Entering the European market for retail tech services

On the European market you need to comply with mandatory requirements and additional requirements that buyers may have. European service providers and intermediaries are your most realistic market entry channels. As competition is strong, you should differentiate on quality rather than purely on costs. Specialising is also a good way to reduce the competition you face.

Contents of this page

- What requirements and certifications must retail tech services comply with to be allowed on the European market?

- Through what channels can you get retail tech services on the European market?

- What competition do you face on the European retail tech services outsourcing market?

- What are the prices for retail tech services?

1. What requirements and certifications must retail tech services comply with to be allowed on the European market?

On the European market for retail tech services, requirements vary per type of use, per technique and even per country. New legislation is always in the making. In addition, as most retail tech solutions fall in the software development category, we recommend that you read our study about entering the European market for software development service.

As it would be impossible to list (or to know) all possible requirements, this section discusses the most common requirements. For more information, see our study about the requirements outsourcing services must comply with on the European market.

What are mandatory requirements?

Legal requirements

There are different rules you have to follow:

- Rules concerning copyright (in the Directive on the legal protection of computer programs),

- Privacy protection rules (in the General Data Protection Regulation under the GDPR and the ePrivacy Directive).

If you do not follow these rules, this will have consequences. The fact that you are located outside of the European Union does not mean that you will escape these consequences.

We advise you to check the exact rules that apply in your European target market. On the ePing website you can find an overview of country-specific measures that affect trade and which differ from the international standards.

On the ePing website you can also find the contact persons per country that have been appointed by the World Trade Organisation (WTO).

You can subscribe to receive e-Ping alerts that might be relevant for your product or service.

There is also specific legislation for the retail sector; however when it comes to retail tech, most legislation you have to deal with is aimed at the techniques you use for your retail tech solutions (like Artificial Intelligence), or the purpose of your solutions (like cyber security solutions or payment).

Tips:

- Pay attention to copyright and infringement (the act of breaching or disobeying copyright law or clauses) in the contracts you sign with European buyers.

- If you handle personal data, study the GDPR’s new European data protection rules and principles, for a good understanding of what is allowed and what is not. For software development-specific GDPR information, check the seven-step guide to GDPR-compliant software development. Be aware of what data you store and where, to be able to comply with potential consumer requests.

- Use IDC’s GDPR Readiness Assessment to determine how compliant you are and what you may need to improve.

- Set up clear consent request forms and privacy policies that inform customers how you process their personal data. Check the GDPR consent guidance from the British Information Commissioner’s Office (ICO) and Econsultancy’s GDPR: How to create best practice privacy notices. Keep records of the consent you have obtained from data subjects. For more information, see the ICO’s advice on how to record consent.

- Read more about digital privacy on the website of the European Commission. Here you can also find the latest information on the reforms of the European ePrivacy rules.

Tips:

- Make sure you have effective security processes and systems in place, from business continuity and disaster recovery to virus protection.

- Ask your buyer to what extent they require you to implement a security management system like the ISO 27001 standard.

- Consider obtaining the ISO/IEC 27701:2019 certification. To do so, you will need to either have an existing ISO 27001 certification or implement ISO 27001 and ISO 27701 together as a single implementation audit.

What additional requirements do buyers often have?

European buyers of retail tech solutions often have additional requirements, which mostly concern security, quality and corporate social responsibility (CSR).

Security

Non-legal requirements mainly concern security. Although you are not obliged to comply with such requirements by law, they are considered minimum requirements to enter the European market.

Data security is one of the main challenges for providers of IT outsourcing (ITO) and business process outsourcing (BPO) services. This includes both data protection and recovery systems. Many European buyers expect you to implement an information security and management system, especially in industries where security is essential, such as finance and banking, healthcare or mobile applications. Although there is no specific legislation on this, the ISO 27000-series contains common standards and guidelines for information security.

Quality management systems

Some European buyers only do business with companies that have a quality management system in place. Although it does not automatically guarantee good-quality retail tech solutions, it proves that you have a repeatable process, and you are a serious company that values standardisation.

