Entering the European market for dried rosemary

When exporting to the European market, it is crucial to meet European legal standards and the specific requirements set by buyers. The buyer requirements have to do with quality, food safety, and sustainability standards. For dried rosemary, you will be competing with suppliers from within Europe, like Spain and France, and suppliers from developing countries like Morocco and Turkey. The dried rosemary market offers various entry channels, with importers and wholesalers being the most common.

Contents of this page

- What requirements and certifications must dried rosemary meet to be allowed on the European market?

- Through which channels can you get dried rosemary on the European market?

- What competition do you face in the European dried rosemary market?

- What are the prices of dried rosemary in the European market?

1. What requirements and certifications must dried rosemary meet to be allowed on the European market?

Dried rosemary should comply with the general requirements for spices and herbs. You can find these in CBI’s study on the requirements for spices and herbs. You can also use Acces2Markets, which provides an overview of the requirements per country.

What are mandatory requirements?

Dried rosemary sold in the EU must be safe and is therefore subject to official food controls when imported. The EU has set maximum levels for certain contaminants, like mycotoxins, microbiological contaminants, and pesticide residues. Make sure to comply with EU regulations. Products exceeding the maximum levels are removed from the European market.

Official food controls

Dried rosemary imported into the EU is subject to official food controls. These controls include regular inspections either carried out at import (at the border) or at any further stages of trade. Non-compliance with the European food legislation is reported through the Rapid Alert System for Food and Feeds (RASFF).

Repeated non-compliance with the European food legislation for by-products from a particular country may result in special importation conditions or even suspension of imports from that country. Dried rosemary is currently not subject to increased border control for any supplying country.

Contaminants control

Dried rosemary may contain contaminants. These substances are not intentionally added to food but may end up in dried rosemary because of production, packaging, transport, holding, or environmental contamination. As contamination has a negative impact on the quality of food and can cause risks to human health, the EU has set maximum levels for certain contaminants in food. For dried herbs (relevant for dried rosemary), the EU has set limits for mycotoxins (Ochratoxin A), plant toxins (Pyrrolizidine alkaloids), and processing contaminants (polycyclic aromatic hydrocarbons). In 2023, RASFF reported one issue with plant toxins in dried rosemary from France.

Tip:

- Read more about contaminants on the European Commission’s website.

Microbiological contaminants

Regulation (EC) No 2073/2005 lays down the microbiological criteria for foodstuffs. The EU regulation does not set specific limits for dried rosemary, which means that the general limits apply. The most important microbiological risk is salmonella. Salmonella must be completely absent from spices and herbs. In 2022, there was one issue with salmonella in dried rosemary from Egypt, which was reported in RASFF.

Tips:

- Consider having dried rosemary heat-treated (sterilised) by a third party in your country. Heat sterilisation is a natural method (free from chemicals and radiation) popular among European buyers.

- Comply with the Codex Alimentarius Code of Hygienic Practice for Low-Moisture Foods (CXC 75-2015).

Pesticide residues

Regulation (EC) No 396/2005 sets maximum residue levels (MRLs) of pesticides in or on plant origin food and feed. An MRL is the highest amount of pesticide residue legally permitted in or on food products when pesticides are used. Products exceeding these permitted levels are withdrawn from the European market.

When assessing MRLs, the pesticide residues found in dried rosemary must be put in relation to fresh rosemary. In the case of dried products, Article 20 of Regulation (EC) No 396/2005 allows the concentration caused by the drying process to be considered when determining the MRL. To have a harmonised MRL assessment, the European Spice Association (ESA) set dehydration factors for dried herbs. This means that the pesticide limit fixed in the Regulation for the fresh product should be multiplied by the dehydration factor. The dehydration factor for rosemary is seven.

In recent years, there have only been two incidents with levels of pesticide residues that were too high. The RASFF database has reported one issue with ethylene oxide and one issue with, among others, chlorpyrifos and bifenthrin.

Tips:

- Consult the EU Pesticides database for more information on the MRLs for the pesticide residues that apply to rosemary.

- See ESA’s document on Dehydration factors for products of the spice industry for more information about the dehydration factors for herbs

Labelling

It is important to label dried rosemary in the correct way.

Make sure that labels of bulk packaging have the following information:

- Name and variety of product

- Batch code

- Net weight in the metric system

- Shelf life of the product or ‘best before’ date and recommended storage conditions

- Lot identification number (or identification mark)

- Country of origin

- Name and address of the manufacturer, packer, distributor, or importer (or identification mark)

- Batch details (may also be included in the Product Data Sheet)

For consumer packaging, product labelling must comply with Regulation (EU) No 1169/2011. This regulation clearly defines nutrition labelling, origin labelling, allergen labelling, and minimum font size for mandatory information.

