Entering the European market for dried thyme

Europe buys dried thyme for the food industry, retail and service segments. Exporters must adhere to European Union limits on contaminants and pesticide residues and provide clear labelling. Egypt leads non-EU supply, showing significant growth and covering about half of extra-EU imports. Cost-efficient exporters who meet the requirements of the various European buyers and segments can win space on European shelves.

Contents of this page

- What requirements and certifications must dried thyme meet to be allowed on the European market?

- Through which channels can you get dried thyme on the European market?

- What is the most interesting channel for you?

- What competition do you face on the European dried thyme market?

- What are the prices of dried thyme on the European market?

1. What requirements and certifications must dried thyme meet to be allowed on the European market?

Dried thyme must comply with the general requirements for spices and herbs, which cover both mandatory requirements and additional buyer requirements. Buyer requirements range from general quality requirements to certification for specific market segments, such as organic and halal.

What are mandatory requirements?

Dried thyme that comes into the European Union (EU) has to be safe. The EU sets strict limits for microbiological contamination, pesticide traces, traces of PAH, mould toxins and mineral oils. Keep your thyme below these limits to meet EU regulations. Thyme that exceeds maximum levels is withdrawn from the European market.

Official food controls

Dried thyme entering the EU is regularly checked. Testing may take place at the border or further on in the supply chain. If a batch is not compliant with EU food safety legislation, the problem is posted on the Rapid Alert System for Food and Feed (RASFF). If a country’s thyme often fails checks, the EU can set extra checks or block further shipments. Currently, no country faces these extra border checks for dried thyme.

Microbiological contaminants

Regulation (EC) No 2073/2005 lists microbiological criteria for foodstuffs. The EU regulation does not set specific limits for dried thyme, meaning that general limits apply. The most important microbiological risk is Salmonella. Salmonella must be completely absent from spices and herbs. From 2022 to 2024, issues with Salmonella were reported in RASFF every year. A French company’s most recent check led to a product recall.

Tips:

- Consider having dried thyme heat-treated (sterilised) by a third party in your country. Heat sterilisation is a natural method (free from chemicals and radiation) popular among European buyers.

- Comply with the Codex Alimentarius Code of Hygienic Practice for Low-Moisture Food (CXC 75-2015).

Other contaminants

Contaminants are unwanted substances that end up in food unintentionally. They can get into food during farming, drying, packing, transport, storage or as a result of environmental pollution. Some contaminants can harm people’s health. The EU sets strict limits for many of these substances in food to protect consumers.

In addition to bacteriological contamination, which is a serious issue for dried thyme, plant toxins can also be an issue in dried thyme, as was the case for Spanish thyme in January 2025. Other types are less common for dried thyme, and include mycotoxins and polycyclic aromatic hydrocarbons (PAH).

Tip:

- Read more about contaminants on the European Commission’s website.

Pesticide residues

Regulation (EC) No 396/2005 sets maximum residue levels (MRLs) of pesticides in or on food and feed of plant origin. An MRL is the highest amount of pesticide residue legally permitted in or on food products when pesticides are used. Products exceeding these permitted levels are withdrawn from the European market.

When you check pesticide limits (MRLs) on dried thyme, you must first adjust them to match fresh thyme. EU Regulation 396/2005 (Article 20) lets you correct for the extra concentration caused by drying. The European Spice Association has set standard ‘dehydration factors’ to ensure this calculation is the same for everyone. For thyme, the factor is 7, so you multiply the fresh thyme MRL by 7 to get the permitted level for dried thyme.

In recent years, there have been several incidents where pesticide residue levels in dried thyme were too high. In 2022, 2-chloroethanol was found in dried thyme from Egypt. In April 2025, it concerned chlorpyrifos in dried thyme from Egypt and linuron in dried thyme from Poland.

Tip:

- Consult the EU Pesticides database for more information on MRLs for pesticide residues that apply to thyme.

