Entering the European market for dried ginger

Complying with European regulations is a minimum requirement to access the European market for ginger. Pay special attention to controls on contamination, pesticide residues, heavy metals, food additives and food fraud. Even with its strict requirements, the European market offers many opportunities for exporters.

Despite the dominance of China on international and European markets, suppliers from Peru, for example, have developed their ginger exports to Europe impressively – combining certification, large volumes and promotion. Another good example is the National Sustainable Ginger Platform (NSGP) in Nigeria, active in improvement of quality, sustainability certification, organic production and refined processing.

Contents of this page

1. Which requirements and certifications must dried ginger comply with to be allowed on the European market?

What are mandatory requirements?

All foods, including dried ginger, sold in the European Union must be safe, as specified in the General Food Law. This applies to imported products as well. Additives must be approved. Harmful contaminants, such as pesticide residues, and excessive levels of mycotoxins or preservatives are banned. It should also be readily obvious from the labelling whether a food contains allergens.

Official border control for dried ginger imported to the European Union

Official food controls include regular inspections that can be carried out at import or at all further stages of marketing. In case of non-compliance with the European food legislation, individual cases are reported through the Rapid Alert System for Food and Feeds (RASFF), which is freely accessible for the general public.

You should be aware that repeated non-compliance with the European food legislation by a particular country might lead to special import conditions or even suspension of imports from that country. Those stricter conditions include laboratory tests for a certain percentage of shipment from specified countries.

The European Parliament and Council adopted the New Official Controls Regulation, which entered into force in December 2019. New official controls regulation will extend its scope to organic products. Exporters from third countries will use the single standard Common Health Entry Document for the prior notification of exports.

Contaminant control in dried ginger

The European Regulation on Contaminants sets maximum levels for certain contaminants in food products. This regulation is frequently updated and apart from the limits set for general foodstuffs, there are a number of specific contaminants limits for specific products including dried ginger. The most common requirements regarding contaminants in dried ginger are related to presence of pesticides residues, mycotoxins, heavy metals, microbiological organisms and food additives. Contaminant levels shall be kept as low as can reasonably be achieved following recommended good working practices.

There were more than 50 notifications of issues with ginger in the RASFF database between 2020 and 2022. The notifications relate to several issues: ethylene oxide residues (used to combat fungi and bacteria in several production countries, but which are banned by the European Union), presence of aflatoxin, presence of Bacillus and Salmonella, presence of lead.

Mycotoxins

Presence of mycotoxins (aflatoxins and ochratoxin A) was the main reason for banning dried ginger from the European market until 2012. The maximum level of aflatoxin for dried ginger is 5 μg/kg for aflatoxin B1 and 10 μg/kg for the total aflatoxin content (B1, B2, G1 and G2). For ochratoxin, the maximum level is 15 μg/kg (CELEX 32006R1881).

Pesticide Residues

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticide residues than allowed will be withdrawn from the European market. However, excessive residues of pesticides are not very frequent case in trade with dried ginger. The European Union regularly publishes a list of approved pesticides that are authorised for use in the European Union. This list is frequently updated.

Heavy metals

Until recently, specific limits for the presence of heavy metals in spices and herbs were not set in the European legislation on contaminants. However, this changed in 2021, following a review process for the maximum allowed levels of lead. The new maximum level for lead (in mg/kg) is set at 2 for ginger.

Microbiological contaminants

Steam sterilisation is the best way to combat microbiological contamination. However, this treatment negatively affects the taste of ginger. Therefore, research is being conducted into alternatives to steam sterilisation. Since it is still the cheapest and safest method to combat microbiological contamination, European buyers usually require their suppliers to use steam sterilisation.

Tips:

- Consider supplying ginger that is sterilised at the source. It will give your ginger much more value. However, investments in the necessary equipment can be very costly, amounting to up to €1 million.

- Arrange heat treatment by contracting specialised service providers in Europe, such as Fisce.

Food additives

Buyers and European authorities can reject products if they have undeclared, unauthorised or too high levels of extraneous materials. There is specific legislation for additives (like colours, thickeners) and flavourings that list what E-numbers and substances are allowed for use. Additives that are authorised are listed in Annex II to the Food Additives Regulation.

Although you might consider using food additives in the production of dried ginger, keep in mind that European traders and consumers prefer spices that are additive-free.

Food fraud

Food fraud in the spices and herbs sector is a serious issue, and European buyers are increasingly attentive to it. Many laboratories around Europe have increased testing to discover this type of fraud in spices and herbs. Common methods include DNA analysis, isotopic techniques, mass spectrometry, spectroscopy, chemometrics, and a combination of detection methods. Concerns around ginger include adulteration with spent ginger, flours and starch products. Ginger adulteration constitutes food fraud, which is illegal and will affect a supplier’s reputation in the European market.

