8 tips on how to organise your spices and herbs exports to Europe

When you start exporting spices and herbs to the European market, you have to be well prepared. You have to understand your contracts with buyers, agree payment and delivery terms, prepare the required export documents, and organise transport. The tips below will help you organise your first shipment to the European market.

Contents of this page

1. Draw up a detailed contract

Having a contract with clear and precisely outlined agreements will protect your business. Contracts serve as a reminder and a record of what needs to be done. They are also the basis of legal proceedings if you or your buyer does not meet agreements.

A contract should generally include:

- Product specifications

- Quantity

- Value: currency, price and conditions such as a price escalator clause

- Payment terms

- Packaging, labelling and marking requirements

- Delivery terms

- Delivery procedure: place of dispatch and delivery, period of delivery

- Taxes, duties and charges

- Insurance

- Documentary requirements

- Default procedures (if contractual agreements are not met)

- Dispute resolution procedure

- Reference to general terms and conditions

Companies may also include some of these conditions in their ‘general terms and conditions’, often supplied as a separate PDF file. General terms and conditions usually describe standard business practices and include a phrase such as “Business terms and conditions that are contrary to, or which deviate from, these terms and conditions will not be recognised unless their validity is expressly confirmed in writing”.

Protection against unfair trading practices

EU Directive 2019/633 protects weaker suppliers against unfair trading practices of stronger buyers in the agricultural and food supply chain. It applies to farmers and small and medium-sized suppliers that sell to buyers in the European Union (EU), even if you are located outside the EU.

The directive bans 16 unfair trading practices, for example prohibiting:

- Refusal to enter into a written contract, despite a request from the supplier

- Unilateral contract changes by the buyer

- Payments later than 60 days

- Short-notice cancellations of perishable agrifood products

- Risk of loss and deterioration transferred to the supplier

- Transferring the costs of examining customer complaints to the supplier

Study the directive to learn about your rights as a supplier.

Tips:

- Make sure you fully understand the contract terms and their implications. Do not sign or confirm a contract that is unclear or incomplete. Ask a lawyer who is experienced in international trade to help with your first contracts.

- See the model contracts and clauses of the International Chamber of Commerce (ICC) and the model contract for small firms of the International Trade Centre (ITC) for more information and examples. See Trove Spices’ General Terms and Conditions for an example specifically for spices.

- Follow internationally recognised standards for your product specification, such as the European Spice Association's (ESA) product information (PI) standard. Specifications for individual spices and herbs include Codex Alimentarius and ISO standards.

- Agree on a price escalator clause tying the price to certain external conditions, such as the exchange rate.

2. Agree on payment terms

Exporting involves a lot of risk mitigation. Your contract should include your payment terms, stating when and how your buyer has to pay you. Payment terms can vary depending on the relationship you have with your buyer and the type of product you are selling. They also differ in the level of risk you bear as the exporter.

For example, if you sell your spices from stock without any custom adaptions to the packaging and labelling, the risk is lower than if you customise packaging and labelling to customer requirements. Also, payment terms for relatively low-value spices such as cloves will be different than for high-value spices such as vanilla or cardamom. High-value spices are typically sent by plane, and buyers make full or partial payments in advance.

Reaching agreements can be challenging, particularly when dealing with a buyer for the first time. Make sure to agree on payment terms that enable you and your buyer to do business while minimising your risk.

Advance payment

For your first export shipments, it is wise to ask for at least partial advance payment. This means the buyer pays you before any goods are delivered or services are rendered. This arrangement limits your risks as the seller and gives you working capital to organise your exports. Because this is riskier for buyers, partial advance payments are more common than advance payments in full.

A well-known and safe payment method for this type of transaction is a bank transfer, generally by SWIFT. You should avoid payments by cheque, which is an insecure method that can be expensive and slow.

