Entering the European market for AI software development services

To enter the European market for AI software development services, you must comply with various laws and regulations, such as the EU’s Artificial Intelligence Act. Buyers often have additional requirements. The best way to enter the European market is by working with strategic partners. Your strongest competition is from Asia and Central and Eastern Europe.

Contents of this page

- What requirements and certifications must AI software development services meet to be allowed on the European market?

- Through which channels can you get AI software development services on the European market?

- What competition do you face on the European AI software development market?

- What are the prices of AI software development services on the European market?

1. What requirements and certifications must AI software development services meet to be allowed on the European market?

To enter the European market for AI software development services, you have to comply with various mandatory legal requirements, as well as requirements from your buyers. Niche markets may also have specific requirements.

Market entry requirements for IT and business process outsourcing (ITO and BPO) are listed in our study about the requirements outsourcing providers have to meet. This chapter discusses the most common requirements for AI software development services. New legislation is constantly being developed, particularly in relation to the European Green Deal (Europe’s roadmap to become a climate-neutral continent by 2050) and the EU’s digital transformation. So stay up to date.

What are mandatory requirements?

The development, deployment and use of AI are governed by various general laws, including the:

- Directive on the legal protection of computer programmes (2009/24/EC);

- General Data Protection Regulation (EU 2016/679);

- Data Act (EU 2023/2854) and Data Governance Act (EU 2022/868);

- ePrivacy Directive (2002/58/EC);

- Cyber Resilience Act (EU 2024/2847);

- Corporate Sustainability Due Diligence Directive (EU 2024/1760); and the

- Forced Labour Regulation (EU 2024/3015).

The European Union (EU) also introduced the world’s first legal framework for AI.

Artificial Intelligence Act

The Artificial Intelligence Act (AI Act – EU 2024/1689) provides clear guidelines for AI developers and users with regard to specific uses of AI. With these rules, the EU seeks to ensure safety and fundamental rights, and support human-centric AI. They apply to public and private actors. If you place an AI system on the EU market or if the use of your system affects people in the EU, you must comply with the AI Act, even if you are located outside the EU.

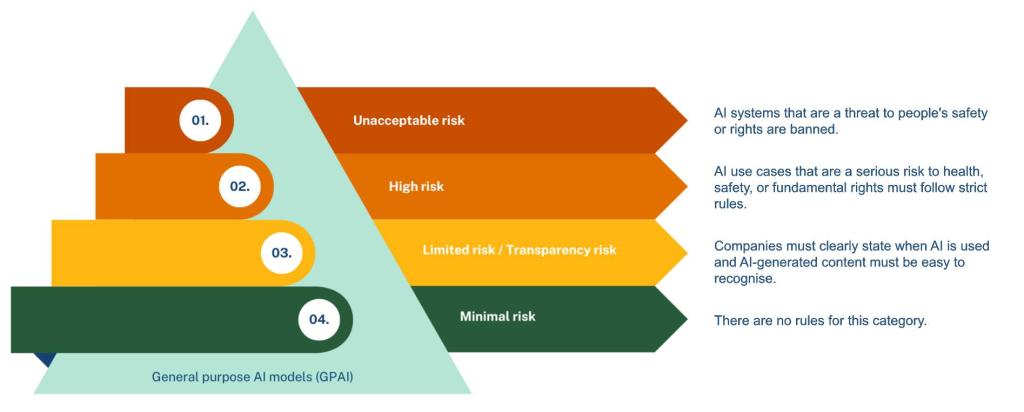

The AI Act outlines four levels of risk for AI systems.

Figure 1: Risk levels for AI systems in the AI Act

Source: Globally Cool

The AI act entered into force on 1 August 2024. The regulation will come fully into force on 2 August 2026, with some exceptions. The timeline of its application is as follows:

- 2 February 2025 – Prohibitions and AI literacy obligations.

- 2 August 2025 – Governance rules and obligations for general-purpose AI models.

- 2 August 2026 – The AI Act will come fully into force (except for the rules for high-risk AI systems).

- 2 August 2027 – Rules for high-risk AI systems.

Tips:

- Follow the Implementation timeline of the Future of Life Institute (FLI);

- Study the AI Act. What do you need to comply with and when? For more information, check the AI Act Q&A, FLI’s AI Act Explorer, Small businesses’ guideline to the AI Act and EU AI Act compliance checker;

- Stay updated on AI Pact Events organised by the European AI Office, including webinars and workshops.

