Entering the European market for cardamom

Accessing the European market requires compliance with strict regulations on contamination, pesticide residues, heavy metals and additives. Supply chain transparency is also increasingly important, due to rising concerns about food fraud. While Guatemala and India dominate European cardamom imports, suppliers from other countries can stand out by emphasising unique origins and sustainability. High-quality and certified cardamom presents valuable opportunities, especially in niche markets.

Contents of this page

1. What requirements and certifications must cardamom comply with to be allowed on the European market?

To enter the European market, you must comply with several mandatory (legal) requirements. Buyers often have additional requirements and may ask for certifications. In Europe, mandatory requirements for cardamom centre on consumer health and safety. Sustainability requirements are also becoming increasingly important.

What are the mandatory requirements?

Most mandatory requirements for the import of cardamom are related to food safety. The European Commission for Health and Food Safety is responsible for European Union policy and for monitoring the implementation of related laws.

Official food controls

Cardamom undergoes official food inspections when imported into the European Union (EU). Non-compliance with European food laws is reported through the Rapid Alert System for Food and Feed (RASFF). Since 2021, there have been 16 issues related to cardamom. Most concerned pesticide residues in cardamom from India.

If imports from a specific country repeatedly violate European food legislation, the frequency of official checks at the border goes up. For cardamom, India is the only country currently subject to more frequent checks.

Rules for Indian cardamom are very strict and apply to all Indian goods, regardless of origin, containing a mix of produce where 20% of the quantity is cardamom. They also apply if the cardamom itself is not of Indian origin but other ingredients are.

Tip:

- Search the RASFF database for examples of product withdrawals from the European market. You can find common issues that have led to withdrawals in Europe in the past. This information can help you strengthen your quality control and compliance efforts and so reduce the risk of rejections. By proactively addressing these issues, you can build trust with buyers and avoid costly disruptions.

Contaminant control

Food contaminants are substances not added to food intentionally. Cardamom may be contaminated during various stages of production, packaging, transport or holding, or due to environmental contamination. Contaminants can pose health risks to consumers. To minimise such risks, the EU has set maximum levels for certain contaminants in foodstuffs. Pesticides are the most relevant.

- Pesticides:the main reason for banning cardamom from the European market is the presence of pesticide residues. The EU regulation on Maximum Residue Levels of pesticides sets maximum residue levels (MRLs) for pesticides in or on food products. Products with residues exceeding these levels are withdrawn from the European market. Between July 2021 and August 2024, 13 pesticide residue cases were reported in RASFF for cardamom, mostly concerning cardamom from India.

- Mycotoxins: limits for mycotoxins are set by EC Regulation 1881/2006. The maximum level of aflatoxin for cardamom is between 5 μg/kg for aflatoxin B1 and 10 μg/kg for the total aflatoxin content (B1, B2, G1 and G2).

- Microbiological contaminants: Salmonella must be absent from cardamom for the European market.

Tips:

- See the EUAccess2markets’ My Trade Assistant tool for country-specific legislation on cardamom.

- Prevent microbiological contamination by complying with the Codex Alimentarius Code of Hygienic Practice for Low Moisture Food (CXC 75-215) and the International Organisation of Spice Trade Associations’ General Guideline for Good Agricultural Practices on Spices and Culinary Herbs.

- Consider heat sterilisation as a natural, chemical and radiation-free option. Since the equipment is rather expensive, you could use a third party.

Food fraud

Food fraud in the spices and herbs sector is a serious issue. European buyers are increasingly attentive to it, certainly for more expensive spices such as cardamom. Many laboratories around Europe have increased testing to detect this type of fraud in spices and herbs. Common methods include DNA analysis, isotopic techniques, mass spectrometry, spectroscopy, chemometrics, and a combination of detection methods. It has been reported that cardamom is sometimes imported from Bhutan or Nepal to India and presented as having Indian origin. Another example is green cardamom pods, which are often adulterated with used cardamom pods or ones from which volatile oils have already been extracted. These actions constitute food fraud and will affect a supplier’s reputation in the European market.

Labelling requirements

For bulk cardamom, your product label must include the following:

- Product name

- Details of the manufacturer (name and address)

- Batch number

- Date of manufacture

- Expiry date

- Weight of contents

If your product is organic and/or Fairtrade-certified, the label should contain the name/code of the inspection body and the certification number.

