Which trends offer opportunities or pose threats on the European natural ingredients for health products market?

The trends in the European natural ingredients market for health products present both opportunities and challenges. The growing interest in alternative medicine and natural remedies is boosting demand for new and innovative ingredients. At the same time, the popularisation of botanicals in herbal infusions is also boosting demand. However, botanicals are increasingly scrutinised and there are rising concerns about fraud and adulteration that pose threats. Simultaneously, the industry’s commitment to ethical sourcing and transparency is reshaping supply chains. It requires exporters to adapt by implementing stricter traceability systems, investing in long-term relationships with the clients they supply to, and ensuring compliance with sustainability standards.

Contents of this page

- Sector transformation

- Growing attention to alternative medicine and natural remedies

- Demand for natural health products grows and provides opportunities for new ingredients

- Increased scrutiny of botanicals in the European market

- Fraud and adulteration are growing concerns in the health-product sector

- European industry continues to invest in innovation

- The popularisation of botanicals in herbal infusions

- Growth of private label in food supplements and herbal infusions

- Growing importance of ethical and sustainable sourcing for natural ingredients

- Increased need for traceability and transparency within supply chains

1. Sector transformation

The trends described in the study illustrate the transformations the natural ingredients for health product sector will undergo in the coming years. In the next decade, the European market is expected to change in the following ways:

- Due to the ageing European population there will be a greater demand for health products addressing chronic conditions. The categories of immunity-boosting, digestive health, and stress and anxiety products, which are already experiencing growth in the current demographic and market conditions, are likely to continue growing.

- European consumers will be more and more aware of the negative side effects of synthetic pharmaceuticals products to their long-term health, driving growth in alternative natural remedies and resulting in greater demand for natural ingredients. However, it is important to consider that pharmaceutical product development focuses on greater efficacy and fewer side effects, creating a threat to natural health products.

- European companies will invest more heavily in traceability systems and requirements, and will require more sophisticated information at the production and manufacturing levels of producing countries. The increasing adoption of artificial intelligence in traceability systems is something to look out for European companies face stricter regulations on sustainability obligations, which will also increase the need for data and other evidence on social and environmental impact in countries of origin, resulting in the wider adoption of sustainability standards and requirements.

European authorities will have stricter systems and procedures to assess the safety and efficacy of botanicals used in health products. Current developments indicate that botanicals are subjected to greater scrutiny when it comes to their safety profile and possible impact on consumer health. Given the growing emphasis on consumer protection and consumer information, it is likely that there will be greater control on efficacy claims especially in relation to the food supplements industry.

2. Growing attention to alternative medicine and natural remedies

European consumers are increasingly concerned about the potential side effects of pharmaceutical drugs or regular medication. Many consumers are turning to alternative medicines, such as homeopathy, natural remedies and supplements. There is a growing awareness of the benefits of natural remedies in Europe. In 2023, the European herbal supplement market was valued at USD 7.5 billion (about €6.8 billion), and is expected to grow at an average annual rate of 5.2% between 2024 and 2030.

Some professionals and practitioners in the field of healthcare and medicine have also been promoting the benefits of alternative medicine, especially to patients suffering from chronic health conditions. Europe is the largest global market for complementary and alternative medicine (CAM). In 2023 it had an estimated value of USD 49.2 billion (about €44.5 billion). The global CAM market is expected to grow at an annual rate of 25% between 2024 and 2030.

The increasing attention for and interest in alternative medicine and natural remedies is an important driver for the natural ingredients market in health products. As consumers seek more natural approaches to improving their health and staying healthy, companies are responding by incorporating these ingredients into their product range. This rising demand influences key trends in the industry, such as the shift toward increased scrutiny of ingredients, a growing range of private-label products, a focus on sustainability, and the search for new ingredients and natural health solutions.

Tips:

- Explore our study on the demand for natural ingredients in health products within the European market to gain more in-depth insights into key drivers of growth.

- Visit the website of Food Supplements Europe for more information on the European food supplementation market and specific consumer data. This website also provides an overview of national member associations and member companies in Europe.

