Entering the German fresh fruit and vegetables market

Germany is a demanding market. Consumers are very price driven, but they also want the best quality and sustainability standards. Food safety standards are stricter than the European and German law. Certification is the most important proof of compliance, and it is expected to become more important. The leading end-market segments for fresh produce in Germany are retailers and discounters. Importers are the best channel to enter this segment. Suppliers from developing countries face competition from locally grown products and other suppliers from developing countries.

Contents of this page

- What requirements and certification must fresh fruit and vegetables comply with to be allowed on the German market?

- Through what channels can you get fresh fruit and vegetables on the German market?

- What competition do you face on the German fresh fruit and vegetables market?

- What are the prices for fresh fruits and vegetables in Germany?

1. What requirements and certification must fresh fruit and vegetables comply with to be allowed on the German market?

Germany follows the European Union (EU) legal standards and requirements. This includes mandatory requirements regarding tariffs, quotas, packaging, labelling, food safety and sustainability. For some topics, such as food safety, quality and sustainability standards, German buyers have stricter requirements than general legislation and other European markets.

Tip:

- Read the CBI study about buyer requirements in the fresh fruit and vegetables sector for all of the information about European legal and non-legal requirements applicable to Germany.

What are mandatory requirements?

Stricter requirements than the law

The Federal Office of Consumer Protection and Food Safety (BVL) is the national body that grants authorisations and runs monitoring programmes with the Federal States, or ‘Bundesländern’, in Germany. It is responsible for the official food control and inspection.

Fresh fruit and vegetables for the German market must comply with the EU’s legal food safety requirements at least. The use of plant protection and post-harvest treatment products cannot exceed the limits established by European legislation. You must provide residue analyses to show you are meeting these standards, but buyers may perform analyses as well. Analyses must be carried out by accredited laboratories. Several German buyers prefer QS-approved laboratories.

Many suppliers from developing countries have problems complying with the strict maximum residue levels (MRLs) set by German retailers. LIDL and Kaufland (part of Schwarz Gruppe) have the strictest customer requirements. Their MRLs cannot be more than 33.3% of the European permitted levels. To see this in perspective, this percentage is 50% for REWE and 70% for ALDI.

Tips:

- Use the European MRL database to find the applicable MRLs for your product. You can search the database by product or pesticide.

- Ask your buyer for their product specifications and ask if your fruit needs to comply with specific requirements.

- Make sure you keep track of all your spray records as buyers often ask about them.

Green deal

In 2020, the European Union implemented a set of policies and actions called the European Green Deal. Its aim is to make the European economy more sustainable and climate neutral by 2050. The plan also includes a 50% reduction in the use of pesticides and an increase of the amount of land used for organic farming to 25% by 2030. This means that many pesticides will be banned, and residue levels will decrease slowly in the coming years. When supplying the German market, you must make sure your product is in line with changing regulations. German buyers are known for their strict enforcement of residue levels.

Compliance with marketing standards

The Federal Office for Agriculture and Food (BLE) controls the compliance with marketing standards in Germany. This is also the competent authority for monitoring imports from third countries (Figure 1).

Figure 1: The German Fruit and Vegetables Market – Quality through Inspection

Source: YouTube channel of the Federal Office for Food and Agriculture

The European Regulation (EU) No. 543/2011 sets the marketing rules for certain fruit and vegetables. For products that do not have specific marketing standards, the relevant UNECE standard must be applied.

Always ask your buyers about the specific quality requirements of their end client. However, you should expect German buyers to ask for the highest possible standards and top-quality products.

BLE developed a free programme called ELSKA to explain marketing standards for fresh fruit and vegetables in words and pictures. The programme also includes selected UNECE standards in their current versions, taking into account the German market demand.

Tips:

- Check out the full list of products included in ELSKA or run a search to display all the available pictures for a product. ELSKA is only available in German, but you can use the translation function in your browser.

- Think about hiring an independent quality control firm to oversee the quality of your product upon arrival in Europe. Some examples are D-Quality and Freshtech QMS.

GLOBALG.A.P. is a must in Germany

There is almost no German buyer that accepts a product that does not have GLOBALG.A.P. certification. Importers are required to supply only GLOBALG.A.P.-certified goods to comply with the requirements of their customers and the final consumers. This is explained by the importance of food safety in the country.

If you pack your own goods, the GLOBALG.A.P. certification must have the note ‘with product handling facility’. Otherwise, the GLOBALG.A.P. chain of custody Standard (CoC) or a HACCP-based food management system certification, such as IFS or BRCGS, is a must.

You must adapt these systems and maintain traceability throughout the chain, from cultivation to packing houses and logistical providers. You also need to do this for products re-exported to Germany from other European countries.

What additional requirements do buyers often have?

Sustainability standards

The German market is well-known for demanding sustainability certifications. Most German buyers follow the guidelines of the German Fruit Trade Association and Amfori BSCI. This is why both social and environmental standards are becoming necessary rather than an option for suppliers that want to enter the German market. The Sustainability Initiative Fruit and Vegetables (SIFAV) developed a basket of social standards and a basket of water standards. SIFAV members include leading German importers and retailers.

GLOBALG.A.P. also developed several add-ons related to sustainability aspects. The most famous is the GRASP assessment on social practice, which is used in combination with the Integrated Farm Assurance standard.

GRASP is the most important and widely accepted sustainability standard. However, producers must be ‘fully compliant’ with all the GRASP-evaluated criteria. If a producer does not have GRASP, there are other social standards that buyers accept after prior consultation with their clients. For some products, like bananas, avocados and mangos, GRASP is not enough. Depending on the product and the end-market, suppliers need to have Rainforest Alliance or Fairtrade certification. SMETA is still accepted, but it is no longer a must as it was some years ago.

