Entering the European market for bridal wear

If you want to export bridal wear to Europe, you must comply with several legal requirements and expect additional, company-specific requirements.

Contents of this page

1. What requirements and certification must bridal wear comply with, to be allowed on the European market?

If you want to sell bridal wear in the European market, you need to comply with several requirements. Some are mandatory, whether they are legal requirements or not. Others are voluntary, but meeting them can give you a competitive advantage.

Mandatory requirements

There are many legal requirements for exporting bridal wear to Europe, including those concerning product safety, the use of chemicals (REACH), quality and labelling. Check the EU’s Access2Markets online helpdesk for an overview. Additionally, many buyers have created non-negotiable terms and conditions for their suppliers to comply with. Although meeting these requirements is not required by law, they are still mandatory.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Make sure your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Make sure you comply with the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain Azo-dyes, flame retardants, waterproofing and stain-repelling chemicals and nickel.

- Ask your buyer if they use a Restricted Substances List (RSL). These are often inspired by the guideline on safe chemicals use from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance here.

- Specify the material content of every item that you export to the EU, in accordance with Regulation (EU) No 1007/2011. Check the EU Access2Markets online helpdesk to find out how to do this.

- Do not violate any Intellectual Property (IP) rights and do not copy or share designs with other buyers. If your buyer provides the design, they will be liable if the item is found to violate a property right.

Non-legal mandatory requirements

In addition to the legal requirements mentioned above, you may be required to comply with non-negotiable terms and conditions that buyers have created for their suppliers. Such requirements are not required by law, but they are still mandatory.

Sustainable production and social compliance

Many fashion buyers in Europe have strict demands regarding sustainable production and social responsibility. The bridal wear industry is not a frontrunner in sustainability, but it is catching up. Expect buyers to ask you to open your factory doors for them, so they can conduct personal inspections. Additionally, you may be requested to comply with the following independent standards.

- Regarding harmful substances and organic production, European buyers may request standards such as the Standard 100 by Oekotex®, EU Ecolabel, BCI (Better Cotton Initiative), GOTS (Global Organic Textile Standard) or Bluesign®.

- Regarding social compliance, Amfori BSCI (Business Social Compliance Initiative) is the most popular (and often only) certification that European buyers will require. Other popular social standards are WRAP, SEDEX, ETI, SA8000, ISO 26000, FWF and Fair Trade.

Other sustainability requirements may be:

- Use of fabrics blended with regenerated fibres or fabrics made with recycled content. The most commonly used certifications for recycled content are the Recycled Claim Standard (RCS) and the Global Recycled Standard (GRS);

- Use of recycled materials for accessories, trims, hangers and tags such as recycled glass (for beads), recycled PET (for zippers) or recycled paper and cotton for labels and tags;

- Saving water during production by dyeing fabrics with new techniques (using CO2 instead of water) such as Dyecoo;

- Fabrics dyed with only natural ingredients such as Rubia, Fibre Bio or Greendyes or dyestuffs made from recycled materials such as Recycrom.

Tips:

- Provide buyers with as much information on your product as possible. The more information you can give about the origin of your materials, the better.

- Read how to comply with transparency requirements on the websites of the Clean Clothes Campaign and Human Rights Watch.

Packaging requirements

In most cases, your buyer will give you instructions on how to package the order, in a manual. If you agree with your buyer that he or she will clear customs in the country of import (which is the norm in the apparel industry), it is his or her responsibility to make sure the instructions comply with EU import procedures. Your buyer will also appreciate any efforts you make to reduce the environmental impact (and financial cost) of the use of packaging materials and hangers.

Payment terms

The payment terms you will be able to agree on with your buyer are determined by the market segment you are working in. For volume orders in the budget market, European buyers may agree with a down payment (for instance, 30%) for a first-time order.

The buyer will pay the rest (70%) after the order has been completed. The safest payment method for you as a manufacturer is the Letter of Credit (LC). An LC obligates a buyer’s bank to pay the supplier when both parties meet the conditions they have agreed upon. However, many buyers no longer favour LC payments, as this will block their cash flow. Be aware that LCs do not offer financial protection against bankruptcies!

