Entering the European market for baby wear

Some of the world’s most interesting apparel markets are in Europe. However, setting up a business relationship with a European buyer can be challenging. You will need to investigate the various European markets and sales channels and set realistic goals, so that you can measure your performance and success.

Contents of this page

1. What requirements must baby wear comply with to be allowed on the European market?

There are several requirements that you need to comply with when exporting babywear to Europe. Some are mandatory (both legal and non-legal). Others are voluntary, but meeting them can give you a competitive advantage. Some requirements only apply to certain niches in the babywear market.

Mandatory requirements

There are several legal requirements for exporting babywear to Europe, including those concerning product safety, the use of chemicals (REACH), quality, and labelling. Check the EU Access2Markets online help desk for an overview. Additionally, buyers may create non-negotiable terms and conditions for their suppliers to comply with. Although meeting these requirements is not required by law, they are still mandatory.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Product safety. Make sure that your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Safety requirements for babywear. Pay special attention to the EU’s standard for the safety of babywear. This standard contains requirements to ensure that cords and drawstrings are placed safely on apparel for children up to 14 years.

- Use of chemicals. Make sure that you comply with the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain azo dyes, flame retardants, waterproofing and stain-repelling chemicals, and nickel.

- Use of restricted substances. Ask your buyer if they use a Restricted Substances List (RSL). These are often inspired by the guideline on safe chemicals use of the Zero Discharge of Hazardous Chemicals (ZDHC) Foundation. Download the ZDHC Conformance Guidance here.

- Labelling. Specify the material content of every item that you export to the EU, in accordance with EU Regulation 1007/2011. Check the EU Access2Markets online help desk for more information on how to do this.

- Intellectual property. Do not violate any intellectual property (IP) rights and do not copy designs from or share designs with other buyers. If your buyer supplied the design, they will be liable in case the item is found to violate a property right.

Tips:

- Read the CBI study on buyer requirements for more information on the requirements you need to comply with before you can export babywear to the EU.

- Familiarise yourself with the complete list of chemicals restricted by REACH. For more background information on the characteristics of all types of chemicals, check the freely accessible Chemexper database.

- Check the Q&A section on the website of the European Chemicals Agency for answers to the most common questions about REACH and the use of chemicals in apparel, accessories and trims.

- Check Inditex’s Restricted Substances List to get an idea of the specific requirements buyers can have.

- Check the EU’s 2019 Guidance Document for extra information on safety requirements for babywear and babywear.

Non-legal mandatory requirements

In addition to the legal requirements mentioned above, you may be required to comply with non-negotiable terms and conditions that buyers have created for their suppliers. Such requirements are not required by law, but they are still mandatory.

Certifications

Many buyers in Europe are increasing their requirements for sustainable production and social responsibility. Especially the use of organic cotton in babywear is a popular requirement. This trend was once started by C&A and has inspired many other European brands. Buyers will also ask you to open your factory doors for them, so they can conduct personal inspections of your factory. Additionally, you may be requested to comply with the following independent standards.

- Regarding harmful substances and organic production, European buyers may request standards such as the Standard 100 by Oekotex®, EU Ecolabel, BCI (Better Cotton Initiative), GOTS (Global Organic Textile Standard) or Bluesign®.

- Regarding social compliance, Amfori BSCI (Business Social Compliance Initiative) is the most popular (and often only) certification that European buyers will require. Other popular social standards are WRAP, SEDEX, ETI, SA8000, ISO 26000, FWF and Fair Trade.

A particular new focus for European brands and retailers is the shift to a “circular economy”. With its new Green Deal, the EU is targeting the reuse, repair, remanufacturing, and recycling of consumer products in Europe, including apparel. This means that manufacturers should train their design teams to develop new styles that are durable and easy to reuse, repair, refurbish, repurpose, or recycle. Ideally, manufacturers should play a significant role in remanufacturing, refurbishing, and repairing babywear that has reached the end of its life cycle. If you want to increase the amount of recycled content in your styles, check out the following certifications:

- The Recycled Claim Standard (RCS) tracks recycled raw materials through the supply chain using the chain of custody requirements of the Content Claim Standard.