Labelling

Dried thyme must be labelled properly. Bulk packs should show:

- Name and variety of the product;

- Batch code;

- Net weight in the metric system;

- Shelf life of the product, or best before date, and recommended storage conditions;

- Lot identification number (or identification mark);

- Country of origin;

- Name and address of the manufacturer, packer, distributor or importer (or identification mark);

- Batch details (may also be included in the Product Data Sheet).

Retail or consumer packs must follow Regulation (EU) No 1169/2011 on food information. The regulation sets out what to show on nutrition and origin, how to list allergens, and the minimum font size for all required details.

Figure 1: Consumer label of dried thyme in the Spanish market

Source: Globally Cool, June 2025

What additional requirements and certifications do buyers often have?

European buyers have requirements in addition to legal requirements. These concerns include quality requirements for dried thyme, food safety certification, packaging requirements, and social and environmental sustainability.

Quality requirements for thyme

The quality of dried thyme is very important to European buyers. Several factors, including subjective aspects like colour, taste and flavour, influence quality. European buyers often ask suppliers to comply with the European Spice Association’s (ESA) Quality Minima Document. Common parameters used to specify the quality of dried thyme include:

- Cleanliness or purity: The ESA Quality Minima Document states that herbs must be free from off-odour, off-flavour and foreign matter. However, requirements may vary per buyer and may include more specific indicators. The maximum ash content is 12%, and the acid-insoluble ash maximum is 3.5%. Good quality and clean dried thyme should contain below 1-2% acid-insoluble ash;

- Moisture content: The maximum moisture content set by the Quality Minima Document is 12%;

- Volatile oils: The Quality Minima Document sets a minimum volatile oil content of dried thyme of 1 ml/100g;

- Mesh or particle size: These are only applicable to ground thyme;

- Odour and flavour: dried thyme should have a characteristic odour and flavour, which is influenced by chemical components of volatile oil. The flavour profile can vary based on factors like geographical location, climate and growing conditions.

The ISO organisation also published a standard for dried thyme under ISO 6754:1996. Sampling should take place according to ISO 948:1980.

Food safety certification

European buyers will ask if you have a Global Food Safety Initiative (GFSI)-recognised food safety system certification, such as Food Safety System Certification (FSSC 22000). FSSC 22000 offers the most structured and logical approach to an internationally recognised and used food safety management system in Europe and many other regions. Third-party certification programmes are beneficial to your company and highly appreciated by new buyers. However, serious buyers may also choose to visit and/or audit the production facilities of new suppliers.

Packaging requirements

Dried thyme is primarily exported in bulk. It can be packed in various sizes for industrial purposes according to the buyer's needs, but most are between 10 and 15 kg. The dimensions of the chosen packaging must align with standard pallet sizes (800 mm x 1,200 mm and 1,000 mm x 1,200 mm).

In retail, dried thyme is offered in various packaging types, with glass containers being the most common, followed by plastic containers, plastic bags, paper bags and stand-up pouches. The net weight of retail packages typically ranges from 15 g to 40 g.

Figure 2: Retail packaging types of dried thyme in different European markets

Source: Globally Cool, June 2025

Sustainability compliance

Social and environmental sustainability are important topics for European buyers. Large European spices and herbs companies have all set goals to buy sustainably sourced spices and herbs and enhance transparency throughout their supply chains. As a result, suppliers must often undersign the buyer’s Code of Conduct.

Since 2022, the European Spice Association (ESA) has developed a Code of Conduct for responsible sourcing. Many European spices and herbs companies are members of the ESA. As such, you will likely come across this guideline.

Another possibility is that buyers will ask for certification against other standards, such as the Ethical Trading Initiative (ETI) and the Business Social Compliance Initiative (BSCI).

Tips:

- For payment and delivery terms requirements, see CBI’s study on organising your spices and herbs exports to Europe.

- Follow ESA’s Quality Minima Document on the chemical and physical parameters (Appendix I) and the recommended analytical methods (Appendix II) for dried thyme.

