Entering the Spanish market for fresh fruit and vegetables

The requirements for entering the Spanish market for fresh fruit and vegetables are changing rapidly. The growing role of Spain as a hub to serve other demanding markets in the north of Europe, has also resulted in increasing requirements in terms of certifications and pesticide levels. In addition to the competition from non-European suppliers, you will be competing with Spanish producers as well. While some producers might be your potential buyers to cover the off-season, others are becoming competitors by investing in their own production in developing countries.

Contents of this page

1. What requirements and certifications must fresh fruit and vegetables meet to be allowed on the Spanish market?

Fresh fruit and vegetables must meet the European requirements to enter Spain, as detailed in our European buyer requirements study.

What are the mandatory requirements?

To enter the Spanish market, you must comply with European Union (EU) requirements, including tariffs, quotas, phytosanitary requirements, labelling, packaging, food safety, quality and sustainability. Table 1 presents an overview of the Spanish bodies that ensure compliance with European standards and regulations for the different topics.

Table 1: Spanish government bodies that oversee mandatory requirements

| Topic | Agency / Government body |

| Tariffs and quotas | Agencia Tributaria (Spanish Tax Agency) |

| Phytosanitary requirements and pesticide maximum residue levels (MRLs) | Agencia Española de Seguridad Alimentaria y Nutrición (AESAN) |

| Quality and marketing standards | Secretariat of State for Trade |

| Labelling | Spanish Agency for Consumer Affairs, Food Safety and Nutrition (AECOSAN) |

Tips:

- Consult the EU’s TARIC database to determine specific tariff rates for your products.

- Check the recent phytosanitary issues indicated by Spain in the Rapid Alert System for Food and Feed (RASFF) for your country of origin and product.

Maximum residue levels are becoming stricter

The EU has established Maximum Residue Levels (MRLs) for pesticides in food products. Fresh fruit and vegetables must be tested to ensure that pesticide residues do not exceed these limits. Otherwise, they can be rejected at the border or withdrawn from the market. This might result in financial losses and reputational damage for your company and your client.

Product liability insurance

Large clients increasingly request product liability insurance to cover liability for third party damage and the costs associated with an eventual product withdrawal. If you do not have such insurance, your client might accept a commitment letter stating that you will acquire the insurance soon. Your client will give you details about the required coverage.

This is not yet a generalised practice in the sector, but talks with exporters supplying the Spanish market confirmed that this was a requirement to start doing business with a large buyer

Previously, Spanish importers rarely requested MRLs below legal limits. This is now more common due to large European retailers' purchase centres in Spain and their role in stricter Northern European markets. For example, REWE and EDEKA, which have purchase centres in Spain, only allow 50% of the legal maximum quantity.

In the Spanish market, you can expect additional pressure from sector organisations that defend the interests of Spanish growers, and lobby at the European level to increase phytosanitary inspections from certain origins and products that they consider risky.

The European Green Deal

In 2020, the EU implemented a set of policies and actions called the European Green Deal. Its goal is to achieve a sustainable, climate-neutral economy by 2050, with a 50% reduction in pesticides use and 25% of available land for organic farming by 2030.

Although many farmers in Spain oppose the Green Deal, it will gradually ban more pesticides and reduce residue levels. Stay updated to ensure compliance with evolving regulations.

Tips:

- Check the European pesticides database to find the applicable and updated MRLs for your product. You can search the database by product or pesticide.

- Contact insurance companies in your country to find more information about product liability insurance. Since this insurance is uncommon for fresh produce, you might need to consult different companies. Allianz, for example, offers this insurance, but you need to confirm the availability in your country.

Packaging waste requirements

The Spanish Royal Decree 1055/2022 mandates measures to prevent waste, promote bulk food sales, increase the use of reusable packaging, and encourage recycling and product marking. Paragraph 4 of Article 7 requires fresh produce to be sold in bulk if sold whole. This requirement does not apply to fruit and vegetables that are:

- packaged in quantities of 1.5 kilograms or more

- packaged as a protected or registered variety

- labelled with a quality or organic farming designation, or

- at risk of spoilage or depletion (reduction) when sold in bulk

Current trends in packaging for fresh produce emphasise the dual importance of maintaining product quality and minimising environmental impact. Packaging that prevents bruising and extends shelf life is valued, with a preference for sustainable materials like recycled plastics (Figure 1) and biodegradable options.

