Which trends offer opportunities or pose threats on the European market for natural ingredients for cosmetics?

Exporters of cosmetic ingredients need to be aware of the dominant trends of sustainability, responsibility and what's 'natural', which demand positive impacts on both the environment and society. These trends are not temporary; they have changed expectations across the value chain, where traceability and transparency have become essential. Companies will be under increasing pressure to pursue ambitious goals in these areas, as failing to do so can pose a threat to their competitiveness and relevance in the market.

Contents of this page

- An increasing number of cosmetic companies are committing to UN Sustainable Development Goals

- Ethical sourcing becomes a key expectation in the cosmetic industry

- The European Green Deal will impact exporters of cosmetic ingredients to Europe

- Due diligence requirements may change business relationships between buyers and suppliers of cosmetic ingredients

- Intensified focus on safety and ingredient scrutiny in the EU could have implications for exporters

- Growing consumer interest in sustainable cosmetic products and natural ingredients

- Rise of biotech cosmetics in Europe could threaten demand for traditionally-sourced ingredients

- Consumers continue to show strong interest in wellness and health

- Consumers are embracing healthy aging as a key wellness trend

1. An increasing number of cosmetic companies are committing to UN Sustainable Development Goals

More and more companies are now making commitments aligned with the United Nations' 17 Sustainable Development Goals (SDGs). The SDGs provide a useful framework, with plenty of resources and guidance available, for companies to manage and report their steps to becoming sustainable. As a supplier in a developing country, it is recommended that you align your activities with the SDGs to back up your sustainability claims.

Companies want to show their efforts and initiatives in the areas of sustainability and social responsibility. All companies wanting to be sustainable need a framework that provides structure, measurability and accountability for their activities.

The SDG framework does not provide certification as such. Still, the United Nations offers guidance on actions that companies can take to support SDG implementation in their operations. The SDGs also complement other sustainability initiatives, such as the UN Global Compact and SEDEX. A downside of the SDGs is that companies can use them and refer to them without third-party substantiated data. Yet, buyers committed to responsible and sustainable sourcing will conduct their own verification.

Figure 1: The 17 UN Sustainable Development Goals

Source: United Nations, 2023

By developing activities based on the SDG framework, you can align your own actions with those of your customers. If you do not pursue any activities relating to social and environmental responsibility or do not substantiate what you claim to be doing, you risk being overlooked by potential buyers, especially those that have made such commitments.

An example of a cosmetic ingredient supplier using the SDGs as part of its sustainability framework is Fairoils (Kenya). This company aims to lift farmers out of poverty by creating a sustainable source of income without damaging the planet. As such, Fairoils guides its business according to the sustainable development goals, using them to make decisions about where to focus efforts and how to measure impact. On its website, Fairoils clearly describes which specific SDGs they are actively working towards, providing a mission and progress statement for each one. Currently, Fairoils' work is actively contributing to 16 of the 17 SDGs.

Tips:

- Review the SDGs and identify those that are most relevant to your operations and the natural ingredients you work with. This will help you to prioritise your efforts and create specific initiatives.

- Publish your targets and progress on your website or online media. This data backs up your claims and can be showcased to potential buyers to build trust and credibility.

- Use your sustainability actions as a Unique Selling Point (USP). Your USP is your differentiating factor, which helps attract a buyer's attention.

2. Ethical sourcing becomes a key expectation in the cosmetic industry

An ever-growing group of consumers now expects that the products they buy align with their values, such as sustainability, climate consciousness, social impact, and more. Consumers are demanding products that both deliver on performance and prioritise ethical practices. Ingredient transparency and product efficacy are becoming key factors in attracting customers, according to the Revieve’s Global Beauty Landscape 2024. In Europe, customers of all ages are placing more importance on ethical production and sustainability, with 50% of consumers preferring eco-friendly brands. There is a particularly high demand for products from brands that practice transparency in both their sourcing and manufacturing processes.

More brands are considering the ethical implications of their products to meet these expectations. For instance, several major cosmetics companies like L’Occitane, L’Oréal, Nuxe, and Groupe Clarins, among others, formed the Traceability alliance for sustainable cosmetics (TRASCE). This initiative aims to improve traceability in ingredient and packaging supply chains, assess social and environmental risks, and determine what action needs to be taken to help suppliers become more sustainable. Julien Garry, International Director of Purchasing and Packaging Innovation Development at CHANEL, notes that it can sometimes be difficult for a company to convince distant suppliers to commit to these ethical processes, especially when they do not share the same regulatory requirements. Therefore, supplier companies that offer transparency in buying can gain a competitive advantage, while those that fail to meet these standards risk losing market share.