- The Global Recycled Standard (GRS) is a product standard that incorporates recycled material verification, including social and environmental responsibility criteria, as well as chemical management.

Supply chain transparency is another increasingly popular topic in the European apparel industry. Many companies have already published the names of their suppliers in the Open Apparel Registry. Fashion Revolution rates European brands in a transparency index. Information on how to comply with transparency requirements can also be found on the websites of the Clean Clothes Campaign and Human Rights Watch.

Reducing your carbon footprint also has a high priority within the European Union. It is therefore important that you start to measure the carbon footprint within the entire supply chain and not only your own factory. This will make you a more attractive supplier to European brands and retailers. It will also qualify you for a custom duty exemption in the near future, as the EU is planning to introduce a carbon levy for imported goods.

Other sustainability requirements may be:

- use of fabrics blended with eco-friendly fibres, such as hemp; regenerated fibres such as Tencel®, Modal® and Refibra™ (by yarn manufacturer Lenzing); or other sustainable fibres such as Recover, REPREVE or Infinited Fiber, or even with innovative bio-based polymer fibres such as polylactic acid (PLA), milk, seaweed and soy;

- saving water during production by dyeing fabrics with new techniques (using CO2 instead of water), such as Dyecoo;

- fabrics dyed with only natural ingredients such as Rubia, Fibre Bio or Greendyes or dyestuffs made from recycled materials such as Recycrom.

Tips:

- Check the CBI study The sustainable transition in apparel and home textiles for a complete overview of sustainability requirements and solutions for apparel manufacturers. For detailed info on opportunities and requirements for sustainable cotton, read the CBI study Exporting sustainable cotton to Europe.

- For a better understanding of new EU regulations regarding sustainable production, read the CBI study The EU Green Deal – How will it impact my business? or watch this short video on YouTube about the EU’s textile strategy.

- Provide buyers with as much information on your product as possible. The more information you can give about the origin of your materials, the better.

Garment care preferences

When selecting base materials for babywear, go for easy-to-care-for fabrics that can be machine washed at high temperatures (40° minimum) without the risk of shrinkage or fading. This is one of the reasons for the widespread use of cotton in babywear.

Packaging requirements

In most cases, your buyer will give you instructions on how to package the order, in a manual. If you agree with your buyer that they will clear customs in the country of import (which is the norm), it is their responsibility to ensure the instructions comply with EU import procedures. Your buyer will also appreciate any efforts you make to reduce the environmental impact (and financial cost) of the use of packaging materials.

Payment terms

For a first-time order, European buyers may agree with a down payment (for instance, 30%). They will pay the rest (70%) after the order has been completed. The safest payment method for you as a manufacturer is the LC (Letter of Credit). An LC obligates a buyer’s bank to pay the supplier when both parties meet the conditions they have agreed upon. However, many buyers no longer favour LC payments, as this will block their cash flow. Be aware that LCs do not offer financial protection against bankruptcies!

For any further orders, most European buyers will ask for a TT (Telegraphic Transfer) after 30, 60, 90 or sometimes even 120 days. This means you as a manufacturer finish production and hand over the shipment to the buyer, including the original documents, before payment is due. The payment will be made after the number of days that you have agreed on with the buyer. This is a risky payment agreement because you are taking the full financial risk.

Tip:

- COVID-19 has shown the negative impact of extended payment conditions for manufacturers. It is advisable to negotiate a down payment on every order and a balance payment before handover. This reduces the risk of a cancellation due to a lockdown.

The buyer manual

When you do business with a European buyer for the first time, they will typically give you a contract and/or a manual to sign. By signing the contract, you confirm that you will comply with all the listed requirements. This means you will be held accountable in case of a problem after the delivery of an order. Especially complying with REACH can be challenging. With small orders, most European buyers will not ask for expensive testing, but if illegal chemicals are discovered after delivery, you will bear all expenses involved.