Acknowledged and common systems are ISO 9001:2015and the Capability Maturity Model Integration. Other ISO standards that apply to retail tech services are ISO/IEC 9126, ISO/IEC 9241-11, ISO/IEC 25000:2005 and ISO/IEC 12119.

Tips:

- If you (aim to) specialise in particular sectors, find out which certifications are relevant. When considering a particular quality certification, ask yourself three questions before working out the details: is it good for my company? Is it good for my clients? Does it have marketing value?

- Check if you can apply for financial support to achieve quality certification. Contact your national IT association (such as TAG Georgia or BPESA in South Africa) or a business support organisation in your country responsible for (IT) export promotion.

- Look at ISO/IEC/IEEE 90003:2018 for a guideline (checklist) on how to apply ISO 9001:2005 for software development. Also check out which other ISO certification might apply to your service. For example, ISO developed guidelines for developing VR and AR based education and training systems.

- If you offer VR or AR solutions for the retail sector, also read our study about entering the market for VR and AR solutions in Europe.

Corporate Social Responsibility

Corporate Social Responsibility (CSR) refers to companies taking responsibility for their impact on the world. Not only in the products or services they offer, but also when it comes to:

- consumer rights

- education and training of staff

- human rights

- health

- innovation

- the environment

- working conditions

The importance of CSR to the IT outsourcing (ITO) industry is debated, as the impact of small companies in this industry is often marginal.

Documented CSR policy

CSR is becoming particularly important to large companies and governments in Northern and Western Europe. Many European companies involve their suppliers in their CSR policies. Having a well-documented CSR policy may give you a competitive advantage over companies without one. The ISO 26000 standard provides guidance on CSR. For small software companies, the most relevant and practical aspects of this standard are labour practices, fair operating practices and community involvement.

Impact sourcing destination

You can also match the CSR policy of your potential buyer by becoming an impact sourcing destination. This is a relatively new term and refers to a sourcing model that aims to improve the lives of people, families and communities through meaningful employment in ITO and BPO. This can be achieved either through outsourcing or by setting up remote or virtual teams using digital technology. Impact sourcing has good potential for companies that wish to make their business more socially responsible (buyers and sellers of cyber security solutions). And it can be a unique selling point (USP) for your business.

Fair trade software

Another example of how CSR initiatives extend to small IT businesses is fair trade software. It means software that is developed for better prices, under decent working conditions, supporting local sustainability and with fair terms of trade. In essence, fair trade software is a part of impact sourcing. Impact sourcing has a wider reach than fair trade software.

Tips:

- Clearly communicate your commitment to CSR in your marketing activities. Also, show that you care about your impact on society and the environment by implementing your own CSR policy.

- Consider profiling yourself as an impact sourcing provider or a fair trade software developer. See if you meet the requirements for impact sourcing supplier. For more information about fair trade software, see the Fair Trade Software Foundation and Web Essentials’ video on what fair-trade software development actually means.

- Consult the ITC Sustainability Map for a full overview of certification schemes addressing sustainability in the outsourcing sector.

Up to date knowledge and skills

The retail sector is very sensitive to trends. As a retail tech service provider, you have to stay on top of the developments in the market. European buyers expect you to work with the latest technology, it is very important to stay informed about the latest technologies, platforms, frameworks and innovations, and to keep your skills up to date.

European buyers may expect you to work according to the Agile concept. This is based on the Agile Manifesto, representing the ability to respond to change. It focuses on how people work together, letting solutions evolve through collaboration between self-organising and cross-functional teams. Agile software development advocates adaptive planning, visualisation, evolutionary development, early delivery and continual improvement. With about 56% of companies using Agile methodologies using Scrum, this is the most widely used Agile framework.

Tips:

- Stay on top of the latest trends in both retail tech solutions and the possibilities software you develop for this segment can offer. Learn about Agile methodologies, via the annual State of Agile report. Familiarise yourself with Scrum, for example via a high-quality training programme and/or apply for an internationally accepted personal Scrum certification.

- Provide references, testimonials and examples of recent work, preferably on your website, as European companies often require proof of your technical skills.

- Make sure your website has an extensive QA service portfolio. It should present a wide range of retail tech solutions and/or services and address a variety of methodologies and platforms.

