Exporting fresh melons to Europe

Melons, including watermelons, are one of the main fruit categories in Europe. Convenience and taste are important drivers for consumption. The market is supplied by European melon producers and complemented by exporters, mainly from developing countries. It is a competitive market and as a supplier you must keep quality and differentiation in mind.

Exporting fresh melons to European markets offer opportunities. From trends which offer opportunities in the European market for fresh melons, to what requirements must fresh melons comply with to be allowed on the European market and which trade channels can you use exporting fresh melons on the European market.

Contents of this page

- Product description fresh melons

- Which European markets offer opportunities for exporters of fresh melons?

- Which trends offer opportunities in the European market for fresh melons?

- What requirements must fresh melons comply with to be allowed on the European market?

- Which additional requirements do buyers often have?

- What are the requirements for niche markets?

- What competition will you be facing on the European melon market?

- Which trade channels can you use to put fresh melons on the European market?

- What are the end-market prices for fresh melons?

1. Product description fresh melons

Melons are part of the Cucurbitaceae family. Officially they are a vegetable, but they are more often classified as a fruit.

Originating in Africa and the Middle East, melons are now produced globally, mostly in hot, sunny climates, including Southern and Eastern Europe.

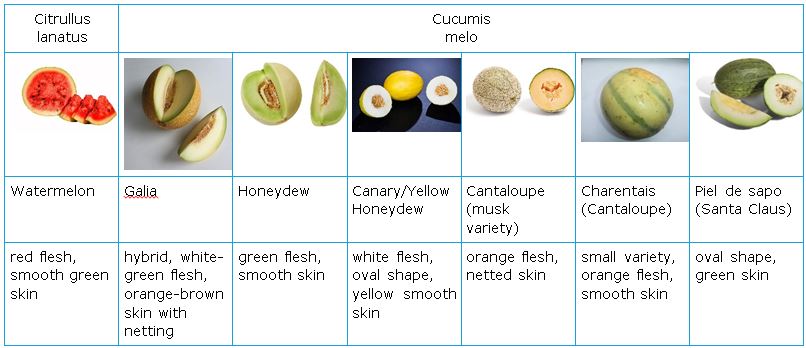

The most common varieties for consumption in the European Union (EU) are from the genera Citrullus and Cucumis:

Table 1: Overview of common melon varieties in Europe

Source images: Wikipedia

See further information on melon varieties on Clovegarden.

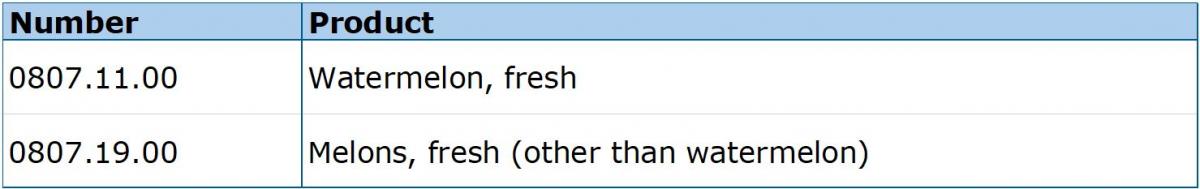

Table 2: Combined Nomenclature (CN) Code for fresh melons

Source: Eurostat Comext

2. Which European markets offer opportunities for exporters of fresh melons?

European import is almost exclusively from developing countries

Based on trade and production figures, Europe consumes roughly 3 million tonnes of watermelon and just over 2 million other melon varieties annually. Between 10 and 15% of the melons that are consumed are imported. The imported melons are almost exclusively from developing countries.

Watermelon is the most popular melon, with fast growing volumes and a diversity of suppliers. For other popular melon varieties, such as Galia, Cantaloupe, Yellow Honeydew and Piel de sapo, Brazil is the leading supplier to Europe.

You can find importers in Europe for many melon varieties, and most will have overseas suppliers. However, the production volumes are sometimes difficult to predict and markets can easily become saturated by an abundant supply.

Tips:

- Read the tips for finding buyers on the CBI market intelligence platform.

- Keep yourself informed by reading news updates, such as the regular overview of the global melon market on Freshplaza.

