Entering the European market for nutmeg

The most important requirement for the European market is having low levels of aflatoxins. Food safety certification, sterilisation, and reliable and frequent laboratory tests are very important. Sustainable production and the implementation of corporate social responsibility standards provide additional advantages for emerging suppliers. Strong competition for new nutmeg suppliers mostly comes from Indonesia. Smaller volumes come from Vietnam, Grenada and Sri Lanka.

Contents of this page

1. What requirements and certifications must nutmeg comply with to be allowed on the European market?

You must comply with multiple mandatory requirements to enter the European market. Buyers will likely have additional requirements, and they may ask for certification. Mandatory requirements for nutmeg in Europe mainly focus on consumer health and safety. Sustainability requirements are also becoming increasingly important.

What are mandatory requirements?

Most mandatory requirements regarding importing nutmeg are related to food safety. The European Commission for Health and Food Safety is responsible for the European Union’s policy and monitoring the implementation of related laws.

Official food controls

Nutmeg imported into the European Union (EU) undergoes official food checks. Non-compliance with European food laws is reported through the Rapid Alert System for Food and Feed (RASFF). In 2022, there were ten cases related to nutmeg out of a total of 290 reported issues for all spices and herbs. These were all related to mycotoxins.

If nutmeg imports from a particular country repeatedly violate European food regulations, the frequency of official border controls is increased. This is the case for nutmeg from India (CN codes 090811 and 090812), where 30% of the products are subject to checks for aflatoxins.

Nutmeg from Indonesia faces an increased 30% frequency of official checks for aflatoxins too. This is more complex than for Indian nutmeg. For Indonesian goods that contain a mix of produce, where 20% of the overall produce is nutmeg, the rule already applies; the increased frequency still applies even if the nutmeg does not come from Indonesia, but the other ingredients are of Indonesian origin.

A similar rule also applies to checks on pesticide residues in nutmeg from India. This increased frequency is 20% and applies to all spices and herbs registered under CN codes 0905, 0906, 0907, 0908 and 0909, which are imported into the EU from India.

Tip:

- Search the RASFF database for examples of withdrawals from the European market.

Contaminants control in nutmeg

Food contaminants are substances that are not added to food intentionally. They may be present in nutmeg as a result of production, packaging, transport, holding or environmental contamination. Contaminants can pose a risk to consumers’ health. To minimise these risks, the EU has set maximum levels for certain contaminants in foodstuffs. Mycotoxins are the most relevant.

- Mycotoxins: There are limits for nutmeg. The maximum level of aflatoxin for nutmeg is between 5 μg/kg for aflatoxin B1 and 10 μg/kg for total aflatoxin content (B1, B2, G1 and G2). For ochratoxin A, there is a maximum level of 15 μg/kg. In the period January 2020 – October 2023, there were 44 cases reported in RASFF for nutmeg, all of them related to mould.

- Metal contaminants: The EU has had lead residue limits for spices since 2021. This limit for nutmeg is 0.9 mg/kg.

- Microbiological contaminants: The EU regulation on microbiological criteria for foodstuffs does not set specific limits for nutmeg. The general limits apply. The most important microbiological risk is salmonella, which must be completely absent.

- Polycyclic aromatic hydrocarbons (PAH): PAH can increase the risk of cancer. Consequently, the EU has set PAH limits for spices and herbs, including nutmeg: 10 μg/kg for benzo(a)pyrene and 50 μg/kg for the sum of all PAHs.

Tips:

- Check the national legislation in your target countries using the ‘My Trade Assistant’ tool on EUAccess2markets to see if there is country-specific legislation for nutmeg in place.

- Comply with the Codex Alimentarius Code of Hygienic Practice for Low Moisture Food (CXC 75-215) and the International Organisation of Spice Trade Associations’ General Guideline for Good Agricultural Practices on Spices and Culinary Herbs to prevent microbiological contamination.

- Consider heat sterilisation as a natural, chemical and radiation-free option. Since heat sterilisation equipment is quite expensive, it might be interesting to use a third party.

Pesticide residues

The EU regulation on Maximum Residue Levels of pesticides sets maximum residue levels (MRLs) for pesticides in or on food products. Products containing more pesticide residues than allowed are withdrawn from the European market. There were no issues with pesticide residues reported in RASFF for nutmeg in the period between January 2020 and October 2023.

Tip:

- Select your product or the pesticide you use in the EU pesticide database for a list of relevant MRLs.

Labelling requirements

Each export package should declare:

- Name of product (e.g. ‘ground nutmeg’)

- Batch code

- Net weight in the metric system (mostly in kg)

- Shelf life of the product or best before date, and recommended storage conditions

- Lot identification number

- Country of origin and name and address of the manufacturer, packer, distributor or importer

The lot identification and the name and address of the manufacturer, packer, distributor or importer may be replaced by an identification mark. A label can also include details, such as brand, drying method and harvest date. These batch details can also be included in the Product Data Sheet. This may also be called a ‘Technical Data Sheet’, ‘Product Specification Sheet’ or something similar. This document contains the specific characteristics of your product, which your buyer will ask for to assess your product. Take a look at this example for organic nutmeg.

For consumer packaging, product labelling must comply with the EU Regulation on the provision of food information to consumers. This regulation defines nutrition labelling, origin labelling, allergen labelling and minimum font size for mandatory information more clearly.

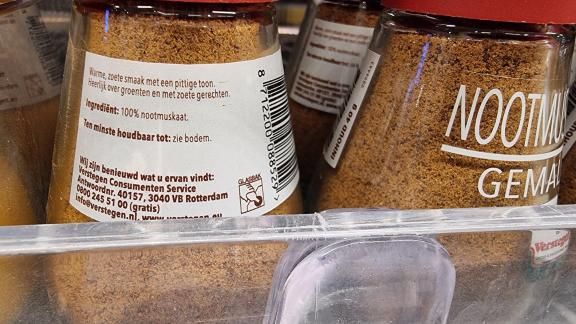

Figure 1: Consumer label of ground nutmeg available in a supermarket in the Netherlands

Source: Photo by Globally Cool

If you provide organic nutmeg, your label needs to include the name/code of the inspection body and certification number.

