What is the demand for natural food additives on the European market?

Europe has a large food and beverage industry that demands natural additives for various applications. There is an increasing demand among consumers for healthier and more sustainable food ingredients instead of artificial ingredients, boosted by stricter European Union (EU) legislation. This evolution is driving up demand for natural additives which makes Europe an interesting market for export companies producing natural sweeteners, emulsifiers, and natural colours, among others. The European countries offering most opportunities for exporters of natural food additives include Germany, France, the Netherlands, the United Kingdom, Italy, and Spain.

Contents of this page

1. Sector definition

The European Food and Safety Authority (EFSA) defines food additives as substances added intentionally to foodstuffs or beverages to perform certain technological functions or purposes, for example to colour, sweeten or help preserve foods. They are not normally consumed by themselves nor used as typical or characteristic ingredients for food. Many food additives are naturally occurring and some are even essential nutrients, but they must have demonstrated a useful purpose and undergone a safety evaluation before they can be approved for use.

In the European Union (EU), all food additives are identified by an E number. E numbers indicate that an additive has passed safety tests and has been approved for use by the European Food Safety Authority (EFSA). The list of authorised food additives and their specific conditions of use can be consulted on the European Commission (EC) website and in Annex II of Commission Regulation (EU) No 1129/2011.

Natural food additives can be categorised into several groups, according to their purpose of usage. EU legislation defines 27 functional classes of food additives. The most common group additives are:

- Antioxidants (added to prolong shelf-life of foods by protecting them against oxidation);

- Colours (used to add or restore colour of foods);

- Flavourings and flavour enhancers (used to bring flavour to foods);

- Emulsifiers, stabilisers, gelling agents and thickeners (used to form or maintain a homogeneous mixture, give texture, or increase viscosity of a foodstuff);

- Preservatives (used to prolong shelf-life of foods by protecting them against micro-organisms); and

- Sweeteners (added to give a sweet taste to foods and replace sugar).

This study focuses on natural sweeteners, natural emulsifiers, stabilisers, thickeners, gelling agents, natural flavours, and natural food colours, as these ingredients are more produced in developing countries and present an opportunity for suppliers seeking to enter the market.

Table 1: Main categories and applications of selected natural food additives in Europe

|

Category |

E-number |

Main applications |

Examples of additives |

|

|

Natural sweeteners |

E900s |

Beverages (incl. soft drinks and energy drinks), bakery, dairy, confectionery, table-top sweeteners |

Steviol glycosides (stevia), coconut sugar, date sugar |

|

|

Natural emulsifiers, stabilisers, thickeners, and gelling agents |

E400s |

Soups, sauces and dressings, bakery (incl. fillings), beverages (incl. juices), dairy and ice cream |

Gum Arabic, guar gum, seaweed extracts |

|

|

Natural flavours |

E600s |

Beverages (incl. alcoholic beverages), dairy and ice cream, bakery, confectionery, snacks, soups and sauces, meat and meat alternatives |

Vanilla extract, citrus oils, clove oils |

|

|

Natural food colours |

E100S |

Bakery and cereals, beverages, confectionery, dairy and cheese, meat and meat alternatives, dietary supplements |

Beet extract, turmeric, paprika extract |

|

Source: ProFound, 2023

2. What makes Europe an interesting market for natural food additives?

Europe is a very interesting market as it has a large food and beverage industry with growing demand for natural food additives for various applications. European consumers are paying more attention to the ingredients in their food and beverages, leading to a progressive replacement of artificial ingredients by natural ingredients. Plant-based diets are very much ‘on trend’, driving up demand for natural and innovative alternatives in the additive categories. This certainly represents an opportunity for suppliers in developing countries.

Growing European food and drinks market stimulates growth of the food additives market

Europe is one of the largest and more mature food and drinks markets in the world, along with the US. The European food and beverage industry provides a wide range of applications for food additives. The size of the European market and its steady growth create opportunities for natural food additives and their suppliers.

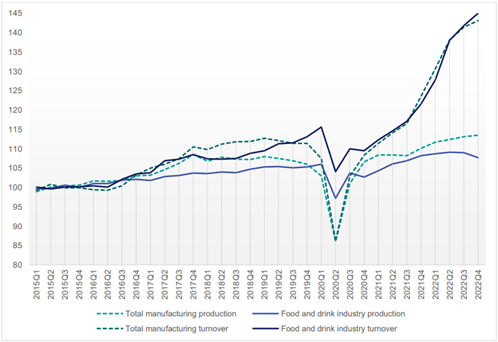

In 2019, the European food and drinks market was valued at between €1,100 billion and €1,400 billion, making it one of the region’s largest manufacturing industries and a major contributor to the European economy. By 2023, Europe’s food and beverages market was estimated at a value of about €1,869 billion. During the past decade, market growth was steady, except for 2020 when turnover dropped because of the fall in demand linked to the COVID-19 pandemic. Figure 1 shows that the European food and drink industry is resilient. This resilience is evident because both production and turnover (revenue) within this industry had a more consistent and stable pattern of development compared to the broader manufacturing sector as a whole.

Figure 1: Quarterly manufacturing production and turnover (2015=100)

Source: Food Drink Europe, 2023

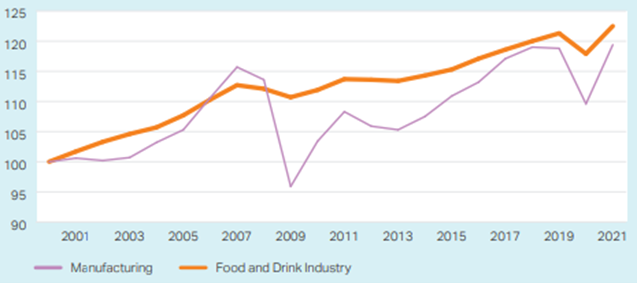

Europe also stands out for its production and exports. Production volumes have been showing steady growth for more than 10 years now. The European food and drink industry is diverse, with multiple product sectors. Meat products (20% share of total turnover), dairy products (14%), drinks (14%), and bakery and farinaceous products (11%) are the top 4 sub-sectors in the European food and drinks market.