Figure 1: Packaging with recycled plastic in Spanish supermarket

Source: Dana Chahin

Tip:

- Read the report written by AESAN on fruits and vegetables that have a risk of spoilage when sold to consumers in bulk. Berries and sprouts are considered to be very high risk.

What additional requirements and certifications do buyers often have?

Additional requirements and certifications vary for buyers. However, with Spain becoming a relevant trade hub for the European fresh produce sector, the requirements are becoming more rigorous.

Increasing attention to certifications

For a small number of Spanish buyers, compliance with European legal requirements is enough. Industry sources estimate that at least 90% of the buyers require GLOBALG.A.P.. Demand for products without this certification is rapidly decreasing, especially considering that most buyers are engaged in international trade within Europe or supply supermarkets. For supermarkets, certifications are crucial to guarantee traceability and quality along the value chain.

Sustainability standards such as SMETA and GRASP for social responsibility or Rainforest Alliance and SPRING for environmental impact are becoming more important. Other certifications such as BRC and IFS might be required for your packaging plant. These certifications ensure the implementation of HACCP principles, a requirement according to European legislation.

Tip:

- Familiarise yourself with the different social and environmental standards and developments, by reading our tips on how to become a socially-responsible exporter and how to go green in the fresh fruit and vegetables sector.

Quality standards

If you want to export your product to Spain, you must comply with the general quality and marketing standards. These include qualities such as cleanness, maturation and sizing. The Spanish Secretariat of State for Trade provides a table with quality standards and brochures applicable to each fruit and vegetable. This is your starting point for your preparations, but your importer may have specific standards which will be checked upon arrival of your product.

Class I is usually the preferred minimum quality, although appearance might not be very important if your product is placed on the local market. Because Spain is a large producer, consumers are more used to seeing different product classes on the market. However, with more Spanish companies supplying northern European countries, quality requirements are getting stricter.

Tip:

- Upon arrival of your product, you can hire an external surveyor to perform an independent quality check at your client’s warehouse. This can be done in parallel to your client’s quality check. Transcoma is an example of a company providing this service in Spain.

Payment terms

A common payment term among Spanish importers is consignment: you deliver the produce, and the market decides the price. This means that you send the produce without knowing how much you will get paid for it. Because this is a considerable risk, you should avoid this payment term – especially if you do not know the client or do not have any references. Some exporters work by consignment as a last resort. For example, if the produce will otherwise be lost because a client cancelled an order that was already in transit.

Spanish importers that have supermarket programmes or export within Europe are more likely to offer you to work under a minimum guaranteed price (MGP). They can also offer you a combination in 1 shipment, by setting an MGP for certain qualities/calibres and leaving the rest to market prices.

Most clients will make a partial payment against presentation of the documents and complete the payment upon arrival of the shipment or after 30-45 days. Advance payments are rarely used and depend on the specific situation and the trust between both partners. The Incoterms FOB (Free On Board) and CIF (Cost, Insurance, Freight) are common delivery terms. Which one is used, will depend on the needs of your buyer.

Risk assessment of the business

Before starting a business relationship, you must carefully assess the risks. If you decide to work by consignment, this is even more important. Some ways of doing this include:

- Work with export credit companies like Coface. They will send you a report including a credit score measuring the risk, and a recommended maximum credit, based on the company’s credit history.

- Combine this information with references. Consult other exporters that are already doing business with this buyer, trade promotion agencies or logistics companies.

- Evaluate the professionalism and reputation by checking their website and presence at trade fairs. Read their annual reports to see financial information.

- Do this often, as a company performing well today might not be performing well in the future

What are the requirements for niche markets?