What are the requirements for niche markets?

Some more specialised markets in Europe set additional requirements, often in the form of certification. The most relevant one is organic certification.

Organic certification

To market dried thyme as organic in the EU, it must be cultivated using organic production methods that comply with EU organic regulations. Growing and processing facilities must also undergo audits by an accredited certification body.

Figure 3: Organic-certified dried thyme in a German high-end retail outlet

Source: Globally Cool, February 2025

Ethnic certification

Islamic (Halal) and Jewish (Kosher) dietary laws propose specific restrictions. If you focus on these niche markets, consider implementing Halal or Kosher certification schemes.

Tips:

- Read CBI’s study on the requirements spices and herbs must comply with to be allowed on the European market for a complete overview of requirements, including organic certification.

- Consult the ITC Standards Map for an overview of relevant certification schemes and their requirements.

2. Through which channels can you get dried thyme on the European market?

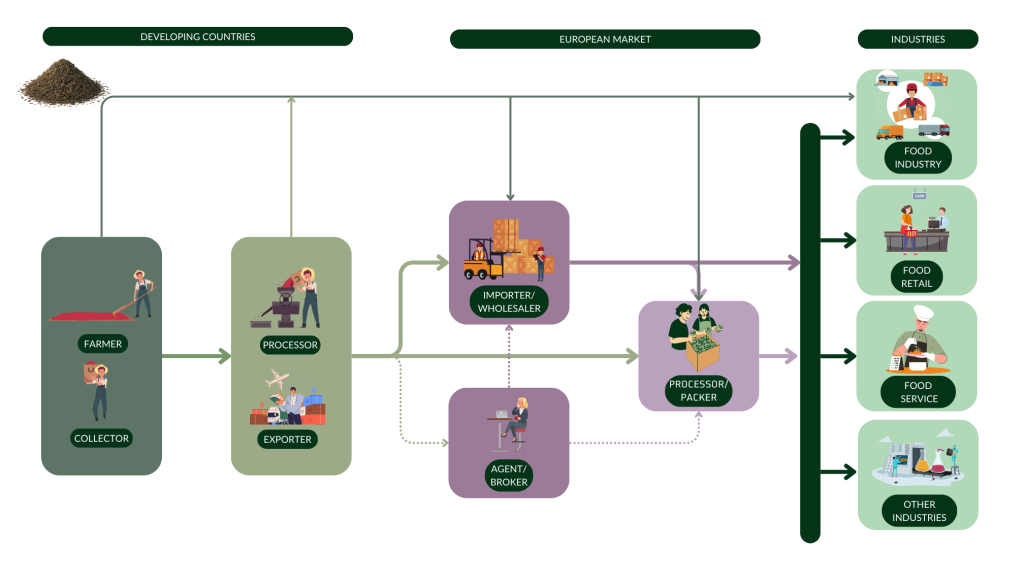

Dried thyme is sold through different channels to reach the food industry, food retail, food service and other industries where companies use dried thyme in non-food applications. Dried thyme usually reaches the European market through importers and wholesalers.

How is the end-market segmented?

End-market segments for dried thyme include the food industry, food retail, food service and other industries (such as cosmetics and health products).

Figure 4: End-market segments for dried thyme in Europe

Source: Globally Cool, June 2025

Food industry

The food industry is the biggest segment for dried thyme in the European market. The food industry consists of spice mixture and ingredient producers, sauces and condiments manufacturers, meat and fish (plus substitutes) processors, the baking industry, and other industries. Dried thyme is used in two main ways: as a stand-alone herb and as an ingredient for herb and spice mixtures. Packaging specifications vary, but bags of between 10 and 15 kg are often used.