Tip:

- See our study on requirements for spices and herbs to find requirements for consumer packaging and labelling. In Europe, there are very strict requirements for the packaging and labelling of consumer products. These differ from the requirements mentioned here.

What additional requirements and certifications do buyers ask for in nutmeg?

European buyers often have additional requirements, in addition to legal obligations. These often concern the European Spice Association’s (ESA) minimum quality requirements or ‘quality minima’ for spices. Others relate to food safety, and sustainable and ethical business practices.

Quality requirements for nutmeg

Several factors determine the quality of nutmeg, some as subjective as taste or flavour. Other quality criteria relate to the nutmeg cultivar, such as size of the seeds, shape or colour. Agricultural practices, climatic conditions during the production season and post-harvest operations affect product quality too. Thus, the same cultivars can have different qualities even when produced in the same country.

Several quality parameters are also set by the Codex Alimentarius Commission in the Codex Standard CXS 352-2022 for nutmeg.

The most common parameters for nutmeg quality include the following.

- Cleanliness or purity: Nutmeg should be intact when traded as a whole. The product must be free of diseases, foreign matters, foreign odours and any other issues. The European Spice Association (ESA) Quality Minima Document does not allow for the presence of any foreign objects greater than 2mm in diameter, and it proposes that the maximum presence of external matter should be below 1% of the total weight. Other indicators include ash level and acidity.

- Moisture content: The maximum moisture content for nutmeg set by the Quality Minima Document of the ESA and the Codex Standard is 10%. Still, buyers may request a lower moisture content.

- Mesh or particle size: When nutmeg is exported in powdered form, they are ground to pass through a sieve of a specific diameter. Sieves are often specified in micron sizes. Typical requirements demand that 95–99.5% of ground nutmeg pass through the specific size of the sieve, usually 500–600 microns for fine powder, and up to 1 mm for coarsely ground.

- Odour and flavour: Nutmeg must have a specific odour and flavour. The flavour profile of nutmeg mostly depends on the chemical components of the essential oil. The most important essential oil that contributes to the specific flavour is myristicin (3-methoxy-4, 5-methylenedioxy-allylbenzene; 5-methoxy-3, 4-methylenedioxy-allylbenzene). The flavour profile varies depending on variety, cultivar, and geographic, climatic and growth conditions.

- Volatile (essential) oils: As described above, the content of essential oils is important for the sensorial characteristics of nutmeg. Nutmeg seed quality is higher when the percentage of ash is low, and the content of essential oils is high. The minimum content of essential oil in nutmeg should be 6.5 ml/100 g. Nutmeg essential oil contains quite a range of compounds, including sabinene, limonene, α-pinene, β-pinene, myristicin and safrole.

Packaging requirements

Nutmeg is mostly exported in bulk and packed in multi-wall laminated bags of different weights. Common weight classes are 12.5 kg and 25 kg. The dimensions of the selected packaging size should conform to conventional pallet sizes (800 mm x 1,200 mm and 1,000 mm x 1,200 mm). Please note that in some European countries, labour health and safety legislation only allows workers to lift a maximum of 20 kg, so smaller packaging weights are increasingly being used (e.g. 10–20 kg).

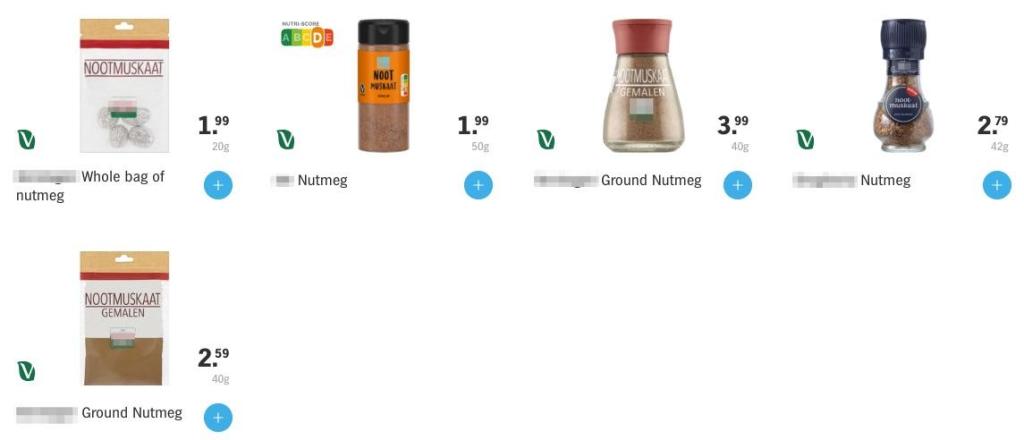

The net weight of retail packaging is usually between 20 and 50g. Retail packaging includes glass containers, plastic bags, plastic containers and paper bags. Transparent packages are particularly popular, enabling consumers to visually inspect the product before buying.

Figure 2: Retail packaging varieties of nutmeg offered by a Dutch mainstream supermarket

Source: Picture by Globally Cool

Food safety certification

Food safety is essential in the European market. While legislation already prevents many risks, it is not sufficient. For this reason, importers prefer to work with producers and exporters who have a Global Food Safety Initiative (GFSI) recognised food safety system certificate.

For spices and herb processors and traders who trade in nutmeg, the most popular certification programmes are as follows.

- Food Safety System Certification (FSSC 22000) is the most important certification programme and gives access to almost all countries in the world.

- International Featured Standards (IFS) can be relevant.

- British Retail Consortium Global Standards (BRCGS) can be relevant.

Third-party certified programmes can be an asset to your company and appreciated by new buyers. Nevertheless, serious buyers may also visit and/or audit new suppliers’ production facilities.