Figure 1: Consumer label of dried rosemary in the Spanish market

Source: GloballyCool, August 2024

What additional requirements and certifications do buyers often have?

European buyers have requirements in addition to legal requirements. These include quality requirements for dried rosemary, food safety certification, packaging requirements, and social and environmental sustainability requirements.

Quality requirements for rosemary

The quality of dried rosemary is very important to European buyers. Several factors, including subjective aspects such as colour, taste, and flavour, influence the quality. European buyers often ask suppliers to comply with the European Spice Association (ESA) Quality Minima Document. Common parameters used to specify the quality of dried rosemary include:

- Cleanliness or purity: The Quality Minima Document states that herbs must be free from off-odour, off-flavour, and foreign matter. However, the requirements can vary per buyer and may include more specific indicators.

- Moisture content: The maximum moisture content set by the Quality Minima Document is 10%.

- Volatile oils: The Quality Minima Document stipulates a minimum volatile oil content in dried rosemary of 1 ml/100g.

- Mesh or particle size: These are only applicable to ground rosemary.

- Odour and flavour: dried rosemary should have a characteristic odour and flavour, which is influenced by the chemical components of the volatile oil. The flavour profile can vary based on factors including geographic location, climate, and growing conditions.

The ISO organisation also published a standard for dried rosemary under ISO 11164:1995.

Food safety certification

Legal requirements alone do not secure food safety in the European market. Several European buyers will ask if you have a Global Food Safety Initiative (GFSI)-recognised food safety system certification.

The most relevant certification programme for dried rosemary and other herbs and spices is Food Safety System Certification (FSSC 22000). FSSC 22000 offers the most structured and logical approach to an internationally (in Europe and many other regions) recognised and used Food Safety Management System.

Third-party certification programmes are beneficial to your company and highly appreciated by new buyers. However, serious buyers may also choose to visit and/or audit the production facilities of new suppliers.

Packaging requirements

Dried rosemary is primarily exported in bulk. It can be packed in various sizes for industrial purposes according to the buyer's needs. It is commonly packed in 25kg polypropylene bags or kraft paper bags, though smaller sizes (i.e. 10kg) are also used. In some European countries, labour health and safety regulations restrict workers to a maximum lifting weight of 20kg. As a result, smaller packaging is becoming more common. The dimensions of the chosen packaging must align with standard pallet sizes (800 mm x 1,200 mm and 1,000 mm x 1,200 mm).

In retail, dried rosemary is offered in various packaging types, with glass containers being the most common. Other options include plastic containers, plastic bags, paper bags, and stand-up pouches. The net weight of retail packages typically ranges from 15g to 40g.

Figure 2: Retail packaging types of dried rosemary in different European markets

Source: GloballyCool, August 2024

Sustainability compliance

Social and environmental sustainability are important topics for European buyers. Large European spice and herb companies have all set goals to buy sustainably-sourced spices and herbs and improve transparency throughout their supply chains. As a result, suppliers must often undersign the buyer’s code of conduct.

Since 2022, the European Spice Association (ESA) has developed a Code of Conduct for responsible sourcing. Many European spices and herbs companies are members of the ESA. As such, you will likely come across this guideline.

Another possibility is that buyers ask for certification against other standards, such as the Ethical Trading Initiative (ETI) and the Business Social Compliance Initiative (BSCI).

Tips:

- For payment and delivery terms requirements, see CBI’s study on organising your spices and herbs exports to Europe.

- Follow ESA’s Quality Minima Document on the chemical and physical parameters (Appendix I) for your dried rosemary and the recommended analytical methods (Appendix II).

What are the requirements for niche markets?

If you want to supply dried rosemary to a particular niche market, consider additional requirements such as organic, fair trade, and/or ethnic certification.

Organic certification

To market dried rosemary as organic, it must be cultivated using organic production methods that adhere to EU organic regulations. Additionally, the growing and processing facilities must undergo audits by an accredited certification body.

Figure 3: Organic-certified dried rosemary in a German organic retail outlet

Source: GloballyCool, August 2024

Fairtrade certification

In the global fairtrade market several fairtrade certification organisations exist. Fairtrade International is the most widely known fairtrade certification scheme. Fairtrade International developed a specific standard for herbs, herbal teas and spices for small-scale producer organisations. The standard defines, among other things, Fairtrade Minimum Prices and Premiums for certified products. For dried rosemary, there is no fixed Fairtrade minimum price or premium. For herbs without a fixed price, the Fairtrade premium is set at 15% of the commercial price.

Ethnic certification

Islamic dietary laws (halal) and Jewish dietary laws (kosher) prescribe specific dietary restrictions. If you focus on these niche markets, consider implementing halal or kosher certification schemes.