2. Through what channels can you get retail tech services on the European market?

How is the end market segmented?

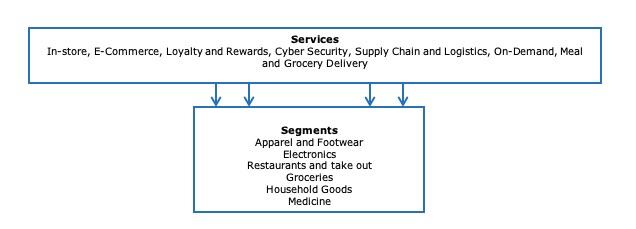

The market for retail tech can be divided into seven (horizontal) segments, see figure 1. Below, we highlight a few segments and current developments (source: State of Retail Tech Q1’21 Report by CBInsights).

In-store segment

Examples of retail tech solutions for the in-store segment are: self-checkout, smart mirrors, inventory management and tech solutions for human resource management. One of the fastest growing retail tech segments is self-checkout services in brick-and-mortar stores. As much as 72% of consumers said that accelerated checkout is their favourite retail invention. However, traditional cash registers are not expected to disappear from shops entirely within the next ten years.

Generally speaking, brick-and-mortar retailers that want to survive the storm currently raging through the retail market need to invest in tech solutions for their companies.

E-commerce

The e-commerce segment was the segment with the biggest retail tech investments in in 2020, both in response to the COVID-19 pandemic and as part of a long-term trend that will continue. To keep up with the expectations of online shoppers, most investments in e-commerce are spent on offering personalised shopping experiences.

Supply chain and logistics

Retailers and brands remain focussed on tech solutions that will strengthen and streamline their supply chains. Examples include on-demand warehousing and micro-fulfilment. Investment in this segment doubled from 2019 to 2020 (worldwide).

On-demand delivery

On-demand delivery is also growing. Deals in this segment went up 9% from 2020 to 2021. As consumers continue to expect fast order fulfilment, platforms that connect brands and retailers to local delivery carriers are most popular for investments. Here, opportunities for retail tech providers lie in offering solutions for these platforms, and targeting local European delivery carriers and retailers and brands that work with this on-demand delivery model, because this segment is growing fast.

Meal and grocery delivery

This segment has grown explosively during the lockdowns and the pandemic as a whole. However, it is not the segment that is expected to achieve the biggest growth in the coming years.

Figure 1: Horizontal and vertical market segments in retail tech that have the best opportunities for retail tech service providers

Tips:

- Monitor developments within the European retail tech market that are relevant for your company by conducting Google searches that combine your product with a particular niche market.

- If your retail tech service area is a more of a commodity market, you should focus on a niche market. Your best option is to can find a niche market that is underserved with software or has the room/need for digital innovation/transformation.

Through what channels do retail tech services end up on the end market?

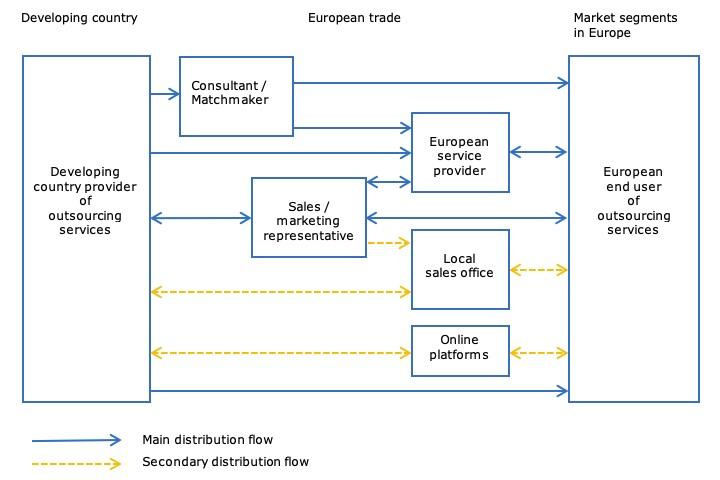

You can use several trade channels to enter the European market. Figure 2 provides an overview of that trade structure. This structure is more or less the same in every European country.