The Alliance for Water Stewardship, Rainforest Alliance and other GLOBALG.A.P. add-ons like GLOBALG.A.P. SPRING, GLOBALG.A.P. BioDiversity and GlobalG.A.P. Farm Sustainability Assessment are the most common environmental standards. These certifications mainly show that you have responsible water management and a commitment to biodiversity protection. The GLOBALG.A.P. SPRING is mandatory for some countries where water scarcity is an issue.

GLOBALG.A.P. offers the possibility of registering your other certifications and schemes to your database GGN profile. This way, buyers can see your overall commitment to food safety and sustainability in one place. Many buyers are interested in having long-term partnerships and are willing to partner with their suppliers to help them meet new market requirements.

Tips:

- Before getting certified, talk to your buyers and look at the needs of the market. Ask about specific requirements for your product and country and explore partnership opportunities.

- Check the Global Supermarket Scorecard developed by OXFAM that analyses the policies and practices on human rights of leading supermarkets. It includes scores for the German supermarkets LIDL, ALDI, REWE and EDEKA.

- Read the CBI tips for becoming a more socially responsible exporter and the tips for going green in the fresh fruit and vegetables sector. The studies contain further information about sustainability standards and legislation.

The German due diligence legislation

In January 2023, the German Act on Due Diligence in Supply Chains (LkSG), also known as the new Supply Chain Act, entered into force. Certification plays an important role for affected German companies. Certification is expected to continue to grow in importance as this is how German companies affected by the legislation show compliance.

The German Supply Chain Act requires companies with a workforce of at least 3,000 and later companies with a workforce of at least 1,000 to ensure compliance with human rights along their entire supply chain. Although the duty of care only applies to the company’s business areas and their direct suppliers, companies must act if they have knowledge about human rights violations among their indirect suppliers.

As part of the legislation’s implementation process, many German importers include a commitment to provide requested information and reports within a certain period (two or three weeks) in their supplier declarations. They also include recommendations to their suppliers to ensure the implementation of measures to avoid the violation of human rights. These are the first steps, but you can expect stricter control overall in the near future.

Tip:

- Take a look at this video to understand the German due diligence legislation. The implications for suppliers not based in Europe are explained at 2:31.

Documentation

For German buyers, it is very important to back up what you say you have with corresponding documentation. The most important documents that German buyers ask from their suppliers before doing business are listed below. These requirements are often asked for by buyers supplying supermarkets and with strict end-market segments. The documentation in the spot market might be simpler.

- Copy of your certificates

- Quality specifications

- Laboratory analysis

- Traceability procedures

- Detailed field information

- Spray records detailing which inputs were used in what quantities

- Signed supplier declaration

- Supplier questionnaire

If you are asked to fill in a supplier questionnaire, take the time to answer it and deliver it on time. This is the first impression that you will leave on the client and the first filter for many of them. It is also how they check if you can be listed as a supplier and if you comply with their requirements. Answering on time will show that you are really interested in doing business with them.

Some buyers may require product liability insurance, in case of any complaints by end-consumers. Although this is not very common, it is good to find out about this kind of insurance to be prepared. This insurance is most likely to be wanted by importers that supply retailers or if negotiating volumes are high.

Sustainable and recyclable packaging

The German Packaging Act (VerpackG) came into effect on 1 January 2019. It was last amended in 2021. Under this law, traders are responsible for participating in the recycling of their product packaging. The law sets increased recycling targets for different packaging materials. It also mandates all businesses that sell consumer packaged products to register with the central packaging registry and pay a license fee. In most cases, this will be your importer’s responsibility, but you should be aware of the pressure on buyers to use sustainable packaging.

This pressure comes from legislation and consumers. German consumers consider plastic waste the greatest environmental challenge (see page 52). Supermarkets are trying to reduce the use of plastic packaging. Importers are following this trend by looking for alternative biodegradable packaging options, such as sugar cane. Importers might be interested in co-developing alternatives with you. Figure 2 shows an example of Colombian physalis in sugar cane packaging on the German market.

Figure 2: Physalis for the German market in sugar cane packaging

Source: Dana Chahin

Note that if you provide packaging made of wood, pulp, bamboo, viscose or cellulose-based fleece, importers might ask for certification, like FSC, Blue Angel or similar.

Many retailers, such as ALDI South, have commitments to achieve a 100% recyclable packed products target. Importers are also following and setting their own targets. It is common, for example, to ask suppliers to ensure adhesive labels on trays or bags are easy to detach, to not affect the recyclability.

Tips:

- Try to reduce the use of plastics or replace it with alternative, more sustainable packaging materials. Get inspiration and the latest news on the website packagingeurope.com.

- Look for sustainable packaging alternatives in your country and share this information with your buyers, even if your product is re-packed in Europe.

Price agreements and payment terms

Price agreements and payment terms used by German buyers are similar to those used in the European fresh produce sector.

- Minimum guarantee price (MGP): a minimum price is agreed. After arrival, there is an account sales document that shows the final price at which the product was re-sold in Europe.

- Fixed price: a fixed price is agreed. There can still be deductions because of food safety or quality rejections.

- Open price or by consignment: the market decides the final price at which the product is sold.

MGPs and fixed price options are often used if your product is going to a supermarket programme. Consignment is often done by large companies or by importers that sell on the spot market.

German buyers can pay in advance, after arrival (immediately or 30 to 45 days after) or against documents. They can also pay a percentage against documents, based on the MGP or the fixed price. Some buyers are willing to make advance payments to secure a continuous supply in certain seasons. This only happens when suppliers and buyers have already built a trustful and long-term relationship.

If you are going to work by consignment, you need to assess your risks carefully. It is recommended that you do this with buyers you trust or with buyers you have good references from. In any case, do a risk analysis exercise and evaluate your potential buyers. Export credit companies like Coface can perform a credit evaluation of your potential buyers, and you can secure a part of your shipment with them.