Figure 1: Consumer label on organic ground cardamom in a German supermarket

Source: GloballyCool, August 2024

You also have to mention the colour group on the label to indicate the grade of the cardamom when 95% of the cardamom corresponds with one colour (deep green, green, light green, pale brownish). If your cardamom does not have one uniform colour, you do not have to indicate the colour on the label. Buyers are often interested in buying one specific colour or grade.

Tip:

- See our study on requirements your spices and herbs should comply with for a broader overview of legal requirements in the European market.

What additional requirements and certifications do buyers often have?

European buyers often have additional requirements, such as the European Spice Association’s (ESA) minimum quality requirements. Other requirements relate to food safety and sustainable and ethical business practices.

Quality requirements

The European Spice Association represents the interests of the European spices industry and has established non-legal minimum quality requirements for spices, including cardamom, in its Quality Minima Document. While these requirements are not legally binding and non-compliance will not result in rejections by border controls, compliance is expected by most European buyers and is often enforced through purchasing contracts that include product specifications. The specific requirements applicable to cardamom are:

Table 1: Specific minimum quality requirements for cardamom

| Chemical/physical parameter | Value |

| Ash (% Weight for Weight Max) | 9.0 |

| Acid insoluble ash (% Weight for Weight Max) | 2.5 |

| Moisture (% Weight for Weight Max) | 12 |

| Volatile oil ml/100G Min | 4.0 |

Source: ESA Quality Minima Document, March 2018

There are also parameters in the ESA Quality Minima Document that relate to all spices, including cardamom. These cover chemical/physical parameters, contaminants/residues and purity.

Table 2: General minimum quality requirements for cardamom

| Subject | Details |

| Water activity | Water activity is a key parameter that affects microbiological growth; therefore, ESA recommends a target value of max. 0.65. |

| Microbiology | The product shall be free from microorganisms at such levels, which may represent a health hazard. Specific requirements to be agreed between buyer and seller. |

| Adulteration | It must be free from adulteration. |

| Infestation | Should be free in practical terms from live and/or dead insects, insect fragments and rodent contamination visible to the naked eye. |

| Extraneous matter (all matter from the specific plant other than the desired part) | Max. 1% by weight. |

| Sensory properties | Must be free from off-odour or off-flavour. |

Source: ESA Quality Minima Document, March 2018

ESA has no cleanliness specifications. European buyers therefore often use the American Spice Trade Association (ASTA) cleanliness specifications for cardamom.

Table 3: ASTA Cleanliness specifications for cardamom

| Whole insects dead | Excreta mammalian | Excreta other | Mould | Insect defiled/infested | Extraneous foreign matter |

| By count* | By mg/lb | By mg/lb | % by weight | % by weight | % by weight |

| 4 | 3 | 1 | 1 | 1 | 0.5 |

Source: ASTA cleanliness specifications, 2014

*per sub-sample

Quality grading

Cardamom is graded on the basis of colour, clipping (pods with the tips trimmed), size, whether bleached or unbleached, the proportion of extraneous matter present, and product origin. The proportion of burst fruit pods (‘open pods’) also determines quality, as do colour (green or yellow) and drying methods (mechanical or sun). Grading is done in accordance with a relevant national standard, if available. For example, the Bureau of Indian Standards (BIS) has specific quality specifications for cardamom:

- IS 1987:1984 (Cardamom - capsules and seeds)

- IS 13446:1992 (Large cardamom)

The International Standard for Standardization (ISO) also has two specification standards for small cardamom:

- ISO 882-1: Cardamom (Elettaria cardamomum Maton var. minuscula Burkill) Specification, Part 1 –Whole Capsule

- ISO 882-2: Cardamom (Elettaria cardamomum Maton var. minuscula Burkill) Specification, Part 2- Seeds.

Packaging requirements

The packaging must not be a source of contamination or migration, should be food grade, and must protect the product quality during transportation and storage. Cardamom should be packaged in:

- Double-layered jute bags (42-50 kg)

- Single-ply fabric bags lined with polythene (42-50 kg)

Premium-grade cardamom is often packed in vacuum-sealed bags and shipped in 5-kg cartons.