Watermelon imports are increasing in many European countries

In most European countries, imports of watermelons are on the rise. The suppliers are diverse and trade channels are direct. Your location can be decisive in determining your best market options.

The Netherlands and the United Kingdom obtain most of their imports from Brazil. Spain and France are more focused on watermelons from Morocco and other North-West African suppliers (Senegal, Tunisia). In Senegal, Spanish companies have invested in watermelon production and import early in the season. Poland also has a relative high import volume and receives part of its watermelon from the east, such as Ukraine and Turkey. Note that the statistical data for 2017 may still be subject to updates.

European countries have different preferences

Opportunities and preferences for specific melon varieties differ per consumer market. Galia is one of the most common melon varieties that is widely available throughout Europe. Some of the other varieties are typically consumed in specific regions.

For example, the Charentais (cantaloupe type) is a traditional melon in France. The Piel de sapo is a Spanish favourite, but nowadays also increasingly sold in northern Europe, same as the yellow honeydew variety.

In watermelons, the mini and seedless varieties are growing fast in demand due to their convenience and ‘personal’ size. Smaller and seedless watermelons are most popular with the mass public in Northern Europe. Ethnic markets still have a demand for seeded watermelons, similar to the Mediterranean region. Traditional or ethnic consumers are used to the seeds and value taste over convenience.

Tip:

- Make sure you understand the different preferences in Europe and compare your product with the popular melons that are sold in Europe. Your product must fit the consumer expectation of your target country. Failing to adapt will decrease both your selling chances and price.

The Netherlands is the main point of entry for non-European melons

For exporters from developing countries, the Netherlands is a main point of entry. From here, Dutch and international distributors supply the European market. Important destinations for re-export from the Netherlands are Germany, Scandinavian markets, the United Kingdom, Poland and Belgium. Large consumer countries such as the United Kingdom and Germany can often be supplied directly as well.

Tip:

- If your focus is the European market as a whole, consider finding your importing partner in a main trade hub such as the Netherlands.

Top 3 importers: Germany, United Kingdom, France

The United Kingdom and Germany barely export melons. Together with France, they share the largest net import volume (imports minus exports). Part of this volume is supplied by overseas companies, directly or through logistical hubs such as the Netherlands.

For watermelons, Germany is by far the largest net importer (€187 million), ahead of France and the United Kingdom. The United Kingdom has the highest net imports of other melon varieties (€144 million), followed by Germany and France.

Tip:

- Get in contact with the main traders for melons by visiting trade fairs such as Fruit Logistica and Fruit Attraction.

Producing countries consume more melons than importing countries

Despite the higher imports in Northern Europe, you can find the strongest melon consumption in the producing countries in the south, such as Spain, Italy and Greece. Spain is one of the main producers and suppliers of melons to Europe. In 2017, Spain supplied Europe with 738 thousand tonnes of watermelons and 439 thousand tonnes of other melon varieties.

As a supplier, you may find the best opportunities in the northern countries that depend most on imported melons. Nevertheless, producers in Southern Europe are looking to fulfil their supply all year round as well, with early-season supply from ‘nearby’ producing countries such as Morocco and Senegal.

Local melon production takes over summer supply

Spain is Europe’s main producer of melons and by far the largest European exporter of melons. Spanish growers are your main competitor throughout Europe during the summer months.

Other European production that affects you when exporting near the summer are the watermelons from Italy and Greece (see Figure 4). Romania is a large producer of watermelons, but mostly produces for the internal market.

Several other melon varieties are not only produced and exported by Spain, but also by Italy and France (see Figure 5), such as the Charentais and other cantaloupe varieties, Piel de sapo (also ‘vert olive’ in France) and Galia melons.

Tip:

- Find more information about your competition in different seasons below and in Figure 8.

3. Which trends offer opportunities in the European market for fresh melons?

Freshly cut melons and seedless watermelons

The consumption of melons is supported by developments in convenience. Consumers in Europe save time by purchasing freshly cut melons in individual packaging. They are ideal as fruit snacks. Watermelons are increasingly sold in seedless varieties as well as mini sizes. Consumers are prepared to pay a premium price for easy-to-eat fruit and individual portions.

