Which trends offer opportunities or pose threats in the European apparel market?

Change means opportunity, if you act upon it. This is especially true for the apparel industry, which is built on change. It follows, interprets and creates new trends. To learn how you can use global trends to your advantage, it is important to find the right response to several key factors: legislation, technical innovation, environmental and social sustainability, market requirements and new business models. This report will tell you how.

Contents of this page

- Short-term trend: uncertainty in the European apparel market

- Become a value chain partner, not just a supplier

- European end consumers shop increasingly online and demand full transparency

- Adapt to geopolitical instability and economic uncertainty

- Make both your production and your product more sustainable

- Stay informed on geopolitical issues

- The European population in 10 years: older and more diverse

- Technology will make apparel production and sales more efficient

1. Short-term trend: uncertainty in the European apparel market

The European economy grew slowly in 2023 but showed signs of recovery in the first quarter of 2024, according to the EU’s latest forecast (spring 2024). Inflation rates have gone down in 2024, but the influence of high inflation in 2022 and 2023 is still felt by European consumers. If living costs increase in 2025, consumers may cut spending on apparel. Apparel companies will need to balance rising production costs (due to energy prices and regulations) with consumer sensitivity to price.

The long-term future of the European apparel market

The apparel industry has seen many changes. In the 1970s production moved away from Europe to Asia, where labour costs were low. In the 1980s the focus shifted to speed-to-market and production grew in countries closer to Europe. Since the year 2000, certification for fair and sustainable production has become more popular thanks to consumer pressure. In the 2010s, governments realised that more was needed to make the apparel industry futureproof and this needed to be done in the form of legislation. Now, in the 2020s, Artificial Intelligence (AI) promises to take the industry into the ‘5th industrial revolution.’

To remain competitive in an apparel industry with increasing production costs, it is crucial for production processes to embrace automation. The future of the apparel manufacturing industry lies in the establishment of intelligent, circular, fully automated manufacturing units that operate in compliance with European social and environmental laws. These units will be guided by market data and respond to on-demand developments. Input materials will be based on market waste streams to minimise environmental cost.

Help your buyers to comply with sustainability requirements

Sustainability is not a choice. Many social and environmental sustainability requirements have become law and if you do not comply, you cannot export apparel to Europe. At the same time, sustainability is a moving target. A lot of responsibility is still left in the hands of individual companies. Some buyers focus primarily on supply chain transparency and minimising their carbon footprint. Others invest mainly in working conditions and circularity. Some companies try to do it all. Select your customers wisely in line with your sustainable strategy.

New legal requirements

For the EU, a fully transparent circular economy is its core strategy to minimise the negative impacts of the apparel industry. The goal is a closed-loop system in which textiles and fibres retain their value for as long as possible and waste is minimised. This requires recycling, refurbishing, re-using and rethinking the lifecycle of apparel. The ideal system has minimal impact on the environment, is fully transparent, avoids the use of non-renewable inputs and guarantees respect for workers’ rights, including a living wage.

Mandatory sustainability requirements have been getting stricter since decades, but lately the EU and national governments have increased the speed and scope of new and revised laws. These concern product safety, the use of chemicals (REACH) labelling and intellectual property rights. New import regulations concern topics such as Due Diligence (CSDD), Corporate Sustainability Reporting (CSRD), reducing carbon emissions (CBAM), anti-deforestation (for leather), Extended Producer Responsibility, the right to repair for end-consumers, the (intentional) use of microplastics and ‘greenwashing’.

Note that some of these new laws still apply only to bigger companies (CSDDD and CSRD). Some do not yet apply to textiles (CBAM for carbon emissions). The new legislation on microplastics does not yet apply to the shedding of microplastics from apparel made with synthetic fibres. The general direction is clear, however. The EU and national governments want to tighten control on the entire value chain: from production to use and end-of-life. EU companies must comply and as their supplier, so must you.