Tips:

- Follow Codex Alimentarius Code of practice for the prevention and reduction of mycotoxins in spices and Code of Hygienic Practice for Low-Moisture Foods. Comply with food safety requirements during drying, storage, processing (such as sieving, mixing, grinding or crushing), packaging and transport. This will help prevent contamination with mycotoxins and other substances. Not even steam sterilisation can fully remove these substances.

- Always discuss with your potential buyers whether they want steam sterilisation. If you cannot sterilise your ginger yourself, look for local sterilisation companies that can provide this service for you. Keep up-to-date on the development of alternatives to steam sterilisation by checking online sources such as GreenFooDec.

- For the control of contaminants use only services of laboratories that are ISO/IEC 17025 accredited. Presence of aflatoxins must be tested according to the EU regulation on methods of sampling and analysis for the official control of the levels of mycotoxins in foodstuffs.

- Read more about MRLs on the European Commission website about Maximum Residue Levels. Read the Ongoing Reviews of MRLs in the European Union to ensure you are prepared for any changes made to them.

- Check the Rapid Alert System for Food and Feed (RASFF) database for examples of dried ginger withdrawn from the market and the reasons behind these withdrawals. However, you should keep in mind that withdrawals can occur and avoid them at all costs. A withdrawal will influence the reputation of your company as well as the reputation of your country as a dried ginger supplier.

- Read the Guide on Authenticity of Herbs and Spices published by the UK Food and Drink Federation to find out more about actions and initiatives that can help you prevent fraud in your supply chain.

What additional requirements do buyers often have?

Consider complying with the following non-legal requirements to ease market access. European buyers can use these requirements as selection criteria.

- Food safety certification as a guarantee: Many European buyers (e.g. traders, food processors, retailers) require the implementation of a (HACCP-based) food safety management system.

- The most important food safety management systems in Europe are the Food Safety System Certification 22000 (FSSC 22000), BRCGS Food Safety, International Featured Standards (IFS Food) and Safe Quality Food programme (SQF). Always verify your buyer’s preference for a specific food safety management system, as some of them may prefer one system over another. For example, retailers in the United Kingdom have developed BRCGS. For that reason, BRCGS is more frequently required in the United Kingdom than in other countries. If you want to target the United Kingdom, BRCGS may be more important to your buyers than, for example, IFS.

- Corporate Social Responsibility (CSR): companies have different requirements for CSR, such as signing their code of conduct or following common standards or reporting methodologies including the Supplier Ethical Data Exchange (SEDEX), Ethical Trading Initiative (ETI), the Business Social Compliance Initiative code of conduct (BSCI) or BCorp.

Quality requirements

Product quality is a key issue for buyers in Europe. You need to comply with the Quality Minima Document published by the European Spice Association (ESA). This document is leading for the national spice associations affiliated with the ESA and for most key buyers in Europe.

The Quality Minima Document specifies the chemical and physical parameters that dried ginger needs to comply with when sold in Europe before crushing and grinding (after drying):

- ash: maximum 8%

- acid insoluble ash: maximum 2%

- moisture: maximum 12%

- volatile oil: minimum 1.5 ml/100 gr

- SO2: maximum 150 ppm

The ESA has not developed cleanliness specifications. As a result, European buyers often use the cleanliness specifications for ginger stated by the American Spice Trade Association (ASTA):

| Whole insects dead | Excreta Mammalian | Excreta other | Mould | Insect defiled/infested | Extraneous foreign matter |

| By count* | By mg/lb | By mg/lb | % by weight | % by weight | % by weight |

| 4 | 3 | 3 | More than 3% mouldy pieces and/or insect-infested pieces by weight | More than 3% mouldy pieces and/or insect-infested pieces by weight | 1 |

*per sub-sample

Tips:

- Check the main page of ISO’s Technical Committee #34/SC 7 from time to time. This committee develops standards for spices, culinary herbs and condiments, and the page offers an overview of which standards the committee is working on. Also, the finished standards can be found there.

- Check ESA’s Quality Minima Document (in English and Spanish) for more information on the chemical and physical parameters that your unprocessed ginger needs to comply with when it is sold in Europe.

- Learn more about good practices for spices, including cleanliness and adulteration prevention, by reading the various Best Practices and Guidance documents offered by the American Spice Trade Association (ASTA).

- Learn more about maintaining the quality of your dried ginger supplies during transportation on the website of the German Transportation Information Service: Dried Ginger.

- In addition to the quality requirements mentioned here, please refer to our study about buyer requirements of spices and herbs for a general overview of buyer requirements in Europe.