Europe is also the world’s largest exporter of food and drink products, with exports outside the EU reaching €156 billion in 2021. With a value of €35 billion, the beverages segment is the largest exporter outside Europe.

Figure 2: Volume of production in the food and drink industry and manufacturing industry (index, 2000=100)

Source: Food Drink Europe, 2023

Based on the above data, it is assumed that the European food and drinks market will continue to grow, driven in part by population growth and the resulting demand for more food. Although the forecast is positive, the exact growth rate is uncertain. Some sources predict an average annual growth of the European food and drinks market of 6.5% between 2023 and 2028, reaching a total value of about €2,560 billion. These forecasts may be overestimated considering that today there is a slowdown in the global economy. The outlook for Europe’s economy is one of slow growth and sticky inflation, and prices in the EU food supply chain have risen significantly. Although the economic situation poses challenges for both consumers and businesses in Europe, the food and drinks market has proven to be resilient to economic downturns.

Size of the European natural additives market

There is not much quantitative information on the natural additives market. The European natural food additives market was estimated to be worth €9.1 billion in 2021, which represents a small fraction of the total food and beverage market. However, the food additives market is directly related to the food and beverage sector, as natural food additives are added to various products in some of the most important food segments of the total food and beverage market.

The application of natural food additives in the European food and drink industry is wide and diverse. Dairy and confectionery products are the main categories using food colours, followed by desserts, ice cream, juice drinks, bakery, chocolate, snacks, meals, soft drinks, sauces, and seasonings. Bakery, meat products, dairy and beverages are the main application areas for oleoresins. Soft drinks, dairy products, chocolate and biscuits are very relevant end-industries for natural sweeteners.

Assuming this close relationship between the European food and drinks market and the natural food additives market, Europe also constitutes a large market for natural food additives. As long as the food and drinks industry continues to grow, the market for food additives can be expected to grow as well, driven by increasing demand from food manufacturers. In fact, there is a forecasted average growth of 6.2% per year until 2030. This upward trend or general growth in the food market creates opportunities for suppliers of natural food additives in developing countries.

Europe is a relevant importer of natural food additives from developing countries

Europe is a large importer of natural ingredients, some of which are widely used as natural food additives in foodstuffs and beverages. The growing demand for natural food additives translates into increased intra-European and extra-European trade. This provides good reasons for exporters in developing countries to target Europe as an important market.

Natural food additives is a wide category, consisting of several product groups. As such, trade data on natural food additives is not aggregated, but spread over multiple HS codes. It would be very difficult to have total data on food additives. Nevertheless, some relevant conclusions can be drawn by analysing trade data for specific ingredients that may act as proxies for others. Figure 3 presents the import value behaviour of some popular natural food additives in Europe, namely colouring matter (HS code 32030010), natural gum Arabic (HS code 13012000), oils of lemon (HS code 330113), and glycosides including steviol glycoside (HS code 29389090).

Source: ProFound with data from ITC Trade Map, 2023

In 2022, Europe accounted for about 50% of the value of global imports of colouring matter, Arabic gum, and oils of lemon. Considering that these are some of the most common additives, it is assumed that Europe also dominates a considerable and noteworthy proportion of the global import value for other similar additives. As such, the European market offers great opportunities for suppliers.

Overall, the value of European imports of selected food additives increased over the past 5 years, mainly driven by colouring matter and glycosides. Between 2018 and 2022, the total value of European imports of the selected ingredients grew at an average rate of 8.8% per year.

All ingredients showed continuous import growth over the past few years, except for the oils of lemon whose value fell in 2021. One of the most notable growths for the 4 selected ingredients is observed in the period 2021-22. This behaviour suggests a positive future trend, driven by growing regional demand.

Developing countries play an important role in the supply of some natural food additives to Europe such as essential oils and glycosides. In 2022, 49% of the value of European glycosides imports were sourced from developing market economies. At the same time, 65% of the value of European imports or oils of lemon came directly from developing countries. Some of the main import hubs in Europe are France, Germany, the Netherlands, and the United Kingdom.

Although not all additive imports are analysed, the above information serves as an indicator that there is good potential in the European market for natural additives from developing countries.

Organic and plant-based trends to drive demand for natural food additives

One of the main trends in the European food and drinks market is the rising demand for organic and plant-based products, as well as an increased availability of these products in retail channels. This might boost overall demand for the use of natural food additives, creating opportunities for exporters whether their ingredient is used in a certified organic product or not.

Pesticide residues in food is among the main food safety concerns among Europeans. Consumers now want to avoid pesticides and other chemicals in what they consume. Most consumers (81%) consider that products coming from organic agriculture are produced with better environmental practices, meet specific rules on pesticides, fertilisers and antibiotics and have better quality than other food products. Many are also concerned about the environmental impact of conventional farming and want to support organic production methods. This trend among consumers is boosting sales for organic and clean label products.

Europe is now the world’s second-largest market for organic food and drinks, after the USA. In the USA, the organic market segment had a share of 6.0% in the total market in 2022. In Europe, this share was only 3.8%. The drivers behind growth in the organic market are similar between Europe and the USA. The difference in organic market share largely comes from the difference in disposable incomes. In the USA, disposable incomes are higher on average than in Europe, giving consumers more financial room to purchase the generally more expensive organic options instead of conventional options.

