The European market potential for vanilla

Vanilla is a leading flavour used worldwide. The vanilla market is expected to grow in the years ahead, driven by the ice cream, chocolate products, drinks and bakery industries. Most European trade is concentrated in France, Germany and the Netherlands. The continuing growth is based on the demand for natural ingredients, clean labels, traceability and sustainability certifications (i.e. organic, Fairtrade). Demand exceeds the current supply, leaving room for companies to enter the market.

Contents of this page

1. Product description

Since the 19th century, vanilla has been grown and harvested in tropical areas such as Madagascar, Mexico, Indonesia and Tahiti. Today, the majority of natural vanilla comes from smallholder farms in Madagascar, but Indonesia has also become a large supplier. And while its popularity has certainly not declined over the centuries, availability has long been an issue. Demand quickly exceeded the supply from farms, resulting in chemists turning to the production of synthetic alternatives as early as the 1900s.

The growing clean label trend and consumer demand for all-natural foods and drinks has boosted the demand for traditional vanilla beans. Cost has increased greatly and supply depends on availability, price and quality. Currently, less than 1% of vanillin is derived from actual vanilla bean production. Simply put, the demand for natural vanilla cannot be met by the small amount of cultivated vanilla beans available globally.

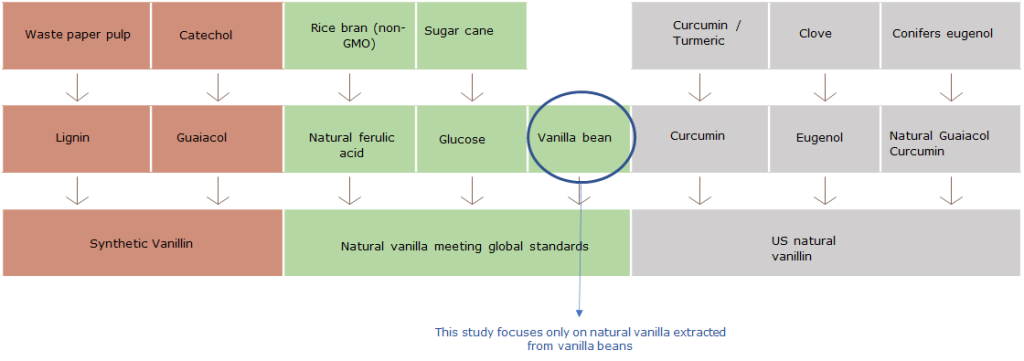

Figure 1: Vanilla production options

Source: Solvay

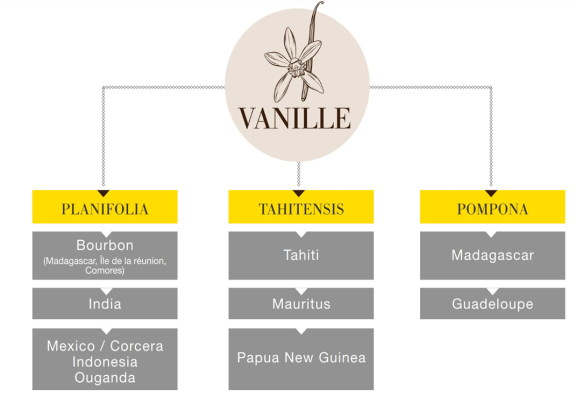

There are 2 main types of vanilla on the international market coming from different regions:

- Bourbon vanilla, from Vanilla planifolia Andrews. This type is the most popular cultivated variety, mainly from Madagascar. V. planifolia is the same variety, originating and grown in Mexico, but has become synonymous with Madagascar. Mexican vanilla is produced in much smaller quantities and marketed as vanilla from its land of origin. Bourbon vanilla is the preferred type of vanilla used in Europe, although vanilla extracts are also used.

- Extract-grade vanilla, from Vanilla tahitensis (Tahitian vanilla), is from French Polynesia. This type is a weaker vanilla with ‘fruity, floral and sweet flavours’. It is grown in Papua New Guinea and Indonesia. West Indian vanilla is made from V. pompona, grown in the Caribbean and Central and South America. Extract-grade vanilla is used to produce vanilla extract, which is the main form used in the United States.

In Europe, vanilla is sold in the following forms:

- Whole or ground natural vanilla, used as a spice. Vanilla is most traded in pods (i.e., beans), but vanilla powder can also be found on the market (ground pods, pure or blended with sugar (vanilla sugar), starch, or other ingredients).

