8 tips on how to organise your fresh fruit and vegetable exports to Europe

When organising your export of fresh fruit and vegetables to Europe, it is important to agree on acceptable payment terms and put agreements in writing. Although the sector is relatively informal, the expectations of buyers are high and the export process must be done with precision. To make sure that your product reaches its destination in a good condition, pay extra attention to packaging and cold chain logistics.

Contents of this page

- Put your agreements in writing

- Protection against unfair trading practices in the agricultural sector

- Agree on payment terms

- Choose the right export insurance

- Understand European customs policy

- Use quality packaging to protect your products and ensure shelf life

- Keep your products fresh with the right international transport

- Look for support organisations to help you organise your exports

1. Put your agreements in writing

A contract is a legally binding agreement between you and the buyer that outlines the agreed-upon terms and conditions. It helps clearly define the mutual expectations and acts as a documented reminder of the obligations. A contract also forms the basis for legal proceedings in the event of a breach.

A contract should cover the following aspects:

- product specification (quality, size, etc.)

- quantity (number of boxes, boxes per pallet, etc.)

- value: currency, price per unit, total

- delivery date or period

- payment terms

- delivery terms (Incoterms)

- packing details

- Applicable fees and/or charges

- insurance

- documentary procedures

- default procedures (if the contractual agreements are not met)

- dispute resolution procedures (governing law, jurisdiction, arbitration)

- reference to general terms and conditions

If your buyer does not have general purchase conditions, you can use the COFREUROP code of practiceas a basis for the transaction. This code outlines various obligations and responsibilities of sellers and buyers specifically in the fresh produce sector. It specifies solutions in disputes concerning matters like quality, prices, contract breaches and payment issues. The International Arbitration Chamber for Fruits and Vegetables (CAIFL) provides arbitration in international disputes and promotes the COFREUROP code of practice.

2. Protection against unfair trading practices in the agricultural sector

Imbalances in bargaining power between suppliers and buyers are commonly seen in the agricultural sector. To prevent such unfair trading practices, the European Commission (EC) has introduced EU Directive 2019/633, aiming to protect small and medium-sized suppliers against stronger buyers. This also applies if the supplier of the European buyer is located outside the EU.

This legislation prohibits 10 trading practices (‘black’ practices), including:

- refusal of a written confirmation of a supply agreement by the buyer;

- payments later than 30 days for perishable products;

- short-notice order cancellations of perishable products;

- unilateral contract changes by the buyer;

- risk of loss and deterioration transferred to the supplier.

Tips:

- To set up your first contract, consult with a lawyer experienced in international trade of fresh produce. Make sure that you understand the contract’s terms and conditions and its consequences.

- Use the general terms and conditions of a European company like Dole Europe GmbH or Total Produce B.V. as a template to define your own general conditions for supplying fresh fruit and vegetables.

- Read more about your rights as a supplier with regard to the Directive on unfair trading practices in the food chain.

- Be precise in your product specification. Use the EU Marketing Standards for fruit and vegetables in Annex I of Regulation (EU) No 543/2011, the UNECE fresh fruit and vegetable standards or the product standards in the Codex Alimentarius of the Food and Agriculture Organization of the United Nations (FAO).

3. Agree on payment terms

Payment terms are an important element of the contract. The payment terms determine when and how your buyer should pay you. It also comes down to how the risks are distributed. Payment terms vary based on the relationship you have with your buyer.

In the fresh fruit and vegetable trade, payments often take place at different moments in time. Typically, for the first business transactions with a new buyer the payment is made after your buyer has received the goods. After a relationship and trust with your buyer develops over time, a range of payment terms can be used.

In the fresh produce sector, the following payment terms can be used:

Pre- and post-payment

Pre-payment means that goods are paid for before they are delivered to the buyer. With post-payment, the buyer will receive the goods first and then makes the payment at a later, agreed date. In the fresh produce sector, payments can take place at various stages of the transaction, such as pre-season advances, before shipment, upon arrival, or after resale.

In the case of pre-season advances, the payment is made to the supplier before the actual production season begins. This method is common in integrated partnerships within the fresh produce sector. It helps the supplier cover initial costs associated with the upcoming season, creating a more stable financial situation.

