The European market potential for big data services

The European market for big data products and services is growing very quickly, due to the rapid digitalisation of many processes, combined with the shortage of big data talent to work on these processes. Demand is particularly high in Northwestern European countries. Good opportunities can also be found in Eastern European countries where outsourcing providers are increasingly looking for partners.

Contents of this page

1. Product description

The term ‘big data’ refers to the massive amount of information collected from a wide variety of sources (e.g. social media, websites, sensors). Because the volume of information is so large and comes in so quickly, special tools are needed to make sense of it. Companies and researchers use these tools to find patterns and make smart decisions based on the data.

Key components of big data services include:

- Data Storage: solutions for efficiently storing and managing massive amounts of data, often using distributed file systems or NoSQL databases to ensure scalability and fault tolerance.

- Data Processing: tools for processing and transforming data in parallel, leveraging distributed computing frameworks (e.g. Hadoop and Apache Spark) to handle the high computational demands of big data analysis.

- Data Analytics: techniques and platforms for extracting insights, patterns and trends from large and complex datasets through various methods, including machine learning, statistical analysis and data mining.

- Data Integration: services that help consolidate data from various sources, including both structured and unstructured data, into a cohesive format for analysis.

- Real-time Processing: solutions that enable the processing and analysis of data in real time (or near real time), thereby allowing organisations to make informed decisions rapidly based on the most up-to-date information.

- Data Visualisation: tools for creating meaningful and informative visual representations of big data to facilitate easier understanding and interpretation by users.

- Data Security and Governance: ensuring that data privacy, security and compliance regulations are upheld while managing and analysing large datasets.

- Cloud Services: many big data services are offered through cloud-computing platforms, allowing organisations to scale their resources up or down based on their data-processing needs without the need for heavy upfront investments in hardware.

Big Data as a Service (BdaaS)

Big data services are becoming increasingly important to European companies. These services play a critical role in helping organisations gain valuable insights, optimise operations, make data-driven decisions and innovate across various sectors, including business, healthcare, finance and research.

Big data technologies are very closely related to artificial intelligence (AI), machine learning (ML), robotics and the Internet of Things (IoT)/Industrial Internet of Things (IIoT). All of these technologies run on big data.

2. What makes Europe an interesting market for big data services?

The European market for big data services is large. It is growing rapidly, due to the continuing advance of digitalisation. European companies are also seeking resilience (strength) and agility (flexibility) in their ICT solutions. Demand for the outsourcing of big data services is also high, due to the lack of skilled data analysts and companies’ increasing openness to outsourcing.

The market is growing rapidly

In 2022, the market for big data in Europe was valued at EUR 73.37 billion. Despite the challenges posed by the COVID-19 pandemic, the demand for big data analytics has increased over the past two years. This shows that big data is not just a luxury, but a necessary technology that can assist businesses in building up their ability to handle digital challenges and bounce back from difficult situations faster. The European big data market is expected to experience a compound annual growth rate (CAGR) of 7.7% from 2023 to 2029.

Source: Stellar Market Research

As shown in Figure 1, the European market for big data is divided into three segments, by far the largest of which comprises services, accounting for around 70% of the entire market.

The growth in the European big data market is driven primarily by the adoption of cloud computing, the popularity of the internet, rapid technological advances and improved connectivity. These developments have led to an enormous amount of data. European companies are increasingly understanding the value contained within this body of data, and they are eager to use that value to improve their businesses.

There is a shortage of skills

In Europe, there is a large gap between the demand for big data services and the number of available big data scientists. For this reason, European big data service providers are having difficulty finding the right employees. As a result, they are increasingly seeking to work with big data service providers from other countries.

The top 8 most in-demand data science jobs in Europe in 2022 were as follows:

- Data Engineer

- Data Analyst

- Data Scientist

- Data Architect

- Database Administrator

- Machine Learning Engineer

- Business Intelligence Developer

- Statistician

The United Kingdom, Germany, France, Poland and the Netherlands are experiencing the greatest demand for data scientists in Europe. Together, these countries account for almost 72% of all data science job postings. Less than 29% of such postings are from other European countries.