Figure 2: Trade structure for outsourcing retail tech services in the European market

What is the most interesting channel for you?

The most common and the most promising market entry channel for you is working in a team with European retail tech service providers.

Selecting a channel depends on:

- your type of company;

- the nature of your product or service;

- your target market;

- the available resources for market entry.

Regardless of the channel you choose, your own marketing and promotion is a vital part of your market entry strategy, and you are responsible for it.

Software development for retail tech is a trust business. Most deals are be closed on the basis of word-of-mouth recommendation by companies and people.

Subcontracting by European service providers

Subcontracting for European service providers is generally your most realistic market entry channel. A European service provider that is similar to your company would be your most suitable subcontractor. Ideally, this company designs, develops, markets, sells and maintains its own retail tech (software) products and offers retail tech services similar to yours. For retail tech services, a European service provider is usually an Independent Software Vendor (ISV) in the target country.

The relationship between an ISV and a subcontracted supplier is generally characterised by:

- trust;

- interdependence;

- a structured relationship (functions, tasks, communication and procedures);

- potentially limited marketing visibility and market access opportunities for the subcontracted supplier;

- no intellectual property (IP) rights, or a loss of IP rights for the subcontracted supplier;

- work orders on an if/when necessary basis.

You can find a European service provider directly or by working together with a matchmaker and/or a sales representative. Because many European companies prefer to deal with a local contact person, an intermediary is a good option.

Tips:

- Attend relevant industry events in your target country to meet potential partners. For example, events that are aimed at the retail sector like EuroShop, (Europe’s leading retail trade fair) or Retail Expo. But also trade fairs that are targeted towards the technical solutions you offer, like events aimed at VR/AR solutions or software development. Or specific retail tech trade fairs like FUTR. Keep in mind that most events for 2021 will be online events.

- Use industry associations to find potential customers in Europe, such as the European XR association EuroXR, and IT associations like Bitkom in Germany, NLdigital or and Nederland ICT in the Netherlands, and techUK and BIMA in the United Kingdom.

- Use outsourcing associations to find potential customers in Europe. For example, the Global Sourcing Association (GSA) in the United Kingdom, Outsourcing Verband in Germany and Sourcing Nederland in the Netherlands. The GSA has also launched a Partner Platform. It is the first open platform that publishes and ranks the performance of service providers. This platform allows you to promote your profile to a huge audience of potential customers.

Consultant/matchmaker

A consultant/matchmaker is a person or a company with a large number of relevant contacts in a specific market segment or industry. As an intermediary, they are a “door opener” and not an agent who makes cold calls or sends cold emails.

Make sure you properly inform your consultant/matchmaker about your company. They speak with many potential customers and are often involved in creating long lists of potential outsourcing providers. The more information they have on your company and the better they understand your capabilities, the more they can spread the word about you.

If you work with a consultant/matchmaker:

- the consultant/matchmaker makes appointments with prospects for you;

- the presentation and sales process remains in your own hands;

- you pay a retainer and success fee (which can be expensive);

- the consultant/matchmaker usually has multiple clients;

- you need to set clear expectations and objectives to measure their performance.

A retainer and success fee structure can be expensive. While the success fee depends on what the intermediary has delivered, you have to pay the retainer (usually a fixed monthly payment) regardless of their performance. Together, the retainer and success fee should provide a strong incentive for the intermediary to deliver: the retainer should be high enough to cover some of the costs, but low enough to encourage delivery. A proper contract, drafted by a lawyer, is a must!

You also need to determine an exit strategy in the contract, with a clearly defined period after which the contract can be terminated without any further consequences. This period is usually not longer than three or four months, after which the contract will be evaluated and can be terminated or extended. You should set clearly defined deliverables and targets which the consultant/matchmaker has to meet within this period (such as the number of relevant contacts, meetings and leads delivered). You could also negotiate a trial period.

Tips:

- When contracting an intermediary, involve a good lawyer who knows the applicable law of the country where the intermediary resides and has previous experience with this type of contracting. Pay special attention to exit clauses, success criteria, deliverables and payment terms.

- Also consider the option of contacting headhunters to find the right retail tech project for you.