Table 1: Opportunities for reducing social and environmental impact in each step of the apparel value chain

| Value chain step | Social impact | Environmental impact |

| Raw material production | Respecting local labour laws Eradicating forced, bonded or involuntary labour Not letting factors such as race, caste, national origin, religion, age, disability, gender, sexual orientation, marital status, union membership or political affiliation play a role in the recruitment, payment or promotion of employees Respecting the legal standard working week, fair payment for overtime Paying the legal minimum wage, working towards living wage Banning child labour Providing a safe and healthy working environment | Organic/regenerative production Energy efficiency and renewable sources Water efficiency and renewable sources Biobased materials Animal welfare Recycling |

| Spinning, weaving or knitting | Energy efficiency and renewable sources Recycling post-production waste | |

| Dying, bleaching and finishing | Reducing chemical inputs Use of eco bleach and dyestuffs Wastewater treatment Reducing air emissions | |

| Design | Design for durability Design for circularity | |

| Ready-made garment production | Energy efficiency and renewable sources (solar, wind, biogas) Recycling post-production waste | |

| Packing and transport | Biobased, recycled materials Material efficiency: reducing packaging Renewable energy use | |

| Data collection and reporting | Transparency Digitisation Measuring and sharing impact data (third-party) certification | Transparency and traceability Digitisation Measuring and sharing impact data True pricing (third-party) certification |

Tips:

- Read the CBI study on Buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements you will face as an exporter of denim to Europe.

- Read the CBI studies on Sustainable Cotton, Recycled Fashion, the Sustainable Transition in apparel and home textiles, 10 tips to measure and reduce your carbon footprint and 9 tips on responsible chemical management in the apparel sector for more information on sustainable apparel production.

- The CBI studies Tips on how to go green and Tips on how to become more socially responsible provide practical guidance to prepare yourself for (future) sustainability legislation by making your factory more fair and sustainable

2. Become a value chain partner, not just a supplier

With the EU’s efforts to shift away from the traditional ‘take-make-waste’ model and move towards a circular economy, your traditional role as a supplier will change beyond recognition. Today, the apparel industry is still almost entirely based on the linear ‘take-make-waste’ model. Manufacturers use non-renewable resources and cheap labour to produce fashionable apparel items that are sold to brands and burned or landfilled after use. After you have produced the order, you will never see the product again.

That will change. The EU and European apparel companies want to gain control over every aspect of production (including the raw materials you source) and over the end-of-life phase. This means you need to make efforts to gain understanding about how your suppliers have produced the raw materials. It also means that European apparel brands and retailers will be responsible for their products even after they have sold it. They will become (your) supplier of raw materials, in the form of post-consumer waste. A truly circular loop.

The EU is considering the introduction of an EU-wide EPR for apparel (extended producer responsibility). Some European countries including France and the Netherlands have already implemented national EPR schemes. EPR places the responsibility for managing the environmental impact of a product on the importer of that product, rather than the consumer or the government. The aim is to incentivise producers to design products that are more environmentally friendly, to promote recycling and reuse, and to reduce the environmental impact of apparel items.

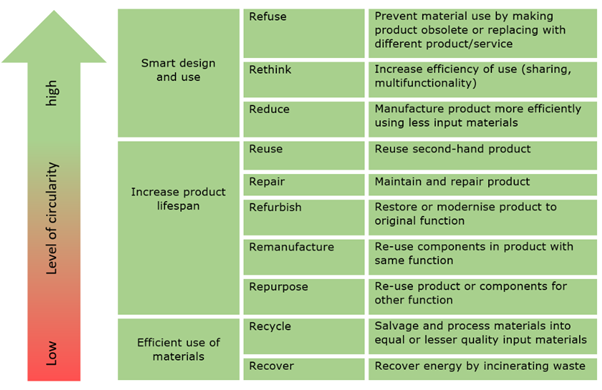

Figure 1: The R-ladder of circularity

Source: FT Journalistiek

The shift towards a circular economy offers opportunities for manufacturers that can:

- Minimise waste during production. Invest in automated systems for cutting patterns and improve the efficiency of material use. Non-avoidable cutting waste should be repurposed by choosing strategies high up the R-ladder of circularity (see above);