Labelling requirements

Correct labelling is important for European buyers. To this end, pay extra attention to labelling your product.

For bulk ginger, you must include the following information:

- name of the product

- details of the manufacturer (name and address)

- batch number

- date of manufacture

- product grade

- producing country

- harvest date (month-year)

- net weight.

Other information that exporting and importing countries may require include the bar, producer and/or packager code, as well as any extra information that can be used in order to trace the product back to its origin.

In case your product is organic and/or Fairtrade-certified, the label should contain the name/code of the inspection body and the certification number.

Packaging requirements

For shipping, bulk dried whole ginger roots should be packaged in PP or PE woven bags (36-65 kg) with good respiration/ventilation. The most applied packaging sizes depend on customer demands, and on what is common in the supplying country. For example, in Nigeria ginger is typically packed in 50kg bags.

Ginger processed in the form of slices or powder is packaged in multi-wall laminated bags of different weights ranging from 1 to 25 kg. Common weight classes are 12.5 kg and 25 kg.

Tips:

- Ask your buyer for their specific packaging requirements.

- Store packaged ginger in a dry, cool place to prevent quality deterioration. If you offer organic certified ginger, physically separate it from ginger that is not certified.

- See the Practical Actions website to learn about improving ginger pre-harvest handling and processing.

What are the requirements for niche markets?

Organic ginger

In order to market your ginger as organic in the European market, it must comply with the regulations of the European Union for organic production and labelling. Obtaining the EU organic certificate is the minimum legislative requirement for marketing organic ginger in the European Union.

Note that all organic products imported into the EU must have the appropriate electronic Certificate of Inspection (COI). These COIs must be issued by control authorities prior to the departure of a shipment. If this is not done, your product cannot be sold as organic in the European Union and will be sold as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

Refer to this list of recognised control bodies and control authorities issued by the EU to ensure that you always work with an accredited certifier. To become organic-certified, you can expect a yearly inspection and audit, which aims to ensure that you comply with the rules on organic production.

If you want to export to countries outside of the European Union (EU), check the required legislations per country. For instance, Switzerland has its own Swiss Organic Law and the UK has its Organic Products Regulations 2009.

In addition to the EU organic standard, most European countries also have their own voluntary organic standards, like Bio-Siegel (Germany), AB mark (France) and the Ø logo (Denmark). Some countries also have private standards or labels, like Naturland (Germany), Soil Association (United Kingdom), Bio Suisse (Switzerland) and KRAV (Sweden). But note that having the EU organic standard is usually sufficient for most buyers.

Sustainability certification

Two most commonly used sustainability certification schemes are Fairtrade and Rainforest Alliance. Fairtrade international has developed a specific standard for herbs, herbal teas and spices for small-scale producer organisations. According to this standard, a premium price of 15% over and above the negotiated price between producer and seller must be established.

In order to improve sustainable production and sourcing of spices, a group of mainly European companies and organisations formed the Sustainable Spice Initiative in 2010. The major objective of this initiative is to strive for fully sustainable spice production and trade in the sector.

As of August 2022, there are 13 Rainforest Alliance-certified farms groups for ginger worldwide. These producers are spread throughout Nigeria and India (both countries supplying the largest volumes), China, Sri Lanka, Bangladesh, Tanzania, Peru and Ivory Coast. Together, producers in these countries yield around 5,800 tonnes of ginger.

Tips:

- For the overview of the developments of the sustainability initiatives in the European spices market read our study on Trends on the European Spices and Herbs Market.

- Work together with European buyers, non-governmental organisations, national or international governmental organisations to make it economically feasible for you to receive certification. Further information is available on websites such as the Sustainable Spice Initiative, the Netherlands Enterprise Agency, and the German Ministry for Economic Cooperation and Development.

- Check the publication by the Open Trade Gate Sweden on the new European rules regarding organic production and certification (PDF) to familiarise yourself with the requirements to supply organic-certified products to Europe.

- Consider organic ginger production seriously. Although the organic ginger market is still small, organic certification can offer opportunities for ginger producers. Several companies from Peru have jumped into this market in the past years, and they booked good successes.

- Familiarise yourself with the concept of self-verification. Self-verification means that suppliers assess their own compliance with the sustainability code of buyers. Examples include Unilever’s Sustainable Agriculture Code (SAC) or the Olam AtSource comprehensive sustainable sourcing system.

2. Through what channels can you get dried ginger on the European market?

Of course, dried ginger is used at home as a spice in Asian-style food dishes, and to a lesser extent also to spice self-baked cookies etc. In addition, ginger pieces are used to make tea or extracts for cold treatments. Consumer use at home of ground ginger or ginger pieces accounts for between 10-25% of the total market.

