Which trends offer opportunities or pose threats on the European honey market?

Several trends and developments are changing the honey market and opening up opportunities for certain suppliers. In Europe, the health of bees is under threat and people are calling for action to save the bees, stabilise honey supplies and source honey responsibly. Suppliers who produce sustainably and who can also avoid being associated with adulteration have a great chance to enter the European market. They can also help European buyers replace declining Ukrainian honey supplies.

Contents of this page

1. When the bees die, so will people

The famous scientist Albert Einstein once said: "If the bee disappeared off the surface of the globe, then man would have only 4 years of life left. No more bees, no more pollination, no more plants, no more animals, no more man." In recent years, these words gained attention from many people in Europe and elsewhere, as the health of bees in Europe is under threat. The threat is mainly coming from parasites, use of chemicals in agriculture, and loss of food for bees as landscapes lose plant diversity. Pesticides not only kill unwanted pests, they also make bees and other beneficial insects more vulnerable to diseases.

Out of 100 crop species that provide 90% of food worldwide, 71 of are bee-pollinated. This means that the mass death of bees threatens global food production. Bees also play a key role in pollinating natural flora and protecting biodiversity. Because of the importance of bees, many different groups, including consumers, beekeepers and policymakers, are raising attention to this threat. They are researching the causes of the loss of bees and looking for solutions to save the bee – for example the Horizon 2020 B-GOOD project of the European Commission, aiming to develop a tool to measure bee health status in different locations, and the Trees for bees bee-saving campaign of the International Federation of Beekeepers' Associations Apimondia.

While concerns over the death of bees have not resulted in a run on honey, buyers in Europe are becoming more aware of the need to source honey sustainably. Consumers and policymakers are holding suppliers responsible for their impact on the environment, and importers in Europe want to avoid being held responsible for the mass death of bees through their sourcing practices. For example, the German company Walter Lang focuses on sourcing organic-certified honey: "If the bees are allowed to fly out while pesticides are sprayed 3 fields away, bee colonies can suffer great damage. For this reason, organic action is indispensable for us." In the UK, honey importer Rowse funds research on bee health. The pressure from EU regulators and consumers will increase in the coming 10 years and force more companies to take comparable sustainability measures.

Tips:

- Find out if the health of bees in your area is under threat and what causes loss of bees. Take measures to protect bees in your area and report on these measures and their effects through your promotional materials to show that you are taking responsibility for bee health.

- Sign up for Apimondia's newsletter to stay up to date on research and developments in the global apiculture sector.

European buyers and their partners are investing heavily in research and laboratory technologies to counter the threats of honey contamination, adulteration and laundering. While contamination can be harmless for consumers, certain contaminants are life-threatening and are absolutely not allowed. A notable example with major consequences was the contamination of Chinese honey with antibiotics in the beginning of this century. Between 2002 and 2004, Chinese honey was banned from the EU market because Chinese beekeepers widely used the antibiotic chloramphenicol to treat their bees. Residues of this antibiotic in honey are dangerous for certain people, and after European laboratories detected the antibiotic in many Chinese honeys the EU decided to protect its consumers against this threat by banning Chinese honey altogether.

In attempts to maximise profits from beekeeping activities, some beekeepers and traders add substances that are not wanted in honey. This practice of intentionally adding unwanted substances is also known as adulteration. By adding substances cheaper than honey, beekeepers and traders want to make more money from their honey sales. As part of the EU coordinated action ‘From the hives’ in 2021/22, the Joint Research Centre in the EU found that 46% of honey samples they collected across the EU were suspected of adulteration. There are many types of adulterants: common adulterants in honey include syrups made from maize, sugarcane, rice, wheat, and sugar beet. Laboratories in the EU are now using high technology, including nuclear magnetic resonance (NMR), to identify substances such as syrups that do not belong in honey. They use the data to make fingerprints of suspicious honeys. When comparing these fingerprints with those from pure and authentic honeys, they can identify differences indicating adulteration.

European consumers and beekeepers are particularly concerned about the purity and authenticity of cheap honeys from outside the EU. To make an informed decision about their honey purchases they can look at the label on the honey. Currently, the EU Honey Directive only requires honey packers to mention on the label if the honey is from EU or non-EU origin or a mixture. This lack of origin specification enabled 'honey laundering' by making it impossible for consumers to identify the exact origin of the honey. In 2023, the EU was working on a revision of the Honey Directive that will require packers to specify the country or countries of origin. It is expected that in the coming years consumers will avoid honeys from countries with a bad reputation.