Consult with your buyer for any packaging specifications.

Figure 2: Cardamom packaging varieties for food retail (left) and food service (right)

Source: GloballyCool from Verstegen, August 2024

Food safety certification

Only very few cardamom buyers require suppliers to implement an advanced food safety management system and obtain a certificate from an accredited certifier. This is mostly if the cardamom is crushed/ground and pre-packed at the origin. Examples of such advanced food safety management systems are the Food Safety System Certification (FSSC 22000), BRCGS Food Safety, International Featured Standards (IFS Food), and the Safe Quality Food Programme (SQF). These standards are all part of the Global Food Safety Initiative (GFSI).

Implementation and certification of these standards usually cost thousands of euros and are only recommended for large-scale processors targeting major European retail chains. For those processors, such a certificate shows professionalism. Smaller buyers in niche markets for cardamom are likely to have more relaxed food safety requirements as they prioritise other aspects, such as authenticity.

Buyers may also visit and/or audit new suppliers’ production facilities.

Sustainability

More and more European buyers are demanding social and environmental compliance. Often, this means signing their code of conduct. They may also ask for certifications by organisations such as the Rainforest Alliance (though this is not very common yet).

Codes of conduct (CoC) vary from company to company, but tend to be similar in setup and scope. In 2022, the European Spice Association (ESA) published a sustainability code of conduct for the spices and herbs industry requiring members to monitor their own and their suppliers’ operations.

Specific criteria include:

- Companies must conduct business in an ethical way.

- Child labour and forced labour are prohibited.

- All forms of discrimination are prohibited.

- Companies and suppliers must continually endeavour to reduce resource and energy use and emissions.

Tips:

- Ask your buyer for their current and preferred packaging requirements and do your best to meet these requirements. This ensures your product meets their expectations and European market standards. Meeting specific packaging needs also demonstrates your professionalism and responsiveness, helping you stand out in a competitive market.

- Take European market access requirements seriously and follow the recommended analysis and sampling methods as described in Appendix 2 of ESA’s Quality Minima Document.

- Read more about payment and delivery terms in our tips for organising your exports. Familiarise yourself with European market standards and expectations to ensure smoother transactions and avoid potential misunderstandings with buyers. Knowing the standard terms will help you negotiate confidently, reduce financial risk and improve your cash flow management. Clear agreement on payment and delivery terms also builds trust with buyers and contributes to a strong, reliable business relationship.

What are the requirements for niche markets?

The most common additional requirements relate to organic, fair trade and ethnic certifications.

Organic certification

To sell your cardamom as organic in Europe, your production methods have to comply with EU organic legislation. Growing and processing facilities must be audited by an accredited certifier.

Figure 3: Cardamom in refill packages in an organic supermarket in the Netherlands

Source: GloballyCool, August 2024

In addition to the EU organic standard, most European countries also have their own voluntary organic standards. Examples are Bio-Siegel (Germany), AB mark (France) and the Ø label (Denmark). Some countries have private standards or labels, for instance Naturland (Germany), Soil Association (United Kingdom), Bio Suisse (Switzerland) and KRAV (Sweden). However, it should be noted that the EU organic standard is usually sufficient for most buyers.

Fairtrade certification

European demand for Fairtrade-certified spices has grown. Fairtrade International has a standard for herbs, herbal teas and spices from small-scale producers which defines minimum prices and price premiums for Fairtrade-certified cardamom.

FLO has established a minimum price for cardamom (Elettaria and Amonum sp.) from different countries: India, Sri Lanka and others (worldwide). For conventional cardamom, a Fairtrade premium of 15% is offered on top of the commercial prices for all origins. For organic cardamom, a minimum price of €5.53/kg plus a Fairtrade premium of €0.99/kg (ex-works) is offered for cardamom from India and Sri Lanka. For other origins, a Fairtrade premium of 15% is offered on top of the commercial price.

As at October 2024, there are seven Fairtrade-certified cardamom producers, five of which are in India and two in Guatemala.