Although skills shortages were initially limited primarily to Western and Northern Europe, they have now become apparent in other areas in Europe as well (e.g. Eastern Europe). Poland, Bulgaria, Romania and other countries in this region have developed into common nearshore destinations for Northern and Western Europe, but they are now facing skills shortages as well.

Tips:

- Find the right people. Consider hiring people who possess the necessary talents but who have yet to attain the required competencies. You can train them on the job. In addition, make sure that you have access to the right people needed to scale up operations and serve clients on short notice.

- Specialise in a few programming languages, rather than working with several that you have not fully mastered. The most in-demand programming languages are Python, Java and C++.

3. Which European countries offer most opportunities for big data services?

Northern and Western European countries generally have the largest markets for outsourcing. Some countries offer opportunities based on size, and others offer opportunities based on openness to the use of big data technologies. Countries on the Eastern borders of Europe are promising markets for you, as many service providers are located there, and they are likely to offer opportunities for cooperation.

Source: Globally Cool

France: A large country with a rapidly growing market for big data services

As Europe’s third-largest economy, France has a market that is particularly interesting because of its size.

The big data market in France is expected to experience strong growth between 2022 and 2029. This is driven by the rapid adoption of the Internet of Things (IoT) and the growing demand for large-scale data analysis in many vertical business segments. The market is expected to reach a value of EUR 362 billion by 2029, which translates to a CAGR of 11.5% between 2022 and 2029.

In France, there are not enough people with the right skills in data science and artificial intelligence. This problem is expected to become even worse, as technology is used everywhere, including by smaller businesses. It has been reported that more than two-thirds of large companies in France are struggling to find the right staff.

Fluency in French is helpful if you wish to provide big data services to French companies. Given that French is the official language in 29 countries worldwide, this requirement does not pose a market-entry barrier for many service providers. On the contrary, it makes France a particularly interesting target market for providers from African countries (e.g. Senegal). Offering services in French also allows you to target francophone companies in Belgium and Switzerland.

When providing big data services to France, be aware of the France Data Protection Act, which goes beyond the regulations specified in the GDPR. Additional information on this point is included in the section on market entry in this study.

Germany: Europe’s largest economy

The largest economy in Europe, Germany, is home to 19% of the EU’s population. Its economy is widely considered a stabilising force within the EU. Germany’s main industries include the automotive, electrical and chemical sectors. They are increasingly using big data to optimise production, improve products and stay competitive. At present, the e-commerce and advertising sectors are making the most use of big data services. The greatest amount of growth in the use of big data services is expected to occur in the IT, telecom and media industries.

Although its large size makes the German market highly interesting, German companies naturally prefer to work and collaborate in German. Compared to other countries in Northern or Western Europe, Germany is less open to offshore outsourcing, as it is more risk-sensitive. This is changing, however, as German companies face skills shortages and gain more experience with offshore outsourcing.

You can increase your chances of success in Germany by collaborating with a local German-speaking partner rather than approaching end users directly. If you can do business in German, you could also target German-speaking companies in Austria and Switzerland.

Additional information is available in this article on the market for big data in Germany and the changes that are relevant to service providers.

Italy: Catching up on digital technologies

The Italian market for big data services has long been overlooked. Even though Italy ranks 8th in the EU in terms of the integration of digital technologies, the use of more complex technologies (e.g. big data and AI) remains limited. The country thus offers good market-entry opportunities for companies offering big data services.

According to the Big Data & Business Analytics Observatory, the Italian market for data and analytics was worth approximately EUR 2.41 in 2022. The sectors that are most likely to use big data services in Italy are distribution, retail, public administration and healthcare.