Tips:

- To discourage malpractices, make clear to your suppliers that European laboratories are capable of identifying contaminants and adulterants using high technology.

- Put in place a rigorous traceability system and keep honey samples from your suppliers to identify sources of bad honey when you receive laboratory results that show contamination or adulteration.

2. Organic honey moves from niche to mainstream

The organic food and beverages market is gaining popularity across the globe. Consumers have concerns about the impact of food production on the environment, and specifically the widespread use of chemicals, which has also been linked to the death of bees. The European market for organic products is moving more and more from niche to mainstream. Europe has the largest organic market worldwide, accounting for almost half of global sales of organic products: these sales, including honey, are no longer the sole domain of health food shops and other specialist retailers. Organic products can now also be found in supermarkets, hypermarkets, convenience stores and discount stores across Europe.

Moreover, the range of organic food products is expanding. Retailers no longer offer just organic table honey, they also increasingly offer products that contain organic honey as an ingredient. In other words, the food industry is slowly becoming a significant user of organic honey. Germany is the largest market for organic food products in general, followed by France and the UK, and other, mainly Western European countries.

In 2013, the European market for organic honey was estimated to account for a small percentage of the total honey market. In 2022, 17,533 tonnes of imported honey were organic-certified, representing 9% of total imports from outside the EU. Interviews with buyers suggest that the organic honey market currently comprises 10-15% of the total European honey market.

One exporter of organic-certified honey is Green Face Trading from Ethiopia. The company sources its honey from rural areas in Ethiopia where the use of pesticides and other chemicals is minimal or even absent. They have established demonstration sites where they provide training on organic beekeeping practices to ensure compliance with the EU organic standard. The organic certificate and promotion of their honey at the Biofach trade fair and through other channels has been crucial for the company in becoming successful on the European market.

The European Union (EU) is actively promoting organic production through its Organic Action Plan, which is part of the European Green Deal and aims to achieve the target of 25% of agricultural land under organic farming by 2030. A major element of the action plan is to stimulate demand and ensure consumer trust in the EU organic logo. This means that demand for organic honey will continue to grow in the coming years.

Tip:

- If your production system is organic by default or conversion requires little investment, apply for organic certification. See our study about European buyer requirements for the honey market for more information on regulations for organic products on the EU market. Certification helps make consumers trust that your honey is free from chemical residues and antibiotics.

3. Buyers need to take action to source responsibly

Compliance with certain sustainability standards was voluntary for a long time in Europe, and buyers committed to sustainability each had their own strategy. However, this is beginning to change and certain elements from these sustainability standards are now becoming legal requirements across Europe. European companies increasingly need to report on sustainability concerns related to their business and need information from supply chain partners.

As part of the European Green Deal, in 2021 the EU introduced the EU Due Diligence Directive. This legislative act requires that EU companies identify and, where necessary, prevent, end or mitigate adverse impacts of their activities on human rights and on the environment. Such impacts include child labour, exploitation of workers, pollution and biodiversity loss. These requirements first become mandatory in 2024 for the biggest European companies with more than 500 employees and a turnover in excess of €150 million.