What additional requirements and certifications do buyers often have?

European buyers often have additional requirements when choosing a provider, including:

- An information security management system, preferably ISO 27001 compliant/certified;

- A quality management system, often ISO 9001 or CMMI;

- ISO-compliant software development, such as ISO/IEC/IEEE 12207; and

- Agile project management methodologies.

Technical requirements

Common technical requirements include knowledge of and experience in programming languages like Python, R, Java, Scala, TypeScript, Julia, C++, Neural Network Architectures and natural language processing (NLP). Big data technologies such as SPARK, Hadoop, Cassandra, and MongoDb are also required. Other requirements relate to specific algorithms and frameworks, such as deep learning, PyTorch, Theano, TensorFlow, Caffe, Scikit-learn and NumPy. You also need knowledge about concepts and methods like linear algebra, probability and statistics, discrete mathematics, data science, data engineering and other relevant AI concepts.

Soft skills

Besides technical knowledge and experience, developers must also have good soft skills. Clear communication helps them understand what clients need and work well together. This also builds trust. Skills like problem-solving and flexibility help developers tackle tricky issues and adapt to changes. Understanding what end users want and making software easy to use is also important. Good leadership and teamwork keep everyone on track and motivated, ensuring projects run smoothly.

AI risk management standards

ISO has various standards that help any organisation that develops, provides or uses AI-based products, systems or services manage the risks of AI. ISO/IEC 23894 provides guidance and assists organisations in integrating risk management into their AI-related activities and functions. ISO/IEC 22989 is a supporting document that establishes terminology and describes concepts in the field of AI.

ISO/IEC 42001 aims to ensure responsible development and use of AI systems. This standard sets requirements for establishing, implementing, maintaining and continually improving an AI Management System (AIMS). It addresses AI-specific challenges like ethical considerations, transparency and continuous learning.

Sustainability

Companies are increasingly required to demonstrate their socially and environmentally sustainable business practices. Voluntary standards can help you demonstrate responsibility, such as ISO 26000 (social) and ISO 14001 (environmental).

The EU AI Act also addresses sustainability aspects in AI. It requires regulators to support the setup of voluntary codes of conduct on matters such as the impact of AI systems on environmental sustainability and energy-efficient programming. These codes of conduct must define clear objectives and include key performance indicators (KPIs) so you can track how you meet your goals. These codes have not been created yet, but you should watch out for draft versions as they appear.

Tip:

- Read about sustainability in ITO/BPO in our studies 7 tips on how to go green in the outsourcing sector and 7 tips on how to become more socially responsible in the outsourcing sector.

What are the requirements for niche markets?

Requirements for AI software development vary per industry, segment and even country. When planning to offer AI software development services in a specific niche, please check the applicable requirements.

Country

For country-specific information, please check government websites. For example, if you plan to export to Germany, take a look at the website of Bitkom, Germany’s digital association.

Industry

Different industries have different requirements. In healthcare, for example, Health Level 7 (HL7) and the Health Insurance Portability and Accountability Act (HIPAA) are important. The automotive industry uses standards like ISO 24089 and ISO 26262.

Segments

AI software can also be divided into segments according to their application. Each segment has specific requirements.

For example:

- ISO/IEC 23053 – Framework for describing a generic AI system that uses machine learning (ML) technology;

- IEEE 2945-2023 – Standard for technical requirements for face recognition; and

- ITU-T F.746.5 – Framework for a language learning system based on speech and NLP technology.

Tips:

- Learn from your clients and check what potential clients require. Perhaps you can work on certifications or social goals together;

- See IEEE’s portfolio of Autonomous and Intelligent Systems (AIS) technology and impact standards and standards projects. It covers everything from face recognition standards to AI and ML terminology and data formats. It helps you to align yourself with industry best practices.

2. Through which channels can you get AI software development services on the European market?

The European market for AI software can be divided into horizontal and vertical market segments. You can tap into these segments through several market channels. The most realistic channel for you is working with a strategic partner.

How is the end market segmented?