Ethical sourcing is a key element of being a sustainable supplier. Merely using the SDGs framework as a guide is not enough, unless you can also prove that you are an ethical supplier. Fortunately, there are several low-cost tools and frameworks available to systemise your ethical commitments and activities. These include the UN Global Compact, SEDEX and Environment, Social, Governance (ESG). All are easy to implement, and European customers may expect you to use at least one of them.

These ethical frameworks focus on a narrower set of commitments than the SDGs. They arise from growing consumer expectations of fair labour practices, elimination of bribery and corruption, and concern for the environment. These expectations will continue to grow, putting pressure on companies in the cosmetics sector. Furthermore, these ethical frameworks are becoming law in the European Union.

SEDEX

SEDEX is a popular ethical auditing tool in the cosmetics industry. It aims to help companies develop business practices to address social and environmental risks in their supply chains. SEDEX is based on:

- the UN Guiding Principles for Business and Human Rights (UNGPs)

- the UN SDGs

- the Ethical Trading Initiative Base Code

- the International Labour Organization Conventions

The members of SEDEX are both buyers and suppliers. Suppliers complete a self-assessment questionnaire and the platform helps them prioritise areas that need action. Suppliers can share information about their business and make their ethical profile data available to buyers. They can also choose to have a third-party SMETA audit, based on the same questionnaire. Businesses can use SMETA to assess suppliers' working conditions across the areas of labour, health and safety, environment, and business ethics.

PT Mignon Sista International, based in Indonesia, supplies a wide range of essential oils and spices. This company has grown into a successful exporter that meets many international standards. However, they lacked a framework to prove their commitment to ethical and responsible business practices. To address this, they joined SEDEX in 2022. They have already been assessed and certified by the SEDEX membership organisation.

Figure 2: Certifications held by Mignon-Sista International

Source: PT Mignon Sista International

UN Global Compact

The UN Global Compact framework is a self-assessment process based on 10 principles and built around four pillars: human rights, labour, environment and anti-corruption. According to the UN Global Compact website, 'by incorporating the Ten Principles of the UN Global Compact into strategies, policies and procedures, […] companies are not only upholding their basic responsibilities to people and planet, but also setting the stage for long-term success'. To date, more than 26,000 businesses have joined the UN Global Compact.

To join the Global Compact you must:

- prepare a letter of commitment (LOC) addressed to the UN Secretary-General and signed by your company's highest-level executive, committing your company to the UN Global Compact's Ten Principles;

- take action to support the Sustainable Development Goals;

- submit an annual communication on progress (COP).

Environment, Social, Governance (ESG)

ESG is a general framework used to inform investors about the social and environmental impact of companies and their governance beyond revenue or profit generation. According to an article of the UK's National Development Bank and the Confederation of British Industry,two-thirds of investors now consider ESG factors when investing in a company. This means that following the ESG framework has the potential to grow your business while benefiting the environment and the community.

Looking to the future, European companies are likely to face stricter ethical sourcing requirements, not only from lawmakers but from consumers too. Consumers are increasingly demanding that companies prove a real commitment to ethical sourcing and biodiversity. Requirements may extend all the way down the supply chain to you as a supplier. You need to be prepared to meet this challenge and understand future European Union (EU) legislation on sustainable and responsible corporate conduct.

Tips:

- Develop a baseline for measuring your social and environmental commitments. Make sure you have easy-to-measure and easily verifiable targets.

- Keep clear records of your buying, production and labour practices to communicate with potential buyers and customers. This will show your commitment to ethical sourcing.

- Invest in local training and capacity building programmes to improve sustainable practices, while also promoting social impact stories to attract buyers.

3. The European Green Deal will impact exporters of cosmetic ingredients to Europe

European buyers face increasing pressure under EU legislation to ensure their supply chains are sustainable and transparent. The European Green Deal (EGD) is the most important emerging development to be aware of. This regulatory framework is expected to change and strengthen the requirements for cosmetic ingredients and products. The EGD will indirectly affect suppliers from developing countries doing business with European companies.