- Visit the website of the European Herbal & Traditional Medicine Practitioners Association (EHTPA) to follow market developments, sector discussions and regulatory developments in Europe related to traditional medicine.

- Do your own research into the European market for health products to find opportunities for your specific botanical. Check online magazines such as Nutraceuticals World, Nutra Ingredients or Vitafoods Insights.

- For more information on research into the health benefits of your specific ingredient and to access scientific resources, visit Examine.

3. Demand for natural health products grows and provides opportunities for new ingredients

The growth in the demand for different health products has created scope for botanical ingredients of interest to emerging market exporters. This is particularly the case within the food supplement sector.

Europe is a growing market for several health product categories. For instance:

- Immunity-boosting health products: The European market for immune-boosting health supplements was valued at USD 15.0 billion in 2024 (around €13.6 billion), and is expected to grow by 6.2% annually between 2024 and 2029. Germany, France, the United Kingdom (UK), Italy, Spain and the Netherlands are the European countries with the most opportunities for exporters of immune-boosting botanicals in emerging market economies. These European countries have a strong natural health product industry and a growing demand for immune-boosting supplements, and they play an important role in the imports of botanicals.

- Digestive health products: The European market was estimated at USD 14.1 billion in 2023 (around €13.0 billion), and expected to grow at an annual rate of 7.3% from 2024 to 2030. Germany, Italy, France, the UK, Spain and the Netherlands are the leading markets for natural ingredient exporters targeting digestive health. These countries have significant numbers of citizens with digestive disorders and have herbal medicine and food supplement markets that promote sales of digestive health products.

- Stress and anxiety products: The global market for these products was valued at USD 530 million in 2023, and expected to grow at an average annual rate of 6.8% between 2024 and 2032. The European market for stress relief supplements holds the second-largest market share globally after North America. Germany, France, the UK, Spain, Italy and Poland are the leading European markets for natural-ingredient exporters targeting stress and anxiety products. These countries are the top importers of medicinal and aromatic plants in the region, have strong manufacturing industries and large consumer markets.

Despite the opportunities, exporters still face difficulties in consolidating their position in the European market compared to more established ingredients such as fennel and peppermint (typically used in the digestive health segment). Achieving consumer recognition can be a long process.

An example of an ingredient that has secured its place in the market is baobab (Adansonia digitata). This fruit is harvested from the ancient Baobab tree native to Madagascar, mainland Africa and Australia. Baobab was approved by the Novel Food Regulation in 2008, and is nowadays commonly marketed within the European food supplement market as an ingredient that improves digestion, increases energy levels and supports the immune system and general health.

Despite overcoming a regulatory hurdle in Europe, baobab markets outside Africa remain underdeveloped. International consumers still need to be educated on its benefits and become familiar with its taste. For example, a 2018 survey of UK consumers showed that only 23% of consumers had heard of Baobab, of whom just 26% had actually tasted it. Baobab is still relatively unknown in Europe amongst consumers in 2024, but product launches with baobab have been rising slowly but steadily over the past decade. Brands such as Aduna (UK), Matahi (France) and Baola (Germany) continue to support and promote the product, and remain an important link between exporters and consumers.

Another example of a new ingredient being used on the market is the spice Aframomum melegueta. This spice is of West African origin, also known as Grains of Paradise. Nektium formulated a botanical extract of this spice: Vanizem, marketed for stress and mood support. Nektium is a Spain-based nutraceutical company that combines ethnobotanical knowledge, science and market insights to create innovative plant-based products.

Figure 1: Baobab products on the European market

Source: Terra Elements, Aduna and Health Essentials Direct, 2023

Tips:

- Consult the CBI study on exporting immune-boosting botanicals to Europe for more information on this market and how to access it. Consult our studies on digestive health and stress & anxiety health products to learn more about those market segments.

- Promote your products and educate both consumers and buyers on their scientifically-proven health benefits as well as their positive social and ecological benefits. Take a look at the website of the company B’Ayoba (Zimbabwe) for an example of simple and effective communication on both technical and impact data in regard to their baobab products.