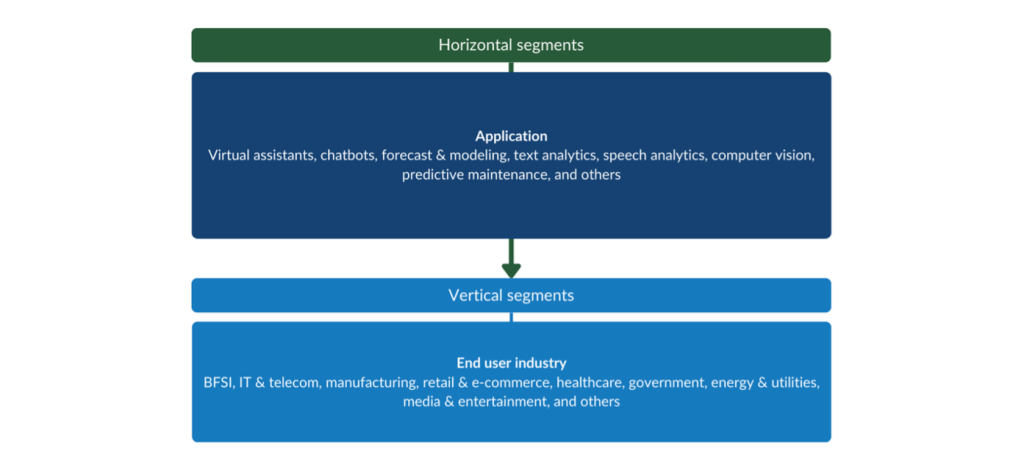

There are two ways to segment the AI software development market. One is by application, such as virtual assistants and computer vision. We call these horizontal market segments. The other is by end-user industry (vertical segments), for example healthcare and manufacturing. This means there are quite a few niche segments in AI, with plenty of space for new ideas and innovation. Early adopters can benefit from less competition. However, as the technology matures and more companies enter the market, it becomes more saturated and there will be fewer opportunities. So, grasp your opportunity now.

Figure 2: Horizontal and vertical market segments with opportunities for service providers

Source: Globally Cool

The demand for AI-related jobs increased in the European healthcare and pharmaceutical sector. Vacancies grew from 534 in May 2020 to 1,699 in May 2024. AI software has many applications in this sector: it can be used in clinical trials, diagnostics, imaging, patient care, personalised treatments, and research and development. For example, the French company Wandercraft developed a self-balancing exoskeleton that helps paralysed people walk. It uses AI to help with balancing. They won the 2025 SXSW Innovation Award for AI.

AI also has many applications in the financial sector. It can be used by a wide range of institutions and departments. Think of customer service (conversational AI and NLP for chatbots), fraud detection and prevention (deep learning to analyse customers’ buying behaviour), cyberattack prevention (using data science to analyse patterns) and trading (developing trading algorithms to analyse market trends).

In telecommunications, ML and deep learning are used to process big data for better insights. Generative AI is especially useful to improve customer experience. Digital twins can be used to test network infrastructure and identify user patterns.

Tips:

- Research the end-user industry that you want to target. Subscribe to the mailing lists of organisations that combine that end-user industry with technological solutions, such as the British Health Tech Association;

- Specialise and focus on a niche market to avoid strong competition. This will also help you market yourself better. Then, focus on finding strategic partners in that niche;

- For more information on the application of AI in different sectors, see IBM’s articles on AI in finance, telecommunications, retail, marketing and medicine.

Through which channels do AI software development services end up on the end market?