Another situation is where payment takes place after the buyer has sold the product (‘after resale’). In this situation, the final price is calculated based on sales prices minus the total costs of product handling, testing, commission and taxes. This payment method gives you no security and is therefore only advisable if you have a trusted, long-term relationship with your buyer.

Open account

Open account (OA) payment terms involve shipping products to the buyer without immediate payment. Payment is made after delivery within an agreed timeframe, for example 30, 60 or 90 days from the invoice date. This method is relatively cheap but is riskier and puts pressure on your cash flow, so be careful when using OA. Your financial situation and the trust between the two parties must be strong.

Documentary credit

Documentary credits, in the form of Cash Against Documents (CAD) or Letters of Credit (L/C), are not common in the trade of fresh produce. Fresh produce has a limited shelf life, so quick and efficient transactions are crucial to ensure the quality and freshness of the product. Documentary credit is relatively complex, expensive and time-consuming.

Tips:

- Learn more about international payment terms through online training and guides on trade finance provided by the International Chamber of Commerce (ICC).

- Seek assistance from financial institutions to assess the extent to which you can negotiate various payment terms. This will enhance your negotiation effectiveness and enable you to make more informed decisions.

- Investigate your buyer’s history and creditworthiness before agreeing on terms, by using resources like export credit agencies.

- Verify that the payment terms agreed upon with your buyer are explicitly stated in the contract. Make sure you clearly understand the agreement and the terms before signing the contract.

4. Choose the right export insurance

Insuring your exports is a way to reduce the risks of international shipments. In the fresh produce sector, export credit insurance is among the most used insurances.

Pre-shipment

Short-term loans and working capital financing provide liquidity that is needed in the pre-shipment period. This covers the costs made during production, harvesting, storage, and export preparation. This type of financing can be combined with other types of financing that follow later in the process, such as factoring, supply chain finance (reverse factoring) and documentary credit.

The options you have depend a lot on which country you are located in, so check with your local banks or financial agencies. You can also try to find international banks that provide trade finance solutions or a private or social impact investor to finance your business. For example:

- Rabobank provides corporate banking products for food and agri-businesses in several eastern and southern African countries from their representative office in Kenya.

- Triodos provides trade finance at the point of harvest through payment in cash. This enables farmers to bridge the gap between processing, storage and shipment until payment by the buyer. The loan maximum is 70% of the value of export contracts to companies with a sustainable certification, such as organic, Fair Trade and Rainforest.

- Oikocredit invests in social impact. They provide loans to partners in 33 countries, plus invest in equity and capacity-building.

- FMO, a Dutch entrepreneurial development bank that provides loans, private equity or guarantees while supporting the United Nations Sustainable Development Goals (SDGs).

- For small companies and farmers there may be innovative digital finance solutions available. Read more about these in CBI’s tips to go digital in the fresh fruit and vegetable sector.

Some of the best trade finance providers 2024 (according to Global Finance magazine) are BNY Mellon (best bank for trade finance), Finastra (best non-bank for trade finance), Credit Agricole (best bank for export finance), TDB Group (best bank for trade finance in emerging markets) and Standard Bank (best regional bank for Africa).

Export credit insurance

Export credit insurance protects you against non-payment or default by a buyer, for example due to commercial risk (such as insolvency) or political risks. There are different export credit insurances available. A single-buyer policy covers one single debtor or risk. A multi-buyer policy can be used if you have regular shipments to multiple buyers and use a pay-as-you-go service. In the fresh fruit and vegetable sector a short-term insurance (up to one year) is typically used.

Export credit agencies (ECAs) can offer you an export credit insurance. Make sure to look for a reliable ECA that is part of a global network. Well-known export credit insurance companies are Allianz Trade, Atradius and Coface. The costs of your insurance depend on several aspects, such as the type of coverage you select, your annual revenue that needs to be insured, your history of bad debts, and the buyer’s creditworthiness.