Acceptable quality limit

To guarantee product quality, your buyer may set an acceptable quality limit (AQL) for you. This refers to the worst quality level that is still tolerable. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the whole order quantity over several production runs is defective.

Tips:

- Read the CBI study on buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements you will face as an exporter of babywear to Europe.

- Check the EU Access2Markets online help desk for an overview of all legal requirements set for your product. Here, you can identify your product code to get a list of applicable requirements.

- Check the freely accessible CSR Risk Check database to discover the social and environmental risks associated with apparel production in your country and ways to manage them.

- Do not take financial risks with new buyers. Insure your orders via an insurance company or insist on a Letter of Credit.

What additional requirements do buyers often have?

European buyers are looking for manufacturers that offer low minimal order quantities (MOQs) and flexibility and can deliver multiple product variations, including detailed designs and special decorations. Still, prices for babywear are far below those of adult styles. This means that you need to have a highly efficient manufacturing setup to comply with the buyers’ expectations and still make a profit.

Product design and development

European buyers are always looking for special designs, materials or production methods that will help them stand out in the market. Features that are highly appreciated by European buyers of babywear are:

- the use of chemical-free, hypoallergenic, sustainable materials;

- ease of washing (at high temperatures);

- resistance to staining during wear;

- colourful coatings and prints, preferably using sustainable techniques;

- highly comfortable fabrics (jersey).

Printing

Prints are highly popular in babywear. There are different printing techniques: lithography (using printing plates and rollers on fabric); digital printing (inkjet and laser, allows for small production runs); and screen printing (transferring images onto fabric or garments using a fine material or mesh/film. Printing can be outsourced, but having your own printing and embroidery machines increases your flexibility.

Communication

Smooth communication is an implicit requirement of all buyers. Always reply to every email within 24 hours, even if it is just to confirm that you have received the email and will send a more complete reply later. If you have a problem with a production order, immediately notify the customer and try to offer a solution. Another good tip is to create a T&A (time and arrival) for every order and share it with your buyer. This file will help you to manage expectations and monitor progress and is the best guarantee of on-time delivery.

Tip:

- Be proactive and prompt in your communication. Provide short updates to your buyer via text, photo or video, using WeChat, WhatsApp or Signal. To make free video calls, try Skype or Google Meet. Register all confirmations to prevent any unclarity in a later stage.

Flexibility

If you want to start a business relationship with a European buyer, be prepared to accept complicated orders first. Buyers will want to test your factory before giving you large, easy orders. Make sure at the start that a buyer will not continue to place only difficult orders with you and convenient orders elsewhere.

Expect a European buyer to require in their first order:

- High material quality and impeccable workmanship;

- Order quantities below your normal minimum order quantity (MOQ);

- A price level that is lower than you would normally accept for small-quantity orders.

Niche requirements

The following niche categories offer opportunities for babywear manufacturers. The required qualities, styles and quantities may differ from mainstream production.

Sustainable babywear

Ever more European babywear brands and retailers are using sustainable materials in their collections. For instance, check out Swedish brand Polarn O. Pyret or C&A. Buyers may focus on organic natural materials such as organic cotton or merino wool or bamboo, bio-degradable plastics and recycled fabrics such as regenerated nylon or polyester.

Second hand

The second-hand market is growing fast in Europe, and many brands and retailers are trying to benefit. Many incentivise end consumers to return used garments by offering them discounts on future purchases. The second-hand products are then cleaned, repaired and re-sold. Check SELLPY, for instance, initiated by H&M, or Zircle, by online multi-brand platform Zalando. Brands will appreciate your efforts to develop styles that can easily be cleaned, repaired (using stock fabrics and trims) or disassembled.

Folk style

Cultural heritage is increasingly influencing babywear. Showing cultural symbols or ethnic designs is highly appreciated in the EU market. This may require a sensitivity for the history and cultural context of certain symbols and designs.