For any further orders, most European buyers will ask for a TT (Telegraphic Transfer) after 30, 60, 90 or sometimes even 120 days. This means you as a manufacturer finish production and hand over the shipment to the buyer, including the original documents, before payment is due. The payment will be made after the number of days that you have agreed on with the buyer. This is a risky payment agreement because you are taking the full financial risk.

If you are working in the middle or luxury market, supplying high-quality dresses and offering made-to-order service, buyers will most likely agree to pay a much larger percentage (for instance, 70%) of the order in advance.

Tip:

- COVID-19 has shown the negative impact of extended payment conditions for manufacturers of volume orders. It is advisable to negotiate a down payment on every order and a balance payment before handover. This reduces the risk of a cancellation due to a lockdown.

The buyer manual

When you do business with a European buyer for the first time, they will typically give you a contract and/or a manual to sign. By signing the contract, you confirm that you will comply with all the listed requirements. This means you will be held accountable in case of a problem after the delivery of an order. Especially complying with REACH can be challenging. With small orders, most European buyers will not ask for expensive testing, but if illegal chemicals are discovered after delivery, you will bear all expenses involved.

Acceptable quality limit

To guarantee product quality, your buyer may set an acceptable quality limit (AQL) for you. This refers to the worst quality level that is still tolerable. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the whole order quantity over several production runs is defective.

Tips:

- Read the CBI study on Buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements you will face as an exporter to Europe.

- Check the EU Access2Markets online helpdesk for an overview of all legal requirements set for your product. Here, you can identify your product code to get a list of applicable requirements.

- Check the freely accessible CSR Risk Check database to discover the social and environmental risks associated with apparel production in your country and ways to manage them.

- Do not take financial risks with new buyers. Insure your orders via an insurance company or insist on a Letter of Credit.

What additional requirements do buyers often have?

In addition to non-legal, but mandatory requirements like standards and certifications, there are many services that buyers implicitly expect or at least highly appreciate if you want to do business with them. This includes product development and design, but also offering additional items such as matching veils, stolas, hairpieces, shoes, bridal maid dresses, party clothing and jewellery.

Product design and development

European buyers are always looking for special designs, materials or production methods that will help them stand out in the market. In recent years, the following interesting innovations have been applied to bridal wear entering the European market:

- High-quality synthetic materials with a silky hand feel;

- High-quality silky mesh;

- Synthetic fur;

- Easy-to-clean finishings;

- Polyesters with cotton-like characteristics;

- Recycled and regenerated fibres.

Styles

Some bridal wear styles are true classics and can be found in every collection, such as the boat neck dress with a split. Other popular styles and designs are:

- Ivory white dresses (pure-white is currently out of fashion);

- Short dresses; cheerful, colourful or floral prints;

- Pastel cool colours, like dove, lavender and sea green;

- Lace, extreme use of ruffles, shimmering fabrics, use of feathers;

- Bohemian style, including smocking, long sleeves;

- Bold shoulder styling, like puff sleeves or off-shoulder sleeves, high splits or square necklines;

- Mixed media (different fabrics in 1 dress);

- Convertible dresses; dresses with pockets;

- Modest/Islamic wedding dresses.

Note that women in Northern Europe generally tend to appreciate timeless, understated styles with quirky, sexy elements. In Southern Europe women tend to appreciate exuberant, wide dresses with much lace. They may be tight-fitting but should typically not reveal too much skin.

Figure 1: The preference of many European brides has shifted away from pure-white to off-white shades

Photo by Hannah Olinger on Unsplash

Communication

Smooth communication is an implicit requirement of all buyers. Always reply to every email within 24 hours, even if it is just to confirm that you have received the email and will send a more complete reply later. If you have a problem with a production order, immediately notify the customer and try to offer a solution. Another good practice is to create a critical path of every order and share it with your buyer. This file will help you to manage expectations and monitor progress and is the best guarantee of on-time delivery.

