The European market potential for fresh pineapples

Pineapple is a large product in European tropical fruit import and typically sourced in developing countries, mostly by sea but also by air freight. France, Germany, Spain and Italy are the largest consumer countries for pineapples. Because of the maturity of the market, it is crucial to have a long-term strategy and add value to your product through superior quality, sustainable production and branding.

Contents of this page

1. Product description

Pineapple (scientific name: Ananas Comosus) is a tropical plant with edible fruit that is indigenous to South America.

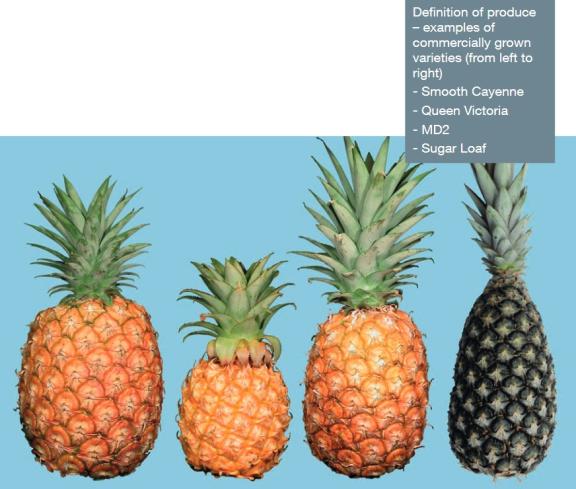

Until the mid-1990s, pineapple production and trade was dominated by the Smooth Cayenne variety, which is characterised by high sugar and acid content and is well suited to canning. In the mid-1990s, Del Monte experimented with a new hybrid pineapple variety, the MD2. The MD2, also known as ‘Sweet Gold’ or ‘Golden’, has an even sweeter taste, higher vitamin C content and a longer shelf life.

The MD2 variety has now replaced Smooth Cayenne pineapples as the preferred variety in every major market. Over 80% of all European imports are MD2. Other commercial pineapples are the ‘Sugarloaf’ and ‘Victoria’.

Fresh pineapples and its trade data fall under the Harmonized System (HS) code 080430 ‘Fresh or dried pineapples’. Fresh pineapples represent the majority of the import within this code.

Figure 1: Commercially grown pineapples

Source: United Nations Economic Commission for Europe (UNECE) Standard on the marketing and commercial quality control of Pineapples, 2013

2. What makes Europe an interesting market for pineapples?

The European market consumes a large volume of pineapples. Most of these pineapples are imported from developing countries. Building a profitable pineapple business requires long-term thinking and finding niches in which you can excel, such as superior-quality pineapple by air.

A large and year-round market for fresh pineapple

Pineapple in Europe is a mature market. They are consumed all year round, with a peak demand for fresh pineapple during Easter and Christmas. There is no clear data on how much pineapple is being produced in the southern tips of Europe, but these volumes will be low. Therefore, the demand is almost entirely fulfilled with imported pineapples.

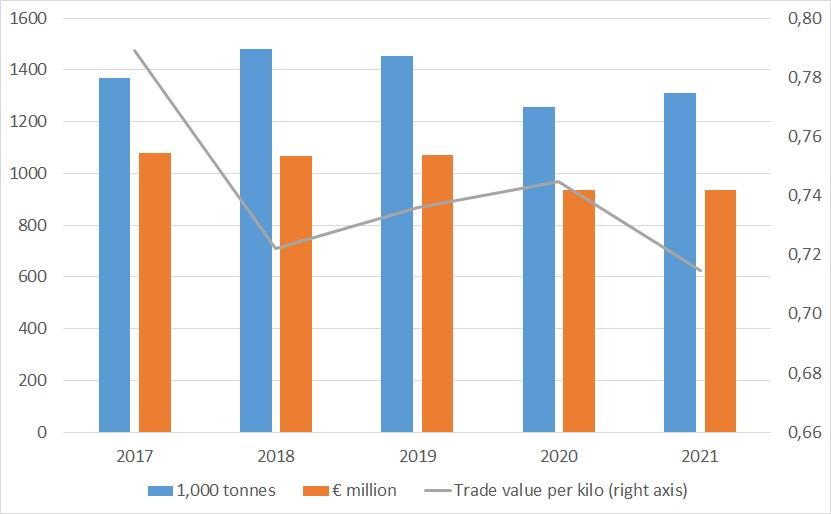

A large part of pineapples is consumed as a preserved fruit in cans, but the fresh trade must not be underestimated. The total import volume of fresh pineapple (including European trade and a small volume of dried pineapple) is roughly between 1.3 and 1.5 million tonnes – and valued at around €1.1 billion. The years 2020 and 2021 turned out to be somewhat lower (see Figure 2). This may have been an effect of the COVID-19 pandemic and the reduced availability of crops and logistics.