All-natural

The all-natural look does not only refer to the use of natural materials and basic styles but also to the overall sustainability of a piece of babywear. Using organic materials and eco-dyes often results in a relatively understated design. Combined with a truly transparent supply chain, this leads to styles that can truly be called all-natural.

Licensed graphics

Many babywear collections in the lower-end market segments feature licensed graphics and characters from popular cartoons, books or brands, such as Mickey Mouse or NASA. Such designs may only be used with permission from the copyright holder.

Figure 1: Understated designs made with sustainable materials are a growing niche

Photo by Dakota Corbin on Unsplash

2. Through what channels can you get babywear on the European market?

Before you start to approach European babywear buyers, you need to determine what market segment fits your company best and through what channel(s) you want to sell your product.

How is the end market segmented?

European babywear buyers can best be classified by price/quality level.

Table 1: Babywear market segmentation

| Consumer type | Price level | Fashionability | Material use | Order quantities |

Luxury consumer

| Very high retail prices | Highly fashionable, “adult”, unique designs | Luxury materials | Low order quantities |

Fashion-conscious consumer

| High retail prices | Styles in line with latest trends | High-quality, sometimes organic materials | Low to medium order quantities |

Practical consumer

| Medium retail prices | Practical, fashion-conscious designs | Medium-quality, sometimes organic materials | High order quantities |

Price-conscious consumer

| Low or extremely low retail prices | Basic and functional styles, use of licensed graphics | Medium to low-quality materials | High order quantities |

Luxury consumers

High fashion consumers shop at luxury brands and retailers such as Galeries Lafayette and high-fashion brands such as Versace and Emilio Pucci. These consumers expect their babywear to represent a strong brand image and the latest fashion trends. Babywear brands in the luxury market require top-quality materials and manufacturing, the latest technical innovations and highly comfortable designs. This market is growing.

Fashion-conscious consumers

In the middle market, lifestyle brands such as La Coste and Scotch & Soda sell collections created around a brand image with fashionable and comfortable designs. These brands offer a good-quality product for a mid to high-level price. Products must have the technical look of a high-end product, but retail prices are substantially lower. This segment is under pressure.

The middle market: practical consumers

Practical consumers shop in the middle market. Here, you will find brands and retailers such as Mango and WE selling functional and fashionable items. The focus is on safety, washability, durability, fit and medium-quality materials. Buyers will sometimes require organic fabrics. Order quantities are high, retail prices low to medium. This segment is under pressure.

Price-conscious consumers

The budget market includes companies such as Primark and H&M, which cater to the price-conscious babywear consumers. Design and technical innovation are less important, but the item needs to give the impression that it is fit for its purpose and in line with the latest fashion trends. Prices are low and competition is heavy in this market segment, with regard to both retail and manufacturing. This market is growing.

Tips:

- Research your target market and buyer. Your added value lies in flexibility.

- Focus on working with stock fabric manufacturers that will enable you to deliver any MOQ requested.

- Build a database of international fabric suppliers that manufacture sustainable materials.