- Vanilla extract (in alcoholic or occasionally glycerol solution; both pure and imitation forms of vanilla contain at least 35% alcohol), used as a flavour in the food industry and as a fragrance in the cosmetics industry.

This study focuses on vanilla as a spice in the consumer market. Food processing, cosmetics and pharmaceutical/medicinal industries are also important players on the European vanilla market.

Tips:

- Activate the ‘Translation’ function of your browser to make this document available in your native language.

- For more information on vanilla extracts for the food processing industry, read our study on vanilla extracts.

| HS Code | Description |

| 0905.1000 | Vanilla, neither crushed nor ground |

| 0905.2000 | Vanilla, crushed or ground |

2. What makes Europe an interesting market for vanilla?

Vanilla finds a vast market in European food and beverages

The European food and drink market is 1 of the largest in the world. According to Food and Drink Europe, the industry has a turnover of nearly €1.1 trillion. The European vanilla market has shown growth in consumption in recent years. The growth in vanilla is related to the increasing demand for natural products and the higher consumption of processed foods, like chocolate, ice cream and bakery products.

Vanilla is 1 of the top flavours used by the food industry. Every year almost 1,800 new food and drink products containing vanilla are launched in Europe. After chocolate, strawberry, apple and hazelnut, it is the fifth most-used flavour in new product development.

Many industrial users include real vanilla beans in the manufacture of their ice creams, yoghurts and desserts. This can be in the form of vanilla powder, vanilla extracts or natural vanilla flavourings.

The global vanilla market is fragmented by both product type and application. The product types are defined by their geographical origins, including Madagascar, Mexico, India and Indonesia.

Malagasy vanilla is the most widely used vanilla type. It is popular because of its dark, creamy and rich flavour, along with a buttery and sweet aroma. It is used in major food products like ice creams, cakes, desserts and drinks. After Madagascar, the Indonesian vanilla type holds second position in terms of vanilla production. These beans have a deep and rich vanilla flavour that is suitable for dark chocolates, cakes, caramels, etc.

In food and drink products, vanilla is mostly labelled as ‘vanilla’ without further details. In some cases, the origin or the type of vanilla is given, like Bourbon vanilla, Madagascar vanilla, Tahitian vanilla or Mananara vanilla.

Europe is 1 of the leading destinations in the vanilla trade

Vanilla is 1 of the most popular spices worldwide and an important ingredient in many products. However, compared to other spices and flavours, European imports of vanilla are relatively low and prices are very high. In times of scarcity, the high prices for vanilla even force ice cream producers to consider taking the flavour off their menu. The popularity of the spice will give you opportunities on the European market if you are able to supply vanilla at a reasonable price.

Europe is a very important destination for vanilla. France, Germany and the Netherlands together account for about 32% of global imports (and 75% of all European import volumes), compared to 42% for the entire USA. European vanilla imports from developing countries increased from 1,186 tonnes in 2017 to 1,470 tonnes in 2021. Please note that since 2020, no import statistics are included for the United Kingdom. In 2021, €356 million worth of vanilla was imported into Europe. This value has decreased since 2018. This is most likely the result of the relatively high prices in 2017 and 2018 due to the failed harvest in Madagascar.

Source: Eurostat, 2022

Source: Eurostat, 2022

Tip:

- Read more about the general developments in the spices and herbs market in our study What is the demand for spices and herbs on the European market?

3. Which European countries offer the most opportunities for vanilla?

Due to the climate, no vanilla grows on the European continent. Europe thus depends on imports to meet its vanilla demand. Some vanilla is produced in several French overseas territories, such as Reunion, Mayotte, Guadeloupe and Tahiti (French Polynesia), yet these are relatively small producers. Hence Europe has to import almost all of its vanilla from producing countries like Madagascar, Indonesia and Papua New Guinea.

Some key players operating on the European vanilla market are Nielsen-Massey Vanillas, Heilala Vanilla Limited (Tonga), Archer Daniels Midland (USA), Givaudan, Sensient Flavors, Lochhead Manufacturing (USA), International Flavors & Fragrances, McCormick & Company (USA), Symrise, Kerry Group, Firmenich and E.A. Weber Flavors.

