Entering the European market for vanilla

Complying with European regulations is a minimum requirement to access the European market. Special attention should be paid to controls on contamination, pesticide residues, heavy metals and food additives like artificial colours and flavourings. Food fraud has also become an important issue on the market, especially in the vanilla trade, and it is crucial for you to be transparent about your supply chain. Madagascar and Indonesia are the most consolidated suppliers to the European vanilla market and represent your biggest competition.

Contents of this page

1. What requirements must vanilla comply with to be allowed on the European market?

What are mandatory requirements?

When exporting to Europe, you have to comply with the legally binding requirements of the EU. The most crucial requirements relate to food safety and the basis for EU legislation is laid down in the General Food Law. This law relates mainly to traceability, hygiene and control. Compliance with this legislation ensures that the spice is safe to eat. Related to this are the legal limits for food contaminants.

Official border control for vanilla imported to the European Union

Official food controls include regular inspections that can be conducted at import or at any further stages of marketing. In case of non-compliance with the European food legislation, individual cases are reported through the Rapid Alert System for Food and Feeds (RASFF), which is freely accessible to the general public.

You should be aware that repeated non-compliance with European food legislation by a particular country might lead to special import conditions or even suspension of imports from that country. Those stricter conditions include laboratory tests for a certain percentage of shipments from specified countries.

The New Official Controls Regulation will extend its scope to organic products. You will have to use the Common Health Entry Document to notify authorities in Europe before you export your products.

Contaminants control in vanilla

The European Regulation on contaminants sets maximum levels for certain contaminants in food products. This regulation is frequently updated and, in addition to the limits set for general foodstuffs, there are a number of specific contaminant limits for specific products, including vanilla. The most common requirements regarding contaminants in vanilla relate to the presence of pesticide residues, mycotoxins, heavy metals, microbiological organisms and food additives. However, there were no notifications of issues with vanilla in the RASFF database in 2021.

Contaminant levels must be kept as low as can reasonably be achieved following recommended good working practices:

- Pesticides: The European Union (EU)regularly publishes a list of approved pesticides applicable to specific products (see the maximum levels for vanilla) that are authorised for use in the EU. This list is frequently updated. Note that in June 2020, new specific binding maximum residue levels (MRLs) were set for chlorate. Products containing more pesticide residues than allowed will be withdrawn from the European market. However, excess pesticide residues do not appear very often in the vanilla trade;

- Mycotoxins: Limits for mycotoxins are set by EC Regulation 1881/2006. For vanilla, maximum levels for mycotoxins are set for ochratoxin A (the maximum level is 15 μg/kg).

- Food additives and adulteration: spices and spice blends are rejected by custom authorities for containing undeclared, unauthorised materials or excessive levels of extraneous materials, which is all matter from the specific plant other than the desired part;

- Maximum levels of polycyclic aromatic hydrocarbons (PAHs): Contamination with PAHs stems from bad drying practices. Importers usually claim the costs of such withdrawals back from their suppliers or discontinue the trade completely. The maximum PAH limits for vanilla are 10.0 μg/kg for benzo(a)pyrene and 50.0 μg/kg for the sum of benzo(a)pyrene, benz(a)anthracene, benzo(b)fluoranthene and chrysene;

- Heavy metals: Until recently, specific limits for the presence of heavy metals in spices and herbs were not set in European legislation on contaminants. This changed in 2021, following a review process for the maximum allowed levels of cadmium. The new maximum level for lead (in mg/kg) is set at 0.60 for vanilla;

- Microbiological contamination (PDF): Salmonella must be absent from vanilla destined for the European market.

Large European buyers usually require their suppliers to use steam sterilisation to combat microbiological contamination. Currently, steam sterilisation is the cheapest and safest method to combat microbiological contamination. You could gain access to the most demanding retail chains in Europe if you can supply vanilla that is sterilised at the source. However, smaller buyers in niche markets for vanilla will often not require steam sterilisation at the source.

Irradiation: This process is legally allowed in many EU countries under restrictive conditions. However, in practice irradiation is not applied to vanilla for the European market, as consumers do not always accept this treatment. Only discuss this option with your buyer when other types of treatment such as fumigation and steam sterilisation are not possible.

Food fraud

Food fraud in the spices and herbs sector is a serious issue and European buyers are increasingly attentive to it. Many laboratories around Europe have increased testing to discover this type of fraud in spices and herbs. Common methods include DNA analysis, isotopic techniques, mass spectrometry, spectroscopy, chemometrics, and a combination of detection methods. In 2019, a study was started in France with Consumer Affairs and Fraud Control (DGCCFR) and the results were reported in January 2022. Only a quarter of the vanilla pods and half of vanilla derivative products (pods, extract) seemed to meet the regulatory standards. A quarter of the pods appeared to be spent pods, which means they were already used, or were beans dipped in vanilla aroma. For the extracts it was mainly the misleading labelling, mostly around the words extract, concentrate and natural. These actions constitute food fraud and will affect a supplier’s reputation on the European market.

Tips:

- For a complete overview of requirements, refer to our study on buyer requirements for spices and herbs or consult the specific requirements for vanilla on the Access2Markets website.

- Apply the general guidelines for Good Agricultural Practices (GAP) on spices & culinary herbs (PDF) of the International Organisation of Spice Trade Associations (IOSTA).