Tips:

- Read CBI’s study on the requirements spices and herbs must comply with to be allowed on the European market to get a complete overview of all the requirements, including organic and fairtrade certification.

- Consult the ITC Standards Map to get an overview of the relevant certification schemes and their requirements.

2. Through which channels can you get dried rosemary on the European market?

Dried rosemary is used across various segments, including the food industry, food retail, and the food service sectors. The segments can be reached through different market channels. Dried rosemary typically enters the European market through importers and wholesalers. To successfully enter the European market, it is essential to identify and target the appropriate buyers.

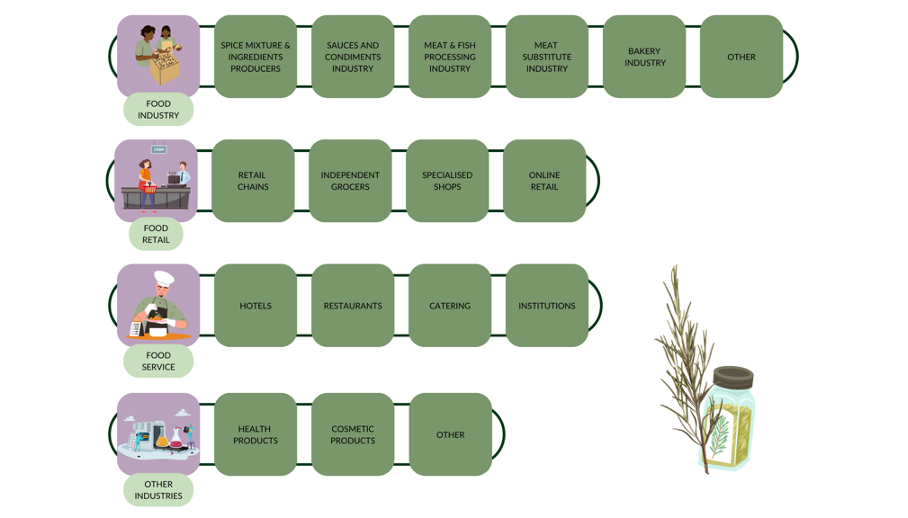

How is the end market segmented?

The end-market segments for dried rosemary include the food processing industry, retail, food service, and ingredients.

Figure 4: End-market segments for dried rosemary in Europe

Source: GloballyCool, August 2024

Food industry

Dried rosemary is used by various users in the food processing industry, such as spice mixture producers, the meat and fish industry, the sauces and condiments industry, the meat substitute industry, and the bakery industry. It is either used as a stand-alone spice or included as an ingredient in herb and spice blends, like Herbes de Provence, Bouquet Garnie, Italian seasoning, Mediterranean seasoning, and meat seasoning.

Producers of spice mixtures and ingredients specialise in spices, herbs, and seasonings for a variety of uses. An example of a spice company is McCormick (the United States), which markets spices and herbs under multiple brands in Europe, like Ducros, Schwartz, and Silvo. Another example is AVO (Germany), a leading spice processing specialist in Europe. AVO produces spices, spice blends, liquid spices, marinades, and seasoned sauces and dressings. They supply to different clients in the food processing industry, such as the meat, fish, ready meals, and baked goods industries.

The meat-processing industry buys custom-made spice and herb mixtures from specialised ingredient companies. For example, Nubassa (Germany) primarily serves the meat processing industry. It offers ground and chopped rosemary, but it also includes rosemary in their herb mixtures, gyros blends, and certain marinades. Large players in the European meat-processing industry include Vion Food Group (the Netherlands) and Groupe Bigard (France).

The sauces, condiments, and soup industries are also important users of dried rosemary. European companies that operate in this sector include Kraft Heinz, Maggi (Nestlé), and Knorr (Unilever). These companies add dried rosemary or rosemary extract as an ingredient to, for example, Bolognese sauce, balsamic sauce, mixes for Italian pasta, and bouillons.

In the bakery industry, rosemary is used as an ingredient in products such as focaccia bread, grissini, crackers, and toasts. Examples of companies that use dried rosemary in their bakery products include Schär (i.e. focaccia, crunchy bread), Bolletje (i.e. ciabatta crackers), Jacob’s from Pladis Global (i.e. crackers).

Other industries that utilise dried rosemary include the fish industry and the plant-based meats industry. With the growing demand for vegan and vegetarian meals, companies are expanding into this market by developing meat substitutes, often using the same spices and herbs as those in the meat processing industry.

Food retail

The food retail sector can be segmented into several categories: food retail chains, independent grocers, specialised shops, and online retail (web shops). Retailers offer dried rosemary either individually packaged or as an ingredient in various blends. Some herb blends containing dried rosemary (i.e. Herbes de Provence) are traditionally used in local cuisines, such as in France and Italy, and are also popular throughout other European countries.