Letter of credit (L/C)

Letters of credit (L/C) are often used in international trade transactions. They are a relatively safe and popular method for new business relationships. In an L/C, an importer’s bank issues a document guaranteeing payment once you have met the terms of the credit. For security, the L/C should be irrevocable, so the bank cannot make any changes to it without your approval. The downside of an L/C is the additional fee, which can be up to 3% for small transactions. To reduce this burden, you can suggest splitting the fee with your buyer.

An L/C generally involves the following steps:

- You sign a contract with your buyer to sell goods, agreeing to use an L/C as the method of payment.

- The buyer requests an L/C from their bank and signs the bank’s L/C application form.

- The issuing bank approves the application, issues the L/C and sends it to you.

- After receiving the issuing bank’s assurance of payment, you ship your goods to your buyer.

- You prepare the documents as stated in the L/C and provide them to the issuing bank.

- The issuing bank examines the documents, confirms all documents are present and compliant and then pays you.

- The issuing bank receives the payment from your buyer according to the terms defined in the L/C.

- The issuing bank forwards the documents to your buyer.

- The buyer uses the documents to collect the goods from the carrier.

If you regularly do business with a buyer, you can open a standby letter of credit (SLOC) for a whole year to reduce costs.

Cash against documents (CAD)

This method guarantees that you have physical control of the goods until you are paid. You ship the goods and send key export documents (such as a bill of lading and a commercial invoice) through your bank to the buyer’s bank. The buyer’s bank holds these documents until it receives the payment from your buyer. After payment, the buyer’s bank releases the shipping documents to the buyer so they can claim the goods from the carrier. This has a higher risk for you than an L/C, but the costs are low and it is often used in established relationships.

Post-payment and open account (OA)

In a post-payment (or deferred payment) arrangement, the buyer pays you after the goods are delivered. For example, when buyers purchase products that are subject to strict quality requirements, they may want to check the consignment and make sure the goods are compliant before making the final payment. In an open account (OA), payment is made within a set time period agreed between you and the buyer, such as within 30 or 60 days of the invoice date.

These payment methods are risky and depend on trust and long-term trade relations between partners. In general, avoid using them. Under the Directive against unfair trading practices, buyers must pay within no more than 60 days after:

- Delivery

- The end of an agreed delivery period (in which products are delivered on a regular basis)

- The date on which the amount payable is due

Table 1: Advantages and disadvantages of payment terms for exporters

| Payment term | Risk for the exporter | Advantage | Disadvantage |

| Advance payment | Low | Safe, low costs and positive effect on working capital | - |

| L/C | Low | Safe | Relatively costly |

| CAD | Medium | Lower costs than L/C | Less suitable for initial transactions |

| OA | High | Low costs, mainly suitable for high-volume and low-margin commodities | Negative effect on working capital, risk of non-payment, only for trusted partners |

| Post-payment and OA | High | Low costs, mainly suitable for high-volume and low-margin commodities | Negative effect on working capital, risk of non-payment, only for trusted partners |

Source: Globally Cool (2024)

Tips:

- Familiarise yourself with international payment terms. The ICC offers online training and trade finance guides to help you understand payment options and procedures.

- Carefully consider the risks of international trade transactions. It takes time and experience to build relationships and trust with buyers. For your first transaction with a new buyer, you should insist on a low-risk payment term such as advance payment or letter of credit (L/C). You can switch to CAD terms after you have built a trusted relationship.

- Ask financial institutions to help you work out in how far you can negotiate different payment terms. This enables you to negotiate more effectively and make better-informed decisions.

- Make sure the payment terms you agree with a buyer are included in the contract. Before signing, be sure you understand and agree to the contract terms.

- If you opt to use an L/C, familiarise yourself with the what an L/C is and involves. Ask your bank about the costs and procedures. Be sure to choose a bank that is experienced with L/Cs and recognised in Europe. Your European buyer’s bank must also be reputable. Look up which banks are the best trade finance providers in Europe and your country or region.