However, the main market segment of ginger is the food-processing industry with 75‑90% of the market. The leading segment is bakery products (such as gingerbread and cookies and other sweet pastry products), but also Asian food products, soups and sauces, and various drinks or infusions (e.g. ginger ale, ginger beer, tea).

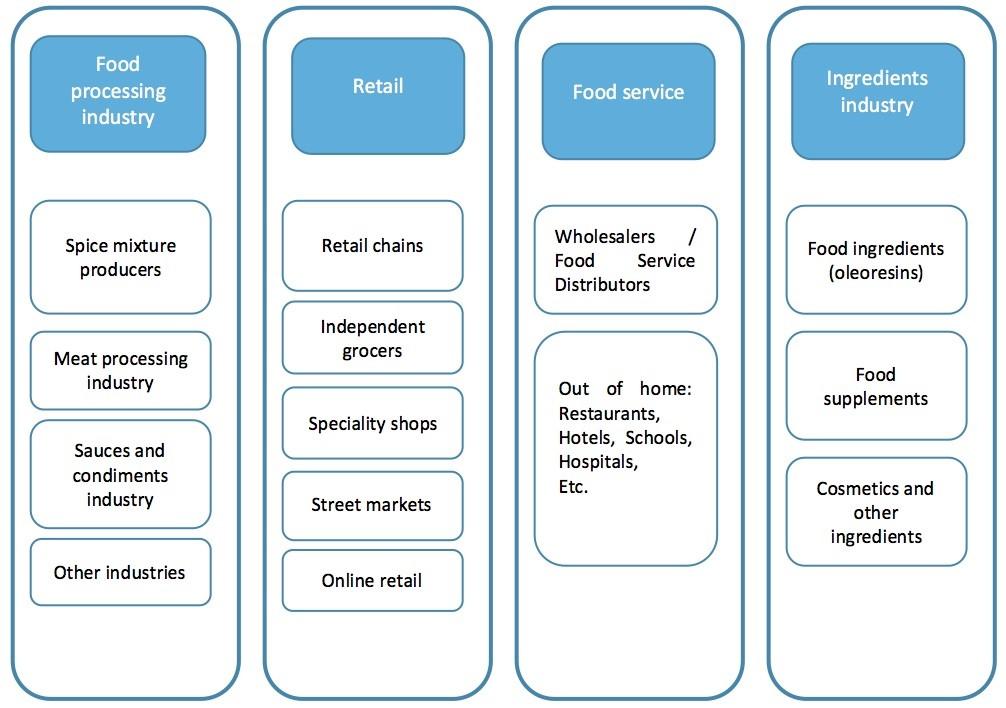

How is the end market segmented?

The largest buyer of dried ginger in Europe is the food-processing industry, followed by retail, foodservice and food ingredients (additive segments).

Figure 1: End market segments for ginger in Europe

Food-processing industry

The food and drinks processing industry is roughly estimated to use 75-90% of all dried ginger on the European market. The largest users within this segment include spice mixture producers, convenience food and snacks, culinary, bakery products, the sauces, seasonings and soups industry, the drinks and beverages industry, and the confectionary and chocolate industry.

Spice mixture producers are companies specialised in production of spices and seasonings for different applications. Those companies are constantly investing in research to develop custom formulations for food-processing companies and help launching new attractive tastes. They produce either dried or liquid spice ingredients. Some examples of such companies in Europe are AVO (German producer with also a factory in Poland and in France), Meat Cracks, Kerry Ingredients, Frutarom (part of IFF), Farevelli Group, Food Ingredients Group, Kalsec, EHL Ingredients or Ion Mos.

The meat industry is an important user of dried ginger but very often not supplied directly but through spice and food ingredient companies. However, larger groups of companies may import dried ginger directly. An example of such a group includes OSI Food Solutions.

The European sauces, seasonings and soups industry is also an important user of dried ginger. However, this market is dominated by international brands such as Kraft Heinz, McCormick, and Maggi (Nestle).

Retail

The retail and food-service segments for spices and herbs are dominated by European (often national) spice brands/companies, such as Fuchs in Germany, Verstegen and Euroma in the Netherlands, Santa Maria, part of the Paulig Group (Scandinavian countries) and multinational brands such as McCormick, Kraft Heinz, etc. For example, the Dutch spice specialist Silvo is part of McCormick since 2004. Also, some strong brands are developing in south Eastern Europe, such as Prymat Group. These spice companies import spices directly from all over the world and have in-house processing and R&D facilities.