Figure 2: European import and trade of pineapples (including internal European trade)

Source: ITC Trade Map

Pineapples are mainly imported from developing countries

With an import value of €750 million in 2021, pineapples are the sixth most imported fruit from developing countries. Bananas and grapes are the most popular fruits from developing countries. In the last 7 years, the import values of avocado, mango and blueberry from developing countries have also surpassed that of pineapple. The pineapple trade itself is not really growing, but there may be opportunities to diversify origins.

Most pineapples are imported from Latin America, with Costa Rica being the dominant supplier. The import value from the African continent is still below €70 million. For European buyers, Africa could be a logical origin to source pineapples considering the smaller distances. But the supply chain and logistics are often less efficient. And as a producer, you need to be able to compete with the high volume of Costa Rican MD2 pineapples or differentiate your offer. In Africa, only Ivory Coast and Ghana export significant volumes by sea. Other countries are limited to air freight due to the pineapple varieties and distance to the market.

The Del Monte company’s investment in Kenya to export Del Monte Gold pineapples by air from Kenya to Europe is evidence that there is potential for African pineapples. These large multinationals have set up their business in a number of developing countries. As a smaller exporter, you will have to optimise your performance or distinguish yourself if you want to stay in the game. You can do this by adding an ‘authentic’ story in addition to a fair trade label, or you can try to enter a niche market of special or organic varieties.

Profitability requires long-term thinking

In 2018, the highest volume ever was exported to Europe, close to 1.5 million tonnes. This went together with a steep drop in prices. The saturation of the market and low revenues naturally caused a decline in production. Trade volumes in 2019 decreased as expected, but the COVID-19 pandemic in 2020 led to an unexpected deeper dip and increasing uncertainty.

The market seems to be recovering in 2021 and 2022, but high freight costs and logistical delays have made the trade much more unpredictable. It is not clear what the effect will be on consumption. Higher prices could raise the expectation of quality. Some of the key pineapple suppliers are trying to restore profitability by investing in premium fruits (see trends below).

Exporters in developing countries need to standardise and improve the quality of their fruit. This is the only way to make sure they can cope with longer and more expensive transport.

Being able to supply pineapples with lower prices would be a great advantage but would be nearly impossible due to the increasing prices. One thing is for sure: if you want to make a good profit, you will need to think long term.

Air-freighted pineapples can be an interesting niche for small suppliers

Air-freighted pineapple is a niche market that can be interesting for smaller suppliers. However, the lack of consistency, availability and quality has not always been favourable for the sales in Europe. There are also larger retail chains that have practically banned air-freighted fruits due to obvious sustainability reasons. But there will always be a market for perfectly ripened fruits by air in niche segments.

There is a demand for premium pineapples within certain consumer groups and in the foodservice sector. Restaurants in Europe as well as airline routes have opened up again after several lockdowns due to the COVID-19 pandemic, giving way again to flown pineapples. More and more, air-freighted pineapples are also seen in retail, for example in Grand Frais in France.

Air-freighted pineapples can be exported with a higher maturity level (brix level of 15+). This greatly improves the eating quality. Importers can also select the best origin at any moment, which creates opportunities for more diverse supply countries. Air-freighted pineapples from Panama and the Dominican Republic are popular, but Ghana and Kenya are also known to export premium pineapples by air. Also, freshly cut pineapple from Ghana has become quite popular through the company Blue Skies.

For exporters, it can be a good strategy to differentiate from the bulk pineapple trade. But this is not always easy. In Europe, buyers have lost much of their interest in the Smooth Cayenne. As a result, Smooth Cayenne exporters in Ivory Coast have changed their export to air logistics because they cannot compete with the sweeter sea-freighted MD2 varieties. Today, only the best-quality pineapples are suitable for the more expensive logistics.

The European market for air-freighted pineapples is very demanding. The pineapples must have a consistent quality with an excellent taste and appearance. Golden fruits with yellow flesh are preferred over green and white-flesh pineapples. Air-freighted Sugarloaf pineapples are sometimes ‘de-greened’ to make them more attractive in the premium market. Not many exporters are able to comply with the high quality requirements.