- If you think you meet the requirements to be an impact sourcing provider, look at the multiple options offered by consultants and matchmakers that specialise in impact sourcing. Examples can be found on the website of Impact Hub.

Sales/marketing representative

Another type of intermediary is a sales/marketing representative. These representatives are more involved in the sales process than consultants/matchmakers.

When working with a sales/marketing representative:

- the sales/marketing representative contacts prospects for you

- the sales/marketing representative also makes the sales and sometimes manages projects

- you pay a retainer and success fee (which can be expensive), or a fixed monthly fee

- the sales/marketing representative can have multiple clients or work exclusively for you

A good sales/marketing representative has a large, relevant network, so they do not make cold calls to bring in services for you. Their success fee is often a percentage of the projects they bring in. Your expenses will increase because you have to pay a sales/marketing representative, but you will be free to focus on your core business and search for other markets by yourself.

Tips:

- As with consultants/matchmakers, involve a good lawyer when contracting a sales/marketing representative and include exit clauses, success criteria, deliverables and payment terms.

- Be cautious when intermediaries (consultants/matchmakers or sales/marketing representatives) want to work solely based on a success fee, as this means they are either excellent at their job, or they are desperate and may not (be able to) deliver. Also be cautious when intermediaries want to work for you part-time besides their regular job, because they will often be so busy that they do not deliver.

Local sales office

Ideally, you should establish a local sales office in your European target market. A local presence makes it easier to build up long-term relationships with customers through personal contact. It also increases your credibility, builds trust and allows you to retain complete control over your marketing and sales activities. However, this is very difficult in practice, as it requires a lot of experience and large investments. Most companies in developing countries are simply too small and do not have the financial strength for this. And it is only viable if there is a verified market for your services.

Tips:

- Be aware that establishing a local sales office will be very costly and you will need to have a strong financial position.

- Consider establishing your own office if you already have an established client base in the target country/region, or if you have a sound estimate of the demand for your services/products. If you decide to establish an office, involve your sales/marketing representative.

- Look for alternatives to lower your costs, such as business incubators or government incentives to bring your business to a particular country or region.

Direct sales and online marketplaces

You can also try to sell your retail tech services directly to European end user companies. Many European companies are looking for cost savings and delivery capabilities, which developing countries can often provide. This is one of your unique selling points.

Electronic marketplaces are a cheap marketing tool that may make direct sales easier. They also make it easier to find companies to work with as a subcontractor, possibly as an independent consultant (someone from your team could do that) or as a subcontracting team. These platforms used to focus on freelancers, but they are now increasingly suitable for SMEs.

In addition to using online marketplaces, you can decide to do your direct sales on your own, but that requires having experience in the European market. This strategy is most suitable to relatively large service providers that want to target large European end users. Your best bet is to focus on a small, underserved niche market.

For most suppliers from developing countries, it is very challenging to sell finance and accounting services directly. Sometimes, they work together to make a direct sales offer. Having one or more existing customers in Europe will help, as references are a must when you want to enter this market through direct sales.

Tips:

- There are platforms that specialise in SMEs, like Appfutura and Talent Alpha, there are platforms that specialise in freelancers, and platforms for both. Some examples are UpWork, Freelancer, Fiverr, ITeXchange, Clutch, and pliXos. As a provider, you can usually join these types of platforms for free. For more information on online marketplaces, please read our news item about Open Talent Platforms.

- Combine offline and online promotion channels to develop as many contacts as possible. This maximises your chances of finding suitable partners/customers. Use (professional) social media platforms as a marketing tool to reach potential customers. LinkedIn can be particularly useful for making initial contacts and conducting market research.

- Have a professional, high-quality company website, where you provide comprehensive, accurate and up-to-date details of your offering at low cost. Make it compatible with mobile devices and invest in Search Engine Marketing and Search Engine Optimisation, so potential customers can easily find you online.

3. What competition do you face on the European retail tech services outsourcing market?

Which countries are you competing with?

India, Poland, Egypt, Romania, Czechia and the Ukraine can be considered your strongest competition. This selection is based on their location, their ITO industry and the Global Services Location Index (GSLI).