Private label (supermarket) brands are important as well. European spice packers and blenders conduct production for all these brands. Since supermarkets often require large quantities and have very specific requirements regarding packaging, it is very difficult to supply them directly from outside Europe. Products already packed in origin countries are mainly found in European ethnic supermarkets, open-air markets, and webshops.

The retail sector can also be segmented into supermarkets, independent grocers and specialty shops. Most retailers sell individually packed spices or herbs and also a range of specific mixtures. Overall, tailored spice and herb mixtures are becoming more popular in the retail segment, partly due to the increasing interest in ethnic food but also due to the growing demand for convenience.

Leading supermarket chains in Europe include Tesco, Carrefour, Lidl, Metro, Aldi, Delhaize, Rewe, Edeka, Auchan and Albert Heijn.

Food service

The foodservice channel (hotels, restaurants and catering) is usually supplied by specialised importers or wholesalers. These companies are sometimes the same as the brands that supply the retail segment. The foodservice segment often requires larger packaging sizes of dried ginger, e.g. cans from 300 to 500 grams or sacks of a few kg.

World cuisines, healthy food and food enjoyment are the major driving forces in the foodservice channel in Europe. The fastest-growing business types are likely to be new (healthier) fast food, street food, pop up restaurants, international cuisines and sandwich bars.

Ingredients industry

The ingredients industry is composed by ingredient formulators that serve various end-using industries such as food, cosmetics and health care. Ingredient formulators are often large-scale companies operating globally, like Givaudan, Firmenich (now part of DSM), Symrise, Naturex and Oterra. These companies focus on cutting-edge technology and usually source from various global suppliers. They have very strict sourcing protocols for quality control and consistency, as well as sustainability.

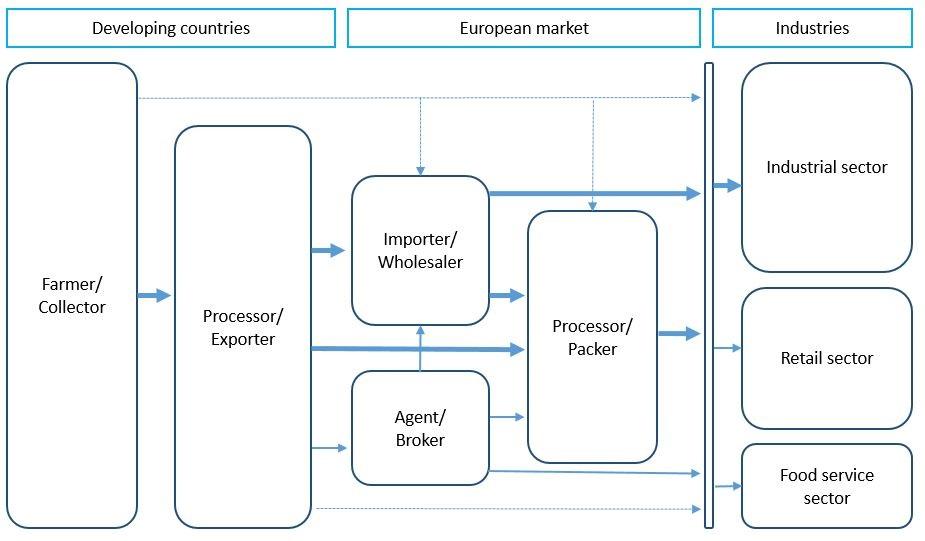

Through what channels does the ginger reach the consumer?

Specialised spice importers

Specialised spice importers represent the most important channel for dried ginger in Europe. However, sometimes, dried ginger can be placed on the market through an agent or directly supplied to food processors or food service companies. Some wholesalers also have packing facilities and usually supply private label spices and herbs.

Importers and wholesalers can be general spice importers or further specialising in specific roles. Some now exclusively deal with ingredients aimed at the food-processing industry while others pack spices and spice mixes for retail chains. Some importers also deal with a broader range of products apart from spices, such as beans, seeds, dried fruits and nuts, tea, or fine foods/delicatessen.

An important trend is the growing pressure that retailers put on their suppliers (importers and companies active in the food industry). The higher requirements from the retail industry determine the supply chain dynamics from the top down the chain. Pressure is translated into lower prices but also added value aspects such as ‘sustainable,’ ‘transparent’, ‘natural,’ ‘organic’, or ‘fair trade’ products. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred developing-country suppliers.

Examples of bulk importers of dried ginger in Europe include Albarracin (Spain), Nedspice (the Netherlands), European Spice Services (Belgium), Husarich (Germany) or Saran Enterprises (Poland).

Examples of specialised importers that are using dried ginger in different spice mixtures include Culinar (Sweden), Epos (the Netherlands; the only producer in Europe with a range of allergen-free blends), and Colin Ingredients (France).