Cargo insurance

Cargo insurance provides coverage for potential damage, loss or theft of goods during transportation. Given the perishable nature of fresh produce, having cargo insurance helps you mitigate potential financial losses and ensures that you are protected in case of unforeseen events during transportation. It provides an added layer of security.

The cargo insurance is the responsibility of either you or your buyer. This depends on the type of Incoterms that you have agreed upon with your buyer. If the Incoterms is FOB, then your responsibility stops when the products are loaded onto the vessel. If it is CIF, then the seller bears the cost of insurance.

Currency insurance

Currency insurance helps protect against potential losses caused by fluctuations in exchange rates between different currencies. When doing business with European buyers, you will typically trade in either euros or US dollars. In the fresh fruit and vegetable sector, the risk of conversion loss is relatively low as transactions happen quite fast. However, when you deal with long-term supply contracts and retail programmes or expect currency risks, you can choose to insure your business against conversion loss.

Seller’s interest insurance

If cargo damage or loss occurs during a transport phase for which your buyer is responsible, they are obligated to cover the costs. However, inadequate insurance coverage on the buyer’s part may have a negative impact on you as well. Seller’s interest insurance offers coverage to protect your financial interest in products sold but not yet paid for by the buyer. This type of insurance is less common than export credit insurance.

Tips:

- Keep in mind that insurances tend not to cover 100% of potential losses. Make sure to shop around when looking for insurances, carefully read the terms and conditions, and understand the limitations of each policy.

- Get informed on export credit insurances by visiting the websites of ECAs such as Allianz Trade. Look for a reputable ECA through the member lists of Berne Union (International Union of Credit and Investment Insurers) or ICISA (International Credit Insurance and Surety Association).

- To find a reliable insurance company for cargo insurance, visit the member associations list of IUMI (International Union of Marine Insurers).

- Check the risk of trading with a specific country through the Country Risk Map of Atradius or the Country Risk Ratings & Reports of Allianz Trade.

5. Understand European customs policy

Having a good understanding of European customs policy is crucial in the export process. As an exporter you have to provide several export documents to be able to clear your goods at customs. Moreover, be aware that import tariffs may apply, which could have an impact on your competitiveness in the European market.

Export documents

When exporting to Europe, you need to present multiple export documents to customs. It is essential to familiarise yourself with customs procedures in Europe and to know which documents are needed for customs clearance. Also, make sure to correctly fill out all the required documents. A small mistake may lead to increased costs and/or serious delays. Some documents need to be filled out by the exporter, other documents will be prepared by the buyer.

Documents that you – as an exporter – need to provide include:

- Commercial invoice: contains information about the details of the transaction between you and the buyer, such as the description of the goods, quantity, delivery terms, payment terms, etc.

- Documentary proof of origin: a ‘Certificate of Origin’ declares the country a good originates from. This document is necessary if you want to claim preferential tariff treatment under a free trade agreement. The document can vary between free trade agreements. For countries with a preferential trade agreement with the European Union, a EUR.1 certificate is used. If your country is part of the Generalised Scheme of Preferences you should use a Form A.

- Packing list: this commercial document provides information about the imported goods along with packaging specifics, including the quantity, content, weight and dimensions of the packages.

- Transport documents: CMR for road transport, bill of lading for sea freight, air waybill for airfreight, and/or CIM for rail transport.

- Freight insurance invoice: you will only need the insurance invoice when the commercial invoice does not show the details about the premium paid for insuring the goods.

- Phytosanitary certificate: a lot of fresh fruits and vegetables from miscellaneous origins require phytosanitary certificates prior to shipping. You can find these products in Annex XI part A and part B of Regulation (EU) 2019/2072 (stipulated by Article 11). The certificate follows after a check by the competent authority in your country to guarantee that the products have been inspected and are pest- and disease-free.

The following documents are provided by the buyer:

- Single Administrative Document (SAD): a form for import declaration. It contains information about the parties involved, the goods, and commercial and financial data.

- Customs value declaration: a document stating the value of the goods, if it exceeds €20,000.

- Common Health Entry Document (CHED-D): a registration form for shipments of high-risk foodstuffs of non‑animal origin as listed in Annex 1 of Commission Implementing Regulation (EU) 2019/1793.