For supplying fresh fruit and vegetables to Germany the Incoterms FOB (Free On Board) and CIF (Cost, Insurance, Freight) are common delivery terms. DDP (Delivered Duty Paid) delivery may be best if you are directly supplying a large retailer or some smaller wholesalers.

Tips:

- Ask for references of potential buyers from your colleagues, competitors, trade promotion agencies or logistic companies.

- Check the website of your potential buyers and their presence at trade fairs. Read their annual reports to see the financial information.

What are the requirements for niche markets?

The organic niche market needs to comply with specific requirements in addition to the mandatory and market requirements.

Organic

Suppliers of organic products must comply with the European organic legislation according to Regulation (EU) 2018/848. If you produce both organic and conventional products, you need to guarantee strict separation of the products and production lines to avoid contamination. Buyers will ask you for information about the packing process, including the spatial and temporal separation of organic and conventional goods.

A product label can include the term ‘organic’ and all the derivatives or abbreviations (e.g. ‘bio’ and ‘eco’) only if the product complies with the EU organic production rules. This applies for both products produced in the EU and outside the EU.

Besides the EU organic logo, Germany also has the organic seal ‘Bio’. This can be used in addition to the EU organic logo. There are other private labels related to organic agriculture that have even stricter or additional requirements. These include Bioland, Demeter and Naturland. Of these three, Demeter offers more opportunities for suppliers from developing countries. Demeter adds an additional level to organic with its biodynamic approach.

Figure 3: Example of a label included in a box of organic limes exported to Europe

Source: courtesy of Bio Agroexport, Colombia

Figure 4: Organic labels on the German market

Source: Ökolandbau.de

Tips:

- Buyers may have specific requirements or need additional documentation for organic products. Always check with your buyers and ask for a detailed list of requirements.

- Find out if your country has its own Demeter certification body or if there are ongoing Demeter projects here. You can also read important information about the certification process on the Demeter website.

2. Through what channels can you get fresh fruit and vegetables on the German market?

How is the end-market segmented?

The German fresh fruit and vegetables market is dominated by discounters (Figure 5). Discounters sell about 50% of all fresh fruit in the fresh fruit market. Supermarkets and hypermarkets have a market share of 41%. Street markets, greengrocers and farm gate sales only account for 5.3% of total fresh fruit sales.

Source: USDA Product Brief based on data from AMI Marktbilanz Obst, 2022

Discounters

Discounters are the most popular end market to buy fresh fruit and vegetables in Germany. LIDL is the most popular discounter amongst consumers. In 2022, they won the Fruchthandel Magazin Retail Award in the discounter category for the sixth time. LIDL offers around 170 fruit and vegetable articles. German consumers like LIDL’s quality, freshness and price.

Based on both purchase share among consumers and revenue, the most popular German discounters to buy food from are ALDI, LIDL, Netto Marken-Discount, Penny and Norma. Although discounters are recognised by offering low prices, they distinguish themselves with aspects like high quality, sustainable packaging, regional products and organic products.

Discounters have particularly strict food safety requirements. Their certification requirements are also becoming stricter. Since 1 January 2023, LIDL suppliers of mangoes and avocados have needed Rainforest Alliance certification. Decisions taken by LIDL and ALDI are often followed by other discounters and supermarkets. Thus, preparing to comply with requirements for discounters will allow you to supply other market segments.

Although trade channels are becoming more direct in Europe, German discounters only import fresh fruits and vegetables in very large volumes. The rest is purchased from a selection of specialised importers and distributors that act as service providers.

Hypermarkets and supermarkets

German supermarkets are the second most important end-market for Germans buying fresh fruit and vegetables. The most popular supermarkets are EDEKA, REWE and Alnatura. Alnatura won the Fruchthandel Magazin Retail Award among supermarkets in 2022. It also won the ‘German Fruit Prize’ in 2022 in the organic fresh fruit and vegetables category. Unlike REWE and EDEKA, which are conventional supermarkets that also sell organic produce, Alnatura is an organic specialised retailer.

Figure 6 shows an EDEKA supermarket in the German city Frankenthal. This supermarket received an award for having the best fresh fruit and vegetables department in Germany. For this award, consumers evaluate criteria like regional produce, assortment, produce presentation, staff recommendations and cleanliness.

Figure 6: EDEKA supermarket in Frankenthal, Germany

Source: YouTube channel of RUNDSCHAU, 2023

Besides Alnatura, there are several specialised organic supermarkets in Germany that only offer organic products. The most relevant ones are Denn’s Biomarkt, Basic bio, Bio Company, Ebl Naturkost and Super Bio Markt.

Hypermarkets are also relevant, making up almost 12% of purchases. In 2022, Globus was the preferred hypermarket. Other hypermarkets include Kaufland and Mein Real.

Like the discounters, supermarkets and hypermarkets do not source fresh produce directly from developing countries. They usually buy from specialised importers and distributors. There are some exceptions for specific product categories or for products with large volumes. For example, Campina Verde Deutschland GmbH is a company of the REWE GROUP that imports organic fresh fruit and vegetables for their own REWE supermarkets. EDEKA also sources some produce directly.

Tip:

- Check the videos of other award-winning supermarkets in Germany here. Use the option offered by YouTube to enable subtitles in your language.

Street markets, greengrocers and farm gate markets

Only a small portion of Germans (5.3%) buy fruit and vegetables from street markets, greengrocers and farm gate markets. There is a nationwide campaign to attract more shoppers to weekly markets, under the slogan ‘Love your local market’.

Small greengrocers in well-known residential areas also offer a selection of exotic fruits but at higher prices than supermarkets. For example, the price of the pitahaya in Figure 7 was €9.95 per piece. This same fruit was priced €8.99 in the same week at Galeria Markthalle, a high-end supermarket.