Biodynamic certification

Biodynamic farming is an enhanced method of organic farming. Biodynamics uses traditional farming techniques and a prescribed list of biological or natural ‘preparations’ and works with universal or cosmic forces that influence the farming environment. Demeter is the internationally recognised label for biodynamic-certified agricultural products. India and Sri Lanka are home to many Demeter-certified producers of spices and herbs.

Multiple certifications

Having more than one certification, such as organic and Fairtrade, is a clear asset in both of these niche markets. These consumers are typically more socially and environmentally aware than mainstream consumers. In most countries, products with multiple certifications are available only in organic supermarkets. An exception is Switzerland, where mainstream supermarkets offer a sizeable range of multiple-certified spices, including cardamom.

Ethnic certification

Islamic dietary laws (Halal) contain specific dietary restrictions. If you want to focus on this market segment (for example, the popular North African spice blend ‘ras el hanout’ contains cardamom), consider a Halal certification scheme.

Tips:

- See our study on requirements your spices and herbs should comply with for a complete overview of requirements to enter the European spices market.

- Check the EU's organic product import guidelines for details on how to export organic products to the EU.

- Consult the ITC Standards Map for a comprehensive overview of relevant certification schemes and requirements.

2. Through which channels can you get cardamom on the European market?

There are several types of companies that you can sell cardamom through, including importers and wholesalers. The most interesting market channel for you will depend highly on your capacities as an exporter of cardamom.

How is the end-market segmented?

The market segmentation of cardamom is similar to other spices. The largest segment is the food and beverage industry (55-60% of the total market), followed by food retail (30-35%) and foodservice (10%-15%). In most markets, the industrial sector has been expanding, a reflection of the growing popularity of ready-to-use spices and seasoning mixtures.

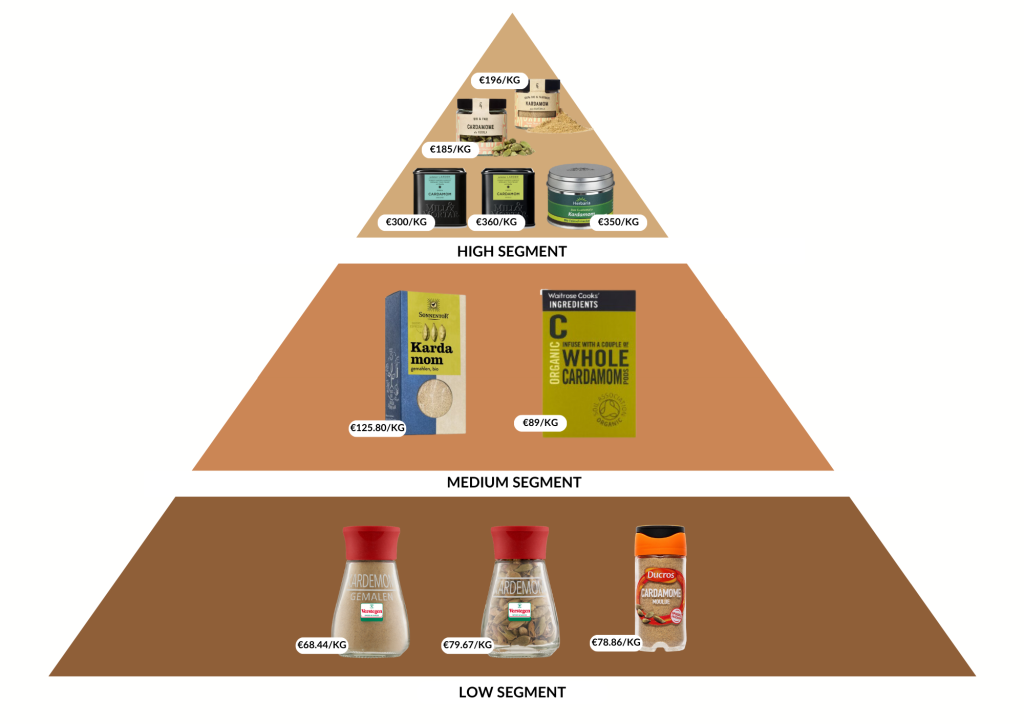

Figure 4: Market segments for cardamom in the European food retail segment

Source: GloballyCool, August 2024

Low-end segment

The low-end segment comprises a lower-valued cardamom of a quality that meets minimum requirements. These low-end retail products are not certified and are packed in small units made of relatively cheap materials, such as plastic or glass.