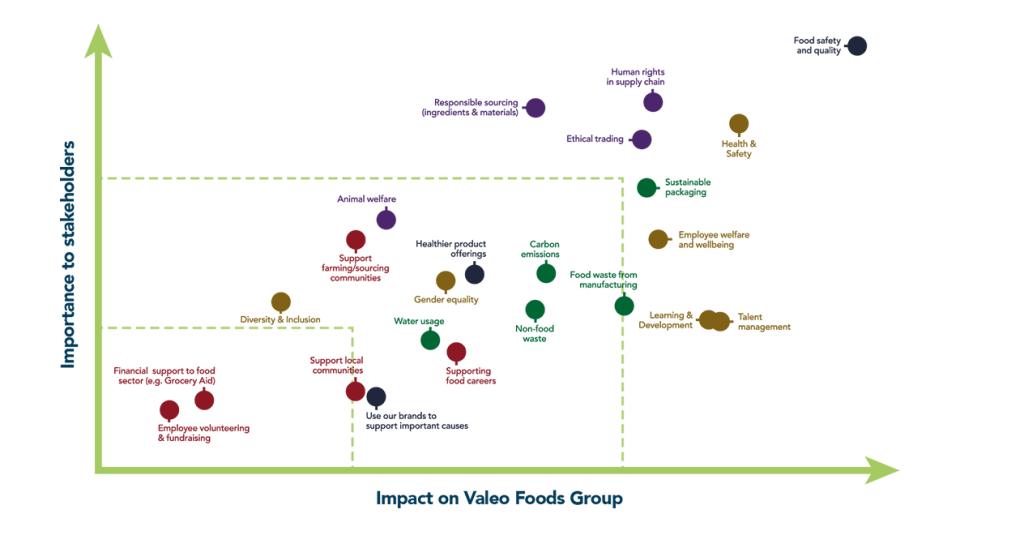

The case of the European company Valeo Foods Group, which is behind the Rowse Honey brand, is a good example of how leading companies in Europe's honey sector are dealing with due diligence requirements. They consulted 100 stakeholders to identify sustainability topics that matter most to their business and in line with stakeholder expectations. While food safety and quality remain top priority, human rights, responsible sourcing and ethical trading are other priorities. The company uses the Supplier Ethical Data Exchange (SEDEX) platform to ensure transparency about these issues in their supply chains.

Figure 1: Strategic sustainability topics of Valeo Foods Group

Source: Valeo Foods Group, 2023

In the next 10 years, more of Europe's leading honey companies will develop sustainability strategies. These strategies can have major implications for their suppliers. Suppliers that can meet new requirements of these European companies or even support their buyers in achieving their sustainability targets will have a competitive advantage.

Tips:

- Initiate conversation with your clients to identify their preferences on social standards and criteria. Buyers may prefer a certain label, depending on their end clients and distribution channels.

- Prepare information for your buyers on relevant sustainability topics. Consider joining SEDEX as a tool to share information.

4. Let bees make beeswax

Besides the opportunities for honey, Europe offers significant opportunities for beeswax. Beeswax is another product from the beehive and has applications in food, cosmetics and several other markets. While many synthetic waxes offer the same functionality as beeswax, a preference for natural solutions is leading to increasing demand for beeswax.

European beekeepers managed 20.2 million hives in 2022 and produced 285,700 tonnes of honey. This makes Europe the second-largest honey producer after China. Despite this large beekeeping sector, Europe is highly dependent on supplies of beeswax from other countries. In fact, the need for beeswax imports is growing as European production remains more or less the same and demand increases. Between 2018 and 2022, Europe's beeswax imports rose from €85 to €95 million. Out of those imports, 49% came from outside Europe. Part of the reason for Europe's dependency on beeswax imports is that European beekeepers focus on pollination and honey production. Beeswax production requires a different approach to beekeeping. Bees mainly produce beeswax to produce the honeycomb which stores the honey. European beekeepers mostly use beehives with frames that already contain foundation sheets from wax, and their bees need to produce little extra beeswax to build the honeycombs – the beekeepers use the beeswax to produce new foundation sheets for their hives. Excess production of beeswax for sale is small.

The situation is different for many beekeepers in developing countries. Those beekeepers often use traditional beekeeping technology. Instead of the modern beehives, they use hive types in which the bees need to produce much more beeswax to build the honeycombs. For example, in Ethiopia beeswax makes up 30% of crude honey from traditional hives: beekeepers often harvest a very large part of the honeycomb, which they sell without separating the beeswax from the honey. With historic import price levels for honey around €3 and beeswax around €12, it is clear that processors of this crude honey can make more money from the beeswax than from the honey.

What exporters still need to consider before focusing on beeswax production is that the productivity per hive is often much lower with traditional hives and when a very large part of the honeycomb is harvested. They must make cost calculations adapted to the local situation to determine the most economically attractive beekeeping approach.

Tips:

- If you have access to sources of crude (raw) honey, a combination of honey and beeswax, you could benefit from the relatively high prices for beeswax. Many European buyers are interested in purchasing both products, which can even offer opportunities to reduce administrative and transportation costs per unit.

- Calculate how profitable an existing beekeeping business is and whether it is more profitable to switch to a different beekeeping approach. Consider potential losses in honey productivity when switching to a focus on bee-produced beeswax.