Figure 7: Greengrocer in a residential area of Munich, Germany

Source: Dana Chahin

The main buyers of the German wholesale markets are street market vendors and independent retailers like greengrocers. If you want to target this segment, you should look for an importer with a presence in the wholesale market. Keep in mind that street market vendors and independent retailers prefer to offer regional products, so the volumes for this segment might be small compared to other segments.

Online channels

The demand for online shopping is still in its early stages in Germany. Supermarkets like REWE are expanding their presence by selling fresh produce online. The organic retailer Tegut partnered with Amazon Prime to offer an online shopping option to its clients. There are also dedicated online retailers and innovative concepts, such as fruit and vegetable boxes. Examples of online concepts to buy fresh produce online include Bringmeister, Mytime, Amazon Fresh, Freshorado, Stadt Land Frucht, Frische Helden and etepetete.

These online platforms offer information about the origins of the fruit and vegetables, often with stories about the products. This information is useful for reaching the right market segment. Amazon Fresh, for example, shows Landgard Frischeservice GmbH as the manufacturer contact for their passionfruit from Colombia. Landgard is a producers’ cooperative with several subsidiaries, with Landgard Nord and Landgard Overseas being responsible for sourcing from overseas.

Tip:

- Check this OECD report for further information about online sales of fresh produce in Germany and other European countries.

Hotels, restaurants and caterers (HoReCa)

The German foodservice market sales reached €53.6 billion in 2020, despite the strong COVID-19 lockdown measures. Compared to other European markets, Germany experienced the lowest drops. This market includes gastronomy, hotels and caterers.

The wholesale markets are important suppliers of the foodservice channel. An estimated 26% of the wholesalers’ clients are restaurants and caterers. Other important players supplying the foodservice segment are cash and carry wholesalers, such as Edeka Foodservice and Metro, and food service distributors like Fripa. Most of these players are supplied by specialised importers or wholesalers.

Tip:

- Visit the website of the German Foodservice Association (Grosshandelsverband Foodservice e.V.) and check their members list.

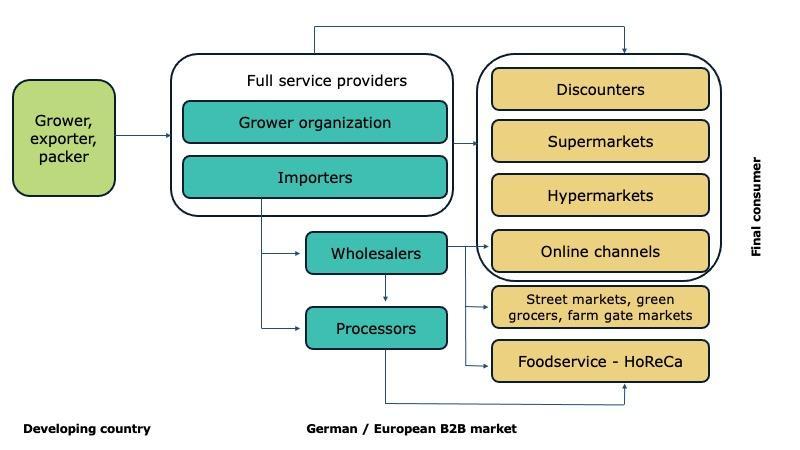

Through what channels does a product end up on the end-market?

The main channels to supply the German market of fresh fruit and vegetables are grower organisations, specialised importers, wholesalers and processors.

Figure 8: The German value chain of fresh fruit and vegetables

Grower organisations

Grower organisations are important suppliers of fresh fruit and vegetables and can offer full-service packages to their clients. They produce a wide range of fruit and vegetables, from apples and strawberries to carrots, onions and white asparagus. As a response to the growth in regional consumption and to protect their members, there is little room for foreign fresh produce during the local season. To offer a varied and year-round supply to their clients, they import these products during the off season, as well as importing tropical and exotic produce.

Their clients are mainly retailers and the food service sector. They are often present in the wholesale market so they can serve food service clients.

Landgard and Gemüsering are among the largest German cooperatives that source directly from developing countries. Both have several subsidiaries, covering a large share of the market. Landgard centralises overseas imports from its offices near Hamburg, while Gemüsering has different companies for different product categories. For example, Herbert Widmann GmbH, part of Gemüsering, imports berries and asparagus.

Importers

Importers are key players in the fresh produce value chain. They manage the sourcing process and perform quality checks based on their clients’ demands. Importers supply different end-market segments, from retailers to the foodservice.

German importers include Port International and Fruchtimport vanWylick. There are importers that specialise in certain products. For example, the company Afrikanische Frucht-Compagnie specialises in banana imports, Don Limon mainly focuses on citrus fruits and Lehmann Natur is a leading importer of organic produce. Other relevant importers that are also preferred suppliers of retailers and discounters include Trofi, Global Fruit Point and OGL.

There are relevant German players in this channel, but Dutch importers are also relevant suppliers of the German market. Examples include Eosta and Roveg. International companies also have a presence in Germany, such as Dole.

Several importers are expanding their services to become full-service providers of supermarkets and discounters. Full-service providers pack, re-pack, ripen, storage, label and distribute the fruit, depending on the retailer’s needs. All the importers mentioned above have direct relationships with German supermarket chains and have programmes to supply them as full-service providers all year round. Another example is Bratzler, which supplies mangos and avocados to Kaufland.

Wholesalers

Wholesalers mainly supply the foodservice suppliers, street and local markets, and retail shops. The total area occupied by Germany’s wholesale markets is 2.7 million m2, and they are spread all around Germany. 66% of the companies based in the German wholesale markets are wholesalers, 24% are growers and 10% are service providers. Although some wholesalers are also importers, many of them rely on other importers to offer overseas products.