Organic retail sales in Europe grew at a strong average yearly rate of 10%, from nearly €35 billion in 2017 to over €50 billion in 2021. In 2023, the European organic-certified food market accounted for 3.9% of all sales in the general food and drink market. The organic food share of the European food and drink market has grown for several years, at an average rate of 7.7% per year since 2014. The organic food segment has a positive forecast for the coming years of steady growth projected to reach a share of 4.8% by 2027.

Source: Statista, 2023

Demand for plant-based foods and beverages is also growing among consumers. The European plant-based food sector grew by 21% between 2020 and 2022, reaching a total sales value of €5.8 billion. Plant-based milk leads the market with sales of €2.2 billion in 2022, followed by plant-based meat with sales of €2 billion during the same year. These segments grew respectively by 7% and 3% in terms of sales value between 2021 and 2022.

Source: GFI Europe, 2023

Both organic and plant-based food and drinks products avoid the use of synthetic food additives, while boosting demand for natural, plant-based food additives such as colours, organic preservatives and flavourings, rosemary extract and stevia-based sweeteners. This trend received a boost from the COVID-19 pandemic and is expected to continue growing.

Today there is a need for transparency in relation to organic food, and companies need to show consumers that they produced the food sustainably and humanely. Some companies in the industry, especially buyers of essential oils, oleoresins, and plant extracts, now require organic certification or at least the implementation of organic farming practices. This has put some pressure on suppliers to join certification schemes in the market, such as the EU Organic label. According to the new European Union organic regulation, a product can only bear the organic logo if it meets the production standards set by law, if it was certified by the control authorities, and if at least 95% of the agricultural ingredients are organic.

Given the small size of the organic market, applying for organic certification is not interesting for every exporter. Exporters should carefully consider their options and be sure to do a cost-benefit analysis of organic certification for their company.

Upcoming EU regulations will favour usage of natural food additives

It is believed that EU regulatory approaches to food safety, sustainability and social impact will create new opportunities for the use of natural food additives from developing countries in the European food and drinks industry.

So far, the EU regulatory framework's approach to food safety has been key to the growth of the natural food additives market. For example, additives such as food colours have had to undergo continuous safety evaluations over the years by scientific experts in Europe. These evaluations have led the European food industry to ban the use of certain food colours, which is increasingly the case for non-natural colours. Due to these increasing regulatory limits, natural alternatives from fruits, vegetables and other plants are being adopted in Europe for all colours and food categories.

In addition, the EU regulatory framework aims to reduce the potential impact of sugars on human health, leading to new policies and legislation that favour the use of sugar alternatives like natural sweeteners. This is also true for the United Kingdom, where the government introduced its ‘sugar tax’ on soft drinks in 2018 as a way to tackle childhood obesity. Around 50% of soft drink manufacturers have reduced their sugar content as a result. This is likely to have influenced the imports of stevia and other natural sweeteners into the UK.

Furthermore, the demand for sustainable sourcing is being strengthened and further extended among companies by developments on the regulatory front, namely the European Green Deal (EGD) and the Directive on corporate sustainability due diligence. Sustainable sourcing has become an important expectation of all supply chains in the European food industry and beyond. EGD regulations such as the Farm to Fork Strategy, the Chemicals Strategy for Sustainability, and the Biodiversity Strategy expect companies to assume and play a key role in building a sustainable economy and society. The proposed regulatory changes will impact the food additives industry in multiple ways and the requirements on European companies may affect exporters as part of their global supply chains. These regulations may create opportunities for exporters who can produce food in a sustainable way in developing countries where the impact on the environment and communities is often most evident.

Tips:

- Check our study on trends in the European market of natural food additives to find information on opportunities that may increase your chances of market access.

- Make sure to align your business with the objectives of the European Green Deal and Corporate Sustainability Directive. Read our study on the EU Green Deal impact for more detailed info.

- Read our study on buyer requirements for natural food additives for further information on certifications and regulations for exporting to the European Union (EU).

- Stay up to date on the European food and drink market by visiting Food and Drink Europe.

- Learn more about food ingredient trends/developments and meet industry operators at the main food ingredient trade shows in Europe, such as Vitafoods in Geneva, BioFach in Nuremberg, SIAL in Paris, Fi Europe in Frankfurt, and Anuga in Cologne.

3. Which European markets offer most opportunities for natural food additives?

Western European countries such as France, Germany, Italy, the UK, Spain, and the Netherlands offer great opportunities for natural food additives and are therefore the most attractive national markets for suppliers of these ingredients. These countries are the largest food and drink producers by turnover. They also play an important role in trade, often with suppliers from developing countries, so they are assumed to have the most importers and potential buyers. These countries also have a particular focus on end-users preferring organic and plant-based food and beverages, while demanding natural food additives.

Source: ITC Trade Map, 2023

Table 2: Characteristics of European countries with the most opportunities for natural food additives

|

Country |

Food and drink market size 2020 (€ billion) |

% change 2016-20 |

Organic food and drink market size 2021 (€ billion) |

% change 2017-21 |

Plant-based food market size 2022 (€ million) |

% change 2021-22 |

|

Germany |

185 |

2.0 |

16 |

12 |

1,911 |

11 |

|

France |

212 |

4.2 |

13 |

13 |

426 |

3 |

|

Italy |

144 |

2.0 |

3.9 |

5.9 |

681 |

9 |

|

UK |

121 |

- |

3.5 |

9.9 |

1,077 |

3 |

|

Spain |

127 |

7.2 |

2.5 |

7.1 |

447 |

4 |

|

Netherlands |

75 |

0.3 |

1.4 |

6.2 |

411 |

0 |

Source: ProFound, 2023

France

The French market offers the most opportunities for suppliers. Besides having the largest food and beverage market in Europe, France is also a rapidly growing market for organic and plant-based foods, as well as a leading importer and distributor of several natural ingredients used as food additives. All of this suggests that there is a high demand for natural food additives in this country.