Source: Eurostat, 2022

France and Germany are by far the biggest vanilla importers of Europe, also in value. Though volume increased between 2017 and 2021, value decreased. Vanilla was very expensive in 2017 and 2018, but experienced a drop in price as of 2019.

Source: Eurostat, 2022

Europe is currently the largest market for vanilla beans and derivative products and the trend is unlikely to change until 2030. The market is expected to offer lucrative opportunities for producers of high-quality vanilla beans, especially those showing sustainable sourcing. After years of being hailed as the ‘queen of flavours’, vanilla is still going strong as a classic and versatile ingredient. In the food industry, vanilla is added to various food applications, including dairy-based products, ice cream, bakery products and chocolate & confectionery, to enhance flavour and taste. Vanilla is also used by the chocolate confectionery industry to reduce bitterness and enhance flavour.

Price is a major challenge for the European vanilla bean market. The sourcing challenges, production shortage and the resulting price spikes generate lucrative opportunities for suppliers providing stocks at reasonable costs.

Although vanilla is sold in nearly every supermarket, it is not a staple in every household. The major vanilla user is the food industry, in its application as flavouring ingredient. When it comes to vanilla-based food and drink product launches, Germany, France and the UK show the highest product development activity.

Source: Mintel GNPD

The ranking of countries with the highest number of vanilla-based product launches is different from the ranking of countries with the largest import or consumption figures because vanilla is used both as a consumer product and as a food ingredient. There are 2 reasons for this. First, a consumer product launched in country A can be produced by country B. This vanilla volume is then imported by country B. For example, Belgium has a relatively high import volume for its population size. That is a result of both trading activities and the production location of Barry Callebaut, which produces large volumes of chocolate that are exported worldwide. The second reason is that across the food and drink categories, vanilla is used in different vanilla inclusion rates. For example, vanilla in ice cream might be formulated in a higher dosage than in chocolate products.

Source: Mintel GNPD

It is evident that the import of vanilla is strongly linked to the location of the importer or food manufacturer. The importer is usually a flavour house, while other importers are trading companies that mainly supply vanilla consumer products online and to medium and smaller food manufacturers and retailers. According to an analysis of product development data by Mintel GNPD, the industrial use of vanilla is quite concentrated. The top-30 food and drink companies account for one third of all product launches formulated with vanilla. Note that this analysis only shows the level of innovation and not the volume of vanilla used, as the vanilla dosage was not assessed. The biggest innovators using vanilla are Mars, Unilever, Lindt & Sprüngli, Ben & Jerry's, Nestlé, Loacker, Niederegger, Krüger Gruppe, Mondelez International and Groupe Danone.

Of course, in addition to the development of these branded products vanilla is also used in private-label products. Private-label products account for about 30% of vanilla-based product launches.

It should be noted that the biggest industrial vanilla users are very open about their suppliers:

- In June 2022, vanilla supplier Prova and chocolate manufacturer Barry Callebaut teamed up to support vanilla farmers. The partnership also funds and supports local communities through social, health and educational programmes. This latest commitment is supported by the Sustainable Trade Initiative (IDH) and supports both companies’ responsibilities to 100% sustainable ingredients.

- Livelihoods Fund for Family Farming (L3F) is a cooperation between Mars, Danone and Symrise.

- Coca-Cola is the world’s leading consumer of vanilla and uses about 10% of world production. Although the company is a big industrial user of vanilla, they only share limited information about their vanilla sources and sustainable activities.

France: major user and re-exporter of vanilla

At 65 million, France has the second-largest population in the EU. This largely explains its major role in the European vanilla market. Being the biggest European vanilla importer, in 2021 France imported 1,081 tonnes of vanilla worth €166 million. That same year, France exported 476 tonnes of vanilla, resulting in a local consumption of 605 tonnes. This means that a relatively large share of 56% is locally used, primarily by the food industry and food service. France houses the port of Marseille, 1 of the EU’s largest seaports and the fourth-largest in Europe, contributing to France’s role as a trade hub.

Mintel GNPD data analysis shows that in French vanilla-based consumer products, organic seems to be the most important positioning. Approximately half of product launches are positioned as organic, while only 26% are positioned as sustainable (without a specific certification).

Like many Northern European markets, the retail market in France is highly concentrated. France houses a number of large retail chains like Carrefour, Delhaize, Auchan and Intermarché, that take up a large part of the domestic vanilla sales. Looking at the industrial applications, private label accounts for 23% of all vanilla-based food and drink launches, including vanilla used as both an industrial ingredient and a consumer product.

