Entering the European market for cloves

The most important requirements for the European market relate to low residue levels for pesticides. Food safety certification, sterilisation, and reliable and frequent laboratory tests are important to be competitive. Sustainable production and the implementation of corporate social responsibility standards provide other advantages for new suppliers. Most cloves Europe imports come from Madagascar, Indonesia, Sri Lanka and Comoros. There is also some competition from suppliers in Tanzania and Vietnam.

Contents of this page

1. What requirements and certifications must cloves comply with to be allowed on the European market?

You have to meet several mandatory requirements to enter the European market. Buyers will probably have other requirements, and they may ask for certification. Mandatory requirements for cloves in Europe focus on consumer health and safety, but sustainability requirements are becoming more important.

What are mandatory requirements?

Most requirements for clove imports relate to food safety. The European Commission for Health and Food Safety is responsible for the European Union’s policy and for monitoring the implementation of related laws.

Official food controls

Cloves imported into the European Union (EU) have to go through official food checks when they arrive in the European Union. Non-compliance with European food laws is reported through the Rapid Alert System for Food and Feed (RASFF). In 2022, only 1 case related to cloves out of a total of 290 reported issues for all spices and herbs.

If imports from a specific country repeatedly violate European food legislation, the frequency of official checks at the border is increased. India is the only country that faces this increased frequency for cloves, alongside all other spices and herbs within Combined Nomenclature code paragraphs 0905, 0906, 0807, 0908 and 0909. India has a 20% testing frequency for pesticide residues.

The rules for Indian cloves are very strict. For Indian goods that contain a mix of produce, where 20% of the quantity is cloves, the rule already applies, regardless of the origin. The increased frequency still applies even if the cloves do not come from India, but there are other ingredients of Indian origin.

Tip:

- Search the RASFF database for examples of withdrawals from the European market.

Pesticide residues

The EU regulation on Maximum Residue Levels of pesticides sets maximum residue levels (MRLs) for pesticides in and on food products. Products that contain more than the allowed pesticide residues are withdrawn from the European market. In 2022, there was 1 issue reported in the RASFF for cloves, which was related to excessive pesticide levels or traces of illegal pesticides. The particular case related to excessively high levels of 2-chloroethanol (sum of 2-CE and EO). The test showed a value of 0.22 mg/kg, while the MRL was 0.1 mg/kg.

There have been more reported issues in other years. In 2021, there was also only 1 issue reported (Chlorpyrifos in organic cloves), but in 2023, 3 issues were reported in the first ten months. 2 of the 3related to the presence of foreign bodies (stones) in cloves from Madagascar, and the third related to excessive levels of MOAH (mineral oil) in cloves, also from Madagascar. The allowed level for MOAH is 1 mg/kg, while the analytical results showed 4.4 mg/kg.

Tip:

- Select your product or the pesticide you use in the EU pesticide database for a list of relevant MRLs.

Contaminants control in cloves

Food contaminants are substances that have not been added to food intentionally. They may be present in cloves as a result of production, packaging, transport or holding, or environmental contamination. Contaminants can pose a health risk to consumers. To minimise these risks, the EU has set maximum levels for certain contaminants in foodstuffs:

- Microbiological contaminants: The EU regulation on microbiological criteria for foodstuffs does not set specific limits for cloves. The most important microbiological risk is salmonella. There must be absolutely no salmonella.

- Polycyclic aromatic hydrocarbons (PAH): PAH can increase the risk of cancer so the EU has set PAH limits for cloves: 10 μg/kg for benzo(a)pyrene and 50 μg/kg for the sum of all PAHs.

- Metal contaminants: Since 2021, the EU has set residue limits on the presence of lead in spices in place. For cloves this limit is 0.1 mg/kg.

- Mycotoxins: While EU legislation does not define maximum levels for aflatoxins in cloves, there may be different national legislation on aflatoxins. The same goes for microbiological contamination limits (excluding salmonella).

Tips:

- Check the national legislation in your target countries through the ‘My Trade Assistant’ tool at EUAccess2markets to see if there is country-specific legislation for cloves in place.

- Comply with the Codex Alimentarius Code of Hygienic Practice for Low Moisture Food (CXC 75-215) and the International Organisation of Spice Trade Associations’ General Guideline for Good Agricultural Practices on Spices and Culinary Herbs to prevent microbiological contamination.

- Consider heat sterilisation as a natural, chemical and radiation-free option. Since heat sterilisation equipment is expensive, using a third party may be a good idea.

Labelling requirements

Each export package should declare the following:

- Name of product (for example, ‘cloves, whole’);

- Batch code;

- Net weight in the metric system;

- Product shelf life or best before date and recommended storage conditions;

- Lot identification number; and

- Country of origin and name and address of the manufacturer, packer, distributor or importer.

The lot identification and the name and address of the manufacturer, packer, distributor or importer may be replaced by an identification mark. Labels can also include details like the brand, drying method and harvest date. These batch details can also be included in the Product Data Sheet. This may also be called a ‘Technical Data Sheet’, ‘Product Specification Sheet’ or something similar. This document contains the specific characteristics of your product, which your buyer will ask for to assess your product. Take a look at this example for organic clove powder.

In the case of consumer packaging, product labelling has to comply with the EU Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and minimum font size for mandatory information more clearly.

If you supply organic cloves, your label needs to include the name/code of the inspection body and certification number.

