The Dutch market potential for fresh fruit and vegetables

The Netherlands is a good market for developing-country suppliers, in particular for exporters of tropical fruit such as avocado, mango and banana. The dominant hub function and a growing domestic consumption make the Netherlands a promising export market. As a supplier, you can benefit from this by giving attention to sustainable production and offering specific market-focused solutions.

Contents of this page

1. Country description

The Netherlands, often also referred to as Holland, is a small populous country in the northwest of Europe. The country plays a key role in the trade of fresh fruit and vegetables. It borders Germany, the largest consumer market for fresh fruit and vegetables in the European Union.

- Population: 17.4 million

- GDP: €800 billion

- GDP per capita: €45,870

- Language: Dutch

- Important regions: Rotterdam area (port), Amsterdam (capital), The Hague (government)

- Main trading partners in fresh fruit and vegetables: Germany, Belgium, United Kingdom

Figure 1: Location of the Netherlands in Europe

Source: The World Factbook 2021. Washington, DC: Central Intelligence Agency, 2021.

2. What makes the Netherlands an interesting market for fresh fruit and vegetables?

Dutch importers form a main trade hub for fresh fruit and vegetables. About 20% of the fresh produce from developing countries find their way into Europe through the Netherlands. Domestic consumption had also increased on the verge of the COVID-19 pandemic.

The Netherlands is an important trade hub

The Netherlands plays an important role in the trade of fresh fruit and vegetables. The country is responsible for a fifth of all fresh fruit and vegetables imported into Europe, and most products are distributed throughout the rest of Europe. Exporters can use the Netherlands as a commercial or logistical trade hub.

The total export value of fresh fruit and vegetables of the Netherlands equals its total import and production value. This means that most fresh products are (re-)exported and additional value is created while doing so.

Rotterdam is home to the largest seaport in Europe. In this area, you will find logistical service providers such as Cool Control, LBP and Kloosterboer and a large number of trading companies. These companies offer a wide selection of services, from simple reselling to packing and ripening facilities and small distribution. Amsterdam airport is a gateway for air-freighted fruit and vegetables.

The main destinations of Dutch exports and re-exports are countries in northern Europe, Germany being by far the largest. For these countries, the Netherlands is one of the key suppliers of imported tropical fruit as well as fresh vegetables from both local and exotic origins. For exporters of off-season fruit and vegetables or more exotic varieties, Dutch traders offer an interesting distribution network in northern Europe and beyond.

Figure 2: The hub function of the Netherlands

Source: figure by ICI Business with data from Fresh Produce Centre

Dutch imports from developing countries are growing

The Netherlands is the largest European importer of fruit and vegetables from developing countries. With this, it takes a central position in the European market.

Although the highest volume of Dutch imports still comes from European countries, in trade value developing countries have surpassed European supplies (see Figure 3). Their value in Dutch imports reached €4.0 billion and represents around 20% of total European imports. This makes the Netherlands the main market for developing-country suppliers.

The current most dominant suppliers include Peru and South Africa with a very diverse offer, Brazil with mainly mangoes and melons and Costa Rica, mainly due to their leading exports in the banana and pineapple trade. Imports from Costa Rica, as well as Panama and Ecuador, have increased in the past five years. This was mainly because of a shift in banana logistics. For example, Chiquita has decided to transport their bananas through the port of Vlissingen in the south of the Netherlands. Colombia profited from a successful development of its avocado exports.

The import value from developing countries continues to increase, but the Dutch import share in the European market has also been increasing by 1% each year. You can expect the Netherlands to remain a key export market for foreign suppliers.

Consumption is growing during COVID-19

With 17 million inhabitants, the Netherlands is a mid-sized market in Europe. The Dutch do not excel in the consumption or consumption growth of fresh fruit and vegetables. The COVID-19 pandemic has turned this around causing a peak in household sales. The next few years will have to show if this consumption level will be maintained.

Over the past years, the Dutch consumption rate has been modest compared to the rest of Europe. In 2019, 58.2% of the consumers had a daily intake of at least 1 portion of fresh fruit and vegetables, compared to 67.1% on average in the European Union (see Table 1). At the same time, 29.5% of Dutch consumers say they eat more than 5 portions a day, one of the highest figures in Europe. The average daily consumption measured in 2012-2016 was 131 g of vegetables, 130 g of fruits, nuts and olives and 72 g of potatoes.