- Check the Rapid Alert System for Food and Feed (RASFF) database for examples of spices withdrawn from the market and the reasons behind these withdrawals.

- Always discuss with your potential buyers whether they want steam sterilisation. If your buyer requires steam sterilisation, look for local sterilisation companies that can provide this service for you. Sterilisation at your own facility is very expensive. Investments in the necessary equipment can cost thousands of euros.

- Comply with food safety requirements during drying, storage, processing (such as sieving, mixing, grinding or crushing), packaging and transport. This will help prevent contamination with mycotoxins and other contaminants. Not even steam sterilisation can fully remove these substances.

- Read the Guide on Authenticity of Herbs and Spices published by the UK Food and Drink Federation to find out more about actions and initiatives that can help you prevent fraud in your supply chain.

What additional requirements do buyers often have?

Quality classifications

Like any other spice, vanilla also has variations. Vanilla bean quality is determined by moisture content, bean length and condition. Moisture content is 1 of the most important aspects of high-grade vanilla. Grade A (gourmet grade) vanilla beans are extremely moist. Along with the variations come differences in texture and flavour. Although there is no organisation setting standards for vanilla, there are 2 grades of vanilla that most buyers are familiar with: Grade A Prime Gourmet, which is about 30% moisture, and Grade B Extract, which is about 20% moisture.

Grade A should be used for cooking and can be used for making extract. Grade B should be used for making vanilla extract. Grade B is usually too dry to scrape the caviar out, although you might be able to do so with some beans. Thus quality features preferred by most importers include vanillin content (minimum 1.5-2%) and moisture content in the range of 20% to 30%. Vanilla is graded in accordance with the relevant national standard of the producing country. Also, ISO standard 5565-1:1999 provides some general guidelines on the grading, handling and packing of vanilla.

In addition to grades A and B, another classification is used:

- Noire or black: General term for black-coloured beans that is now used when talking about any vanilla from Madagascar that appears black;

- Gourmet: 35-38% humidity and appears juicy, but of inferior quality as it is used by dishonest companies to sell more beans and maintain higher margins by avoiding bleeding off the water weight and hence profit. Gourmet beans can be used immediately for extracting or baking or must be vacuum-packed to remain juicy and aromatic. These beans often have not expressed their full flavour. Even though they are nice in appearance, they are unstable, in critical need of vacuum-packing to biologically and aerobically stabilise them, and it is a near-certainty that they will become mouldy within a month;

- TK: Used to describe beans around 30% humidity, give or take, with a balanced vanillin-to-moisture ratio and lab analyses match, and a fully developed aromatic expression and flavour. Good vanilla at this level, and as it ages and dries may also have off-white or sugar-like vanillin crystals on the surface or spiking from the skin like ice;

- Rouge or red: Has 22-25% humidity, which begins to appear ‘fox-coloured’ red in contours and surface. These are dry, and you must get closer to smell the aroma, which is just as potent as TK. In the Malagasy regions of Andapa, SAVA’s vanilla coast and Diana, vanilla tends to be redder, while Madagascar’s Mananara and Maroansetra vanilla (from south of the great Masoala rainforest) is more black in colour. Once boiled, the vanilla colour tone turns further, depending on whether it is put directly in the sun or is put in the shade first. Premium-ground Madagascar vanilla powder, for example, which sells well and has an amazing smell with a 1.6-1.8% vanillin level, is ground from red vanilla beans and their red splits (split pods). There is a marked difference – not in quality but in taste – between the flavour profiles of red vanilla and black vanilla. There is also a difference in the finished scent of the pod and its strength of aroma – the ‘jump’ of the smell from the beans’ exposed particulate matter that transits through the air to the human nose;

- Very dry beans: With around 15-20% humidity, very brittle and hard and shrunken, but bursting with flavour. These beans may be deceptively lacking in smell because they have dried and closed all of the pores on their skin and cannot ‘breathe’. As a result, it can be difficult to tell if they are good vanilla with lots of vanillin per weight, or extracted or spent vanilla.

Taste

There are 2 species of vanilla beans, Planifolia and Tahitensis. Planifolia is the flavour that people are most familiar with and this is what supermarket vanilla extract is made from. Tahitensis is a mutation of Planifolia and has a sweet floral note. Madagascar is known for producing the highest-quality vanilla. Not only is the aroma intense, but the flavour profile also works well in food dishes, beer-brewing, desserts, vanilla extract, and many other possibilities. Vanilla from Mexico has a bold, dark and smoky taste; Tahitian vanilla tastes floral, with cherry and chocolate notes; Ugandan vanilla tastes rich, creamy and strong; and Indian vanilla tastes chocolatey.

Colour

The colour of vanilla beans varies by regional origin. Beans from Madagascar and Uganda are black, beans from India and Mexico are dark brown.

Sizes

The vanilla bean’s length is also an indication of vanilla quality. Grade A vanilla beans are typically over 6 inches, or 15 cm, in length. Grade A vanilla beans should also be flexible and soft to the touch. Vanilla beans that appear to be stiff, split or cracked are considered Grade B or Grade C.

Additional food safety requirements

Only very few vanilla buyers require suppliers to implement an advanced food safety management system and obtain a certificate from an accredited certifier. This will usually happen if the vanilla is processed at origin (for example crushed/ground). Examples of such advanced food safety management systems are Food Safety System Certification (FSSC 22000), BRCGS Food Safety, International Featured Standards (IFS Food) and the Safe Quality Food programme (SQF). These standards are all part of the Global Food Safety Initiative (GFSI).

