8 tips on how to organise your IT and IT- enabled services exports to Europe

While IT and IT-enabled services export to Europe is not ‘export’ in the traditional meaning of the word, there are several things to take into consideration when you start exporting your product or service. This document consists of eight tips to successfully get your product or service onto European market. Most tips focus on getting the necessary paperwork for exporting, but there are also tips on how to stand out from your competition.

This report mentions a few documents that are needed for exporting IT and IT-enabled services to Europe. It is important to keep in mind that these documents are normally prepared by a lawyer. While you might come across these documents, you do not have to be capable of drafting/writing them yourself. You should be aware of the basic terms and implications and get a lawyer to draft or check them.

Contents of this page

1. Get certified

Certification for outsourcing has not always been very important, but that has changed over the past 5 years. Certification shows you are reliable, follow important rules, and can provide high-quality services. European companies prefer to work with outsourcing partners who have the right certifications because it makes them trustworthy. Here are some reasons why European buyers are increasingly looking for certified providers: European buyers are increasingly concerned about safety issues. Examples of such issues are data security and privacy, cyber security threats, intellectual property protection and operational continuity. Complying with certain standards ensures a safer delivery model for the customer. Certification is also important for the following reasons:

- European legislation increasingly demands certification;

- European buyers are increasingly looking for environmentally and socially sustainable providers. Sustainability certification helps to identify them;

- European buyers look for high-quality suppliers. If you have certifications in the programming languages you master, for example, then you can stand out from the crowd and increase your chances of successfully exporting to Europe.

Examples of safety certifications are:

- CSSLP – Certified Secure Software Lifecycle Professional. SSLP certification shows you have the advanced technical skills and knowledge necessary for authentication, authorisation and auditing throughout the software development life cycle (SDLC);

- ISO/IEC 27001 - Information Security Management. This certification shows that a company keeps its information secure. This is very important for European buyers, especially ones that work with classified information and personal data like companies in the financial sector, government and healthcare.

Examples of legal certifications include:

- General Data Protection Regulation (GDPR). This certificate proves that your business is GDPR compliant. It is important because any entity (you) which collects or processes personal data from residents of the EU must be compliant with the GDPR;

- The European Green Deal legislation. Relevant regulations are the Corporate Sustainability Due Diligence Directive (CSDDD) and the Forced Labour Regulation.

Examples of sustainable certifications are:

- ISO 14001 - the internationally-recognised standard for environmental management systems (EMS). It provides a framework for you to design and implement an EMS, and continually improve your environmental performance. When you have this standard, you show your buyers you are taking preventative actions to minimise your environmental footprint, comply with relevant legal requirements, and achieve environmental goals;

- SA 8000 - an internationally-recognised certification standard for social responsibility;

- BSCI – Business Social Compliance Initiative. Amfori BSCI provides a Code of Conduct with a set of values and principles that help amfori members (you) improve their own policies and practices, in relation to child labour, fair wages and workplace safety standards.

Examples of certifications for quality standards are:

- ISO 9001 - Quality Management Systems. This certification proves that a company is committed to providing quality services consistently. It shows that the company meets customer needs effectively;

- ISO/IEC 20000 - an international standard for IT service management that specifies best practices for delivering high-quality IT services. Buyers are assured that you can effectively manage and improve IT services, aligning them with business needs and customer requirements;

- Capability Maturity Model Integration (CMMI) - CMMI helps companies improve their processes and deliver better products and services. This certification is good for showing that a company is committed to making its operations run smoother and more effectively;

- For specific sectors: ASPICE or ISO 26262 for software development in the automotive industry, HIPAA for the healthcare sector and TL 9000 for telecommunications;

- Certification in programming languages such as Python, JavaScript, Java, Swift, GO or SQL.

Some of these examples fall under more than one category.

Tips:

- When you are considering a particular quality certification, ask yourself three questions to find out if it is worth your time and financial investment: 1. Is it good for my company? 2. Is it good for my clients? 3. Does it have marketing value?

- If you (aim to) specialise in offering IT or IT-enabled services for particular sectors, find out which certifications are relevant.

- Check if there are resources available that might provide your company with financial support to achieve certification. Contact your national IT association (for example BPESA from South Africa, ICTAK from Kenya, ICTAU from Uganda, IIPGH from Ghana, or Itida from Egypt, or one of the business support organisations in your country responsible for (IT) export promotion.