Spain has niche markets for ethnic, premium, and organic produce, each with specific requirements.

Ethnic and premium produce

Spain has a small market for ethnic products such as yuca, eddo, plantain and exotic fruits. Some of these products are found in select supermarkets, or in specialty shops that target immigrant communities. Compliance with European legal requirements is usually enough to enter the ethnic market, but you should always confirm the requirements with your client.

Figure 2: Yuca from Costa Rica in Spanish supermarket Mercadona

Source: Dana Chahin

Spain can also be an interesting market for premium import products with superior taste, such as tree-ripened mangoes or sweet pineapples. These products must be transported using efficient logistics and perfect handling. However, the added costs of airfreight make these products expensive and less sustainable. Only a small consumer group is willing to pay the higher cost.

Organic produce mainly for the export market

As described in the market potential part of this study, the possibilities for exporting organic produce to Spain are limited, but they do exist. However, if you are successful in doing business with Spanish importers that require organic products, you must ensure that your product is certified according to Regulation (EU) 2018/848. This regulation outlines the principles and rules for organic production, labelling, and certification within the EU.

Tip:

- Read the EU organic farming legislation and the rules to use the organic logo.

2. Through which channels can you get fresh fruit and vegetables on the Spanish market?

Understanding the segmentation of Spain's end-market is key to choosing the best export channels for your produce.

How is the end-market segmented?

At 48%, supermarkets hold the largest market share in the distribution of fresh fruit and vegetables. Between 2013 and 2023, specialised shops lost 10 percentage points of their market share to supermarkets. Other distribution channels such as hypermarkets, farmers’ markets, and other channels, account for less than 30% of the market. Their market share has been relatively stable over the past 10 years.

Source: MERCASA, 2024

Supermarkets and hypermarkets

When choosing a supermarket, consumers consider different factors. As observed in Figure 4, good prices and offers and promotions have become increasingly important again since 2021. Proximity has remained the most important factor over the last five years, explaining why many supermarkets are opening new stores to be closer to more customers.

Source: Kantar Worldpanel in ALDI’s fresh food observatory, May 2024.

With 97% of the population buying fresh products in supermarkets, this end-market segment is expected to continue growing over the next years. Mercadona, the leading Spanish supermarket, held a market share of 27.6% in 2023 and expanded from 1.3 thousand stores in 2010 to over 1.6 thousand in 2023.

The top 3 is completed by Carrefour (7.6%) and the German discounter Lidl (6.1%). Other relevant supermarkets include Día, Eroski, Consum, Alcampo, and Aldi. Carrefour, Alcampo and Eroski offer different retail formats, including hypermarkets, supermarkets, convenience stores and e-commerce. Lidl, Aldi and Día are in the discounter category.

To position your fruit in this end-market segment you need to offer a good price-quality balance and comply with stricter requirements in terms of certifications. Target importers that supply supermarkets, such as producers that have a distribution network and engage in import activities, or central purchase centres.

Tips:

- Find an overview of Spanish retailers on Freshplaza and visit their websites to see their range, promotions, origins, and strategies.

- If you visit a trade event in Spain, take a day to do a supermarket tour. Look at the produce labelling to identify potential importers for your product.

Specialised stores

Although their share has rapidly decreased over the past 10 years, speciality and independent grocery stores still play a vital role in the distribution of fresh fruit and vegetables in Spain. They are known for offering unique and high-quality produce, often sourced from local farms or specific regions.

Generally, speciality shops source their produce daily from the wholesale market. Therefore, if you want to enter this segment, you should look for an importer with a presence in the largest Spanish wholesale markets: Mercamadrid or Mercabarna.

Other segments

Farmers’ markets are becoming increasingly popular, but their focus is mainly on locally-grown produce. Direct sales through farm stands, community-supported agriculture programmes, and online platforms are growing in popularity. Examples of such online platforms in Spain include DeLaHuertaCasa.com, La Fruteria and Talkual. These online platforms do not usually offer imported produce, and if they do they source it from importers or wholesalers.