Mainstream retail chains often have physical and online stores and operate exclusively in one market or across multiple European countries. Examples include Mercadona (Spain), Jumbo (the Netherlands), Sainsbury’s (the United Kingdom), and Carrefour (France). These retailers offer dried rosemary from leading spice brands like Verstegen (the Netherlands), Ostmann (Germany), and Ducros (France) and/or sell under their own private labels. Rosemary from private labels comes from European spice packers and blenders such as Luis Penalva, La Especiera del Norte, and Conservas Dani (Spain).

Various specialised stores also offer dried rosemary. These include online shops dedicated to spices and herbs, like Todo Especias (Spain) and L’ile aux épices (France). Some spice companies operate their own online store like Fuchs Gruppe Shop. Other specialised shops include organic stores like Ekoplaza (the Netherlands), Alnatura (Germany), and Veritas (Spain). These stores provide different brands compared to large supermarkets, for example Het Blauwe Huis (the Netherlands) and Artemis (Spain).

Foodservice

Specialised wholesale food suppliers – like Bidfood, Metro Cash & Carry, and Brakes (part of Sysco) – deliver spices and herbs to the food service sector. The food service sector includes hotels, restaurants, catering, and various institutions. The specialised wholesale food suppliers purchase dried rosemary from wholesale bulk importers or spice companies.

Packaging sizes in the food service sector differ from those in the retail sector. They require larger quantities than retail but smaller than those used in industrial settings. In the food service sector, packaging typically ranges from 200g to 1kg. Various brands cater to this market, including large spice companies and companies specialised in serving the food service industry. For example, Bidfood offers dried rosemary from the brands Verstegen (large spice brand) and Apollo (the foodservice brand of Solina), with packaging sizes of 200g and 250g.

Other industries

Dried rosemary is commonly used to produce rosemary essential oil or extracts, which finds its application across various industries. In the cosmetics industry, for instance, rosemary is an ingredient in products like soaps, shampoos, and shower gels. It is also utilised by companies that manufacture health or household products.

Companies in these industries obtain rosemary extracts from specialised suppliers. For example, Biolandes (France) produces aromatic plant extracts for use in cosmetics, aromatherapy, perfumery, and food flavouring. The company buys dried rosemary from Morocco and processes it by extraction at their production facility in Morocco.

Tips:

- Determine which segment or segments are most suitable to you. Based on the specific segment or segments, select the right trade fair to look for potential buyers. For the food ingredient segment you should visit Fi Europe (Germany), for private label the PLMA (the Netherlands), and Sirha (France) and Internorga (Germany) for the food service segment.

- To learn more about the potential of dried rosemary as a natural ingredient in cosmetics and health products, read our studies on Exporting natural ingredients for cosmetics to Europe and Exporting natural ingredients for health products to Europe.

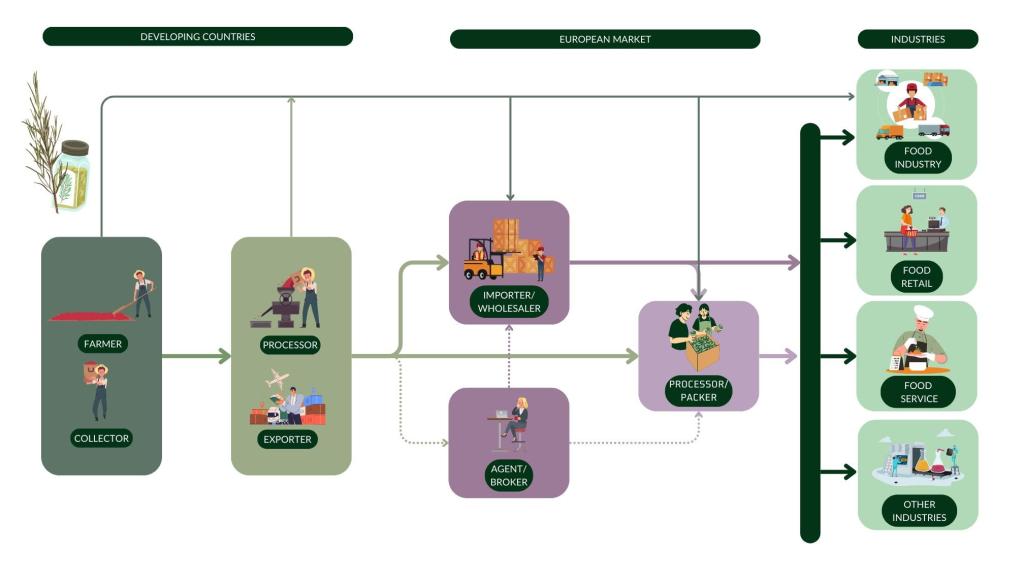

Through which channels does dried rosemary end up on the end market?