- Design styles that are durable and easy to reuse, repair, refurbish, repurpose or recycle. Ideally, manufacturers play a role in remanufacturing, refurbishing and repairing end-of-life apparel. For practical tips on how to do this, check the Circular Fashion Design Guide by the Ellen McArthur Foundation;

- Take responsibility of post-consumer textiles by offering buyers the option of returning their product for circular purposes such as recycling into new lint and fibres. An option higher up the R-ladder is servicing buyers with the possibility to remanufacture, refurbish or repair used items;

- Collaborate with European brands on a leasing model. Instead of selling products, end consumers are offered the possibility of leasing apparel items for a periodic fee. This means ownership of the product remains in the hands of the manufacturer, brand or retailer, who can collect the items for recycling, remanufacturing, refurbishment, repairing or reuse. This model has been pioneered by workwear manufacturers and fashion brands such as MUD Jeans;

- Offer made-to-measure for the mass market. Offering buyers stock service in fabrics and trims reduces mismatches and unsold collections and increases speed-to-market. This principle is based on manufacturing according to market demand.

Tips:

- For inspiration on circular business models, check out consumer brands MUD Jeans (leasing and reusing, recycling jeans), NUDIE (refurbishing, repairing, recycling, re-using), and Eileen Fisher (refurbishing, re-using.

- To evade the responsibilities of EPR schemes, European buyers might ask you to deliver ‘DDP’ (Delivery Duty Paid) instead of FOB. This is very risky, as you will become responsible for import into Europe. Thus you are considered the ‘producer’ in ‘Extended Producer Responsibility’. Avoid this responsibility.

- Find out what recycling companies can do for you. Machine builder Andritz designs and delivers complete textile recycling set-ups. Recycling companies such as SOEX, Recover or Wolkat provide solutions for collecting, sorting and recycling services for many European brands. Use an online search engine to find recycling solution providers in your market. Type in ‘textile’ + ‘recycling’ + ‘solution’.

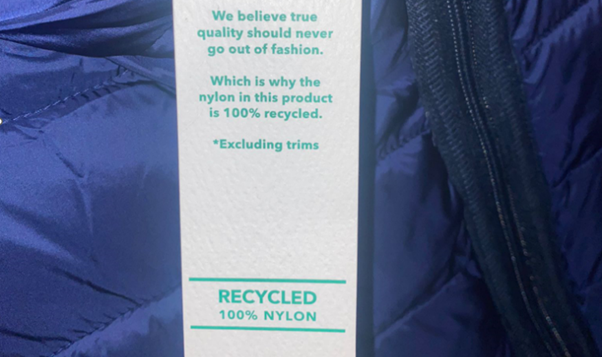

Figure 2: The shift towards apparel made from recycled materials is one of the most important trends in Europe

Source: Forward in Fashion

3. European end consumers shop increasingly online and demand full transparency

The European online apparel market is projected to grow at a compound annual growth rate (CAGR) of around 10%, with the total market size reaching approximately $180 billion by 2027. Online shopping has made European consumers used to maximum choice in styles, competitive prices, superfast delivery and full disclosure about product quality and production. Use storytelling to create an emotional connection with consumers, differentiate your brand, and drive purchasing decisions. Be aware however that all stories need to be substantiated by verifiable facts.

Transparency

Help your buyers to offer full transparency to European end consumers. Lack of regulation in the apparel industry has allowed products to be marketed as green without sufficient proof. This is starting to change because consumers no longer tolerate this (nor does the EU). Sustainability goals in the coming years will need to be objective and measurable. Brands and retailers should set goals and provide full disclosure about results, both good and bad.

Third-generation fast fashion

While the EU and European national governments are trying to force apparel brands and retailers to provide full transparency, a ‘third generation’ of fast fashion-companies including Shein and Temu have captured a large audience in Europe and the US with ultra-cheap fashion. These companies sell styles via smartphone apps at ultra-low prices and offer a customer experience driven by gamification, micro-incentives and social media. The challenge for these companies is to comply to increasingly strict European social and environmental laws.