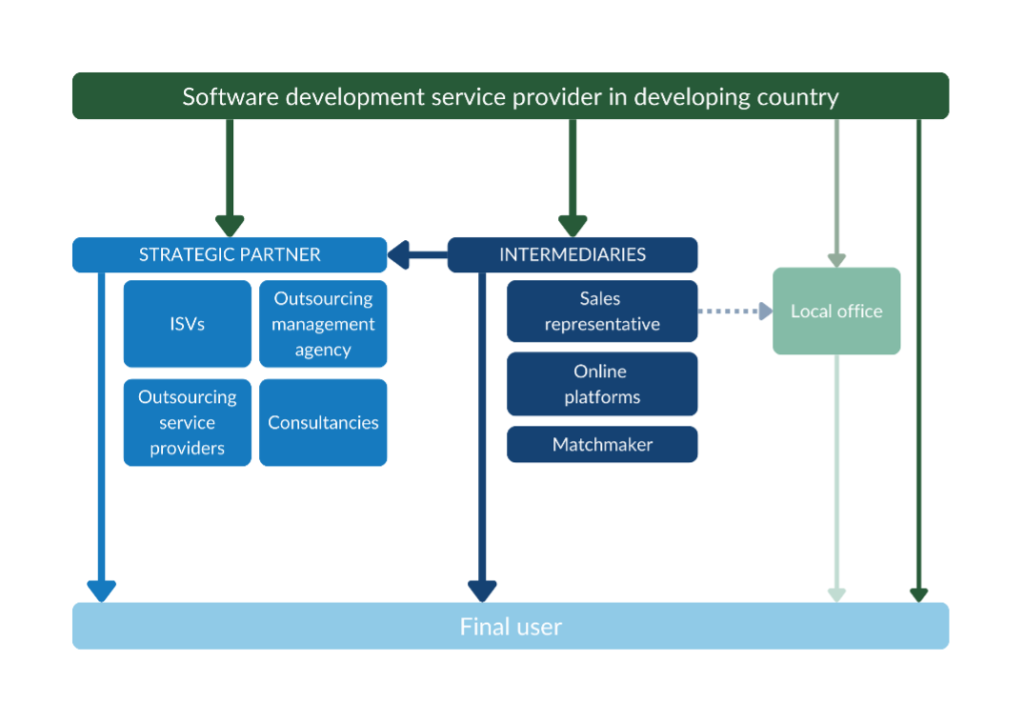

Figure 3 provides an overview of the trade channels you can use to enter the European market. This structure is very similar in every country. Working with a strategic partner is your most realistic option.

Figure 3: Trade structure for outsourcing software development services in the European market

Source: Globally Cool

Strategic partners

Working with strategic partners is your most realistic market entry channel. They could be Independent Software Vendors (ISVs), outsourcing management agencies, outsourcing service providers or consultancies.

A provider that is similar to your company (e.g. in terms of size, technology portfolio and customer portfolio) would be most suitable. Ideally, this company should design, develop, market, sell and maintain AI software.

The relationship between a strategic partner and a subcontracted supplier (you) is generally characterised by:

- Trust;

- Interdependence;

- A structured relationship (functions, tasks, communication, and procedures);

- Potentially limited marketing visibility and market access opportunities for the subcontracted supplier; and

- No intellectual property (IP) rights, or a loss of IP rights for the subcontracted supplier.

Please note that when you work with a strategic partner, they communicate with the final user of the software you develop. You are a subcontractor and will probably not appear in their marketing communications. You will be referred to as a ‘delivery centre’.

You can find a strategic partner either directly or by working with an intermediary. Since many European companies prefer to deal with a local contact person, using an intermediary is a good option.

Tips:

- Attend relevant industry events like AI Expo Europe in Amsterdam, AI World Congress in London and MWC in Barcelona to meet potential partners and competitors. Do your homework and select events that fit your profile. Make a list of relevant events using directories like 10Times;

- Use AI industry associations or outsourcing associations, like the European Association for Artificial Intelligence (EurAI), to find potential customers in Europe;

- Use general IT industry associations to find potential customers, such as Bitkom in Germany, NLdigital in the Netherlands and techUK and BIMA in the United Kingdom. If you specialise in a particular industry, you can also use associations in that niche, such as the Association of British HealthTech Industries.

Intermediaries

You can work with an intermediary to find a buyer or strategic partner.

Matchmakers

A matchmaker is a person or company with many relevant contacts in a specific market segment. They do not make cold calls. Always inform your matchmaker about your company properly so they can match you with suitable leads from their network.

If you work with a matchmaker:

- The matchmaker makes appointments with prospects for you;

- The presentation and sales process remains your responsibility;

- You often need to pay a retainer plus success fee (which can be expensive);

- The matchmaker often has multiple clients;

- You need to set clear expectations, objectives and exit criteria to measure their performance.

The retainer plus success fee can be expensive. The success fee depends on what the matchmaker has delivered, but you must pay the retainer regardless of their performance, usually a fixed monthly payment. The retainer should be high enough to cover some of the costs, but low enough to encourage delivery. A lawyer must draft the contract.