3. Document your quality process

The spices and herbs trade always involves product testing and control. Your buyer may test your spices and herbs more rigorously if they are organic or destined for health market channels, especially in northern and western European markets. Many quality claims concern excessive pesticide residue, for which organic products have zero tolerance. Although you cannot avoid quality issues completely, good and well-documented procedures can mitigate your risk.

Follow the steps below to ensure product quality and handle quality claims correctly:

- Avoid cross-contamination by keeping your storage well organised, with separated product lots.

- Use recognised sampling and inspection companies such as SGS, Bureau Veritas or Intertek to collect samples.

- Have your product tested by European laboratories such as Eurofins, Groen Agro Control or TLR International laboratories.

- Collect counter samples of each lot you export and keep them for as long as the product’s shelf life.

- Make sure samples are from the lot you will be shipping.

- Include technical product data with your quotation and shipment.

- Use traceability codes.

- Ask your buyer for written confirmation of their acceptance of product quality on arrival.

- If a quality issue occurs, take the claim seriously and look for a solution with your buyer.

To be sure of product safety, importers may also ask for food safety system certifications recognised by the Global Food Safety Initiative (GFSI), such as FSSC 22000, IFS or BRCGS. FSSC-certified companies include Uyar Spice in Turkey and Mata Hari Spice in Indonesia.

Figure 1: FSSC certification

Source: Foundation FSSC on YouTube (2017)

Tips:

- Use internationally recognised testing methods, such as those of the American Spice Trade Association, to determine specific product characteristics such as moisture, mould, heat and colour.

- Use the same laboratory as your buyer, if possible. Testing methods and precision vary between laboratories, which may result in different test outcomes.

- Find traceability criteria and requirements in the FAO Food traceability guidance or ITC Traceability in food and agricultural products overview.

- Implement a food safety certification programme. For example, FSSC 22000 requires you to conduct a hazard analysis and implement HACCP (hazard analysis of critical control points) principles to identify and control significant food safety hazards.

- Maintain a network of brokers and traders so you always have an alternative sales channel for rejected products (provided they meet European market minimum requirements).

4. Use proper packaging

Your product must be packaged correctly to guarantee the quality and efficiency. Which packaging is best depends on what you are shipping and the sales channel you are using. Packaging choices are mainly determined by buyer preferences, but there is some flexibility.

Packaging for spices and herbs must:

- Preserve the product’s hygienic, nutritional, technological and organoleptic qualities.

- Be intact, dry, clean and free from insect infestation or fungal contamination.

- Be made of materials that are safe and that do not impart any harmful substances, undesirable odours or flavours to the product.

Common bulk packaging options for spices and herbs include:

- Multi-wall laminated paper or polypropylene/polyethylene bags of 25, 20, 12.5, 10 or 5 kg.

- Carton boxes of 8-20 kg.

- Double-layered jute bags or bales of 20-50 kg.

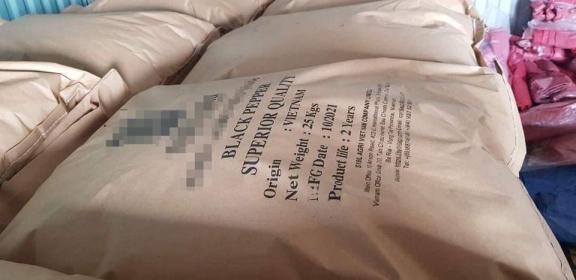

Figure 2: Black pepper in a 25 kg multi-wall laminated paper bag

Source: Globally Cool (2024)

Ground spices are packed in waxed, paper-lined tin boxes or in small glass, tin or aluminium containers. Another option is pouches made of laminated, metallised, multi-layered food-grade material. Alternative packaging methods such as vacuum packing may be considered for products at a high risk of quality deterioration due to, for example, oxidation or external pest contamination.

Woven bags have become the most common type of bag, whereas jute bags are rarely used anymore. Note that the EU’s 2018 Plastics Strategy aims to ensure that all plastic packaging that comes onto the market be cost-effectively reusable or recyclable by 2030. In addition, the European Commission’s proposal for a new regulation on packaging and packaging waste aims to increase the use of recycled plastics in packaging.