Dried rosemary enters the European market through various channels (see Figure 5). The most important ones will be discussed in greater detail below.

Figure 5: Market channels for dried rosemary to Europe

Source: GloballyCool, August 2024

Importers and wholesalers

Different types of importers and wholesalers can be identified, varying from general (spice) importers to importers specialised in specific product categories and segments. While one importer focuses solely on supplying ingredients to the food industry, other importers specifically target retail chains, the food service sector, and/or the non-food industry.

Below, we give examples of the different kinds of importers and wholesalers you come across for dried rosemary:

- Bulk spice and herb importers: These include wholesale traders and owners of retail brands such as Albarracín (Spain), European Spice Services (Belgium), and Barnes Williams (the United Kingdom).

- Spice mixes and ingredient suppliers: These companies specialise in supplying ingredients to different food industries. Examples include Sleaford Quality Foods (the United Kingdom) and Worlee (Germany).

- Suppliers of aromatic plant extracts: These companies purchase and process dried rosemary for the food and non-food industries, such as cosmetics, aromatherapy, perfumery, and food flavours. Examples include Biolandes and Golgemma (France).

- General food importers: These importers manage a diverse range of food products. In addition to herbs, they have, for example, cereals, seeds, dried fruits and nuts, and dehydrated vegetables in their product range. Examples of companies include Kündig (Germany) and Catz International (the Netherlands).

Each type of buyer may have different requirements for dried rosemary, depending on the segment they serve. Therefore, it is crucial to understand the segment you aim to target, be aware of its specific requirements, and seek out importers that operate within that particular segment.

European buyers are increasingly prioritising transparency in their supply chains and sourcing their herbs sustainably. Consequently, major players have developed their own codes of conduct. Those affiliated with the European Spice Association also adhere to the ESA’s Code of Conduct for responsible sourcing. In this regard, buyers aim to build long-term relationships with their suppliers.

Agents and brokers

Agents and brokers act as intermediaries, connecting buyers and sellers while earning a commission for their services. They are valuable when dealing with niche products that are harder to market or if you have limited sales capacity. Agents can also support you in participating in tenders from European retailers, helping you place dried rosemary directly within the European retail sector. Examples of spice brokers that can assist with trading dried rosemary include AVS Spice Brokers and Van der Does Spice Brokers (the Netherlands).

Tips:

- Search for a buyer who aligns with your company and the type of dried rosemary you offer. There are multiple channels to consider, each with its specific requirements. Understanding the different market segments and types of buyers is crucial. Finding the right type of buyer will improve your chances of success in the European market.

- As a beginning exporter to the European market, start by supplying the food processing industry. Retailers are more demanding so only consider targeting this segment if you have already gained experience in the European market and can comply with their strict requirements.

What is the most interesting channel for you?

For a beginning exporter of dried rosemary, look for importers that are specialised in the trade of spices and herbs in the European market. These companies have extensive knowledge on how to market spices and herbs and can guide you in the process.

If you are an experienced, well-equipped and price-competitive supplier, consider packing for the private label brands of European retailers. Packing is typically managed by European spice importers – for example The Spice Factory (Belgium), Luis Penalva, and Conservas Dani (Spain) – which have established partnerships with European retailers. However, due to rising labour costs in Europe, importers are increasingly exploring options for packaging in developing countries. Be aware that retailers have strict quality requirements and require full traceability and quality control.

Tip:

- Search the member list of the European Spice Association to find buyers from different channels and segments.

3. What competition do you face in the European dried rosemary market?

You will face competition from several European countries, such as Spain and France. In addition, there are competitors from several developing countries that you need to take into account. Morocco is known for its high-quality dried rosemary and is therefore preferred by many European importers. Other competing countries include Turkey, Tunisia, and Egypt.

Which countries are you competing with?

Rosemary is a native product of the Mediterranean region. It is grown or cultivated in countries like Morocco, Tunisia, Spain, Portugal, France, Turkey, and Algeria. Morocco, Tunisia (mainly for essential oils), and Spain are the main producing countries of this herb.

Trade data are unavailable, as there is no dedicated HS code for dried rosemary. The countries listed below are based on primary and desk research using reports, articles, national statistics, and insights into where European buyers get their dried rosemary from.

Morocco: largest producer and exporter of rosemary from outside Europe

Morocco is considered the largest producer and exporter of rosemary outside Europe, good for a share of 70% of the European dried rosemary market. Over the last decade, Morocco has modernised its production, and rosemary is now considered as one of their flagship agricultural export products. Many European importers buy dried rosemary from Morocco. According to the spice company Verstegen, the best quality rosemary comes from Morocco.

Morocco has wild rosemary and cultivated rosemary. The country largely depends on managing wild-grown areas in forests and mountainous regions. The wild rosemary production spans more than a million hectares, and is available for export all year round.

