Exporting fresh papayas to Europe

Exporting papayas to Europe requires a lot of hard work and knowledge. To help you prepare CBI provides market information with trends which offer opportunities in the European market for papayas. From information about buyer requirements and certifications when exporting papayas, to main market segments and distribution channels for exporting papayas as well as information about the competition.

Papaya consumption in Europe is not yet as common as it is in most tropical countries, but it is gradually increasing. Developments in better logistics, convenience such as ready-to-eat and increased product promotion contribute to its growth and make papaya an interesting supplement to more well-known tropical fruit. As an exporter, you will have to deal with strong competition from Brazil and excel in quality and product handling to export to Europe successfully.

Contents of this page

- Product definition papayas

- Product specification

- Which European markets offer opportunities for papaya exporters?

- Which trends offer opportunities in the European papaya market?

- What requirements must fresh papayas comply with to be allowed on the European market?

- What competition will you be facing on the European papaya market?

- Which trade channels can you use to put fresh papayas on the European market?

- What are the end-market prices for papayas?

1. Product definition papayas

Papaya (Carica papaya) is the oval or pear-shaped fruit of a large tree-like plant. The plant is sensitive to frost and can be grown only in tropical regions. Two kinds of papaya are commonly grown. One has sweet, orange flesh, and the other yellow flesh. Either kind is called a green papaya when picked green.

The leading varieties of fresh papayas available on the European market are the Solo, Solo Sunrise, Golden and Formosa. Papayas are most frequently consumed fresh in slices or chunks, as well as in fruit compotes.

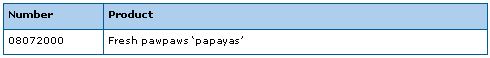

Table 1: CN commodity code for fresh papayas

Source: Eurostat Comext

2. Product specification

Quality

Marketing standards for fresh products can be found in the UNECE standards and the General Marketing Standards of Regulation (EC) No. 543/2011.

Papayas are divided into three classes: Extra Class, Class I and Class II. For the different classes of papayas, you can follow the standard in the Codex Alimentarius, the ‘food code’ of the World Health Organisation (WHO) and the Food and Agriculture Organisation (FAO) of the United Nations:

The standard for papayas in the Codex Alimentarius.

When exporting papayas to Europe, they should at least be:

- whole and sound;

- clean, practically free of any visible foreign matter;

- practically free of damage caused by pests;

- practically free of pests affecting the general appearance of the produce;

- free of abnormal external moisture, excluding condensation following removal from cold storage;

- free of any foreign smell and/or taste;

- firm and fresh in appearance;

- free of damage caused by low and/or high temperatures;

- have a peduncle, if present, not exceeding 1 cm in length.

Papayas are known to be difficult to handle, due to their relatively short shelf life and delicateness. The fruit bruises easily, and its storage temperature should be maintained at 10 degrees Celsius to prevent over-ripening due to heat and decay due to cold temperatures.

The development and condition should be such that the papayas:

- are able to withstand transport and handling;

- arrive in satisfactory condition at their destination.

Size and packaging

Papayas are classified according to Size Codes A–J, ranging in average weight from 200–300 grams (Size A) to over 2000 grams (Size J). See also the Codex Alimentarius Standard for Papayas.

Packaging requirements differ by customer and market segment. They must at least be packed in such a way as to ensure proper protection for the produce. The packaging should be new, clean and of sufficient quality to prevent damage to the product. Discuss preferred packaging requirements with your customers.

Common packaging characteristics:

- Wholesale packaging in cardboard boxes, which can vary in size.

- Papayas are ideally packed in single layers, with a protective lining to prevent bruising and damage.

Labelling

Consumer package labelling must be in accordance with the rules and regulations that apply in the European market. Labels may not contain any toxic ink or glue. See also the:

- Codex General Standard for the Labelling of Pre-Packaged Foods;

- Regulation (EU) No 1169/2011 on the provision of food information to consumers.

If the nature of the produce is not visible from the outside, the package must be labelled with the name of the product, and the name and any optional name of the variety and/or commercial name.

Labels or marking for (pre-packed) fresh fruits should provide the following information:

- Packer and/or dispatcher/shipper, i.e. name and physical address (for example, street/city/region/postal code/country) or a code mark officially recognised by the national authority

- Product name ‘Papayas’ if the contents are not visible from the outside and name of the variety

- Country of origin and, optionally, district/region/place

- Commercial specifications. i.e. class, size (code), number of units and net weight

- Official control mark (optional)

In addition, the label should include any certification logo (if applicable) and/or retailer logo (in the case of private-label products).