Recently, European buyers have become more cautious about the risk of mineral oil hydrocarbon residues on packaging materials and products themselves. These residues are fall into two main groups:

- MOSH (mineral oil saturated hydrocarbons)

- MOAH (mineral oil aromatic hydrocarbons)

Buyers are increasingly likely to ask how you deal with this risk during the packaging process. Examples of actions you can take to manage this risk are:

- Use packaging materials that are certified food-grade and free from mineral oil-based substances. Avoid recycled cardboard and paper, which are common sources of MOSH and MOAH.

- Use barrier layers in packaging to prevent migration of MOSH and MOAH from external sources.

- Use food-grade lubricants and oils in machinery to prevent cross-contamination. Regularly inspect and replace any machinery parts that may cause contamination.

- Set up a monitoring programme to track contamination levels over time and identify potential contamination sources.

Packed goods must comply with the carrier’s size and weight limits. European traders commonly use pallets measuring 1,200x800 mm (Euro-pallets). The recommended height of a cargo unit is approximately 1.7 m, but you should always ask your buyer for their requirements.

Labelling

Food imported into the EU must comply with European food labelling legislation. Bulk packaging labels must include the following information:

- Product name and variety

- Batch code

- Net weight (metric system)

- Shelf life/best before date

- Recommended storage conditions

- Lot identification number

- Country of origin

- Manufacturer, packer, distributor or importer name and address

Other details that may be included are:

- Brand

- Harvest date

- Drying method

If you are transporting organic or novel food, additional information must be stated on the label. For organic this includes:

- The word ‘organic’

- The certification body code, printed as follows: XX-BIO-YYY, where XX is the country code and YYY the certification body code

- The EU organic logo

Labelling information for non-retail containers (or bulk packaging) can be provided either on the container or in accompanying documents. The container must at least be labelled with the product name, lot identification number and manufacturer or packer name and address. Alternatively, you can also put an identification mark on the container instead of the lot identification and manufacturer or packer name and address. This identification mark must clearly correspond with the accompanying documents.

Tips:

- See our product-specific market entry studies for specific packaging requirements for a variety of spices and herbs.

- If you are new to exporting, try to partner with another company with export experience. Look for one experienced in packaging spices and herbs for export to Europe.

- See the list of product standards in the Codex Alimentarius. This provides basic information about packaging and labelling and on topics such as moisture content, hygiene and contaminants.

- Use tools like ShipHawk, Logen Solutions, Easy Cargo, packVol and TOPS Pro to calculate and design packaging and optimise the arrangement of goods inside containers and lorries. To save space in containers, you can also store bags without pallets, using liners on the floor and walls (see images of dunnage) for sufficient ventilation and protection. However, the handling costs for your buyer will be higher, as they have to unload manually.

- Consider alternative packaging methods, such as vacuum packaging, for products that can lose quality if stored for long periods or have a higher risk of pest infestation. An example is the VacQPack system. However, this packaging is also more expensive. You can also consider fumigation alternatives offered by providers such as Ecotec.

5. Organise your transport properly

Spices and herbs are usually shipped by sea. If your shipment is less-than-container load (LCL), you can share a container via a groupage service that combines cargo from different companies in your country.

Your spices and herbs have to be stored under good conditions during transport to avoid deterioration and quality loss. You need to consider factors including temperature, humidity and ventilation to keep the goods cool and dry:

- Temperatures must be between 10 and 25 degrees Celsius and not above 30 degrees Celsius, which can lead to product deterioration.

- Humidity should stay between 50 and 60%. Avoid humidity levels above 70%, which can cause spices to absorb moisture and lead to growth of moulds and clumping.

- Proper ventilation avoids moisture development. You can use desiccant packs or moisture-absorbing materials inside containers to control humidity levels. You can also use temperature and humidity data loggers to monitor conditions throughout the transport process.