Implementation and certification of these standards usually costs hundreds of thousands of euros and is only recommended for large-scale processors targeting major European retail chains. For those processors, such a certificate shows professionalism. Smaller buyers in niche markets for vanilla are likely to have more relaxed food safety requirements as they prioritise other aspects, such as authenticity.

Labelling

Clear labelling of your vanilla is important for both bulk and pre-packed consumer products. The European labelling legislation applies to pre-packed consumer products. This regulation (EU No 1169/2011) relates to labelling, presentation and advertising of foodstuffs, as well as providing information on nutritional content. The information must be in the language of the country that you are selling to. You can also use multi-language labels if you sell your product in more than 1 country. Regulation (EU) 341/03 (PDF) sets out guidelines for the labelling of foodstuffs using Protected Geographical Indications (PGI).

For bulk vanilla, your product label must include:

- Product name;

- Details of the manufacturer (name and address);

- The name of the Protected Geographical Indication (PGI) (only allowed when GI is registered with the EU);

- Batch number;

- Date of manufacture;

- Expiry date;

- Weight of contents;

- Other information required by the exporting and importing countries, like producer and/or packer code, as well as all extra information that can be used to trace the product back to its origin; and

- In case your product is organic- and/or Fairtrade-certified, the label should contain the name/code of the inspection body and the certification number.

Packaging requirements for vanilla in bulk

Vanilla is packaged in new, clean and dry multi-wall laminated bags made of food-grade material such as polypropylene. Do not use polythene bags, as they result in flavour loss. The practice of vacuum-packing vanilla in bulk to retain moisture not only leads to lower quality, it can also cause mould formation. The size of the packaging can range from 1 to 25 kg and must be agreed with the buyer.

Tips:

- Choose a food safety management system that is approved by the Global Food Safety Initiative (GFSI).

- Do not vacuum-pack your vanilla, particularly if it is not yet dry enough, as this process can lead to food safety and quality risks.

- Make sure that, during transport, the vanilla is either dried or there is sufficient ventilation.

- Always ask your buyer for their specific packaging requirements. Learn more about maintaining the quality of your vanilla during transportation on the website of the Transportation Information Service.

- Add website links and QR codes on your package to provide more information about the product.

What are the requirements for niche markets?

Packaging requirements for vanilla in retail packaging

Requirements for consumer-packaged vanilla products are more demanding than for vanilla in bulk. The most common types of consumer packaging for vanilla are:

- Plain Glass tubes with plastic caps. These tubes are packed in a carton which makes it look like a very luxurious product; and

- Multi-laminated flexible plastic sachet.

Consumer packaging usually contains 1 or 2 pods. Packaging needs to be functional (to protect the product from infestation, spoilage and quality loss) and of high quality to enhance the sales appeal of the product. Vanilla is a relatively expensive consumer product. The design and feel of the product are just as important as the quality of the packaging material. Some product examples are given below.

Table 1: Examples of vanilla consumer packaging

|

| |||

Germany Company: Sonnentracht 1 unit / €4.79 Source: Alor Archipelago Indonesia EU Organic and Naturland | Denmark Company: Lidl (private label) 2 units / €5.24 Source: Madagascar

| Denmark Company: Aust & Hachmann 1 unit / €4.03 Bourbon Vanilla EU Organic and Fairtrade | UK Sainsbury’s (private label) 1 unit / €7.21 Source: Madagascar Fairtrade | Czech Republic Golden Way (Korení od Antonína) 1 unit / €8.21 Bourbon Vanilla |

Additional liability requirements for retail products

When you supply vanilla in retail packaging through a legal representative in Europe, such as a distributor, your buyer can pass claims related to product defects and injuries to consumers on to you, especially if you are supplying retailers directly. You will then have to reach an agreement with the consumer about compensation. You need to have logistics in place to resolve such issues. For example, make an agreement with your buyer that they will act as your agent. In case of problems, they can act on your behalf and transfer the costs of compensation and product recalls back to you.

Tips:

- Visit the website of the European Commission for additional information on food labelling legislation. Note that this requirement only applies to final products that are sold directly to consumers.

- Obtain insurance for product liability if the risk of liability claims is big, for example when you supply directly to retailers or when you have a valuable brand or reputation. In other situations, European importers will often be held liable.

Authentication and transparency

Prices for vanillin and the official recognition as ‘natural vanilla flavour’ greatly depend on availability, processes used and labelling. Authentication methods are essential to guarantee full transparency for consumers, as they serve to differentiate natural from synthetic vanillin. The latter is only allowed to use the label ‘Flavour’ or ‘Vanilla Flavour’ in Europe. Advanced analytical methods have been developed to discriminate botanical origins and can be used to check compliance with regulations for naturalness. Botanical origins of natural vanillin can be distinguished by isotopic differentiation methods such as 13C EA-IRMS and 2H SNIF-NMR ®, ensuring full traceability and guaranteeing its botanical origin.

Sustainability

European buyers are increasingly paying attention to their social and environmental impact. Important issues at origin typically include the correct use of pesticides, fair payment and healthy and safe working conditions.