You also need to include a trial period (usually ≤3–4 months) after which the contract can be terminated without further consequences. The delivery expectations and targets for this initial period must be clearly defined, such as the number of relevant contacts, meetings and leads. Your contract should also have clear exit options.

Sales representatives

Another type of intermediary is a sales representative. These are more involved in the sales process than matchmakers.

When working with a sales representative:

- The sales representative contacts prospects for you;

- The sales representative also makes the sales and sometimes manages projects to a certain degree;

- You often pay a retainer and success fee (which can be expensive), or a fixed monthly fee;

- The sales representative can have multiple clients or work exclusively for you.

A good sales representative has a large, relevant network, so they do not make cold calls. Their success fee is often a percentage of the value of the projects they bring in.

Online platforms

Electronic marketplaces are a cheap marketing tool that may make direct sales easier. These platforms used to focus on freelancers, but some serve SMEs now too.

Tips:

- Make sure that any selected matchmaker or sales representative has a large, relevant business network;

- Be cautious if intermediaries only ask for a success fee, because either they are excellent at their job, or they are desperate and may not deliver. You should also be cautious if intermediaries want to work for you part-time besides their regular job, because they are often too busy to deliver;

- Work with a good lawyer who knows the laws of the country where the intermediary resides and has experience with this type of contracting. Pay special attention to exit clauses, success criteria, deliverables, and payments;

- Look for leads on online platforms like Appfutura and Talent Alpha (specialised in SMEs), UpWork, Freelancer, Fiverr, ITeXchange, Clutch and pliXos. For more information on online marketplaces, please read our study on finding buyers in the European outsourcing market.

Local office

Another option is to establish a local office in your European target market. You can also open an office in one of Europe’s nearshoring destinations (e.g. Central and Eastern European markets), which is generally cheaper.

Having a local presence makes it easier to build long-term relationships with customers through personal contact. It also increases your credibility, builds trust and allows you to retain complete control over your marketing and sales activities. However, this can be difficult, as it requires a lot of experience and large investments. Many IT service providers in developing countries are simply too small and do not have the financial strength or enough verified market opportunities for this.

Tips:

- Be aware that establishing a local sales office is very costly and you need a strong financial position;

- Consider establishing your own office if you already have a client base in the target market, or if you have a well-founded indication of the demand for your services/products. If you decide to establish an office, involve your sales or marketing representative;

- Look for alternatives to lower your costs, such as business incubators or government incentives to bring your business to a particular country or region.

Direct sales

You can also try to sell your AI software development services to European end users directly. Many European companies are looking for cost reduction and delivery capacity, which developing countries can often provide. This is one of your unique selling points – or at least a competitive selling point. However, you should be aware that these end users might not have qualified IT staff to work with.

Direct sales require experience in the European market and are most suitable for relatively large providers that want to target large European end users. Your best bet is to focus on a small, underserved niche market. For most suppliers from developing countries, however, it is very challenging to sell AI software development services directly. Having existing customers in Europe will help, because you need references for direct sales.

Tips:

- Combine offline and online promotion channels to develop as many contacts as possible. This maximises your chances of finding suitable partners and customers. Use social media platforms as a marketing tool. LinkedIn can be particularly useful for making initial contacts and conducting market research;

- Build a professional, high-quality company website, where you present full, accurate, and up-to-date details of your product or service. Make it compatible with mobile devices and invest in Search Engine Marketing and Optimisation so potential customers can easily find you online.

What is the most interesting channel for you?

European strategic partners are generally the most promising market entry channel for providers like you. Selecting a channel depends on your type of company, the nature of your service, your target market, and the available resources for market entry. Regardless of the channel you choose, your own marketing and promotion is a vital part of your market entry strategy, for which you are responsible.

Tips:

- Decide on a business model. You can try to work for European end users directly or focus on becoming a subcontractor for European partners;

- Create your ideal client persona to help you tailor your offer. For example, ‘a technology provider with fewer than 200 staff in Germany, specialised in forecast & modelling for the transport sector’.

3. What competition do you face on the European AI software development market?

Competition in the AI software development services market is strong. Besides competition on price and quality, there is also competition based on location. European ‘end-user’ companies generally prefer outsourcing to providers within their country. Especially smaller ‘end-user’ companies outsource IT tasks locally. However, European ITO providers often subcontract to nearshore and offshore outsourcing companies. They usually prefer nearshore locations because of proximity, language, cultural similarities and minimal time zone differences.