In addition to these direct trade online platforms, most retailers offer online shopping in addition to the on-site shopping experience. Día and Mercadona are the most popular ones, but other supermarkets such as Eroski, El Corte Inglés, Alcampo and Carrefour have also engaged in e-commerce.

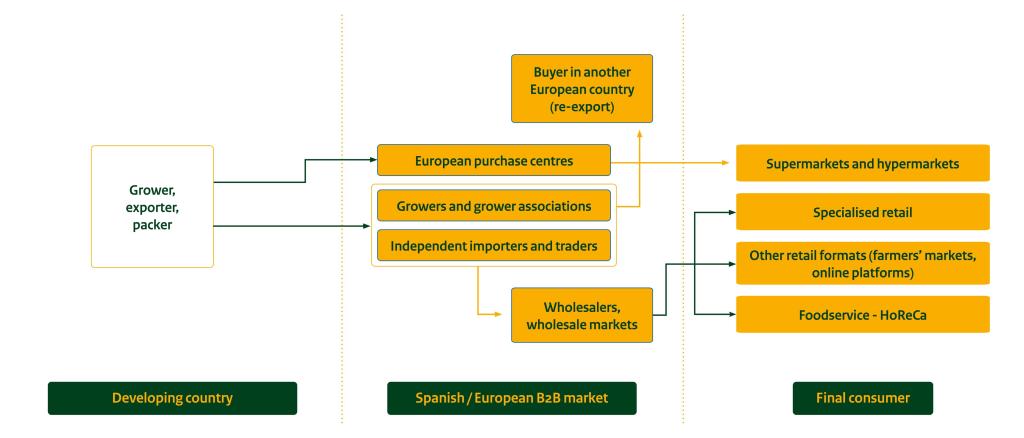

Through which channels does a product end up on the end-market?

Purchasing centres, growers and grower associations that engage in imports, specialised and independent importers, and wholesale markets are the main channels for fresh produce to reach the end-market.

Figure 5: Distribution channels for fresh fruit and vegetables in Spain

European purchase centres

Considering the important role of the country as a producer, large buyer groups have regional offices and sourcing activities in Spain. These offices were responsible for managing the relationship with Spanish growers, but in recent years they have also assumed international sourcing activities to make further use of their distribution network.

REWE Group from Germany, for example, has central buying operations in Spain with Eurogroup España and Campiña Verde Ecosol. Eurogroup focuses on sourcing from Spain, France, Portugal and Morocco, while Campiña Verde focuses on organic products, including from overseas. The latter sources products such as avocados, mangoes, grapes, and limes directly from exporters in developing countries. Other German examples with purchasing centres in Spain include EDEKA and LIDL.

With retailers wanting to have greater traceability of their products and a more direct relationship with their suppliers, this distribution channel is expected to continue growing over the next years.

Growers and grower associations

Spain has strong growers’ associations, like Anecoop for citrus and Casi for tomatoes and other produce. They primarily support local growers but are gradually entering the import market for specific products and seasons.

On the other hand, many independent producers are increasingly transforming into importers to use their distribution network. To offer a year-round service to their clients, producers are increasingly integrating their production activities into foreign trade operations during the off-season.

Mercajara, for example, is a leading producer of mushrooms and fungi that rapidly expanded its import and export operations across Europe in several fruit categories: from limes, grapes and pineapples to exotic fruits and more. Other examples of producers that also trade and import from abroad are Nufri, Natural Tropic, Reyes Gutierrez, Axarfruit, and Trops. When it comes to avocados and mangoes specifically, it is very likely that your potential buyer is also a producer. This gives them good knowledge of the fruit and ensures everyone is on the same level when discussing quality issues.

Independent importers and traders

Independent importers specialise in sourcing from outside of Spain, but their most important market in terms of clients is usually the local one. They often import tropical fruits such as bananas, pineapples, mangoes and exotics. Cultivar, for example, is one of the first companies that introduced exotic products to the Spanish market. Their exotic fruit packaging includes a booklet with a QR code for recipes and information about their range of exotics.