According to Food and Drink Europe, France had the largest food and drink market in terms of turnover in 2020. The French market was valued at €212.2 billion during that year. The most important sectors were meats, dairy, beverages, and confectionery. In the period 2016-20, the French market grew by 4.2% from €180 billion and is expected to grow at a CAGR of 5.5% by 2027. France has a large food-processing sector and the second largest number of food and drinks companies (54,899).

France is also the second largest organic food and drink market in Europe. The French organic food market topped €13 billion in 2021. Interest in organic products will prolong this growth and boost demand for natural ingredients. For plant-based foods, France ranks fifth in Europe with a market value of €426 million in 2022 and is forecasted to continue growing.

France plays a particularly important role in ingredient formulation, with leading companies in sectors such as flavours and fragrances, and natural sweeteners. France has a prominent industry for natural sweeteners and has held a strong position in the European stevia market since it approved the use of stevia sweeteners, particularly the Reb A strain, in 2009. The country also has an important flavouring sector, including major flavouring companies such as MANE and Naturex (now part of the Swiss-based multinational Givaudan, one of the world’s leading natural extract companies).

In terms of imports, France stands out as the main European importer of natural gum Arabic, essential oils, and natural glycosides. Some important traders of gum Arabic in France are Nexira and Alland & Robert. The country’s leading importers of essential oils and oleoresins include companies such as Elixens, SNPM Huiles Essentielles, Nactis, Robertet, Métarom and Anec France. A large share of French imports is sourced directly from developing countries, such as glycosides (including stevia) at 87% and essential oils at 63%. This is very interesting for suppliers from non-European countries.

Germany

Germany combines all the elements that make up an interesting market for natural food additives: a large food and beverage industry, a large organic and plant-based market, significant imports across several ingredient categories, and several interesting companies requiring ingredients.

Germany is Europe’s largest market for food and drinks. According to the Federation of German Food & Drink Industries, the German food and drink industry had a turnover of €186.3 billion in 2021, the important sectors being meat and meat processing, dairy, confectionery, bakery, and alcoholic beverages. The German food industry has steadily grown in recent years. Between 2017 and 2021, the German market grew by 3.7%, which suggests a positive forecast for the coming years. Germany is also the third-largest exporter of food products in the world and a major re-exporter of several natural ingredients in Europe.

Growing food safety concerns, paired with the pressure to adopt clean label, creates an innovative environment in the German food and beverage sector. Germany has the largest organic food market in Europe, valued at €16 billion in 2021. The country is known to be highly interested in organic-certified ingredients and German consumers have a high awareness and willingness to pay for high-quality products. Suppliers with certified organic should include German importers and distributors in their buyer research. Plant-based products are also popular among German consumers. The country has the largest plant-based products market in Europe, worth €1,911 million, and the second highest per capita spending on plant-based food. Both markets have showed significant growth in recent years.

Germany plays a vital role in the trade of most natural food additives including seaweed extracts, natural gums, essential oils and oleoresins, and glycosides, including stevia. Germany is believed to dominate the Europe food additives market. The country is an important re-exporter of natural ingredients to other European countries. Germany is also the leading European importer of natural food colours. In 2022, Germany imported €127 million of natural colours, accounting for 7.0% of the total European import value of HS code 320300. Between 2018 and 2022, imports of these ingredients grew on average by 8.7% each year in value. Germany imports 46% from developing countries, considered a leading trade hub for these specific ingredients.

Major German companies active in natural additives are the multinational ingredient formulator Symrise, with a 70-year tradition in the industry, and Doehler, which sources ingredients worldwide in a vertically-integrated fashion. Brenntag is another German multinational active across several natural ingredients. Germany has many other important companies that are active in processing and trading natural food additives, such as Silesia Aroma, Henry Lamotte Oils GmbH, ADM Wild Europe and Rüther Gewürze. Roeper and All Organic Treasures (specialised in organic ingredients) are also interesting German-based trading companies that are active in some natural additive categories.

The United Kingdom

The UK has 1 of the largest consumer markets in Europe. According to the UK Food and Drink Federation (FDF), the country’s food and beverage sector generated about €121 billion in turnover in 2020. Since Brexit, the UK has retained its proven stability and maintained its vibrant trade with Europe and the rest of the world.

In 2021, the UK organic market was valued at €3.5 billion, corresponding to an average annual increase of 9.2% since 2017. The British market for organic food and drinks showed consistent growth and is expected to continue growing based on historical data. Rising consumer awareness and growing demand for natural and healthier food and drink products are major drivers. People are now actively trying to lead an environmentally friendly lifestyle. Indeed, 1 in 5 UK consumers would choose a specific eating-out venue over another if it had a focus on sustainability.

The UK has the second-largest plant-based products market in Europe, valued at €1,077 million. A wide range of plant-based alternatives to meats and dairy products are available from British retailers.

The UK is among the main importers of natural food additives in several categories. The country is 1 of the leading importers of essential oils and oleoresins and of natural thickeners gum Arabic and agar (or agar-agar). It is also 1 of the main players in natural sweeteners, including stevia.

The UK is home to several interesting companies across several natural food additive categories. The main importers of natural food colours in the UK are Dura Color, Plant-Ex and ScotBio, a company that developed ScotBio Blue, a natural blue colourant extracted from spirulina usable in food and drinks. Leading importers of oleoresins in the UK include British Pepper and Spices, Lionel Kitchen, Treatt, House of Flavours and Phoenix Products. Within natural sweeteners, the UK is home to the headquarters of major European stevia company Tate & Lyle, which has a portfolio of stevia-derived food additives.