Which countries are you competing with?

As European companies prefer to outsource to nearshore locations, you first of all compete with European providers, especially from Central and Eastern Europe (CEE). These countries have many tech hubs, highly skilled professionals, lower prices than Northern/Western European markets, high English proficiency, a minimal difference in time zone and cultural similarities. You also face competition from two major offshore ITO powerhouses: China and India. They are strong competitors when it comes to AI, especially China. Brazil is also a strong player.

The Global Services Location Index (GSLI) shows countries’ attractiveness as an offshore location for ITO/BPO services. It ranks their competitiveness based on four categories:

- Financial attractiveness;

- People skills and availability;

- Business environment; and

- Digital resonance.

Based on the GSLI, India and China are the most attractive ITO/BPO destinations. Brazil also has a high position, ranking fourth. Although the CEE countries score lower, they are nevertheless leading outsourcing locations for European companies.

Source: Kearney

While the GSLI does not look at AI specifically, the countries selected are also interesting offshore locations for AI software development. European companies regularly work with AI professionals from these countries. For example, a 2024 survey among Dutch AI companies revealed that (besides the Netherlands) their AI talent comes from: Eastern Europe (35%), Western Europe (32%), India (14%), the USA (11%), Latin America (11%) and China (5%).

Although the United States (US) will not be discussed in detail, you should know that the US is an important AI powerhouse, home to providers like ChatGPT’s OpenAI. It has the largest AI market in the world and is the leading country in the AI startup industry. However, it ranks lower on the GSLI (eighth), making it a slightly less attractive outsourcing supplier than India, China and Brazil.

CEE countries: preferred nearshoring destinations

European ITO providers often subcontract to nearshore destinations in CEE. Poland is the most attractive destination, ranking 13th on the GSLI 2023. It has many higher education institutions, including 40 state universities and 20 public technology institutes. They have trained around 400,000 IT specialists in fields like AI, cloud computing and data science.

The country draws a lot of foreign investment. Global companies have invested billions of dollars in the Polish Digital Valley, new data centres and expansions to Polish offices. Global companies plan to hire 5,000 cloud and automation specialists. For example, Microsoft intends to train one million people in Poland with AI skills by the end of 2025 as part of its investment in the development of the Polish Digital Valley.

Within Eastern Europe, Poland ranks fourth on the Government AI Readiness Index (2024). In January 2024, it formed a political alliance with France and Germany (the Weimar Triangle for AI) to coordinate their national plans for investments in AI with EU policies. Moreover, at the end of 2024 the country promised to invest €232 million to support the creation of domestic AI models, such as the development of a Polish large language model.

Romania is another strong CEE destination. It has built a strong AI startup ecosystem, ranking 11th globally (2024). This is 33 places higher than its overall startup ranking, showing a strong focus on AI. Bucharest is Romania’s top AI startup city, ranking 26th worldwide. The country launched its national AI strategy in July 2024, focused on economic competitiveness, modernisation of the public sector and ethical AI deployment.

In addition, Romania has a large tech workforce of 120,000 programmers and more than 360 custom software development companies. Around 25,000 students (7% of all university applicants) enrol in computer science programmes across nearly 100 universities annually.

Estonia is also an attractive nearshore location, ranking 16th on the GSLI 2023. Moreover, it is the world’s sixth largest AI startup industry, with the highest Government AI Readiness Index (72.6) among CEE countries. In addition to being a competitor, Estonia is also a promising market for offshore providers like you. See our market potential study for more details on AI in the Estonian market.

Hungary is also important to consider. It has made significant progress as an attractive outsourcing destination. While the country ranked 37th on the GSLI in 2021, it climbed to the 19th position in 2023. This made it the third most-improved country on the list, thanks to investments in emerging technologies and AI and IT-friendly policies.

Programming languages like Java, Javascript, Python and C++ are highly demanded AI skills in Europe. Traditional skills like SQL and big data are also needed. This is another reason for European companies to outsource to CEE. Java, JavaScript, HTML/CSS, SQL and Python are the most popular technologies in the CEE.