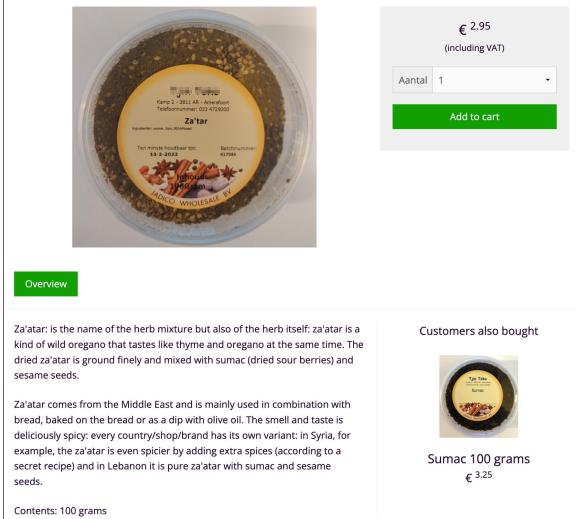

Spice mixtures originate from all over the world. For instance, thyme is an essential component of Middle Eastern Za’atar, a traditional herb and spice blend becoming increasingly popular in Europe. Thyme is also used in Italian seasoning, the French mixture Herbes de Provence, and Cajun seasoning from the US.

Besides dry herb and spice mixtures, dried thyme is also used in the sauce and condiments industry. For example, Knorr (an Unilever brand) uses dried thyme in its wet (and dry) marinades. It is often blended with other herbs, acids and oils to enhance the taste of meats, poultry and vegetables. Dried thyme is also a relatively common ingredient in brown gravy, such as in this brown gravy sauce by Knorr.

The meat, fish and substitute processing industry requires customised spice and herb mixes. Dalziel Ingredients is an example of a company that sells these mixtures, as it creates custom seasoning blends in cooperation with its customers. Major players in the meat and fish processing industry include Hilton Foods and Premium Food Group. Several meat and fish producers also make plant-based alternatives.

The baking industry uses dried thyme too, but in much smaller volumes. For example, dried thyme is used in crackers (for example in Blévita crackers by Swiss Migros), and in Mediterranean-style flatbreads.

Food retail

Another important segment is food retail. Food retail offers customers dried thyme in small containers, or mixed in with other herbs and spices as part of a blend. It is sold through various channels, including retail chains, independent groceries, specialised shops and online retail.

Much of the dried thyme that is sold in food retail is sold through physical outlets. Relatively large players are Albert Heijn in the Netherlands, REWE in Germany, E.Leclerc in France, and Mercadona in Spain. While some of these have grown their own online/home-delivery sales, there are online-only supermarkets too, such as Picnic (in the Netherlands, Germany and France), which delivers groceries to the customer’s doorstep.

Retailers often sell well-known spice brands such as Verstegen in the Netherlands and Ostmann in Germany, but they also sell their own (private-label) brands, such as Hacendado by Mercadona in Spain.

Specialised shops also offer dried thyme. These speciality shops may trade only spices and herbs (and related products). Some examples of such shops are 1001Especias (Spain), Todo Especias (Spain) and Mes Épices (France). Other types of specialised shops are supermarkets that only sell organic produce, such as Naturalia in France and Bio-Planet in Belgium. A final category of specialised shops is ethnic retail, such as Turkish, North African and Middle Eastern food stores. These stores sometimes offer dried thyme packed in the country of origin.

Food service

The food service sector includes supplies to restaurants, hotels, catering services, and other institutions that prepare and serve food to customers. This channel is typically supplied by specialised wholesale distributors like Sligro Food Group, Transgourmet and Metro Cash & Carry. These suppliers source dried thyme directly from exporters or, more often, through large-scale bulk importers.

Unlike the retail or industrial segments, the food service industry requires intermediate packaging sizes, specifically tailored to the needs of professional users such as professional kitchen staff. Packaging sizes typically range from 150 g to 1 kg, offering a practical balance between portion control and shelf life.