Tips:

- Make a detailed calculation of your total costs of production and shipping and assess the different options for sea and air freight. Calculating your cost price is important to define your competitive position compared to other suppliers. Remember that air-freighted and sea-freighted pineapples are 2 completely different markets. Some varieties, such as the Sugarloaf, are not very suitable for long sea transport.

- Stay informed about the latest updates in the European pineapple market through news items on Freshplaza and their regular overview of the global pineapple market, Eurofruit, FreshFruitPortal and Fruitrop.

3. Which European countries offer most opportunities for pineapples?

France, Germany, Spain and Italy are the largest consumer countries for pineapples. France and Belgium are also important markets for African pineapples by sea or air. The Netherlands and Belgium have an important position in the import and distribution of pineapples into Europe.

France: largest importer of African pineapples

France is a key market for pineapples. It is a strong consumer market, and it is the largest importer of African pineapples. It is also 1 of the only markets that shows a positive growth in value (see Figures 4 and 5).

France is 1 of the most diversified countries in supply sources for pineapples. Although Costa Rica was responsible for almost 80,000 tonnes in 2021, France also imported significant volumes from Ecuador (19,000 tonnes), Ivory Coast (18,000 tonnes) and Ghana (6,700 tonnes). Other suppliers include Mauritius (1,500 tonnes), Kenya (1,400 tonnes) and Togo (1,000 tonnes), which mainly supply pineapples by air. Mauritius is known for its baby Queen Victoria Pineapples, a very fragrant, flavourful variety.

According to Fruitrop, France is the leading European country for pineapples imported by air. French consumers are prepared to pay a higher price but do not compromise on quality. Grand Frais is a typical supermarket where you would find high-quality, air-freighted pineapples. Other supermarkets also offer them on occasion, in particular during special festivities. Note that growing concerns about the carbon footprint of air freight can hamper this high-value trade. On the positive side, pineapples generally travel on passenger flights.

Belgium: distribution hub for multinational traders

Belgium is a transit country. Several multinational fruit companies such as Dole and Del Monte use Belgium as a gateway into Europe. Also, a lot of pineapples from African suppliers pass through the Belgian ports and airport.

Belgium imported 132,000 tonnes of pineapples from non-European sources. Costa Rica dominates the supply, with 108,600 tonnes in 2021. According to data of Procomer, Belgium is also the main destination in Europe for organic certified pineapples from Costa Rica. This organic supply had a (FOB) value of almost €1.5 million in 2021.

In addition to Costa Rica, Belgium has several other pineapple suppliers. These include Ivory Coast (9,800 tonnes), Ghana (6,900 tonnes) and a relatively new supplier: Honduras (3,500 tonnes). Ecuador used to have a significant export to Belgium of 10-15,000 tonnes between 2017 and 2019, but most of this volume has been redirected to other countries, including the Netherlands.

From Belgium, pineapples are redistributed mainly to Germany, the Netherlands and France. Around 107,000 tonnes, more than 80% of the non-European import, was re-exported in 2021.

Germany: large consumer market

The German market is a large consumer market. The calculated consumption of fresh pineapples was roughly about 113,500 tonnes in 2021.

Pineapples reach the German market either directly or via the Netherlands and Belgium. Like in other European countries, Costa Rica is the main supplier, with a direct supply of just over 100,000 tonnes in 2021. Costa Rica is followed by Ecuador with 6,100 tonnes and Ghana and Ivory Coast both with 1,400 tonnes.

German consumption of fresh pineapples has slowed down a little since the peak supply in 2018. Still, the purchasing office of Rewe supermarkets has pointed out that pineapples are responsible for 9% of the exotic fruit turnover and that they are among the fruits with growth potential.

The best opportunities in the near future may be found in convenience. German consumers already purchase a lot of preserved and canned pineapples. The fresh convenience market is less developed in Germany compared to other Western European countries. You can expect this segment to grow gradually as more retailers are offering freshly cut pineapple. Supermarkets may also try to boost consumption through new innovations such as ‘pina to go’, an automated, in-store pineapple cutter.

The quality of freshly cut pineapples has to be good enough to satisfy consumers. On top of that, German retailers are also very focused on residue limits. This makes it a challenging market to supply.

The Netherlands: main trade hub for developing country suppliers

The Netherlands is the largest importer of fresh pineapples from developing countries. The country functions as a logistical hub of tropical fruits for neighbouring countries.

The Netherlands will always be an important country to focus on because of its logistical function. Lots of fresh fruit, especially tropical and exotic, are shipped through the Netherlands. This also means you will find a concentration of traders.