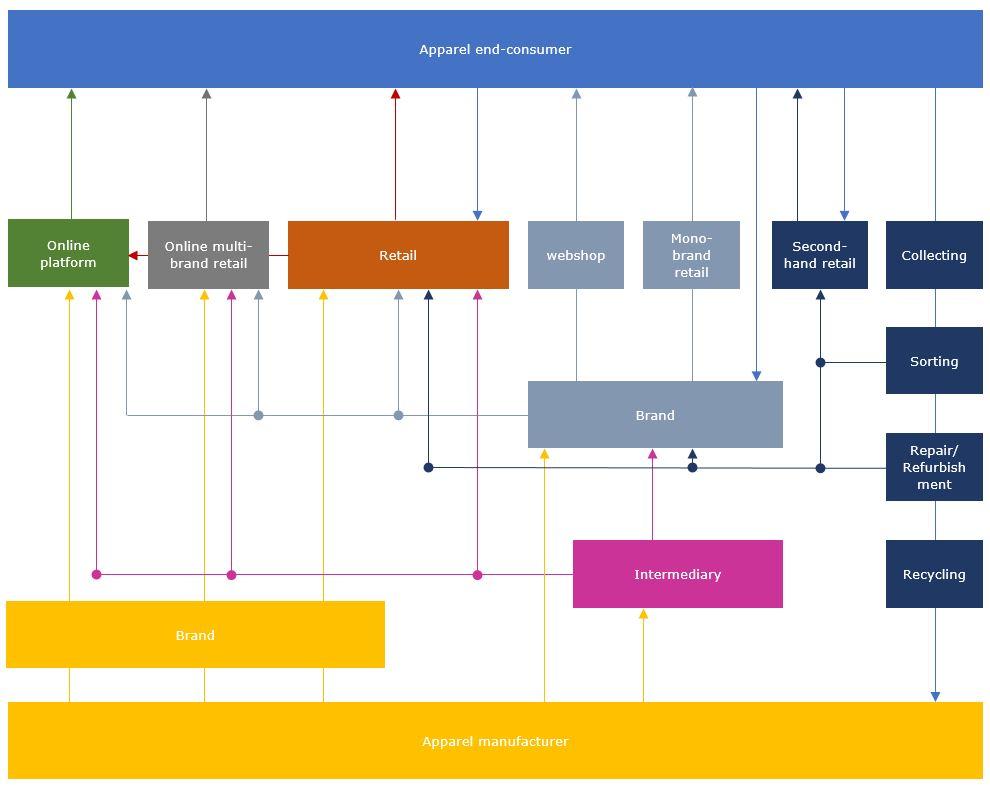

Through what channels does the product end up on the end market?

Their place up the value chain determines how buyers will do business with you. Each buyer requires a specific approach. Always try to find out in what part of the value chain your buyer is operating, what challenges they face in the market and how you can contribute to their sales strategy.

- If you want to target European end consumers, try selling via platforms such as Alibaba, Wish, Amazon or Wolf & Badger for independent brands. Most online consumers can be found in countries in Europe’s northwest. You will need to invest in a web shop, stock, order management and customer service. Your biggest challenges will be return policies and a lack of brand awareness.

- The growing second-hand market in Europe is serviced by online platforms such as vestiairecollective.com, vinted.com, depop.com or national websites such as marktplaats.nl (the Netherlands).Online multi-brand retailers such as Zalando, Nickis and Wehkamp sell existing babywear brands and develop their own private collections. They can detect market interest very fast and will immediately react upon sales data. Usually, such companies will place a small test order first. If the item is selling well, they will place the actual production order. Fast delivery is a must.

- Most European retail chains, department stores and supermarkets sell both adult and babywear. Especially in Northern EU countries, babywear is mostly part of a total concept servicing children, men and women. Notable exceptions are Polarn O. Pyret, Le Petit Bateau and jacadi.

- Babywear brands develop their collections 6-12 months in advance. You will need a large sample room, as brands require salesman samples (SMS) of each collection style. Every sample needs to be current: meaning it must look exactly like the product will in the shop, with branded hangtags and accessories. It may take many months before orders are placed.

- Intermediaries such as agents, distributors, traders, importers and private label companies will sell your product on to buyers up the value chain. They are price focused and require flexibility in quantities and qualities. Some are located near or in the production countries and primarily do sourcing and logistics, such as Li & Fung. Others, such as HVEG Fashion Group and Jolo, work from Europe and also do market research and design. Their service level determines the commission rate they charge.

Tips:

- Find potential buyers on the exhibitor lists of trade fairs for babywear such as INDX Kidswear (UK), Kind und Jugend (Germany) or Pitti Imagine Bimbo (Italy). For an overview of trade fairs, check TradeFairDates.

- If you plan to meet a buyer or potential buyer at a trade fair, check what collections they have and prepare matching or even improved samples. Also, work out the costing before you introduce your company and your samples to a potential buyer.