5. Healthy manuka honey

The health and wellness trend has a large impact on the European food market. Consumers are very interested in products that they believe are healthy. As obesity is one of the main health issues related to food consumption, many consumers are trying to avoid high-calorie products and ingredients, such as sugars. Honey mainly consists of sugars and the trend of low-sugar products is a threat. However, the reduction of sugar intake is focusing on products with sugar added as an ingredient, such as soft drinks. Policies of European governments to stimulate reduction of sugar intake are mainly targeting those products and not honey. For example, some governments impose a sugar tax on certain products, such as confectionery, ice cream and soft drinks. Despite this threat from sugar intake reduction, there is at least one example of a honey benefitting strongly from the health and wellness trend: manuka honey.

Figure 2: Manuka flowers and manuka honey production in New Zealand

Source: Unsplash, 2019 & Unsplash, 2023

The case of manuka honey shows that research and a strong marketing campaign based on exceptional research results can lead to product differentiation and exclusivity. Manuka honey is amongst the most expensive honeys in the world, with retail prices in Europe as high as €138/kg. It is produced by bees feeding on the manuka tree (Leptospermum scoparium), native to New Zealand and South Australia. The high prices for manuka honey are strongly related to the research done on the health benefits of this honey and the identification of its broad-spectrum antimicrobial activity. The Unique Mānuka Factor Honey Association (UMFHA), the main trade association of New Zealand's manuka honey producers, trademarked a honey rating system. UMFHA then marketed it to generate demand and position it as a unique health product.

Figure 3: Unique Manuka Factor trademark

Source: Unique Mānuka Factor Honey Association

It is important to realise that the manuka honey sector has made large investments in the research, standardisation and marketing of manuka honey and that the health benefits of manuka honey are unique. No other honeys have a scientifically proven health benefit. Without such scientific proof and approval of the health claim, the EU does not allow the use of any health claims on the product label or in promotional messages. UMFHA has been very successful despite the EU not approving any health claims relating to manuka honey.

Tips:

- Look at the website of one of New Zealand's manuka honey exporters to understand how they benefitted from the research and marketing of manuka honey.

- Do not make health claims when promoting on the European market. It is not allowed. If you want to inform people about potential health benefits, you can share scientific studies on those potential health benefits.

6. Diversification with monofloral honeys and geographical indication

An increasing number of consumers in the most developed markets of the EU are growing a preference for monofloral instead of polyfloral honeys. Monofloral honeys are made by bees that collect a large part of the nectar from a single floral origin such as acacia trees. In contrast, polyfloral honey is made by bees that collect nectars from a wide variety of flowers. Common monofloral honeys in Europe and their major origins:

- Acacia: Romania, Spain, Hungary

- Chestnut: Italy, Spain, Greece

- Clover: France, Sweden

- Eucalyptus: Spain, Italy

- Lavender: France, Italy, Spain

- Linden: Romania

- Orange blossom: Spain, Italy

- Rapeseed: Czech Republic, Poland

- Sunflower: Romania, Spain, France

- Thyme: Spain, Greece

How common a certain monofloral honey is differs between countries. This strongly relates to the flora of the country. In Spain, for example, orange blossom honey is a common monofloral honey as beehives are held in orange orchards. Northern Europe does not grow oranges and orange blossom honey is much less common there. These preferences also affect monofloral honeys from outside Europe. For example, in countries where consumers are familiar with darker monofloral honeys, the likelihood of consumers accepting a dark monofloral honey from outside Europe is greater. In many European countries, consumers actually prefer liquid honeys with a light colour and mild taste.

The market for monofloral honeys in Europe is currently small, at an estimated 10% of the total honey market. This segment is expected to grow in the coming 10 years, as demand for these monofloral honeys is rising, mostly in the leading European markets. Demand for monofloral honeys is driven partly by a growing appreciation for the different unique tastes and partly by a growing interest in the link between taste and floral origin. Consumers of monofloral honey are interested in the story around the origin of the honey and its unique properties. They appreciate all information on the area where bees collect their nectar, including types of vegetation and Latin names of dominant flora. This information must obviously include information on the flora providing the nectar for the monofloral honey production. In general, consumers find it interesting to see photos and videos of the flora and beekeeping activities in support of the story.