Other industries

Besides food applications, dried thyme is also used to produce essential oils and botanical extracts that serve a variety of non-food industries. In the cosmetics and personal care sector, thyme is valued for its natural purifying, soothing and aromatic qualities, making it a common ingredient in products such as shampoos, facial cleansers and body care formulations. It also plays a role in health and household products focusing on plant-based, functional ingredients.

One company that incorporates thyme in this way is Croda, a global leader in innovative and sustainable ingredients for the personal care industry. Croda includes thyme in its extensive portfolio of botanical actives.

Tips:

- Pick your target segment first, then book the right fair. Food ingredient buyers should reserve a stand or visitor pass for Fi Europe in Germany or France. Retail private-label buyers should register for PLMA in Amsterdam. Food service distributors and chefs can best be targeted through Sirha in Lyon and INTERNORGA in Hamburg.

- Explore non-food options. Read CBI’s studies on exporting natural ingredients for cosmetics to Europe and exporting natural ingredients for health products to Europe. They map regulations, buyers and price points—use them to develop your pitch before contacting prospects.

Through which channels does dried thyme end up on the end market?

Dried thyme can reach the European market in several ways. Figure 5 shows the most important channels are importers/wholesalers and processors/packers.

Figure 5: Market channels for dried thyme to Europe

Source: Globally Cool, June 2025

Importers and wholesalers

Importers and wholesalers each have their own focus and specialisation. They can be (bulk) importers/wholesalers or companies that process or pack spices.

- Bulk spice and herb importers: companies that specialise in importing large quantities of dried spices and herbs, and often also offering other ingredients like lentils, beans or seeds. One example is BC Foods Europe (the Netherlands);

- Spice mixes and ingredient suppliers: companies that provide blended seasonings and mixes to the food industry. For example, Colin Ingredients from France, and Epos from the Netherlands;

- General food ingredient importers: companies that manage a broad portfolio of food products, including herbs, spices and other ingredients, like grains and vegetable powders. One example is EHL Ingredients from the United Kingdom.

Remember that all these importers have (slightly) different requirements for your product. This means you need to decide which segment you want to target and how to do so, and find importers that cater to that segment.

Agents and brokers

Agents and brokers facilitate the spices and herbs trade, helping to match suppliers with potential buyers in exchange for a commission. Their role in the dried thyme trade is limited and estimated at less than 5% of total trade. Examples of brokers are Catz International from the Netherlands and Victoria from Italy.

Tips:

- Define your target segment (for example organic, bulk-pack or speciality blends) and list the specifications your product must meet.

- Review important individual requirements, such as moisture levels, mesh size and residue limits, and tick off compliance issues for the target segment.

- Approach only those buyers whose segment focus matches your offer; they will value your tailored product offer.

3. What is the most interesting channel for you?

When entering the European market for dried thyme, new exporters are advised to partner with specialised importers of herbs and spices. These companies have in-depth market knowledge and established networks, and can support suppliers in meeting regulatory and logistical requirements. Direct access to the retail segment is generally limited to seasoned exporters with strong capabilities. This is due to the demanding nature of retailers, including high expectations on quality assurance, traceability and efficient supply chains.

For producers who are well-prepared, cost-efficient and able to meet European quality benchmarks, supplying private-label products can be a promising route. Typically, private-label packaging is coordinated by European importers with long-standing agreements with retail chains. Bart Ingredients, part of one of Europe’s larger spice groups, Fuchs Gruppe from Germany, is one such example.

However, with labour costs steadily rising in Europe, some importers are increasingly exploring packaging partnerships in developing countries, provided those partners can ensure strict quality control and full traceability from source to shelf. Fresh Fields from Egypt, for instance, is trying to fit into this market by offering herbs and packaging services for private-label brands.

Tip:

- Search the member list of the European Spice Association to find buyers from different channels and segments.