In numbers of vanilla-based product launches, the chocolate confectionery industry is most innovative, followed by bakery, desserts & ice cream, and sweet spreads. Note: bakery includes vanilla consumer products and bakery products where vanilla is formulated as a flavour ingredient.

The table below shows some vanilla-based products that were launched in 2022. It includes 1 ice cream example, showing the importance of organic and the vanilla origin on the package. The other products are baking mixes that come in a variety of formats, including pods, powder and a liquid.

Table 1: Examples of vanilla-based products in French retail

| Company | Product picture | Product description |

| Les Glaciers Parisiens, France |

| Maison Alpérel Crème Glacée Artisanale Vanille Bourbon de Madagascar (Artisanal Bourbon Vanilla From Madagascar Ice Cream) was previously known as Alpérel and has been relaunched under a new brand name with updated packaging. The whole vanilla pods from Madagascar are grated by hand and infused for at least 24 hours with free-range eggs and whipping cream from Pamplie dairy factory. |

La Pateliere, France €5.49 / 2 gr. |

| La Pateliere Gousse de Vanille Origine Papouasie Nouvelle Guinée (Papua New Guinea Vanilla Bean) is described as a delicate and floral high-quality vanilla bean from Papua New Guinea, selected for its unusual flavour. |

Arcadie, France €12.55 / 10 gr. |

| Cook Vanille de Madagascar en Poudre (Organic Madagascar Vanilla Powder) has been relaunched with a new formulation and a new packaging design. This fair trade product is free from gluten and is described as a sweet spice that can be used for creams, pastries, ice cream and chocolates. |

Source: Mintel GNPD

Companies active in the vanilla market include importers and processors, as well as brands. The leading vanilla importers and processors are listed in the National Union of Processors of Pepper, Spices, Herbs and Vanilla. One of them, Eurovanille, is a French company specialised in vanilla for both food service and industrial applications. The products in their range (powders, aromas, concentrates and infusions) can be adapted to include a particular variety or origin of vanilla. All the processing stages take place in the factory in France, where they grind, sieve and heat-treat vanilla in all its forms.

Figure 8: Eurovanille product range origins

Source: Eurovanille

Germany: a major industrial user

Germany has a large population of 83 million, making it the largest consumer market in Europe. Germany is also a major re-exporter of food ingredients and processed foods. Many vanilla importers and food manufacturers in Germany supply their products throughout all of Europe.

Germany is expected to dominate the market because of its strong growth and presence of food and drink manufacturers. It is the third-largest importer of vanilla in the world. In 2021, Germany imported 695 tonnes of vanilla, worth €83 million, and exported 245 tonnes, resulting in a net consumption of 450 tonnes. This includes vanilla used both as a consumer product and as a food ingredient. Germany sources 63% of its vanilla imports directly from producing countries.

Analysis of vanilla-based food and drink product launches in Germany shows that private-label products make up 30% of product launches. The positioning claims made on vanilla-containing consumer products are mainly focused around sustainable (environmental and ethical) and organic aspects. The table below displays some products that contain vanilla:

Table 2: Examples of vanilla-based products in German retail

| Company | Product picture | Product description |

| Kaufland Dienstleistung, Germany |

| K Classic Maxx Bourbon-Vanilleeis Überzogen mit Weißer Schokolade (Bourbon Vanilla Ice Cream Covered with White Chocolate) has been repackaged with a new design. This sustainable product features the Rainforest Alliance Certified logo. |

| Byodo Naturkost, Germany |

| Byodo Gourmet Pudding Vanille (Gourmet Vanilla Pudding) contains bourbon vanilla. It is organic-certified and carries the Vegan Society Approved Vegan Trademark logo. |

KoRo Handels, Germany €17.70 / 250 gr |

| KoRo Bio Bourbon Vanillezucker (Organic Bourbon Vanilla Sugar) is described as organic bourbon vanilla sugar made of raw cane sugar and infused with vanilla. |

| Aust & Hachmann, Germany | This product is found in many European countries, including Denmark. Adil Van'ile Øko Bourbon Vanilje (Organic Bourbon Vanilla Pod) is suitable for use in desserts, cakes, ice cream, jam, smoothies and drinks. It is organic- and Fairtrade-certified. | |

Biovegan, Germany €5.49 / 5 gr.

|

| Biovegan Vanille Gemalen (Ground Vanilla) is organic-certified. It is made from whole ground pods, contains the natural fullness of flavours, can be used in baked goods, drinks or desserts, is suitable for vegans, and is free from gluten. |

Source: Mintel GNPD

Most of the vanilla imported by Germany is sold to large-scale processors. Germany has a very large food industry which uses a large number of different spices, including vanilla. The food industry produces large amounts of processed foods, including chocolate confectionery, dairy products, desserts and ice cream, and bakery products.