The EGD is the EU's new growth strategy. It is a package of measures focusing on climate, agriculture, energy, industry and the environment. The EGD aims to overcome threats of climate change and environmental degradation. It seeks to transform the EU into a modern, resource-efficient and competitive economy, based on:

- Net-zero greenhouse gas emissions by 2050

- Decoupling economic growth from resource use

- Leaving no person and no place behind

The EGD has many components that work together. While many focus only on the European continent, some involve global supply chains and will impact all stakeholders. A good example is the regulation on deforestation-free products and supply chains (EUDR), which came into force in June 2023. This legislation aims to ensure that a set of commodities no longer contribute to deforestation and forest degradation, both in the EU and in other parts of the world. As the EU is a major economy and consumer of these commodities, this measure will help to end, reduce and mitigate the EU's contribution to environmental degradation and biodiversity loss.

Under the new rules, all companies importing palm oil, cattle, soy, coffee, cocoa, timber, rubber, and their derivatives into the EU market will have to do strict due diligence on their supply chain. This will also affect the cosmetics industry, as soy, cocoa and palm oil are base materials in cosmetic products. Suppliers from developing countries working with these commodities will also be required to implement due diligence systems and take mitigating measures. Companies were originally expected to comply with the regulation by December 2024. However, the European Commission has proposed extending the deadline by 12 months for large and medium companies, and by 18 months for small ones in order to address concerns from various stakeholders and to give companies additional time to ensure proper and effective implementation.

Over time, EU demand for deforestation-free products is expected to grow beyond these commodities. Many leading companies may want to differentiate themselves by going beyond the minimum legal requirements and introducing similar due diligence for all raw materials used in their products. Some, such as Givaudan, have already started to do so. Givaudan's responsible sourcing policy requires that all products purchased be deforestation- and conversion-free. The company is also committed to creating transparent sourcing networks with traceability back to the origin of raw materials.

The implementation of regulatory compliance measures may affect exporters in developing countries. For example, Givaudan expects its direct suppliers to provide information on their own supply chains, back to the primary production level. It also requires suppliers to apply the standards described in its Responsible Sourcing Policy. This way, to meet higher sustainability standards and expectations suppliers will have to provide more information about the products they export to Europe. Although this will increase costs in the short term, it will ultimately make them more competitive in a sustainable global market.

Tips:

- Read the CBI study on how the EU Green Deal will impact your business.

- Consider obtaining a certification system providing guarantees that commodities are deforestation-free, like Rainforest Alliance's Sustainable Agriculture Standard and UEBT Ethical BioTrade standard.

- Read our study on buyer requirements for detailed information on current and future EU legislation that applies to natural ingredients for cosmetics.

4. Due diligence requirements may change business relationships between buyers and suppliers of cosmetic ingredients

The Directive on Corporate Sustainability Due Diligence (CSDDD) is another important development in EU legislation. It entered into force in mid-July 2024 and aims to contribute to the EU’s goals of creating a climate-neutral and sustainable economy and supporting the United Nations Sustainable Development Goals (SDGs).

The CSDDD seeks to promote sustainable and responsible business behaviour to achieve a positive impact on human rights and the environment. It sets out rules for companies in relation to adverse impacts on human rights and the environment in their own operations and those of their subsidiaries, and in their value chains. It also regulates the liability of companies in case of non-compliance. Requirements for companies include:

- integrate due diligence into their policies

- identify, prevent, mitigate and remedy actual or potential adverse impacts

- establish a complaints procedure

- track the effectiveness of their due diligence policy

- communicate publicly on due diligence

The legislation applies to large EU companies with a total turnover of >€450 million and 1000+ employees. Third-country companies will also be affected by this measure. It is estimated that the Directive will apply to about 900 non-EU companies active in the EU with turnover thresholds comparable to those of EU companies.

Under the CSDDD, corporate due diligence must cover the entire supply chain, meaning that European companies now need assurances from their suppliers that they are complying with these due diligence policies. To this end, European companies will need contractual assurances from their business partners that they also comply with the company's due diligence policy. In some cases, they will also need a preventive action plan from their business partners. European companies can rely on suitable industry initiatives or independent third-party verification to ensure policy compliance. One upside for SMEs is that European companies must bear the cost of verification. Also, when a contract is concluded with an SME, the terms used must be fair, reasonable and non-discriminatory.