Sustainability compliance

Although less important than product and food safety requirements, European buyers are increasingly demanding social and environmental compliance. This often means that suppliers must undersign their buyers’ code of conduct. Another possibility is that buyers ask for certification against a third-party scheme such as Rainforest Alliance.

Codes of conduct (CoC) vary from company to company, but they are often similar in terms of structure and the issues they cover. In 2022, ESA published a guideline for their members. Since a lot of European spices and herbs companies are members of ESA, you will likely come across this guideline sooner or later.

Under this sustainability code of conduct, ESA’s members monitor their own and their suppliers’ operations.

Tips:

- Always ask your buyer for their specific packaging requirements.

- Use methods of analysis and sampling recommended by the ESA from Appendix 2 of the Quality Minima Document to determine quality parameters for nutmeg.

- Read more about payment and delivery terms in the CBI Tips for organising your spices and herbs exports to Europe.

What are the requirements for niche markets?

Most additional buyer requirements apply to the mainstream spices and herbs markets. However, some niche markets have their own, specific requirements. Ethnic certification can be interesting for the large and growing ethnic food segments. Fairtrade lays down requirements for sustainability in the social, environmental and ethical domains. Product certification for the organic market mainly focuses on environmental requirements.

Ethnic certification

Islamic dietary laws (Halal) involve specific dietary restrictions. If you want to focus on this market segment, consider implementing a Halal certification scheme.

Organic certification

If you want to sell your spices and herbs as organic in Europe, they must be grown using organic production methods that comply with EU organic legislation. Growing and processing facilities must be audited by an accredited certifier.

Fairtrade

The Fairtrade market is built on Fairtrade certification. Every player in the supply chain needs to be certified to participate in this market. The Fairtrade market is privately regulated.

Fairtrade International has specific standards for herbs, herbal teas and spices from small-scale producer organisations. It defines minimum prices and price premiums for conventional and organic products from several countries and regions. Organic nutmeg from Sri Lanka and India have a fixed Fairtrade Minimum Price of 1.74 USD/kg and a premium of 0.24 USD. The Fairtrade Premium is 15% of the commercial price for all other nutmeg sold under this scheme.

As of October 2023, there are 24 Fairtrade certified nutmeg producers worldwide, eight of which are in India and 16 in Sri Lanka.

Dual certification

Having organic and fairtrade certification together is a clear asset on both the European Fairtrade and organic markets. Consumers in these markets are typically more conscious than mainstream consumers. As a result, they are more likely to appreciate and buy products that have both Fairtrade and organic certification. In most countries, dual-certified products are only available in organic supermarkets. One exception is Switzerland, where mainstream supermarkets offer quite a large range of dual-certified spices.

Figure 3: Fairtrade-certified and dual-certified nutmeg in a Swiss mainstream supermarket

Source: Picture by Globally Cool

Tips:

- Read the CBI’s study on requirements for exporting spices and herbs to the European market for a complete overview of all requirements, including organic and fairtrade certification.

- Check out the guidelines for imports of organic products into the EU to familiarise yourself with the requirements for European traders.

- Consult the ITC Standards Map for a full overview of relevant certification schemes and their requirements.

- Check Fairtrade International’s standards for herbs, herbal teas and spices and other Fair Trade Standards relevant to your production, processing and trade.

- Try to combine organic certification with other sustainable initiatives (dual certification) to increase your competitiveness.

2. Through what channels can you get nutmeg on the European market?

Nutmeg is sold through different channels to reach all segments: retail, food service and ingredients. Some consumers prefer to keep a whole nutmeg from which they take slices if a recipe requires nutmeg. This is quite common in Spain and Italy. Whole nutmeg is mostly sold in the retail segment.

Ground nutmeg, whether ground at origin or in Europe, is mostly used by spice manufacturers to create spice mixes or to create customised spice solutions for the food industry.

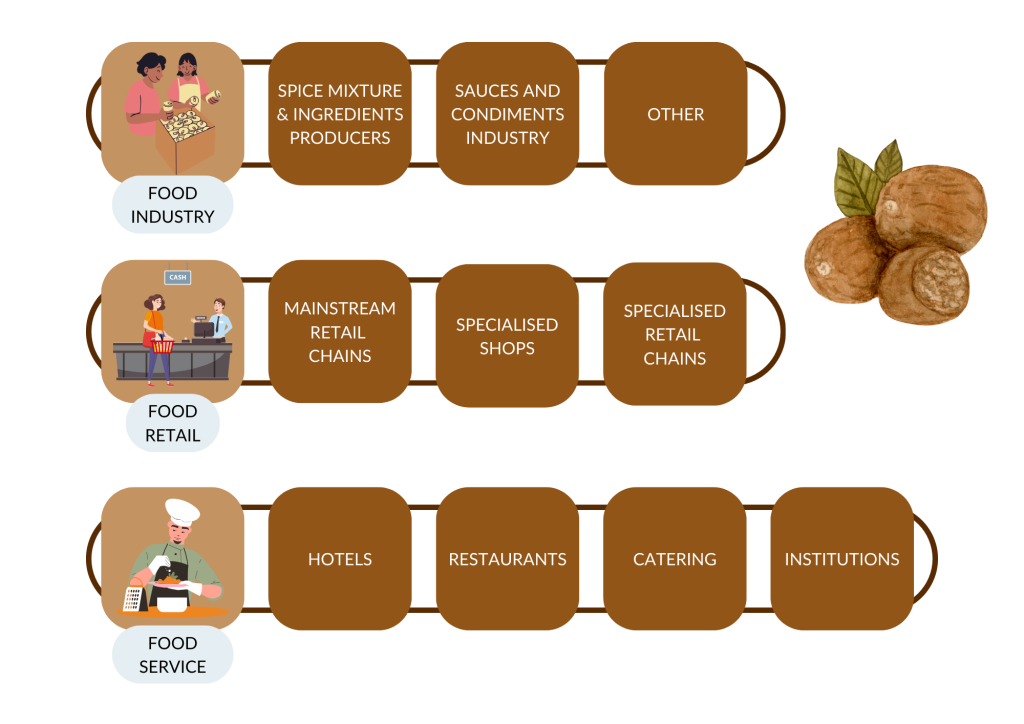

How is the end market segmented?