Examples of spice importers that are supplying several segments include Isfi Spices (Belgium) and Verstegen (Netherlands).

Processors/packers

Large spice processors source their ginger and other spices directly from producing countries. Since these companies often have large portfolios and work with several spice origins, they tend to have designated departments for sourcing. In most cases they will have more than one supplier per spice, so as to spread their risks regarding product consistency, quality and availability. These companies process spices by cleaning, sterilisation, grinding, blending and packaging.

Spice processors may supply ginger as both an ingredient or a finished product, under their own brand or under a private label. Examples of large-scale processors in Europe are: Euroma (Netherlands), which opened its new factory in 2019, and Fuchs (Germany), which has a product line for retail and another one focusing on the industrial sector.

Figure 2: Trade channels for dried ginger in Europe

Agent/broker

Brokers and agents are intermediaries who bring buyers and sellers together. They charge a commission for their services. European buyers can be trading companies, but they are mostly processors. Agents and brokers are interesting when you have a specialised product (such as high quality or sustainably certified) for which buyers are harder to find. The role of the agent is slowly diminishing due to the increased transparency demanded by the market.

Tips:

- Download the members list (PDF file) of the European Spice Association (ESA). The first pages list the several national spices associations that are member of the ESA. From page 2 on there is a long list of so-called “full member companies”. Many of these companies are dedicated spices and herbs traders and packers. In the document these companies are grouped per European country.

- Search the list of exhibitors of the specialised trade fair Fi Europe. This fair is the leading event in Europe where all ingredients companies in Europe gather. It takes place every year. In the even years the FI is in Germany, in the uneven years in France.

What is the most interesting channel for you?

Specialised importers seem to be the best contact for placing dried ginger on the European market. This is specifically relevant for new suppliers as supplying the retail segment directly is very demanding and requires a lot of quality and logistical investments.

Importing wholesalers source large amounts of dried grinder, often from different origins, and break these bulk imports into smaller amounts for the smaller end users, including spice companies and other food industry players. Although many exporters from developing countries often aim to supply European smaller industrial users directly to obtain higher margins, this bulk-breaking function can contribute to an increase in trade volumes and eventually higher profits.

However, for the well-equipped and price competitive producers, packing for private labels can be an option. Until now, importers often do private-label packing for European supermarkets. As the cost of the workforce in Europe is increasing, importers of dried ginger sometimes search for opportunities to pack in supplying countries if they can assure full traceability and quality control. High volume and consistent availability, high quality consistency and high food safety will be very important here. Industrial buyers are expected to be very strict in the implementation of food safety certifications like FSSC 2000, BRCGS and IFS.

If you have limited experience exporting to European countries, agents can play a very important facilitating role. Agents can evaluate and facilitate connections with buyers and finance institutions. Working with an agent is also useful if you need a trusted and reputable partner within the spice sector. Be prepared to pay an extra commission for their work, usually ranging between 3 and 10%.

As an exporter, you can use several channels to bring your spices or herbs on the European market. However, you should realise that if you are unable to supply at least one container within your buyer’s (short) time frame, it is unlikely that you will successfully manage to supply to the European market. If you are unable to do so, you can work together with other suppliers interested in supplying to the European market.

Tips:

- See our Tips for finding buyers on the European market for spices and herbs.

- Benefit from the experience and knowledge of specialised European importers and agents instead of approaching manufacturers directly.

- To help you enter the market, consider working with an agent or representative with a good reputation. You can look for commercial agents on the website of Internationally United Commercial Agents and Brokers (IUCAB). The IUCAB website lists all their national member organisations; you can use the services of these organisations to find an agent or representative in a specific country.

- Visit or participate in trade fairs to test whether the market is open to your product, to obtain market information and to find potential buyers. The most relevant trade fairs in Europe are ANUGA, SIAL SANA, Food Ingredients and Health Ingredients Europe, Biofach (for organic) and Vitafoods.

3. What competition do you face on the European dried ginger market?

Suppliers from other developing countries are your main competitors. In 2021, suppliers from developing countries exported a total of €304 million. Around 90% of this value consisted of whole ginger, of which a considerable part is fresh ginger. If you are a supplier of dried ginger only, China, Peru, Nigeria and India will be your main competitors. Brazil is a strong competitor in fresh ginger, together with China, Peru and Thailand, in case you also handle this product next to dried ginger.

Which countries are you competing with?

China

China is Europe’s main supplier of ginger and also your most important competitor. In 2021, the country accounted for more than 60% of all exports from developing countries to Europe. At least 50% of Chinese exports are fresh produce, and over 90% of Chinese fresh and dried ginger is exported in uncrushed/unground form; only less than 10% is crushed or ground product.