For exporters, this means implementing policies and practices to identify, prevent, and address human rights violations and environmental risks in their operations. The same will apply to your suppliers. Cultivator Natural Products, an Indian exporter of several herbs, botanicals, and vegetable oils, integrates due diligence into its business by prioritising sustainability in all its operations. The company uses organic farming practices to prevent and reduce negative environmental and social impacts, protecting biodiversity and supporting local farming communities. Additionally, the company shows their commitment to transparency and responsibility by publishing annual sustainability and impact reports, which are available on their website. These reports showcase their initiatives and achievements in sustainability, aligning with international due diligence standards and demonstrating their dedication to ethical and sustainable trade. The Directive requires European companies to refrain from starting new relationships or extending existing relationships with partners whose operations fail to prevent or minimise potential or existing adverse impacts. Looking to the future, it is advisable to start developing due diligence measures as this will prepare you to improve your relationships with business partners, your value proposition and your long-term business success.

Tips:

- Review the responsible sourcing policies of large companies like Firmenich and Givaudan, which are already following due diligence policies.

- Focus on continuous improvements in areas such as fair labour, environmental protection, and supply chain transparency. These investments will enhance your credibility and strengthen your buyer relationships, leading to more business opportunities.

- Check if buyers have a supplier code of conduct and evaluate how well your business practices align with these requirements. Be prepared to demonstrate compliance through documentation, audits, or reports.

5. Intensified focus on safety and ingredient scrutiny in the EU could have implications for exporters

The EU is already the most stringent cosmetics market in terms of requirements and regulations. These are becoming even tougher with a new focus on safety and ‘essentiality’. This means that ingredients are checked to see if they are necessary or can be replaced with safer or more sustainable options. Additional and more stringent requirements and regulations can affect how cosmetic products are made and labelled, affecting the demand for some natural ingredients for cosmetics, particularly for essential oils.

Regulation 2023/1545 regarding the labelling of fragrance allergens in cosmetic products was introduced by the European Commission in July 2023 with the aim of improving consumer safety. This regulation adds 56 new allergens to the existing list of substances that must be labelled in cosmetic products. Popular ingredients like menthol, Ylang Ylang flower oil, lemongrass oil, rosa canina flower oil, and lavandula oil are now included. The regulation stipulates that if these ingredients are present in high enough amounts, their names must be shown on product labels. Cosmetics manufacturers have three years to follow these new rules either by updating their labelling or changing their product formulas.

This new regulation gives consumers better information about what is in their cosmetics. However, it is important to note that just because an ingredient is labelled as an allergen does not mean it is dangerous or toxic. Many ingredients labelled as ‘allergens’ are perfectly safe for many people and are important to make cosmetics smell and feel good.

Another significant challenge is the European Chemicals Agency (ECHA) classification of tea tree oil as a Category 1B reproductive toxin under the Globally Harmonised System (GHS) of hazard identification. This decision followed a standard European safety review of a plant fungicide that uses tea tree oil as its active component. The classification raises concerns because it is based on a hazard-based approach—focusing only on the potential for harm—rather than a risk-based approach, which considers the actual likelihood of a hazard causing harm. Many industry stakeholders are actively defending tea tree oil as a safe cosmetic ingredient, emphasising its long history of use in personal care products. They point out that hazard assessments alone do not reflect the true safety of natural substances, especially when they are used in controlled concentrations.

Exporters of essential oils and vegetable oils to the EU will face new challenges due to this intensified scrutiny. Ingredients that are now seen as risky, like tea tree oil, may be in less demand. This is because consumers and companies may avoid ingredients that are labelled as allergens or toxins. As an exporter, you should consider offering a wider range of products to reduce the risk of losing business. You may also need to update safety data sheets (SDS) and other technical documents to meet EU requirements. Providing clear and complete safety information is now more important than ever.

Tips:

- Read Cosmetics Europe’s guidelines to better understand the requirements for fragrance allergens and use them to align your documentation and ingredients with EU manufacturers’ compliance needs.

- Work with local or international testing laboratories to ensure your ingredients meet EU requirements. Highlight your products’ compliance and traceability in your marketing efforts to appeal to buyers.

- Expand your portfolio with low-risk, high-demand ingredients. Focus on ingredients with versatile applications in cosmetics, such as cold-pressed vegetable oils or botanical extracts.