The end-market segments for nutmeg include the food industry, food retail and food service.

Figure 4: End-market segments for nutmeg in Europe

Source: Globally Cool

Food industry

Food processors use the most nutmeg on the European market. The largest users are spice mixture producers and the sauce and seasoning industry.

Spice mixture and ingredient producers specialise in the production of spices and seasonings. They invest in research to develop custom formulations for the food processing industry and to help launch new, attractive tastes. Nutmeg is an important ingredient in meat spice blends, curry, other Asian spice mixes and gingerbread spice mixes.

Traditional spice companies often have a range of spice blends for the industry. There are also companies that specialise in custom spice solutions to meet specific industry needs. Examples include Meat Cracks and Scheid from Germany, the international Solina Group from France, Libra Food Ingredients from Poland and the international group Kalsec, which has its headquarters in the USA and European production in the United Kingdom.

Other companies import and offer an even wider range of products, including spices, grains, pulses, dried fruits and nuts. One such company is EHL Ingredients.

Companies in the sauce and condiment industry mostly use grounded nutmeg as part of blends for specific curries and sauces. The curry sauce industry includes brands like Patak’s and Rajah in the United Kingdom.

Companies in the category other produce other types of food products and need relatively large volumes of nutmeg and spices, so import these spices directly from origin countries.

Food retail

European brands (often national ones) and private labels share the retail and food-service segments. Leading brands in Europe include Schwartz (United Kingdom), Fuchs (Germany), Ducros (Spain, France, Belgium, Portugal), Euroma (Netherlands), Verstegen (Netherlands), Cannamela (Italy) and Prymat Group (Poland). McCormick is the global and European market leader, present in Europe with several brands, including Drogheria, Kamis, Margao, Ducros and Schwartz.

Supermarket private label brands occupy an important place on the shelves as well. Production for private label brands is conducted by European spice packers and blenders. Supermarkets often require frequent and regular shipments and have very specific requirements regarding packaging. This means it is difficult to supply them directly from outside Europe. Nutmeg packed in origin countries can be found in some European ethnic shops, mostly in Asian food stores.

Discount retailers sell packed nutmeg, particularly in ground form. Retailers that offer a wide range of products also offer whole nutmeg. Nutmeg can also be part of specific mixtures. Some examples include gingerbread spice mix in the United Kingdom and its counterparts in the Netherlands and Germany.

The retail sector can be further segmented into several subcategories.

- Mainstream retail chains with physical outlets – Several of these chains operate on an international scale, such as the Schwartz Gruppe (Lidl and Kaufland brands in Germany and many other European countries) and Ahold (which includes Delhaize and Albert Heijn in Europe).

- Specialised shops mostly online – Spice shops usually belong to the high-end market segment and offer a wide range of spices from different origins. They often sell spices measured by weight, but they also have their own branded products. Some of them have grown into specialised chains, such as Alfons Schuhbeck, named after the Germany celebrity chef, which has many shops across Germany. Examples of specialised spice shops in Europe are Épices Rœllinger (France), Van Beekum and De Kruidenbaron (Netherlands) and Spice Mountain (United Kingdom).

- Specialised retail chains with physical outlets – Most of them operate in the organic market; some focus on the ethnic market. Examples of organic retail chains are Biomarkt and Alnatura in Germany. Examples of ethnic retail chains are Wah Nam Hong and Go Asia.

Food service

Specialised distributors supply the food service channel, which includes hotels, restaurants, catering companies, and institutions like hospitals and schools. These distributors can import nutmeg directly in theory, but in practice, they often buy from wholesale bulk importers. The food service segment often requires specific packaging for nutmeg, which is different from bulk or retail packaging.

Examples of distributors that supply the food service segment with nutmeg are Metro Cash & Carry, which has outlets in several European countries, and Brake Brothers, in the United Kingdom. The share of certified products, which includes organic certified and fairtrade certified spices, is typically low in the food service segment.

Figure 5: Nutmeg in 0.5 kg jars in a cash-and-carry outlet in the Netherlands

Source: Picture by Globally Cool

World cuisines and healthy foods are major driving forces in the European food service channel. The fastest-growing business types are new and focus on healthier fast food, street food, pop-up restaurants, international cuisines and sandwich bars.

Tips:

- Study the exhibitor lists of large trade fairs, such as Food Ingredients or Biofach, to find potential buyers for your nutmeg. If you intend to supply to supermarket private labels, search for opportunities at PLMA, the world’s leading private label trade fair.

- To supply to the food service segment, visit Sirha or Internorga.

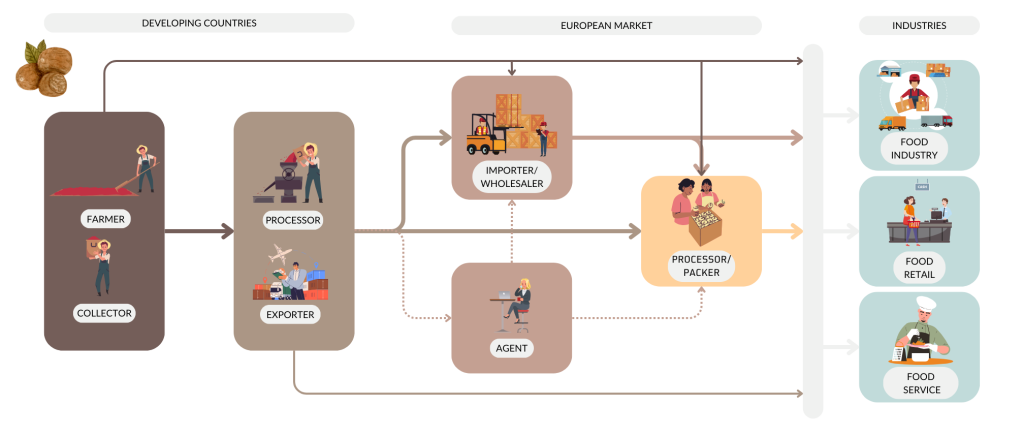

Through what channels does nutmeg end up on the end-market?