Figure 6: Exotic fruit packaging for supermarkets by Cultivar

Source: Dana Chahin

In addition to supplying supermarkets, many independent importers supply other channels such as speciality shops, restaurants and the food service segment. Although trading is their main role, some of them have also started their own production at the origin. CMR Group, for example, has its own off-season production in Brazil.

Wholesale markets

Wholesale markets serve as central hubs where producers, importers, and distributors trade large quantities of produce. These markets are crucial for supplying small and independent retailers, food service providers, and other wholesalers. They provide an efficient platform for both domestic and international producers to access the Spanish market. Although this channel is expected to continue growing in sales, the long-term outlook is that their significance will decline due to the decreasing market share of specialised retail and the growth of supermarkets.

Many specialised importers have a solid presence in the wholesale market. Cultivar, for example, has a presence in Mercabarna, Mercamadrid, Mercabilbao, Mercasevilla and Mercapalma. From these markets, it mainly serves other wholesalers, specialised retail and the hotel industry.

Tips:

- Connect and start building relationships with the major players of these channels, listed in Table 2. A good place to start doing this is Fruit Attraction in Madrid, which is the leading fresh fruit and vegetables meeting point for Spain, and increasingly for Europe too.

- Check the websites of the largest wholesale markets in Spain: Mercamadrid in Madrid and Mercabarna in Barcelona.

What is the most interesting channel for you?

The Spanish landscape of distribution channels is rapidly evolving, and you can find opportunities in both new and traditional channels. Importers, producers and purchase centres offer the most interesting ones.

Producers, importers and purchase centres

It is difficult to draw an exact line between Spanish producers and importers. Many producers are becoming importers to use their distribution network and offer products in the off-season. At the same time, many importers and large distributors also have their own production abroad and in Spain to secure a stable supply. Both client profiles described above offer interesting opportunities for you.

Table 2: Major players in the Spanish tropical and exotic fruit market

| Company | Volume (t) 2022 | Volume (t) 2023 |

| EUROBANAN, S.L. | 60,588 | 60,355 |

| ANECOOP, S.COOP. | 120,000 | 55,110 |

| CULTIVAR, S.A.U. | 48,594 | 51,412 |

| REYES GUTIÉRREZ, S.L. | n.a. | 33,000 |

| FRUITS CMR – GRUPO | 29,500 | 32,000 |

| S.A.T. TROPS | 49,800 | 31,000 |

| JOSÉ LUIS MONTOSA, S.L. | 35,000 | 30,000 |

| AXARFRUIT, S.L. | 24,000 | 28,500 |

| HNOS. FERNÁNDEZ LÓPEZ, S.A. | 25,902 | 26,882 |

| FRUITGROWING QUALITY, S.L. | 25,000 | 25,000 |

Source: Agroberichten Buitenland, 2024

Eurobanan is a large player in the market, with Dole as one of the shareholders of the group. Other relevant players besides the ones already mentioned in this study include Frutas Montosa, Tropical Millenium, Axarfruit, Garcia Mateo & Sinova, and AgriAzula. These companies are usually open to exchanging market information to define the feasibility and best time to start doing business together.

Purchase centres are also an interesting channel that is rapidly growing in Spain. Since the products sourced by these centres will most likely go to other, stricter, markets in Northern Europe, their requirements and sustainability standards are also more demanding. As purchase centres are usually sourcing for their own distribution or retail chains, it might be easier to sell on the basis of a MGP or fixed price.

Tips:

- If you want to supply a client that is also a producer, make sure that your product does not compete with the local season. Check the seasonal calendar in this report on page 11 and 12 (the report is in Spanish but the calendar is an infographic)

- Browse the websites of industry associations like FEPEX to identify potential buyers and gain market insights. Turn on the translate option in your browser to read the content.

3. What competition do you face in the Spanish fresh fruit and vegetables market?

To be successful in the Spanish market of fresh fruit and vegetables, having a clear understanding of the competition landscape at the country, company and product level is key.