Tip:

- See our study on the Requirements for spices and herbs to find requirements for consumer packaging and labelling. In Europe, there are very strict requirements for the packaging and labelling of consumer products, which differ from the requirements mentioned here.

What additional requirements and certifications do buyers ask for in cloves?

European buyers often have additional requirements, in addition to the legal obligations. These often concern the European Spice Association’s (ESA) minimum quality requirements for spices. Other requirements relate to food safety, and sustainable and ethical business practices.

Quality requirements for cloves

Several factors determine the quality of cloves. Some are subjective, such as taste and flavour. Other quality criteria may relate to the size of the buds, shape or colour, and they may depend on the tree variety. In the world’s largest production countries, there are usually multiple varieties in use. The Codex Alimentarius Commission also sets several quality parameters in the Codex Standard CXS 333-2021 for cloves.

The most common parameters for cloves quality include:

- Cleanliness or purity: Cloves should be intact when traded as a whole, and they must be free from diseases, foreign matters, foreign odours and any other disorders. The European Spice Association (ESA) Quality Minima Document does not allow the presence of any foreign objects greater than 2 mm in diameter and proposes that the maximum presence of external matter should be below 1% of the weight. Other indicators include ash level and acidity of the ash.

- Moisture content: The maximum moisture content for cloves and powder set by the Quality Minima Document of the ESA is 13%. However, according to the Codex Standard it is 12% for whole and 10% for ground cloves. Still, buyers may request a lower moisture content such as 8 or 9%.

- Mesh or particle size: When cloves are exported in powdered form, they are ground to pass through a sieve of a specific diameter. Sieves are often specified in micron sizes, and typical requirements demand that between 95% and 99.5% of ground cloves pass through the specific size of the sieve, usually of 600–900 microns. As cloves are fibrous, the size of the sieve is usually larger compared to most other ground spices, such as pepper or chillies.

- Odour and flavour: Cloves must have a characteristic odour and flavour. The flavour profile of cloves mostly depends on the chemical components of the essential oil. The most important essential oil in terms of the specific flavour is Eugenol (4-allyl-2-ethoxyphenol). The flavour profile varies depending on the geographic, climatic and growth conditions.

- Volatile (essential) oils: As described above, the content of essential oils is important for the sensorial characteristic of cloves. Cloves quality is higher when the percentage of ash is low, and the content of essential oils is high. The minimum content of essential oil in whole cloves should be 17 ml/100 g (in ground cloves, 14 ml/100 g.

The Codex standard does not set classes or grades for cloves, but such grades are common in the origin countries. For example, Sri Lanka and Indonesia recognise 3 grades: Cloves Handpicked, Cloves Grade 1 and Cloves FAQ (Fair to Average Quality). These grades differ from each other by factors such as levels of purity, number of headless cloves and colour. Indonesian suppliers use ‘Lal Pari’ for Grade 1 and ‘AB6’ for Handpicked.

Packaging requirements

Cloves are mostly exported in bulk and packed in multi-wall laminated bags of different weights. Common weight classes are 12.5 kg and 25 kg. The dimensions of the selected packaging size should be according to the conventional pallet sizes (800 mm x 1,200 mm and 1,000 mm x 1,200 mm). Please note that in some European countries, labour health and safety legislation allow workers to lift a maximum of 20 kg, so smaller weights of packaging are increasingly used, such as 10–20 kg.

The net weight of retail packaging is usually between 10 g and 50 g. Retail packaging includes glass or plastic containers (for 25–50 grams), or small bags of plastic or paper for 10–20 grams. Transparent packages are particularly popular as they enable consumers to see and visually inspect the product before buying.

Figure 1: Retail packaging varieties of cloves offered by a Dutch retail chain

Source: Picture by Globally Cool

Food safety certification

Food safety is essential for the European market. Although legislation already prevents many risks, it is not sufficient on its own. For this reason, importers prefer to work with producers and exporters who have a Global Food Safety Initiative (GFSI) recognised food safety system certificate.

The most popular certification programmes for spices and herb processors and traders who trade in cloves are:

- Food Safety System Certification (FSSC 22000) is the most important certification programme and gives access to almost all countries in the world.

- International Featured Standards (IFS) can be relevant if European buyers ask for it.

- British Retail Consortium Global Standards (BRCGS) can be relevant if European buyers ask for it.

Third-party certified programmes are an asset to your company and new buyers appreciate them. Nevertheless, serious buyers might also visit and/or audit the production facilities of new suppliers.

Sustainability compliance

Although less important than product and food safety requirements, European buyers increasingly demand social and environmental compliance. This often means that the supplier must undersign the buyer’s code of conduct. Another possibility is that buyers ask for certification against a third-party scheme, such as Rainforest Alliance.

Codes of conduct (CoC) vary from company to company, but they are often similar in terms of structure and the issues they cover. In 2022, ESA published a guideline for their members. Since a lot of European spices and herbs companies are a member of ESA, you will likely come across this guideline sooner or later.

Under this sustainability code of conduct, ESA’s members shall monitor their own and their suppliers' operations.

Tips:

- Always ask your buyer for their specific packaging requirements.

- Use methods of analysis and sampling recommended by ESA from Appendix 2 of the Quality Minima Document to determine quality parameters for cloves.

- Read more about payment and delivery terms on the CBI Tips for organising your spices and herbs exports to Europe.