One large German food processor is Dr. Oetker, with a large share of the global baking industry. It is assumed that the company uses a relatively large share of the European vanilla volume, both in its industrial baking products (cake, cake mixes, etc.) and in vanilla home baking products. The company is working on its sustainability goals. By 2023, 20% of the vanilla the company uses will be sustainably certified.

Flavour companies with direct links to selected food processing companies are also important players. In Germany, Symrise is a main player in this industry. They work with almost 7,000 farmers across the SAVA region of Madagascar to ensure their vanilla is sustainable, traceable and of premium quality.

Other vanilla and spice companies in Germany are organised in the German Spice Association, which has 92 member companies.

The Netherlands: trade hub for vanilla

In general, the Netherlands is a major European trade hub for spices. While the size of its population and respective domestic consumption are small, importing wholesalers in the Netherlands play a large role in the processing and particularly the re-exporting within Europe of vanilla and other spices. In 2021, the Netherlands imported 287 tonnes of vanilla, worth €48 million.

In 2021, the Netherlands re-exported 255 tonnes of vanilla (mainly to France and the USA), making it the eighth-largest exporter of vanilla in the world. These trade figures show that at 11% the Netherlands uses a relatively small share of all imported vanilla for local consumption and processing into food and drink products, and the largest share is re-exported.

The use of vanilla in food and drink launches in the Netherlands is quite concentrated. Chocolate, desserts & ice cream, and bakery account for the largest share of all launches. Several major food producers are based in the Netherlands – like Mars, which has its second-largest factory in the country. In dairy, you find Friesland Campina and Unilever. The latter owns an ice cream production site in Hellendoorn, in the eastern Netherlands. For bakery products, the Netherlands seems to rely mainly on imports from Germany.

For vanilla-based product launches, private label accounts for around one third of products. This includes both industrial products like desserts, ice cream and chocolate, and consumer products like ingredients for home baking. Retail chains like Albert Heijn (AH label), Aldi (De Kruidencompany label) and Jumbo control much of the vanilla retail sales in the Netherlands. Vanilla is also sold at speciality food stores and online platforms.

For consumer product launches, most vanilla-based product claims are focused around ethics and sustainability. The Dutch Spice Association strongly supports sustainable sourcing of spices. The association is committed to Corporate Social Responsibility. In addition, a leading group of spice importers in the Netherlands established the international Sustainable Spices Initiative with members from the Netherland and other countries. Positioning vanilla as an organic product is an ongoing trend in the Netherlands. Some consumer products are shown in the table below.

Table 3: Examples of vanilla-based products in Dutch retail

| Company | Product picture | Product description |

Het Blauwe Huis, Netherlands €9.68 / 4 gr |

| The product retails in a 4gr pack featuring the EU Green Leaf logo. Positioned as organic product. |

Nielsen-Massey Vanillas International, Netherlands €4.99 / 1pod | Nielsen-Massey Vanillastok (Vanilla Pod Stick) is described as a moist, flavourful and aromatic gourmet vanilla bean. It is said to be deliciously ideal for any number of cooking and baking applications, and retails in a pack with 1 vanilla pod equivalent to 15ml vanilla extract. It bears the Certified Gluten-Free and CRC Kosher logos. |

Source: Mintel GNPD

There are several industrial players in the Netherlands sourcing vanilla:

- Unilever has an ice cream production site in the Netherlands. Since 2013, Unilever has been working with partners in a programme called Vanilla for Change in Madagascar. It is designed to help smallholder farmers improve their livelihoods and provide more secure and sustainable sources of natural vanilla.

- IFF, along with strategic customers and partners, is using blockchain to create a tamper-proof record of each vanilla bean’s journey throughout the supply chain. Starting from a cooperative of 450 smallholder farmers in Madagascar, the technology traces the beans along their path from farm to final product.