The Global Services Location Index ranks ITO/BPO destinations by competitiveness across four categories: financial attractiveness, people skills and availability, business environment, and digital resonance. The selection criteria for the GSLI are weighted as follows: digital resonance 60%, business environment 20%, financial attractiveness 10%, and people and skills 10%.

In general, European companies prefer to outsource services to providers within the same country (also known as domestic outsourcing or onshore outsourcing). For more information on nearshoring versus offshoring, see our study on the European market potential for retail tech services.

The Global Services Location Index (GSLI) ranks the competitiveness of ITO/BPO destinations based on 4 categories: financial attractiveness, people skills and availability, business environment and digital resonance. For retail tech services, we have selected six countries that can be considered your strongest competition. The GSLI weighs the following selection criteria: digital resonance 60%, business environment 20% financial attractiveness 10%, and people and skills 10%.

India

India is expected to have the largest software developer population in the world by 2024. The country continues to lead the GSLI. This mainly due to the country’s combination of excellent English language skills and low-cost services, because when it comes to digital resonance, India is only in 17th place. Although the rates for senior software developers in India are moving towards Eastern European levels, rates in Asia are among the lowest in the world at €15 (for junior developers) to €34 per hour.

Example: do not only compete on price

India was one of the countries that successfully catered to the initial surge in demand for ITO and BPO, and continues to rely on low-skilled workers who perform services that meet the traditional demand. However, with the current digital transformation, a gap has emerged between the demand for digitally savvy professionals and the skillset of the workforce being developed in India. This is reflected by the ranking of Indian professionals as the 35th best developers in the world, with a relatively modest score of 79%.

This illustrates that although offering competitive rates is important, you should not compete only on price. As relatively simple (and therefore cheap) tasks can be automated, your focus should be on excellent skills, knowledge and creativity, which have a higher value. Demonstrating your commitment to quality through references and quality management systems is key to building trust among potential European clients, especially when it comes to cyber security services.

Poland

Poland is a major player in software development outsourcing. As a Central and Eastern European (CEE) country, it benefits from European buyers’ preference for nearshore providers due to proximity, language, cultural similarities and relatively small time differences (if any). The country is home to about 25% of the developer population in the region, adding up to around 300,000 professional developers. These professionals rank as the number 3 best developers in the world with a score of 93%, which further adds to Poland’s popularity.

CEE developer rates are higher than in offshore destinations. However, these rates generally do not deter European buyers, as they are often prepared to pay for the benefits that nearshoring offers them. Poland currently ranks 14th in the GSLI, having climbed ten places, primarily due to its financial attractiveness and start-up activity. Polish people also score very high on English proficiency, making it relatively easy for European clients to communicate with them. This makes Poland a particularly strong competitor in your line of business.

However, as its software industry flourishes, Poland may increasingly need to turn to offshore partners to meet demand. With the highest hourly rates for software development in CEE (€34 to €47), Polish software companies can actually achieve significant cost savings by outsourcing some development tasks or projects to you. To learn more about Poland as an ITO or BPO destination, read the destination guide, issued by the German Outsourcing Association.

Egypt

Egypt is a strongly emerging African destination for software development offshoring. Its time zone (GMT+2) partly overlaps with Western and Northern Europe, eliminating the time differences generally associated with offshoring. The country ranks 15th in the GSLI, as its considerable investments in infrastructure and cybersecurity are boosting the country’s business environment performance.

Egypt is home to a large workforce that is highly skilled in IT and skilled in English, Arabic, French, German, and other European languages. With a score of 77%, the quality of Egyptian software developers is ranked 41st, placing them between India and China. As buyers become more familiar with the country as a sourcing destination, this rating could well improve. The hourly software development rates in Egypt are relatively low at €17 to €34, which is comparable to the average rates in Asia.

The country’s New Administrative Capital (called NAC in short) is designed as a Smart City using the Internet of Things and big data analytics, and is meant to create an Egyptian Silicon Valley. To learn more about Egypt as an ITO or BPO destination, reading the destination guide, issued by the German Outsourcing Association.