The HackerRank shows that Poland’s programmers are among the best in the world. Looking at the best developers by domain, the top three countries for Java are Poland, Bulgaria and Hungary. Poland and Bulgaria also rank high in Python, and Hungary excels in C++.

China: a country with many top-tier AI researchers

China ranks second in the GSLI 2023. It provides relatively cheap outsourcing services and has a big talent pool with strong tech skills. The country can also rapidly upskill its workforce in response to changing market demands and tech disruptions. China focuses on building a strong education system, offering emerging technologies like AI at an early stage. 29% of the top AI researchers are from China, although only 11% work in China.

In the mid-to-long term, China’s workforce will likely shrink due to the ageing population and low birth rate. Other weaknesses are its large time difference with Europe, limited English proficiency, IP concerns and firewall restrictions.

Moreover, China is a global leader in filing tech-based patents, for example on AI and ML. China's AI startup industry ranked eight in the world in 2024, although it has dropped four positions since 2023. Many Chinese cities are vibrant hubs for AI startups. In 2024, Beijing was the third best AI startup city in the world. Others include Shenzhen (ninth place), Shanghai (11th), Hangzhou (30th) and Chengdu (46th).

When looking at the best developers in the world by domain, Chinese developers excel in skills like functional programming (first place), data structures (first), algorithms (third) and Python (fourth). For AI in particular, Chinese companies specialise in computer vision, facial recognition and IoT-AI.

India: low-cost destination, mostly known for ‘bulk’ projects

India continues to lead the GLSI with its combination of low-cost services, high English proficiency and a skilled workforce. This makes it a strong competitor in the IT outsourcing market. India has a young and fast-growing workforce. To stay ahead, the country needs to transition from lower-skilled jobs that can be replaced by robots to more creative and high-skilled work. Technological advancements and socioeconomic changes will reduce India’s labour cost advantage. This applies to other low-cost countries as well.

India is usually regarded as a ‘bulk’ destination. Buyers often associate extremely low developer rates in Asian countries with poorer project quality. They assume that cheap service providers must be using less skilled or less experienced developers, or that working conditions must be poorer. With a score of 62.8, India ranks relatively low on the Government AI Readiness Index (46th). Nevertheless, Bangalore (23rd) and New Delhi (32nd) are considered good global AI startup cities.

In AI software development, the strengths of Indian companies lie in full-stack AI, NLP, ML opt and chatbots. The government has launched several programmes to keep up with booming technologies. For example, the PMKVY 4.0 programme offers training to upskill 4.7 million people on i4.0 technologies, including AI. AI is also an important topic in India’s New Education Policy 2020. They want it to be included in the curriculum at all educational levels.

Brazil: climbing the ladder on the GSLI

Brazil ranks fourth in the GSLI 2023. This is one spot higher than in 2021, and five spots higher than in 2019. Its improved ranking suggests that the Brazilian outsourcing sector is performing well. Brazil is home to many technology hubs, and companies are expanding their innovation hubs. Sao Paolo is Brazil’s main hub for the AI startup industry, ranking 24th in StartupBlink’s Top 50.

Among Latin American countries, Brazil scores the best on the 2024 Government AI Readiness Index (65.9). The country invests a lot in AI. With the Brazilian Artificial Intelligence Plan (PBIA) launched in July 2024, the government will spend about $4 billion (USD) on AI between 2024 and 2028. Almost $2.5 billion of this will go to business projects, such as supporting the development of the AI value chain and helping startups and micro, small and medium-sized enterprises (MSMEs).

Brazil has a large talent pool, moderate English proficiency and a low-to-medium cost level. Looking at AI, Brazilian companies specialise in fintech, agritech and logistics AI. However, Brazil has a poor time zone alignment with European countries. This creates opportunities for companies from other regions that are better aligned with European working hours.

Tips:

- Invest in country branding. For more information on this topic, see our tips on doing business with European buyers;

- Compete on skills, not on price;

- Be aware that ITO companies from CEE countries are also potential partners.

What companies are you competing with?

Examples of AI software providers are:

Nexocode (Poland)

Nexocode is a Polish AI company. They excel in innovative AI development and have strong technical abilities and strategic vision. Their expertise in ML enables them to create intelligent solutions that enhance everyday lives. They offer advanced AI development services throughout the AI lifecycle. They are proud of their tight-knit team of talented developers and designers who specialise in innovative business solutions focused on AI. With clear communication and custom AI solutions, they support clients in strategy, product vision, AI software development, DevOps and UX/UI design.