European buyers have different definitions and priorities regarding sustainable sourcing depending on their business strategies. Although there is no universal way to address these matters, many buyers will require transparency about sustainability issues. Some buyers will simply ask you questions about the sustainability of your business and others may require you to fill out forms to conduct a self-audit.

Vanilla is mostly used by the food processing industry while other spices are mainly used as a consumer product. These industrial vanilla companies, which in fact are the flavour houses, all have sustainability alliances with food processors and local vanilla organisations. An example is Livelihoods, an alliance between Mars, Danone and Firmenich.

Companies have different requirements for sustainability. This may include signing their code of conduct or following common standards such as the Farm Sustainability Assessment/SAI Platform, SMETA/Supplier Ethical Data Exchange (SEDEX), Ethical Trading Initiative (ETI) and Business Social Compliance Initiative (BSCI).

The Sustainable Spices Initiative (SSI), which includes some of the main spice companies worldwide, does not have its own standard for spices and herbs but has developed an SSI basket of standards (PDF) to broaden the possibilities for certification and verification of sustainable spices by member companies. The standards in this basket cover the main issues and are therefore considered sufficient by SSI members to certify or verify sustainable production of spices.

Certification of sustainability in the vanilla market is no longer a niche. Analysis of the positioning of retail products with vanilla as an ingredient and as a consumer product shows that organic products now account for nearly 30% of all vanilla-based product launches in Europe. The interest in sustainability in the spices market is stimulated by initiatives such as the Sustainable Spices Initiative. The major certification systems are Organic, Fairtrade and Rainforest Alliance. Each certification scheme addresses different issues (social, environmental, economic) and serves different niches.

The main certification scheme applicable to the mainstream market is Rainforest Alliance. The main European markets for products certified by the Rainforest Alliance are the United Kingdom, the Netherlands and Germany. There is no specific data available for vanilla. On the supply side, there are 20 vanilla companies certified by the Rainforest Alliance, producing a total of 1,808 tonnes in 2022.

Organic certification

The European demand for organic vanilla is growing. To market your vanilla as organic on the European market, it must comply with the regulations of the European Union for organic production and labelling. Obtaining the EU organic certificate is the minimum legislative requirement for marketing organic vanilla in the European Union.

Note that all organic products imported into the EU must have the appropriate electronic Certificate of Inspection (COI). These COIs must be issued by control authorities prior to the departure of a shipment. If this is not done, your product cannot be sold as organic in the European Union and will be sold as a conventional product. COIs can be completed by using the European Commission’s electronic Trade Control and Expert System (TRACES).

Refer to this list of recognised control bodies and control authorities (PDF) issued by the EU to ensure that you always work with an accredited certifier. To become organic-certified you can expect a yearly inspection and audit, which aims to ensure that you comply with the rules on organic production.

If you want to export to countries outside of the European Union, check the required legislations in that country. For instance, Switzerland has its own Swiss Organic Law and the Organic Products Regulations 2009 apply in the United Kingdom.

In addition to the EU organic standard, most European countries have their own voluntary organic standards, like Bio-Siegel (Germany), AB mark (France) and the Ø logo (Denmark). Some countries also have private standards or labels, like Naturland (Germany), Soil Association (United Kingdom), Bio Suisse (Switzerland) and KRAV (Sweden). But note that having the EU organic standard is usually sufficient for most buyers.

Fair trade certification

Fairtrade International (FLO) is the leading standard-setting organisation for fair trade certification. Fairtrade International has developed a specific standard for herbs, herbal teas and spices for small-scale producer organisations. According to this standard, a premium price of 15% over and above the negotiated price between producer and seller must be established. FLOCERT is the accredited certifier for Fairtrade. Refer to this full guidance to learn more on how to become a Fairtrade producer.

Note that demand for Fairtrade-certified vanilla represents a smaller market compared to organic certification. Getting certified would mainly be a branding strategy, to distinguish your product from your competition and attract more conscious consumers. Fairtrade finds its largest market in the United Kingdom.

Fair for Life (by IMO/Ecocert) and Fair Choice (by Control Union) are other fair trade certifications available to producers and other operators. Although less recognised on the European market, Fair for Life and Fair Choice have the advantage that the control bodies Ecocert and Control Union can combine the fair trade audit with, for instance, organic or Rainforest Alliance audits. However, always check demand and interest for a specific certification with your existing or potential buyer.

Tips:

- Provide transparency on your sourcing and processing through your website and company documentation or consider the Supplier Ethical Data Exchange (SEDEX) which enables you to declare that you do business in a responsible way and in a uniform format that is acceptable for many larger buyers, such as retail chains.

- Refer to the Sustainable Spice Initiative’s Basket of Standards (PDF) and the ITC Standards Map for an explanation and comparison of sustainability standards.

- Refer to the International Trade Centre’s Sustainable Spice Initiative Equivalency Tool for an explanation and comparison of sustainability standards.

- Try to combine audits, if you have more than 1 certification, to save time and money. Also investigate the possibilities for group certification with other producers and exporters in your region.

- Use this cost calculator to estimate what costs will be involved for your organisation to get Fairtrade-certified.

- Familiarise yourself with the range of organisations and initiatives that offer technical support to help you convert to organic farming. Start your search at the organic movement in your own country and ask if they have their own support programmes or know about existing initiatives. Refer to the database of affiliates of IFOAM Organics to search for organic organisations in your country.