Several importers mentioned above have a presence in local wholesale markets. VanWylick, for example, has locations all around Germany in leading wholesale markets. INTER is another importer that has a presence in the wholesale markets.

85% of the volume of produce sold at Germany’s wholesale markets are fruit and vegetables. Other products sold include fish and meat.

Processors

Processors offer a wide range of fresh convenience products to the gastronomy and hotel industries and the catering sector (HoReCa). Their assortment ranges from ready-to-cook fresh vegetables to ready-cuts and more.

The companies Abels Früchte Welt GmbH, Klaus Berckenbrinck GmbH (part of Gemüsering) and Kai Brüning GmbH are examples of processors that specialise in servicing the HoReCa sector. Many of these companies are wholesalers that expanded their range of services and do not import the produce themselves. Abels Früchte, for example, partners with importers to guarantee the highest quality goods.

What is the most interesting channel for you?

Grower organisations like Landgard and importers like Port International are the most interesting channels for you. These actors are responsible for importing products into Germany. They service all the end-market segments for fresh fruit and vegetables. This can be directly in the case of retailers and discounters, or indirectly, by supplying wholesalers and processors. Grower organisations and importers have experience working with suppliers from developing countries. They know the requirements of each end-market segment, but also the issues you should closely monitor to successfully enter the market.

Grower organisations and importers often describe themselves as ‘not only’ being importers. They are the link between the producer and the market, involving everything in between. This includes procurement, storage, ripening, packing and transport. Many grower organisations and importers also invest in their production in the countries of origin to ensure a transparent value chain. When not supplying from their own fields, they need full traceability to be accountable. When possible, they also prefer to source directly from growers.

Business culture in Germany is formal and precise. German importers make rational decisions, and they expect you to provide a factual presentation of your offer. Germans value punctuality and fast responses. Not answering an email on time might take you out of the business. Importers will lose interest in doing business with you.

Sharing personal data is not common for Germans, who value their privacy highly. This is why it can be challenging to find buyers’ personal data. If you find a mobile number online, do not use WhatsApp as a first channel to connect with them. This can become a communication channel to speed up daily business operations but only once a relationship has already been built. Germans often have different mobile numbers for personal and professional matters.

When you reach out to buyers for the first time make sure to present your company with a professional company presentation. This presentation should include pictures and information valuable to your buyer, such as:

- Company description, highlighting your value proposition and differentiators

- Product assortment and details of each product

- Certifications and sustainability initiatives

- Logistic information (export routes to the market, location and distance to the main ports)

- Other information such as export experience, awards or affiliations

Besides the examples of the previous subsection, other important German players include Bivano, a leading importer of organic fresh fruit and vegetables. ABC Fresh GmbH handles both conventional and organic produce. HLB Tropical Food GmbH specialises in tropical and exotic fruit.

Tips:

- Attend leading international trade fairs of your sector. Fruit Logistica is particularly significant. It takes place every year in Berlin. Review the trade fair exhibitor lists in advance. These are available for free on the trade fair websites.

- Find and reach out to buyers on LinkedIn. Leading German buyers are more and more present in this professional network and many exporters have found new clients here.

- Read the CBI tips for finding buyers on the European fresh fruit and vegetables market.

3. What competition do you face on the German fresh fruit and vegetables market?

Germany’s main suppliers of fresh fruit and vegetables are Spain, the Netherlands and Italy. They account for 60% of the total value of imports. A big share of imports from Spain and the Netherlands are re-exports, meaning part of their imports include produce from developing countries. Direct imports from developing countries represent 25% of the total imported value. These countries are your main competitors in the German market and will be the focus of this analysis.

It is worth monitoring the developments of the Spanish production. The country is also a producer of tropical fruit like avocados and mangoes, top imported products from developing countries. Spain has even begun to produce exotic fruit like red pitahaya, where African and South American countries used to be the only providers. Consumer preferences to buy from origins as close to them as possible might pose a threat to developing countries.

Which countries are you competing with?

Figure 9 shows the 6 main supplier countries from developing countries. In addition to these countries, imports from selected African and Latin American countries exhibited high growth rates over the last five years. These include Côte d’Ivoire (17.6%), Cameroon (63.9%), Tanzania (66.6%) and Guatemala (17.6%).

Source: Trade Map, 2023

Morocco

Morocco is the main non-European supplier of fresh fruit and vegetables. In 2022, the country exported a value of €476 million, accounting for 15% of the imports coming from developing countries. Morocco has steadily grown its exports to Germany in the past five years at a compound annual growth rate of 19.2%.

Morocco’s fresh produce exports to Germany include tomatoes, berries (strawberries, raspberries, blueberries), capsicum, avocados, citrus fruit, beans and table grapes. Organic fruit and vegetables and citrus fruits are of particular interest for the German market. Morocco has enormous potential in this segment as many small farms traditionally grow their produce without pesticides.

Morocco’s main competitive advantages are its favourable climate and proximity to Europe. The harvest period for fruit and vegetables starts earlier in Morocco than in Europe. This is why Morocco is a very attractive origin to supply the European market with nearby origins throughout a long season. Morocco is also an ideal country for European producers to set up their outsourced production. This is especially relevant while the carbon footprint and regional production are hot trending topics for German consumers.

Despite the increasing interest in Morocco, German importers have difficulty finding reliable suppliers. Morocco was recently added as a new partner country of IPD, the German import promotion programme. This should help to get exporters ready for the German market. Additionally, the government is actively promoting the agricultural sector to increase productivity and export readiness. The country has increased its production with government incentives in the past.

Regarding food safety, Germany has notified five issues for fruit and vegetables from Morocco since 2020 in RASFF. These were largely related to pesticide residues in products like beans, peppers and berries.