The cultivated production area is around 10,000 hectares, with harvesting season running from May to December. This cultivated area is primarily used to produce specialised rosemary varieties for advanced applications, like the botanical extraction of acids. This Moroccan rosemary is known for its high carnosic acid content. While competitors’ and wild Moroccan rosemary typically contains between 1.5% and 2.6% carnosic acid, cultivated Moroccan rosemary has concentrations as high as 6%.

Thanks to the high rosemary and carnosic acid content, Moroccan rosemary is highly appreciated in the international market. Moreover, it makes Moroccan rosemary suitable for a wide range of applications and industries, including infusions, food supplements, and the extraction of essential oils and botanical extractions. As an extraction, carnosic acid is used in numerous industries, such as cosmetics, pharmaceuticals, food, and animal feed. Carnosic acid can be used to improve the shelf life of foods, for example.

Large producers of active ingredients in countries such as Spain, Germany, and the United Kingdom are responsible for the demand for Moroccan rosemary. Depending on the industrial process and the desired active ingredient, rosemary is exported in various forms, including dry, shredded, or sheeted.

In 2024, the ongoing drought in Morocco has affected the production of aromatic plants, including rosemary, resulting in reduced supply and quality. For wild rosemary, the authorities have postponed the harvest, and in some regions, harvesting will be halted altogether to allow for plant regeneration. Consequently, Morocco must temporarily rely more on cultivated and irrigated rosemary. In terms of quality, the rosemary plants are shorter, paler, and have a lower consistency in acids.

Egypt: known for thyme and mint, but also supplies rosemary

Egypt is one of the leading producers and exporters of dried rosemary in North Africa. The country has around 2,500 hectares dedicated to rosemary cultivation. Rosemary cultivation benefits from the warm, sunny weather, mild winters, and the irrigation provided by the Nile River.

After harvesting, the rosemary is dried either in the sun or using mechanical dryers to retain its essential oils and flavour. This drying process ensures that the dried rosemary is of high quality. Annually, Egypt produces approximately 1,000 tonnes of dried rosemary, with a very large portion destined for export.

Within Egypt, rosemary cultivation faces competition from other, more important herbs, mainly thyme and mint. Common rosemary cultivars grown in Egypt include ‘Arp’ and ‘Tuscan Blue’, known for their strong flavour and adaptability to local conditions.

Egypt’s strategic location provides easy access to European and Middle Eastern dried rosemary markets. Examples of Egyptian dried rosemary exporters are Seadawy Spices and Natural Herbs Egypt.

Europe: Spain and France a mix of aromatic, perfume, and medicinal rosemary production

In Spain, producers, processors, and marketers of aromatic plants are organised under the association ANIPAM. Member producers cultivate nearly 6,700 hectares of aromatic plants, representing over 82% of the country's total production. Lavandin is their primary crop, constituting more than 75% of their cultivated area. Rosemary accounts for only 1% of their total crop area. Additionally, they harvest a minimal amount of wild aromatic plants. In total, the members produce around 24,000 tonnes of plant material and flowers.

Most of their crops are processed into essential oils at distilleries located near the fields, resulting in an annual output of approximately 300 tonnes of essential oils. Most rosemary is transformed into essential oils. Spain belongs to the top three producing countries of rosemary essential oils. The herb flourishes mainly along the Mediterranean coast and in the mountainous regions of central Spain, with key areas including the Catalonian coast, the Pyrenees, southern and eastern Castilla-La Mancha, Murcia, Valencia, Andalusia, and the Balearic Islands.

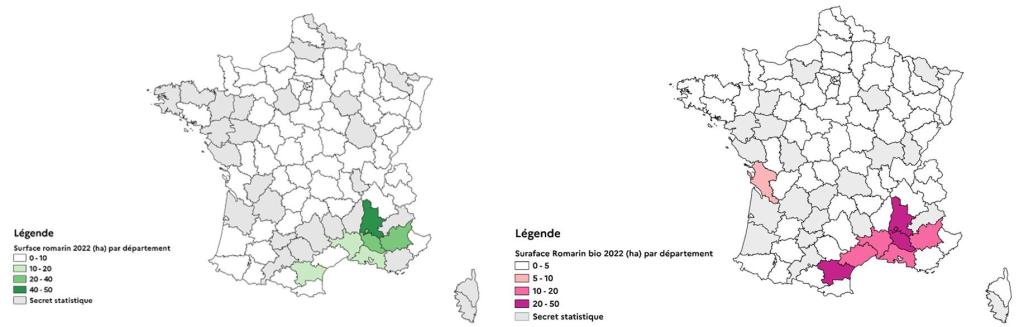

In France, the association PPAM de France brings together producers, cooperatives, marketers, and distillers of perfume, aromatic (for food applications), and medicinal plants. The association consists of approximately 2,000 farmer members. French aromatic plants are largely exported to Northern Europe, in addition to being sold in the local market.