For more information on labelling, packaging and quality, see also the marketing standards above or read about food labelling at the EU Trade Helpdesk.

3. Which European markets offer opportunities for papaya exporters?

Positive import growth in recent years

After several years of a steady import volume of around 30 thousand tonnes, European imports have increased from 2013 onwards to around 40 thousand tonnes in 2015 and 2016. In 2017, the volume reached 43 thousand tonnes, with a total value of €103 million. This indicates that more consumers are becoming familiar with papayas. Practically all papaya imports into Europe originate in developing countries. The above developments increase your opportunities for export to the European market.

Tip:

- Find European importers at trade fairs such as Fruit Logistica or Fruit Attraction.

Germany is an important destination for fresh papayas

Germany and the Netherlands are leading importers of fresh papayas, and also show the highest import growth. A large share of German import takes place through the Netherlands, which explains the high import figures for both countries. Portugal and Spain also import large quantities of papayas; for Portugal in particular, this is due to its historic ties to Brazil, the largest exporter of papayas. Spain’s imports are just behind those of Portugal.

The Netherlands is a trade hub for papayas, while Germany as well as the United Kingdom, Spain and Portugal are the main destination countries.

Volumes in the Eastern Europe are still low. Poland and the Czech Republic have increased their imports to several hundred tonnes per year. These volumes are comparable with those of the Scandinavian countries. If volumes grow in Western Europe, you can expect the Eastern European demand to increase in as well.

As an exporter, you can either find import partners in the Netherlands, or focus on direct trade routes to relevant destination countries.

Tip:

- Keep yourself well informed of the market status by checking the global overview of the papaya market on Freshplaza.

The Netherlands is an important market for re-exports

The export of papayas within Europe is limited. The Netherlands is the only country that plays a significant role as a trade hub. Over 70% of the papayas that enter the Netherlands are re-exported, mainly to Germany. The rest of the Dutch export is spread over the rest of Europe.

Tip:

- Find a Dutch importer to supply the European market as a whole. The Netherlands is an important trade hub for papaya imports in the European market.

European papaya consumption has room for growth

Although the import of papayas in Europe is increasing, it is still very low in relation to global production. With regard to consumption, Europe lags far behind producing countries and consumes much less than, for example, the United States. In theory, there is ample room for growth which you can support with promotional activities.

Tip:

- Join or look for initiatives that promote papayas, for example, export promotion agencies and associations in your country. Papayas are not yet very well known in Europe, so these organisations could be important partners.

4. Which trends offer opportunities in the European papaya market?

Technical improvement to stimulate papaya imports

Papayas are delicate, and are therefore difficult to handle and ship. New varieties and technical improvements to facilitate sea transport can lower both the risks and shipping costs. An example is the papaya ‘Original’ from Brazil that has a longer shelf life and more resistance to diseases. Increasing experience in ripening papayas at their destination will also contribute to this, stimulating the demand for ready-to-eat papayas in Europe.

Tips:

- Pay careful attention to handling and quality. Ensure that your harvest and cold chain are perfectly managed. Poorly ripened or damaged papayas will have a negative effect on consumer experience.

- Also keep yourself informed about technical developments in the papaya market.

Convenience fruits are popular

Although papayas are not easy to handle, they fit well within the development of convenience fruit. Papayas are available in various sizes, including small individual sizes (baby papayas) and freshly cut fruit in consumer packages is also on offer. Ready-to-eat papayas are still a niche product, but are expected to become more prominent.

There are always companies involved in innovation to make fruit more convenient for consumption. In 2015, a newly cultivated ‘seedless’ papaya won the innovation award at the Fruit Logistica trade fair, with the idea of making it even easier to consume. All these developments will help to position your papayas in Europe. According to a Dutch importer, it is still a very new product, but there is some demand for it in the German food service segment.

Tip:

- Monitor market trends through news platforms such as Freshplaza, FreshFruitPortal and trade fairs such as Fruit Logistica to explore potential for new varieties and niches.

Flavour and size are important

Flavour is becoming increasingly important for European consumers, who prefer papayas to be ripe when purchased, so the fruit can be eaten quickly after purchase. The flavour should be sweet, and the texture of the fruit firm.