6. Growing consumer interest in sustainable cosmetic products and natural ingredients

Consumer buying trends are shifting towards more sustainable cosmetic products. These products are generally not harmful to the environment and often have a higher content of natural ingredients. As a supplier of natural ingredients for cosmetics, you should highlight your environmental efforts at both the company level and the ingredient supply chain level.

Due to consumer interest in environmental and social issues, natural ingredients are becoming a desirable component of cosmetics. People are becoming more conscious about the impact of the products they use. This has led to a shift towards plant-based, organic, and sustainably-sourced ingredients, as consumers seek out products that align with their values of health, safety, and environmental responsibility. Natural ingredients are perceived as safer and healthier than synthetic substitutes. They are also perceived to have a low environmental impact and potentially a high social impact. Affordability is the main barrier to consumers buying a green alternative. Yet, the number of online products with sustainability claims rose by one million between 2022 and 2024, reflecting a broader shift in consumer preferences. Retail sales of products with sustainability claims also grew significantly between 2020 and 2023. In the beauty and personal care sector, these products generated over USD 120 billion in revenue in 2023, making it the leading industry by sales.

This growing interest in natural ingredients is closely linked to the clean beauty trend, which has gained significant momentum over the past few years. Clean beauty focuses on using products that are free from harmful chemicals, environmentally friendly, and sustainable. At the same time, it promotes transparency in buying and manufacturing processes, prioritises eco-friendly packaging, and minimises unnecessary waste. Clean beauty products are based on natural or organic ingredients, such as plant-derived extracts, oils, and actives, which are valued for their nourishing and skin-friendly properties. Millennials and Gen Z are the main consumer demographics driving the trend, showing more interest in organic and natural beauty products than the average consumer.

The demand for natural and organic cosmetics is rising sharply, driven by the perception that natural ingredients are safer and healthier than synthetic alternatives. In fact, searches for "natural ingredients makeup" surged by 180% in 2021. According to the Revieve Global Beauty Landscape 2024, there is a 93% engagement rate in eco-friendly product categories, reflecting strong European consumer alignment with environmental values. Popular ingredients like aloe vera, rosehip oil, green tea, and shea butter are in high demand due to their gentle properties and ability to address common skin concerns such as sensitivity and dryness. Additionally, ingredients like moringa seed oil and baobab from Africa are gaining popularity not only for their cosmetic benefits but also for their cultural significance, especially in body care products.

Another key aspect of this trend is the rise of upcycled ingredients. These are ingredients that are repurposed from waste materials, adding another layer of sustainability to the cosmetics industry. For example, pomegranate peels, seaweed, and spent coffee grounds are being used to create high-performance cosmetic products. These upcycled ingredients help reduce waste and support a circular economy, which appeals to environmentally-conscious consumers who are looking for innovative and sustainable solutions.

The growing demand for natural ingredients presents significant opportunities for suppliers across the whole value chain, from raw material producers to cosmetics manufacturers. Companies throughout the European supply chain are investing in developing environmental and social credentials to meet changing consumer demands and increase their visibility. As a supplier of natural ingredients, you should take similar steps in your own operations. Failure to act is a threat to your business. Looking to the future, you can expect consumer preference for sustainable products to continue growing. This will enhance the need to prove positive social and environmental impacts in raw material supply chains.

Adopting voluntary standards and certifications might be useful to demonstrate your commitment to ethical sourcing and sustainability. There is a wide range of certifications and standards to choose from, covering ethical sourcing, fair trade, natural and organic. All these standards fit under the broad umbrella of sustainability. Natural, organic and fair trade are more relevant for niche markets, according to industry experts. However, social and environmental responsibility in supply chains can no longer be considered optional.

Private certification bodies for suppliers of natural, organic, fair and ethical ingredients for use in cosmetics include:

- Union for Ethical BioTrade (UEBT) certification label – awarded to companies that meet the criteria of the UEBT standard for respectful sourcing. These companies are committed to ethical sourcing of ingredients from biodiversity and to treating people and biodiversity with respect. The UEBT standard is based on the Convention on Biological Diversity to conserve and sustainably use biodiversity plus ensure fair benefit-sharing.

- Fair for Life certification – guarantees that human rights are safeguarded at all stages of production. Workers are assured good and fair working conditions and smallholder farmers receive a fair share. Fair for Life is improving the livelihoods of thousands of smallholder farmers and workers.

