CBI presents latest market insights at largest trade fair for food

CBI joined efforts with partners from Germany’s Import Promotion Desk (IPD) and the Swiss Import Promotion Programme (SIPPO) in the largest food event of 2019, the ANUGA fair in Cologne. Consultants from CBI at ANUGA presented specific developments and trends in the European processed fruit and vegetables, and the grains and pulses industries. Exporters from several developing countries took this opportunity to check their product assortment against the latest trends and consider necessary adjustments.

This was the first edition of CBI Market Information Presentations for both sectors. In it, exporters from developing countries, were offered an unique opportunity to learn about the latest trends and to validate them directly in person afterwards, on the ANUGA trade fair. At the start of the presentation ANUGA Exhibitors were classified in one or more of 11 trend categories, according to their product range, namely: Functional and free-from products, halal food, kosher products, non-GMO products, organic products, products with protected designations of origin, ready-to-eat products, superfoods, fair trade products, vegan products and/or vegetarian products. The CBI presentation offered practical, hands-on tips for exporters from developing countries to take advantage of these trends.

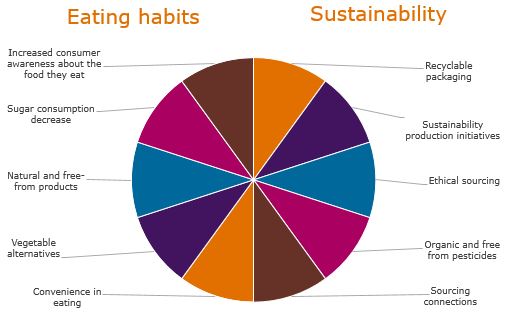

Market research experts describe multiple trends affecting consumer choice in Europe, but most can be classified into two meta trends: changing eating habits and sustainability aspects. Developing country suppliers that grasp these trends will be better able to adjust their assortment to seize the opportunities they offer.

Eating habits

Europeans are more concerned about what they eat, and how they eat their food. This is reflected an increased consumer awareness about the food they eat, secondly in a reduced sugar consumption, and lastly in an increase in sales of natural and free-from products. Exporters from developing countries were recommended the following actions, in line with these trends:

- Reformulating products to obtain better nutritional scores, promoting products’ nutritional benefits online;

- Using sugar substitutes, educating consumers on the differences between natural and added sugars;

- Offering better perceived processing methods, such as not-from-concentrate juices, high-pressure pasteurisation, cold pressing, preservative-free drying and controlling pesticide use.

Vegetable alternatives to meat consumption and convenience in eating are two other trends that are on the increase in 2019. Exporters were encouraged to think about this in particular with regards to marketing and packaging, and were given the following recommendations:

- Promoting edible nuts as good protein sources, using vegetables and beans as meat substitutes, and developing nut spreads;

- Offering ready-to-eat or easy-to-prepare foods, such as frozen smoothie mixtures, nuts and dried fruit, healthy snacking portions, dried fruit and nut bars, pre-cooked frozen food, etc.

Sustainability

Producing sustainable is no lo longer a niche activity and has become the standard when it comes to supplying European food importers. Working with recyclable packaging is one way to stand out. Examples of new recyclable packaging, which will likely increase in the short-, and long term future that were given include: Working with materials containing polyethene from sugar cane that can be recycled into new plastic; using wood pulp and corn for biodegradable packaging; introducing innovative bioplastics, such as Austrian fruit processor Agrana’s starch-based, 100% home compostable material; and working with 100% recyclable bottles.

European consumers are becoming more aware of sustainability and are making their purchases accordingly. This development is influencing the whole supply chain. Based on The Sustainable Competitiveness Index, Europe is the most sustainable continent in the world. Of the top twenty nations ranked by sustainable competitiveness, only three are not European. A second way exporters can distinguish themselves from their competitors is to join sustainable production initiatives. More established and newer sector-specific initiatives, such as the Sustainable Juice Covenant and the Sustainable Nut Initiative, were discussed as good options.

Three other trends to watch out for were: consumer interest in ethical sourcing, strong growth of organic and free from pesticide products, and a surge in upcoming new sourcing destinations in developing countries. Recommended actions to align with these trends can be summarized as: The need to obtain certification and to start implementing a recognised sourcing system, such as FairTrade, BSCI or SMETA; using the latest agricultural advancements to treat your fruit and vegetables with limited use of chemicals’ and offering to European buyers the possibility of vertical integration and long-term sourcing cooperation.

Learn more about the latest developments and read the CBI’s study on trends for processed fruit and vegetables. See what specific products offer most opportunities for developing country suppliers in the CBI statistics and outlook study on processed food and vegetables.

Stay up-to-date

To stay-up-to date on the latest developments in the processed fruit and vegetables sector, click here to subscribe to our newsletter.

This news article was written for CBI by Autentika Global.