Import tariffs

Import tariffs can influence your competitive position in Europe. It is therefore important to find out what tariffs and other restrictive trade barriers apply to your product and country.

In the fresh fruit and vegetable sector, imported products that are also commonly cultivated in Europe are usually taxed according to the season. For some fresh produce, additional tariff rate quotas apply. The table below gives a few examples of tariff rates for different types of fruit and vegetables.

Table 1: Tariffs applied to fresh fruit and vegetables imported to the EU from third countries without a preference

| Tariff code | Product | Tariffs |

| 07020000 | Tomatoes, fresh or chilled | Variable entry price, depending on the value and season:

|

| 08044000 | Avocados | 1 Dec-31 May: 4% 1 Jun-30 Nov: 5.1% |

| 08061010 | Table grapes |

Variable entry price, depending on the value and season:

|

| 080711/19 | Melons | 8.8% |

| 08081080 | Apples | Variable entry price, depending on the value and season:

|

Source: Commission Implementing Regulation (EU) 2023/2364

Trade agreements

If your country has a preferential trade agreement with the EU or your products come from a country covered by the Generalised Scheme of Preferences, your import duties will be partly or fully removed. There are three types of GSP arrangements:

- Generalised scheme of preferences (GSP): reduces tariffs for low- and lower-middle-income countries.

- GSP+: reduces the tariffs to 0% for vulnerable low- and lower-middle-income countries that implement international conventions related to human rights, labour rights, environmental protection and good governance.

- EBA (Everything but Arms): providing the least developed countries with duty-free and quota-free access to the EU market. This applies to all products, except for arms and ammunition.

To find out which countries are GSP beneficiary countries, check the interactive map of the GSP hub. If your country is listed, you will benefit from better tariffs compared to non-GSP beneficiary countries. To qualify for the preferential rates, you need to follow the rules of origin and demonstrate that your goods originate from a particular country.

In addition to the GSP, the EU has over 40 trade agreements with almost 80 countries. Trade agreements with important supplying countries of fresh fruit and vegetables include:

- Economic Partnership Agreements (EPAs): trade and development agreements between the EU and African, Caribbean and Pacific (ACP) countries. The EU applies zero duties and quotas to all products imported from these countries.

- EU-Central America Association Agreement: agreement between the EU and Central American countries: Costa Rica, El Salvador, Guatemala, Honduras, Nicaragua and Panama. It reduces most of the import tariffs and increases the efficiency of customs procedures.

- EU-Colombia-Peru-Ecuador Trade Agreement: with this agreement, benefits for countries include full or partial tariff liberalisations, substantive duty-free quotas, and the removal of non-tariff barriers.

- EU-Morocco Euro-Mediterranean Association Agreement: agreement that creates a Free Trade Area between the EU and Morocco.

To qualify for preferential treatment, your product will need to comply with the rules of origin under the particular agreement, for example a Movement Certificate EUR.1 or an EUR-MED certificate.

Trade restrictions

Some fruits and vegetables originating from specific countries are subject to a temporary increase in border controls when exporting to the EU. Reason for this is that for these specific countries and products there is a higher risk of excessive pesticide residues. For example, 30% of the peppers (of the genus Capsicum) and oranges from Egypt are subject to border inspection for pesticide residues.

The costs associated with the inspection of the goods are often deducted from the final price paid to the exporter. Check out Annex I and II of Regulation (EU) 2019/1793 to see if there is increased border inspection for your fruits and/or vegetables. For products that fall under this restriction, the buyer needs to provide a Common Health Entry Document (CHED-D) to customs.

Tips:

- Make sure you understand which documents you need for customer clearance in the EU.

- Look for a trustworthy freight forwarder to arrange your freight shipments. Read Freightos’ ultimate guide to choosing a freight forwarder. You can find freight forwarders or customs brokers through the International Forwarding Association (IFA), through your national association via the International Federation of Freight Forwarders Associations (FIATA), or through European national associations via the European Association for Forwarding, Transport, Logistics and Customs Services (CLECAT).