- Find out about the local practices in your country in relation to botanicals supporting specific health goals. Traditional uses can be a good starting point when choosing new ingredients. For new ingredients, check if there is a history of medicinal use of at least 30 years. 15 years of these years need to be in the EU. If you cannot find a history of safe use, find out if you can access the food supplement part of the market with your ingredient.

4. Increased scrutiny of botanicals in the European market

Botanical ingredients are constantly under scrutiny by European authorities due to their potential risk to consumers, restricting supply and product development opportunities. In mid-2024, experts from 26 national food safety agencies in the EU published a report on substances that should not be used or used to a limited extent in food supplements.

Amongst the 13 substances shortlisted as posing a risk to human health are a few commonly used in food supplements. These include St. John’s wort, holy basil (tulsi), cinnamon, turmeric and black pepper. This opens up the possibility for the EU to take steps to prohibit or restrict their use in the future, according to Article 8 of Regulation No. 1925/2006. Annex III in this article lists the current substances whose use in foods is prohibited, restricted or under scrutiny.

In addition to these substances, the popular ingredient ashwagandha has been under scrutiny in Europe. There have been concerns about the safety and history of the use of ashwagandha in food supplements in the European market. According to a 2020 evaluation by the Danish Technical University, Ashwagandha can have a negative hormonal effect on reproduction in both animals and humans. In addition, other studies indicate other negative side effects, such as stomach upset, liver damage and very low blood sugar levels.

As a result, in 2023, Denmark prohibited the use of ashwagandha in food supplements in the country. Other Nordic countries, such as Finland and Sweden, are also considering whether to prohibit the use of ashwagandha or not. France has also warned against the use of ashwagandha by specific demographics, such as pregnant women and people under the age of 18. This is likely going to mean that operators in France have to start using new label warnings on food supplements containing ashwagandha. The Netherlands also advised against the use of the ingredients. In Poland, maximum levels for the daily intake of ashwagandha have been established. The UK has put ashwagandha on its Risk Analysis Tracker in order to identify and assess potential risks.

Despite these warnings from national authorities, several experts have disproved these statements and question the studies conducted in terms of how they reached these conclusions. One of the concerns is that although the roots of ashwagandha are traditionally used, some manufacturers are incorporating aerial parts of the plant to boost yield and profitability. This practice could introduce toxicity to ashwagandha products. The ashwagandha industry is actively defending the safety of standardised ashwagandha root extracts after Denmark’s risk assessment that may have failed to differentiate between ashwagandha roots and leaves.

What these examples show is that food safety is a key issue in the European market, leading to constant food safety assessments. It shows the importance for exporters to have complete technical information. The technical dossier provides detailed information about your ingredient, which will help regulators evaluate its safety and suitability for use in food supplements. It will also serve to show buyers that your product complies with EU requirements and that it is safe for consumption and of consistent and high quality. Have a look at the website of KSM-66 (India) to see how they ensure quality control for their buyers and how they communicate it.

The increased scrutiny described in this section is not only a threat; it may provide opportunities and room for other botanicals with similar health benefits and established use in the European market. For example, in the category of digestive health, some established ingredients that could conquer more market space are fennel, peppermint and ginger.

Tips:

- Stay informed on regulatory changes in the European Union. You can do so, for instance, by following the food supplement page of the European Food Safety Agency and the food supplement page of the European Commission.

- Search the EU’s Rapid Alert System for Food and Feed (RASFF) database for examples of withdrawals from the market and the reasons for these withdrawals. These are related to ingredients used in the food and food supplements industry.

- Make sure you have a complete technical dossier on your product that you can present to potential buyers.

5. Fraud and adulteration are growing concerns in the health-product sector

European buyers of natural ingredients for health products are constantly faced with lack of quality and safety control measures in the country of origin. In addition to heavy metal contamination, adulteration is a major issue that presents serious health risks for consumers of health products. The protection of consumers from misleading and potentially unsafe products has been a high priority on the European agenda for many years.