The main varieties on the European market are Solo Sunrise and Golden for small fruits up to 700 grams, and Formosa for large fruits above 1 kg. Consumers tend to prefer smaller papayas, particularly in north-western Europe, because they suit individual consumption better. The Formosa variety is often sold as well, due to its longer shelf life and good flavour, and is therefore also increasingly used by processors.

Tips:

- Ensure that supply chain logistics and transportation do not affect the flavour of the product in any significant way.

- Find the right partner for your specific variety. For smaller varieties, importers with retail contracts provide opportunities. For larger varieties, look for importers that have a good network in food service or processing.

Growing interest in sustainable fruit

In Europe, trends are developing towards more sustainable approaches to production and processing regarding fresh fruit. Environmental and social issues are becoming increasingly important. Social and environmental certification schemes include actions aimed at sharply reducing and registering the use of pesticides, ensuring employee safety and/or even including price guarantees for producers.

Certification schemes that are in line with the Global Social Compliance Programme (GSCP) are more likely to be accepted by European supermarkets.

Tip:

- Consult the Global Social Compliance Programme (GSCP) website for more information about social and environmental conduct.

Attention to health food

Consumers in Europe are becoming more aware of health-related issues, and are paying greater attention to their diet. Papayas are known to be very nutritious and to help digestion. Highlighting these health benefits in the promotion of papayas could help increase the papaya consumption in Europe.

Organic niche

The increased attention to health and the environment is also generating interest in organically produced fruits and vegetables. The demand for organic papayas is still very small, given their status as a typical exotic and ‘small-scale’ fruit in Europe. Nevertheless, the current supply of organic papayas is likely to be insufficient, even for the small-scale demand. As volumes increase, the organic trade can be expected to become much more significant.

Tip:

- For the export of organic papayas into the European market, use a specialised importer who understands the market and has access to niche markets with their particular requirements. Use, for example, the Organic-Bio database.

5. What requirements must fresh papayas comply with to be allowed on the European market?

The food safety requirements for fresh papayas are the same as for other fresh fruit and vegetables. You can find a complete overview in and at the:

- general buyer requirements for fresh fruit and vegetables;

- Trade Helpdesk, which provides an overview of export requirements for fresh papayas (code 08072000) per country.

What legal and non-legal requirements must your product comply with?

Minimise pesticide residues

Pesticide residues constitute a crucial issue for suppliers of fruits and vegetables. With the aim of avoiding health and environmental damage, the European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticides than allowed are withdrawn from the European market.

Note that buyers in several countries, such as the United Kingdom, Germany, the Netherlands and Austria, set MRLs that are stricter than those specified in European legislation.

Tips:

- Find out which MRLs are relevant for papayas by consulting the European MRL database, in which all harmonised MRLs can be found. You can search for your product or the pesticide used. The database has a list of the MRLs associated with your product or pesticide.

- Reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

Comply with phytosanitary requirements

Fruit and vegetables exported to the European Union must comply with European Union legislation on plant health. The European Commission has laid down phytosanitary requirements to prevent the introduction and spread of organisms harmful to plants and plant products in Europe. These requirements are managed by the competent food safety authorities in the importing and exporting countries.

Tips:

- Verify with the national plant protection organisation or food safety authority in your country if and under which conditions you can export fresh papayas to Europe. These authorities normally work with international standards, but always check with your buyer as well.

- Read more about plant health at the EU Export Helpdesk.

Which additional requirements do buyers often have?

GLOBALG.A.P. and other certification as guarantee

Since food safety is a top priority in all European food sectors, you can expect most buyers to request extra guarantees from you in the shape of certification.

The most commonly requested certification for fresh papayas is GLOBALG.A.P., a pre-farm-gate standard that covers the entire agricultural production process, from before the plant is in the ground to the non-processed product (processing is not covered). Whether GLOBALG.A.P. is required also depends on the destination country, market conditions and market channel. For example, it has become nearly impossible to supply northern Europe without GLOBALG.A.P., since it is a standard requirement for most supermarkets.

Examples of other food safety management systems that may be required are:

- British Retail Consortium (BRC)

- International Food Standard (IFS)

- Food Safety System Certification (FSS22000)

- Safe Quality Food Programme (SQF).

These management systems are supplemental to GLOBALG.A.P. and are recognised by the Global Food Safety Initiative (GFSI).