What are the requirements for niche markets?

Most additional buyer requirements apply to the mainstream spices and herbs markets. However, some niche markets have their own specific requirements. Ethnic certification can be interesting for the large and growing ethnic food segments. Fairtrade lays down requirements for sustainability in the social, environmental and ethical domains. Product certification for the organic market mainly focuses on environmental requirements.

Ethnic certification

Islamic dietary laws (Halal) propose specific dietary restrictions. If you want to focus on this market segment, consider implementing a Halal certification scheme.

Organic certification

If you want to sell your spices and herbs as organic in Europe, they must be grown using organic production methods that comply with EU organic legislation. Growing and processing facilities must be audited by an accredited certifier.

Fairtrade

The fairtrade market is built on fairtrade certification. Each player in the supply chain needs to be certified to participate in this market. The fairtrade market is privately regulated.

Fairtrade International has a specific standard for herbs, herbal teas and spices from small-scale producer organisations. This defines minimum prices and price premiums for conventional and organic products from several countries and regions. Organic cloves from Sri Lanka and India have a fixed Fairtrade Minimum Price of 2.36 USD/kg, for all other cloves sold under this scheme, the Fairtrade Premium is set at 15% of the commercial price.

There are currently (as of October 2023) 32 Fairtrade certified cloves producers worldwide, 9 of which are in India, 1 in Indonesia, 5 in Madagascar and 17 are located in Sri Lanka.

Dual certification

Having organic and fairtrade certification is a clear asset in both the European fairtrade and organic markets. Consumers in these markets are typically more conscious than mainstream consumers. Consequently, they are more likely to appreciate and buy products that have both Fairtrade and organic certification logos. In most countries, dual-certified products are only available in organic supermarkets. Switzerland is an exception to this, where mainstream supermarkets offer quite a large range of dual-certified spices.

Figure 2: Dual-certified cloves in a Swiss mainstream supermarket (left jar)

Source: Picture by Globally Cool

Tips:

- Read CBI’s study on requirements for exporting spices and herbs to the European market for a complete overview of requirements, including organic and Fairtrade certification.

- Check the guidelines for imports of organic products into the EU to familiarise yourself with the requirements for European traders.

- Consult ITC Standards Map for a full overview of relevant certification schemes and their requirements.

- Check Fairtrade International’s standard for herbs, herbal teas and spices and other Fair Trade Standards relevant to your production, processing and trade.

- Try to combine organic certification with other sustainable initiatives (dual certification) to increase your competitiveness.

2. Through what channels can you get cloves on the European market?

Cloves are sold through different channels to reach the different segments of the market: the food industry, the retail and food service sectors. The food industry mainly uses ground cloves. To enter the European market, exporters need to go through an importer. Often the importer is also a processor and targets some or all 3 end markets.

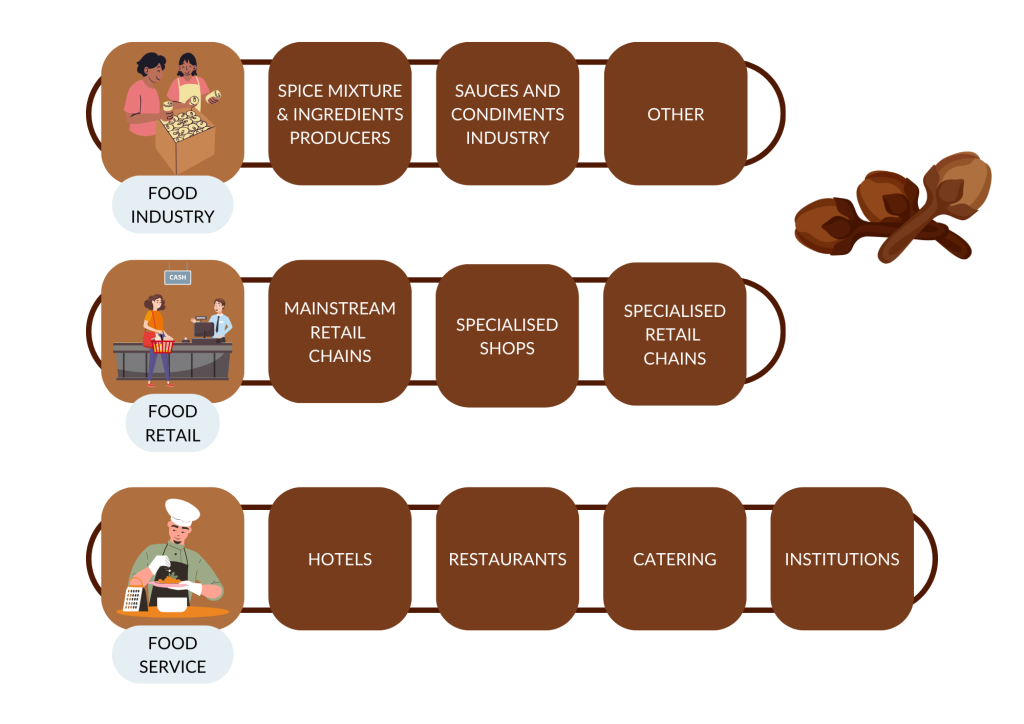

How is the end market segmented?

The end-market segments for cloves include the food industry, the food retail and the food service sectors.