Specialist spice importers are the most important channel for nutmeg in Europe. Selling the nutmeg directly to food processors or retailers is not impossible, but it is difficult. These opportunities are scarce and are mostly driven by entrepreneurs who are committed to supporting farmers in origin countries.

Importers and wholesalers

Importers and wholesalers can be general spice importers or specialised in specific roles. Some deal exclusively with ingredients for the processing industry, while others pack nutmeg for retail chains. Some importers also deal with a broader range of products in addition to spices, such as grains and pulses.

High requirements from retailers put pressure on importers and food manufacturers. This pressure forces prices down, but also brings more products to the market that have other qualities, such as being sustainable, natural, organic and fair trade.

Remaining attractive to large retailers requires transparent, short and effective supply chains. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred suppliers from developing countries.

Several sub-types of nutmeg importers include the following:

- Bulk spice importers – In Europe, this category includes wholesale traders and owners of retail brands. Many of these brand owners have already been mentioned in this study’s market analysis. Other bulk importers and wholesalers include British Pepper & Spice (United Kingdom), AKO (Germany), Husarich (Germany), Euroma (Netherlands), European Spice Services (Belgium), Saran Enterprises (Poland, mostly importing from Vietnam) and The Spice Factory (Belgium).

- Spice mixes and ingredient suppliers – These traders specialise in supplying solutions to a wide range of food industries. This category includes businesses like Worlée (Germany), Culinar (Sweden), Epos (Netherlands) and Colin Ingredients (France).

- General importers – Importers in this segment also import several other types of products in addition to nutmeg and other spices. One example is the company Koro in Germany.

Figure 6: Trade channels for nutmeg in Europe

Source: Globally Cool

Agents

Brokers and agents are intermediaries that bring buyers and sellers together. They charge a commission for their services. Agents and brokers are an interesting option if you have a special product for which buyers are harder to find, such as high-quality or sustainable nutmeg. The role of agents is under pressure due to the market’s demands for greater transparency.

Another role agents play is in participating in tenders launched by European retailers. Agents can help exporters place nutmeg in the European retail segment directly.

Other channels

Selling more directly to the European market and bypassing importers and wholesalers is not impossible, but it is difficult. Opportunities for doing this are usually created by entrepreneurs in Europe who are committed to supporting farmers and sectors in origin countries. One example of such a company is Pacific Spices from the Netherlands, which sells nutmeg and other spices from the Moluccas directly to Dutch consumers.

What is the most interesting channel for you?

Spice importers are the best contacts for placing nutmeg on the European market. This is especially relevant for new suppliers because supplying multiple segments directly is very demanding and requires a lot of quality and logistical investment.

For well-equipped and competitive producers, packing for private labels can be an option. Private label packing is often done through importers that enter into partnerships with retail chains in Europe. As labour costs in Europe are increasing, importers of nutmeg are searching for opportunities to pack spices in developing countries. This is only possible if the supplier can ensure full traceability and quality control.

Tip:

- Search the European Spice Association’s members’ list to find buyers from different channels and segments.

3. What competition do you face on the European nutmeg market?

Indonesia is the main supplier of nutmeg to Europe. It accounts for almost 80% of European imports from developing countries. Vietnam takes second place with 11% share in European imports. Other countries export much smaller volumes to Europe.

Which countries are you competing with?

Europe imports most of its nutmeg (98%) from only four countries: Indonesia, Vietnam, Grenada and Sri Lanka. Of the 5,200 tonnes imported to Europe, Indonesia accounts for 79%, followed by Vietnam (11%), Grenada (5.3%) and Sri Lanka (3.2%). India and China export relatively small quantities to Europe.

Source: UN Comtrade (August 2023)

Indonesia: the world’s leading nutmeg producer

Indonesia is the world's largest producer of nutmeg, accounting for a significant portion of the global supply. Indonesia’s exports peaked in 2021 at more than 22,000 tonnes. Their production output has typically been between 17,000 and 19,000 tonnes. China and Vietnam have been the largest markets for Indonesian nutmeg. The United States of America, Japan, India, Pakistan and Brazil also feature in the top ten destinations. The European destinations in the top ten are the Netherlands (third position in 2022), Germany (#5) and Italy (#6).

Nutmeg trees are grown by more than 180,000 farmers in the five main provinces: North Maluku, Maluku, North Sulawesi, West Papua, and Aceh. These provinces provide an ideal climate and fertile soil for nutmeg cultivation. Most nutmeg producers are smallholder farmers that use traditional processing methods, which is also why the risk of aflatoxin contamination in Indonesian nutmeg is so serious.

Most nutmeg produced in Indonesia is exported. The importance of nutmeg exports for the Indonesian trade balance made the government decide to encourage farmers in other provinces than the five provinces mentioned previously, to grow nutmeg too. This resulted in more provinces producing nutmeg, reaching ten in 2019.

Figure 8: Nutmeg production in ten Indonesian provinces in 2019

Source: Directorate General of Estate Crops of Indonesia

One interesting trend in the past decade has been the growing attention for using all the parts of the harvested crop. While farmers initially defined nutmeg flesh as a waste product, through training from NGOs and the help of local governments, local communities have started to produce side products using the flesh, such as jams, juices, candies and dried fruits. This change has had a positive impact on rural development, enriching local communities’ incomes.

After the farmers, the next stop in the nutmeg value chain often includes village collector traders. They collect nutmeg fruit from farmers who want to sell fresh nutmeg without processing it. Consequently, collectors perform the other tasks that other farmers perform themselves: cutting, splitting and drying.