The COVID-19 pandemic has had a positive impact on the consumption of fresh fruit and vegetables. Out-of-home consumption fell due to lockdowns and the closing of restaurants, but Dutch households bought 9% more fruit and vegetables in 2020, leading to an overall consumption growth of 4%. Vitamin-rich fruit and vegetables such as oranges, kiwis, avocado, blueberries and peppers were particularly popular items. Online purchases, food boxes and meal kits increased as well. The consumption growth continued in 2021 with 4% more household sales of fresh vegetables and 3% more fruit in the first 6 months.

Table 1: Daily consumption of fruit and vegetables (1 portion or more) in percentage of European consumers

| 2014 | 2019 | difference | |

| European Union (EU-27) | 64.0% | 67.1% | +3.1 |

| Belgium | 83.9% | 82.6% | -1.3 |

| Spain | 75.0% | 76.6% | +1.6 |

| France | 65.3% | 74.8% | +9.5 |

| Germany | 54.8% | 66.8% | +12 |

| Sweden | 63.5% | 62.2% | -1.3 |

| Netherlands | 54.0% | 58.2% | +4.2 |

| Czechia | 53.7% | 51.8% | -1.9 |

Source: Eurostat

Tips:

- Select Dutch business partners when you are looking for a broad entry into the European market. You can use the knowledge and network of experienced traders but also work with efficient logistical routes and service suppliers.

- Find information on the Dutch fresh fruit and vegetable sector at the Fresh Produce Centre. Here you will also find a member list of traders and service companies in the fresh fruit and vegetable sector.

- See the CBI study on Entering the Dutch market for fresh fruit and vegetables to see what type of companies you can expect in the Netherlands and with which countries you will likely be competing.

- Use the translation function of your web browser to read website links in this study in your own language.

3. Which products offer the most opportunities for the Dutch market?

The most-consumed fruit and vegetables in the Netherlands are bananas, apples, oranges, mandarins and tomatoes. For the supply from developing countries, (tropical) fruit is the most important category with strong growers such as avocado, banana and blueberries.

Table 2: Domestic purchases in the Netherlands, from week 1 to 24 in 2021, in 1,000 kilograms

| Top 25 | Fresh fruit | 2021 (wk 1-24) | Change compared to 2020 (wk1-24) | Fresh vegetables | 2021 (wk 1-24) | Change compared to 2020 (wk1-24) |

| Total fresh fruit | 381,478.5 | 3% | Total fresh vegetables | 355,883.7 | 4% | |

| 1 | Bananas | 73,057.4 | 1% | Tomatoes | 34,378.1 | 2% |

| 2 | Apples | 71,208.5 | -5% | Onions | 29,110.1 | 16% |

| 3 | Oranges | 69,564.7 | 0% | Cucumbers | 25,562.2 | 3% |

| 4 | Mandarins | 40,288.6 | 6% | Carrots | 25,066.7 | 1% |

| 5 | Pears | 22,262.8 | 20% | Sweet peppers | 20,885.7 | 3% |

| 6 | Grapes | 20,394.6 | 11% | Stir-fry / stew vegetables | 16,689.8 | 4% |

| 7 | Strawberries | 15,696.2 | -2% | Cauliflower | 15,466.1 | 13% |

| 8 | Kiwis | 11,145.0 | 14% | Chicory | 13,976.5 | 9% |

| 9 | Melons | 7,762.6 | 9% | Broccoli | 13,427.0 | 4% |

| 10 | Mangoes | 6,811.5 | 9% | Mushrooms | 11,554.0 | 2% |

| 11 | Blueberries / bilberries | 5,610.5 | 14% | Fresh vegetable packs | 11,137.7 | 10% |

| 12 | Avocados | 4,928.5 | 0% | Green beans | 10,317.5 | -1% |

Source: GfK / Fresh Produce Centre *see complete table in the attachment

Avocado: A Dutch success story

The Netherlands is the second-largest importer of avocados in the world (after the USA), and it is the third-largest exporter, without having any domestic production. Dutch traders and logistics play a key role in the European distribution of avocados.