The lower-end cardamom products are mainly found in supermarkets. These are usually mass-market products by big brands and lower-quality private-label products from retailers themselves.

Mid-range segment

The mid-range segment includes cardamom that is good quality and sustainably certified. Especially organic certification is growing in this segment. Packaging can vary, and increasingly is made of sustainable materials such as recyclable paper.

Mid-range cardamom is mainly sold through supermarkets, and these are usually the high-quality category of retailers. More and more supermarkets have their own premium range of private-label spices, including cardamom. These products offer similar quality and characteristics as branded products but usually at more competitive prices.

High-end segment

Smaller, more specialised spice companies offer high-end cardamom and other spices. Single-origin spices are growing in this segment, both for the flavour and for the uniqueness and traceability of the product. Products are offered in more sophisticated packaging, such as metal tins.

In Europe, high-end cardamom is mainly sold by online and offline speciality shops, such as Piccantino (Germany) and The Spice Shop (United Kingdom).

Through which channels does cardamom end up on the end-market?

As an exporter, you can use different channels to bring your cardamom to the European market. How successful you are will depend on the quality of your cardamom, the level of processing you can implement (whole or crushed/ground) and your supply capacities. There are a few market players that can be interesting to you.

Figure 5: Trade channels for cardamom in Europe

Source: GloballyCool, September 2024

Importers/wholesalers

Importers of spices normally handle large quantities and have direct contact with exporters in producing countries, which provides them access to all the different segments in Europe. These can be spice companies or the food and beverage industry. Importers either sell the spices to other local companies or export the product elsewhere in Europe. They can source both whole and crushed/ground cardamom.

In most cases, importers have long-standing relationships with their suppliers. They are responsible for a wide range of services in the spices/cardamom value chain. These include logistics, customs clearance and documentation, risk management (sourcing from origin, price, exchange rate) and quality control.

At the same time, they have a large network of suppliers from all over the world and can switch relatively easily to other suppliers, which gives them a lot of negotiating power. They know the current price levels in the global market and allow little room for margins unless you can prove that your product is unique and worth a premium price.

Importers are wholesalers that handle products in bulk. They do not have direct contact with, or finished products for, the consumer/retail market.

Examples of large spice importers handling cardamom in the European market are Catz International, Nedspice (Netherlands), Worlée (Germany), and Bodén & Lindeberg (Sweden).

Specialised importers are usually active in specific segments for high-quality and/or organic/Fairtrade-certified cardamom, often dealing with smaller quantities than the large-scale importers mentioned above. They often work directly with producers and producer cooperatives. Organic Herb Trading and Steenbergs (United Kingdom) and Comptoir des Épices (France) are examples of specialised importers in the European market.

Processors/packers

Large spice processors source their cardamom and other spices directly from producing countries. Since these companies often have large portfolios and work with several spice origins, they tend to have designated departments for sourcing. In most cases they will have more than one supplier per spice, so as to spread their risks in terms of product consistency, quality and availability. These companies process spices by cleaning, sterilisation, grinding, blending and packaging.

Spice processors may supply cardamom both as an ingredient or as a finished product (as a single spice or in mixes like Garam Masala) under their own brand or under a private label. Some large-scale processors in Europe are Euroma (Netherlands), Fuchs (Germany, which has a product line for retail and another for the industrial sector), Ducros (France) and Verstegen (Netherlands).

Small spice companies

Smaller-scale spice companies do not always have their own processing facilities. They sometimes source cardamom and other spices directly from producing countries but will mainly source from European processors or importers. These companies may also outsource processing to a company with such capabilities.

Food industry

Large industrial users mostly source their spices, including cardamom, directly from exporters in producing countries. They may also use a hybrid model, sourcing part of their spices directly from producing countries and partly from European traders or European processors. Companies like Unilever, known for many brands like Knorr, and Nestlé, known for brands like Maggi, usually purchase processed spices from exporters in producing countries that are suitable for their products.

Smaller industrial users with smaller volume needs often make use of importing wholesalers in Europe or from European spice processors, as the import of small amounts of cardamom is relatively expensive and adds a lot of cost to the final product for consumers. Also, their core business lies in activities like product development, marketing, sales, etc. and not on sourcing.