The Netherlands

Although this is not a major market, the Netherlands is still very interesting and offers the fourth largest opportunity for suppliers of natural food additives from developing countries.

The Dutch food and drink market is smaller than other national markets. In 2020 the market was valued at €75 billion , showing no significant growth over the previous 5 years. The meat and dairy processing industries are the most important in this sector of the Dutch economy. The organic food and drink market is growing, though it remains small in comparison to other countries. When it comes to the plant-based food market, Netherlands stands out as the country with the highest per capita spend on these product segments.

The Netherlands is widely recognised as a key entry-point for various natural ingredients, which it supplies across the whole of Europe. This is due to re-exports to other European countries as well as to a strong ingredient-processing industry. It is also recognised for its application of technology and know-how in the formulation of ingredients.

The Netherlands is among the leading importers of essential oils and oleoresins, as well as natural colours. In 2022, the Netherlands imported natural colours valued at €97 million, accounting for a 5.3% share in total European imports. Dutch imports have demonstrated outstanding growth in the last 5 years, at an average annual rate of 20% since 2018.

Ingredient formulator DSM (now part of the Firmenich group) and the trading companies Holland Ingredients and Caldic are relevant examples of internationally active companies working with natural food additives. The European headquarters of Cargill, a leading multinational ingredient company, are in the Netherlands. There are also companies working in specific categories, such as Exberry (part of GNT), a major player in the formulation of food colours, and Van Wankum Ingredients, a leading importer of stevia.

Spain

Spain is an important supply market for Europe, being among the top 6 European hubs for imports of natural food additives. While there are many suppliers in this big market, it is also dynamic and there are opportunities to enter with a competitive offer.

Spain is the fifth-largest food and drink market, with a turnover of €127.5 billion in 2022. Between 2016 and 2020, the Spanish market grew on average by 7.2% each year. The food and beverage industry is 1 of the key sectors in Spain’s economy, representing 2.5% of GDP in 2021. The Spanish food and drinks market is made up of a large number of producing companies (29,366).

Spain’s organic market grew significantly between 2017 and 2021, reaching a total value of €2.5 billion in 2021. The steady growth indicates a long-term consumer demand for healthier products. Spain is also the fourth largest plant-based food market, reaching sales of €447 million in 2022. The Spanish plant-based food market showed growth compared to the previous year and is expected to grow steadily.

Spain is 1 of the leaders in the production and import of seaweed extracts, food colours and oleoresins, and plays an important role in the trade of natural gums. Spain is a leading re-exporter of food additives to Europe, including seaweed extracts. The country also has a large and thriving food-processing and ingredient industry.

Spain is the second largest European importer of natural colours in terms of value. In 2022, Spanish imports were valued at €106 million, corresponding to an average annual growth rate of 8.4% since 2018. A 52% share of its imports is already supplied from outside Europe, specifically from developing countries.

Spain-based Roko is the leading European producer of agar (seaweed extract), while other Spanish companies such as Agar de Asturias also play an important role in this category. PROCONA (part of the SEIMEX Group) is 1 of the main natural colour formulators in Spain, founded over 20 years ago and specialising in a wide range of colours. Other Spanish companies specialised in food colours are Sancan, providing solutions for several product categories from meat to a vegan and vegetarian range, and Coralim. Spanish importers of oleoresins include Pimenton, Diego Pérez Riquelme e Hijos and Evesa. There is also some production of stevia in Spain, but local supply is supplemented by imports. Leading companies in Spain handling stevia include Azucares Prieto, Disproquima and EPSA Aditivos Alimentarios.

Italy

Italy represents the sixth largest opportunity for suppliers. Italy’s role in natural food additive imports is more limited but is still relevant in the European context. The country is among the major food and drink markets in Europe and among the leading importers of natural gums, natural food colours and natural sweeteners such as stevia.

Italy ranks as the third-largest food and beverage European market. In 2020, the market was valued at €144 billion and had the largest number of food and drinks companies (56,760). This country is a growing market, recording an average growth rate of 2% per year between 2016 and 2020. The most important food sectors in Italy are bakery, dairy, processed meats and seafood. Italy is also a significant manufacturer and exporter of food and drink products in Europe.

With a traditional food and beverage market of great importance in Europe, Italian consumers focus on high-quality ingredients. However, the development of the food and drinks business in Italy is increasingly oriented towards sustainability, with a greater focus on environmental and social aspects related to economic activity. The organic market in Italy, valued at €3.9 billion in 2021, plays a smaller role than other European markets in the import of natural food additives, but is still prominent for specific ingredient categories. Moreover, the country has the third-largest plant-based food market in Europe.

Some of the main importers and formulators of natural ingredients in Italy are Aromata Group and D-Ingredients, in addition to international companies with branches in Italy such as Brenntag and Sensient. Within the natural sweeteners market, particularly stevia, some of the major suppliers in Italy include Bio Mondo and Moralco.

Tips:

- Find out which market offers the best opportunities for your company and products. You can get market information and identify potential buyers through/from industry associations of the main target markets and segments in Europe, such as: European Vegetarian Union, European Alliance for Plant-Based Foods, Natural Food Colours Association, European Flavour Association, German Association of the Aroma Industry (DVAI) and the UK Food Additives & Ingredients Association (FAIA).

- Refer to the CBI study on finding buyers, which provides practical guidance and tips on how to improve your chances when approaching European buyers.