- Visit trade fairs for organic products, like Biofach in Germany. Check out their website for a list of exhibitors, seminars and other events at this trade fair. Here you will also find booths of the organic certification bodies.

2. Through what channels can you get vanilla on the European market?

How is the end market segmented?

The food industry accounts for around 50-80% of global demand for vanilla. Retailers account for the other 20‑50%. The biggest industrial users for vanilla are the desserts, ice cream, drinks, chocolate and bakery industries. While the food processing industry is quite concentrated, there are companies which are assumed to be heavy vanilla users like Danone, Barry Callebaut, Unilever, Nestlé and Coca-Cola. Coca-Cola is the world’s leading consumer of vanilla and uses on average 10% of world production.

In addition to the food industry, vanilla is used in the cosmetics and pharmaceutical industries. Vanilla flavour is used in medicine to mask or give taste to medications. It is unlikely that natural vanilla products are used for this purpose. In addition, vanilla has perceived health benefits. Vanilla extract has antioxidant, antibacterial and anti-inflammatory properties that have significant impact on various body systems, although these benefits have not been scientifically proven.

Tip:

- You need different key capabilities to supply vanilla as a consumer product or as a food ingredient. To export vanilla as a food ingredient, you need to be good at bulk export in cooperation with a leading importer. To export vanilla as a consumer product, you need additional capabilities such as vacuum packaging.

Price segments at the retail level

Vanilla is sold both as a consumer product and industrially for flavouring food and drink products. As a consumer retail product, vanilla itself is a high-end product. Retail pricing depends on the packaging and positioning. As shown in Figure 1, organic and fairtrade pods are priced higher than regular vanilla pods. Retail prices vary from €1.50/pod, packed in plastic, to €5.89 per pod in glass tubes for sustainable and organic vanilla.

Figure 1: Examples of retail vanilla products by package, positioning and pricing

Through what channels does a product land on the end market?

Food industry

Large industrial users, including flavour manufacturers, mostly source their vanilla directly from producers and producer groups. Some large industrial users are Unilever and Mars, who have a joint vanilla project in Madagascar. These companies demand relatively large volumes, which allows them to skip intermediaries with a bulk-breaking function. Smaller industrial users with smaller volume needs often make use of importing wholesalers in Europe to source their vanilla. This is because the import of small amounts of vanilla is relatively expensive and adds a lot of cost to the final product for consumers.

In the vanilla market you mostly find specialised importers that are usually active in specific segments for high-quality, sustainable and/or organic-/fair trade-certified vanilla. They often work directly with producers and producer cooperatives. Eurovanille (France) is a specialised importer in the European market. Vanilla is a unique product that is essential for bakeries, ice cream producers, the food industry and households. Many importers sell vanilla through online platforms, in both small and large quantities, for example Natural Vanilla Store Europe.

Retail and foodservice

Large retail chains like Tesco and Sainsbury’s in the UK, Edeka and Lidl in Germany and Carrefour in France, dominate the retail market segment in Europe, especially at the low end. In addition to their physical shops, they increasingly have webshops where consumers can order products online and have them home-delivered. Retail chains are selling more products, including vanilla, under their own private labels.

Smaller independent retailers, such as delicatessen and foodservice providers (hotels, restaurants, catering), like Metro Chef, are the other retail channels. They mostly serve the high-end retail segment. By offering unique and exclusive products, they avoid direct competition on price with the retail chains.

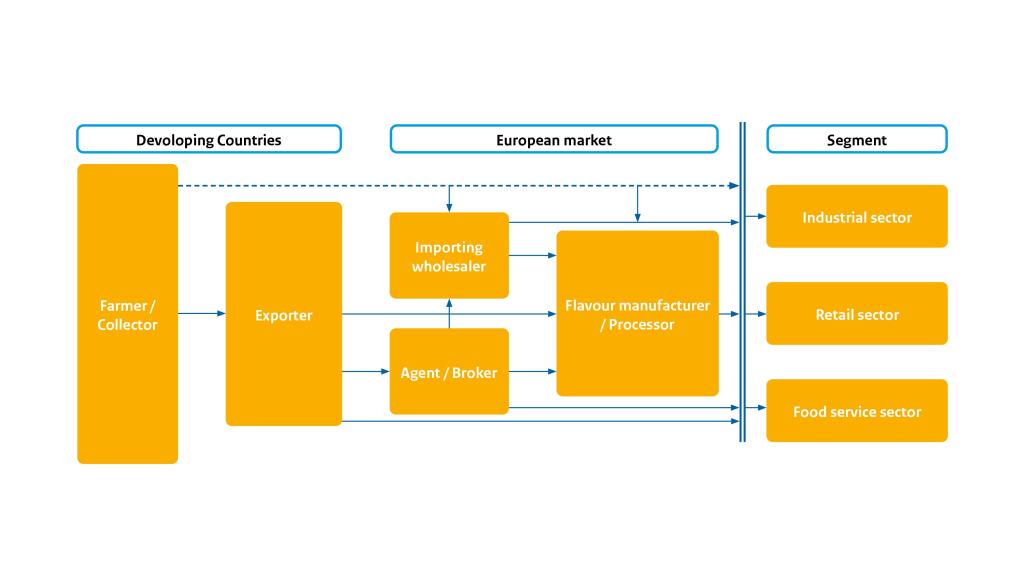

Figure 2: Market channels for vanilla

Source: ProFound

What is the most interesting channel for you?