Figure 3: End-market segments for cloves in Europe

Source: Globally Cool

Food industry

The food industry is the main end market for cloves in Europe. Food processors use the largest number of cloves on the European market. The largest users are spice mixture and seasoning producers, and companies that produce sauces, bakery products, sweets, cured meats, marinated meats and ready-to-eat products.

Spice mixture and ingredient producers specialise in the production of spices and seasonings for different applications. They are constantly investing in research to develop custom formulations for the food processing industry and help launch new attractive tastes. Cloves are an important ingredient in gingerbread spice mixes, meat spice blends, curry and other Asian spice mixes.

In addition to traditional spice companies that often have a range of spice blends (dry and wet), there are dedicated producers of customised (dried and liquid) spice solutions for specific industry needs. Examples include Meat Cracks and Scheid from Germany, the internationally active Solina Group from France, Libra Food Ingredients from Poland, and the international group Kalsec, which has headquarters in the USA and European production in the United Kingdom (UK).

Other companies import and offer even wider ranges of products, that also include grains, pulses, dried fruits and nuts. One such company is EHL Ingredients.

Companies in the sauces and condiments industry mostly use grounded cloves in blends to produce specific curries and sauces. The curry sauce industry features brands like Patak’s and Rajah.

Food retail

European brands and private labels share the retail and food-service segments. Leading brands in Europe include Schwartz (United Kingdom), Fuchs (Germany), Ducros (Spain, France, Belgium, Portugal), Euroma (Netherlands), Verstegen (Netherlands), Cannamela (Italy) and Prymat Group (Poland). McCormick is the global and European market leader, present in Europe with several brands, including Drogheria, Kamis, Margao, Ducros and Schwartz.

Supermarket private label brands occupy an important place on the shelves as well. Production for private label brands is conducted by European spice packers and blenders. Since supermarkets often require frequent and regular shipments, and they have very specific requirements regarding packaging, it is difficult to supply to them directly from outside Europe. Cloves packed in origin countries can be found in some European ethnic shops, most in Asian food stores.

Most retailers that sell cloves offer them in both whole and grounded form. Most discount retailers do not sell cloves in their outlets. In supermarkets, cloves can also be found in specific mixtures, such as gingerbread spice mix in the United Kingdom and its counterparts in the Netherlands and Germany. Overall, spice and herb mixtures are becoming more popular in the retail segment, partly due to the increasing interest in ethnic food, but also caused by the trend of more convenience.

The retail sector can be further segmented into several subcategories such as:

- Mainstream retail chains with physical outlets. Several of these chains operate on an international scale, such as Schwartz Gruppe (Lidl and Kaufland brands in Germany and many other European countries) and Ahold (including Delhaize, Albert Heijn and more in Europe).

- Specialised shops mostly online. Spice shops are usually part of the high-end market segment and offer a wide range of spices from different origins. They commonly sell spices measured by weight, but they also have their own branded products. Some of them have grown into specialised chains, such as Alfons Schuhbeck, named after the German celebrity chef, with many shops across Germany. Examples of specialised spice shops in Europe include Épices Rœllinger (France), Van Beekum and De Kruidenbaron (Netherlands), and Spice Mountain (United Kingdom).

- Specialised retail chains with physical outlets – Most of them operate in the organic market, some focus on the ethnic market. Examples of organic retail chains are Biomarkt and Alnatura in Germany. Examples of ethnic retail chains are Wah Nam Hong and Go Asia.

Food service

Specialised distributors supply the food service channel, which includes hotels, restaurants, catering outlets and institutions like hospitals and schools. In theory, these distributors can import cloves directly but, in practice, they often buy from wholesale bulk importers. The food service segment often requires specific packaging of cloves, which is different from bulk or retail packaging, for example, from 300 g to 1 kg packs.

Examples of distributors that supply the food service segment with cloves are Metro Cash & Carry, which has outlets in several European countries, and Brake Brothers in the United Kingdom. The share of certified products, including organic-certified or fairtrade-certified spices, is typically low in the food service segment.

Figure 4: Cloves in 0.3 kg jars in a cash-and-carry outlet in the Netherlands

Source: Picture by Globally Cool

World cuisines, healthy food and food enjoyment are the major driving forces in the food service channel in Europe. The fastest-growing business types are likely to be new, focusing on healthier fast food, street food, pop-up restaurants, international cuisines and sandwich bars.

Tips:

- Study exhibitor lists of large trade fairs, such as Food Ingredients or Biofach to find potential buyers for your cloves. If you intend to supply to supermarket private labels, search for opportunities at PLMA, the world’s leading private label trade fair.

- To supply to the food service segment, visit Sirha and Internorga.