4. Which products from developing countries have most potential on the European natural food additives market?

European demand for natural food additives has been growing for years, and the COVID-19 pandemic has accelerated growth. This creates relevant opportunities for certain additive categories, such as natural sweeteners, emulsifiers, stabilisers, thickeners, and gelling agents, as well as natural flavours and colours. Natural food additives with good potential in the European market include stevia, gum Arabic, guar gum, seaweed extracts, essential oils, and oleoresins.

Stevia and natural sweeteners

European industry is increasingly using natural sweeteners to replace sugar in food and beverage products. The quest for healthier diets among Europeans and the commitments at the industry level have contributed to the expansion of natural sweeteners.

Natural sweeteners are substances that provide a sweet taste in food and beverages. They are extracted from plant sources like stevia or produced by animals like honey. Today natural sweeteners have a diverse range of applications in the European market, including confectionery, beverages, breakfast cereals and dairy. Natural sweeteners are mostly present in products such as low-calorie drinks, sugar-free chewing gum, low-calorie yogurts, and some processed products such as ketchup.

Table 3: Examples of natural sweeteners that are allowed in Europe

|

Additive |

E-Number |

HS Code |

|

Erythritol |

E968 |

290549 |

|

Mannitol |

E421 |

290543 |

|

Neohesperidine DC |

E959 |

293890 |

|

Sorbitols |

E420 |

290544 |

|

Steviol glycosides from Stevia |

E960a |

293890 |

|

Thaumatin |

E957 |

350400 |

Source: ProFound, based on Commission Regulation (EU) No 1129/2011

In Europe, demand for natural sweeteners is boosted by consumers trying to lower their sugar intake and looking for products with no added sugars. At the same time, European industries and sector associations have also committed to sugar reduction, motivated by the EU regulatory framework. As an example, the European soft-drinks sector reduced added sugars in products at an average rate of 17.7% since 2015. Based on the European Soft Drinks Associations (UNSEDA) commitment on sugar reduction, one of the sector’s focal areas is the increased use of natural sweeteners. High demand for natural sweeteners is also coming from the organic food sector, since those consumers are more health-conscious and look for products that have low sugar content. As such, exporters of natural sweeteners should target companies producing healthy food and drinks which may be more likely to demand these ingredients.

Stevia is 1 of the most popular natural sweeteners both in the world and in Europe. In 2022, the global stevia market was worth €667 million and is expected to grow at an average annual growth rate of 8.1% until 2028. Meanwhile, the European market for stevia reached about €143 million in 2021. This market is expected to continue growing on average by 9.1% per year, reaching €221 million in 2026.

Drivers of the stevia market in Europe include growing consumer demand for healthier and natural products, rising consumer and company awareness of stevia, and widening applications in food and drink products. However, substitute sweeteners with similar properties such as barley malts, maple syrup, agave juice and coconut sugar are also gaining in popularity in the European market and therefore present a threat to the stevia market.

Figure 7 shows imports of HS Code 293890, which identifies other glycosides, natural or reproduced by synthesis, and their salts, ethers, esters, and other derivatives. HS code 293890 includes steviol glycoside, better known as stevia. Although this HS code does not refer exclusively to stevia, it works well as an indication of stevia imports.

Source: ITC Trade Map, 2023

The figure shows there was a significant increase in European imports in terms of value between 2018 and 2022. During this period, imports of stevia and other glycosides grew on average by 12% each year. Growth was sustained even in 2020 when international trade and value chains for all products were severely affected by the COVID-19 pandemic. Developing countries play an important role in the trade of glycosides and stevia. In 2022, the value of glycosides imports from developing countries amounted to €221 million, accounting for a 49% share of total imports. Over the past 5 years, the share of imports from developing countries has remained at around 50% of all imports. The main suppliers of stevia from developing countries are China, India, Malaysia, Chile, and Morocco.

The positive trend in total imports and imports from developing countries is expected to continue in the coming years due to increasing demand for stevia and limited production in Europe. There is therefore a clear opportunity for suppliers of natural sweeteners outside Europe.

Tips:

- Read our studies on Exporting stevia to Europe and Exporting coconut sugar to Europe for additional and more detailed information on trends, requirements, and market potential for these natural sweeteners.

- Visit organic and natural product trade shows to find potential buyers and understand their demand and requirements. Key events include Biofach, Natural & Organic Products Europe, Free From Food Expo, and the Nordic Organic Food Fair.

Emulsifiers, stabilisers, thickeners, and gelling agents like natural gums and seaweed extracts

Natural emulsifiers, stabilisers, thickeners, and gelling agents represent a good opportunity for suppliers in developing countries thanks to a growing demand for healthier products from European consumers. Rising demand for ready-meals and processed foods also generates demand for these food additives.

Emulsifiers, stabilisers, thickeners, and gelling agents are a key component of food and drink products. They are used for their texturising properties and to allow the incorporation of other ingredients. Emulsifiers help emulsions to occur between 2 or more liquids that normally cannot be mixed. Gelling agents, thickeners and stabilisers work with emulsifiers to give texture to foods, mainly by forming a gel. Natural sources predominate and many emulsifiers, stabilisers, gelling agents, and thickeners are derived from plants and seaweeds.

There is great interest in emulsifiers, stabilisers, thickeners, and gelling agents in the European market. These food additives have a wide range of applications in sectors such as bakery and confectionery, dairy, meats, condiments, and beverages. For example, food products such as mayonnaise and ice cream would not exist were it not for emulsifiers. Gelling agents are also needed to thicken and stabilise foods such as jellies, desserts and sweets. Table 4 lists some examples of typical emulsifiers, stabilisers, thickeners, and gelling agents in Europe. Although some have their own specific HS code, most are grouped together under HS code 391310 and HS code 130190.