Avocados have become a major success story for the Netherlands in the past decade. According to Statistics Netherlands (CBS), the Netherlands is good for 63% of the import of avocados produced outside the European Union. The avocado trade has evolved into a logistical specialisation of Dutch importers and ripening companies. Leading importers such as Nature’s Pride ripen and pack avocados. But also many foreign avocado companies have a presence in the Netherlands, such as Mission Produce, Westfalia Fruit and the Peruvian Camposol.

Avocados have the highest overall import value of all fresh products that the Netherlands imports from developing countries. In recent years profits have had ups and downs as global production is increasing and occasional oversupply has become more common. But the demand in 2020 and 2021 has been strong, and profitable for most supplying developing countries. In 2020, imports reached €635 million, or 257,000 tonnes. Peru is the largest supplier with 111,000 tonnes, followed by Chile and fast-upcoming Colombia. South Africa, Mexico and Kenya are also major suppliers. Most avocados were re-exported by Dutch traders, mainly to Germany, France and the Scandinavian countries.

Due to the key role that the Netherlands plays in the avocado trade, the estimated consumption of 2.2 to 2.3 kilos per capita is higher than most European countries.

Online recipes and foodservice concepts such as The Avocado Show and Your Avojoy contribute to the promotion of avocados. Trade and consumption continue to grow despite the increasing attention for sustainability issues linked to avocado production, such as scarce water resources and deforestation. Consumption in most European countries is still on the rise, and the Netherlands continues to strengthen its position. It will take at least another couple of years before the growing demand will slow down. At the same time, global production is also booming. Even with growing demand, you must expect market saturation to occur more regularly.

Figure 6: Example of a ready-to-eat avocado in the Netherlands

Photo by ICI Business

Tips:

- Read the CBI study about the European market potential for avocados to get a broader overview of the European demand for avocados.

- Read the article of Statistics Netherlands (CBS) for a recent analysis of avocado imports in the Netherlands.

Banana: Specialised logistics

The Netherlands is the main entrance point for bananas into Europe. This is largely due to the ports of Vlissingen and Rotterdam, which are specialised in banana logistics.

The port of Vlissingen is in the south of the Netherlands, near Belgium. Logistical companies such as Kloosterboer and ZZColdstores offer climate-controlled storage and handling facilities. Reefer operators such as Seatrade offer direct connections to several countries in South America. Chiquita has its own dedicated container service. For them, Vlissingen is the main entry point into Europe.

Bananas are also in the top three of imported food products in Rotterdam, Europe’s largest port with logistical service providers and a high concentration of fruit trading companies. Just south of Rotterdam, the discount retailer Lidl has taken into use the largest banana-ripening facility in Europe.

Bananas are a typical product from tropical and developing countries. Panama and Costa Rica lead the list of suppliers to the Netherlands, followed by Ecuador. The Netherlands has strengthened its position in the banana trade in the past 5 years. The import value from developing countries increased from €198 million in 2016 to €583 million in 2020. About 80% of the bananas are re-exported, mostly to Germany.

The (banana) trade from South America is also a high risk for shipments of drugs. When exporting bananas to Europe, make sure that your container is sealed and maintain good contact with trusted people in the supply chain.

Table grapes: Off-season import

The European table grape market is mature. The Netherlands plays a role in organising year-round availability. For that reason, most grape imports in the Netherlands are counter-seasonal.

During the European season (July-November) Italian, Greek and Spanish grapes are available on the Dutch retail shelves. Retail promotions are common, especially when the supply is high.

As soon as the European season finishes, Dutch imports increase significantly when non-European grape producers start supplying Europe through the Netherlands. Germany, Poland and Belgium are major destinations for grapes that pass through the ports in the Netherlands.

The grape market is very competitive. Supplying countries follow each other in quick succession. South Africa, Peru and India are responsible for 60% of the off-season supply. The rest of the off-season is secured mainly by Brazil (early season), Chile and Egypt (late season). In this mature market, you can expect gradual growth. Peaks in consumption are mostly a result of overproduction and fierce promotions.

Dutch traders are able to work with different origins and grape varieties, but as a supplier, you must always keep the preferences of the end market in mind.

Tip:

- Read the CBI study about the European market potential for table grapes to get a better understanding of the European demand.