Second-hand apparel

Simultaneously, the market for second-hand apparel is growing as well. According to Statista, the global market value of second-hand and resale apparel was estimated to be worth $197 billion in 2023 and projected to reach $300 billion in 2026. The second-hand market is serviced by established platforms such as Vestiaire Collective, Vinted or Depop. The resale market is serviced by brands and retailers including ASOS but also startups such as thredUP or Reflaunt. This development may negatively influence the sale of new apparel but offers opportunities for circular concepts (see above).

Tips:

- Try to expand your service with collection, cleaning and repairing/refurbishing of second-hand apparel (post-consumer waste).

- Try to expand the product lifecycle by designing products that are less influenced by season or trends (timeless designs) and by using high-quality, durable materials.

- Share your sustainable story. This will add value for you and your buyer.

4. Adapt to geopolitical instability and economic uncertainty

Many different developments influence EU buyers’ sourcing strategies: from geopolitical instability and the climate crisis to economic growth in Europe, inflation, trade policies, consumer behaviour and spending patterns. It is always wise to take into account big economic developments in your sales strategy. Europe is not the only interesting market. Economic developments might make it more beneficial to focus on local, regional or other international markets, such as Asia or the US.

The European economy recovered from a slow year in 2023, but growth rates are still below potential, noted the EU in its latest economic forecast (Spring 2024). According to McKinsey’s State of Fashion 2024 report, 62% of executives in its survey (conducted in September 2024), cite geopolitical instability as the biggest risk to growth in the fashion industry. Economic volatility is cited by 55% and inflation is mentioned by 51% (compared to 78% in 2023).

European end consumers are expected to spend less money on apparel, because of weakened economic growth and high inflation. Production costs may also rise due to rising cost for labour, fabrics and transport.

Tips:

- Focus on increased production flexibility and speed to market.

- Promote your country and sector so that sourcing managers know the benefits of doing business with it, adding it as a new sourcing destination.

- Seek collaboration with other local manufacturers to share costs and sales opportunities.

5. Make both your production and your product more sustainable

The apparel industry is one of the most environmentally harmful industries in the world, and its impact is clearly visible in polluted production areas. Meanwhile, end markets struggle with large amounts of apparel waste. Both buyers and manufacturers must re-evaluate and adjust their sourcing strategies. Manufacturers who can secure sustainable material sources and offer solutions for European buyers to meet new consumer demands and comply with EU-regulations have a competitive advantage.

Consider the following steps to reduce your environmental impact.

Source more sustainable materials

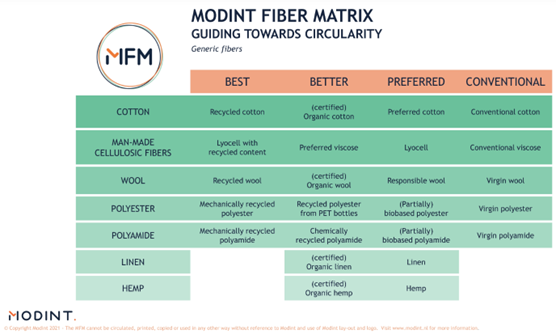

Apparel factories will need to reduce their environmental impact by using materials that are more environmentally friendly, such as organic cotton or recycled and biodegradable synthetic fibres. The growing demand for organic cotton and recycled polyester underpins this need. For both materials, demand outgrows supply, which can make it difficult to secure sources. Check Modint’s Fiber Matrix below for an overview of sustainable materials.

Figure 3: Modint’s overview of sustainable materials

Source: Modint Fiber Matrix

Make your production more environmentally friendly

Both your factory and your buyers will benefit if you reduce impacts and production costs. The most important measures include:

- Reducing the use of fossil fuels or ‘grey’ electricity by investing in energy-efficient machinery;

- Replacing environmentally harmful energy sources with renewable sources such as solar, wind or biogas;

- Reducing the use of fresh water by investing in more efficient wet processes and water treatment and recycling techniques;

- Reducing the use of chemicals by investing in more efficient wet processing;

- Replacing harmful chemicals with eco-friendly alternatives.