A study by the nonprofit ABC-AHP-NCNPR Botanical Adulterants Prevention Program (BAPP) that covered the North American, European and other international markets, reported on the adulteration rates for five botanicals used in health products: black cohosh (Actaea racemosa) rhizome, echinacea (Echinacea angustifolia, E. pallida and E. purpurea) herb and/or root, elder (Sambucus nigra) berry, ginkgo (Ginkgo biloba) leaf and turmeric (Curcuma longa) rhizome. The ingredient with the highest adulteration rate was ginkgo leaf extract, followed by powdered plant materials or extracts of black cohosh root/rhizome, echinacea root/herb, elderberry and turmeric rhizome. It is important to note that products sold as licensed or registered herbal medicines have not been adulterated; the issue is focused on food supplements.

In response to growing authenticity and purity issues in the sector, many laboratories around Europe, such as Eurofins Genomics, have increased testing to uncover fraud in botanicals production. Common methods include DNA analysis, isotopic techniques, mass spectrometry, spectroscopy, chemometrics and a combination of detection methods. Buyers are also increasingly demanding that exporters have (certified) quality and food safety management systems in place, in addition to improved traceability systems.

Tips:

- Refer to existing guidelines and other publications that can help you address the blind spots in your supply chain. For example, the Guidance on Authenticity of Herbs and Spices, published by BRCGS, the UK Food and Drink Federation and the Seasoning and Spice Association, brings a collection of good practices to target adulteration issues. The guide describes diagnostic, preventive, detection and verification measures that suppliers can implement at different steps in the chain.

- Review digital technologies that can also offer you solutions to authenticity issues. Read our study on blockchain technology for agricultural ingredients to learn more about traceability systems and platforms that can help you map out all steps and actors in the chain, creating transparency and ensuring trust.

- Create trust-based and transparent relationships with buyers. This includes clear and fast communication, the fulfilment of promises and an effective response to non-compliance situations. Sending representative samples, which match the product variety and quality that you can supply, is also extremely important to prove that you are a reliable supplier. In CBI’s study on doing business in the European market for natural ingredients for health products, you can find some more tips that can help you build long-term relations with buyers.

6. European industry continues to invest in innovation

Increasing investments in innovation and Research & Development (R&D) make Europe an interesting market for suppliers of natural ingredients for health products. The European health product industry is constantly investing in new product development, extraction technologies and research on medicinal plants. Countries such as Germany (Schaper & Brümmer and Dronania) and Sweden (New Nordic and Apoteum) are home to innovative health product companies. In the coming years, the number of ways to use natural ingredients in health products is expected to rise.

Moreover, the industry continually invests in making botanicals in health products more accessible and convenient for consumers. This includes offering remedies in formats like ready-to-drink herbal teas (see trend below), gummies and capsules. Most herbal products are marketed with a focus on specific health goals, such as reducing stress, improving digestion or enhancing sleep quality. These holistic health benefits tend to resonate more with consumers than simply the targeting of isolated symptoms.

Increasing investment in biotechnology and synthetic production methods, however, may pose a threat to natural ingredient producers and exporters in emerging market economies. For instance, the microalgae spirulina can be cultivated in fully-controlled laboratories or bioreactors. The Latvian biotechnology startup Spirulina Nord grows the algae under controlled conditions in bioreactors, where they are provided with optimal light, temperature and nutrients to ensure consistently high quality throughout the year.

Another example to show what is possible is the US-company Ayana Bio. They have created a technology that uses plant cells to produce beneficial compounds, known as bio-actives. These compounds are found in traditional herbs like lemon balm and echinacea. Instead of growing these plants in fields, which can expose them to issues like soil contamination, pests and the risk of adulteration, Ayana Bio grows the plant cells in controlled stainless steel tanks. This method minimises the risks associated with traditional agriculture, ensuring a purer, more reliable product that maintains the desired health benefits without the negative impacts of conventional farming practices. However, these technologies are still very expensive, making it unlikely that they will pose a significant threat.

Figure 2: Example of stress relief gummies on European market

Source: Bloom Robbins, 2024

Tips:

- Stay up to date on new innovation and developments in the European market, for example by accessing market information from sector associations such as the European Federation of Associations of Health Product Manufacturers. Another good source is Nutrition Insight, a news provider for health and nutrition, sustainability, and the global nutraceutical market.