The most interesting market channel for you will highly depend on your capacity as an exporter of vanilla, in terms of quality and consistency, volume availability and processing capacities.

Importing wholesalers are the most interesting channel for vanilla exporters that have a large product range and available volumes. Importers are also suitable when you have fewer processed products and limited experience on the European market.

Importing wholesalers source large amounts of vanilla, often from different origins, and break these bulk imports into smaller amounts for the smaller end users, including spice companies and food manufacturers. Although many exporters from developing countries often aim to supply European smaller industrial users directly to obtain higher margins, this bulk-breaking function can contribute to an increase in trade volumes and eventually higher profits.

If you export higher-quality vanilla, specialised importers focusing on higher-end markets will be more suitable for you. This is also the case if you supply organic and fair trade-certified products; there are importers specialising in this market segment.

Exporting directly to flavour manufacturers and processors will require high quality consistency and volume availability, usually starting at a few containers per year. Flavour manufacturers usually focus on whole vanilla pods, since their core business is to process the vanilla further and to offer value-added products to the food industry.

The big food and drink manufacturers all have their relationships with flavour manufacturers and local vanilla processors in place. The flavour manufacturers could be an opportunity for future business if you can offer large and stable volumes. Smaller exporters will generally find more opportunities in niche markets where volumes are smaller, such as high-quality and/or organic and fair-trade spices. In these niches the focus is more on unique flavour aspects, storytelling and sustainability.

If you have limited experience exporting to European countries, agents can play a very important facilitating role. Agents can evaluate and facilitate connections with buyers and finance institutions. Working with an agent is also useful if you need a trusted and reputable partner within the spice sector. Be prepared to pay an extra commission for their work, usually ranging between 3 and 10%. Once you have established a trade relationship through an agent you cannot establish a direct relationship with the buyer anymore, as the sales network of the agent is protected by law.

Tips:

- Check all active vanillin organisations in your country. It might be relatively easy to step in with supply for these big industry flavour manufacturers and food companies.

- Search for importing wholesalers in the member lists of the European national spice associations. Go to the member section of the European Spice Association (ESA) for an overview of associations.

- Look for commercial agents on the website of the Internationally United Commercial Agents and Brokers (IUCAB). The IUCAB website lists all their national member organisations. You can use the services of these organisations to find an agent or representative in a specific country.

3. What competition do you face on the European vanilla market?

In 2020, world production of vanilla was 7,614 tonnes, led by Madagascar with nearly 40% of the total and followed by Indonesia with 30%. Demand is rising and prices remain high, though production has also increased in recent years.

Source: Food and Agriculture Organization of the United Nations

Only 15 countries in the world produce vanilla. With few producing countries and the high demand for it, vanilla is subject to volatile price developments. A shortage in 2017 caused rising prices of vanilla, with prices dropping by a third again in 2019.

Source: Food and Agriculture Organization of the United Nations

Recent supply chain issues from the leading global producer Madagascar have resulted in a shortage of vanilla beans, creating opportunities for suppliers in other parts of the world, particularly those that are organic- and/or Fairtrade-certified.

Currently, less than 1% of vanillin is derived from actual vanilla bean production. Simply put, the demand for natural vanilla cannot be met by the small amount of cultivated vanilla beans available globally. A natural alternative is needed. This implies that new entrants are welcomed on the market.

In 2020, the top exporters of vanilla were Madagascar (€472 million), Indonesia (€59 million) and Papua New Guinea (€35 million). France (€57 million) and Germany (€48 million) were also among the largest exporters, but their supplies represent re-exports.

*Excluding the United Kingdom, as data are only available for 2017-2019

Source: Eurostat, 2022

Which countries are you competing with?

Due to its geographic location there is no vanilla production on the European continent, so Europe is dependent on imports to meet its vast demand. Some vanilla is produced in several French overseas territories, such as Reunion and Mayotte, Guadeloupe and Tahiti (French Polynesia). However, these are relatively small producers. Today, the largest share of natural vanilla still comes from smallholder farms in Madagascar.

Madagascar

Madagascar is the largest vanilla producer in the world, at just under 3,000 tonnes annually. Due to drought, cyclones and poor farming practices, there were concerns about the global supply and price of vanilla in 2017 and 2018, but production has remained steady in the past few years.

The Malagasy government continues to enforce the minimum export price for vanilla currently set at US$250.00/kg. But the actual market price for vanilla has been far below this level and exporters are finding more ingenious methods to make up the difference between the actual selling price and the mandated export price without contravening the minimum price policy. The extent of criminal enterprises against Malagasy farmers is high, raising the worldwide cost of using Madagascar vanilla in consumer products. Still, most major international buyers remain focused on Madagascar for their vanilla needs.

The end consumption channels of Madagascar vanilla are mainly international food conglomerates and cosmetics companies. Approximately 40% of vanilla is sold for food purposes and the remainder is used for cosmetic and other industrial purposes. Large food processors have an impact on the Madagascar vanilla supply chains. Projects like The Livelihoods Fund for Family Farming, an impact investment fund created by Danone, Firmenich, Mars and Veolia, is 1 example. This project, with 3,000 family farms, aims to tackle not only quality and traceable vanilla production but also food security for farmers and biodiversity conservation.