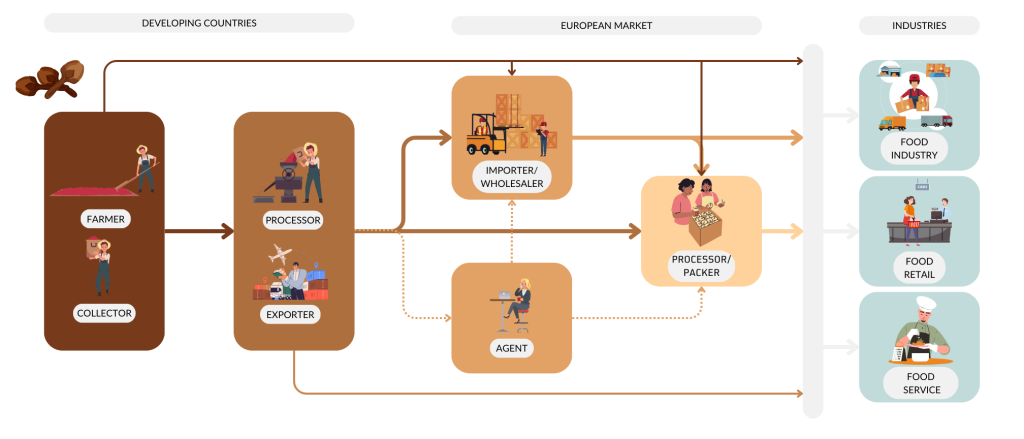

Through what channels do cloves end up on the end-market?

Specialist spice importers are the most important channel for cloves in Europe. Selling cloves directly to food processors or retailers is not impossible, but it is quite difficult. These opportunities are scarce, and they are mostly driven by entrepreneurs committed to supporting farmers in origin countries.

Importers and wholesalers

Importers and wholesalers can be general spice importers or specialised in specific roles. Some deal exclusively with ingredients for the processing industry while others pack cloves for retail chains. Some importers also deal with a broader range of products in addition to spices, such as grains and pulses.

Other requirements from retailers determine the supply chain’s dynamics from the top down, putting pressure on importers and food manufacturers. This pressure forces prices down, but it also brings more products to the market that have added value qualities, such as sustainable, natural, organic and Fairtrade.

Remaining attractive for large retailers requires transparent, short and effective supply chains. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred suppliers from developing countries.

Several sub-types of cloves importers include the following.

- Bulk spice importers – In Europe, this category includes wholesale traders and owners of retail brands. Many of these brand owners have already been mentioned in this study’s market analysis. Other bulk importers and wholesalers include British Pepper & Spice (United Kingdom), AKO (Germany), Husarich (Germany), Euroma (Netherlands), European Spice Services (Belgium), Saran Enterprises (Poland, mostly importing from Vietnam) and The Spice Factory (Belgium).

- Spice mixes and ingredient suppliers – These traders specialise in supplying solutions to a wide range of food industries. This category includes businesses, such as Worlée (Germany), Culinar (Sweden), Epos (Netherlands) and Colin Ingredients (France).

- General importers – Importers in this segment also import several other types of products in addition to cloves and other spices. An example is the company Eric Bur in France, which sells different spices from Sri Lanka (for example, cloves).

Figure 5: Trade channels for cloves in Europe

Source: Globally Cool

Agents and brokers

Brokers and agents are intermediaries that bring buyers and sellers together. They charge a commission for their services. Agents and brokers are an interesting option if you have a special product, which is harder for buyers to find (for example, high-quality or sustainable cloves). The role of the agent is under pressure due to the increased demands for market transparency. Another role agents play is to participate in tenders launched by European retailers. In this case, agents can help exporters to place cloves directly in the European retail segment.

Other channels

Selling in a more direct way to the European market, bypassing importers and wholesalers, is not impossible, but it is difficult. These opportunities usually come from entrepreneurs in Europe who are committed to supporting farmers and sectors in origin countries. An example of such a company is Pacific Spices from the Netherlands, which sells cloves and other spices from the Moluccas directly to Dutch consumers.

What is the most interesting channel for you?

Spice importers are the best contacts for getting cloves onto the European market. They are particularly relevant for new suppliers because supplying multiple segments directly is very demanding and requires a lot of quality and investment into logistics.

Packing for private labels can be an option for well-equipped and price-competitive producers. Private label packing is often done through importers that enter into partnerships with retail chains in Europe. As labour costs in Europe are increasing, importers of cloves can search for opportunities to pack spices in developing countries, but only if they can ensure full traceability and quality control.

Tip:

- Search the European Spice Association’s members’ list to find buyers from different channels and segments.

3. What competition do you face on the European cloves market?

Madagascar is the main supplier of cloves to Europe. Madagascar accounts for more than 33% of European imports from developing countries.

Which countries are you competing with?

Europe imports 90% of its cloves from only 4 countries: Madagascar, Indonesia and Sri Lanka. Of the 5,200 tonnes imported to Europe, Madagascar accounts for 34%, followed by Indonesia (11%), Sri Lanka (7.9%) and Comoros (6.3%). Tanzania and Vietnam export smaller quantities to Europe.

Source: UN Comtrade (July 2023)

Madagascar: Gaining market share in the period 2018-2022

Madagascar is the largest exporter and second largest producer of cloves. The country is good for about 13% of the world's total clove production. The annual clove production in Madagascar is estimated to range between 12,000 to 16,000 tonnes, with 70% originating from the northeastern coastal region, Analanjirofo, which is often referred to as ‘the clove road’. This production primarily serves the spice market, while the remaining 30% produced near the southeastern coast mostly goes to essential oil distillation.

Clove buds play an important role in the livelihood of the farmers on Madagascar's east coast, supporting nearly 18,000 producers. These farmers cultivate cloves across more than 70,000 hectares of land, spread throughout the eastern part of the island. The timing of the harvest season is strategically aligned with the intervals between 2 rice crops, ensuring a continuous source of income for farmers, preventing revenue gaps when rice is unavailable.