- Be on top of new technical developments in the market. Be an advisor as well as a producer to create advantages over the competition.

Figure 2: Apparel market value chain

What is the most interesting channel for you?

As you move higher up the value chain, your margin will increase, but so will the service level that your buyer will require from you. When you have little experience with exporting to Europe, intermediaries and brands are likely the best starting point for you.

Intermediaries

Agents or traders/importers/private label companies are the most adventurous type of buyer and are usually the first to investigate new sourcing destinations (from their perspective) and factories. By working for this type of buyer, you will have access to many different buyers up the value chain, and you can learn how to service them by following their instructions.

Brands

For many European fashion brands, babywear is part of their concept. Others specialise in babywear. There is usually more room for price negotiation with brands (especially in the higher market segments), but your service level also needs to be higher than intermediaries require from you. Make sure you can provide low MOQs and offer flexibility.

Retail

Most large European fashion retailers are used to doing business with manufacturers in developing countries. It can be very difficult to start a business relationship if you do not comply with all mandatory requirements. Besides delivering a good-quality product for a competitive price, your service level needs to be very high. Retailers may lack professional expertise on babywear, so advice on product quality and development is highly appreciated.

If you can adjust your supply chain to handle circular strategies such as refurbishment or repair of second-hand babywear, you might be able to tap into the growing second-hand market in Europe for apparel. This market is serviced by online platforms such as vestiairecollective.com, vinted.com, depop.com or national websites such as marktplaats.nl (the Netherlands).

Tips:

- If you are not sure which intermediary is right for you, consider using an “agent for agents”, such as Anton Dell.

- Otherwise, try to find intermediaries specialised in babywear by using an online search engine. Use keywords such as “full service”, “garment”, “agent”, “distributor” or “babywear” plus “solution”. Trader’s websites usually show the brands they are working with.

- Be on top of new technical developments in the market. Be an advisor as well as a producer to create advantages over the competition.

3. What competition do you face on the European babywear market?

Babywear is manufactured worldwide, so you will likely face stiff competition in this market. The most important ways to create a competitive advantage over manufacturers in other countries are: technical knowledge, service level, flexibility, efficiency and beneficial trade agreements.

Which countries are you competing with?

Table 2: Competing countries

| Country | Strengths | Challenges |

| China | Technical innovation, high quality, high efficiency, excellent customer service, flexible MOQs and the local availability of yarns and trims. | Increasing labour, transport and production costs, human rights concerns and no General Scheme of Preferences (GSP) that removes import duties to the EU. |

| Bangladesh | High-volume production, low production costs and a competitive price level. Bangladesh benefits from the GSP. | Less flexibility than in China. Although yarns are increasingly spun locally, Bangladesh still imports many materials. |

India

| Highly flexible on quality, MOQ and design. India grows its own cotton and has a large industry of yarn and fabric making (knitting and weaving). | Human rights concerns in cotton, yarn and fabric production. Dye houses may not comply with EU standards. |

| Turkey | Close to Europe, which results in very short lead times. The country produces high-quality apparel in small quantities, and it has a European business culture. Turkish manufacturers will accept payment in euros. | Turkish prices are relatively high compared to Asia. Unauthorised sub-contracting may occur. |

| Sri Lanka | Skilled labour force, relatively low production costs and efficient, compliant factories. Focused on higher added value products and benefits from GSP+. | Increasing production costs and lack of locally produced fabrics. |

| Cambodia | Cambodia supplies good-quality products at a competitive price level. Many factories in Cambodia have been set up by foreign investors, which also supply their expertise. | An inexperienced and relatively small workforce works against Cambodia. Social compliance concerns and political repression caused Cambodia to lose its duty-free GSP status in 2020. |

Tips:

- Study the countries you are competing with, compare their strengths and weaknesses to yours and advertise the competitive advantages of doing business with you. Besides the GSP, consider factors such as distance to Europe, ease of doing business and transparency.