Oranges: Higher demand during COVID-19

Oranges and citrus fruit in general are some of the most-consumed fruits in the Netherlands. Vitamins and fresh juice are the main reasons for temporary stronger demand.

Normally there is not much growth in this saturated market, but 2020 was an exception because of the demand for vitamin-rich fruit during the COVID-19 pandemic. This was most notable in the import value of oranges, which increased by 23% from 2019 to 2020. In 2021 the prolonged lockdowns and closures in the foodservice segment in the Netherlands have put pressure on the sales of fresh oranges.

South Africa is the most dominant supplier, supplying over 200,000 of the 529,000 tonnes to the Netherlands. Egypt is gaining market share as well with 137,000 tonnes in 2020. Large volumes from these regions leave the country again to Germany, France, Belgium, Poland, and even leading orange producer Spain.

The European Commission expects the European Union’s orange production to decline slightly by 3% in 2021/2022, mainly due to adverse weather conditions in Italy. This could provide opportunities for nearby suppliers such as Egypt and Morocco that supply northern Europe through the Netherlands, although large volumes from Egypt also tend to flood the market. In the long term, orange fruit exporters could further benefit from the growing demand for fresh fruit and juices instead of concentrates.

Mangoes: Netherlands transit country

The Netherlands is typically a transit country for mangoes from developing countries. Most mangoes by far do not stay in the Netherlands but are distributed throughout Europe.

In 2020, the Netherlands registered a value of €269 million of imported mangoes. The value has been increasing over the past few years. In Europe, the Netherlands is roughly responsible for 30% of total mango imports from developing countries.

Brazil and Peru are the main partners for Dutch mango importers. Western Africa fills in the supply during the European summertime. The demand in summer is lower due to the availability of domestic fruits, and the supply from Western Africa tends to present a number of challenges in terms of reliable quality and volumes. But Dutch traders tend to be good at organising the supply from different origins. Therefore, Dutch mango traders can be a suitable partner for many of the supplying countries.

In the Dutch market, mangoes are also increasing in popularity. Consumption is mainly triggered by retailers that focus on offering freshly cut mango and ripened ‘ready-to-eat’ mangoes. Dutch consumers prefer fibreless varieties.

Dutch companies re-export mangoes to various European countries. No less than 88% of the mangoes are re-exported. Major destinations are Germany and France. The preferences of these destinations vary. Certain supply chains put extra focus on sustainability and social responsibility. For example, the Dutch company Eosta has successfully introduced Living Wage Mangoes in Germany and Austria.

Figure 7: Example of sun-ripened, freshly cut mango at the retailer Albert Heijn

Photo by Fruit Consultancy Europe

Tip:

- Read the CBI study about the European market potential for mangoes to see how the demand develops at a European level.

Blueberries: Popular snack fruit

Blueberries have become a valuable product in the Dutch import market, as well as in domestic retail sales.

Berry imports experienced very strong growth. The total import value of berries of the Vaccinium family increased from €200 million in 2016 to €500 million in 2020. Blueberries made up most of this value, but cranberries and bilberries are also included.

Developing countries (mainly Peru) were responsible for around €260 million of Dutch imports. Chile and Spain also reached high values of respectively €107 and €60 million. The blueberry market is a market for experienced growers that can compete with excellent orchards and product handling.

A quality supply has resulted in a growing demand all over Europe. Part of this demand is fulfilled by blueberry traders and integrated sales offices in the Netherlands. Most blueberries arrive in bulk and are re-packed for retailers on arrival.

In the Netherlands itself, blueberries have become a popular snack fruit too. According to statistics, you can calculate a domestic consumption of roughly 20,000 tonnes of imported blueberries and another 9,000 tonnes of locally produced blueberries and bilberries. Blueberries are a high-value product, but the growing availability results in regular retail promotions.

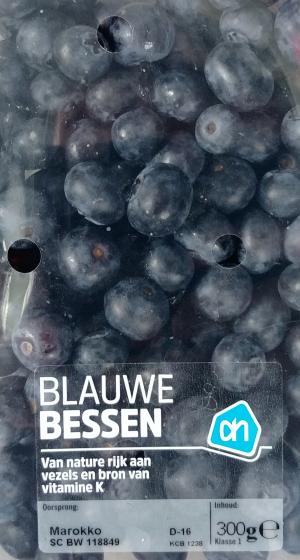

Figure 8: Example of fresh blueberries, packed in a 300 g top seal tray

Source: by Pyrka per Open Food Facts, under Creative Commons Attribution-Share Alike 3.0 Unported licence

Tip:

- Read the CBI study about the European market potential for fresh blueberries to see which other countries offer opportunities for blueberries.