The Dutch trade hub function becomes clear from the trade data. The Netherlands imported 209,800 tonnes in 2021, of which 175,700 from non-European sources, and about 195,500 tonnes left the country again to other European countries. The Dutch market reflects the demand in Europe: the import value decreased in 2020 and 2021 due to COVID-19 and due to a lower availability of fruit.

The Netherlands gets 90% of its pineapples from Costa Rica. This was 158,000 tonnes in 2021. In 2021, Ecuador (12,700 tonnes in 2021) and Ivory Coast (1,500 tonnes) were the only other remaining serious suppliers. Other supply countries did not pass 1,000 tonnes in 2021.

Due to the high share of re-exports, it is difficult to make an estimation of local consumption. However, there is a notable trend for fresh convenience, or freshly cut pineapple. It has become a valuable addition to the canned fruit segment, and it has likely surpassed the retail sales of whole fresh pineapples. At the same time, plastic packaging is something that supermarkets are trying to avoid to reduce waste. But in this case, convenience wins out over sustainability.

Spain: key market for air-freighted pineapples

Spain is the second-largest import market for pineapples from developing countries. Consumption is characterised by seasonal peaks and price consciousness.

Spain has an abundance of locally produced fruit, including a limited production of pineapples on the Canary Islands with which non-European pineapples have to compete. Despite this, Spain is the second-largest import market in Europe for pineapples imported from developing countries.

Consumers purchase a lot of preserved pineapple, which is easy and very affordable. When they buy fresh, they will look for perfectly ripened pineapples. This explains why Spain is 1 of the key importers of air-freighted pineapples. Fresh-pineapple consumption continues year round, but with a clear peak in December (Christmas). Spain (like Italy) is also very seasonal in that sense, more so than other European countries.

Spain has strong ties with Costa Rica, from where it imported 146,000 tonnes in 2021. There is also potential for other suppliers. The import value from African countries has been on the rise (see Figure 5). The import from Ivory Coast is increasing again after several years of low volumes. Its supply has grown from a few hundred tonnes to 2,400 tonnes in 2021. Kenya has also found a market in Spain and exported more than 1,000 tonnes for the first time.

Italy: freshly cut on the rise

Italy is a large country for pineapple in terms of volume, but in value, it is usually behind the other European markets.

The total trade value of pineapples in Italy was €97.7 million (€90.5 million from developing countries), and in volume, Italy is the fourth-largest importer in Europe. Italy mainly imports tropical fruit for domestic consumption. Pineapples have become a relatively popular fruit.

Pineapples have grown to become a mainstream product. The country first adopted air-freighted pineapples, but with improving logistics, it is able to ship fresh pineapples in less than 2 weeks from Central America. In 2021, around 136,600 tonnes were imported from Costa Rica. After the pineapple giant Costa Rica, Colombia is the second-largest pineapple supplier, with 3,500 tonnes.

In Italian supermarkets, sales of freshly cut pineapple have been on the rise. A recent publication by Freshplaza in November 2021 reveals that the penetration of freshly cut is 4.3%, much higher than the 2,5% 2 years earlier. Companies that are responsible for this development are, for example, Spreafico and Orsero Group.

Tips:

- Go to Rungis wholesale market when you are visiting France. This will be a good starting point when you want to enter the French market, but it can be a good reference for the European market as well.

- Focus on trading companies in the Netherlands and Belgium if you are having difficulties finding a direct client for your pineapples.

4. Which trends offer opportunities or pose threats on the European pineapple market?

Pineapples in Europe are part of a mature market. Differentiation and adding value will become more important. As a supplier, you can differentiate by branding premium varieties or facilitating specific segments such as the demand for convenience products. All pineapples destined for Europe will need to comply with increasing sustainability standards.

Adding value in an increasingly specialised market

The size and saturation of the pineapple market is motivating businesses to innovate or add value to their product. This is a trend that will only grow stronger when the global supply increases. For exporters, it is just as important as it is for European fruit companies to differentiate their supply from their competitors.

Pineapple has become a market for specialists. The bulk market is dominated by a few big brands with the sea-freighted MD2 variety. Since the COVID-19 pandemic, logistics have become less reliable and thus more challenging. There are also opportunities for exporters of specialised premium varieties.

Exporting premium pineapples always requires consistency in quality and excellent timing in harvesting. If timing and logistics can be well managed, the next most obvious way to differentiate your supply is by improving cultivation processes or developing better varieties. Colour, flavour and sweetness are important selection criteria for specialised importers.