- NATRUE – a certification scheme for natural and organic cosmetics and ingredients. Besides final product certification, there are two categories for raw materials: Approved Raw Materials and Certified Raw Materials. The difference is that 'approved' raw materials are not organically certified but only have their documentation checked by NATRUE. 'Certified' raw materials are in fact organically certified, and this certification must be verified. Both categories also meet other NATRUE criteria. Their product database is a useful source for finding companies that may be potential customers or competitors.

- COSMOS – a certification scheme for natural and organic cosmetics. Their product database provides information about companies that offer COSMOS-certified and COSMOS-approved raw materials. These companies may be potential customers or your competitors.

- ISO16128 – a self-assessment scheme for natural and organic cosmetic ingredients and cosmetic products, developed by ISO. The aim of ISO16128 is to aid ingredient selection for formulations. The standard is not a certification but a set of guidelines on definitions for natural and organic cosmetic ingredients. It provides a framework to determine the natural content of ingredients and formulations, increasing transparency for both manufacturers and consumers.

Tips:

- Communicate honestly about your progress rather than trying to hide any poor performance. Take responsibility for areas that still need improvement and be open about addressing outstanding issues.

- Consider obtaining one of the certifications for natural ingredients described here. However, be aware that applying for organic certification is not interesting for every producer. Only SMEs in developing countries that can afford the certification, conversion and administrative costs should get certified.

- Check our study on the current offer in social certifications to learn more about Fair for Life and UEBT standards.

7. Rise of biotech cosmetics in Europe could threaten demand for traditionally-sourced ingredients

The European cosmetics industry is experiencing a significant shift with the rise of biotechnology in ingredient production. Biotech ingredients, grown in laboratories, are often promoted as safer, more sustainable, and more efficient alternatives to traditionally-sourced natural ingredients. This trend is reshaping the market, offering new opportunities for innovation but also posing challenges for suppliers of traditional natural ingredients.

Biotechnology allows scientists to create or improve natural compounds in controlled environments, ensuring that ingredients are pure, consistent, and renewable. This eliminates the need for extraction from nature, reducing environmental impact while maintaining high performance. The ability to produce high-quality, lab-grown ingredients is increasingly attractive for manufacturers as it ensures a reliable, sustainable supply chain that is not subject to environmental fluctuations or seasonal limitations in a context of increasing pressure on diminishing amounts of available land and water, while the number of people growing products is declining due to migration to the cities and other countries. Large cosmetics companies, such as L’Oréal, Provital, and dsm-firmenich, are already working with biotech companies to develop bio-based ingredients for skincare, haircare, and even fragrances.

Another major reason for the shift toward biotech ingredients is their potential to support sustainability goals, particularly by reducing carbon emissions. As companies and governments strive to meet the net-zero target, which aims to balance the greenhouse gases added to and removed from the atmosphere, biotechnology is seen as a key tool. In Europe, net zero is a priority not only for political reasons but also due to increasing consumer demand for environmentally-friendly products. Biotech ingredients, produced in local labs, can significantly reduce the distances that ingredients travel, helping to minimise CO2 emissions. This aligns with the "0km" movement, where companies are developing more local sources and producing more using biotechnology. While the 0km movement works for ingredients that can be grown locally, it will not work for those that can only be grown further away.

The rise of biotech cosmetics poses a significant threat to exporters of traditionally-sourced natural ingredients. As more cosmetics brands turn to lab-grown alternatives, there is a risk that demand for natural ingredients will decline. This could have a negative impact on the livelihoods of farmers and producers in developing countries who rely on exporting these natural products.

However, natural ingredients still hold unique advantages that biotech cannot replicate. To compete with the growing popularity of biotech ingredients, you must emphasise the broader benefits of your products. One key advantage of natural ingredients is that harvesting them supports local communities and helps preserve traditional knowledge and biodiversity. Showing your positive social impact by supporting rural economies and ensuring fair wages and worker protection will strengthen your market position.

In addition, you should be looking at ways to improve environmental and social performance. Job creation, fair wages and protection of workers' rights are key requirements of European buyers. In the longer term, pressures to improve environmental performance will strengthen the business case for alternative technologies and local sourcing. Social benefits will not be enough of an argument for using long-distance supply chains.