Romania

Romania is home to 120,000 software developers, which is the third largest CEE developer population, after Ukraine and Poland. The development of this industry is boosted by the presence of such global companies as Hewlett-Packard, Huawei, Ericsson, and Gameloft. It currently ranks 32nd on the GSLI.

Like Poland, Romania benefits from its location close to the main Northern and Western European markets. Romanian people are also highly proficient in English. The country offers software developers that are fluent in English and French, further facilitating business relationships with European clients.

The value of Romanian IT service exports is estimated at €4 billion in 2020. Its IT sector employs over 95,000 IT professionals. Around 32,500 graduates annually enter the market. Romanian software developers are ranked 23rd, scoring 87%. To learn more about Romania as an ITO or BPO destination by reading the destination guide, issued by the German Outsourcing Association.

Czechia

Czechia is opening up to be a subcontracting destination. It is already a well-known CEE destination for software development nearshoring, benefiting from its convenient location. The country ranks 34th in the GSLI and has a very good reputation among European software development companies. Czechia is among the top 20 countries that strongly invest in the development of the tech sector. Total funds in the industry make up 2% of the country’s GDP, surpassing tech giants like Canada and the United Kingdom.

There are more than 100,000 Czech software developers, who are rated as the number 6 highest quality in the world at just 0.3% behind Polish professionals. Czech people are also highly proficient in English. This makes Czech developers strong competitors in your line of business.

However, it is difficult for Czech companies to attract new employees. Many Czech companies with IT-vacancies struggled to fill these positions. Czechia has a higher than average percentage of firms struggling to fill IT vacancies since 2012, and since 2015 has ranked either first or second in the EU in this respect. This may drive Czech software companies towards subcontracting. As in Poland, the relatively high hourly rates for software development in Czechia (€29-€45) add to the attractiveness of offshoring for these companies.

Ukraine

Ukraine is home to nearly 200,000 software developers, which is the second largest CEE developer population after Poland. They are ranked as the number 5 best developers in the world, scoring just 0.2% less than Poland. The value of Ukrainian IT services export in 2019 was estimated at more than €2 billion. Ukraine was named the “Offshoring Destination of the Year” by the GSA in 2017. In 2020, the country’s exports of IT services increased by 15% compared to 2019, accounting for 16% of all services exported from Ukraine.

Ukraine ranks 42nd in the GSLI. Although Ukrainians generally have low English proficiency; most Ukrainian software developers actually have intermediate to upper-intermediate English language skills. Ukraine’s hourly developer rates are relatively low for a CEE country, comparable to rates in Asia. Combined with the highly rated quality of Ukrainian developers and the general benefits of a nearshoring destination, these relatively low costs make Ukraine an attractive destination for European buyers.

Tips:

- Specialise in specific vertical markets and/or niche market segments to avoid competition.

- Visit the websites of IT outsourcing associations, and particularly software development and/or retail (tech) associations, to get a better understanding of competing countries. Examples are the Central and Eastern European Outsourcing Association (CEEOA) and the Ghana Export Promotion Authority (GEPA).

Which companies are you competing with?

Examples of successful retail tech service providers from the abovementioned six countries are:

India

Thinkitive is a relatively new IT company in India, founded in 2015 and showing a year-on-year growth of 100%. They provide customised end-to-end solutions and services for various industries, including retail and e-commerce. Their website clearly describes the types of solutions, features and specifications they offer. It also provides client testimonials and highlights key aspects of the company’s approach. You can find more retail tech companies in India, and reviews of these companies, on the website of Clutch.

Poland

Sii Poland is the largest technology consulting, digital transformation, BPO and engineering service vendor in Poland. Among their focus sectors is the retail, logistics and consumer products industry. They employ over 5,000 people but struggle to keep employees at the company. They are investing in offering more training to keep their employees happy and enable them to grow. You can find more retail tech companies in Poland, and reviews of these companies, on the website of Clutch.

Egypt

Pharaoh Soft is an Egyptian retail tech provider founded in 2014. They mainly focus on e-commerce solutions. Their clients praise them for offering solutions they had not thought of themselves, for taking the whole process on board, and for not having to worry about details. They have won several awards and have national and international clients.