- Check Regulation (EU) 2023/2364 for import tariffs for fruits (Chapter 8), vegetables (Chapter 7) and products subject to an entry price (Annex 2). You can also consult the TARIC database and My Trade Assistant of Access2Markets for information about tariffs, requirements and customs procedures.

- Visit the Access2Markets portal to find out if there is any trade agreement or GSP that applies to your country. If so, make sure to follow the rules of origin. Use Access2Markets’ Quick guide to working with rules of origin.

- To analyse your competitive advantage in terms of tariffs and trade preferences, use the Market Access Map.

6. Use quality packaging to protect your products and ensure shelf life

Proper packaging is crucial for protecting and maintaining the quality of your fruit and vegetables during transportation. When packing your products, make sure:

- to pack fruit and vegetables securely so the produce is protected;

- to use new, high-quality, clean materials to prevent any damage to the products;

- that the content of each package is uniform. It should only contain the fruit or vegetable of the same origin, variety, quality and size. The visible part must be representative of its entire content;

- that the container meets quality, hygiene, ventilation and resistance characteristics for proper handling, shipping and preservation of fruits or vegetables;

- that packages do not contain foreign matter and smells.

You are allowed to use materials bearing trade specifications or marketing messages; however, the printing or labelling should be done with non-toxic ink or glue.

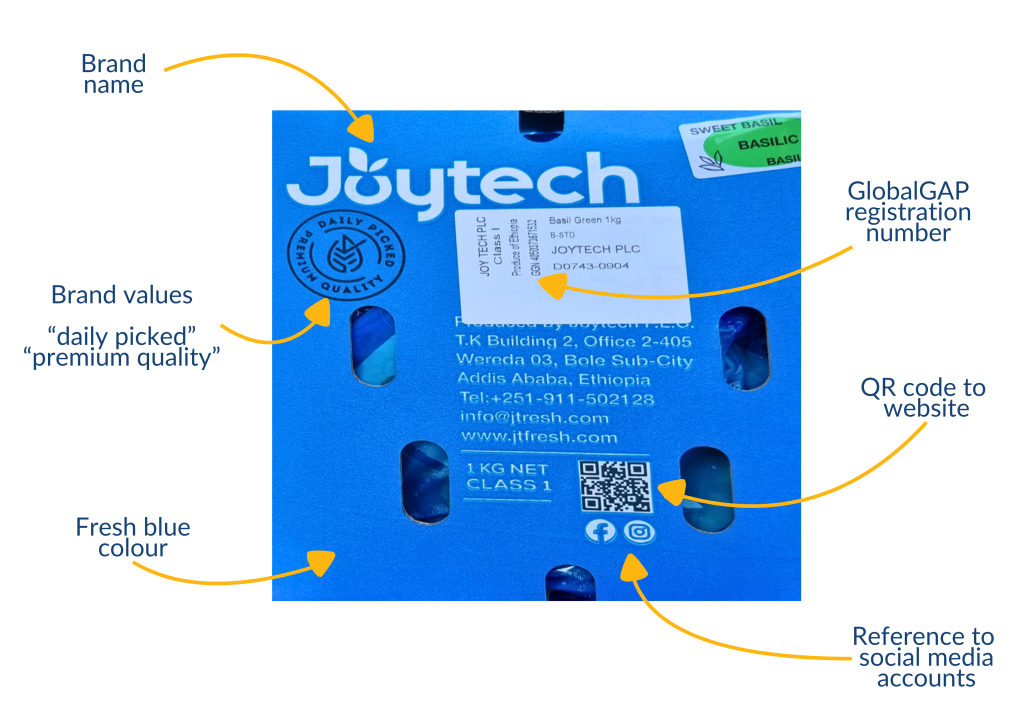

Figure 1: Example of a promotional trade package – sweet basil from Joytech Ethiopia

Source: GloballyCool (October 2023)

The appropriate packaging varies per type of fruit/vegetable and also among customers and market segments. Below are a few examples of common packaging of different types of fruit and vegetables.