Containers must be clean, waterproof and well-painted so there is no rust on the inside. To minimise the risk of moisture damage, you can use moisture-absorbing products such as food-proof gel bags that absorb condensation caused by temperature fluctuations.

Fumigating cargo can prevent insect infestation. Some shippers even require this. However, discuss and agree on this with your buyer first. Also carefully consider which fumigant to use, which ones are allowed in the EU, and check the shipping company’s safety guidelines. European spice companies may allow you to use environmentally-friendly fumigants, but fumigants are generally prohibited for organic goods. If cargo is fumigated, this must be stated in the accompanying documents.

Delivery terms

Understanding delivery terms as defined by the International Commercial Terms (Incoterms) is a crucial aspect of international trade. Incoterms are a set of standardised international trade terms used in sales contracts and are essential for the consignment and payment of goods that are shipped internationally. To prevent misunderstandings or disputes, specify the chosen Incoterm in your contract. Also make sure to consider the Incoterm when calculating your price.

Each Incoterm specifies:

- At what point in the transportation process responsibility and risk transfer from you to your buyer.

- The division of costs between you and your buyer.

- Your and your buyer’s respective tasks and obligations for transportation, insurance, import clearance and delivery.

Figure 3: INCOTERMS 2020 explained by Inco Docs

Source: Inco Docs on YouTube (2020)

The most common Incoterms in the international spices and herbs trade are Cost Insurance Freight (CIF) and Free on Board (FOB). CIF means the seller is responsible for the cost of goods, insurance and freight to the named destination port. FOB means the seller is responsible for delivering the goods on board the shipping vessel at the named port of shipment. Risk and responsibility for the goods transfers from the seller to the buyer once the goods are on board the vessel.

If you have little export experience, Ex Works or FOB are most suitable. They put the fewest obligations on the exporter. Under the EX Works Incoterm, the exporter only has to make the goods available at their premises.

Tips:

- See the Transport Information Service, Container Handbook and Cargo Handbook for more information about the safe storage and transport of spices and herbs.

- Use Freightos' free freight rate calculator to calculate your freight costs and determine your freight rates. Also use Freightos to keep up with news about shipping and freight cost increases, shipping issues and shipping container shortages.

- Visit the International Chamber of Commerce website to learn more about Incoterms.

6. Insure your exports

Another way to mitigate risks is to insure your exports. Export insurance can cover potential financial losses or damage that may arise in international trade. Which type of insurance you need depends on the specific risks for your exports and how much a loss would impact your business.

Export credit insurance

One of the most common types of insurance for spices and herbs exports is export credit insurance. It protects you against non-payment by a buyer, for example due to insolvency. Since having this insurance makes it easier for you to agree to deferred payments, it can also increase your competitiveness. You can get this insurance from an export credit agency (ECA). Rates depend on your annual turnover and claims history, and on your buyer’s risk profile.

Export credit insurance is offered on a single-buyer basis or a multi-buyer basis. Single-buyer insurance typically covers a period of regular shipments to that buyer. You can opt for a multi-buyer policy if you make regular shipments to various buyers and use a pay-as-you-go service. A multi-buyer policy can be short-term (repayment period up to one year) or medium-term (repayment period of 1-5 years). Short-term insurance is more common in the spices and herbs sector.

Getting export credit insurance usually involves the following steps:

- You provide the ECA with basic information about your company and your buyers.

- The ECA analyses the financial health (creditworthiness and financial stability) of your buyers in order to draw up credit limits and commercial terms.

- You export goods to your buyers and the risk is covered within the established limit.

- The ECA updates you of changes to credit limits, such as if economic conditions change.

- You can include new buyers in your existing policy and/or extend your coverage for existing buyers. If you want to add a new buyer, you are responsible for checking their creditworthiness. The ECA will assess it and either confirm or decline.