INCN Technology (China)

INCN Technology is an IT services company headquartered in Guangzhou, with several branch offices in China and a back office in India. They have an international team of highly skilled professionals who serve both local and international clients. The company offers IT and AI services, such as ML development, deep learning solutions and chatbot solutions.

Pixelcrayons (India)

Pixelcrayons is an Indian company. They are an award-winning digital consulting & engineering firm that provides comprehensive software solutions to enterprises, ISVs, digital agencies and startups. Their expertise in AI and ML development empowers clients to think, predict and act smartly. With a focus on advanced frameworks such as Apache Singa, Amazon ML, Azure ML Studio, Caffe, H2O and MLlib (Spark), their ML development company ensures the delivery of optimal solutions.

Elint (Brazil)

Elint is a Brazilian provider of custom software development and data analytics solutions. They have a customer-centric approach and use Agile methodologies to deliver cost-effective solutions. Their services include emerging technologies like AI, ML, computer vision, NLP and big data analytics. Elint has a proven track record of successful business. For example, they perform automated complex tasks with AI for a large energy company.

The company also offers outsourcing services. It provides software engineers, as well as project and product managers who serve as leaders and main points of contact. The company’s unique value proposition (UVP) focuses on outsourcing, highlighted by slogans such as ‘ELINT: your number 1 option for outsourcing development’ and ‘Your global excellence, Brazilian talent’.

Tip:

- Learn from your competitors. Look for competitors that operate in the European market. Compare them on various aspects including price, the AI software services they offer and their target markets.

Which products are you competing with?

Unless you sell your own AI software products directly to the European market, your service is your product. So, the real question is: what makes one service provider different from another? The answer is broad. Providers differ on aspects like technical/domain knowledge, capacity, references, flexibility, reliability, communication and language skills, quality management, security infrastructure and market focus.

Most AI software development solutions involve other IT-related tasks. They require software updates, routine maintenance and the development and implementation of new features. If you can take care of these tasks so your clients can focus on their core business, it will make you stand out from your competition.

There is space in the market for innovation and for the development of your own AI products. However, this is a challenging market that might not be suitable for smaller companies. Developing AI products is quite complex. As well as software development, you need specific scientific skills, such as a good understanding of data science, deep learning, neural networks and statistics

Tip:

- Look at lists of successful AI startups, like these lists of funded AI startups and the top AI startups.

4. What are the prices of AI software development services on the European market?

Multiple buyers of software development services in Europe have indicated that price is not their main criterion. If they choose a provider from a developing country, they are happy the price is lower, but they find communication and skills much more important. Nevertheless, your price must be right and competitive. The biggest price component in any project will be person-hours.

The price is influenced by:

- Technological requirements;

- Skill levels;

- Project complexity;

- Length of the contract; and

- Other requirements in the Service Level Agreement (SLA).

Your offer should include the price, with your hourly rates and an honest estimation of the number of hours you expect to work on the project.

You must also choose a price model for your product or service. There are four popular working models: Fixed-Price, Time and Materials, Incentive Based and Shared Risk-Reward. The most common is a fixed-price contract: an all-inclusive offer in which clients are billed based on pre-defined (in the SLA) milestones. There are various reasons to choose one price model over the other, depending on your situation.

Salaries make up a large share of costs in AI software development. The average annual salary of an AI engineer in North-Western Europe is around €80,000 (2025), up to about €90,000–100,000 in Denmark and Switzerland. Salaries are usually significantly lower in offshore destinations – about €5,400 in India, for example. This means that outsourcing to countries where wages are lower can lead to considerable cost savings.

If you focus on a niche or non-commodity market, European buyers are often even less price sensitive.

Tips:

- Study average prices, for example via IT Jobs Watch. You can also research average salaries via platforms such as Payscale and Glassdoor;

- Analyse your costs and profit expectations to calculate your price and find the right price for your service;

- Go beyond setting the right price and work out your pricing strategy. This should include your preferred pricing model, payment terms and expectations, and how and when you offer discounts.

Globally Cool carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research