When you can distinguish your pineapple as superior quality, it is important to communicate this to your buyers through brand building or labelling. A quality label can also be an organic certification or a Protective Geographical Indication (PGI).

Example of organic pineapples

You can find examples of product differentiation in many of the pineapple origin countries. In Togo, a local cooperative with 1,500 farmers and 500 hectares of pineapple production managed to transform to organic cultivation and obtain Fairtrade certification. With the support of Italian operators and development agencies, the cooperative now supplies Italy with organic ‘Dolcetto’ pineapples via the organic Brio brand. It claims that its selling price is 25% higher than similar Fairtrade certified products. See also the video titled ‘organic pineapple from Togo is a hit’.

Example of protected geographical indication (PGI)

In Benin, they found their uniqueness in a ‘Protected Geographical Indication’ (PGI) for their Sugarloaf pineapple from the Allada Plateau. This variety remains green when fully ripened. Green pineapples are not easily accepted by any consumer in Europe. This PGI label will help sell the green pineapple as a specialty.

Example of branding

Ghanese pineapple exporters united themselves in the association of Sea-freight pineapple exporters of Ghana (Speg). Together, they developed the Sankofa pineapple brand. The required quality and compliance with production standards are ensured via a quality control scheme.

Fresh convenience in the lift

Pineapple is not an easy fruit to peel and prepare for consumption. Therefore, many consumers in Europe go for the easy choice of canned pineapples. But for the best experience, fresh pineapples are preferred. That is why there is a strong growth of freshly cut pineapples in European supermarkets, in particular in northwest Europe, such as in the United Kingdom and the Netherlands. Other countries, such as Italy, are following as well.

Freshly cut pineapple is a typical convenience product that has a higher cost and thus price. When processed in origin, suppliers can save on the air freight costs, because less than the whole fruit is exported. Pineapple can be exported in chunks or in slices. It is a business that is largely dominated by the British-Ghanese company Blue Skies.

The only thing that can slow down the fresh convenience trend is poor management of the ready-to-eat quality and the use of plastic packaging. The use of plastics for fresh fruit no longer fits in the widespread ambition to make products more sustainable. It is a continuous struggle between convenience and consumer experience and thinking about the environment.

Figure 6: Promotion of freshly cut pineapple by Albert Heijn supermarket in the Netherlands

Source: ICI Business.

Growing interest in sustainable fruit

Across the sector, there is a focus on sustainable fruit. Taking action to make your pineapples more environmentally friendly and socially responsible is no longer optional. Compliance with sustainability standards is mandatory.

Complying with the increasing sustainability standards includes basic certifications such as GlobalG.A.P. and Smeta. Certification schemes include actions aimed at sharply reducing and registering the use of pesticides and ensuring employee safety. Soil management and avoiding monoculture are also relevant issues in the pineapple trade. But today, many supply chain actors often go beyond the basic standards, for example with true cost pineapples, zero carbon and innovative waste recycling.

True cost accounting

The Dutch company Eosta introduced the principle of true cost accounting for pineapples. A ‘true cost’ pineapple from Costa Rica reveals all hidden costs, including the impact on the environment, soil restoring, water filtering and loss of biodiversity. This project has been launched with several retailers and health food stores in Germany, Scandinavia and the Netherlands.

Zero-carbon pineapple

The French importer SIIM offers the first ‘zero-carbon’ pineapple. For its Terrasol pineapple from Ecuador, it measures the carbon emissions, and it has been able to certify the product as carbon neutral in 2021.

Waste recycling

One of the more advanced innovations is the re-use of agricultural waste from pineapple production. The multinational fruit company Dole has announced a partnership with Ananas Anam, a natural textile company, to achieve its zero-waste goal. By re-using the fibres of pineapple leaves, a new sustainable material can be made, called Piñatex®.

When you invest in farmers and a sustainable supply, it is important to communicate this to your buyers. Transparency is highly appreciated. But if you want your product to stand out, you need to make it visual, also to consumers. For example, this can be done by adding a label with a QR code (see Figure 7).

Figure 7: Dole label with ‘visit my farm’ QR code, sold in an Edeka supermarket in Germany

Source: ICI Business

Tips:

- Find your specialisation and set your pineapple apart from the mass supply.

- Use labelling to tell your story and emphasise the sustainable aspects of your products.

- Read more about which trends offer opportunities on the European fresh fruit and vegetable market on the CBI market intelligence platform.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research