Madagascar-type vanilla is generally grown on islands in the Indian ocean like Madagascar, Comoros and Reunion. They are the thinnest of all the beans and the richest in flavour. They are black and the flavour is rich and creamy.

Indonesia

According to FAO production data, Indonesia produces some 2,300 tonnes of vanilla. However, Indonesian production is becoming increasingly difficult to estimate given the large quantities of vanilla from Papua New Guinea which are now brought into the country and re-exported as Indonesian vanilla. It is assumed that the real production is much lower at some 300 tonnes in 2022. Although prices for Indonesian vanilla were quite strong at the beginning of 2022, they have fallen recently as most international buyers have turned their attention to Madagascar.

Uganda

Uganda produced 185 tonnes of vanilla beans in 2020 and at least 150 tonnes in 2021. With good growing conditions so far in 2022, Uganda should easily surpass 200 tonnes from their bi-annual vanilla harvests. Vanilla beans from Uganda contain the highest level of vanilla. The colour is black and the flavour is floral, cherry and chocolate. Ugandan quality has improved dramatically over the past years. However, as production and volumes increase, maintaining quality will become more challenging, due mostly to a lack of qualified vanilla technicians on the ground.

Moisture content of whole vanilla beans still tends to be too high, approaching or exceeding the upper end of tolerance levels for the North American market (25%). Uganda remains rather focused on gourmet/black vanilla as this quality usually commands a higher price than extraction grade. This results in a lot of substandard gourmet beans that should have been dried further and reclassified as extraction grade. Uganda makes high-quality vanilla available to its local and export markets.

Family farms with less than 2 acres or several small tracts of land are the main sources of raw fresh Ugandan vanilla. These farms are scattered across the country. The main sources of Ugandan vanilla include the Mukono, Jinja, Kamuli, Luweero, Kasese, Mpigi, Kayunga and Bundibugyo districts. Harvesting, curing, packaging and grading harvesting of Ugandan vanilla commences after the pods turn pale green.

Papua New Guinea (PNG)

According to the FAO, PNG produced about 495 tonnes of vanilla in 2020. In 2018, the amount was 240 tonnes and an estimate of 300 tonnes is given for 2022. About 80% of the total volume is produced in the East Sepik province in Maprik and Ambunti-Dreikikir.

2 species are grown: Vanilla tahitensis and Vanilla planifolia. These are produced almost exclusively for the export of whole cured beans, which is processed by the growers. The vanilla value chain is small compared to PNG’s major export crops, but contributes to poverty reduction for the estimated 17,000 smallholder producers who live in remote areas.

Around 33% of the volume is intended for international export, where grade-A beans are sold directly to buyers and processors mainly in North America, Europe and Australasia. About 67% is sold via cross-border trade in West Papua where, generally, lower-quality beans are sold for processing in Indonesia. Some of these beans then go into Indonesia’s vanilla exports. The trend of PNG vanilla finding its way to world markets via Indonesia continues. It is very difficult to estimate carryover stock and actual exports to end users. The industrial acceptance for PNG vanilla is still limited and will probably remain that way for some time.

There are still no real standards of quality for industrial-grade vanilla in PNG under the Spice Industry Act of 1989. Moisture and vanillin contents can be very inconsistent and there is little microbiological analysis and pesticide testing done on the ground. With food safety standards becoming more rigid each year, these inconsistencies will become more of a challenge for PNG going forward.

Although Tahitensis species is considered as the true PNG vanilla, there is a significant amount of sub-standard Planifolia species still circulating on the market. This creates a lot of confusion for buyers and makes it very difficult to establish consistent industrial vanilla flavouring formulations. This makes vanilla of this origin primarily suitable for the food service and retail sectors where vanilla specifications and labelling requirements are less rigid.

Tahitian (PNG) vanilla beans are known for their flowery, fruity and smooth-flavoured aroma. They are often described as smelling like liquorice, cherries or wine.

Comoros Islands

Though the production of vanilla in the Comoros has fluctuated substantially in recent years, it tended to decrease throughout 1971-2020, amounting to 21 tonnes in 2020. The Comoros exported US$8.24 million worth of vanilla in 2020, making it the 12th largest exporter of vanilla in the world. Europe and North America are main destinations for vanilla from the Comoros: Germany (€3.9 million), United States (€2.1 million), France (€0.7 million), Switzerland (€0.6 million) and Canada (€0.4 million). Black vanilla from the Comoros Islands is used mainly for baking and pastries.

The Comoros Islands are famous for their lush and fertile volcanic soil, delivering bourbon vanilla that is perceived as being of superior quality. The vanilla pods from the Comoros are at least 14 cm in length. The weighted variation of the bean can be up to 24 cm, grade-A vanilla beans have a moisture content of 28-35%, and the taste is creamy with hints of chocolate, marshmallow and brown butter.

Australia

Vanilla production in Australia is very limited (PDF), with about 15 commercial growers . Australian vanilla production is largely centred on a few commercial farms in North Queensland (QLD), as well as the recent establishment of an in-vitro vanilla production unit in New South Wales (NSW).

In 2020, Australia exported €3.9 million worth of vanilla, making it the 15th largest exporter of vanilla in the world. The main export destinations are: USA (€1.0 million), UK (€0.6 million), Switzerland (€0.6 million), India (€0.6 million) and Poland (€0.5 million).