- Make sure to provide complete documentation and specifications of your ingredient(s) to European buyers, including technical data sheets, and dossiers when requested. This information will allow them to assess the potential of your product in different applications.

7. The popularisation of botanicals in herbal infusions

The strong growth of the herbal infusion market in Europe is the reason why consumers are becoming more familiar with natural ingredients. In addition to boosting demand for botanicals within this industry, this development is resulting in increased consumer awareness, lower risk perception and the enhanced credibility of botanicals and their associated benefits in the wider health product market.

Since the 1990s, European tea companies have begun experimenting with a variety of herbal and fruit tea blends. This has also led to a higher diversity of product lines, addressing different health areas and aspects, and driving higher demand within this industry for botanicals with specific health benefits. Amongst some of the main European markets for infusions combining herbs, flowers and fruit are Germany, Poland, the United Kingdom and France.

These herbal infusions use botanical ingredients with specific associated health-promotion benefits. For example, German-based Yogi Tea’s herbal infusion Women’s Energy combines hibiscus, liquorice, raspberry leaves and ginger to ease cramps and help with other menstruation-related complaints. Another example is UK-based Pukka Herbs, who developed a Peace tea combining chamomile, spearmint, ashwagandha, liquorice root and lavender to promote relaxation and reduce anxiety. Both Yogi Tea and Pukka Herbs build on Ayurvedic tradition and principles in their ingredient selection and claims. As highlighted in our previous studies, there is a growing interest and demand for alternative systems of medicine like Ayurveda amongst European consumers.

Supermarket brands have also tapped into the trend, and their private-label herbal infusions also address specific health goals through known ingredients. An example is French retailer Carrefour’s Infusion Digestion Légère (Light Digestion Infusion), combining star anise, anise, bitter and sweet fennel and liquorice.

In spite of the growing popularity of the herbal infusion market and their contribution to the popularisation of ingredients related to specific health goals, it is important to note that the claims for botanical ingredients used in tea and herbal infusions have yet to be evaluated by the European Food Safety Authority (EFSA).

Figure 3: Example of a herbal tea for relaxation/calm on the European market

Source: Clipper, 2024

Tips:

- Identify the chemical and nutritional profile of your natural ingredients, especially if they can be used in self-care and wellness products. Ensure you promote these features to buyers, for example by informing them and mentioning these properties in your marketing materials.

- Ensure you can substantiate your claims with scientific data and certifications. Do not make medicinal claims.

- Visit or participate in trade fairs to find out whether the market would be open to your product, get market information and find potential buyers. The most relevant trade fairs in Europe are SANA (exhibition of organic and natural products in Italy), Food Ingredients Europe (a leading international exhibition for food ingredients in Germany), BIOFACH (dedicated to organic products and hosted in Germany), Natexpo (international trade show for organic products in France) and Vitafoods (a nutraceutical trade show taking place in Spain in 2025, following its long-standing presence in Switzerland).

8. Growth of private label in food supplements and herbal infusions

The growth in the European private-label market also affects health products, particularly food supplements and herbal infusions. Overall, the market for private-label products in Europe has increased slightly at 0.5% between 2023 and 2024, when more than six countries had a share of more than 40% in relation to the total retail market. Switzerland (52.3%), Spain (45.6%) and the Netherlands (45.2%) retain the largest market shares in Europe.

Healthcare products represent one of the main categories within private label, in addition to several food and beverage categories. For example, in the United Kingdom, retailers such as Boots and Holland & Barrett have successfully introduced their own brands to consumers, and offer a wide range of supplements for various health needs. For example, within digestive health products, Boots’ turmeric, peppermint and ginger-based supplements and Holland & Barrett’s milk thistle, peppermint, aloe vera, ginger and cinnamon-based supplements illustrate this trend.

Across Europe, there are several food-supplement manufacturers specialised in private label which use botanicals in their products, such as the Netherlands-based SKEL Supplements and Plantafood Medical (Germany). These companies develop tailor-made solutions for retailers and brands which have their own food supplement lines.