- Read more on certifications for the IT and IT-enabled outsourcing services sector in the Buyer Requirements study.

2. Be prepared for a long sales cycle

When selling your IT or IT-enabled services to the European IT market, you should be ready for relatively long sales processes. The time between first contact and a signed contract is usually between eight and twelve months. This type of sales is also called ‘consultative sales’.

The process takes so long because it is a business based on trust. Buyers need to trust the provider before signing a contract. Moreover, European IT services buyers are usually quite cautious of selecting a service provider offshore. They will consider various risk factors such as business continuity, security, intellectual property protection, communication and references before even talking about the price.

As a provider, this means you may need to schedule multiple meetings or talks and make changes to your proposals to suit the specific needs of your clients. Knowing this and preparing for it is crucial if you want to succeed in Europe.

Figure 1: Sales funnel, from contacts to contracts

Source: Globally Cool

Tips:

- ITO and BPO is a trust business. This means the success and sustainability of the business relationship relies heavily on the level of trust between the service provider (you) and the buyer. It is very important that you meet face-to-face with your prospects and clients. Combine European trade event participation with meeting your clients as well as following up on any leads that you have already developed.

- Focus on building relationships. To shorten the sales cycle, truly connect with new leads and try to spark a relationship quickly. If you have a mutual acquaintance, ask for an introduction.

- Be clear about what you have to offer. Show your capabilities, provide your best references, client testimonials, proof of certification and best practices.

- Customise your range of products/services: know your clients’ needs or issues and offer them a customised solution.

- Be patient and keep in touch with your leads through the entire process; this makes it easier to make the sale when they are ready.

3. Make a memorandum of understanding

A Memorandum of Understanding (MoU) is an important document for establishing initial agreements between IT service providers and their clients. An MoU serves as the foundation for future formal agreements, outlining the expectations, scope, and responsibilities of both parties. This is especially useful in the IT and IT-enabled services sector, where projects can be complex and require thorough understanding before working towards more detailed contracts.

An MoU clarifies the key points of a potential partnership without being legally binding. It helps both parties understand what is expected before entering into a contract. For service providers like you, an MoU can specify the nature of services, project timelines, and key deliverables, and more. This early agreement can prevent misunderstandings and manage the expectations of both parties effectively.

An MoU is not legally binding. A service contract or Service Level Agreement (SLA) is legally binding.

Tips:

- Look at templates of MoUs to get an idea of how you want to shape your (future) MoU. You can include binding and non-binding provisions.

- Communicate to your (potential) client that you wish to draw up an MoU.

- Work with a lawyer in drafting the MoU.

- Plan for future arrangements. Mention how and when the MoU will transition into a formal contract.

4. Decide on your contract terms

Typically, a contract is a written agreement between two or more parties. It is enforceable by law. It outlines the products or services provided, duration, cost, resources, approach, and more.

The term ‘force majeure’ is a common clause, used to cover most extraordinary events or circumstances beyond the control of the parties, like a pandemic, natural disasters, or political unrest. It essentially frees both parties from liability or obligation.

There are different types of contracts, each with advantages and disadvantages. It is crucial for both parties to carefully negotiate and define the terms of the outsourcing contract to minimise risks and ensure a successful outsourcing relationship.

Here are four of the most common types of outsourcing contracts:

1. Time and Materials

This type of agreement compensates the service provider for their time (calculated based on the pre-set rate per hour of each employee) and materials used by the outsourcing company.

It is very important to understand the total cost involved when it comes to ownership and any potential adaptability before the collaboration begins.

2. Fixed Price

In this outsourcing contract, the client and the service provider decide on a consistent fixed price. You estimate the cost based on the task: the project's deadline and scope are both fixed at this price. This type of outsourcing contract can also function well when the customer wants to pay for each task independently under hybrid contracts, like ‘fixed price per iteration’.

3. Outcome-based pricing

Outcome-based pricing is where the two parties agree on an expected cost depending on the outcome. It can be incentive-based, risk-reward pricing and gainsharing. If the final price is less than the expected cost, savings will be divided equally between the two parties. Similarly, if the cost is higher than expected, the additional charge would be borne by both parties equally.

Tips:

- Have a well-written draft contract ready. Show this to your potential customers when they ask for it.