Romania

Fortech is a Romanian software development company. With 800 software engineers, Fortech is among the largest and fastest-growing software outsourcing companies in Central and Eastern Europe. The company provides various retail solutions, particularly in e-commerce. Fortech highlights its commitment to sustainability with dedicated webpages about their award-winning social purpose (CSR) and environmental policy. You can find more retail tech companies in Romania, and reviews of these companies, on the website of Clutch.

Czechia

Eurosoftware, a subsidiary of GK Software SE, is a Czech IT company focused on the retail sector. They are active in more than 60 countries worldwide, and their clients include companies such as Adidas, Douglas and Lidl. The company incorporates modern techniques such as VR/AR, artificial intelligence and machine learning in their (cloud-based) retail solutions. Their goal is to “become a leading provider of cloud solutions”. You can find more retail tech companies in Czechia, and reviews of these companies, on the website of Clutch.

Ukraine

Intellias provides custom software engineering services for global businesses, including retail solutions that use technologies such as artificial intelligence and IoT. Besides its headquarters in Lviv, the company has four locations in Ukraine and offices in Germany, Poland and Saudi Arabia. This gives them access to 1,700 in-house engineers, providing great scalability. The website displays video testimonials of satisfied clients and various certifications/awards. You can find more retail tech companies in the Ukraine, and reviews of these companies, on the website of Clutch.

Tips:

- Use the services of your national export promotion agency and actively participate in the creation of export strategies.

- Search company databases to find more competing companies. These databases can be free, like company.info, or paid databases provided through chambers of commerce (such as the Dutch Kamer van Koophandel), or commercial databases like Bold Data.

Which products are you competing with?

There is no product to compete with in the retail tech services industry, as the product is a service. So the real question is: What makes one service provider different from another? What helps you to stay competitive?

The answer is: technical knowledge, available capacity, references, domain knowledge, flexibility, scalability, reliability, communication and language capabilities, quality management, security infrastructure, vertical and/or horizontal market focus and niche market orientation, among other things. The location (country) of the service provider is also an important factor.

Tips:

- Invest in country branding. For more information on this topic, see our tips on doing business with European buyers.

- Find out how you can get a competitive advantage, based on factors such as quality, cost, technology or product characteristics. If you are in software development for the retail sector, you can study the annual Developer Skills Report for ideas. This includes the most popular programming languages and frameworks, the kind of frameworks hiring managers want versus the frameworks developers know (showing you where demand exceeds supply) and more.

4. What are the prices for retail tech services?

Added value and price are the two main reasons for European companies to outsource their retail tech solution development to developing countries. Price is a very important factor for general, more mainstream software development. Price is less important when you offer new or scarce solutions or if your solutions require developers that are scarce.

But because price remains important for most European companies, and staff salaries make up a large share of the costs of retail tech services, outsourcing to countries with lower wages can lead to considerable savings. For example, the average hourly salary of a software developer in Germany is €38.33 (excluding bonuses). In the Philippines, this is around €4.77 (also excluding bonuses). This can be one of your competitive advantages.

The price for retail tech services is also influenced by technological requirements, skill levels, complexity of the project, length of the contract and other requirements written in the Service Level Agreement (SLA). It is impossible to make a more exact price breakdown, because retail tech projects are so diverse that there is no single price breakdown that suits all (or even most) projects.

Your offer should include the price, with your hourly rates and an honest estimation of the number of hours you expect to work on the project. Choose a type of price model for your outsourcing contract. The most common price model for retail tech services is a Fixed-Price Contract. This is an all-inclusive offer, where clients are billed based on pre-defined milestones (laid down in the SLA).

For more information, see this paper on pricing models in outsourcing. Go beyond setting the right price and work out your pricing strategy. This could include your preferred pricing model (and your clients’ preferred pricing model), payment terms and expectations, and how and when you offer discounts.

Tips:

- Research the average salaries in your European target country. For example on Payscale, or compare the hourly rates of software developers around the world, including some information that compares the countries, on the website of Devox Software.

- Mention the potential salary savings, but also emphasise your good skills and added value.

This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with Laszlo Klucs.

Please review our market information disclaimer.

Search

Enter search terms to find market research