Higher rejection rates for finance requests by SMEs and women-owned firms

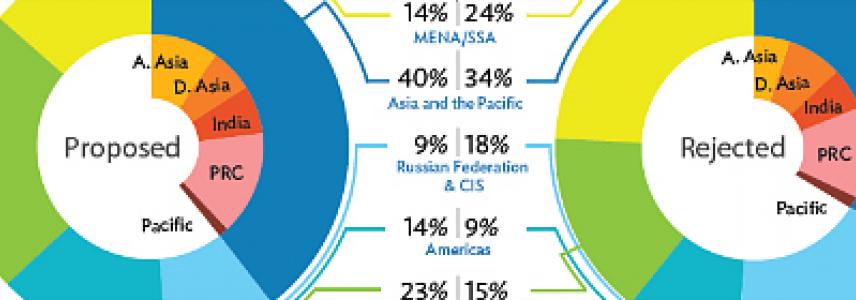

A 2016 Trade finance survey shows that SMEs and women-owned firms face higher than average rejection rates.

For the third year in a row, CBI partnered with the Asian Development Bank (ADB) to survey the gaps in SME trade finance. The survey quantifies market gaps for trade finance and explores their impact on economic growth and job creation. The results help policy makers and financial institutions to improve their services to SMEs.

Key findings

- The estimated global trade finance gap is $1.6 trillion.

- 56% of SME trade finance proposals are rejected, while large corporates face rejection rates of 34% and multinational corporations are rejected only 10% of the time.

- Firms report that 25% more trade finance would enable them to hire 20% more people.

- Woman-owned firms face higher than average rejection rates.

- 70% of surveyed firms are unfamiliar with digital finance, uptake rates highest in peer-to-peer lending.

You can download the ADB Brief '2016 Trade Finance Gaps, Growth, and Jobs Survey' at the ADB website.