- If a buyer does not pay as agreed, you inform the ECA. The ECA settles the unpaid invoices (for the insured amount set in the policy terms).

Cargo insurance

When transporting goods, there is a risk that your goods may be lost or damaged. While marine insurance covers only the liability of a maritime transport company, cargo insurance protects your product shipment throughout its entire journey to a buyer.

The Incoterms you agree with a buyer determine who is responsible for insuring the goods. If you use CIP or CIF terms, you are responsible for the insurance. With FOB, you are responsible until the goods are loaded onto the vessel. After that, your buyer takes over the risk and costs.

Seller’s interest insurance

If cargo is damaged or lost during a stage of transport for which your buyer is liable, your buyer must pay for the damage. However, if they are insufficiently covered, it may affect you. Seller’s interest insurance protects your financial interest in goods that you have sold but which have not yet been paid for by the buyer. This type of insurance is less common than export credit insurance.

Product liability insurance

You have to make sure that your products are safe and comply with legal standards. If it turns out that your products are not compliant, product liability insurance can cover certain costs, such as legal fees and compensation costs. However, the actual amount compensated depends on your practices and efforts to comply with the standards. This insurance does not cover intentional damage or contractual liabilities. You might consider taking out product liability insurance for spices and herbs with high requirements.

Currency insurance

Currency insurance can protect you against potential losses resulting from fluctuations in exchange rates between different currencies. When doing business with European buyers, you will mainly trade in Euros or US dollars. In commodity trade, the risk of conversion loss is low due to the speed of trade. However, if you work with long-range buying contracts or expect currency risks, you can choose to insure your business against conversion loss, or work with forward exchange contracts.

Tips:

- Look for a reliable ECA that is part of a larger network. See the members lists of Berne Union (International Union of Credit and Investment Insurers) or ICISA (The International Credit Insurance and Surety Association) to find an ECA.

- Read more about export (and trade) credit insurance on the websites of export credit insurance companies such as Allianz Trade and Coface.

- Find a reliable cargo insurance company through the International Union of Marine Insurers’ Member Associations list.

- Check the risk of trading with specific countries in Atradius' Country Risk Map or Allianz Trade's Country Risk Ratings & Reports.

- To insure your company against currency and foreign exchange risks, look at credit agencies such as Atradius and Santander.

7. Comply with European customs policy

The EU has standardised customs procedures to streamline imports of goods from outside the EU. These include customs declarations and rules of origin to determine the origin of goods for tariff purposes. Importers, customs brokers or agents are usually responsible for taking goods through customs. However, you still have to know European customs procedures to provide some of the required documents.

Customs documents

A variety of export documents are needed for customs clearance. You have to make sure that all required export documents are provided and completed correctly, as any mistake can cause serious delays.

You must provide your buyer with the following:

- Commercial invoice: a record or evidence of the transaction between you and the importer. It contains details about the exported goods, such as a description, the quantity, value, terms of payment and terms of delivery.

- Certificate of origin: a document declaring a good’s country of origin. This document is required if you want to claim preferential tariff treatment under a free trade agreement. Specifics of the document may vary depending on the free trade agreement. Countries that have a preferential trade agreement with the European Union use an EUR.1 certificate. If your country is part of the Generalised Scheme of Preferences, use Form A.

- Packing list: a commercial document providing information about the imported goods and shipment packaging details. For example, the number, content, weight and dimensions of packages.

- Freight documents: the freight documents you have to present, such as a CMR (road transport), bill of lading (sea freight), air waybill (airfreight) and/or CIM (rail transport), depending on the type of transport you use.

- Freight insurance invoice: this invoice is needed only if the commercial invoice contains no information about the insurance premium paid to cover the goods.

- Official certificate: as described in Article 11 and drawn up in accordance with the template in Annex 4 of EU Implementing Regulation (EU) 2019/1793 (also known as a ‘health certificate’). This is a document issued by the competent authority in the export country, but is needed only for high-risk foodstuffs of non-animal origin as listed in Tables 1 and 2 of our study on buyer requirements for spices and herbs.