4. What competition do you face on the European dried thyme market?

Thyme is a native herb of the Mediterranean, traditionally found in wild or semi-wild form across southern Europe and North Africa. Today, dried thyme is produced in several Mediterranean and adjacent countries, including Morocco, Egypt, Türkiye, France and Spain. Notably, Poland has also emerged as a significant European producer. In the European market, dried thyme faces competition from fresh thyme.

Which countries are you competing with?

Poland is the leading competitor for emerging suppliers in Europe, offering high-quality dried thyme to much of the continent. For supply from outside Europe, main competitors include Morocco, Egypt, Türkiye and the Syrian Arab Republic.

Although supply volumes from outside Europe are substantial, the market is dominated by local supply from Poland and the other production countries, Spain and France. The volumes of European supplying countries in 2024 were 2,400, 1,000 and 620 tonnes for Poland, Spain and France, respectively. Polish supplies declined by 1.8% per year on average, Spanish exports to Europe increased by 5.4%, and French exports dropped by 16%.

Although volumes from European supplying countries are large, there is still considerable potential for suppliers from outside Europe, given that more than 10 developing countries supply over 70 tonnes of thyme to Europe.

Source: Eurostat Comext and ITC Trade Map (June 2025)

Egypt: Europe’s top non-EU supplier

Egyptian exports rose from 863 tonnes in 2020 to 1,800 tonnes in 2024, which is about a 20% average yearly growth. After steady gains of 2-10% a year until 2023, volumes jumped by 48% in 2024, helped by bigger harvests in the Nile Delta, improved steam-sterilising capacity, and the available crushing capacity.

Egypt now covers roughly half of extra-EU imports of dried thyme, and benefits from early-season availability (March–May) and competitive prices. Germany is Egypt’s biggest destination (more than 600 tonnes in 2024), followed by France and the United Kingdom. Export of ground thyme grew fastest, with over 60% annual growth, and even faster for Egypt’s main destination, Germany.

Egypt is a notable producer and exporter of dried thyme, with cultivated and wild varieties contributing to the country’s herb sector. The Faiyum (also spelled Fayoum) region is especially significant, with a historical legacy of thyme cultivation dating back to ancient Egypt. Known for its natural habitats, Faiyum supports the growth of wild thyme, which complements cultivated varieties in local and export markets.

Egypt’s climate allows for year-round herb production, with thyme processed into different (dried) forms. The industry features a mix of large-scale commercial farms and smallholder growers. The latter are increasingly organised into cooperatives and associations to improve market access and income. An example of such an association is the Egyptian Herb Growers Development Society at Fayoum.

Morocco: wild-harvested thyme with overharvesting concerns

In Morocco, thyme is mostly harvested from the wild, with wild varieties accounting for over 90% of the country’s total thyme production. Exports to Europe declined from 721 tonnes in 2020 to 593 tonnes in 2024 (-5% CAGR). 2023 was the weakest year, with 423 tonnes of export volume due to drought in the Atlas foothills. A modest recovery followed in 2024.

Morocco’s European export destination range is rather concentrated, with more than 50% going to the United Kingdom and one-third of the total volume destined for Spain. Tight water rules and rising labour costs keep Moroccan output volatile. Buyers value Morocco for EU-friendly logistics and organic lines. However, the country risks losing a share to Egypt unless yields stabilise.

Species such as Thymus satureioides grow across the High and Middle Atlas Mountains and in the Rif and Anti-Atlas regions. Valued for their aromatic and medicinal properties, these plants play a central role in traditional Moroccan medicine and are increasingly sought after by the international cosmetics and food industries. However, rising global demand has led to overharvesting of wild thyme, placing pressure on natural populations and posing a threat to biodiversity.

Türkiye: stable supplier of cultivated thyme

Turkish export volumes moved within a narrow band of 465–623 tonnes per year and ended in 2024 at 465 tonnes, slightly below the 2020 level (-1% CAGR). Turkish exporters focus more on oregano and sage; thyme remains a side crop. Currency weakness has supported price competitiveness, but strict EU pesticide MRLs have limited faster growth. More than 30% of Turkish thyme exports go to the United Kingdom, followed by the Netherlands (25%), Germany (12%) and France (9%).