A crucial step in apparel manufacturing is measuring your carbon footprint. Several approaches exist for calculating the carbon footprint, including assessing the footprint of a factory, a product, or an entire supply chain. Numerous online tools are available to assist in this process. These tools provide convenient and user-friendly platforms to estimate and analyse environmental impact.

Commonly used online tools include:

- Carbon Footprint: This tool allows you to calculate the carbon footprint of various aspects, including personal emissions, business emissions, and travel emissions. It provides recommendations for reducing carbon footprint;

- Carbon Calculator by Carbon Trust: The Carbon Calculator helps individuals and organisations measure their carbon emissions across different sectors such as energy, waste, and travel. It offers guidance for carbon reduction strategies;

- GHG Protocol: The GHG Protocol provides a standardised methodology for measuring and managing greenhouse gas emissions. Their online tools and resources assist in calculating carbon footprints for companies, products, and supply chains;

- World Resources Institute (WRI) - CAIT Carbon Calculator: this tool enables users to estimate carbon emissions based on energy consumption, transportation, and industrial activities. It provides global data and allows for comparisons across countries and regions.

Tips:

- Read the CBI study ‘7 tips to go green’ and 10 tips on measuring and reducing your carbon footprint for background information and practical guidance to make your factory and your products more sustainable.

- Share your carbon reduction solutions with your supply chain shareholders so they can learn, implement and improve.

6. Stay informed on geopolitical issues

Political dynamics in production countries and in end markets have a big impact on the European apparel industry and buyers’ sourcing strategies. As an apparel manufacturer, you have little influence on political matters, but it is wise to stay informed and respond where you can.

Political dynamics in production countries

Europe’s largest supplier of apparel, China, is now outsourcing production itself. The main reason for this is that, in China, costs are increasing and the apparel workforce is declining. Growing Chinese domestic demand and allocation of capacity to domestic production is leading to a lack of capacity for exports, longer lead times, and higher prices. China is also increasing its focus on the production of more value-added products both within the apparel sector and in other sectors (for example electronics and machinery).

The 2023 State of Fashion report identifies low-labour cost manufacturing locations such as Bangladesh and Pakistan as countries that are likely to increase their share and take advantage of production that is moving away from China. With 65% of survey respondents (industry leaders) considering nearshoring to address supply chain challenges, the report predicts that suppliers from Türkiye, Eastern Europe and North Africa will benefit.

- Political tensions in production countries have direct effects on apparel export. Ethiopia lost its African Growth and Opportunity Act (AGOA) no tariff-deal with the US after civil unrest. The same happened to Cambodia, which also lost its trade deal with the EU. Myanmar still benefits from the General Scheme of Preferences (GSP) but is losing much business from European buyers due to political tensions.

- The Russian invasion of Ukraine has serious negative consequences for the global apparel industry and is still ongoing. The wars in Gaza and Lebanon between Israel and Hamas and Israel and Hezbollah have added to the disruption of global supply chains, with safety risks in the Red Sea on the rise. As a consequence, material and energy prices have risen and trade has been forced to re-route.

- Many European apparel buyers are investigating alternative production locations in Africa. Several countries have invested heavily in their apparel industry (notably Ethiopia) and for some categories Africa can be a good alternative to Asia (basics in Ethiopia, outerwear in Rwanda). Due to low productivity, a lack of local materials and political tensions, Africa has not yet established itself as a competitive alternative to Asia.

Legal measures in the EU

The EU is implementing new legislations to drive sustainable transformation within the industry. The following key legislations will shape the apparel industry:

- EU Green Deal: This initiative aims to achieve climate neutrality and foster a circular economy. It encompasses various policies and actions to promote sustainable practices across sectors.