Farmers and village collector traders sell dried nutmeg to wholesalers. Wholesalers usually live in the capital city of the island. They sort the produce by appearance and classify it by quality grade. They sell several products, by grade, to buyers outside the own island. Buyers are mostly Indonesian exporters located in the big cities in Surabaya and Jakarta, but sometimes also foreign importers. Some nutmeg is also sold to Indonesian refiners who produce nutmeg oil, which is used in the food and pharmaceutical industries.

Since 2021, most of the nutmeg exported to Europe is ground. In 2022, the share of ground product in terms of total exports to Europe reached 58%. The development has been clear: every year, the share of ground product in total exports has increased. The Netherlands and Germany are Indonesia’s main destinations, followed by Italy, which is very far behind. The United Kingdom, France and Spain are far behind Italy.

There are organic production initiatives in Indonesia, such as the project by ICCO in North Moluccas, which has been active since 2015, but the available organic nutmeg export volume has remained limited so far. One company that exports organic certified spices including nutmeg is Tripper. Tripper is headquartered in Indonesia and exports to North America, Europe and several additional countries. Another organic certified exporter is Natural Java Spice.

Figure 9: Nutmeg harvesting in Indonesia

Source: GloballyCool (2023)

Vietnam: grounding as added value

Vietnam produces several spices but not nutmeg. Vietnamese exports 100% grounded nutmeg, with the raw material being imported from Indonesia. This concept of adding processing value to imported raw materials not only applies to nutmeg, but to other spices and agricultural raw materials too. Examples include cinnamon imported from China, Indonesia and Sri Lanka, and cashew nuts imported from West Africa.

Vietnam’s leading destination of nutmeg exports is the Netherlands by a significant margin, ahead of the USA; the second largest destination worldwide. Within Europe, the United Kingdom and Germany follow the Netherlands. For Vietnamese companies that export nutmeg, nutmeg is a service product rather than a core product.

The most important products for the Vietnamese companies are black pepper, for which Vietnam is the world’s largest producer, and cinnamon for which the country is second largest in the world. Spices exporters often trade spices and other important locally produced commodities, such as cashew nuts.

Grenada: losing ground in the European market

Nutmeg is a very important product for Grenada’s national economy, a situation comparable to nutmeg in Indonesia. At the same time, the island is small and the nutmeg crop has been vulnerable to hurricanes in the past. Nowadays, the production output is ‘only’ between 700 and 1,100 tonnes per year. In 2022, about one third of the nutmeg was exported to Europe. This share used to be higher in the past (e.g. more than 50% in 2018).

Since 2017, Grenada’s Cooperative Nutmeg Association (Associated Member of the European Spice Association) has been actively promoting an export market diversification strategy, away from Europe, as the competitive European market resulted in only very low profits for the farmers. They were successful: Grenada’s exports to Europe have been down by 18% on average per year since 2018, reaching 280 tonnes in 2022.

Most of the exports to Europe are not ground. The nutmeg is mostly exported to two countries: the Netherlands and Germany. Only in 2022, a third country was added to the list of European destinations: Italy. Owing to the declining exports to Europe, other countries have appeared in Grenada’s top five destinations for nutmeg: the USA, India, Canada and UAE.

Sri Lanka: important supplier of organic nutmeg to Europe

Typically, nutmeg production in Sri Lanka reaches between 1,500 and 1,800 tonnes per year. The total area of nutmeg cultivation is between 2,700 and 2,800 hectares. Production takes place in the cooler zones of the island. It is mainly cultivated in Sri Lanka’s central districts of Kandy, Matale and Kegalle. Most (80%) plantations are in the Kandy district, owned by small and mid-scale farmers.

Since 2018, Sri Lanka’s export strategy for the nutmeg has focused on promotion of the Ceylon Nutmeg as a high-end product, under geographical indication and with a special chemical composition and a unique flavour. Sri Lanka is an important supplier of organic certified nutmeg to Europe.

Most of Sri Lanka’s nutmeg exports go to nearby countries: India, China, UAE, Bangladesh and Pakistan. Within Europe, Germany is Sri Lanka’s main destination for nutmeg exports (100 tonnes in 2022), followed by the United Kingdom (41 tonnes) and Italy (23 tonnes). Switzerland, Spain and France imported smaller volumes of nutmeg. Grounded nutmeg exports have grown relatively fast, reaching a share of 60% of Sri Lanka’s total nutmeg exports to Europe in 2022.

India: priority markets remain outside Europe

India is a net-exporter of nutmeg. However, it also imports nutmeg in considerable volumes from time to time. Production in India is becoming more geographically spread over the country. The older plantations in the traditional growing areas are increasingly being replaced by alternative crops. However, new plantations are being started in other regions simultaneously. Despite this development, more than 95% of the crop output of more than 15,000 tonnes still came from the Kerala district in the 2021–22 harvest season.

India exports nutmeg in relatively large volumes, but not to European markets. The largest market by a long way is UAE, followed by Nigeria and the USA. Exports to Europe are small and declined from 8 tonnes in 2018 to 5 tonnes in 2022. On the import side, the annual volume reached between 900–1,600 tonnes, and it mostly comes from Indonesia, followed by Sri Lanka.

China: large market for nutmeg and re-exports to Germany

China is a small supplier of nutmeg to the European market. The nutmeg exported by China is not of Chinese origin, but imported mostly from Indonesia and some from Sri Lanka. Most goes to the local market and only about 10% is exported, predominantly to Germany.

Tips:

- Visit the website of a Sri Lankan leading spices exporter G.P.de Silva and see how this company promotes the ‘Ceylon’ brand for its spices, including nutmeg.

- Visit the website of the Ceylon35 online shop and check the Ceylon Nutmeg product.

- Regularly visit leading European trade fairs to keep an eye on your competitors, such as Food Ingredients or Biofach.

- Take a look at this list of nutmeg suppliers in Sri Lanka or find offers of Indonesian nutmeg on InaExport, the official B2B directories platform of the Directorate General of National Export Development, Ministry of Trade of the Republic of Indonesia.

- Visit the Indian Spice Board’s website to stay up to date with news about Indian production and supply.