- Friesland Campina is a Dutch dairy company that exports its products all over the globe. They have a large demand for vanilla for use in their dairy drinks and dessert products, and work with flavour companies Givaudan and Symrise.

- Mars is a producer of chocolate products. The chocolate factory in Veghel (Netherlands) is the largest production site owned by Mars. With the Livelihoods Fund for Family Farming, which the company co-founded with Danone and others in 2015, Mars invested €120 million to develop sustainable agriculture projects that improve incomes for 200,000 smallholder farmers, while also tackling food security and restoring fragile ecosystems.

- Vanille Fabriek is a Dutch vanilla wholesaler specialised in the supply of the best superior-quality cured Premium & Gourmet and General Extract Vanilla Beans, or Vanilla Pods Planifolia Indonesia and Tahitensis Papua New Guinea. They do this in direct cooperation with farmers, growers and processors from origin countries for the local and international market.

- Vanilla Venture sources vanilla from Indonesia and increasingly from China and India.

- Vanille BV: Henk de Kroon founded Vanille BV in 2004, with the aim of training farmers in Papua New Guinea in the cultivation of vanilla beans. Vanille BV supplies vanilla in large quantities under the name ‘Pure Vanilla’.

Belgium: re-exporter and vanilla consumer for the chocolate industry

In 2021, Belgium imported 94 tonnes of vanilla worth €7 million; in the same year the country exported 65 tonnes of vanilla, resulting in a local consumption of 29 tonnes, or 31% of its total volume. This makes Belgium a relatively large re-exporter of vanilla. Like its northern neighbour, the Netherlands, Belgium does not have a large domestic market, hence a large percentage of imports are re-exported.

In line with most other major importers of vanilla in the European Union (EU), Belgium has a large port via which it imports goods. Antwerp is the second-largest port in Europe, welcoming over 10 million containers in 2018. Due to this port, Belgium functions as hub for the region.

In Belgium, private label makes up a smaller share of the food and drink product launches than in other European countries. On average, it accounts for about 20%. Companies producing and marketing private-label products include Carrefour, Colruyt, Lidl and Picard. The vanilla consumer products launched in Belgium seem to be mainly imported from other countries, like France.

Chocolate products, desserts & ice cream, and bakery account for the largest share of vanilla consumption. As Belgium is relatively small, most likely the local consumption of vanilla is primarily attributed to Barry Callebaut. Barry Callebaut is a Swiss chocolate producer with production facilities in Belgium. It has a relationship with Prova for its vanilla supplies. In June 2022, Prova and Barry Callebaut teamed up to support vanilla farmers in introducing cocoa trees. They also provide training to improve productivity and the quality of both vanilla and cocoa. The partnership will also fund and support local communities through social, health and educational programmes. This latest commitment is supported by the Sustainable Trade Initiative (IDH) and supports both companies’ ambition to use 100% sustainable ingredients.

A Belgian vanilla wholesaler is Vanillestokjes.be. The company was founded in 2017 and supplies both consumers and the food service (bakeries and ice cream companies) in Belgium and the Netherlands. They offer vanilla sourced in 12 different countries.

Denmark: vanilla consumer for the food industry

In 2021, Denmark imported 128 tonnes of vanilla worth €11 million; that same year the country exported 24 tonnes of vanilla, resulting in a local consumption of 104 tonnes. This is a relative large amount, with 81% of imports consumed locally.

Private-label vanilla-based food and drink product launches account for 20% of all product launches in Denmark. Some private-label companies are Netto, Lidl, Dagrofa and Coop; they market both vanilla consumer products and food and drink products where vanilla is used in the recipe.

As in other European countries, chocolate confectionery, desserts & ice cream, and bakery products are the main users of vanilla. Most products show sustainability or organic claims on the package.

The table below displays some vanilla consumer products.