Also in 2020, Australia imported €11.56 million worth of vanilla, becoming the 11th largest importer of vanilla in the world. Australia imports vanilla primarily from Papua New Guinea (38%), Madagascar (30%), Mauritius (10%), USA (8%) and India (8%). Part of these imports are re-exported to Europe.

Which companies are you competing with?

New entrants to the market will face competition from already-successful vanilla exporters, especially due to their established long-term relationships with buyers. Entering the market as a newcomer requires you to have extensive knowledge of your product assortment, stable quality and volumes, and good communication skills to start building your own relationships with buyers.

Malagasy companies include:

- Pure Vanilla is based in Sambava, Madagascar, and is a family company run by women which produces and exports organic and Fairtrade-certified vanilla. Their main vanilla curing and warehousing operations are in Sambava, and sourcing is done directly from partner farmers in the SAVA region. Pure Vanilla’s facilities can transform 250 tonnes of green vanilla beans and presently export an annual volume of 20 tonnes to Europe and to the USA.

- Vanilla World calls itself the specialist in collection, preparation and export of Malagasy vanilla. Vanilla World works closely with Inova Vanille, its Sambava-based partner. Inova Vanilla produces several tonnes of vanilla products annually. The main clients are industrial (food and cosmetics), bakers, restaurants, ice cream parlours and wholesalers.

- The Madagascar Vanilla Company supplies vanilla in quantities starting at 1 kg, at wholesale discount rates. They also supply mega orders for cosmetics, extracts, food and fragrance companies.

Indonesian companies include:

- Niaga Organics exports Planifolia Vanilla Beans (Indonesian Vanilla Beans and Sumatra Vanilla Beans), Tahitian Vanilla Beans, Papua New Guinean (PNG) Vanilla Beans and Vanilla Powder (Ground Vanilla Beans). For the European market the products are exported to France, the Netherlands, Germany, the United Kingdom and the Czech Republic. The customers are importers and retailers, vanilla extract companies and vanilla powder manufacturers.

- Rorindo supplies various types and qualities of vanilla beans through its brand Royal Vanili Fabrik. The product portfolio offers vanilla beans from 2 different countries, specifically Planifolia Indonesia and Tahitensis Papua New Guinea.

- Agrio Spice produces its own vanilla. Its vanilla plantation is in the northern part of Bali, Indonesia. The company supplies vanilla from Indonesia and provides private-label services.

Papuan suppliers include:

- Paradise Spices, assumed to be the leading processor and exporter. Paradise Spices Vanilla is sourced from around Papua New Guinea, particularly Sepik, Madang, Miline Bay, Bougainville and other provinces. Since 2019, the company has formed part of GTM Distributors. An article states that most of the company’s exports are destined for Australasia.

- Kamapim trains smallholder farmers that produce high-quality vanilla and buys directly from them. Tribal landowners cultivate both Planifolia and Tahitensis, depending on the local climate and altitude.

A Ugandan company is Ugandan Vanilla by Kinawuka, delivering small and bulk quantities of organic-certified vanilla to international markets. The company exports to the United States, Europe and other global regions.

Which products are you competing with?

Less than 1% of the vanilla flavour in processed products comes from natural vanilla as opposed to artificial vanilla. Artificial vanilla is synthesised from guaiacol or chemically derived from various raw materials, including coal tar. The substance that is mainly responsible for the typical vanilla flavour and which can be synthesised from various raw materials is called vanillin.

Other raw material sources of vanillin are pine bark, clove oil and some residuals from the wood and pulp industries. In addition to these chemical alternatives, there is also an alternative produced through fermentation which is perceived as natural vanilla. It can be labelled as a natural flavour according to both European and American stringent flavour regulations.

On the consumer market, consumers opt for maple syrup as an alternative to vanilla, so the increasing demand for maple syrup will counteract that for vanilla. Almond extract is also used as an alternative to vanilla extract, with a significantly more potent flavour than vanilla. This extract is widely added to baked goods and other desserts to enhance flavour and taste. The rising demand for almond extract in the bakery industry will thus hinder the growing demand for vanilla.

Tips:

- If you are a new producer, prove to your potential buyer that you can offer a continuous supply of good-quality vanilla which complies with food safety requirements.

- Develop long-term partnerships with your buyers. This implies always complying with buyer requirements and keeping your promises. It will give you a competitive advantage, more knowledge and stability on the European market.

- Actively promote your company on your website and at trade fairs. Quality competitions also provide good opportunities to share your vanilla product with a wider audience: check out the Sofi Awards, Superior Taste Award and Great Taste Awards.

4. What are the prices for vanilla on the European market?

Madagascar recently suggested a minimum price of US$250/kg, which contains about 150 vanilla pods. In 2022, the approximate price range for Madagascar Vanilla was between €394 and €455 per kg. The price of around €300/kg for (industrial) vanilla was confirmed by a European importer. The price for vanilla other than from Madagascar is unknown. It should however be noted that not all exporters or European importers adhere to this minimum price. In general, the price for organic vanilla gives a premium of 10%.

Tips:

- Make sure that your prices reflect your product’s quality and level of value addition.

- Check the market reports by Nedspice, Indian Spices Board and the International Trade Centre for the latest price developments and a price outlook.

This study was carried out on behalf of CBI by Kasper Kerver of ProFound – Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research