- Contracting terms are most often set by buyers. It can be difficult for outsourcing providers to set terms regarding flexibility. But you can negotiate the scope definition, what is in the scope and what not? Dedicate a chapter to change management. Are you able to put more or less people on a project if the project or the circumstances ask for it? Can you adapt to varying market dynamics or legal changes? Read more about how to adapt to change management.

- Get a good lawyer in the country where most of your clients are located. Drafting a contract is a specialisation. A good lawyer can also help you to negotiate with your clients.

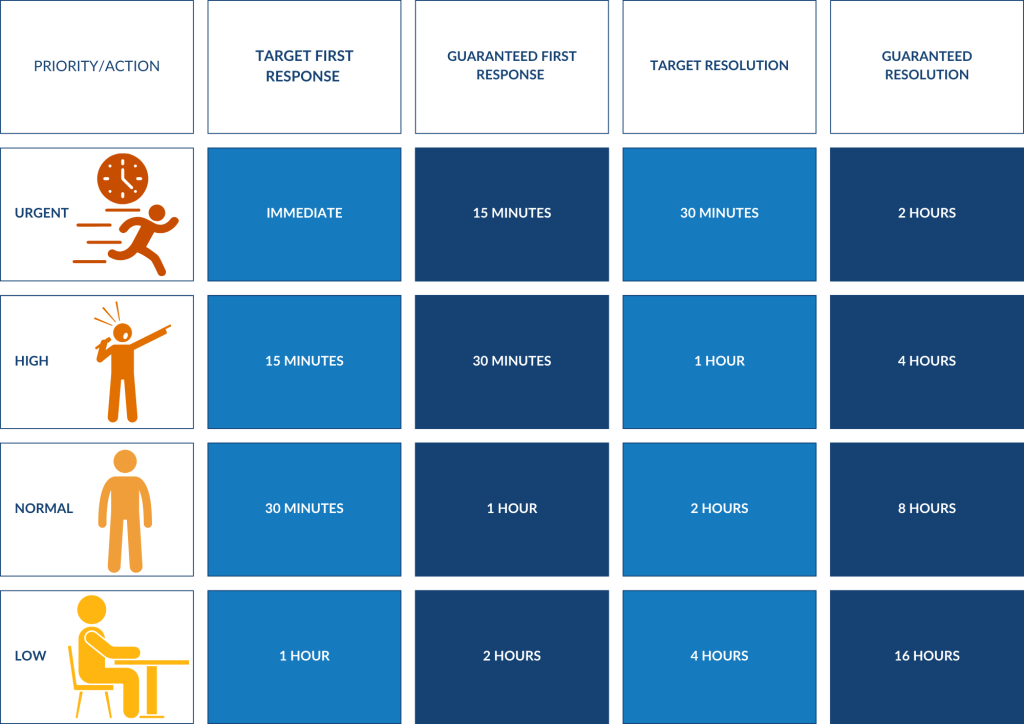

5. Include a Service Level Agreement

A Service Level Agreement (SLA) is part of the outsourcing contract. SLAs can include targets for response times, resolution times, quality levels, availability, and other relevant parameters.

SLAs set clear and measurable guidelines for the partnership. It ensures you are on the same page from the start. It also provides compensation in case the obligations written in the contract are not met. It can protect your business and provides clarity. The reason companies choose to write up an SLA is because you can revise an SLA without having to revise the contract. The contract can just refer to the agreed SLA.

Figure 2: Example of standard operating targets

Source: Globally Cool based on a figure by Gather.tech

There are three types of SLAs: Service-based, Customer-based and Multi-level or Hierarchical SLAs.

Service-based SLA: covers one service for all customers. In case you provide customer contact services for many customers, this type of SLA, the service level for the customer will be the same for all customers that will be using these services.

Customer-based SLA: an agreement with one customer that covers all the services used by this customer. It is like your contract with your telecom operator. You use voice services, SMS services, data services, all from the same telecom operator. Similar to this, you as an IT service provider, provide several services for a business and the customers, and if all the service levels are documented in one service level agreement for the provided services, it will be a customer-based SLA.

Multi-level or Hierarchical SLA: this agreement focuses on the organisation of the customer. It discusses all services you offer and their relationship with other (subordinate) services. This type of SLA is particularly useful in situations where multiple parties are involved and where services need to be tailored to the specific needs of different user groups or organisations.

Tips:

- Have a well-written draft SLA at your disposal. Show this to your potential customers when negotiations reach this point and your client requests it. Many sample SLA contracts can be found online, for example at SampleForms, Template.net or Techdonut.