Table 4: Examples of vanilla-based products in Danish retail

| Company | Product | Description |

Lidl, Denmark €2.02 / 20 ml |

| Deluxe Bourbon Vanilje Flydende Naturlig Aroma til Fødevarer (Natural Bourbon Vanilla Liquid Aroma) contains Bourbon vanilla extract from Madagascar. |

Wiik & Co, Denmark €12.10 / 125 gr. |

| Armour Blomsterberg’s Vaniljepasta fra Mauritus (Vanilla Paste from Mauritius) |

Mill & Mortar, Denmark €10.63 / 15 gr. |

| Mill & Mortar Winter Larder Økologisk Vaniljepulver (Organic Uganda Vanilla Powder) consists of fully ripened and finely ground vanilla pods. |

Spain: re-exporter and vanilla consumer for the food service and bakery industry

In 2021, Spain imported 100 tonnes of vanilla worth €3 million. Spain imports vanilla primarily from other European countries, like France, the Netherlands, Portugal and Germany, and from Indonesia. In 2021, Spain exported 53 tonnes of vanilla, resulting in a local consumption of 47 tonnes, or 47% of the total vanilla volume.

The food service industry plays a key role in the culture and economy of Spain, as shown by the relatively high eating-out spending habits of its population. In food production, Spain is a major player in the development of pastries and cakes where vanilla is often used. Mintel GNPD data analysis shows that for Spanish vanilla-based consumer products, ethical and sustainable are the most important claims used.

The Spanish retail market is concentrated, with Mercadona as the largest retailer. French retailer Carrefour has the second-highest market share. On average, about 30% of the vanilla-based food and drink product launches in Spanish retail are private-label products. The table below displays some products.

Table 5: Vanilla-based product examples in Spanish retail

| Company | Product | Description |

IFA Retail, Spain €1.99 / 1 pod |

| Ifa Eliges Vainilla en Rama (Vanilla Pod) is used for the preparation of desserts, cakes and all kinds of pastries, giving a characteristic flavour and aroma. |

McCormick, Spain €6.35 / 50 gram |

| Vahiné Pasta de Vainilla Bourbon (Bourbon Vanilla Paste) is described as Bourbon vanilla gelled sugar paste. It is said to contain up to four vanilla pods in a tube and to be ideal for use in creams, crepes and cakes. |

4. Which trends offer opportunities or pose threats on the European vanilla market?

Clean Label and the continuing growth in natural ingredients

Demand for natural ingredients is growing in Europe. Food companies are reformulating their products with natural ingredients in response to consumer demand for natural products. Although there are many opportunities for exports, there are also risks, such as price fluctuations, local sourcing, regulations and political uncertainty.

Given the versatility and omnipresence of vanillin in food products, the global demand for natural vanilla will keep growing and formulators can no longer rely only on synthetic alternatives to satisfy consumer demand. Demand for clean labels has been gaining momentum and is projected to grow even more over the coming years. This is due to consumer desire for natural colourings and flavourings and, in some regions, organic food.

Prices for vanillin greatly depend on its availability, processes used and its labelling where the official recognition as ‘natural vanilla flavour’ is key. Authentication methods are essential to guarantee full transparency for consumers. These methods serve to differentiate natural from synthetic vanillin – the latter is the only one allowed to use the label ‘Flavour’ or ‘Vanilla Flavour’ in Europe. Advanced analytical methods have been developed to identify botanical origins and can be used to check compliance with regulations for naturalness. Botanical origins of natural vanillin can be distinguished by isotopic differentiation methods, such as 13C EA-IRMS and 2H SNIF-NMR ®, ensuring full traceability and guaranteeing its botanical origin.

Tip:

- You must address sustainability and provide transparency about the origin and your production process to become a successful player in the vanillin market. While natural vanilla substitutes enter the market for a lower price, you must justify the added value of natural vanillin.

Sustainable sourcing and transparency become vital in the European vanilla market

Consumers want to know where their favourite vanilla comes from, who grew the beans and under which conditions, and how this impacts the planet. Today’s consumers of vanilla and vanilla-based products regard these factors as crucial elements in their purchasing decisions. This requires high-quality vanilla delivery that brings certainty and mutual growth for suppliers and buyers through a transparent supply chain.

Sustainable sourcing is key in Europe. Consumers are becoming more aware of the impact of their purchases on people and the environment. They have growing concerns about global issues such as climate change and expect suppliers to take more corporate social responsibility (CSR). Non-governmental organisations (NGOs) have often taken the lead in stimulating companies to improve their CSR and source sustainably. Together with leading brands and manufacturers, they originally focused on commodities which allowed them to maximise impact.