Table 4: Examples of natural emulsifiers, stabilisers, thickeners, and gelling agents allowed and used in Europe, listed by HS code

|

Additive |

E number |

HS code |

|

Acacia gum; gum Arabic |

E414 |

130120 |

|

Agar |

E406 |

130231 |

|

Alginic acid |

E400 |

391310 |

|

Ammonium alginate |

E403 |

391310 |

|

Calcium alginate |

E404 |

391310 |

|

Carrageenan |

E407 |

13023290 |

|

Cassia gum |

E427 |

130190 |

|

Cellulose |

E460 |

3912 |

|

Gellan gum |

E418 |

130190 |

|

Guar gum |

E412 |

130232 |

|

Karaya gum |

E416 |

130190 |

|

Konjac |

E425 |

13021970 |

|

Lecithins |

E322 |

292320 |

|

Locust bean gum; carob gum |

E410 |

130232 |

|

Pectins |

E440 |

130220 |

|

Potassium alginate |

E402 |

391310 |

|

Processed eucheuma seaweed |

E407a |

121221 |

|

Sodium alginate |

E401 |

391310 |

|

Tara gum |

E417 |

130190 |

|

Xanthan gum |

E415 |

130190 |

Source: ProFound, based on Commission Regulation (EU) No 1129/2011

Natural gums

Natural gums such as gum Arabic, guar gum, and locust bean gum are growing in demand thanks to their unique properties. Natural gums have a lot of potential in Europe due to their usage as substitutes for fat in low-fat or fat-free food products, and their potential usage as a substitute for gelatine in certain gluten-free and vegan products. Demand for natural gums is expected to continue to grow as European food companies increasingly look for such natural alternatives in their formulations.

In the last 5 years, imports of gum Arabic (HS code 130120) to Europe were stable in value, with a significant increase of 50% in 2022. Developing countries play a significant role in the supply of Arabic gum to Europe. In 2022, 59% of European gum Arabic imports were sourced from developing countries. The main suppliers of gum Arabic to Europe are mostly located in West and Central Africa, in particular Sudan, Chad, Nigeria, and Mali.

Source: ITC Trade Map, 2023

European importers depend heavily on Sudan for the supply of gum Arabic. In 2022, Sudan was the leading exporter of this ingredient to Europe, supplying over €105 million in value, which accounts for 48% of total European imports. However, European importers sometimes have difficulties sourcing the product from Sudan and are generally open to finding new suppliers. In fact, in 2022, the share of European imports from other supplying countries such as Chad, the United Arab Emirates, Nigeria, and Mali, increased relative to Sudan’s share.

Guar gum and locust beans gum imports (HS code 130232) show a similar trend. Between 2018 and 2021, imports grew steadily at an average rate of 17% per year, but then showed a large increase in demand of 58% in 2022. Imports in 2022 reached a total value of €613 million, of which €165 million came from developing countries. This indicates that developing countries control about 27% of total exports to Europe. Over the last 5 years, the share of developing countries in total Guar gum and locust beans gum imports has remained around this number, with only a slight decrease. India is the main international supplier, with approximately 28% of the total imports, followed by China and Pakistan.

Source: ITC Trade Map, 2023

Seaweed extracts

Seaweed extracts, or seaweed hydrocolloids, are made of different seaweeds sourced from various countries, such as Indonesia and China. They are often used as gelling and thickening agents. One of the most common seaweed extracts is Agar. This is a gelatinous substance derived from red seaweed, which has nutritional benefits as a source of iron and magnesium, as well as digestive, bone and brain health benefits. Agar has multiples applications in food, health products, biotechnology, and cosmetics sectors. However, it is estimated that 90% of agar production is destined for the food and drinks industry. It is used by the confectionery industry for desserts such as jellies, pies, donuts, cake icings and so on, and in dairy products such as cream cheese and yoghurt. It is also popular in the beverages industry as a clarifying agent of beer and wine.

Figure 10 presents changing trends in European Agar imports (HS code 130231). Between 2018 and 2022, European Agar imports grew on average by 1.3% per year. There was a significant drop in imports during 2019, 2020 and 2021. However, imports rebound with a growth of 30% in 2021/22. In 2022, European Agar imports reached a total value of €71 million, of which €37 million came from developing countries. According to historical data, imports from developing countries account for about half of total imports. The share of developing countries is increasing, reaching 53% in 2022, which suggests that there is great market potential for Agar exporters from developing countries.

Source: ITC Trade Map, 2023

Tip:

- Read our studies Exporting seaweed extracts to Europe and Exporting gums to Europe for more information on market potential and market entry guidelines.

Natural flavours

Natural flavours are in high demand in the European food and drinks market due to their relatively low costs, a rising consumer demand for natural products and processed foods, and the growing organic food market.

Natural flavours are preparations or substances added to foodstuffs to enhance or change their flavour or odour. In Europe, the food flavouring industry is relevant and extremely varied. According to the European Flavour Association (EFFA), the European flavour industry generates a yearly turnover of €3.5 billion, and accounts for about one third of the global market share.

Natural flavours are added to a wide range of food and drink products including beverages such as fruity infusions and soft drinks, confectionery products, dairy products such as yoghurts, and also savoury snacks. All flavourings used by the industry are subject to strict EU regulations to ensure their safety (for example, the EU Flavouring Regulation).

Essential oils

Food-grade essential oils are commonly used as natural flavours to bring or enhance a particular taste in food products. They are obtained from the leaves, flowers, bark, and other plant parts with the help of steam distillation. Europe is the leading global market for essential oils and huge volumes of essential oils are used by the European flavouring sector. There is a large variety of essential oils used in food, estimated at more than 100. Some of the most popular essential oils include peppermint, lemon, orange and other citrus, lavender, rosemary, bergamot, thyme, cinnamon, and parsley oils.