- Extended Producer Responsibility (EPR, 2023): Recycling materials is even more important for European buyers because the EU is introducing new legal measures including a ‘right to repair’ and an EU-wide EPR scheme which makes companies responsible for the way their products are disposed of, recycled or repaired. Producers are required to develop systems for the collection, recycling, and disposal of garments. The Netherlands, France and Sweden have already introduced national EPRs.

- Corporate Sustainability Reporting Directive (CSRD, 2023): The CSRD imposes stricter reporting requirements on companies, including those in the apparel sector, regarding their environmental, social, and governance (ESG) performance. This directive aims to enhance transparency and accountability in corporate sustainability efforts.

- Green Claims Directive: This directive requires apparel brands to back up their environmental claims with verified data. Companies must back up statements such as ‘eco-friendly’, ‘sustainable’ or ‘carbon neutral’ with a Product Environmental Footprint (PEF), ensuring transparency and trust in sustainable product labels.

- Product Environmental Footprint (2024): This legislation aims to establish a standardised methodology for assessing and labelling the environmental impact of (apparel) products. It will provide consumers with reliable information to make sustainable purchasing decisions.

- As part of the Circular Economy Action Plan, this regulation will require clothing products to meet minimum sustainability and quality standards. It also includes a Digital Product Passport that will provide detailed traceability of materials and environmental impacts.

- Microplastics Regulation (Pending): To reduce microplastic pollution, future regulations will target synthetic textiles, requiring improvements in manufacturing processes, filters in washing machines, and stricter rules on microplastic emissions from clothing

Tips:

- Keep yourself updated on the new legislations and discuss potential solutions with your buyers.

- Identify solutions by sharing thoughts with supply chain partners.

- Compliance needs to become part of your company promotion to help you open doors and develop new business.

Figure 4: The European population is ageing and getting more diverse. By 2050, the median age in the EU will be 48.2 years

Source: Jonny Gios on Unsplash

7. The European population in 10 years: older and more diverse

Developments in the European population and in European culture directly influence the apparel industry and buying behaviour. Although Europe is a diverse continent with many separate societies and cultures, there are some general developments you should take into account when doing business with European buyers.

- Europe has an ageing population, with a growing number of older consumers. The median age in the EU-27 is projected to increase by 4.5 years between 2019 and 2050, to reach 48.2 years. This demographic shift will likely lead to increased demand for apparel that caters to the needs of older people. This can include clothing that is comfortable, easy to put on and off, and designed with features that address age-related challenges such as mobility or sensory issues.

- At the same time, Europe is becoming increasingly diverse, with a rising number of multicultural communities. Most European countries have positive net migration figures and this is unlikely to change soon. Brands that can offer a wide range of sizes, styles and designs that reflect the multicultural nature of European societies can gain a competitive advantage.

- Younger generations in Europe, such as Millennials and Generation Z are known for actively seeking out sustainable fashion. As they grow older and gain more purchasing power, these generations might bring their mindset to the mainstream and increase demand for sustainably produced apparel. Brands that prioritise environmentally friendly materials, fair trade practices, and responsible manufacturing processes and transparency will be best positioned to tap into this market segment.

- In Europe the concept of gender fluidity and gender-neutral fashion has gained traction, particularly among younger generations. The blurring of the lines between men’s wear and women’s wear will require brands and retailers to rethink their product design, marketing, and in-store and digital shopping experiences.

- Another apparel niche that is expected to perform well is plus-size apparel, as the Body Mass Index (BMI) of the average European continues to go up. Demand for plus-size fashion is expected to grow as inclusivity becomes a priority for both consumers and brands. Companies offering a wide range of sizes and emphasising body-positive messaging will likely gain a significant market share, especially with more attention for fit and comfort.

Tips:

- Check CBI’s market intelligence studies for specific target groups in Europe, including adaptive apparel (apparel made for senior citizens and people with disabilities) and Islamic wear.

- Changing consumers create a change in demand. Monitor, observe and identify new niche markets with mainstream potential.

- Promote and share your vision and strategy online, on your website and on social media.