South Africa

South Africa is an interesting country for German importers. It offers attractive products almost all year round. The fact that English is an official language makes South Africa an easy country to do business with. South Africa is a well-established origin in the German market. South Africans are perceived as professional business partners and South African produce has a good reputation in terms of safety. However, competition from European countries might be a challenge, especially in the case of seasonal products like peaches, oranges and pears.

Several South African exporters have stable, long-term relationships with Dutch importers, and this is how they reach the German market. However, this does not mean that German buyers are not interested in having more direct business relationships, also without the involvement Dutch traders.

The main exported products to Germany are grapes, oranges, citrus fruit, pears and apples. However, exports of other products like blueberries and avocados have increased in recent years. South Africa has a growing avocado industry. It is also close to being able to grow avocados all year round. Exports to the German market reached €20 million in 2022, making South Africa the sixth-largest supplier of avocados to Germany.

South Africa’s fruit market is highly concentrated, with many large farms accounting for most of the country’s fruit exports and income. Many small farmers have either gone out of business in the last 30 years or are part of bigger fruit companies. This partly explains the high levels of technology adoption by South African growers, who use precision farming and artificial intelligence to produce more sustainably and better their position in international markets.

South Africa’s fruit exporters have been struggling with delays at the port of Cape Town over the past three years. Besides logistical challenges, the South African citrus sector has also faced electricity supply problems, which have affected ports, packing and cooling on farms, and transit. This situation is expected to normalise, but additional internal logistical issues threaten citrus and other fresh produce growth.

Tip:

- Check South Africa’s exporter directory on the website of the fresh produce exporters’ forum (FPEF). The directory also contains an overview of South Africa’s fresh produce industry.

Costa Rica

Costa Rica is a significant supplier of fresh fruit and vegetables to the German market, but mainly in the category of tropical fruits like bananas, pineapples, watermelons and melons. Other fruits including mangoes, apples, oranges, and kiwi are exported too but in much smaller quantities.

Costa Rica’s export promotion agency PROCOMER supports the diversification of Costa Rica’s fresh produce. The country has a favourable geographical location to produce a variety of fresh fruit and vegetables (Figure 10).

Figure 10: Fresh products from Costa Rica

Source: YouTube channel of PROCOMER, 2023

Large international companies like Fyffes are present in Costa Rica. These companies invest in local banana production. Bananas from Costa Rica are especially attractive to retailers and foodservice providers because of their smaller size compared to bananas from Ecuador. Smaller bananas are preferred for school fruit programmes. Del Monte is expanding its single-serve banana distribution across Europe with its carbon-neutral certified banana farms in Costa Rica.

Peru

Peru is a large and well-established supplier of fresh fruit and vegetables to Germany. Avocados, blueberries and mangos are the top three exported products. When Peru’s seasons start, it is difficult for other origins to compete, as prices go down in an oversupplied market.

Besides the strong position for the fruits mentioned above, Peru produces a wide variety of additional fruit and vegetables. The government has run a superfoods campaign since 2012 to promote Peru’s food around the world. ‘Super fruits’ and ‘super vegetables’ like blueberries, mangos, avocados and asparagus are part of the campaign. Peruvian superfoods were recently promoted in Germany with a digital campaign by Foodboom, a leading influencer of German cuisine.

Peru also has enormous potential for organic produce. Since 2012, the number of organic farmers has more than doubled. Agricultural operations in Peru are mostly run by small, family-owned businesses in remote areas, where the use of natural farming without chemicals and pesticides is the norm. Peru has become an important supplier of organic ginger and turmeric to Germany and Europe. It is also the world’s leading exporter of organic bananas.

Peru’s challenges are mainly related to infrastructure, logistics and political instability. Social standards are also an important issue in some parts of the country. Although there are many SMETA and GRASP-certified exporters, certifications are often driven by the market and not by the companies’ strong belief in social responsibility. This is the case in other developing countries as well. This makes it difficult for German buyers to select a socially responsible supplier.

Colombia

Colombia is the fifth most important supplier of the German market. Its exports are focused on bananas, avocados, purple passion fruit and limes. Colombia is also an established supplier of other exotic fruit, like physalis, yellow pitahaya and granadilla. Colombian fresh produce reaches the German market directly and through importers in the Netherlands.

Avocado exports to Europe and Germany are expected to continue their expansive growth path. Colombia has managed to position itself in the market and German importers are satisfied with the quality of Colombian avocados. Regarding new products, many say that blueberries are the next high potential fruits from Colombia. Planted areas have rapidly grown over the last ten years, and the next years will witness an increase in harvest quantities. Some air shipments have already taken place, and exports by sea are expected to start once the country reaches larger production volumes.

Colombia’s main challenges are related to internal transport and storage infrastructure. Many producers struggle to take fruit to the packing houses and the ports. The situation worsens when there are weather events that further affect the roads. This is a frequent cause of shipment delays in Colombia.

Ecuador

Ecuador is the sixth most important supplier of fresh produce to Germany, but this is almost entirely the result of banana exports. Bananas account for 97% of total imports of fresh fruit and vegetables from Ecuador to Germany. Despite this, Ecuador’s warm climate and geographical position make it a perfect sourcing destination for other tropical and exotic fruit and vegetables.

The Ecuadorian government actively promotes the diversification of Ecuadorian exports, with a strong focus on ecological farming. In 2020, Ecuador was Fruit Logistica’s official partner country. This was an opportunity to showcase its banana sector, but the potential for other products too. Ecuador was presented as a ‘premium and sustainable’ origin for fresh produce.

Ecuador is home to leading exporters of yellow and red pitahaya, such as the company Ecuaexotics. There are companies growing non-traditional crops for Ecuador, such as ProAgroTorres with asparagus. New Ecuadorian producers sent 21,500 kilograms of Hass avocado to Europe for the first time in 2022. The fruit was distributed to different European countries, including Germany. Ecuador has the potential to enter the avocado business.