Spain: One of the strongest growth markets in Europe

Spain is also interesting because of its size. It is the 6th largest European economy, behind Germany, the UK, France, Italy and Russia.

In 2021, the market for big data and data engineering services in Spain had an estimated value of more than EUR 50 billion. It is expected to reach a value of more than EUR 176 billion by 2029. This translates to a CAGR of almost 17%, one of the highest in Europe.

Strong growth is expected in the healthcare segment. More specifically, the ‘digital health segment’ is expected to grow rapidly as the demand for data-driven decision-making is rising.

Nordic countries: High adoption of new technology and open to outsourcing

Although the Nordic markets (Norway, Sweden, Finland and Denmark) are smaller than those in France, Germany or the UK), they are early adopters of new technologies, including big data technology, and they are relatively open to outsourcing. Moreover, most decision-makers in Nordic companies speak English very well, making it easier for outsourcing service providers to work with them.

The Nordic countries have strict rules for handling data. These rules are built on shared values and a collective commitment to ensuring the safety and ethical use of data, including during collection, sharing and utilisation. The governments in the Nordic countries are very interested in using big data to help with the green transition in the region. If you are interested in targeting the Nordic countries, read about the Nordic Smart Government and Business initiative.

Note also that while the GDP in most European countries is expected to be negative in 2023 and 2024, the GDP of Denmark is almost the only one that is expected to grow (by 0.48% in 2023 and 0.41% in 2024).

United Kingdom: Large market facing large skills shortages

The United Kingdom (UK) is one of the world’s largest markets for big data analytics. The market is also expected to experience substantial growth, as data continues to be a top priority for businesses.

According to a 2022 study conducted by Virgin Media 02, companies in the UK are also facing a shortage of skilled data science talent. More than half (55%) of the UK companies participating in this survey reported that they lacked the talent to complete AI and data science initiatives. The British government estimated that this skills shortage is costing the UK economy almost EUR 15 billion per year. The combination of this talent shortage and the country’s openness to outsourcing means that the UK offers good opportunities. At the same time, however, it means strong competition in the market.

Of all European markets, the UK is the most open to offshore outsourcing, and it is the least cautious about trading with developing countries.

Because of Brexit, it is harder for UK companies to attract talent from other countries. This is making the existing IT skills shortage even worse. Offshore suppliers like you could benefit from this.

4. Which trends offer opportunities or pose threats on the European market for big data services?

Many trends are influencing the European market for big data services. The most important ones are the demand for customised big data solutions, automation and the demand for data storytelling.

Companies are asking for customised big data solutions

More and more companies are investing in big data solutions for their specific situations (custom design). Specialisation therefore offers the best opportunities. You could specialise in either an application or a sector.

For example, in the healthcare sector, there is a growing demand for customised data analytics tools to improve diagnostics and patient management. Similarly, businesses across Europe are increasingly turning to customer analytics to enhance engagement and refine marketing strategies. The easiest way to start is by working with sectors with which you already have experience. This article provides an overview of big data applications by sector.

Focus on developing high-quality, specialised solutions that are customised to the needs of those industries. Showcase success stories and client testimonials from your home market or any other international market you have already entered. This will build credibility and trust.

Engage with industry groups, forums and social media platforms where European professionals and businesses get together. Build relationships, share knowledge and present your company as a reliable source of expertise.

To tap into this market, you should build up in-house expertise in a relevant market segment. This is known as domain knowledge. In addition, build in-house expertise in related big data disciplines, like data engineering, data modelling, security, big data technologies, databases and programming languages. You can then offer that expertise to European companies that are developing such solutions (i.e. independent software vendors; ISV).

Brightskies is a good example.

Founded and based in Egypt, Brightskies works with solutions based on big data. It is a good example of a company that has successfully chosen a specialisation within the big data sector. Brightskies specialises in solutions for the automotive industry, and it has even managed to build a local sales office in Germany. It is also a good example of a tech company that embraces sustainability. The Brightskies website includes its code of conduct with regard to both the environmental side and the social side of sustainability.