Which countries are you competing with?

The main non-European countries that you will be competing with are Morocco, Peru, Costa Rica, Brazil, Chile and South Africa. You should also take European suppliers and internal production into account, particularly to determine the right time of the year to enter the Spanish market

Source: ITC Trade Map, August 2024

Morocco: an attractive harvest period and nearby origin

Morocco is the leading non-European supplier of fresh fruit and vegetables to Spain and the EU. Its geographical proximity and favourable climate allows for a longer harvest period. This makes Morocco a strategic partner for fresh produce. Many Spanish producers are integrating their production with Morocco by investing in plantations. This makes it more difficult for nearby suppliers to compete with Morocco.

Spain’s imports from Morocco grew at an average rate of 5.6% over the past 5 years, reaching a value of €900 million. In 2023, the most imported products were berries – mainly raspberries (23%) and blueberries (17%). These were followed by fresh or chilled beans (16%), fresh or chilled fruits of the genus Capsicum or Pimenta (11%) and tomatoes (9%). Avocados come next and were the fastest-growing product over the past five years, with an average yearly growth rate of 28%. Blueberries also grew at a high average annual rate over the past five years (14%).

Looking ahead, Morocco’s main challenge is ensuring it meets the European legal requirements and environmental standards. Despite the continuous efforts to meet EU regulations, Moroccan products have faced accusations from Spanish and European producers of inferior product quality and non-compliance.

Tensions between Moroccan and European producers have escalated driven by the perception of Moroccan produce as a competitive threat. In early 2024, Moroccan trucks loaded with fresh produce were attacked by Spanish and French producers, damaging the produce and resulting in customer penalties for Moroccan exporters.

Peru: diverse range of high-in-demand fruit and vegetables

Peru is the second-largest supplier to the Spanish market. It has nearly doubled its export value over the past five years, reaching €479 million in 2023.

More than half of its fresh produce exports to Spain are avocados, which have more than doubled over the past five years. Grapes are the second most-exported fruit, accounting for 12% of the total imported value, followed by asparagus (10%) and mangoes (9%). Products such as blueberries and citrus fruits (mainly mandarins) have experienced high growth. Peru is also the main onion supplier to Spain, reaching €30 million in 2023.

Peru's strengths lie in its diverse range of high-demand fruits and growing focus on vegetable exports. Moreover, Spanish buyers and Peruvian exporters share Spanish as a language. This facilitates doing business and establishing a relationship, which is important for Spanish buyers. Peru is not only a leading exporter to Spain, but it is also one of the leading worldwide exporters. The country wants to position itself as the world’s eighth-biggest exporter of fruits. Peruvian produce is well-regarded for its quality and variety, enhancing its image in the European market.

Peru’s challenges include logistical issues and competition from other tropical fruit producers. Severe climate conditions such as a warm winter, heavy rainfall and floods may affect the country and the market expectations for upcoming seasons. Economic paralysis due to political unrest is also part of Peru’s challenges in maintaining its reliability and trust in the European market.

Costa Rica: an established banana and pineapple supplier

In 2023, Spanish imports from Costa Rica reached €275 million. Costa Rica is a leading supplier of bananas and pineapples, which together accounted for 95% of the total import value. Pineapple imports hit €133 million, and bananas reached €127 million. Despite the focus on fruits, vegetables have shown moderate growth over the past five years, including roots and tubers such as cassavas and eddoes. Cassavas were the third most imported fresh produce from Costa Rica, with imports of €11.5 million in 2023.

Figure 8: Exhibitor from Costa Rica at Fruit Attraction 2023, showcasing roots and tubers and red pitahayas

Source: Dana Chahin

Costa Rica is a relevant competitor for pineapple suppliers from different origins, as its produce is very well-positioned in the market. But importers from Spain have shown interest in new origins because of Costa Rica’s vulnerability to climate change and Spain's high dependency on pineapples from Costa Rica. The challenge for exporters from other countries is to offer a similar product in terms of sweetness, size, and ripeness.