The production of ginger in China is mainly mechanised. Most of the Chinese offer is both fresh and dried ginger that comes from the #1 ginger-producing province Shandong (note that ginger is produced in several other provinces too). While China is the world’s largest exporter of ginger, it is also the largest market for ginger, given it is an important spice in the Chinese kitchen.

The use of mechanised production methods enables China to produce and export larger volumes of ginger than other suppliers from developing countries. This makes it difficult to compete with China if you are a smaller supplier. If you want to compete with China, you should be able to:

- Deliver stable supplies of ginger, both in quantity and in quality;

- Comply with delivery times;

- Comply with food safety requirements.

You can also explore opportunities on niche markets such as organic and Fairtrade, or for specific applications such as beverages, which have specific requirements.

Peru

Accounting for 14% of European imports from developing countries, Peru is the second-largest supplier. Peru is the preferred supplier of several fresh produce importers, as the quality is considered to be superior to Biofact, the fresh ginger from China. Peru’s ginger exports to Europe, and thus its market share, increased significantly between 2017 and 2020. The year 2020 was extremely strong for Peruvian ginger exports to Europe, which is reflected by growth in exports exceeding 100% (from 11 thousand tonnes in 2019 to 23 thousand tonnes in 2020). The quantities supplied by Peru remained relatively small compared to those from China.

But Peru suffered a small decline in exports to Europe between 2020 and 2021. The decline in Peruvian exports is also marked by very strong growth of Brazilian ginger exports to Europe.

A small share (less than 30%) of Peruvian exports to Europe consists of high-quality dried ginger, which is neither crushed nor ground, and much of it is organically certified.

Peruvian ginger production grew slowly but gradually until 2015. In 2015, exports totalled 11 thousand tonnes. Production and exports really took off between 2016 and 2018, when (total) exports of 15-26 thousand tonnes were recorded by Peru. During the record year 2021, Peru exported more than 55 thousand tonnes, with the USA and the Netherlands as top destinations. Canada, Spain and Germany were also among the largest importers experiencing growth between 2017 and 2021.

Exports are strongly promoted and supported by the national export promotion organisation, PromPeru. PromPeru has created a national brand ‘Superfood from Peru’ – ginger is one of them – which is promoted at all leading international trade fairs. Peruvian exports of ginger are expected to continue to grow over the next several years.

Brazil

Brazil is the third-largest supplier, with a 11% share of European imports coming from developing countries. After China, and together with Peru, Brazil is part of the top-3 suppliers of fresh ginger to Europe. All exports are fresh produce of high quality, also because a large share of Brazilian ginger is exported via air freight. Until 2017, most of the Brazilian ginger was conventional, but since 2019 part of the exports is organically certified. If you are a supplier of both dried and fresh ginger, Brazil will represent the most competition in the fresh category.

Nigeria

Nigeria is the fourth supplier, with a 5.5% share of European imports coming from developing countries. All exports are of dried ginger that is neither crushed nor ground. The Nigerian season for ginger runs from May to October and the supply season runs a little longer, totalling 9 months. Production takes place in the northern part of Nigeria, predominantly in Kano and Kaduna States.

The Nigerian Export Promotion Council is responsible for Nigeria’s export promotion. This is important, also in light of the fact that Nigeria identified ginger as one of its focus products for export diversification, away from oil.

India

India is by far Europe’s main supplier of Curcuma longa, but for ginger this is different. Although India is one of the largest producers of ginger in the world, the country only exports dried, ground ginger to Europe. Exports of Indian crushed ginger showed steady growth between 2017 and 2021, peaking at 5.8 thousand tonnes in 2021. Only over 1.5 thousand tonnes is exported to Europe, with the United Kingdom as its main market, followed by the Netherlands and Germany.

Thailand

Thailand is the sixth supplier, with a 1.1% (and stable) share of European imports coming from developing countries. Thailand predominantly exports fresh and organically certified ginger. From August to December, Thai organic ginger is more or less the only available organic ginger, with Peru dominating the organic ginger market in Europe during the rest of the year.

Which companies are you competing with?

Chinese companies

The production of ginger in China is mainly mechanised. Examples of companies from China that are reflecting China’s position as leading supplier of relatively cheap ginger at large volumes, are the following:

- Shandong Anqiu Baisheng Food Co. This company exports to mainly European countries such as the Netherlands and Spain. Their products and production comply with GAP, GRASP, BRCGS and SMETA, plus organic certification.

- Anqiu Luxing Food Co. This company’s export portfolio is more diversified in terms of geography. They export to Europe, America, and the Middle East.