Exporting companies are advised to reassess their strategy and have a more carbon-neutral plan. Companies that embrace net zero can improve their reputation, reduce waste costs, protect their business from over-dependence on fossil fuel-based energy supplies and increase their resilience.

A good example of a company implementing sustainable practices and applying technological developments in their business is PT Mitra Ayu Adipratama. This Indonesian company believes that environmental sustainability is crucial to doing responsible and successful business. They are making several efforts to reduce, recycle and reuse natural resources. PT Mitra Ayu Adipratama recycles most of the solvents used in its processing and turns its waste into a briquette to be used as fuel. As it takes a lot of energy to produce briquettes, the company is trying to use palm shells for fuel to save on electricity.

Tips:

- Visit EuropaBio, Europe’s largest biotech industry group, to learn more about biotechnology and stay informed about advancements in biotech in cosmetics and other sectors.

- Find out how to measure your carbon footprint and adopt some of these environmental practices to achieve net zero emissions.

- Partner with universities and other research organisations to develop and use technologies that will help you achieve net-zero greenhouse gas emissions.

- Create storytelling campaigns that emphasise the origin, natural growth environment, and traditional methods used to harvest your ingredients. This can appeal to consumers looking for authentic, nature-connected products.

8. Consumers continue to show strong interest in wellness and health

The wellness and health trend in the European cosmetics market is no longer just a passing phase; it has become a permanent force shaping the industry's future. Consumers have shifted their focus towards holistic well-being, where beauty is linked not only to physical appearance but also to health and environmental responsibility. This trend is now fully integrated into the daily choices of consumers and is expected to continue driving the evolution of the beauty industry.

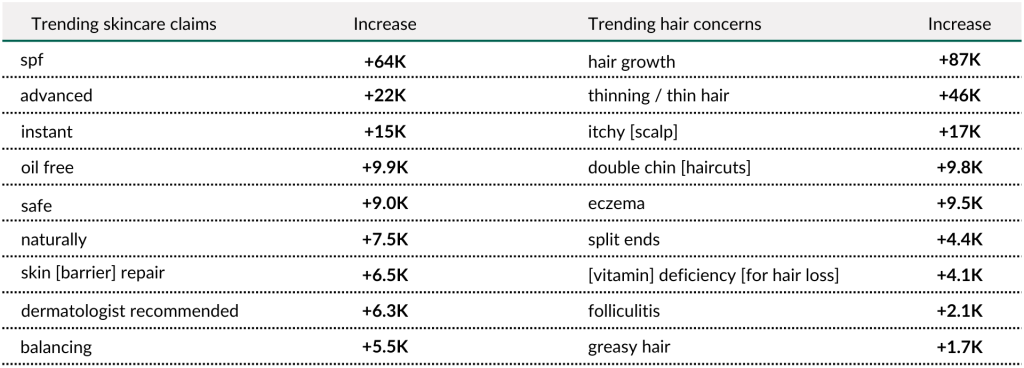

Today, beauty is defined by health and well-being. Consumers are no longer just looking for products that enhance their appearance but are seeking solutions that promote long-term health benefits for both the body and the mind. This is clearly reflected in the most sought-after skin and hair care benefits or features. Between 2022 and 2023, claims such as safe, naturally, skin [barrier] repair, dermatologist-recommended, and balancing were trending, demonstrating consumers’ desire for safe skincare that supports skin health. Over the same period, there was a growing concern about hair loss. There was a significant increase in searches for products to address hair growth, thinning hair, itchy [scalp] and eczema, and this was a sign of consumer interest in hair and scalp health.

Figure 3: Growth in the average search volumes across skincare and hair between 2022 and 2023

Source: Spate Predicted Beauty Trends Report, 2024

The pandemic only reinforced the importance of well-being, as many people became more conscious of their vulnerability and sought products that could support both their physical and emotional health. The blending of beauty and wellness is now the norm. Euromonitor identifies wellness as one of the top-10 trends shaping consumer behaviour, attitudes and choices in the long term. The boundaries between beauty and wellness are expected to continue blurring in the coming years. In fact, the wellness sector is forecasted to grow at an average rate of 10% per year until 2027.

In response to this relevant trend, companies are merging their traditional portfolios with new health needs. Evonik's BeautiFerm range is a recent example of this trend. Evonik is using fermented active ingredients to meet increased consumer demand for natural, safe and efficient ingredients. Fermented skincare helps balance skin microbiota and strengthens the skin's protective barrier. This is important for holistic-minded consumers.