Tips:

- Identify the food safety management systems that are usually requested in your target market. Expect GLOBALG.A.P. to be one of them.

- Read more on the various food safety management systems on the Standards Map website.

- Always remember that food safety is a major issue. Work proactively with buyers to improve food safety, taking care to be transparent and remain up to date with regard to buyer requirements and regulations.

What are the requirements for niche markets?

Growing demand for organic papayas

An increasing number of European consumers prefer food products that are produced and processed using natural methods. The market for organic papayas is much smaller than the conventional market, but demand is growing and the supply is very limited due to the difficulty of growing and transporting organic papayas.

In order to market organic products in the European Union, you must use organic production methods according to EU legislation. Furthermore, you have to use these production methods for at least two years before you can market your fresh papayas as organic.

In addition, you (or your European importer) must apply for an import authorisation from organic control bodies. After being audited by an accredited certifier, you may put the EU organic logo on your products, as well as the logo of the standard holder.

Tips:

- Implementing organic production and becoming certified can be expensive, so assess the market potential before making any investments.

- Read more about the principles of organic agriculture on the website of IFOAM Organics International.

Fair and sustainable

There is growing attention for the social and environmental conditions in the producing areas. Most European buyers have a social code of conduct which they will expect you to adhere to. Although in the day-to-day trade of fresh papayas product quality has top priority, social compliance is important, and for most large retailers this is a must.

It can be a plus to be GRASP certified. With regard to social certification, GRASP, which is part of GLOBALG.A.P., is the most accessible and gaining in importance. It is not yet a requirement in the whole sector, but it is becoming more and more common.

You also increase your chances by implementing standards that are recognised by the Sustainability Initiative Fruit and Vegetables (SIFAV). This comprises an initiative from traders and retailers to become 100% sustainable in sourcing fresh produce from Latin America, Africa and Asia by 2020.

Only very few specialised buyers offer extra opportunities for fair trade certified products, such as Fair for Life or Fairtrade. Do not expect these to be common for papayas.

Tips:

- Examine your company’s current performance, for example by completing a self-assessment on the amfori/BSCI website.

- Consult the Standards Map database for additional information and to learn about differences between fair-trade labels.

- For a complete overview of buyer initiatives for social compliance, see the buyer requirements for fresh fruit and vegetables on the CBI marketing intelligence platform.

6. What competition will you be facing on the European papaya market?

Company competition

In Europe, papayas are an exotic product with potential for growth. At the global level, however, papayas are produced extensively, and competition is ever-present.

Brazil is the main supplier of papayas to Europe

Fresh papayas on the European market are primarily exported by Brazil (€87 million or 40 thousand tonnes in 2017), which has increased its supply over the last years. Thailand and Ecuador were the second largest suppliers with each around €4 million worth of papayas. The Thai import value was high in relation to its volume, probably due to the fact that air freight is common for papayas from Thailand. Ghana, Jamaica, Costa Rica and Mexico all supply smaller quantities, varying from a few hundred tonnes to one thousand tonnes.

Many potential competitors due to large global production

The global papaya production is over 12 million tonnes annually. Most of this production is consumed by domestic markets and therefore only a small part of this production is traded internationally. However, it means that, besides Brazil, there are several potential competitors among producing countries, such as India, Indonesia, Nigeria and Mexico. These are not necessarily your competitors. For countries where the lead time is too large, papayas have to be air-freighted, which can drive up the price significantly.

- India: India is the largest producer of papayas in the world. Almost all of its production (about 5.7 million tonnes in 2016) is intended for its domestic market. Only 12,000 tonnes were exported in 2017, primarily to the Middle East.

- Brazil: Brazil is the second largest producer of papayas in the world, with an annual production of around 1.5 million tonnes. As is the case in India, most of Brazil’s production is sold on the domestic market, with exports reaching almost 40,000 tonnes, mainly to Europe.

- Mexico: With 163,000 tonnes, Mexico exports more of its local production than the two largest producers. Mexico is the largest exporter of papayas in the world. Practically all of its exports go to the United States. If Mexico’s trade relation with the United States is under pressure, you can expect Mexico to become a stronger competitor on the European market.

As a new supplier to Europe, you must be able to distinguish yourself with excellent quality, multiple papaya varieties and supply security. This is the only way to compete with the big producers and suppliers.

Tip:

- Focus on harvesting at the right time, excellent storage and cooling during transportation. These are important factors for successful export to Europe.