Between 2018 and 2022, the area dedicated to rosemary cultivation grew at an average rate of 13% per year, reaching a total of 196 hectares in 2022. This expansion has been especially notable in the southeast of France, where rosemary is already widely cultivated. The number of farms growing rosemary has also risen, from 91 in 2018 to 170 in 2022.

Looking at the area and number of farms devoted to the cultivation of organic rosemary, France shows an even stronger growth. The surface area has increased by an average of 28% per annum to a total of 188 hectares in 2022. The number of farms has increased from 91 in 2018 to 170 in 2022. This development suggests that more farmers have transitioned to or started organic rosemary production, likely the result of the increasing demand for organic and sustainably produced herbs.

Table 1: Development of surface area of rosemary and number of farms in France (2018-2022)

| 2018 | 2019 | 2020 | 2021 | 2022 | CAGR | |

| Surface (ha) | 122 | 146 | 184 | 204 | 196 | 12.6% |

| Surface (ha) - organic | 71 | 100 | 121 | 162 | 188 | 27.6% |

| Number of farms | 109 | 127 | 140 | 170 | 170 | 11.8% |

| Number of farms - organic | 91 | 113 | 128 | 151 | 170 | 16.9% |

Source: FranceAgriMer (August, 2024)

Rosemary is predominantly grown in the southern regions in France: Provence-Alpes-Côte d'Azur, Auvergne-Rhône-Alpes (Drôme department), and Occitanie. Organic rosemary is mostly grown in the regions Occitanie (35%) and Provence-Alpes-Côte d'Azur (34%), followed by Auvergne-Rhône-Alpes (Drôme) (15%).

Figure 6: Locations of rosemary crops in France in 2022 (conventional left side, organic rosemary on the right side)

Source: FranceAgriMer (August, 2024)

Turkey: wild rosemary dominates

In Turkey, rosemary is mostly collected from nature. Rosemary can be found in the regions on the Mediterranean and Aegean coasts. Production data related to rosemary is recorded by the General Directorate of Forestry – Orman Genel Müdürlüğü – under non-wood forest products. In 2023, official records mention Turkey produced 206 tonnes of rosemary. The greatest part, around 75%, is produced in the Mersin region, the Tarsus district. In recent years, Turkey has also begun cultivating rosemary as a crop in fields, though the quantities are still small.

Local people harvest rosemary in exchange for a low fee of 0.17 Turkish Lira (USD 0.0051) per kilogram, which is paid to the General Directorate of Forestry. The harvested rosemary is then sold to buyers through a tendering process. The production follows specific plans and is typically carried out in two-year periods. The rosemary production generally begins in mid-July and extends through August-September. Once cut, the rosemary is either left at the field or spread along the roadsides. The rosemary will be dried for seven to 10 days.

Most of the rosemary production is exported to foreign markets and in 2022 totalled slightly more than 800 tonnes of crushed and uncrushed leaves of rosemary.

Tip:

- Investigate your competitors in the European market: What is their strategy, how do they promote themselves, what are their unique value propositions, etc.? You can find your competitors by visiting European trade fairs such as ANUGA, SIAL, Biofach and Food Ingredients.

Which companies are you competing with?

Competition comes from Morocco in the first place – it is a significant producer and exporter of dried rosemary to the European market. Moroccan companies are known for their high-quality dried rosemary, which has high levels of carnosic acid. However, competition is also expected from within Europe, as rosemary is cultivated in Mediterranean countries such as Spain and France. Below are some insights from three companies that supply dried rosemary to the European market.

Aphysem from Morocco: organic-certified rosemary in various forms

Aphysem is active in the production, export, and marketing of high-end aromatic herbs and spices. The company also offers other products like seeds, fertilisers, and phytosanitary products. As a member of the European Spice Association (ESA), Aphysem follows the ESA Code of conduct for responsible sourcing. The company offers rosemary in various forms, such as oil-free, chopped, and ground, and complies with the highest industry standards for food safety. Aphysem is BRCGS, IFS, ISO 22000, and EU Organic certified.

Uyar Spice from Turkey: sustainably-produced wild and cultivated rosemary

Uyar Spice specialises in producing and exporting a range of herbs, seeds, citrus peels, peppers, and essential oils, with 95% of its operations focused on exports. Uyar Spice is a member of the Sustainable Spice Initiative (SSI) and the ESA and has, therefore, committed to the sustainability goals outlined by SSI and the ESA Code of conduct for responsible sourcing. The company offers wild and cultivated rosemary, harvested between June and August and exported in 10kg craft bags.