There are several alliances in the industry where flavour houses and food and drink processors work together to reach ethical and sustainable local processing. For example, the Livelihoods Fund for Family Farming (Livelihoods 3F) is a specific initiative to restore vanilla quality while increasing food security and preserving Madagascar’s unique landscape. The project aims to triple farmers’ revenues and provide companies with high-quality and fully traceable vanilla over a 10-year time frame. Livelihoods 3F is an impact investment fund created by Danone, Firmenich, Mars and Veolia to foster sustainability and poverty reduction in supply chains.

One of the major sustainability concerns in the vanilla market is the lack of transparency in supply chains. For some buyers, transparency is a major added value and a decisive factor in selecting suppliers. Addressing sustainability issues is particularly important for companies aiming to brand their vanilla. Brands can gain trust from customers by showing their CRS.

Corporate social responsibility, or sustainable business practices, is something that companies dealing with underdeveloped countries, like Madagascar, are being encouraged to embrace. But defining sustainability and applying it within any business model, depending on the product involved, is not so easily achieved. In the case of vanilla from Madagascar there are several approaches which could all be considered sustainable, with each practice providing its own benefits.

Tips:

- Promote the sustainable and ethical aspects of your production process and the transparency of your supply chain. This means you should be able to prove and communicate a traceable chain back to the raw materials.

- Look for potential partners to improve sustainability. You can use available programmes and subsidies from governmental or non-governmental organisations for investments in sustainability. For more information, visit websites like the Sustainable Spice Initiative, the Netherlands Enterprise Agency and the German Ministry for Economic Cooperation and Development.

- See our study on trends for spices and herbs to learn more about current trends in the European market.

Organic

Growing consumer concerns over food safety, the environment and human health are fuelling demand for organic products across Europe, leading to the increased use of organic certification in new food and drink launches. Organic products now account for nearly 30% of all vanilla-based product launches in Europe. Note that this includes both industrial products, where vanilla is used as an ingredient, and vanilla consumer products.

The 2022 edition of the annual World of Organic Agriculture survey shows that organic retail sales in the whole of Europe grew by 15% in 2022 to be worth €52 billion. This means that the European Union (at €44.8 billion) is the second-largest single market for organic products globally after the United States (€49.5 billion).

Organic certification strengthens the perception of your product’s natural and healthy characteristics. While demand for organic products in other categories, such as fresh fruits and vegetables, dairy and meats, is stronger, the spices market follows the general trend in which consumers are demanding more organic products. Part of the reason for the slower uptake of organic spices is the low dosage of spices in many food products. Spices, such as vanilla, often make up only a low percentage of the product, and many certification bodies allow products with at least 95% organic ingredients to be labelled as organic. Hence many food manufacturers do not prioritise the sourcing of organic spices.

Certification bodies are now becoming stricter about the use of non-certified ingredients in organic-certified food products. This also affects spices. Certification bodies state that since the availability of organic spices is increasing, European organic regulation for organic labelling should now be fully applied to demand 100% organic content for spices.

While demand for 100% organic products is growing slowly and certification bodies are becoming stricter on the use of non-organic spices, several buyers in Europe are reluctant to adapt to these market developments, as they have concerns about the legitimacy of organic certificates. Laboratory analyses of organic-certified products sometimes show residues of chemicals that are not allowed in organic farming. While this could be the result of cross contamination from nearby conventional farms, it makes some buyers question the certification process.

Tips:

- Carefully assess your capacity to apply organic farming principles before converting to organic vanilla production. During the transition to organic farming, productivity tends to decline, sometimes by as much as 30%. The transition usually takes 2 years, so take this into account when investing in organic production, as a higher price will only be generated after this period.

- Realise that certification according to international sustainability standards, such as organic, does not necessarily say anything about the quality of your vanilla. If you are interested in exporting high-quality vanilla to the European market, invest in meeting quality criteria too.

Availability of substitute products limits demand for natural vanilla

Vanilla is the most common flavour among consumers, although the availability of alternative flavours is a major challenge to the growing demand for vanilla. Maple syrup, almond extract, citrus zest, and others are alternative flavours available on the market. Consumers often choose maple syrup as an alternative to vanilla because it is cheaper, so the increasing demand for maple syrup will counteract that for vanilla.

Tip:

- Focus your R&D and marketing on key success factors, like a specific flavour and unique properties of your product, and prove its added value to the potential customer.

This study was carried out on behalf of CBI by Kasper Kerver of ProFound – Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research