The wellness trend also includes an emphasis on the demand for eco-friendly, natural, and sustainable ingredients that align with the values of holistic consumers. Environmental awareness has become a key factor as consumers are increasingly concerned about the impact of the products they use on the planet. Suppliers in developing countries should start building on this trend to create business opportunities for themselves. This trend will represent an untapped opportunity for:

- cosmetics with natural and organic ingredients

- suppliers offering eco-friendly and sustainably sourced ingredients

- ingredients derived from waste or by-products of other industries

- cosmetic ingredients that are successfully associated with health and wellness and

- suppliers offering full transparency and traceability

Tips:

- Promote your products as solutions that contribute to both physical and mental well-being to align with consumer preferences.

- Attend trade fairs, participate in virtual B2B platforms, and leverage online networks to connect directly with potential buyers.

- Focus on niche markets within the wellness and health trend, such as vegan or organic. Develop marketing materials that highlight how your ingredients meet the specific needs of these markets.

9. Consumers are embracing healthy aging as a key wellness trend

The beauty industry is experiencing a revival of mature skin concerns. The trend of healthy aging in the European cosmetics market is now a key factor shaping product development and consumer preferences. Rather than trying to reverse aging, consumers are focusing on aging gracefully by taking preventive measures that promote long-term skin health. This shift reflects a broader, wellness-centric approach to beauty, where the goal is to maintain healthy, hydrated, and firm skin throughout the aging process.

According to Revieve’s Global Beauty Landscape 2024, moisturisers and serums with calming ingredients such as chamomile and aloe vera have become especially popular in Europe. These products are not only designed to hydrate but also to protect and soothe sensitive skin, which is a common concern among aging consumers. The demand for gentle, protective skincare reflects the European preference for products that offer rejuvenation and hydration without heavy textures, aligning with the growing desire for light, non-invasive treatments.

Consumers are becoming more informed and proactive about their skincare choices. With access to a wealth of scientific information, they are now embracing products that take a preventive approach to aging. There is a growing interest in products that not only address visible signs of aging but also support skin from the inside out. Ingredients that nourish and strengthen the skin’s natural barrier are highly sought after. According to Spate’s 2024 Beauty Trends report, searches for skin barrier and mature skin grew by 23% and 18% respectively between 2023 and 2024. In the coming years, the emphasis on healthy aging is expected to remain strong, shaping how both consumers and brands approach beauty.

The healthy-aging trend in Europe presents significant opportunities for exporters of natural ingredients from developing countries. As consumers increasingly seek preventive skincare solutions, ingredients that promote hydration, firmness, and skin protection are in high demand. Exporters can benefit by offering natural ingredients that align with this focus on skin health and wellness. For example, shea butter is rich in vitamins and fatty acids that help nourish and restore the skin's elasticity, making it perfect for firming and moisturising products. Also, baobab oil is known for its antioxidant properties which can help prevent signs of aging by protecting the skin from environmental damage. By positioning yourself as a supplier of these natural, health-promoting ingredients, you may tap into the growing demand for high-quality ingredients that support the healthy aging trend.

Afrinatural is a good example of a successful exporter that explicitly markets the benefits of baobab oil for mature skin. This South African company sells botanical extracts, essential oils, pressed oils and butters to customers in the EU and other parts of the world. On its website, Afrinatural has a special section on baobab seed oil, including detailed information on its properties, all supported by industry references and studies. According to the company, baobab seed oil can restore and rehydrate the skin, as well as improve its elasticity. It can also help increase calcium absorption and lower blood pressure in the elderly because it is a natural source of vitamin D. In addition, Afrinatural explains that vitamins A and F in the oil help to rejuvenate and renew cell membranes, while vitamin E is a powerful antioxidant with anti-aging effects.

Tips:

- Provide scientific evidence or case studies showing the effectiveness of your ingredients in anti-aging formulations to make them more attractive to European buyers.

- Share the unique story of your ingredients, such as how shea butter is sustainably bought from women’s cooperatives in West Africa or how baobab oil is harvested from ancient trees in a biodiversity-rich area. This helps distinguish your products in the competitive beauty market.

ProFound – Advisers In Development and Fair Venture Consulting carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research