4. Which trends offer opportunities or pose threats on the Dutch market?

Dutch consumers often shop for fresh fruit and vegetables with an eye for value for money. At the same time, they demand more sustainable products and fresh convenience. The total consumption has gone up during COVID-19, as well as purchases online. This may result in new market channels, but also in more specific requirements in terms of quality and packing.

Strong preference for convenience products

Together with the United Kingdom, the Netherlands is one of the most developed countries when it comes to convenience food. The Dutch consumer increasingly chooses the fast and easy option, such as meal packages, freshly cut and ripened fruit.

In 2019, cut vegetables had a 43% share in the total vegetable sales. The sales of fresh packages and meal solutions increased by 40% in 2019 and, according to EuroFruit, 30% in 2020. 4 out of 10 households buy fresh packages.

In fruit sales, freshly cut fruit is also a growing segment, although mainly limited to mango, pineapple, melon and apple. For mangoes and avocados ripening and ready-to-eat has been an important development.

Table 3: Examples of convenience fresh products

| Convenience products | Types of fruit and vegetables |

| Ready-to-eat or ripened fruit | Avocados, mangoes |

| Seedless fruit | Grapes, citrus fruit, watermelon |

| Easy-peelers | Citrus fruit |

| Freshly cut fruit and vegetables | Pineapple, mango, melon, apple, onion, carrot or mixes |

| Small packages or varieties | Mini cucumbers, blueberries, baby tomatoes |

| Ready-made salads | Lettuce, carrot, celery |

| Ready-to-make meals and soups | Mixed fresh ingredients |

| Pre-cooked vegetables | Potatoes, sweetcorn, beetroot |

| Fresh juices | Freshly made orange juice in the shop |

It is important to realise that most processing takes place in the Netherlands. As a supplier, you can mainly make a difference by choosing your varieties wisely and making sure your supply is suitable for added value such as ripening or cutting. Maturity and consistent quality are important characteristics. For small fruit such as soft fruit (berries) and grapes, it can be an advantage to offer different packaging options.

Figure 9: Example of convenient fresh coconut for direct consumption

Photo by ICI Business

Tips:

- Anticipate developments in convenience products and make sure to have different packaging options for your client. Using attractive packaging will also help distinguish your product.

- Stay up to date with developments on the Dutch market by following international and Dutch news sources such as AGF.nl (in English: Freshplaza), GFactueel.nl and Distrifood. You can also use some of these channels to promote your company and inform your buyers about your product development.

Online boost due to COVID-19

COVID-19 stimulated the consumption of fresh fruit and vegetables in the Netherlands, but it has also given online sales a boost.

During the pandemic in 2020, the total consumption of fresh fruit and vegetables increased by 4%. This was mainly realized by increasing sales in the retail sector as restaurants were closed for several months during lockdowns. Dutch households purchased 11% more vegetables and 6% more fresh fruit for home cooking and consumption.

An increasing number of consumers avoided physical grocery shopping, particularly during stricter coronavirus measures. As a result, the number of households that purchased fresh fruit and vegetables online increased by 30% in 2020. According to the Fresh Produce Centre, online purchases of fruit and vegetables had a share of 6% in 2020 and 8% in the first half of 2021. It is not sure if all consumers will continue to shop online to the same extent as during the pandemic. But it will remain an important channel and develop further in the future.

Phone applications of online supermarkets and grocery stores such as Picnic and Crisp provide easy access for consumers to shop for fruit and vegetables. Wholesalers such as Van Gelder provide an assortment to both consumers and professionals. Regular supermarkets cannot stay behind and facilitate online shopping and delivery services.

These developments at the end of the supply chain provide new channels, but they will have a limited effect on foreign suppliers. However, you can expect more specific requirements on consumer packaging and quality. Consumers are not able to hand-pick and select their fresh purchases online, so quality will be very important to make consumers return.