- Make sure the consequences for failing to meet SLAs, such as financial penalties or service credits, are clearly stated.

- Make background checks on your (potential) clients before you sign any contract. A lawyer can help you with this process as well.

6. International Payment

In IT and IT-enabled services outsourcing, there are usually no export documents involved because there are no physical products involved. Payment issues primarily occur in international payment and depend on how local banks in supplier countries handle these types of payment. Possible issues include: whether or not international money transfers are permitted, the ability to transfer funds in different currencies, bank commissions, exchange rates, transaction completion times, and potential delays due to regulatory compliance checks.

Preferred payment methods vary by country, so it is important to understand what is best for each market you want or plan to do business with. For example; in the Netherlands, credit cards are far less popular than debit cards. Therefore 60 percent of payments are made by direct debit (an arrangement made with a bank that allows a third party to transfer money from a person's account on agreed dates, typically in order to pay bills) and in Germany 46 percent of payments are done by online bank transfer. However, most European companies, also in the Netherlands and Germany, prefer to work with a wire transfer (electronic funds transfer from one bank account to another, or through a transfer of cash at a cash office) as this is one of the more secure ways to receive payment internationally.

Tips:

- Investigate international payment before you sign the contract. You can read this factsheet about International Payments from developing countries. The ability to offer smooth international payment transactions provides you with a competitive advantage. Make sure you carefully select the right bank for your (international) business.

- Try to negotiate short-term transactions (moment between delivery and payment between zero to twelve months).

- Ask advice from your bank or Chamber of Commerce to understand the methods of payments better. You can also purchase several guides and practical documents on trade finance from the International Chamber of Commerce (ICC). Alternatively you can enrol in ICC’s online training on trade finance.

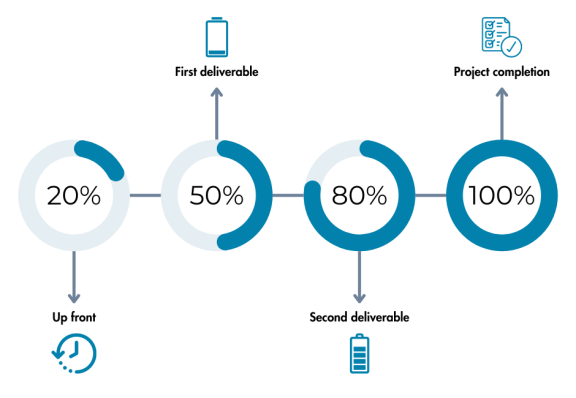

7. Payment terms

Payment terms vary from buyer to buyer and are related to the volume and value of the project, the type of partner, whether or not there is an agent in between, and what delivery terms apply. The most commonly used payment schedule in the IT and IT-enabled services outsourcing sector is payment by instalment.

Payment by instalment means that projects are paid for in fixed instalments, for example in the following way: 20 percent up front, then 30 percent after delivering a certain part of the project (milestones), another 30 percent after finishing the second deliverable and the last 20 percent at project completion.

Related to this topic are possible penalties that might affect or lower payments, or rewards that are linked to certain Key Performance Indicators (KPIs). Conditions for payment should be discussed in your Service Level Agreement.

Figure 3: Example of payment by instalment in the Software Development Life Cycle

Source: Globally Cool

In general, the payment term will be 30 or 60 days after receipt of the goods or date of invoice. Occasionally a deposit or advance payment can be agreed upon. This happens for example in case of Fairtrade business relations. However, it can all vary greatly depending on the project and country.

When, for some reason, your work is delayed and you cannot meet the deadlines in the contract, it is very important to keep communicating. Let your buyer know you are having trouble meeting the deadline and how you are planning to deliver. Also, in case of larger disruptions, such as extreme weather, political unrest or a pandemic, communication is key. Do not fall silent.

If payment terms are not covered in the contract, you can refer to European Directive 2011/7/EU. This Directive protects SMEs against late payment. Although in principle it does not apply to companies outside the European Union, you can use these terms as covered in the Directive as a guideline:

- If no payment term is agreed to in the contract (or General Terms & Conditions), 30 calendar days after receipt of the invoice;

- If date of receipt of invoice is not determined, then 30 calendar days after receipt of goods and/or services;

- If the invoice is received before the goods and or services, then 30 calendar days after receipt of the goods and or services;

- If a verification or acceptance procedure is agreed to with regard to conformity, then 30 calendar days after the date that procedure is completed. A verification or acceptance procedure may not take longer than 30 calendar days;

- Payment terms in Europe that are set in a contract are not allowed to take any longer than 60 calendar days unless otherwise expressly agreed.