Agents

In the food industry, agents act as intermediaries between you, spice importers and spice processors or buyers. They are actors with vast market knowledge and can help you assess and select interesting buyers. Some agents are independent, while others are hired to make purchases on behalf of a company.

What is the most interesting channel for you?

Which market channel is most interesting largely depends on your capacities in terms of quality and volume, consistency, volume availability and processing capabilities as a cardamom exporter.

Importing wholesalers is the most interesting channel for cardamom exporters, who have a large product range and available volumes. Importers are also suitable when you have less processed products and limited experience in the European market. If you are a processor offering crushed/ground cardamom, there will also be importers interested in sourcing your product, often both whole and processed.

Importing wholesalers source large amounts of cardamom, often from different origins, and break these bulk imports into smaller amounts for the smaller end users, including spice companies and other food industry players.

If you export higher-quality cardamom, specialised importers focusing on higher-end markets will be more suitable. This is also the case if you supply organic and fair trade-certified products; there are importers specialised in this market segment due to certification requirements in these markets.

Exporting directly to spice processors will require high-quality consistency and volume availability, usually starting at a few containers per year. Spice processors usually focus on whole cardamom since their core business is to process these spices further and to offer value-added products to the retail and food industry.

Establishing contact with smaller spice companies that do not have processing facilities might be interesting for some exporting processors, especially if you are focusing on cardamom at smaller volumes and higher quality. Food safety will be an important aspect here, and some buyers may require extra certification such as FSSC 22000.

Large food industry users are interesting to exporters focused on processed cardamom. High volume and consistent availability, high quality consistency and high food safety will be very important here. Industrial buyers are expected to be very strict in the implementation of food safety certifications like FSSC 22000.

If you have limited experience exporting to European countries, agents can play a very important facilitating role. Agents can evaluate and facilitate connections with buyers and finance institutions. Working with an agent is also useful if you need a trusted and reputable partner within the spice sector. Be prepared to pay an extra commission for their work, usually 3-10%.

Tips:

- Benefit from the experience, knowledge and bulk-breaking function of specialised European importers instead of approaching smaller industrial users directly.

- Search for importing wholesalers in the member lists of the national spice associations in Europe. Go to the member section of the European Spice Association (ESA) for an overview of associations.

- Agents who look for buyers on your behalf are particularly interested if you lack capacity in sales. However, once you have established a trade relationship through an agent, you cannot pursue a direct relationship with the buyer anymore. The agent's sales network is protected by law.

- Look for commercial agents or representatives on the website of the Internationally United Commercial Agents and Brokers (IUCAB).

3. What competition do you face on the European cardamom market?

The cardamom market is dominated by two main suppliers: Guatemala and India. Small and medium-sized exporters that ship only a few containers annually struggle to compete. Guatemala has become a supplier of large volumes at competitive prices, affecting even India, the original source of cardamom. Figure 6 shows the main suppliers of cardamom to Europe, including developing countries and intra-European re-exporting countries.

Source: GloballyCool based on UN Comtrade statistics, August 2024

Smaller exporters generally find more opportunities in niche markets, where volumes are smaller, such as for high-quality and/or organic and fair-trade spices. In these niches, the focus lies more on unique flavour aspects, story-telling and sustainability.

New entrants to the market will face competition from already successful cardamom exporters from one of the two main supplying countries. Established suppliers will also already have long-term relationships with buyers. Entering the market as a newcomer requires extensive knowledge of your product assortment, stable quality and volumes, and good communication skills to start building your own new relationships with buyers.

At the same time, many European companies aim to diversify their sources in order to mitigate risks of supply problems in one production country. This can open up opportunities for suppliers from other origins.

Which countries are you competing with?

Guatemala, India, Honduras and Tanzania are your main competitors.

Guatemala: main producer and exporter

Guatemala is the main global producer of cardamom, at around 36 thousand tonnes per year. Due to specific climate conditions, cardamom is produced year-round in Guatemala, which gives it a comparative advantage in the international market. Guatemala is also the main supplier to the European market.