The increase in private label is also a major development in herbal infusions. Supermarket brands have strongly tapped into the trend, and their private label herbal infusions also address areas such as digestive health, anti-stress and anxiety, and others, and contain known ingredients. An example is the Dutch retailer Albert Heijn’s Rust (Tranquillity) product, which contains lemongrass, lemon balm, chamomile, lavender, cinnamon, valerian and orange flower.

Tips:

- Learn more about the private-label market on the website of the Private Label Manufacturers Association (PLMA), and consider attending the annual PLMA trade show in Amsterdam, the Netherlands.

- Search through European and national associations for supplements (example: Food Supplements Europe), which include private-label manufacturers on their members’ pages.

- Study the retail profile of different European export markets, focusing on specialised shops and drugstores.

- Keep yourself up to date on developments in the European retail market by accessing news portals such as Retail Detail: Beauty/Care.

9. Growing importance of ethical and sustainable sourcing for natural ingredients

The EU is committed to environmental sustainability and sustainable growth, something it has made clear in the European Green Deal. Sustainability is increasingly important in the European health products market, on several levels.

On an industry level, sustainability has become a central focus in the European food supplements industry. This is driven by both individual companies and through a coordinated, industry-wide strategy. The industry association Food Supplements Europe is leading the way. Its members have signed the EU Code of Conduct for Responsible Food Business and Marketing Practices.

European health product companies are becoming much more involved in sustainably managing the natural resources they use. European buyers may request that you meet the standards of their code of conduct or sign an industry charter. For instance, see the Responsible Sourcing Policy of multinational dsm-firmenich to see what this entails for them and what they expect from their suppliers.

On a consumer level, Europeans are also increasingly demanding sustainable products. For example, they want organically-certified health products that support a healthy lifestyle. Organic-certified ingredients are typically perceived as safer and of higher quality. This is driving demand for organic ingredients and creating opportunities for certified producers.

The total European organic food and beverages market was projected to be valued at USD 141.3 billion in 2024, and is expected to grow to USD 273.8 billion by 2029, reflecting an average annual growth rate between 2024 and 2029. Specifically looking at organic product sales, it is evident that these have been growing rapidly in Europe. Retail sales of organic products in Europe reached a total value of €53.1 billion in 2022. Germany stands out as the largest market with sales reaching €15.3 billion. In 2022, the organic food and beverage market in Europe experienced a decline of 2.2%, after years of consistent growth. This downturn was primarily the result of high inflation, which has reduced purchasing power amongst European consumers. However, the organic market is expected to recover and continue its growth. In Germany, for instance, the demand for organic products was already slowly growing again in 2023. Demand for sustainable sourcing includes not only organic certification, but also the sustainable management of natural resources and supply chains. To capitalise on this opportunity, exporters should consider if they have a business case that can prove this and/or obtain additional certification. For instance, you can show you practice sustainable sourcing by using Good Agricultural and Collection Practices (GACP) for medicinal plants. You could also consider obtaining certification such as FairWild. This certification is proof that you source your ingredients ethically and sustainably. Note that initial certification fees as well as renewal fees in the future can be costly.