Table 2: Common packaging types for different types of fruit and vegetables

| Fruit / vegetable | Common types of packaging |

| Avocado |

|

| Sweet potatoes |

|

| Table grapes |

|

Source: ICI Business

Labelling

Trade packages and cartons of fresh fruit and vegetables should include the following details:

- Name and address of the packer/dispatcher (option: official control mark to replace name and address of the packer);

- Name and variety of the fresh produce;

- Class and size (referring to the marketing standards);

- Lot number for traceability or GGN if GLOBALG.A.P.-certified;

- Country of origin;

- Post-harvest treatment;

- Organic produce: organic certification, including name of inspection body and certification number.

Consumer packages of fruit have slightly different requirements. For example, the brand owner or seller (retailer) should be mentioned on the label, plus post-harvest treatment specifications.

Reducing plastic packaging

Reduction of plastic packaging is one of the targets of the sustainability movement in the European Union. Retailers and policymakers take this objective seriously.

The EU adopted a plastics strategy back in 2018, recommitting to work towards the goal of ensuring that all plastic packaging be recyclable by 2030. March 2020 saw the launch of the European Plastics Pact, a public-private coalition with clear targets up to 2025 to phase out single-use plastic products and packaging.

European countries are also taking action on their own. For example, France has already banned the use of plastic packaging for 30 different types of fruit and vegetables since January 2022. Other fresh produce will follow by June 2026.

Reduction in the use of plastics will continue to affect the packaging of fresh fruit and vegetables. Products like grapes and soft fruit in clamshells are being replaced by punnets with top-seal and other innovative variations using cardboard.

Suppliers of fresh fruit and vegetables will try to replace plastic packaging with more sustainable options. An interesting read is the WUR’s Roadmap for more sustainable solutions for storing and packaging vegetables and fruit.

Figure 2: Table grapes in a paper bag in a German mainstream supermarket

Source: GloballyCool (October 2023)

Tips:

- Read FAO’s Code of practice for packaging and transport of fresh fruit and vegetables for more information on how to pack your fruit and vegetables. Also, CBI's product factsheets on exporting fresh fruit and vegetables to Europe offer valuable insights on packaging requirements.

- See the list of product standards in the Codex Alimentarius of the FAO. It gives basic information on packaging, marking and labelling requirements for fruit and vegetables.

- Discuss with your buyer and freight company the special packaging requirements that are applicable to the fruit and vegetables you want to export.

- Learn more on how to package fresh produce by visiting the FreshKnowledge website of Wageningen University & Research (WUR).

- Make sure to use traceability codes on your packaging, such as the Global Trade Item Number (GTIN). For more information on traceability codes, see GS1’s Fresh fruit and vegetable traceability guideline.

7. Keep your products fresh with the right international transport

There is relatively high loss in the fresh fruit and vegetable supply chain, which occurs mainly during transportation. It is essential to facilitate adequate air circulation and to maintain optimal transportation conditions, including specific temperatures and humidity levels.

Transport modes

Your transport mode depends on several factors: type of product, geographical area, volume that needs to be shipped, costs, etc. You will mostly combine different modes of transport (multimodal method) to transport your fresh fruit and vegetables to your buyer.

In international trade, maritime transport is widely used to transport bulk quantities of perishable goods over long distances. It is the most cost-effective and sustainable option for long distances. Air transport is suitable for transporting high-value, highly perishable fresh produce where the speed of delivery is crucial. However, it should be noted that the costs are considerably higher and only small volumes can be transported.

Storage and transport conditions

Fresh fruit and vegetables are very temperature-sensitive. Therefore, maintaining a perfect cold chain in the fruit and vegetable transport is key. Any fluctuations in temperature can lower the product’s shelf life. As an exporter, your responsibility is to manage the cold chain from the very start, which also involves proper loading and cooling.

Fresh produce should be shipped refrigerated to maintain quality and freshness. Reefer containers or refrigerated trailers are specially designed to help control temperature, humidity and moisture levels to keep the products fresh. The optimal temperature differs per type of fruit or vegetable (see Table 2 for examples). Make sure to look for a reliable carrier that has experience with transporting fruit and vegetables.