Türkiye is famous for what is known as Izmir Thyme. However, this thyme is botanically classified as Origanum onites, placing it in the oregano category rather than thyme.

Syrian Arab Republic: small but recovering thyme supplier

The conflict in Syria cut exports to 120 tonnes in 2022, but exports bounced back to 231 tonnes in 2024, close to 2020 levels. Syria’s main destinations in 2020, Belgium, Germany and Sweden, still lagged behind in 2024. However, new destinations that have grown rapidly since 2022 are the Netherlands (59 tonnes in 2024) and the United Kingdom (52 tonnes). Almost all of the thyme is ground.

Supply chains rely on Jordanian and Lebanese exit ports, keeping costs high. Some European spice blenders buy Syrian wild thyme (Za’atar) for its strong aroma. However, the current political risk and traceability issues limit large-scale expansion in the short term.

Figure 7: Syrian thyme, also called Za’atar, is used in a spice mix of the same name

Source: Globally Cool, June 2025

Which companies are you competing with?

The global thyme market is highly competitive. As a thyme producer or exporter, your main competition comes from companies in key production countries such as Egypt, Morocco, Türkiye, the Syrian Arab Republic, and – last but certainly not least – Poland and Spain. Understanding your competitors’ strengths, product portfolios, certifications and market strategies is crucial to positioning yourself effectively in the international thyme trade.

Spice Kingdom from Egypt: premium steam-sterilised thyme for Europe’s strictest buyers

Spice Kingdom is a leading Egyptian grower-packer of dried herbs and spices, including thyme. The company runs a modern plant with steam sterilisation in Greater Cairo, from which annual exports reach about 7,000 tonnes of herbs, seeds, spices, essential oils, oleoresins and extracts.

Spice Kingdom offers both conventional and EU-certified organic thyme, and has several certificates, including ISO 22000, BRCGS Grade A, Kosher, Halal and SMETA social standards. Its sun-dried leaves are milled to customer-specified cut sizes (whole, 1-2 mm) and packed in food-grade cartons or foil-lined kraft bags. Flexible processing lines allow private-label packing, low-dust grinding and blended Za’atar mixes on request.

Agrin Maroc is leading Moroccan herb exports

Agrin Maroc has three plants for processing, packing and exporting dried medicinal and culinary herbs, including thyme, along with rosemary, basil and marjoram. To ensure high quality and contamination control, the company invested in a modern, automatic sterilisation line. Agrin Maroc has a strong organic assortment and is certified to export organic products to the EU and the US. They have also obtained several food safety certifications that allow them to enter different market segments.

Altuntaş from Türkiye: organic-certified and conventional thyme with full traceability

Altuntaş is a long-established Turkish company specialising in the processing and export of spices, herbs and oil seeds. The company operates a facility equipped with modern technologies for cleaning, grinding, blending, sterilising and packaging a wide range of natural products. Their vertically integrated operations ensure full traceability from sourcing to shipment.

Altuntaş supplies both conventional and organic ingredients. In the first place oregano, for which Türkiye dominates the world market. The company also supplies thyme, sage and rosemary to clients in over 50 countries. The facility complies with international food safety and quality standards, holding certifications such as BRCGS and ISO 22000. Products are processed according to client specifications and are available in multiple formats suitable for industrial, food service and retail applications.

Zarzour: Syrian thyme for the ethnic market

The Zarzour Group is a family-run exporter and packer of Syrian food products. Its core line is dried thyme, blended into ‘Jordanian’ and ‘Royal’ mixes from selected, locally produced thyme leaves and packed on an automated line to keep flavour fresh. The firm also trades coffee, spices, falafel mix, tea, tuna, kafta and olive oil under the Zarzour and Sabah Alnour brands. Zarzour predominantly supplies European retailers and wholesalers in the ethnic segment, who want authentic Levant flavours.