Madagascar exported 1,800 tonnes of cloves to Europe in 2022, valued at €10.2 million. Europe is only a small market for Madagascar, considering the total export volume of more than 50,000 tonnes. The record harvest in 2022 caused a huge increase in exports. Whole cloves made up the majority of the exports, accounting for 95% of the volume, while the remaining (92 tonnes) took the form of ground cloves. The primary European destinations for Madagascar's clove exports include the Netherlands, Germany, Spain and France.

Figure 7: Clove drying facility in Madagascar

Source: APL Vanille (2023)

Indonesia: Huge production with only 10-15% exported

Indonesia is the world’s largest producer of cloves. The country produces more than 70% of the world’s cloves, largely by smallholder farmers. Since about 90% of its production is used for local consumption, Indonesia only exports a small portion of its clove production (around 10–15%). This situation also explains why there are not many Indonesian clove exporters that promote themselves online in the way that Cloves Indonesia (or Dimekris) does.

There are a few suppliers of organic certified cloves in Indonesia. One example is Tripper, which is headquartered in Indonesia and exports both conventional and organic certified spices from Indonesia to North America, Europe and several other countries.

Domestic clove production is generally oriented toward meeting domestic needs, namely as a raw material for the kretek cigarette industry. Clove plants are also used to produce 3 types of essential oils, including clove oil, clove stalk oil and clove-leaf oil. The Indonesian clove oil market has seen a lot of growth in recent years, which even led to clove oil from other countries being imported.

In 2022, European imports of cloves from Indonesia reached 564 tonnes, with a total value of €3.7 million. Most of this volume (88%) consisted of whole cloves, while the remaining 12% was ground cloves. France, the Netherlands and the United Kingdom are the main export destinations for Indonesian cloves.

Sri Lanka: Small volumes to Europe

Clove cultivation in Sri Lanka is concentrated in several regions. The primary clove-producing areas are in the wet zones of the mid-country, in the districts of Matale, Kegalle and Kandy. The unique climatic conditions and fertile soil in these regions are ideal for growing cloves. The country dedicates more than 7,500 hectares to clove farming with an annual production of more than 5,000 tonnes.

In 2022, European imports of cloves from Sri Lanka reached 412 tonnes, with a total value of €3.8 million. 91% of this volume consisted of whole cloves, while the remaining 36 tonnes was ground cloves. Germany, the United Kingdom and France are the main export destinations for Sri Lanka cloves.

Comoros: Export focus on Germany and the Netherlands

Comoros is an independent state that comprises of the 3 Comoro islands in the Indian Ocean, off the coast of East Africa. Most people in Comoros rely on subsistence farming, meaning they only produce for their own consumption. A few products, such as vanilla and cloves, are produced in abundance and therefore exported.

Cloves are grown primarily on the Comoros islands, which include Grande Comore, Anjouan and Mohéli. The climate and soil conditions in the Comoros are well-suited for the cultivation of cloves. Cloves are typically grown in agroforestry systems, where clove trees are intercropped with other crops. In 2022, Comoros exported 4,200 thousand tonnes of cloves in total, making the country the fifth largest exporter of cloves globally. India is Comoros’ leading export destination.

European imports of cloves from Comoros reached 328 tonnes in 2022, valued at €1.9 million . Germany is the main European export destination for Comoros cloves, closely followed by the Netherlands.

Tanzania: Rapidly growing production output

Cloves are grown primarily in the Zanzibar Archipelago, which is a semi-autonomous region of Tanzania, as well as in the Pemba and Mafia islands. Clove production in Tanzania has historically been a major contributor to the country's economy and exports. Cloves make up over 90% of Tanzania’s global spices exports. Clove production is also rapidly expanding on the mainland.

The Tanzanian government created the Tanzania Spices label to support and promote the sector. The International Trade Centre (ITC) supports the initiative within the framework of the Market Access Upgrade Programme (MARKUP), a regional development initiative for the East African Community (EAC), funded by the European Union (EU). Local producers can grow, market and sell their products on a more equal stage through the Tanzania Spices label. This increases their competitiveness in the global spice market.

European imports of cloves from Tanzania reached 110 tonnes in 2022, valued at €757,000. The United Kingdom and Germany are the top export destinations for Tanzanian cloves. The large growth of Tanzania’s production in the 2018–2022 period mostly went to Singapore, Indonesia and India. Exports to Europe remained relatively stable.

Vietnam: Small producer and a net-importer of cloves

Vietnam is not a large producer of cloves. The country plays a role in the global clove market as a net-importer of cloves. In 2022, imports reached 1,500 tonnes versus an export volume of almost 350 tonnes. Local clove production is concentrated in the Quang Tri and Thua Thien-Hue provinces. The climate and soil conditions in these regions are suitable for clove cultivation.

Vietnam cloves exports to the world reached 341 tonnes in 2022. Europe had a share of 28%, amounting to 96 tonnes. The Netherlands, Sweden and the United Kingdom are the main destinations for Vietnam cloves.

Tips:

- Visit leading European trade fairs, such as Food Ingredients and Biofach, to keep an eye on your competitors.

- Read this list of clove suppliers in Sri Lanka.

- Visit the website of the Indian Spice Board to stay up to date about Indian production and supply.

Which companies are you competing with?