Automation will impact many aspects of your business

Automation tools for managing big data are constantly improving. This can have both positive and negative implications for big data service providers like you. This development will have an impact on your way of working, your employees and your costs.

New and innovative automation technologies that run on big data (e.g. AI and ML) are continuously changing the market for big data services. Most solutions make the handling and management of large-scale data collected from various sources easier, and thus less expensive. These tools improve both the speed and accuracy of analytics, thereby decreasing the need for human involvement.

Buyers want more than raw data; they want insights that they can use to make decisions. Traditional big data services involve collecting, storing and processing large volumes of data. If you integrate big data into your business, you will be able to offer advanced analytics and predictive modelling, enabling your clients to extract valuable insights from data more efficiently.

Automation in big data technology will mean less manual labour, faster processing of data and lower prices for your services. If your competitor is working with tools that make data processing faster or easier, they can put you out of business. It is therefore important to stay on top of new developments in the sector.

Tip:

- Do not limit yourself to data processing. Become an added-value provider, and embrace technology that enhances automation. Invest in your staff. Companies that do not empower their employees to be more efficient and productive with automation and self-service are likely to lose talent. Good employees want to work for organisations at the forefront of technological innovation. They will be drawn to companies that embrace intelligent automation, as these organisations will free them from many manual tasks and allow them to take on increasingly strategic activities.

Buyers are looking for companies that can tell stories with the data

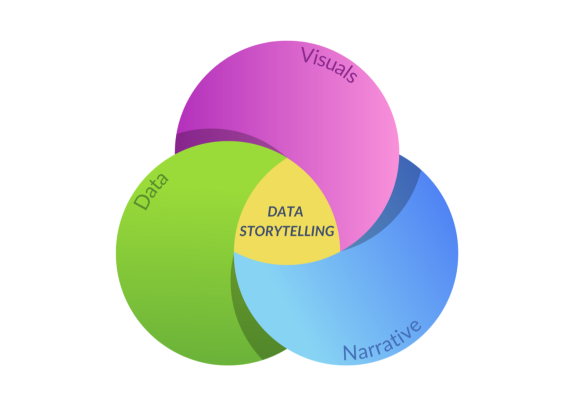

Buyers are increasingly looking for suppliers who can make them understand their own data. One useful tool in this regard is data storytelling, which combines data with visuals and narrative (see Figure 3). It can help readers understand what the data are telling them. Good data storytelling will attract potential readers easily and hold their attention.

From 2015 to 2025, the world is expected to see a 16-fold increase in data. In theory, more data will mean more insights to uncover. Unfortunately, it will also mean more noise. It is becoming harder to collect the right data to get the results and insights you are looking for.

Figure 3: Storytelling in big data

Source: Globally Cool

*A narrative is a spoken or written account of connected events; a story.

Good data storytelling goes beyond making a chart. It involves explaining what it means, why it is important and how it fits into the broader context. Many tools are available on the internet to help you visualise the data. Many of these tools are free to use or require only a small fee for an upgraded version.

Offering big data storytelling services will make you an added-value service provider. Even though your current or potential buyers might not yet want to buy storytelling services, offering them can make you stand out from competition. It demonstrates that you are aware of the future of the big data business.

How to get started

Learn to work with applications that help you visualise your data and use the visualisation to tell a story. Examples include:

- Colour selection: Adobe Color CC, Paletton, Colors on the Web

- Visualisation selection: Data Viz Project, From Data to Viz, Storytelling With Data

Beginner friendly: Infogram, Piktochart, Venngage

Tips:

- Read more about data storytelling in this nicely designed overview, which provides details on how to be a great data storyteller. The overview itself is a fine example of data storytelling.

- Read our study about trends in the European IT outsourcing market to see which trends are having an impact on IT outsourcing in Europe.

Globally Cool B.V. carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research