The trend in convenience has been strongest in northern European countries, such as the United Kingdom and the Netherlands. Supplying seedless watermelon and working closely together with packers and processors can increase your success on the European market.

Consumer experience requires excellence in taste

For the consumption of melons, taste and a constant quality are determining factors for purchasing. The increasing importance of taste is visible along the whole fruit segment. Suppliers of melons increase their success through excelling in taste and enhancing consumer experience.

Well-ripened, sweet and soft-fleshed melons have the preference. On the other hand, prematurely harvested and unripe melons, often at the beginning of the season, can have a negative influence on consumer behaviour for the rest of the season.

Seed companies constantly develop new melon varieties that are tastier, have good yields and a longer shelf life.

Tips:

- Make sure that your harvest and cold chain are perfectly managed. This is crucial to reach the right quality that is expected by the European importers and retailers.

- Experiment with different seeds and improve the quality and profitability of your product.

Growing interest in sustainable fruit

The consumption of fresh fruit in Europe is developing towards a more sustainable approach to production and processing. Environmental and social issues are becoming more and more important. Social and environmental certification schemes include actions to strongly reduce and register the use of pesticides, take action on the safety of employees and/or even include price guarantees.

Certification schemes that are in line with the Global Social Compliance Programme (GSCP) will have a higher chance of being accepted by European supermarkets.

Tips:

- Check the Global Social Compliance Programme (GSCP) website for more information about social and environmental conduct.

- Read more about which trends offer opportunities on the European fresh fruit and vegetables market on the CBI marketing intelligence platform.

4. What requirements must fresh melons comply with to be allowed on the European market?

What legal and non-legal requirements must your product comply with?

Minimise pesticides

Pesticide residues are one of the crucial issues for fruit and vegetable suppliers. The European Union (EU) has set maximum residue levels (MRLs) for melons.

Products containing more pesticides than allowed will be withdrawn from the European market. Note that buyers in several Member States, such as the United Kingdom, Germany, the Netherlands and Austria, use MRLs which are stricter than the MRLs laid down in EU legislation.

Tips:

- To find out the MRLs that are relevant for melons, you can use the EU MRL database, in which all harmonised MRLs can be found. You can search for your product or pesticide used and the database shows the list of the MRLs associated with your product or pesticide.

- Reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

- For other general requirements concerning contaminants, traceability and plant health control, check the buyer requirements for fresh fruit and vegetables on the CBI market intelligence platform for fresh fruit and vegetables.

Quality

For the marketing of fresh melons in the EU, the General Marketing Standards of Regulation (EC) No. 543/2011 apply. This regulation refers to the United Nations Economic Commission for Europe (UNECE) for the following marketing standards and commercial quality control for melons:

Melons are categorised in quality classes I and II. The European market principally demands class I melons, only allowing for small defects. As a minimum requirement in all classes, the melons must be:

- intact, firm, sound and fresh in appearance;

- clean, free of visible foreign matter;

- practically free from pests and damage caused by pests;

- free of abnormal external moisture, foreign smell or taste.

The development and condition of the melons must be such as to enable them to withstand transportation and handling.

Size

The official marketing standards maintains the following size requirements for melons:

- The size for watermelons is determined in weight per unit.

- The minimum size for Charentais, Galia and Ogen type melons is 250 g in weight or 7.5 cm in diameter.

- The minimum size for other melons is 300 g or 8 cm.

Uniformity in size and quality is important. To ensure uniformity in size, the range in size between produce in the same package shall not exceed:

- 2 kg or 3.5 kg if the lightest unit exceeds 6 kg in the case of watermelons;

- 30% more than the weight of the smallest and 10% more than the diameter of the smallest for Charentais melons;

- 50% more than the weight of the smallest and 20% more than the diameter of the smallest for other melon varieties.

Buyers will be very specific about their required sizes, so ask for their specifications. Often around 5 melons or 3-5 watermelons are packed per box.

Packaging

In the trade of (bulk) fresh melons, the use of standardised cardboard (or plastic) boxes is recommended. Packaging requirements and sizes differ between customers and market segments, as well as the type of melon.

- Common melon varieties such as Galia and Cantaloupe can come in boxes of 5, 6, 12 or 13 kg. Small boxes are packed with 4 to 7 melons. Larger boxes contain 7 to 10.