Tip:

- Monitor the exporters directory of ProEcuador to identify non-traditional fruits that Ecuador is trying to position in the European market.

Which companies are you competing with?

The following companies are examples of successful exporters to the German market of fresh fruit and vegetables and of the competition you will face.

Montana Fruits, Colombia

Montana Fruits is a Colombian exporter of avocados, passion fruit and limes. They have their own plantations of passion fruit and partner with small avocado and lime farmers. The company was founded in 2018 and is now a leading supplier to the German and European market. Their fruit is sold in German supermarkets and discounters.

Montana offers technical assistance to their associated farmers, as well as the chance to observe the packing process. The company has strict quality standards that surpass the basic requirements of its target markets. This, together with the right set of certifications, was key to entering the German market. Montana is GLOBALG.A.P., GRASP, SMETA, BRCGS and Rainforest Alliance certified. The process of obtaining certification was a combination of aligning company philosophy with market demands.

Montana has a clear sustainability policy embedded in their company strategy. Their actions range from installing beehives around their crops to taking care of their employees (Figure 11).

Figure 11: Montana Fruits Colombia

Source: YouTube channel of Montana Fruits, 2023

Besides attending trade fairs, Montana is very active in searching for buyers on LinkedIn. Their proactivity and persistence has been decisive in translating identified opportunities into business closures. Montana is perceived as a professional business partner by German importers. They maintain fluent communication with their clients and warn them if shipments will be delayed by factors beyond their control. This creates trust and allows buyers to find alternatives on time.

Latbio, Ecuador

Latbio is a leading biodynamic-certified company in Ecuador, which has Demeter certification. The company is a group of organic and regenerative farmers that decided to export fresh fruit, while ensuring the wellbeing and prosperity of producers and the environment. Bananas are Latbio’s main product, but their recognition goes beyond that. They also offer other fruits such as yellow pitahaya, mangoes, baby bananas and plantains.

Latbio has three differentiators that have allowed them to enter niche markets and differentiate themselves in the traditional banana market:

- They want to heal the planet through organic, regenerative and biodynamic farming practices.

- They have a zero-food waste policy, using 100% of their production to process natural ingredients.

- They promote the circular economy, by donating banana plant stems to an association that manufactures natural fibre hats.

The company attends international trade fairs and has a commercial representation in Europe. Their consistency and persistence have allowed them to sell to leading German importers in the organic and Demeter niche market. Besides these two certifications, Latbio is a B Corp and is GLOBALG.A.P., Fair Trade and Rainforest Alliance certified. Importers perceive Latbio as a professional and innovative company.

Tips:

- Check the IPD event brochures for Fruit Logistica and Fruit Attraction to identify additional companies from developing countries that target the German market. Both Montana Fruits and Latbio were supported by the IPD programme.

- Connect with your competitors on LinkedIn and follow them on Instagram. This is a way to learn from them. Pay attention to how they promote their company and products on the various social media channels.

- Browse the Fruit Logistica and Fruit Attraction exhibitor lists. Apply the country and product group filters to find other companies that offer the products you have.

Which products are you competing with?

German and European products might compete with your products. In Germany, there is a growing preference for more sustainable and regionally produced fruit and vegetables. Conscious consumers prefer in-season products. For example, when locally produced strawberries or plums are available in abundance, the demand for imported mangoes may be less. Your products will still be in demand off-season although in lower quantities. Origins closer to Europe will be preferred.

As an example, the local German strawberry season extends from mid-May until the beginning of August. Around two thirds of total strawberry purchases of German households take place between these months, with peaks in May and June. Other purchases are distributed throughout the rest of the year in smaller quantities.

Asparagus are another locally grown product with a strong preference by consumers. There is a strong campaign for German white asparagus, which are in season during the springtime. Germans even introduced a ‘Day of the German Asparagus’ celebrated every year in May to promote consumption.

Table 1 and 2 show the German production quantities of fresh fruit and vegetables. If you offer one of these products, find out about the best time to supply the market. If you offer a tropical or exotic fruit that is not locally or regionally produced, you will experience less direct competition. However, you need to convince consumers that the product they will buy is both environmentally and socially sustainable. Aspects like water use, carbon footprint and social conditions of the producers will set your company apart.

Table 1: German production of fresh fruit, in thousands of tonnes, 2019–2022

| Fresh fruit | 2019 | 2020 | 2021 | 2022 |

| Apples | 992 | 1,023 | 1,005 | 1,034 |

| Strawberries | 144 | 152 | 131 | 126 |

| Plums | 47 | 47 | 40 | 42 |

| Sweet cherries | 45 | 37 | 27 | 39 |

| Pears | 43 | 39 | 37 | 35 |

| Blueberries | 15 | 11 | 16 | 17 |

| Currants | 11 | 12 | 14 | 13 |

| Sour cherries | 16 | 13 | 11 | 13 |

| Mirabelle plums | 5 | 5 | 5 | 4 |

| Other | 14 | 13 | 16 | 15 |

| Total | 1,330 | 1,352 | 1,301 | 1,338 |

Source: European Statistics Handbook, Fruit Logistica 2023

Table 2: German production of fresh vegetables, in thousands of tonnes, 2019–2022

| Fresh vegetables | 2019 | 2020 | 2021 | 2022 |

| Carrots | 791 | 802 | 962 | 670 |

| Onions | 522 | 540 | 664 | 519 |

| White cabbage | 449 | 446 | 435 | 391 |

| Gherkins | 183 | 149 | 171 | 187 |

| Red cabbage | 125 | 125 | 142 | 128 |

| Iceberg lettuce | 139 | 128 | 131 | 126 |

| Asparagus | 131 | 118 | 119 | 113 |

| Beetroot | 96 | 99 | 110 | 102 |

| Spring onions | 85 | 90 | 74 | 89 |

| Other | 1,187 | 1,196 | 1,248 | 1,174 |

| Total | 3,707 | 3,693 | 4,057 | 3,499 |

Source: European Statistics Handbook, Fruit Logistica 2023

Tip:

- Check the seasonal calendar of EDEKA Foodservice, which contains all types of fruit and vegetables that are grown regionally by season. Make sure you can produce outside the local season.