Manuka honey is a monofloral honey whose marketing success is strongly related to the scientific research on its potential health benefits. Such research takes many years and requires large investments, and the feasibility of doing such research for other monofloral honeys is limited.

For many monofloral honeys, the strategy to obtain a geographical indication (GI) is more feasible. The EU explains GIs as quality labels that "protect the names of specific products to promote their unique characteristics, linked to their geographical origin as well as traditional know-how". The GI can help increase the economic potential of honey. The most recent study on GIs found that the sales value of a product with a protected name is on average double that for similar products without a protected name. There are 2 types of GIs for honey:

- PDO – protected designation of origin

- PGI – protected geographical indication

Figure 4: Geographical indication logos

Source: European Commission, 2023

More than 30 types of honey produced across the EU have received a PDO or PGI. The global database for GIs contains 78 geographical indications for honey. One of the PGIs is for Oku white honey from Cameroon. While this GI is not yet recognised by the EU, the registration at OAPI, the African organisation for Intellectual Property in 2012, provides an example of successful GI registration in a country outside the EU. One of the organisations behind this success is Guiding Hope in Cameroon, promoting Oku white honey under their brand Miel Royal.

In 2023, the EU agreed to review the regulation for GIs to increase uptake of these products and provide a higher level of protection, especially online. The new regulation will also make the registration procedures easier and recognise sustainable practices, which will then have to be mandatory for all producers registered under the GI.

Marketing your honey as monofloral is only possible when you can prove that your honey is made from nectar collected from one particular flower variety. You must agree with beekeepers on procedures to prepare the hives and colonies for collection of this nectar, including the removal of any other honey to avoid 'contamination' by other nectars. Beekeepers must then coordinate the timing between the introduction of the beehive and the harvesting. They must coincide with the blooming period of the specific plant. Last, they must harvest their monofloral honey crop before the bees start collecting nectar from other sources. Laboratories can then perform pollen analysis to determine the floral origin of the honey together with other methods for identification of monofloral honeys.

Tips:

- Find out if you have access to monofloral honey. Identify areas with a dominant single flower such as large plantations and monocultures. Then determine the blooming period of the target nectar source and overlapping blooming periods of other nectar-producing plants.

- Research the potential to register a GI product. This will depend on the size of your production, the willingness and capacity of beekeepers to implement standard procedures, and the unique properties of your honey.

7. Uncertainty around Ukrainian honey supplies

The war in Ukraine has had a major effect on the European honey market and may open up opportunities for suppliers from other countries. Ukraine is one of the world's largest honey producers, with exports exceeding 48,000 tonnes in 2022, according to ITC Trade Map. Almost all exports go to Europe. In 2022, the volume of European imports from Ukraine reached 46,094 tonnes and the value €121 million.

In the last decade (2013-2022), the share of Ukrainian honey imports to the EU increased from 10% to 24%. This surge has been supported by actions by Ukraine and the EU to establish a free-trade zone between the 2 partners. Ukrainian suppliers can benefit from duty-free tariff quotas, but these preferential tariffs are not the only reason for the large trade in honey. Most of the imports are outside the quota and do not benefit from the preferential tariffs. The other reason for Ukraine’s large share in EU honey imports is the satisfaction among European importers about the quality and prices of Ukrainian honey.

In 2022, the war in Ukraine had several effects on honey supplies. First of all, some beekeepers left their beehives to fight in the war or because the location of their beehives had become too dangerous. Second, Ukraine planted less sunflowers, and sunflowers are a major source of nectar for the bees. While the effect on honey supplies of the reduction in sunflower planting was not yet visible in 2022, a lower number of sunflowers will have an effect on honey supplies in 2023 and beyond.

European importers will need to source more honey from elsewhere to replace Ukrainian honey. At the same time, they have to deal with concerns about cheap adulterated honey. The cheapest and most suspicious sources are becoming less attractive as the new labelling rules require honey packers to mention the countries of origin on the labels. Countries with high-quality honey and a good reputation will benefit most from these developments.

Tips:

- Ensure that your honey is not adulterated and of good quality, to benefit from Europe's need to replace Ukrainian honey imports.

- Stay informed about developments in Ukraine to anticipate price developments in the European market. For example, you can regularly check the news on Euractiv.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research