- For the oval shaped yellow Honeydew and Piel de sapo melons, 10 kg boxes are often used, packing 4-12 melons.

- Watermelons are often packed in 16-18 kg boxes (2-6 melons per box), depending on their size and weight (2.5-9 kg). Watermelons from Spain, Greece and Turkey are sometimes traded in larger bins.

They must at least be packed in new, clean and high-quality packaging to prevent damage and protect the product properly.

The Food and Agriculture Organisation’s (FAO) Recommended International Code of Practice for Packaging and Transport of Tropical Fresh Fruits and Vegetables (CAC/RCP 44-1995) includes guidelines for proper packaging and transport in order to deliver the products in good condition.

Labelling

The label or marking of each box should at least give the following information:

- Name and physical address of the packer and/or dispatcher (which can be replaced by an officially recognised code mark)

- Name of the product (if not visible from the outside) and the commercial type

- For watermelons, indicate if seedless and mention colour if not red

- Country of origin

- Commercial identification: class, size in minimum and maximum weight or diameter and optionally number of units

- Officially recognised code mark or traceability code (for example Global Location Number (GLN) or GLOBALG.A.P. number (GGN) (recommended)

In addition, the label should include any certification logo (if applicable) and/or retailer logo (in the case of private label products).

Tips:

- Check out laser printing technology for sustainable or organic labelling.

- Consult the EU Trade Helpdesk for a full list of requirements for melons, selecting the product codes for melons (08071900) or watermelons (08071100).

5. Which additional requirements do buyers often have?

Certification as guarantee

Since food safety is a top priority in all European food sectors, you can expect most buyers to request extra guarantees from you in terms of certification.

The most commonly requested certification for melons is GLOBALG.A.P., a pre-farm-gate standard that covers the whole agricultural production process, from before the plant is in the ground to the non-processed product. It is nearly impossible to supply melons without GLOBALG.A.P., as it has become practically a standard requirement for most supermarkets.

Examples of other food safety management systems that may be required are:

- BRC (British Retail Consortium)

- IFS (International Food Standard)

- FSSC22000 (Food Safety System Certification)

- SQF (Safe Quality Food Programme)

These management systems are supplemental to GLOBALG.A.P. and are recognised by the Global Food Safety Initiative (GFSI).

Tips:

- Identify the food safety management systems that are usually requested in your target market. Expect GLOBALG.A.P. to be one of them.

- Read more on the various food safety management systems on the Standards Map website.

- Always remember that food safety is a major issue. Work proactively with buyers to improve food safety, be transparent and remain up to date with regard to buyer requirements and regulations.

Social and environmental compliance

There is growing attention for the social and environmental conditions in the producing areas. Most European buyers have a social code of conduct which they will expect you to adhere to. For melons, social and environmental compliance is important. For most large retailers, this is a must.

Important ways to prove yourself as a responsible supplier of melons are through:

- GRASP, a social add-on of GLOBALG.A.P. and an accessible certification that is gaining importance in Europe.

- SMETA, which stands for the Sedex Members Ethical Trade Audit. SMETA was developed by the non-profit member organisation of Sedex with the objective to facilitate the exchange of information on social compliance.

You increase your chances by implementing standards that are recognised by the Sustainability Initiative Fruit and Vegetables (SIFAV). This comprises an initiative from traders and retailers to become 100% sustainable in sourcing fresh produce from Latin America, Africa and Asia by 2020.

Actual fair-trade labels are very niche in the melon trade and have generally lost some attention in the fresh trade due to their high cost and complexity.

Tips:

- Examine your company’s current social performance, for example by completing a self-assessment on the amfori/BSCI website.

- For a complete overview of buyer initiatives for social compliance, see the buyer requirements for fresh fruit and vegetables on the CBI marketing intelligence platform.

6. What are the requirements for niche markets?

A growing niche market for organic melons

An increasing number of consumers prefer food products that are produced and processed by natural methods. For melons, organic certification is not a main requirement, but with a general market share of 1 to 8%, it can still be an interesting market. You will find most opportunities for organic melons in northern Europe, especially in German-speaking and Scandinavian countries.