4. What are the prices for fresh fruits and vegetables in Germany?

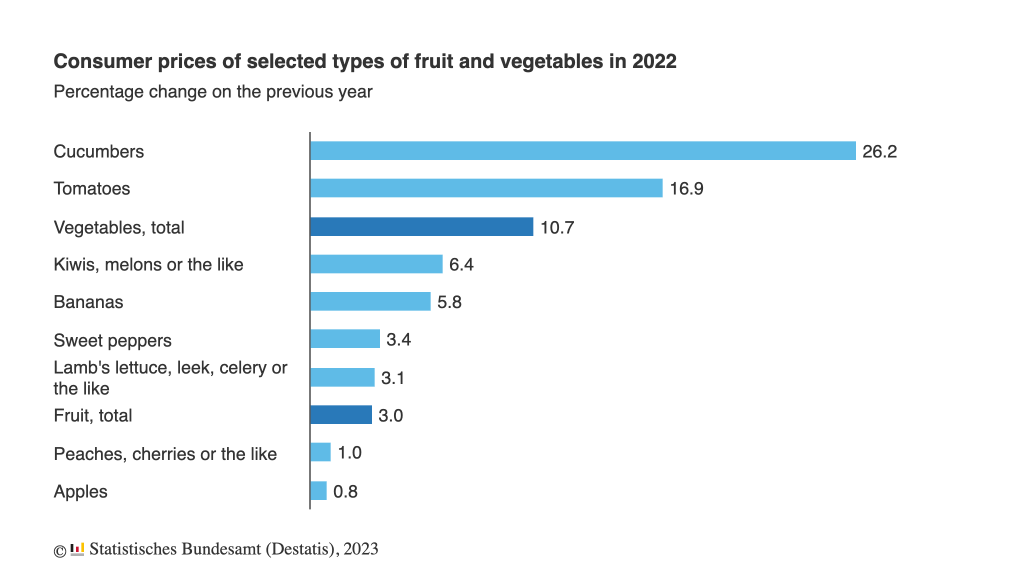

Between 2021 and 2022 German consumers had to pay considerably more for fresh fruit and vegetables. However, the increase was smaller than the one reported for overall food prices, which showed a 13.4% rise in 2022. Consumer prices for vegetables increased by 10.7%, while fruit prices only rose by 3% (Figure 12).

Figure 12: Consumer prices for selected fruit and vegetables in 2022, % change on the previous year

Source: © Statistisches Bundesamt (Destatis), 2023

Prices not only increased at the consumer level, but also at the wholesale market (Figure 13). Between 2021 and 2022, wholesale prices of fresh fruit and vegetables increased by 9.6%. Fresh produce prices are expected to keep rising mainly because of climate change, meaning production costs will grow and sustainability market requirements will become stricter.

Source: © Statistisches Bundesamt (Destatis), 2023

Generally, the market determines the price of your products with basic supply and demand principles. For exotic and niche products, imports are small and mostly demand-driven. For common fruit and vegetables, availability is the main determinant of prices. Prices increase when the market is short of produce. If there is oversupply, prices go down. If you sell in the spot market, you must be ready for this and learn to mitigate risks. Monitor the market, hire independent quality control companies or insure a part of your shipment. Organic produce has a premium of 20% to 30% on average. Be aware that these premiums can change according to the product and demand.

If you want to achieve greater price stability, importers with a supermarket programme are a better option. Supermarkets cannot change prices abruptly over the year. This is why importers will not pay you as much as the market when prices are high. However, when prices are down, importers will pay you better prices. The advantage is that you will always be able to get your produce onto the market. It is a good long-term relationship that requires trust and commitment from both sides. Keep in mind that you need stable volumes to enter a programme.

German and Dutch importers usually work with a profit margin on the sales prices of at least 8%. This excludes expenses like terminal handling charges, scanning costs, laboratory analysis, quality control, handling and storage. Going further along the supply chain, retailers usually apply a 30–35% margin. Margins can be higher for more perishable and slower-selling products. Keep in mind that, for some products, other costs must be considered before the product reaches the end-market segment. For example, packaging, labelling and ripening.

Retailers and discounters often plan promotions, especially in oversupply periods or for special occasions, such as Easter or Christmas. Promotions are very common in Germany. It is important that you anticipate your harvest and inform your buyers about foreseen high supply periods. They can plan promotions to place more fruit in the market, subject to the supermarket’s approval. Promotions are planned at least one week in advance. For long-term suppliers, supermarkets often include promotions in the supply contract. Prices with large retailers are generally more stable. So despite of the promotions, your overall return will likely be higher than when you are only selling your product in the spot market.

Tips:

- Monitor the market prices by checking the weekly price reports for fresh fruit and vegetables at the German wholesale markets here. These reports are published only in German by The Federal Ministry of Food and Agriculture (BMEL) but you can use Google translate to read them.

- Visit the websites of the supermarkets to monitor consumer prices. REWE has an online shopping platform. You might be required to enter a zip code (Postleitzahl in German). Just type any to be able to see the products.

- Check the promotions of the German retailers and discounters in their weekly brochures. These are usually published online, even if the retailer does not have an online shopping platform for fresh produce. Look for the word ‘Angebote’ or ‘Prospekte’, which means ‘promotions’ and ‘brochures’ in German. Some examples are: EDEKA, LIDL, Kaufland and Alnatura.

Dana Chahin in partnership with ICI Business and Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research