- Check the freely accessible CSR Risk Check database to discover the social and environmental risks associated with apparel production in different countries, including your own. Use this information to mitigate risks and to advertise the advantages of sourcing from your country.

- Check if and how other countries benefit from the Generalised Scheme of Preferences on the EU’s website on international trade.

- Most online search engines will let you create a news alert on a topic, so you can automatically follow the latest developments in the apparel industry in a specific country.

Which companies are you competing with?

Its sales office in Leeds (UK) gives Vogue sourcing from India the advantage of being close to its buyers, so it can offer localised service and support. Vogue sourcing is a sourcing organisation that offers buyers a vertical setup including dyeing, knitting, weaving, printing, product development and design.

Jiangsu Guotai Huasheng Industrial Co., Ltd. from China has 7 production units in China and 4 overseas (in Myanmar and Cambodia) and is 1 of the largest Chinese exporters of apparel. As part of a large group, Jiangsu Guotai is vertically integrated, producing its own yarn, fabric and trims. The company offers design and a sample-making centre for fast turnaround of prototypes. It also has sales offices in European countries such as the UK, France and Spain.

Finefine clothing is a manufacturer of babywear based in China. The company uses GOTS-certified organic cotton fabrics and offers product development, design and manufacturing of many different styles, including children’s topwear and outerwear.

Tips:

- Check the free online database Open Apparel Registry. This website lets you look up the suppliers of hundreds of European brands, including babywear brands.

- Read the CBI study 10 Tips for Doing Business with European Buyers to learn how to approach and engage with buyers. This report also describes how you can get practical help with understanding European business culture, analysing your USPs and doing business with European buyers.

Which products are you competing with?

The babywear category is expected to grow in the coming years thanks to a growing European population and the increasing purchasing power of Europeans. For babywear, there is little competition from other product categories.

Adult fashion

Babywear designs may copy those of adult collections. One particular trend in which this is very obvious is called ”mini-me”: parents and their children wearing identical or similar styles. If you are a manufacturer of babywear, you could experiment with developing adult styles that copy children’s styles and market both styles as a package. This may also open doors to other (adult) buying departments at the same company.

4. What are the prices for babywear?

The price of your product, in fashion jargon often indicated as the free on board (FOB) price, is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin.

The challenge with babywear is that, although the average fabric consumption is less than for adult wear, the designs are often more complicated, order quantities are lower and so is the average FOB-price level. This makes it a challenge to keep production efficiency high and make a profit.

The following figure shows the average cost breakdown of a typical FOB price:

Note that these percentages may vary per factory and per order. Some factories accept lower profit margins during off-season periods or when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of the materials. Efficiency goes up and material prices go down when producing large volume orders.

Retail pricing

The retail price of a babywear item is 4 to 8 times the FOB price on average, which is called retail markup. It follows that the FOB price is 12.5%–25% of the retail price of the product on average. Exceptions do exist. Retailers mark the FOB price up 4 to 8 times because they need to account for import duties, transport, rent, marketing, overhead, stock keeping, markdowns and VAT (15%–27% in EU countries), among other costs.

According to Eurostat’s 2020 comparison of retail prices for apparel, France has the highest price level of the top six European importers of apparel and footwear at 107.6 points compared to the European average of 100, followed by the Netherlands (106.1), Italy (101), Germany (98.2), and Spain (92.2). The UK, which is now out of the EU, had a score of 90.7 in 2019. Note that brands and retailers that sell in multiple European countries usually keep prices equal or deviate only slightly from the standard retail price.

Online commerce and a strong budget segment have made consumers in Europe accustomed to low prices. However, an increased focus on sustainability and rising costs for materials and production (due to the global COVID-19 pandemic and political instability) as well as shipping have put manufacturers, suppliers and buyers under enormous price pressure. In the first quarter of 2022, this resulted in sharply rising European retail prices for many consumer goods.

This study was carried out on behalf of CBI by Frans Tilstra and Giovanni Beatrice for FT Journalistiek.

Please review our market information disclaimer.

Search

Enter search terms to find market research