Spain improves local production techniques for papayas

Spain already produces a few thousand tonnes of papayas in the Spanish Canary islands, but is also improving production techniques in greenhouses in Malaga and Almeria. The productivity is high and costs are said to be lower than, for example, in Brazil.

Spain is not yet able to provide a constant year-round supply, but when Spanish growers intensify their efforts in papayas, Spain may have an impact on your competitive position as overseas supplier. On the other hand, you could also try to complement Spanish production and help secure their year-round supply.

Tip:

- Keep well informed on the supply of the Spanish papaya sector, for example though news sites such as Freshplaza.

Market entry

Certification and the need to fulfil both legal and non-legal requirements pose major obstacles to producers and exporters entering the market. The necessity of supplying high-quality papayas and maintaining a perfect supply chain can make it even more difficult for new competitors to enter the market. The requirements are most strict in the supermarket segment, where buyer power is also strongest.

For papayas, quality, ready-to-eat possibilities and corporate social responsibility (CSR) are becoming increasingly important, as are supply-chain transparency and information sharing. Many European buyers prefer long-term partnerships as a means of ensuring the supply and quality of products.

Tips:

- Become part of a long-term retail programme and improve your company’s performance by building relationships with experienced buyers that maintain close contacts with supermarkets.

- Try not to compete on price alone, building partnerships with buyers/ripening facilities and striving for excellence in product quality and handling instead.

Product competition

Papayas are less well-known than other tropical fruits, such as mangoes and pineapples. Some consumers are keen on more exotic fruit or fruit with health benefits, but the lack of familiarity does not work in favour of papaya consumption.

Because most papayas are consumed as a snack food, in smoothies or in fruit salads, they can be easily substituted by or combined with other tropical or regular fruits. As an exporter, you have to view papayas as a less developed fruit, but with growth potential when promoted well. It is easier to compete with other fruit when you supply a product that is more easily eaten as a snack, in small sized and ready-to-eat portions and packaging.

Tips:

- Be realistic in your goals and make sure that your product is fit to be sold as snack fruit.

- Use storytelling (highlighting the origin and producers of your product) and novel packaging, and promote health benefits and premium quality as methods for distinguishing your product.

- Combine your papaya shipments with other fruits if possible. Combination freight makes it possible to provide frequent small deliveries.

7. Which trade channels can you use to put fresh papayas on the European market?

Supermarket versus specialist

It is important to distinguish between the supermarket channel and the specialist retail channel, which includes fresh fruit shops and street markets. Supermarkets are dominant in north-western Europe, while specialised retail is more important in southern Europe. Most papayas are sold in retail settings, with lower sales in the food service segment, such as to caterers and restaurants.

Import quantities are much lower than is the case for other products, making the papaya trade suitable for specialised importers.

Tip:

- Look for importers that already work with tropical and exotic fruit, for example in the fruit directory of food-companies.com and exhibitor lists of trade fairs such as Fruit Logistica or Fruit Attraction.

Logistics

Papayas are usually transported by air, although they are also shipped by sea from South America (primarily from Ecuador and Brazil). Although sea transport is less expensive, the longer transport time raises challenges with regard to product quality. As an exporter, you can increase your profit by exploring the option of sea transport, but you must be sure your papaya variety and the logistical service are suitable.

Tips:

- If you would like to export to supermarket customers, explore the option of sea freight and, if possible, find an importer with ripening facilities.

- Work with trusted partners or intermediary shipping or forwarding companies in order to reduce the risk of diminished product quality.

8. What are the end-market prices for papayas?

Figure 6: Consumer price breakdown for papayas (indicative)

The consumer price of papayas is generally high

In general, consumer prices for papayas are high. The exotic and delicate nature of papayas makes it a relatively expensive fruit. Moreover, papayas are often transported by air, which increases retail prices by up to 20%.

Small papayas (for example, the Solo variety) are sold at retail for a minimum of €1.50 and ranging up to €3 or €4 apiece. The larger varieties (e.g. Formosa) are not usually sold in regular supermarkets, but are available at wholesale retailers, discounters, ethnic shops and street markets. The price/weight ratio for larger papayas is similar to that of the smaller varieties.

Tip:

- For consumer prices, consult the online shops or ranges of supermarket chains, for example Tesco, Albert Heijn and Carrefour.

Please review our market information disclaimer.

Search

Enter search terms to find market research