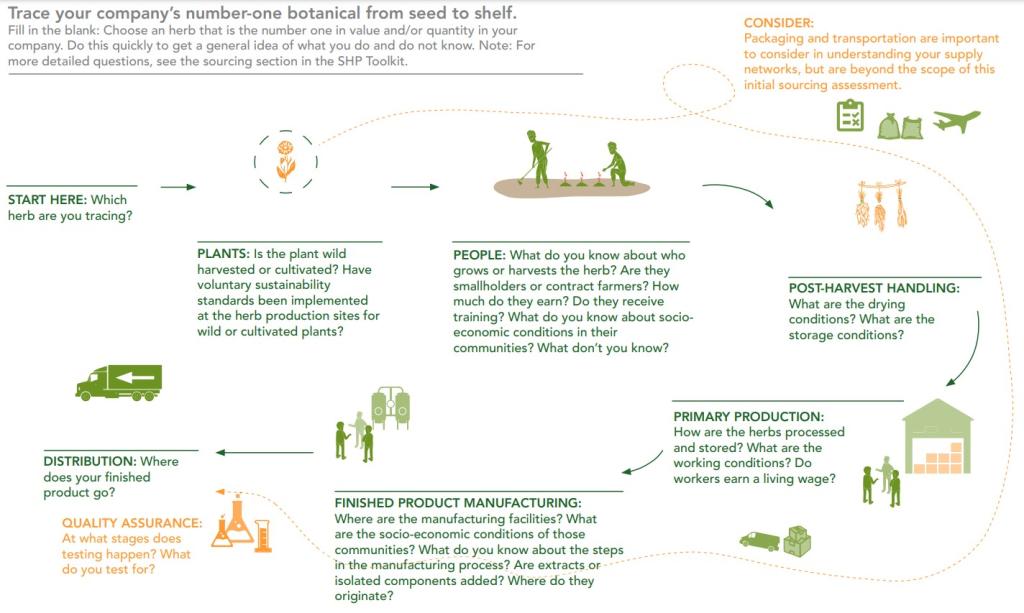

Figure 4: Example of sustainable sourcing roadmap

Source: Sustainable Herbs Program (2023)

Tips:

- Before joining any certification schemes, verify with potential buyers if your target market requires or demands certification and whether it will give you a competitive advantage over other suppliers. Examples of standards include EU organic certification and Fairtrade certification, as well as Fair for Life and FairWild.

- See the CBI study on buyer requirements for natural health products to Europe, as it provides information about the mandatory ethical sourcing and biodiversity requirements you must meet to enter the European market.

- See the CBI study entitled The EU Green Deal – How will it impact my business? for more information on the EU Green Deal and its implications.

- Make your supply chain transparent and your ingredients traceable. Use appropriate tracking and tracing or other audit and certification systems to show where your ingredients come from.

10. Increased need for traceability and transparency within supply chains

Traceability has emerged as a critical trend in the natural ingredients for health products industry. With the increase in health-conscious and environmentally-sustainable consumption, consumers are beginning to demand products with clear information regarding origin, ingredients and manufacturing processes. Simply explained, traceability involves the ability to trace the journey of a product from its source to its end-user, and ensures accountability and clear steps at each stage. Doing this allows a company to tell their customers the story behind its branded botanical ingredient.

This trend is becoming more important as a result of EU regulation on environmental sustainability. In particular, the European Green Deal and the Directive on corporate sustainability due diligence require European companies to identify, and where necessary prevent or mitigate, any adverse impacts along their supply chains in regard to human rights and the environment. This regulation means that importers will be obligated to carry out due diligence investigations in regard to their suppliers. As an exporter, you will be required to provide information on your environmental and social impact.

This can be done by working on a traceability system, which offers several advantages. Trust-building is one of the most important aspects of international trade, and through traceability you can build credibility and loyalty – which leads to positive word of mouth recommendations. Transparent supply chains can make exporters stand out and attract environmentally-conscious importers and consumers. Furthermore, a traceability system can help you to identify potential issues related to contamination of your natural ingredients. Being able to identify issues will ensure product safety and compliance with rigid quality standards.

The use of artificial intelligence (AI) to improve supply chain traceability is on the rise and is expected to grow further. AI has the potential to enhance traceability systems in various ways. For instance, data lies at the heart of traceability, and AI-powered data collection can improve data quality, encourage supplier participation and boost operational efficiency. AI are able to analyse vast volumes of data, identify patterns and make predictions. Within supply chains, it can be applied to demand forecasting, optimise logistics and detect anomalies in data that could indicate fraud or inefficiencies.

Tips:

- Learn how to set up a traceability system in natural ingredients supply chains by reading this article by the Initiative for Sustainable Agricultural Supply Chains.

- Remember that establishing a traceability system does not have to be too complicated. Exporters can design simple systems with their suppliers that document where the products are grown, who is involved, and their impact on the environment and society. To make the process simpler, you should assign codes to each producer and provide information on volume in each batch. The documentation process can be done on paper, but many businesses are implementing digital solutions to make traceability activities efficient.

- Certifications for your ingredients can help you prove the traceability of your products, as this is verified and documented by an independent third-party inspector. However, before obtaining certification and making investments, always check with your (potential) buyer if there is demand and interest in the certified ingredient.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research