Les Aromates de Provence from France: Label Rouge certified herbs de Provence offer a premium

Les Aromates de Provence is a cooperative that brings together 40 producers of aromatic plants and herbs, including rosemary. They produce Label Rouge-certified herbes de Provence. Each plant batch is analysed on a set of quality criteria such as bright green colour and a certain essential oil content. After approval, the batch is blended with the other herbs. The blend is always sterilised using steam. After sterilisation, a minimum essential oil content of 2% is ensured. In addition, the grading of the herbs is checked to ensure proper size distribution.

The cooperative supplies the Label Rouge herbs de Provence to several major spice companies in the French market, such as Ducros (McCormick), Albert Ménès, and Sainte Lucie, which in turn market and label these herbs as Label Rouge certified, originating from the Provence. In addition, the cooperative sells the herbs through their online shop (larger quantities) and the online shop of their partner, France Lavande: Couleurs Provence (for smaller packaging sizes). Therefore, they reach French and international clients.

Tip:

- Assess your competitors' strategies and make sure to set yourself apart from the competition. Either do that by competitive pricing, having unique offerings (i.e. high essential oil content), or catering your rosemary to specific segments (i.e. organic or essential oil). Also, learn from the largest competitors by investigating how they organise, for instance, the quality control and sustainability within their business.

Which products are you competing with?

Several substitutes for dried rosemary exist, including fresh rosemary, single-dried herbs, and herb blends.

Fresh rosemary is often associated with higher quality and freshness, making it appealing to customers who desire a premium culinary experience. The herb is grown in various European countries. For example, the Dutch supermarket Jumbo offers fresh rosemary of Dutch and Italian origin.

Dried rosemary has several advantages over fresh rosemary. It has a significantly longer shelf life, making it more practical to use, and there is a lower risk of waste. Moreover, the dried herb is a convenient and ready-to-use product, more concentrated, and suitable for shorter cooking periods. Additionally, the cost per use is lower, making dried rosemary a more affordable choice.

Dried rosemary is also competing with other dried herbs and herb mixtures. A good substitute is thyme. Whereas rosemary brings a robust, piney taste, thyme has a more subtle, earthier flavour, making it more versatile in delicate dishes. Other substitute herbs include oregano, sage, savoury, and marjoram. Herb mixes that include rosemary – like Herbs de Provence and Italian seasoning – can also serve as an alternative. With the busy lifestyles of European consumers, there is a preference for ready-to-use herb mixes over blending individual herbs.

Tips:

- Get familiar with the market for fresh herbs by reading CBI’s study on Exporting fresh culinary herbs to Europe.

- Read CBI’s study on Exporting dried thyme to Europe to learn more about the demand and potential for dried thyme in the European market.

4. What are the prices of dried rosemary in the European market?

While dried rosemary is imported in bulk at prices of, for example, €1,800 per tonne C&F, the prices of dried rosemary on supermarket shelves are much higher. The difference between import prices and shelf prices seems to be considerable but relates to all costs of transport, storage, processing, packaging, distribution, sales, and marketing.

Food retail prices

Dried rosemary is typically sold in small packages ranging from 18g to 40g in supermarkets. Prices vary greatly between private labels and brands. Discount retailers and other supermarket private labels sell dried rosemary at much lower prices than independent brands. In addition, prices can vary depending on the size and type of packaging.

In European supermarkets, dried rosemary prices vary between €24 and €151/kg. The lower end represents private label prices, while the higher end corresponds to prices of independent brands, products in luxury packaging, and/or products with organic and other certification.

Table 2: Consumer prices of dried rosemary in large European supermarkets, in €/kg

| Dried rosemary | |

| The Netherlands | 39.60 – 149.50 |

| Germany | 31.60 – 114.50 |

| The United Kingdom | 43.26 – 129.91 |

| Belgium | 33.90 – 140.48 |

| France | 24.50 – 150.56 |

| Spain | 33.00 – 102.17 |

Source: GloballyCool, August 2024

The highest prices are observed in France and the Netherlands, reaching up to €150/kg. The prices in Spain are relatively low, with maximum prices of about €100/kg. France has the lowest prices for private label products, with €24/kg.

Price breakdown

Below is a rough indication of a price breakdown for rosemary sold in consumer packaging (€130 per kg) and imported for €1,800 per tonne. The margins seem to be high, but they have to cover many costs: sterilisation, other processing and packaging, stock-keeping, food-safety certification, taxes, sales, marketing, transport, distribution, etc. In terms of margins, food retail receives the largest share.

Source: GloballyCool, July 2024

Tips:

- Think about subscribing to Expana, the leading agri-food price reporting agency.

- Consider subscribing to a third-party market price service. Be critical about what kind of prices are offered; for example, the Tridge platform focuses on rosemary for applications other than food.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research