In 2023, around 61% of total European imports were sourced from Guatemala and the country dominates the supply of almost all countries in Europe. The product is very important to the Guatemalan economy; cardamom is responsible for nearly 1.0% of Guatemala’s GDP. This is why it also receives strong institutional support, which makes the country a competitive supplier in the global market.

Guatemala’s export-promotion agency, Agexport, has a special committee for cardamom. APEXCARVGUA is the association of green cardamom producers and exporters in Guatemala. With two single cardamom farms certified by the Rainforest Alliance and two Fairtrade-certified cardamom producers, the number of certified farms is not very large. However, the country is also home to the world’s first organic-certified producer, the Guatemalan Federation of Cooperatives of the Verapaces (FEDECOVERA), which is also one of the leading organic cardamom producers.

The cardamom sector in Guatemala at large is also making important progress in the field of sustainability. The Guatemalan government has partnered with The Livelihoods Funds, an impact investment fund designed to support cardamom farmers in the mountain range of Cerro San Gil. The project will convert local farms to agroforestry systems.

Initiatives are also led by the private sector. For example, UK tea company Twinings partnered up with the NGO Mercy Corps to enhance the livelihoods of cardamom growers by supporting them to improve their productivity, add value to their current products, and introduce agroforestry crops such as cloves and black pepper, which provide additional income.

Being the largest cardamom producer worldwide, Guatemala and its cardamom industry are deeply affected by international price fluctuations, as prices are not regulated.

India: birthplace of cardamom and traditional supplier

Cardamom is native to the hills of India. The country is the second-largest cardamom producer in the world, after Guatemala, producing 20-30 thousand tonnes per year (almost 25 thousand tonnes in 2024), depending on weather conditions. India has a very large domestic consumption that dictates its export volumes and prices. Indian cardamom accounted for 8.9% of total European imports in 2023, with a CAGR of 1.9% in 2019-2023. Most of India’s exports go to the United Kingdom.

India is a very competitive global supplier and the largest exporter of spices globally. India also has a strong presence in niche markets for certified cardamom. A study from the Sustainable Trade Initiative reveals a list of nearly 50 companies in India exporting organic-certified spices, many of which also handle cardamom. In addition, the list of FLO-Cert operators reveals that five producer groups and 12 traders in India are Fairtrade-certified or licensed. There are also three small groups of Indian cardamom farms and one single cardamom farm certified by the Rainforest Alliance.

Honduras: a small but emerging cardamom supplier

Honduras’ cardamom production has grown gradually to reach a record 600 tonnes in 2022. The country accounted for 2.0% of the European market in 2023, its highest share so far. Honduras significantly improved export volumes in the 2019-2023 period (+11% CAGR). Until now, most export volume has gone to neighbouring countries such as Guatemala.

Honduras’ main cardamom supplier is Inversiones Corporativas Oro Verde. There is one producer/exporter of organic-certified cardamom (ExpoAgro Honduras), and a single cardamom farm is certified by the Rainforest Alliance.

Figure 7: Cardamom harvest in Honduras

Source: ExpoAgro Honduras, February 2024

Tanzania: stable producer with strong potential

Tanzania has excellent agro-climatic conditions for cardamom cultivation, offering a hot, humid, and tropical climate. Since 2019, Tanzania’s production volume has been very stable at between 790 and 800 tonnes per year. It accounted for around 1.3% of total European imports in 2023.

The country is an important supplier to some European countries, like Germany, where companies such as AKO The Spice Company offer Tanzanian cardamom. Green Leader Spices is the main cardamom exporter from Tanzania, offering a range of organic and conventionally-farmed cardamom in addition to cloves. Green Leader Spices sources from small Tanzanian farmers but has its main operations in Dubai (United Arab Emirates). There is one Tanzanian group of small cardamom farms certified by the Rainforest Alliance (through SAT, Sustainable Agriculture Tanzania).

Which companies are you competing with?

Guatemala and India together account for 90% of European cardamom imports from developing countries. Therefore, Guatemalan and Indian companies are the biggest competitors for new suppliers.

Guatemalan companies

Guatemala has the world’s strongest cardamom sector, and its exporters are able to supply large volumes at competitive prices. Most exporters can supply both whole and ground cardamom, so they have solid processing capacity. Guatemalan exporters have a strong position in the conventional market, but some players have also accessed niche markets successfully, maintaining an especially strong position in the organic market.