Hundreds of companies export cloves from Madagascar, Indonesia and Sri Lanka. Many of them do not perform any processing activities but only act as brokers. However, several large companies perform a full range of control and processing operations before exporting. The 3 examples below are illustrative.

Jacarandas spices and ingredients from Madagascar

Jacarandas is a producer and wholesaler of cloves, pepper, ginger, turmeric, cinnamon, pink peppercorns and kaffir limes grown organically and conventionally in Madagascar. The company works with a network of farmers and partner cooperatives. Jacarandas’ team provides step-by-step support with technical management and helps farmers adopt good agricultural and hygiene practices. The majority of the spices and all of the organic and Fair for Life certified spices can be traced back to the farmers.

Jacarandas has a part of their products available with organic certification, including cloves, pink peppercorn, cinnamon, turmeric, ginger, chilli pepper and vanilla. A smaller range (only pink peppercorn, cinnamon, turmeric and ginger) is available with Fair for Life certification. The company has been a member of the SYMABIO (Syndicat des Sociétés Biologiques de Madagascar – Madagascan syndicate of organic companies) since its creation.

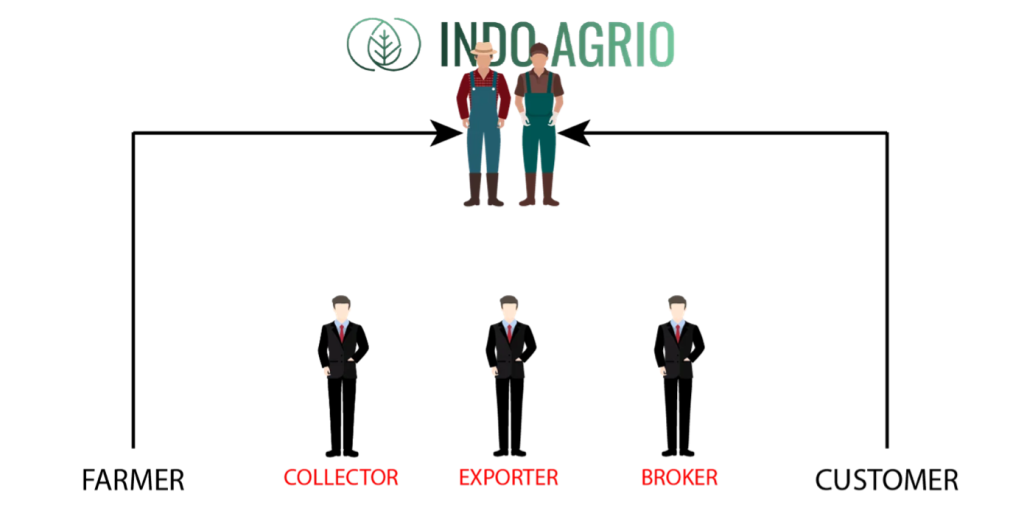

Indo Agrio from Indonesia

Indo Agrio is an Indonesian supplier and exporter of agricultural products located in north Bali. Indo Agrio (or PT Agro Bumi) is a privately owned company created through a partnership of exporters and farmers. The company trades 3 commodities in 3 branches: Agrio Spice, Agrio Coffee and Agrio Coco. In terms of spices, the main product is cloves, followed by vanilla beans.

Indo Agrio is committed to making trade more transparent so that final buyers of cloves know where their cloves come from so producers gain greater margins since independent collectors, exporters and brokers become redundant.

Figure 8: Indo Agrio’s trade model

Source: Indo Agrio

LHD EXPORTS (PVT) LTD from Sri Lanka

L H D Exports (Pvt) Ltd has been involved in the spices trade for more than 2 decades, and it exports to around 20 different countries. As with most of Sri Lanka’s spice exporters, LHD’s core product is Ceylon cinnamon. The company also exports all the other spices that are grown in Sri Lanka, including cloves, nutmeg, pepper and cardamom. The cloves that LHD exports are grade Handpicked and of a reddish-brown colour.

The company has its own processing and packaging facility and has own logistics. This ensures high quality products, and timely and smooth delivery to the local port. LHD’s customer service is available 24/7.

Tips:

- Study your competitors’ different strategies carefully to successfully penetrate the European clove market. You need to be price competitive, offer safe and good-quality products, offer unique products (for example, cultivars with high essential oil content and specific flavour profiles) or customise your product to specific segments, such as organic or for alcoholic beverages.

- Participate in the International Spice Conference to learn more about clove competition and to get updates about the clove market.

- Use your national export promotion agency’s services and actively participate in the creation of export strategies. The Spices Board of India is a good example of a sector-specific export support organisation.

Which products are you competing with?

Cloves are typified by their strong, sweet and spicy aroma, and distinct warm, woody and slightly floral note. The flavour of cloves is also intense. It is sweet and spicy with a hint of bitterness. Cloves can add a warm and rich flavour to both sweet and savoury dishes.

Cloves are hard to replace. However, there are some other spices that can substitute cloves in some recipes. For example, cinnamon has a sweet and warm flavour with some subtle spiciness. Mace, which is the outer covering of the nutmeg seed and has a slightly mild flavour, can also be used instead of cloves in some recipes.

In addition to the culinary application, cloves have traditionally also been used for their potential health benefits. They may have antibacterial, anti-inflammatory and analgesic properties. Clove oil is sometimes used to relieve toothaches. Obviously for these ‘medical’ applications there are a lot of competing products available.