- Qingdao Serve Nature Future. This company (also) mostly exports to Europe.

Most of the Chinese companies sell both fresh and dried ginger that comes from the #1 ginger production province Shandong (note that ginger is produced in several other provinces too).

Peruvian companies

Peruvian exporters of ginger mostly export a range of agricultural products. In the first place, often they export both ginger and curcuma, the two leading spices produced in Peru. Other products that might be part of the range are cacao, dried berries, etc. Some examples of such Peruvian exporters are Agro-Expo-Llacta SAC, SupraCorp SAC, and Fito Export.

Nigerian companies

Exporters from Nigeria typically export the whole range of Nigerian agricultural outputs. Examples are Enkay Indo Nigerian Industries, and Tinker and Bell.

Indian companies

Companies from India will be your main competitors when you would like to export ground ginger. Indian exporters can offer products at a low price, but at the same time, there are concerns among buyers regarding quality and quality consistency, including adulteration.

There are many companies in India that export spices. Ginger is in the top-3 of spices produced in India, so virtually all Indian spice exporters can export ginger, although it is not their most important export product. For example, curcuma is a more important export product for them. Most Indian exporters are small or medium-sized local companies, such as Nashik Maharashtra and Herbcyte. Competition among the many companies is considerable, which gives buyers a clear advantage when it comes to price negotiation.

Which products are you competing with?

Ginger has a typical flavour and taste; therefore, real substitution is not possible. The only substitution that one can think of is the use of fresh ginger instead dried ginger. Fresh ginger is used for cooking, at home or in restaurants, and in the manufacture of food and beverages.

Tips:

- Develop and express your unique selling points as a supplier of ginger. Think about factors that set you apart from your competitors and create your marketing story around these factors. For example, they can be related to the origin of your ginger, the agro-climatic characteristics of the producing region, the profile of producing communities, the unique quality of your product, your post-harvest techniques, or a combination of these aspects.

- Check the harvesting calendars at the website of Nedspice to understand the different harvesting periods in large producing countries. This information is important to know, as harvesting periods in different ginger producing countries vary considerably, which has a major impact on your competitive position throughout the year.

- Stay up to date on worldwide harvests and stock levels. Look for crop reports, which are often shared by industry players during specific spice events. Nedspice also publishes up-to-date information on national and international prices for ginger.

- Explore opportunities to cooperate with European processors, especially large ones that have the size and resources to invest. You can find European processors in the member lists of the national spice association in Europe. See the member section of the European Spice Association (ESA) for an overview of associations.

- Check the Food and Agriculture Organization of the United Nations (FAOSTAT) website for ginger production data.

4. What are the prices for dried ginger?

Ginger is an annual crop. The prices fluctuate from harvesting season to harvesting season. The price of dried ginger also depends on the price of fresh ginger. In addition, the different product varieties and origins have different prices.

Global market prices for ginger are strongly influenced by the largest producer of both fresh and dried ginger: China. While Chinese ginger is – on average – the cheapest ginger available on the global market, traders often prefer more expensive, high-quality ginger from suppliers in Peru and Brazil. They also buy from these countries because of quality differentiation and/or risk mitigation.

The price of ginger that consumers buy in the supermarket consists of:

- Raw materials: 5-15%.

- Processing: 5-15%

- Transport costs: 2-5%

- Import and processing in Europe: 15-30%

- Retail margin: 30-60%

Here are a few examples of dried ginger available across Europe:

- Dried ginger, as a snack, 1kg for GBP 16.5 (up 1 GBP from 2019 to 2020 and up another 0.5GBP from 2020 to 2021).

- Dried ginger pieces packaged in various quantities, UK. Price varies from €30 to €40 per kg.

- Ground ginger, Germany, prices vary from €20-60 per kg depending on the packaging size.

The margins you can obtain as an exporter may differ. These are influenced by factors such as:

- Country of origin

- Current and expected future harvest situation

- Quality of the raw material

- Level of processing

- Level of demand

- Trends in prices

Margins and profits can be higher for you as an exporter if you are able to add value locally. For example, by further processing or certification, you can create a competitive edge and benefit more.

Tips:

- See the websites of Spices Board India, Nedspice and International Trade Centre: Market Price Information for up to date information on national and international prices for ginger.

- Establish long-lasting relationships with your buyers. Buyers are willing to pay higher prices to suppliers that are able to help secure supply and comply with delivery times as well as food safety requirements. They will also be more willing to invest in your partnership.

This study was carried out on behalf of CBI by Autentika Global, and updated by Gustavo Ferro.

Please review our market information disclaimer.

Search

Enter search terms to find market research