- Analytical report: shows the results of sampling and analysis (described in Article 10 of Regulation (EU) 2019/1793) of the aforementioned high-risk products for identified risks such as mycotoxins and pesticide residues.

Your buyer must prepare:

- Single Administrative Document (SAD): an import declaration form providing information about the parties involved, the goods and commercial and financial data.

- Customs value declaration: a document stating the value of the goods, if more than €20,000.

- Common Health Entry Document (CHED-D): a registration form for shipments of high-risk foodstuffs of non‑animal origin as listed in Tables 1 and 2 of our study on buyer requirements for spices and herbs.

Import tariffs

Most spices and herbs have a 0% import tariff, particularly if they come from developing countries. The EU’s Generalised Scheme of Preferences (GSP) removes or reduces import duties for goods from specific developing countries. The EU also has free-trade agreements with several countries and regions. For example:

- Association between the EU and Central America (EU law D0734/12), applies to Honduras, Guatemala, Nicaragua, Panama, El Salvador and Costa Rica.

- Free trade agreement between the EU and Vietnam (EU law D0753/20).

There are a few exceptions where a tariff rate applies to spices and herbs imports. For example, vanilla from Indonesia (2.1%), bay leaves and thyme from India (2.4%-2.9%), cloves from India and Indonesia (2.8%) and crushed dried chillies from China (ad valorem tariff of 5.0%). Specific tariff quotas apply for garlic.

Use freight forwarders

Instead of organising the whole export logistics process yourself, you can use the services of freight forwarders. These are intermediaries between shippers and transportation services who facilitate the movement of goods from one location to another. Freight forwarders provide services in logistics planning and management, warehousing, cargo space booking, customs documentation, cargo insurance, customs clearance and freight consolidation.

Tips:

- Familiarise yourself with customs clearance documents and procedures.

- Read Freightos’ guide to choosing a freight forwarder to learn what freight forwarders do and how to choose the right one for you. You can find freight forwarders and customs brokers through the International Forwarding Association. You can also look up European national associations via the European Association for Forwarding, Transport, Logistics and Customs Services (CLECAT) or your national association via the International Federation of Freight Forwarders Associations (FIATA).

- Use the TARIC database and Access2MarketsFind’s My Trade Assistant to look up information on tariffs, requirements and customs procedures for your product and country. Use the Market Access Map to assess your competitive advantage based on trade preferences and tariffs.

- Read Access2Markets’ guide to working with rules of origin and follow the instructions on how to pay lower customs duties.

8. Look for organisations that can support you

Several international organisations may be able to help you organise your spice exports. They can help both with technical aspects of making shipping arrangements and explain requirements for entering the European market.

Support organisations include:

- ESA represents the European spice industry and publishes many relevant publications, including a code of conduct, product information standard and quality minima document.

- The American Spice Trade Federation (ASTA) also publishes various internationally recognised guidelines and standards, including a cleanliness specification and good manufacturing practice guide.

- The ICC offers arbitration, export learning tools and information about Incoterms.

- ITC offers trade-related practical training and advisory services for small businesses. Their SME Trade Academy provides online courses on trade-related topics. They also have Model Contracts for Small Firms.

- The FAO has published a list of product standards in its Codex Alimentarius as a guide for exporting specific spices and herbs.

- Local spice sector associations and export promotion organisations or chambers of commerce can provide advice and information on export-related topics.

Tips:

- Check if there are trade support organisations in your country that offer advice or export training programmes. Use ITC’s global Business Support Organization directory to look for institutions that can support you.

- For more tips on exporting to Europe, read CBI’s tips for finding buyers on the European spices and herbs market. This study provides step-by-step guidance on the journey to finding buyers that match your offer. When you are ready, CBI’s tips for doing business with European spices and herbs buyers gives practical tips on topics such as European business culture, how to hold a sales pitch and how to build business relations.

Globally Cool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research