Tip:

- Read the CBI outlook and statistics study to learn more about other spices with a growing demand, which also mentions cinnamon and mace.

4. What are the prices for cloves?

The prices for cloves vary depending on the grading of the product and the certifications. The supply of and demand for cloves also vary during the year. Accordingly, prices always vary throughout the year.

The quality of the cloves defines the price

The main factor that determines the price of clove is grading. Cloves are usually classified as follows:

- Hand Picked Selected: these cloves are free of odd matters and have a maximum of 1% stems, baby cloves and headless cloves, and a moisture content below 10–11%. Handpicked cloves have the highest quality and price. This type of clove is often used in high-end restaurants and gourmet food products.

- Grade 1: These cloves may be up to 2% stems, baby cloves and have a moisture content below 13%. They can contain up to 5% headless cloves. The foreign matter might be present up to 2%. Grade 1 cloves follow the handpicked cloves in quality and price. This grade is sold as a single spice in retail and used in the hotel, restaurant and catering sector.

- FAQ (Fair to Average Quality): These cloves may be 3% stem, baby cloves, headless cloves and have a moisture content below 13%. These cloves can be between 20% and 50% headless cloves, and they can be up to 3% foreign matter. FAQ cloves have the lowest price and are mainly used for industrial purposes.

This classification varies among countries and even among companies.

Table 1: Indicative FOB prices of cloves (USD/MT), October 2023

|

Grading |

Price in USD/MT |

|

Hand Picked Selected |

12,250 |

|

Grade 1 |

10,750 |

|

Cloves FAQ |

10,000 |

Source: Verstegen

International certifications impact the price

Certification schemes like Fairtrade and organic also affect clove prices. Fairtrade does not set a minimum price for conventional and organic cloves, as market prices seem to be good enough to provide a reasonable margin for producers. Accordingly, the Fairtrade premium still increases the overall income of the farmer by 15% of the commercial price.

The organic certification increases the price of cloves by 1–3 USD per kg, depending on the supply and demand. Cloves are relatively easy to convert to organic. The main hurdles for farmers to get the organic certifications are the administrative tasks and the certification costs.

Table 2: Indicative FOB prices of organic cloves from Sri Lanka (USD/MT), October 2023

|

Grading |

Price in USD/MT |

|

Hand Picked Selected |

17,000 |

|

Grade 1 |

16,000 |

|

Cloves FAQ |

14,000 |

Source: Verstegen

Improve the income of farmers with training

Farmers do not currently grade or clean cloves. They sell their produce with mixed grades. The collector or exporter cleans and grades the cloves. This means it is unclear for the farmer what the value of their produce is. Training farmers to understand the different grades and show them how to clean and grade their products would directly affect their income. At the same time, exporters will benefit by having less rejects and ultimately by improving the quality of the produce they have access to.

Retail prices

The majority of cloves that enter the European market go to the food industry. At the retail level, spice mixes containing cloves are growing. Only a fraction of the cloves imported will be sold as single spice in the retail.

The retail price of cloves depends on variables like quality, brand and outlet, but it may exceed €270 per kg for ground cloves sold in small packages. Ground cloves can be cheaper than whole cloves because low quality cloves can be used. Nevertheless, there are also ground cloves that demand very high prices in the market. It is impossible for end consumers to know what quality is used. They may trust a specific brand and be ready to pay a higher price for it.

For whole cloves, the quality is more important, as the consumer can see what the cloves look like. Nevertheless, there are also big differences in the retail prices of whole cloves.

Examples of cloves prices available across Europe in September 2023 are given below.

Germany

- Whole cloves in a 50 gm plastic bag from the Indian brand TRS for €1.97 available at Tukwila-Zazu online get Grocery store

- Whole cloves in a 60 gm glass jar from CHANDLER manufacturer for €5.30 available at the supermarket chain Kaufland.

- Whole cloves in a 250 gm plastic box from PEnandiTRA for €8.99 available at the supermarket chain Kaufland.

United Kingdom

- Whole cloves in a 150 gm plastic bag from the British brand Indus for 1.99 GBP available at Morrisons supermarket chain.

- Whole cloves in a 30 gm glass jar from Tesco for 1.00 GBP available at Tesco supermarket chain.

Spain

- Whole cloves in a 23 gm glass jar by the brand Ducros for €3.09 (€134.35 per kg) available at El Corte Inglés stores.

- Ground cloves bio in a 50 gm plastic bag by the brand El Antiguo Herbolario for €1.50 available at El Antiguo Herbolario stores.

The Netherlands

- Whole cloves in a 15 gm plastic bag by the brand Verstegen for €1.99 (€132.67 per kg) available at Albert Heijn stores.

- Ground cloves in a 35 gm glass jar by the brand Verstegen for €3.95 (€112.86 per kg) available at Jumbo stores.

France

- Whole cloves in a 23 gm glass jar by the brand Auchan for €2.12 (€92.17 per kg) available at Auchan stores.

- Ground cloves bio in a 40 gm plastic jar by the brand Biodyssee for €3.00 (€75.00 per kg) available at Biodyssee stores.

Tip:

- Stay informed about global harvests and inventory levels. Search for crop reports that are frequently shared by big actors like the Indian Spice Board. The Dutch importer Nedspice also regularly releases the latest data on national and international clove prices.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research