheaper to import okra from countries such as Jordan (May-September) and India (in winter).

Preference for a secure supply

Demand for exotic or ethnic vegetables continues all year round. European buyers prefer sourcing from producers that can offer a secure supply, guaranteeing availability and uniform quality. Different origins can be combined to ensure the product can be sourced throughout the year.

Certification starts with GLOBALG.A.P.

Just as with other fresh fruits and vegetables, GLOBALG.A.P. has become an almost standard requirement for exotic vegetables. It is a must for larger retail chains and Asian supermarkets, but it also shows a basic level of good agricultural practices to the importer. Other (social) standards such as SMETA are recommended, but are not always required.

Tips:

- Do your own product checks before shipping to avoid the risk of your product not being accepted into the EU market.

- Read more about the general buyer requirements for fresh fruits and vegetables on the CBI market information platform.

- Use the EU’s My Trade Assistant to see a full overview of legislation and export requirements for your specific product (use the HS code (see Table 1)).

6. How can you best organise your export of exotic vegetables?

When you export your exotic vegetables, you are expected to use quality packaging and flawless cold-chain logistics to maintain freshness. You can reduce your risks by taking out insurance and making sure you have control over your product and shipment.

Logistics: small volumes

Wholesalers prefer to buy smaller quantities to ensure optimal freshness. Because of the focus on freshness, you must opt for the most efficient logistics. This is most often air-freight.

For products that can be shipped by sea, mixed load containers can be an attractive option for selling a variety of vegetables. Only do this with products that can be kept under similar conditions and which will not affect each other’s quality.

The commonly used Incoterms vary a lot among different buyers: Ex Works (EXW), Free On Board (FOB), Cost and Freight (CFR), etcetera. Most buyers opt for CFR when vegetables are air-freighted. In some cases, the buyer does not even know which Incoterms are being used. The main interest of buyers in Europe is proper cold-chain logistics and that the products arrive in good shape.

It is important for exporters to check the Incoterms in combination with the payment conditions. You must be aware of who is responsible for the product during shipment and who is the main risk taker. When you sell your product FOB (Free on Board), your buyer is responsible for most of the logistics and risk. But if your product is paid for after arrival, your buyer can still refuse to pay if something has gone wrong during transport. Remember that Incoterms do not protect your business against non-payment.

Insurance

Cargo insurance is recommended, but it is not uncommon for an importing company to leave the responsibility for insuring the goods to the supplier or not be insured at all. Transport via air freight is fast and this may be a reason why less attention is paid tor cargo insurance.

Export credit insurance can be helpful if you are not sure about the financial status of your client. It is also convenient to check the creditworthiness of your buyer through the insurance agency.

Packaging

Every exotic vegetable has its own packaging specific to the type and variety you are selling. For most products and wholesale markets these are quality carton boxes with 2, 3, 4 or 5 kilos. Some clients prefer additional plastic liners to be used to protect the vegetables.

Retail packaging is less common. But it can be an asset when your product is in demand with conventional supermarkets, for example for small green asparagus or baby corn (see Image 5).

Figure 9: Example of a consumer packed vegetable, supplied by Koerner Agro in Thailand and distributed by Nature’s Pride in the Netherlands

Photo by ICI Business

Double check your product

Always double check your product before shipment. Check your products regularly for pesticide residues and take pictures of the product and its packaging prior to shipping. Work accurately to avoid products being rejected at the EU border.

Tips:

- Be aware of a lack of knowledge about Incoterms or insurance among importing wholesalers. Take control over your own shipment and learn to understand the Incoterms and responsibilities.

- Maintain perfect cold chain logistics and collect evidence of the quality of your production, such as photos or read-outs from sensors and data loggers in containers. Data is useful for finding the source of a problem in case your buyer makes a quality claim. See how the smart data logger MOST works, for example.

- Find the best logistics options, such as direct flights in the case of air freight.

- Compare insurance rates. Insurance rates can vary a lot depending on your volumes and origin.

- Read the CBI tips for organising your export of fresh fruit and vegetables to learn more about packaging and cold-chain logistics.

7. How can you find buyers of exotic vegetables?

Many buyers have their established trade relationships and are not actively looking for new suppliers. But in the fresh exotic vegetable market there are always opportunities as product availability varies. The buyers are diverse with different types of players from small ethnic buyers to big international specialists in exotic fruit and vegetables. Trade fairs and wholesale markets are good starting points for making contact.

Visit trade fairs

Trade fairs are still one of the main ways for fresh produce companies to meet new suppliers. Companies that trade in exotic vegetables are no exception. European wholesalers may not have their own stand at the trade fair, but they take advantage of the opportunity to visit or meet with foreign suppliers.

Use your contacts and try to schedule meetings with buyers if you plan to attend a trade fair. Larger importers will have a stand and can be found on the list of exhibitors.

The main trade fair is the Fruit Logistica in Berlin, Germany. The Fruit Attraction in Madrid, Spain, is also gaining importance and offers opportunities for a wide range of vegetables.

Due to the COVID-19 pandemic the most recent edition of the Fruit Logistica could not take place in its traditional form. The next fair is planned for February 2022.

Use marketing to attract new buyers – your name on the box

Several wholesalers admit they get new supplier names from the vegetable boxes of other wholesalers. At wholesale markets the boxes are piled up and are easy to check when passing by. So it is easy for wholesalers to copy other buyers.

Remember that experience counts. Buyers have more confidence in companies that are already actively supplying the European market. Having your brand and name clearly visible on the box will help spread your name throughout wholesale markets and beyond.

Browse through the member lists of wholesale markets

Wholesale markets generally have a list of the companies that operate there. These member lists can be used to find wholesale buyers that import exotic vegetables. See the list of wholesale markets mentioned previously in this study.

Do internet searches and use LinkedIn

Some of the companies in Europe, especially those that are new on the market, admit they search for new contacts online. Professional online networks such as LinkedIn are also used. Even though your potential buyer may not be easy to find, as a supplier you can increase your visibility and chances on the market by presenting yourself well on the internet.

Tips:

- Make sure your product looks attractive in nice packaging and with a clear name on the box. On the wholesale markets your vegetable box is your calling card.

- Create a profile on LinkedIn and a website that can be found easily. If you have experience in Europe, highlight this experience on your website. Take for example the Indian company Nature One Fresh Produce, which caters primarily to the European market and has over 2,000 followers on LinkedIn.

- Visit trade fairs and make the most out of them by being well-prepared and scheduling meetings and contacting potential buyers in advance.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research