Brazil: stable and good quality supply

In 2023, Spanish imports from Brazil reached €186 million. The country has shown stable growth over the past five years, with an average yearly growth rate of 7%. Brazil’s exports focus on mangoes (39% of the total imported value), melons (31%), and papayas (9%). For these products, Brazil is the main supplier in the Spanish market. Other products with notable market shares and growth rates include limes, avocados and grapes. Brazilian fruits are well-regarded for their diversity, good quality and availability throughout the year.

Between 2022 and 2023 the import value of mangoes from Brazil increased by 53%. This growth rate was much higher than that of its competitors from Peru and Mexico. Besides the good quality of Brazilian mangoes and different varieties, other factors that have facilitated exports to the European market include a reduction in freight prices and more regular shipping schedules. Adverse climatic conditions and a lower production level in other mango-producing countries have also contributed to Brazil’s good export performance.

Brazil’s main challenge in trading with Europe relates to tariffs for certain products. Melons, limes, and grapes, for instance, face tariffs that make Brazilian produce less competitive. Mangoes are tariff-free, as the general EU third-country duty for this product is 0%. In 2019, the EU and Mercosur, a trade bloc which includes Brazil, finished negotiations after 20 years for a free trade agreement that would lower tariffs and reduce non-tariff barriers. However, the agreement has not yet entered into force and the perspectives for that remain uncertain.

Chile: experienced and well-organised fresh produce sector

Chile is the fifth most important non-European supplier, with stable growth and an export value of €134 million in 2023. 34% of the total import value consisted of avocados, 20% of grapes, 14% of kiwis, and 9% of onions. The country is also an established supplier of pears, cherries, blueberries, citrus, stone fruit and apples.

Chile is the fourth most important supplier of fruits in the world and its produce is well-regarded in Europe for its consistency and quality. Chile has a strong presence at trade fairs such as Fruit Logistica and Fruit Attraction, with the aim of further positioning the country’s range. The new brand “Fruits from Chile” was unveiled at the latest Fruit Logistica in the presence of over 100 representatives from the Chilean fruit industry.

Chile faces challenges such as water scarcity and competition from other South American producers. Moreover, its long distance to the market poses challenges for certain products.

South Africa: a leading citrus exporter with a challenging outlook

South Africa is the sixth most important non-European supplier. Spanish imports from South Africa reached €134 million in 2023, reflecting a growth of 39% over the past five years. South Africa is a leading fruit supplier and 71% of its total exports to Spain are focused on citrus: oranges, lemons and mandarins. South Africa is the world’s second-largest citrus exporter. Other products exported to the Spanish market include blueberries (7% of the total) and grapes (5%).

South African exporters are perceived as professional business partners. However, an important challenge for the future growth is the country’s logistics infrastructure. South Africa’s container ports are poorly ranked on a worldwide scale. The port's capacity to efficiently process and ship goods is a constant concern.

South Africa also faces a challenge regarding EU phytosanitary regulations for citrus black spot (CBS) and false codling moth (FCM). It initiated a dispute with the EU in 2024, arguing for example that CBS only affects fruit appearance, not quality.

Tips:

- Consult Veritrade, a platform with import and export data from Latin America and the world, useful for identifying competitors and potential clients.

- Focus on timing your entry during your competitors' off-seasons, understand their weaknesses, and align your value proposition with consumer trends and European quality standards.

- Obtain certifications for niche markets such as the organic market and use targeted marketing to highlight your sustainable practices and appeal to Spanish buyers focused on the European export market.

Which companies are you competing with?

Non-European competitors will mainly come from Latin America and Africa. Spanish companies with production at the origin are also worth monitoring.

Inkawald – Peru

Inkawald is a family-owned and operated company, which focuses on producing, packing and exporting a variety of fruits: avocado, ginger and turmeric. Inkawald is committed to organic farming and social responsibility, backed up with certifications such as GLOBALG.A.P., organic EU, GRASP and SMETA. They have their own packaging plant, and combine their own production with alliances with more than 70 farmers in Peru.