Most organic melons are supplied by Europe itself. The supply of organic melons from overseas is still low due to transit times and the limited possibility of preservation. Recently, importers have started importing organic melons from Brazil.

In order to market organic products in Europe, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier.

Tips:

- Consider organic as a plus, not as a must, and be prepared to comply with the whole organic process. Remember that implementing organic production and becoming certified can be expensive. Transit times are also an important factor for being able to supply organic melons to Europe.

- Find companies that specialise in organic produce that understand the market and have access to this niche market. Look for organic buyers using specific databases such as Organic-Bio.

- Read more about the principles of organic agriculture on the website of IFOAM Organics International.

7. What competition will you be facing on the European melon market?

Morocco shows exponential growth in the export of watermelons to Europe

The main non-European suppliers of watermelons in 2017 were Morocco (€86 million) and Brazil (€54 million), both of which significantly increased their exports to Europe. Morocco has the advantage that it produces watermelons nearby Europe, just before the European season starts.

However, other countries can also profit in the watermelon trade with Europe. Several other suppliers, for example Costa Rica, Turkey and Panama, export volumes worth between €9 million and €43 million (see Figure 6).

Tip:

- Make sure you are able to organise a good logistical route and compete with companies from other areas.

NB: Trade figures for 2017 may still be subject to revision.

Brazil and Costa Rica fill up the off-season supply

The main supplier of melon varieties other than watermelons is Brazil (€206 million). Together with Costa Rica, Morocco and Honduras, it meets an important part of the off-season demand in Europe.

The supply is more stable than that of watermelons. To compete in this market, you must be able to meet the same standards and have a similar (or better) offer than the current suppliers. This is something to check regularly with your (potential) clients. Most successful suppliers manage large volumes and have well-organised partnerships with European counterparts.

NB: Trade figures for 2017 may still be subject to revision.

Tip:

- If you cannot compete in volume and price, try to focus on other aspects to differentiate yourself. Consider special varieties and other types of buyers.

Production levels can easily oversupply the market

Production volumes worldwide are large and the European demand for melons (especially watermelons) in winter is smaller than during the summer. Warm weather can boost the demand for watermelons, but a bad summer can do exactly the opposite. The fresh melon market can easily be oversupplied.

Overseas import usually runs from September to April. Harvest seasons often overlap, however, and sometimes shift depending on the climate. The level of competition is variable, which makes it important to plan your production well and find opportunities in supply gaps. For example, Senegal can be a good alternative with its shorter distance for the supply from Central America, and producers in Israel could find a small space between the Spanish and Brazilian season (see Figure 8).

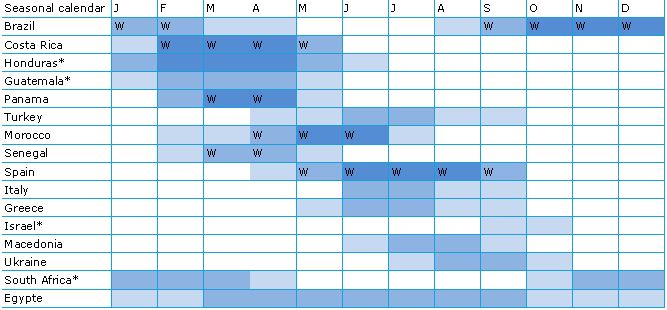

Figure 8: Indicative production & supply of melons (including watermelons)

Sources: Watermelon.org, Eurostat, news sources and experts

W = watermelon season

*Honduras, Guatemala, Israel and South Africa mainly export other melons than watermelons.

Tips:

- Stay on top of the developments and the supply from competing countries and plan for the right moment, but avoid premature picking. News sources in the fresh business such as Freshplaza and FreshFruitPortal can be good sources of information.

- Experiment with early or late varieties and try to find gaps in between seasons. Try to avoid the European production season.

- Maintain product quality at the beginning and the end of the season. Do not harvest premature melons or melons with a low sugar content.

Supermarket are well positioned in the competitive melon market

Rivalry is fierce in the trade of fruit and vegetables and large European retailers have a dominant position. As a supplier of fresh produce, you are not in a position to argue about the rules of the game. This is not any different for melons. It is a large category with several strong players.