Tips:

- Look closely at what other suppliers are doing if you want to break into Europe’s dried thyme market. Like many Egyptian, Moroccan and Turkish exporters, you can compete on price while maintaining food safety and quality, offer a special item such as pharma-grade dehydrated thyme, or target a niche such as organic-certified.

Which products are you competing with?

Thyme has a unique aromatic profile that is hard to replace. However, fresh thyme competes with dried thyme, while oregano is the herb most like dried thyme. In some European markets, spice brands sell freeze-dried thyme. This is a different, more costly process that gives more smell, colour and taste to the dried product. Roughly 3 kg of fresh thyme results in 1 kg of dried thyme.

Fresh thyme

Fresh thyme shares the same botanical origin and offers a similar flavour, but with a milder, greener and slightly more delicate taste. While dried thyme is stronger and more concentrated, fresh thyme is often preferred for dishes that require a subtle herbaceous note and a fresh aroma.

Dried thyme offers several advantages: it has a longer shelf life and a more intense flavour, is available year-round, and provides greater convenience for long-cooking dishes. Fresh thyme is available in supermarket outlets with large fresh produce sections and comes from, for example, the Netherlands, Italy, Spain, Morocco, Israel or East Africa. Examples are REWE and Sainsbury’s.

Oregano

Oregano can serve as a substitute for thyme because it offers a comparable earthy and herbal flavour profile, although it is generally stronger, slightly more bitter and less floral. While thyme offers a softer and more balanced aroma, oregano provides a bolder, more intense taste that works well in many of the same dishes, particularly in Mediterranean and Italian cuisine.

Tips:

- Learn more about the fresh thyme market in the CBI study on exporting fresh herbs to Europe.

- Remind buyers that dried thyme keeps far longer and tastes more concentrated than fresh thyme, making it perfect for slow-cooked dishes and year-round menus.

- Stress convenience for chefs. Highlight that pre-cleaned, dried leaves save time in professional kitchens compared to fresh stems (which need to be stripped).

- Position against oregano. Show how thyme’s softer, more balanced aroma complements dishes where oregano can be too strong, especially outside Mediterranean cuisine.

5. What are the prices of dried thyme on the European market?

While dried thyme is imported in bulk at between €2,500 and 6,000 per tonne CIF (Cost Insurance Freight), prices of dried thyme on supermarket shelves are much higher at levels above €200/kg. The difference between import and shelf prices is considerable, but shelf prices must cover all transport, storage, processing, packaging, distribution, sales and marketing costs.

Food retail prices

Supermarkets usually sell dried thyme in packs of 15-40 g. Private-label packs cost less than those of independent brands. The price per kilo also drops when packs are larger, as volume deals offer better value.

In Europe’s biggest supermarkets, dried thyme prices vary between €13/kg and €257/kg. The lower price range typically reflects private-label products or larger packaging sizes available in ethnic supermarkets, while the higher end is associated with independent brands and premium packaging. Higher prices might also be justified by organic or food quality certifications.

Table 1: Consumer prices of dried thyme in large European supermarkets, in €/kg

| Country | Consumer price |

|---|---|

| The Netherlands | 13.91–220.71 |

| United Kingdom | 19.71–213.49 |

| Germany | 39.50–166.00 |

| France | 30.56–222.00 |

| Poland | 19.26–178.16 |

| Spain | 38.89–217.27 |

| Belgium | 18.86–183.33 |

| Italy | 19.95–256.25 |

Source: Globally Cool, May 2025

Price breakdown

Figure 7 provides a rough price breakdown for dried thyme sold in European supermarkets, at the imaginary but realistic price of €150 per kg. It assumes the dried thyme is imported at €3,000 per tonne. Although margins may appear high, they must cover various costs, including processing and packaging, inventory management, food safety certifications, taxes, sales and marketing activities, transportation and distribution.

Source: Globally Cool, July 2025

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research