Table 5: Examples of essential oils used in the European food and drinks market, listed by HS code

|

Essential oil |

HS code |

|

Cardamom |

330129 |

|

Cinnamon Leaf |

330129 |

|

Cinnamon Bark |

330129 |

|

Ginger |

330129 |

|

Lavender |

330129 |

|

Lemon |

330119 |

|

Nutmeg |

330129 |

|

Oregano |

330129 |

|

Peppermint |

330124 |

|

Rosemary |

330129 |

|

Rose Geranium |

330129 |

|

Sandalwood |

330129 |

|

Spearmint |

330125 |

|

Tea Tree |

330129 |

Source: ProFound, 2023

European demand for essential oils is increasing, driven by a general increase in the demand for natural products, including natural flavourings for processed food. In 2022, European imports of essential oils (HS code 3301) reached over €2,171 million. Over the last 5 years, the value of imports has been increasing overall at an average annual rate of 2.8%, with some small fluctuations. Developing-country suppliers play an important role in the supply of essential oils to Europe. In the past 5 years, over 50% of essential oils imported into Europe were sourced from developing countries, which shows potential for non-European exporters. The main supplier of essential oils to Europe is India, accounting for almost 10% of all essential oil imports, followed by Brazil, China, Argentina, and Indonesia.

Source: ITC Trade Map, 2023

Many essential oils are specific to a particular region. Essential oil producers and exporters should work out which essential oils can be produced in their location before they can develop a strong value proposition for the European market. Some plants used for essential oil production are grown in Europe, so suppliers in developing countries should also focus on niche essential oils that cannot be grown in Europe.

Tips:

- Read our study on Exporting essential oils for food to Europe. You can find more detailed information on trends, buyer requirements, competitors, and so on.

- Connect with sector associations specialised in flavours such as the European Flavour Association and the International Organization of the Flavor Industry. Check their members list to find potential partners and buyers. You can also find relevant information on markets and trends.

Natural food colours

Natural colours are a promising category within the European market. Due to increasing consumer preference and popularity of natural colour alternatives instead of artificial additives, the industry is constantly searching for raw materials and extracts that can meet performance, stability, and safety requirements. As such, demand for natural food colours in Europe is forecasted to grow steadily in the coming years.

Table 6: Examples of natural pigments with colouring properties allowed in Europe, listed by E-numbers:

|

E-number(s) |

Colour |

Natural Source |

Natural pigment |

Applications |

HS code |

|

E163 |

Red / Blue |

Black grapes, elderberries, cherries |

Anthocyanins |

Drinks, jams, and sugar confectionery |

320300 |

|

E162 |

Red / Pink |

Beetroot |

Beetroot, betanin |

Ice creams and yoghurt |

320300 |

|

E140 |

Green |

Parsley, spinach |

Chlorophylls |

Sugar confectionery and dairy products |

320300 |

|

E101 |

Yellow |

Eggs, milk, yeast |

Riboflavin |

Dairy products, cereals, and dessert mixes |

293623 |

|

E153 |

Black |

Carbonised vegetable material |

Carbon black |

Primarily in sugar confectionery |

280300 |

|

E120 |

Red |

Cochineal |

Carminic acid, carmines |

Alcoholic beverages and processed meat products |

3204 |

|

E160a to E160g |

Orange / Red / Yellow |

Carrots, oranges, prawns, red peppers, saffron, tomatoes |

Carotenoids |

Margarine, dairy products and soft drinks |

320419 |

|

E100 |

Orange |

Turmeric |

Curcumin |

Pickles, soups, confectionery |

091030 |

Source: ProFound with data of the Natural Food Colours Association, 2023

Food colours are dyes, pigments or substances that are added to foods to add, enhance, or restore colours. Natural colours are extracted and purified directly from nature. They can be obtained from a wide range of sources, mainly fruits, vegetables, spices, and algae, and can be found in many forms: liquid, powder, gel, and paste.

Food colours are key ingredients in dairy products, flavoured drinks, confectionery, cereals, plant-based meat, bakery products, among others. Some of these product categories are the major segments in Europe’s food and drink industry. For example, dairy products, drinks, and bakery products account together for over 39% of the industry’s total turnover. As they represent some of the leading product categories, they are assumed to always require large volumes of additives. This certainly creates opportunities to exporters of natural food colours.

The increasing use of natural colours in several leading food categories in Europe is driving imports of various plant-based alternatives. European imports of colouring matter of vegetable origin (HS code 320300) have increased consistently over recent years. Between 2018 and 2022, imports of colouring matter of vegetable origin to Europe grew on average 7.5% per year, amounting to €870 million in 2022.

Most imports of colouring matter are sourced from suppliers within Europe, while only 26% of imports come from developing countries. However, it is worth noting that the share of imports from developing countries increased steadily over the last 5 years (at an average annual rate of 4.4%) and is expected to increase further in the near future. The main developing countries exporting colouring matter of vegetable origin to Europe are China (59% of total developing country exports), Peru, Israel, and India.

Source: ITC Trade Map, 2023

Tips:

- Read our studies on Exporting natural food colours to Europe and Exporting turmeric to Europe for additional information.

- Visit the website of the Natural Food Colours Association (NATCOL) to stay up to date on regulatory changes and other relevant news items that might impact your business.

- European buyers prefer to work with suppliers that offer a constant supply of additives with consistent colour intensities, stability to light and heat exposure, no reactivity with other food components and no off-flavours or off-odours. Make sure you meet these requirements and provide full product documentation to your potential European buyers.

ProFound – Advisers in Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research