Which companies are you competing with?

Several Indonesian companies export nutmeg. Most only act as brokers without websites. In Vietnam, companies offer nutmeg as service product, while in Sri Lanka and India, there are several companies that have fairtrade and EU organic certification. The three examples below are purely illustrative.

Subur Anugerah Indonesia from Indonesia

Subur Anugerah Indonesia is a young and ambitious company from West Java. The company supplies all the spices grown in Indonesia. This includes peeled, ground nutmeg (Grade ABCD/SS/BWP) and oval nutmeg (peeled/with skin). Other spices in their product range are white pepper, black pepper, cloves, cardamom and cinnamon. The company buys raw materials from wholesalers all over Indonesia. Then, it adds value through processing and grading the nutmeg according to international standards.

The company claims that it supports the Indonesian farmers in gaining a fair income, but the company is not able to give a clear explanation of what this means in practice. The company has worked hard to establish sustainable relationships with international buyers since its foundation in 2019.

KimToanPhuc from Vietnam

KimToanPhuc is a trader of agricultural commodities from Vietnam. They mostly sell spices. Black and white pepper are their main product. After pepper follow cassia cinnamon, curcuma, chillies, ginger, nutmeg, cloves and bay leaves. Other exported commodities are desiccated coconut, coffee and cashew nuts.

The company offers a lot of information on spices from Vietnamese origin. In terms of nutmeg, the company depends on raw material imported from the main production countries in Asia, such as Indonesia and India. The company has three ‘pepper and spices’ factories, which also exhibits a strong focus on pepper. Other products like nutmeg are offered as a service.

Biofoods SLK from Sri Lanka

Biofoods SLK is one of Sri Lanka’s pioneers in sustainable business. The company has obtained quite a wide range of certifications, from EU and USDA Organic to Fairtrade, and biodynamic (Demeter) certification: the certification gallery on the homepage shows them all. The largest product for the company is tea, followed by spices, coconut products and frozen products. The company has one spice factory located in Sri Lanka’s central dry-zone, where drying, grounding and packaging take place.

The company is strategically partnered with MOPA, the Marginalized Organic Producers’ Association. Through it, more than 10,000 farmer families with almost 10,000 hectares of land are supported in converting to organic production. Currently, more than half of the farmers have succeeded in becoming organic certified.

In 2014, the founder and the chairman of Bio Foods, Dr Sarath Ranaweera, won the first ever ‘World’s Fairest Fairtrader Award’, presented by the World Fairtrade Labelling Organization (FLO). This short video The Biofoods Way shows a short documentary of the vision and story of Bio Foods Sri Lanka. This blog on their recent organic fertiliser invention is another interesting read.

Tips:

- To successfully penetrate the European nutmeg market, you need to study your competitors’ strategies, including how they are price competitive, offer safe and good-quality products, offer unique products (e.g. cultivars with high essential oil content and a specific flavour profile) or customise their product to specific segments (e.g. organic or alcoholic beverages).

- Participate in the International Spice Conference to learn more about nutmeg competition and to get updates about the nutmeg market.

- Use your national export promotion agency’s services and actively participate in the creation of export strategies. The Spices Board of India is a good example of an export support organisation.

Which products are you competing with?

Mace is a good alternative for nutmeg, as both spices come from the Myristica fragrans tree. While mace can be considered a competing product, farmers and exporters do not consider mace as such, as both nutmeg and mace are harvested at the same time and follow similar routes to market.

Internationally, garam masala, an Indian spice blend, is considered as an alternative for nutmeg. Allspices is also often mentioned; this is the dried fruit of the Pimenta dioica plant. Cinnamon can also be used as alternative for nutmeg.

As the availability of nutmeg has been steady over the years, not much attention has been paid to nutmeg replacements.

Tip:

- Read the CBI outlook and statistics study to learn more about spices in growing demand, which are potential competitors to nutmeg.

4. What are the prices for nutmeg?

The prices for nutmeg vary depending on the grading of the product, the volume and quality of the crops in Indonesia (the main producer) and the certifications.

Quality highly impacts the price

Nutmeg is classified depending on the quality of the products as seen below.

- Nutmeg ABCD: Top quality, good looking, whole nutmeg. Often sold with count per kilogram. The bigger the fruit, the more expensive. The main application for whole nutmeg is the retail sale and food service.

- Nutmeg SS (Sound Shrivelled): This middle grade quality might contain nutmeg that look less good than the ABCD and are ‘shrivelled’ or wrinkled. It can even contain some broken fruits. This quality is mainly used for grinding nutmeg powder. For this reason, ground nutmeg can be offered for a lower price than whole ABCD nutmeg.

- Nutmeg BWP (Broken, Wormed, and Punctured): This is the lowest quality of nutmeg, only suitable for volatile oil extraction.

The higher the quality of the nutmeg, the higher will be the price. The nutmeg graded ABCD usually has a premium of 5% up to 10% of the price for nutmeg classifies as SS. The price of BWP nutmeg varies widely depending on the quality. The price for BWP nutmeg with no guarantee of compliance with maximum aflatoxin levels required by the EU can be half of the price of the SS and lower.

Table 1: Indications of FOB prices of Nutmeg (USD/MT)

| Grading / Month and year | Price in USD / MT |

| Indonesian ABCD / April 2023 | 9,900 |

| Indonesia SS / April 2023 | 9,400 |

| Indonesia BWP (with EU aflatoxins level) / October 2023 | 7,750 |

Source: Nedspice, Market Update, April 2023

Impact of the overall crop quality

The price difference between the nutmeg grades is mainly driven by the quality of the overall nutmeg crop in Indonesia. In years with an excellent quality crop, the yield after cracking, sorting and grading will generate more ABCD than normal. In these years, the price premium of ABCD compared to SS could be only a few percent.

International certifications increase the price

Certification schemes like Fairtrade and organic also increase the price of nutmeg. Fairtrade does not set a minimum price for conventional and organic nutmeg. However, the Fairtrade premium increases the income of the farmer by 15% of the commercial price.