Inkawald sells directly to specialised importers in Spain and other European countries. After becoming established in the market, they registered a company in Spain. Their warehouse in the Velez-Malaga region has capacity for 4 containers. This conveniently serves both importers that run out of produce and need some extra pallets, and small clients that do not import directly. Their attendance to leading trade fairs, as well as their participation in the IPD programme, was key to acquiring market knowledge and establishing their buyer network.

Jalhuca Exportaciones – Spain and Peru

Jalhuca is a Spanish producer that invested in their own plantations in Peru to supply their customers all year round. In Spain, Jalhuca focuses on the production of organic mangoes and avocados. In Peru, in addition to these, they also grow ginger, turmeric and sweet potato.

With many Spanish producers turning their attention to countries such as Morocco, Brazil and other tropical producing countries, Jalhuca is a good example of the type of Spanish competitor that is also active in the origin, and that you will be competing with.

Delassus Group

Delassus is a Moroccan fresh produce sector success story with more than 70 years of history. Although they started with a focus on citrus, Delassus’s current product portfolio also comprises of snacking tomatoes, grapes, avocados and flowers. The company was a pioneer of GlobalG.A.P in Morocco and was the first one focusing completely on snacking tomatoes.

92% of the group’s export comes from its own farms and the company invests in research and development to introduce better varieties and environmentally-friendly solutions. As one of the largest fresh produce companies in Morocco, and a strong presence in the European market, Delassus is a benchmark and a relevant competitor for potential exporters.

Tips:

- To offer transparency and reliability to your clients, be as close as possible to the production: either with your own fields or strong alliances with producers.

- Consider investing in Spanish-speaking personnel to do business with Spain.

Which products are you competing with?

In the Spanish market, you will be mainly competing with local produce. Spain produces a variety of fruits and vegetables that are preferred by consumers if they are in season, because of shorter supply chains, sustainability and freshness. Oranges, avocados, and blueberries are relevant products produced in Spain, which are also important exporting products from developing countries.

Oranges

Spain is the leading citrus production country and an important exporter not only to Europe but all over the world. There are large citrus cooperatives in Spain that protect the interest of the Spanish citrus growers. Therefore, if you want to supply Spain with oranges or citruses, you need to pay close attention to the off-season and the compliance with European requirements.

Avocados

Although extreme drought is challenging the production of Spanish avocados, exporters targeting the Spanish market need to monitor the developments of the Spanish producers. Although many producers are turning to the import market to offer a steady supply, some others are investing in the origin. The latter might, however, open opportunities for joint ventures and partnerships as well.

Blueberries

Local or European produce is usually preferred by consumers, with Poland and Spain being the strongest European blueberry suppliers. If you are supplying from a long-distance origin, it will be difficult to sell during the Spanish and European season. Counter-seasonal countries such as Chile, Peru and South Africa sell more than other long-distance suppliers such as Canada, Mexico and the United States which have the same production season as Spain and Europe.

Tips:

- Try to focus as much as possible on the off-season demand or on the edges of the local supply season.

- Check the IPD seasonal calendar for fruit and vegetables and identify the right timing for your product. In the calendar, ES stands for Spain.

Source: Fruit and Vegetables supply chain App, EU

The 8% commission that most importers add onto the sales price also applies in Spain. This excludes expenses like terminal handling charges, scanning costs, laboratory analysis, quality control, handling and storage. Retailers usually apply a 30–35% margin. Margins can be higher for more perishable and slower-selling products. For some products and clients, other costs such as packaging, labelling and ripening must also be considered.

Tips:

- Use the EU Fruit and Vegetables supply chain App to monitor prices in the Spanish market. Ex-packaging station prices are available for a variety of products. Farmgate and retail buying prices only cover tomatoes, apples, oranges, peaches and nectarines.

- Monitor prices for your product in platforms such as Avobook for avocados. To find the right platform for your product, ask your buyers for recommendations.

Dana Chahin in partnership with ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research