Supermarkets have a very strong position and the highest standards, especially in northern Europe. There is a preference for long term partnerships, but buyers will switch to other suppliers if expectations are not met.

Tip:

- Find an experienced importer before entering the European market, especially if you are aiming for large retailers.

High standards are necessary to enter the market

Entering the European market is a big hurdle for many companies because of certification and the need to meet both legal and non-legal requirements. There are established importers of fresh melons with extensive experience and steady relations in various producing countries. In order to achieve similar relations, supplying top quality and/or product differentiation are a necessity.

Tips:

- Do not compete on price alone, but build partnerships with buyers and strive for excellent product quality and handling.

- Establish a credible track record, including transparent information on your company and product quality. Being part of a stable partnership and being a trustworthy supplier can help you to establish and maintain your position on the market.

- Read the CBI tips for doing business with European buyers.

Product competition

Fresh melons can be substituted by other tropical fruit or by other melon varieties. Local preferences and attractive offers play a role in the product choice. For example, an attractively priced Galia melon can be more attractive to a German consumer than a more expensive melon, while in Spain a tasty Piel de sapo is preferred over any other variety. France has local Cantaloupe varieties that can push imported melons out of the market. In the United Kingdom, whole melons are exchanged for the convenience of freshly cut packages.

As an exporter, you must be aware of the different preferences and varieties that will compete with your product. You must understand the market before you can find the right opportunities for your product.

Tips:

- Use storytelling (e.g. show its origin and producer) and premium quality as methods for setting your product apart.

8. Which trade channels can you use to put fresh melons on the European market?

Supply chains become integrated

In general, sourcing and distribution is a strong expertise of importers. However, fresh melons are mainly sold in larger retail stores, such as supermarkets and hypermarkets, and the supply chain in these market segments is becoming increasingly integrated. For large-fruit categories, supermarket chains often enlarge their control and sometimes organise their own sourcing programs.

Supermarkets are exceptionally strong in the northwest of Europe. In Southern and Eastern Europe, street markets and specialised retailers have a more significant role than in Northern Europe.

Tip:

- Be prepared to commit to a joint cooperation and accept supermarket conditions in order to work with large retailers.

Branding strategy with importers

Importers/distributors differ in their relationship with the retail sector. Some are suppliers for private-label products, others have their own brand, while yet others market the brand of a producer (cooperation).

Branding your product will give you the advantage of setting your product apart from the rest. It is best to do this in cooperation with an importer, because they are often experienced in marketing branded products.

Tip:

- Choose the right importer, based on the size of your company or marketing strategy.

Alternative channels for larger sizes

Wholesalers for food services (e.g. caterers, restaurants), cash and carry and street markets are more likely to sell larger sizes of melons (especially watermelons), while supermarkets strive for convenience and smaller sizes.

Increasing processing channel in northern Europe

Freshly cut melons in consumer packages are becoming more popular, especially in northern Europe. This means that some of your melons will pass through food processors. This channel is ideal for melons that visually do not live up to the expectations of the critical consumer, but are internally sound.

9. What are the end-market prices for fresh melons?

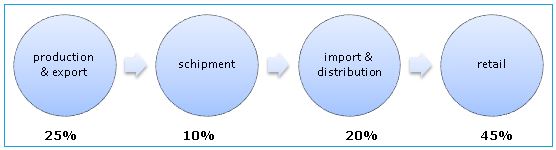

Figure 9: Consumer price breakdown for melons

The consumer price of regular, small-sized melons found in the main retail outlets varies between 2 and 3 euros per piece. Mini watermelons can be purchased for around the same price. Larger watermelons are often sold for a price per kilo, approximately 2 euros per kilo.

Mainstream melons such as the Galia melon are lower priced than Piel de sapo or yellow Honeydew.

Prices are slightly lower during the summer months, when fresh melons are available from suppliers such as Spain and Italy.

Melon prices on street markets are usually lower than in supermarkets.

Tip:

- Check retail prices through the online shops or assortments of supermarket chains such as Tesco, Albert Heijn, Rewe, Hipercor or Carrefour. Be aware that these prices have little to no connection with international trade prices.

Please review our market information disclaimer.

Search

Enter search terms to find market research