As mentioned before, there is a minimum price for nutmeg coming from India and Sri Lanka (1.74 USD/kg). When the minimum price is lower than the market prices, Fairtrade requires that producers receive the current market price, or the price negotiated at contract signing. This is most probably the case for India and Sri Lanka.

Nutmeg crops are easy to certify organic, as they usually do not require pesticides or fertilisers. Companies would have to invest in the administrative aspect of the certification as well as the auditing process. These costs will be reflected in the price. On top, there is a premium for the certification. This premium will depend on the demand and supply. Currently, the demand for organic nutmeg is small, and so is the supply.

Table 2: Indications of FOB prices of Organic Nutmeg from Sri Lanka (USD/KG)

| Grading / Month and year | Price in USD / kg |

| Whole nutmeg 80/85* | 17 |

| Nutmeg powder | 17 |

| ABCD whole nutmeg | 16 |

*One kg contains 80 to 85 nutmegs, meaning, the nutmegs are large.

Source: Globally Cool, based on input from Verstegen

Focus on high-quality, whole nutmeg for better profits

For farmers to be able to make a living by cultivating nutmeg, they need to focus on growing high-quality products. This means they can get a better price for their efforts. There are buyers the European market interested in buying higher grade nutmeg, while there are others keen on buying the lower grades. For farmers, however, the prices for the lower grades are too low.

Table 3: Price per kilogram in USD for farmers and exporters for the different nutmeg gradings, April 2023

| Actor | Type of price | Price ABCD | Price SS | Price BWP* |

| Farmer | Farmers gate price | 7–7.2 | 6.5–6.7 | 4.2–4.7 |

| Exporter | FOB origin price | 9.9 | 9.4 | 7.7 |

Source: Globally Cool, based on input from Nedspice and Verstegen

*BWP nutmeg compliant with EU limits for aflatoxins

What to do on the farmer level

Farmers are often unaware of the different qualities. They bring nutmeg to collectors after harvesting without a clear idea of how their products will be graded, and the impact on the price. The collector makes an estimate and pays the farmer accordingly.

Accordingly, to make the supply chain fairer, it is important that farmers understand the different gradings and their pricing. This way, farmers can receive fairer prices for their products.

It is also important to offer farmers training on how to increase their quality. Once they are aware they will receive better returns, they will be more motivated to implement good practices.

What to do at the exporter´s level

There are buyers in the European market interested in buying high-quality products. This is especially true of buyers of whole nutmeg. Focus on these buyers to obtain better profits.

Ensuring high-quality supply is not easy. Exporting companies should train their farmers how they can improve the quality of the product. This is not always easy, as farmers rely on traditional methods passed down over generations. Nevertheless, the prospect of receiving a higher income often motivates the farmers to adapt.

What to do in Europe

Buyers in Europe are the drivers of lower spice prices. The price for BWP is not the lower limit for nutmeg. Some companies buy mixes that contain BWP nutmeg and nutmeg powder after the extraction of the essential oil. These mixed products have even lower prices.

Buying low qualities is not only a matter of the characteristics of the product. Buyers should recognise that the use of these products has long-term implications for the sustainability of nutmeg farming.

Retail prices

Most nutmeg imported into the European market is used by the food industry. At the retail level, spice mixes that contain nutmeg are growing in popularity, while the use of nutmeg as a single spice is stable and relatively low.

Retail prices of nutmeg depends on the quality, brand and the type of outlet. Ground nutmeg can have a lower price than whole nutmeg because processors often used low-quality, reconditioned nutmegs to produce it. Larger nutmegs are also sold for higher prices in the retail market.

Examples of nutmeg prices available across Europe in September 2023 are as follows.

Netherlands:

- Whole nutmeg in a 20 gm plastic bag from the brand Verstegen for 1.99 EUR (99.50 EUR per kg) available from Albert Heijn stores.

- Ground nutmeg in a 40 gm glass jar from the brand Jumbo for 3.29 EUR (82.25 EUR per kg) available from Jumbo stores.

United Kingdom:

- Whole nutmeg in a 33 gm glass jar from the brand Tesco for 1.00 GBP (30 GBP per kg) available from Tesco stores.

- Whole nutmeg in a 36 gm glass jar from the brand Sainsbury’s for 1.10 GBP (33 GBP per kg) available from Sainsbury’s stores.

- Ground nutmeg in a 42 gm glass jar from the brand Waitrose (Cooks’ Ingredients) for 1.60 GBP (38 GBP per kg) available from Waitrose stores.

Spain:

- Ground nutmeg in a 58 gm jar from the brand Hacendado for 1.65 EUR (28.45 EUR per kg) available from Mercadona stores.

- Whole nutmeg in a 25 gm glass jar from the brand Ducros for 3.29 EUR (131.60 EUR per kg) available from El Corte Inglés stores.

France:

- Whole nutmeg in an 18 gm glass jar from the brand Auchan for 2.84 EUR (157.78 EUR per kg) available from Auchan stores.

- Whole nutmeg in a 40 gm glass jar from the brand Carrefour for 1.65 EUR (41.25 EUR per kg) available from Carrefour stores.

Sweden

- Ground nutmeg in a 35 gm glass jar from the brand Santa Maria for 3.30 EUR (94.36 EUR per kg) available from ICA stores.

- Whole nutmeg in a 10 gm plastic bag from the brand Santa Maria for 1.69 EUR (169 EUR per kg) available from Hemköp stores.

Germany

- Ground nutmeg in a 35 gm plastic jar from the brand Ostmann for 3.19 EUR (91.14 EUR per kg) available from Edeka stores.

- Whole nutmeg in a 12 gm glass jar from the brand Rewe for 1.99 EUR (165.83 EUR per kg) available from Rewe stores.

Tip:

- Support the farmers supplying your company in improving their quality. This will help them receive a better price and will help your company obtain a steady supply of high-quality nutmeg.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research