Tips:

- If payment is done in instalments, try to negotiate the highest possible instalments (amount) as early as possible in the project.

- When facing delayed payments from your client, remember that the jurisdiction typically lies within the client’s country, not yours. Going to court can be very costly and may not be worth the expense. Carefully assess whether pursuing legal action is worth it before taking this step.

- Carefully study the payment terms offered by your (potential) buyer, especially the number of days for deferred payment. European businesses normally expect payment terms of 30 days or more. If this does not suit you, try to negotiate a different term. Always include the payment term in your negotiation in relation to the price, where an advance payment can justify a lower price. On the other hand, a long credit period can justify a higher price.

- Study the Directive 2011/7/EU regarding payment terms and late payment regulations in case payment terms are not covered in the contract.

8. Seek support from organisations

Make use of support offered by relevant government bodies and private sector organisations in your European target markets. They may be able to help you successfully organise your export. They may offer export promotion programmes, access to industry groups, sector knowledge and other export-related information. Even if they do not employ the kind of person you are looking for (for example a lawyer), they will most certainly know trustworthy people in their network they can refer you to.

Examples of support organisations are:

European government organisations

- CBI – the Centre for the Promotion of Imports from Developing Countries is a Dutch governmental agency that assists exporters in developing countries who want to enter European markets for export. They offer coaching, trade fair visits, training and market studies to help exporters access European and regional markets.

- Deutsche Gesellschaft für Zusammenarbeit (GIZ) – GIZ implements IT outsourcing projects in various countries such as Ghana, Morocco and South Africa.

- IPD – the Import Promotion Desk helps importers and tour operators find overseas business partners, opening up new supply sources for them in selected developing countries and emerging markets. The IPD facilitates access to the EU market for small and medium-sized enterprises (SMEs) in the partner countries.

- SIPPO – the Swiss Import Promotion Programme’s overall objective is to integrate developing and transitioning countries into global trade by advising and supporting business support organisations.

European non-government organisations

- International Trade Centre (ITC) - a development trade agency that provides publications such as How to Access Trade Finance, Model Contracts for Small Firms and ITC’s SME Trade Academy provides online courses (some are free of charge). Together with CBI, ITC implements the Netherlands Trust Fund (NTF V) programme which runs from July 2021 until June 2025. Its ambition is to support Micro, Small and Medium Enterprises (MSMEs) and their ecosystems in the digital technologies and agribusiness sectors, linking both for the purpose of synergising and business opportunities. The programme covers both sectors in Ethiopia, Ghana, Senegal, and the digital technologies sectors in Benin, Côte D’Ivoire, Mali and Uganda. ITC has also initiated the #FastTrackTech Africa Initiative. Since 2022 the project has been powered by ITC’s Switch On initiative/Moonshot.

- Deutscher Outsourcing Verband - an independent member organisation supporting ICT sectors in Germany and elsewhere.

- Global Sourcing Association – outsourcing industry association that is based in the UK. They provide resources in the form of online and offline events, webinars, and different kinds of research.

- Enterprise Europe Network - large support network for small and medium-sized enterprises (SMEs) with international ambitions.

Figure 4: Logos of different support organisations

Source: corresponding websites of the support organisations, 2024

Tips:

- Do not forget to look at support organisations in your own country or region. For example GEPA in Ghana or the Nigerian Investment Promotion Commission.

- Your own chamber of commerce and industry can provide you with advice and information on how to organise your exports. They usually have staff specialised in dealing with certain issues such as certificates of origin, trade agreements and legal issues.

- Use the European Union’s import and export page and their Access2Markets platform to find extensive information on import regulations and taxes in the European Union. For specific information on selling services to the UK, check out the website of the UK government’s Department of International Trade.

Read our additional studies regarding IT and IT-enabled services outsourcing

- Tips for Doing Business with European Buyers – to find tips for doing business with European buyers in the outsourcing services sector.

- Tips for Buyer Requirements - needed to export your products and services to Europe.

- Tips for Finding buyers – to find tips for finding buyers for your products and services.

Globally Cool B.V. carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research