Some of the main exporters of conventional cardamom in Guatemala are CARDEX, Del Trópico and Agroproducts Dinámica. The Guatemalan Federation of Cooperatives of the Verapaces (FEDECOVERA) is the first producer and exporter of organic cardamom in the world. It also exports cardamom essential oil. The federation consists of 36 cooperatives, with 60,000 small producers that depend directly on this spice. In addition to organic, Fairtrade and Kosher certification, FEDECOVERA’s model integrates small producers into a system of agroforestry production chains that is environmentally and socially sustainable.

Indian companies

There are many companies in India that export spices, with cardamom as one of the most common products in exporters’ portfolios. India has large-scale and pioneering exporters like MAS Enterprises, which also has its own spice plantations in the country, as well as small and medium-sized local companies that include Royal Spices and Adrianna Springs. Indian exporters compete on quality and enjoy a good reputation in the European and other international markets.

Indian exporters have also gained a strong position in certified cardamom, where many Indian companies offer organic, fair trade and Rainforest Alliance-certified cardamom. This gives Indian suppliers an advantage in niche markets. Some certified cardamom exporters are Suminter India Organics, PDS Organic Spices and Sarwam Organics.

Which products are you competing with?

Cardamom has a typical flavour and taste and very particular applications. Real product substitution is not possible. However, in some product applications and recipes, cardamom is replaced with lower-valued ingredients like ginger (which is in the same botanical spice group as cardamom), nutmeg, and cinnamon.

Tips:

- Define your unique selling points as a cardamom supplier. Think about which factors set you apart from your competitors and create your marketing story around them. For example, factors related to the origin of your cardamom, agro-climatic characteristics of the production region, the profile of production communities, quality of your product, your post-harvest techniques, or a combination of these.

- Get inspired by examples like FEDECOVERA in Guatemala (described above). Or the Sri Lanka-based Small Organic Farmers’ Association (SOFA). They practice a mixed cropping system with cash crops, shade trees, repellent crops and medicinal herbs to maintain local biodiversity and support local farmers.

- Develop long-term partnerships with your buyer. Read more about how to do this in Tips to do business with European spices and herbs buyers.

- Actively promote your company on your website and at trade fairs. Look at how Suminter India Organics highlights its work to protect the local ecosystem by working closely with farmers to find sustainable ways to grow, harvest and processing organic goods. They also clearly describe their sustainability-related certifications on their website, as well as strict food safety standards, supported by BRCGS certification.

4. What are the prices of cardamom on the European market?

Although there are a handful of countries producing cardamom, only Guatemalan and Indian production influence international prices significantly. It is important to realise that trade prices and retail prices for cardamom are not directly linked. The margins you can receive as an exporter may differ. They are influenced by factors such as:

- Country of origin

- Current and expected future harvest situation

- Quality of the raw material

- Level of processing

- Level of domestic demand

- Level of international demand

- Trends in prices

Within the European market, prices of cardamom imported to different countries are quite similar, with one exception: Sweden’s cardamom imports are priced higher than in other countries.

Source: GloballyCool, August 2024

Figure 8 illustrates that:

- European cardamom import prices (cost insurance and freight-based, or CIF) peaked in 2020, mainly due to production problems in Guatemala. After this, import prices declined gradually and are now at levels below initial prices in 2019.

- Most supplying countries’ prices have gone down since 2019. India is the only country with a higher price outcome. Additionally, all supplying countries except India peaked in 2020. India’s European market prices for cardamom are subject to different conditions, including the situation in the domestic market and dynamics in India’s main European market, the United Kingdom.

- The average cardamom import price is close to Guatemala’s, the dominant supplying country.

- Guatemala and Honduras clearly offered the lowest prices in 2022 and 2023.

- Tanzania had the most stable prices between 2019-2023.

You can achieve higher margins and profits as an exporter if you are able to add value locally. You can do this by processing cardamom into powder, or by obtaining certifications (such as organic or Fairtrade).

Source: Globally Cool, September 2024

Tip:

- Keep up to date on the global supply situation and prices. Mundus Agri and the Indian Spice Board regularly publish useful crop and price reports.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research