Table 3: Reefer temperature ranges for fruit and vegetables

| Product | Temperature range (°C) |

| Bananas | 13.33 – 14.44 |

| Blueberries | 0 – 1.67 |

| Broccoli | 0 |

| Garlic | 0 |

| Grapes | -0.56 – 0 |

| Lemons | 11.11 – 12.78 |

| Mangoes | 10 – 12.78 |

| Sweet potatoes | 12.78 – 15.56 |

Source: Fruit and Vegetable Transportation: A Comprehensive Guide

As transport takes time, it pays off to control more than only temperature. Reefer containers offer more options, such as fresh air exchange and controlled atmosphere. The ideal option is a controlled atmosphere, with regulation of the concentrations of oxygen, carbon dioxide, nitrogen, temperature and humidity.

In addition, it is important to pay attention to which fruits can and cannot be shipped together. Some fruits and vegetables release ethylene, while other fruits are sensitive to it. Mixing these products can cause ethylene-sensitive products to deteriorate faster. To maintain quality and freshness, ethylene-producing products must be separated from ethylene-sensitive ones.

You may also consider fumigation treatment during shipping, but first discuss with your buyer whether it is acceptable to use it. Carefully consider which fumigant to use and whether it is allowed in the EU, and also check the shipping company’s safety guidelines. For example, fumigation is not allowed for organic produce.

Incoterms

International Commercial Terms (Incoterms) are standardised international trade terms for contracts. They specify the tasks and obligations for you and the buyer related to transportation, insurance, import clearance and delivery of the goods. To avoid misunderstandings or disputes, specify the chosen Incoterm in the contract. Also make sure to consider the respective Incoterm when calculating the price. The most common Incoterms for fresh fruit and vegetables are Cost Insurance Freight (CIF) and Free on Board (FOB).

Figure 3: INCOTERMS 2020 explained by Inco Docs

Source: Inco Docs on YouTube

Tips:

- Learn more about how to store and ship fruit and vegetables on the BMT Cargo Handbook for perishables, the Container Handbook or the Transport Information Service.

- Read Hamburg Süd’s Reefer guide to learn more about temperature control and atmosphere management, and to get recommendations for transport conditions and shelf life of reefer cargo.

- Check if your forwarder makes use of sensor technology to monitor temperature during shipment.

- To better understand the Incoterms, read Inco Docs’ blog Incoterms 2024: Guide, and changes of Incoterms explained.

- Use Freightos’ International freight shipping costs & rates calculator and stay up to date on shipping & freight cost increases, current shipping issues, and shipping container shortages.

8. Look for support organisations to help you organise your exports

Several international organisations are available to assist you in coordinating your exports, offering guidance on technical and practical aspects of organising an export shipment:

- International Trade Centre (ITC) can offer you trade-related practical training, advisory services and business intelligence data, also specifically for the fruit and vegetable sector. They have an online learning platform – SME Trade Academy – where they offer over 100 online courses on trade-related topics. They also can provide you with Model Contracts for Small Firms.

- Access2Markets informs you on tariffs, rules of origin, taxes, general and specific import requirements, and trade barriers relevant when exporting to the EU. It also teaches you about the EU trade agreements and how to benefit from them.

- The International Chamber of Commerce (ICC) offers arbitration, export learning tools, and information about Incoterms. They offer documents on trade finance and online training on a variety of topics.

- Your country’s Chamber of Commerce can give you advice on how to organise your exports.

- BMT Cargo Handbook is a large database on the transportation of cargoes in the marine industry, set up by BMT Netherlands B.V. The handbook provides detailed information about perishable goods, including a large variety of fruit and vegetables.

- Container Handbook provides cargo loss prevention information from German marine insurers.

- The FAO maintains product standards in the Codex Alimentarius.

- The Institute of Export & International Trade (UK) offers training courses on a variety of topics, such as trading with the UK, customs, customs declaration, and finance and trade.

Tip:

- Use ITC’s global Business Support Organization directory to look for trade support institutions in your country that can help you organise your exports. ment, compare prices of forwarders and their conditions.

Get more tips for exporting to Europe

Read our Tips for finding buyers and Tips for doing business, which can help you further understand how to enter the European market and provide insight into how European buyers think. Use the Exporting to Europe Guide to prepare for export to Europe.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research