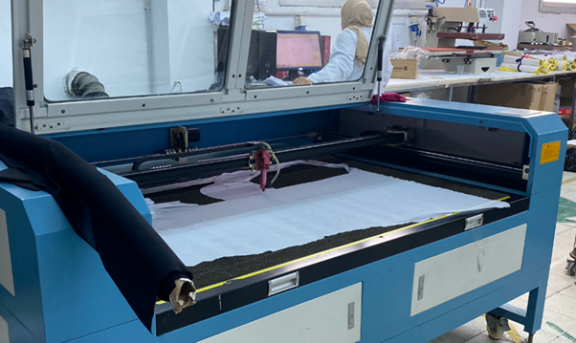

Figure 5: Laser-cutting pattern machines can reduce labour and save material

Source: Forward in Fashion

8. Technology will make apparel production and sales more efficient

New technologies are transforming the apparel industry in several ways. Self-monitoring and self-learning software and machines exchange data to integrate the production process and match supply to market demand. The aim is a value chain that is more transparent, less labour-intensive, more efficient, more flexible and more cost-effective than ever.

- More than half of all fashion executives that responded to the annual McKinsey State of fashion survey (2024) are already using Artificial Intelligence (AI) in their companies. AI is applied in many different stages of apparel production; improving efficiency, speed, and boosting creativity. In apparel design, AI can create designs for fabrics, single styles and even entire collections. In the approval process, AI supports 3D sampling processes (see below). Thanks to AI, end consumers can customise the design, colour, and fit of garments in real time. In pattern cutting, AI is used to reduce waste. Crunching large amounts of data, AI can also be used to forecast trends and generate marketing materials.

- Automation and robotics can handle tasks such as fabric cutting, sewing, and pattern-making with precision and speed. Automation reduces labour costs, improves efficiency, and allows for increased production capacity. It also enables customisation and flexible manufacturing by integrating digital design and production systems.

A truly digitised apparel factory uses software to interconnect ‘smart machines’: from the material warehouse to the sampling room, cutting department, assembly line, finishing department and product warehouse. - 3D design tools and virtual prototyping software allow designers to create, visualise, share and quickly adjust garments online, speeding up the approval process. 3D-avatars can also be used to set up virtual showrooms. When applied in (online) retail, it even allows end consumers to better choose the right apparel item (fit, shape, appearance), significantly reducing returns.

- The integration of Internet of Things (IoT) technology into apparel creates new opportunities for functionality and connectivity. Sensors and wearable devices can collect data on body metrics, activity levels, and environmental conditions. This data can be used for personalised experiences, performance monitoring, and health tracking.

- Technologies such as blockchain can improve supply chain traceability and transparency in the apparel industry. Blockchain allows for secure records of every transaction, ensuring transparency and accountability. This technology enables consumers and brands to verify the authenticity of sustainability claims.

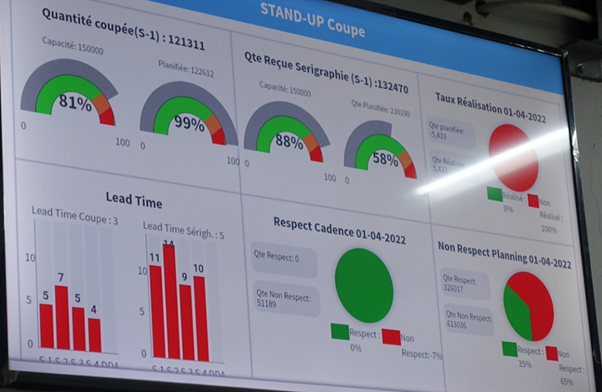

Figure 6: All improvement starts by measuring and monitoring production data. This can be done with software systems, but you can also start with simple pen and paper

Source: Forward in Fashion

Tips:

- Read the CBI study ‘Tips on how to go digital’ for background information and practical guidance to benefit from technological innovations in the apparel industry.

- Identify the buyers’ positive and negative experiences with innovative solutions before you decide to invest.

- Start building on collecting data throughout the supply chain to measure, learn and improve.

FT Journalistiek carried out this study in partnership with Frans Tilstra and Giovanni Beatrice on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research