Value for money and high standards

The quality and expectation level for fresh produce in the Netherlands is very high, but it is also a cost-efficient and competitive market. Dutch consumers are very much focused on value for money. As a consequence, supermarkets often prize a long shelf life and a good-looking product over perfect taste.

If your products are marketed in a higher price segment, you have to make sure you focus on consumer experience. Marketing and branding are very important tools to differentiate your product. This can be seen, for example, in the presentation of the locally grown honey tomatoes, ready-to-eat avocados with the “Eat Me” label and premium club varieties such as Pink Lady apples.

Especially when dealing with experienced buyers who appreciate premium quality, you can distinguish yourself with superior quality and taste.

Consumers expect a sustainable product

Dutch consumers expect you to have a sustainable approach to production and logistics. At the same time, they have difficulties in recognising sustainable products and put a lot of responsibility on the retailer. Buyers act on this by requiring transparency and certifications from your company.

As a supplier, it is crucial to understand these requirements. Social and environmental certification schemes include actions to reduce and register the use of pesticides, focus on the safety and well-being of employees and limit the use of water.

Consumers spent 25% more on sustainable fruit and vegetables in 2020, from €746 million in 2019 to €935 million in 2020. The most important labels for sustainable fruit and vegetables are organic and On the way to PlanetProof. On the way to PlanetProof is currently a label that is active in western and southern Europe. Other labels such as Rainforest Alliance and Fair Trade are mostly used in the Netherlands for bananas. Not all labels will be applicable for products or exporters in developing countries. But the attention to sustainable measures will be important regardless of an available label. Besides sustainable consumer labels, in trade, you will have to deal with additional compliance rules, for example with Sedex SMETA.

One of the Dutch initiatives to make fruit and vegetable imports sustainable is the covenant Sustainability Initiative Fruit and Vegetables (SIFAV). The new 2025 strategy has a clear focus on reducing the environmental footprint across the supply chain, improving working conditions, wages and incomes, and strengthening due diligence reporting and transparency.

Remember that Dutch traders also supply many other European countries. Each country has different expectations concerning sustainability. That is why Dutch traders may have different requirements when importing fruit and vegetables.

Tips:

- Identify the priority areas in your supply chain in terms of sustainability and social responsibility. Think for example about fair wages, water use or your carbon footprint. Take active measures to improve these aspects and make them transparent to your potential buyers.

- Learn more about labels and sustainability standards in the CBI study on Entering the Dutch market for fresh fruit and vegetables.

Nearly 5% of fresh fruit and vegetables is organic

Growing attention for healthy and sustainable products triggers the growth of organic fruit and vegetables.

According to the Bionext trend report of 2020, the turnover of organic fresh produce in supermarkets grew from €181.2 million in 2019 to €209.5 million in 2020. This is a market share of 4.5% of the total supermarket sales of fresh fruit and vegetables. Specialised organic retailers represented an additional turnover of €59.3 million.

Organic sales will continue to grow together with the general demand for fresh products. The organic market share will also gradually increase, but slower than in most other northern European countries. In the Netherlands price is still a major factor in purchase decisions. 65% of consumers would buy more organic food if prices were lower.

Most organic supply comes from within Europe, but the growing demand will also create opportunities for non-European growers. This is also true for more tropical products with limited production possibilities in Europe such as mangoes and avocados. For example, the company Fruiteq in Burkina Faso produces organic mango for the Dutch company Eosta. To supply organic products to Europe, you must be able to produce according to strict European standards. Organic products in the Netherlands are recognisable by the labels EU organic, EKO or Demeter for biodynamic products.

Figure 11: EU organic label, the EKO label and Demeter logo for biodynamic products are all indications for an organic product in the Netherlands

Tips:

- Consider organic as a plus, not as a must, and be prepared to comply with the entire organic process when switching to organic production. Remember that implementing organic production and becoming organic certified can be expensive.

- Read more about organic growth and requirements in the Netherlands on the websites of Bionext and control body Skal.

- Find companies that specialise in organic produce to understand this niche market and have access to organic market channels. Use databases such as Organic-Bio or visit the trade fair Biofach in Germany.

- Read more about which trends offer opportunities on the European fresh fruit and vegetables market on the CBI market intelligence platform.

This study was carried out on behalf of CBI by ICI Business.

Please see our market information disclaimer.

Search

Enter search terms to find market research