Tip:

- Be proactive and prompt in your communication. Provide short updates to your buyer via text, photo or video, using WeChat, WhatsApp or Signal. To make free video calls, try Skype or Google Meet. Register all confirmations to prevent any unclarity in a later stage.

Flexibility

The level of flexibility that European buyers require from you depends on the market segment in which you operate. In the higher price/quality segment (€1500 retail price and higher), brands and retailers typically offer consumers many options for customisation. A single dress is put on display in the shop, and the dress is then ordered including adjustments and made to order. In the lower price/quality segment (€1500 retail price and lower), dresses are typically sold as-is, with minor adjustments being made by the retailer’s own dressmakers. Minimal order quantities (MOQs) in this segment can vary between 10-50 or higher.

Niche requirements

The following niche categories offer opportunities for bridal wear manufacturers. The required qualities, styles and quantities may differ from mainstream production.

Sustainable bridal wear

Although the bridal wear industry is not considered a frontrunner, sustainability is increasingly important for European buyers. Buyers will appreciate any efforts you make to: offer transparency about your suppliers; use eco-friendly materials; guarantee social compliance using third-party standards; and use recycled and regenerated materials (such as ECOVERO™), natural dyes and animal-friendly silk (such as Ahimsa).

Check, for instance, the #WeDoEco collection by Spanish bridal wear brand Pronovias (eco-fabrics, recycled materials for trims), English brand Indiebride (organic cotton and ramie) or Larimeloom from Italy (plant-based eco-dyes). Other inspiring examples are Australian brand Lost in Paris, which sources its lace from antique markets in Paris, and Anita Dongre, an eco-conscious brand supporting female dressmakers in India.

Re-make and re-use

Most brides keep their dresses. Others have them re-made into something else, such as a baptismal gown. In addition, there is a small, but growing second-hand market for wedding dresses. Brides may sell their dress on apps such as Vinted or via retailers that offer a second-hand service. The challenge with second-hand dresses is that the styles are made to fit a specific person and can be damaged or dirty. Playing into this trend requires basic styles, use of high-quality, easy-to-clean materials and designs that are easy to disassemble and repair.

Generation Z

The youngest generation of European brides belongs to the so-called “Generation Z”: people born between the late 1990s and the early 2010s. The oldest portion of this generation of digital natives currently accounts for 6% of weddings. This generation is used to a more personal relationship with the brands they like. Their purchase journey and shopping experience requires personal, digital and creative support. Think about services such as 3D virtual fitting and providing background info, pictures and video of the of the production progress.

Tip:

- When developing a collection, make sure your styles comply with the sizing and fit that is required in your target market. Average body types differ between Northern and Southern Europe and even between countries. If your sizing does not meet the general expectations, you will not be able to service the market adequately.

2. Through what channels can you get bridal wear on the European market?

Before you start to approach European bridal wear buyers, you need to determine what market segment fits your company best and through what channel(s) you want to sell your product. There are 3 types of players in the European bridal wear market:

- Specialised multi-brand retail shops (primarily in Northern Europe);

- Brands (in many cases with their own retail channels: dominant in Southern Europe);

- Wholesale.

How is the end-market segmented?

The bridal wear market is segmented by price/quality level. Roughly speaking, the luxury segment starts at retail prices around €1500. The mainstream segment starts at retail prices of €800. Cheaper dresses are considered budget market. Many brands operate primarily in 1 segment but may offer 1 or 2 styles in another segment.

Table 1: Bridal wear market segmentation

| Consumer type | Price level | Fashionability | Material use | |

Luxury consumers

| Retail prices starting at €1500 | Highly fashionable, unique designs | Luxury materials | |

Middle-market consumers

| Retail prices from €800-1500 | Classic designs and styles in line with latest trends | Medium-quality materials | |

Budget consumers

| Retail prices below €800 | Styles in line with latest trends | Low-quality materials |

Luxury consumers

Brides that shop in the luxury market expect flawless, highly fashionable, unique designs made by expert dressmakers using top-quality materials such as satin, mikado, crepe, chiffon or silk organza. Most dresses in this price segment are manufactured in Europe or at least finished in Europe. European retailers in this segment typically offer brides the opportunity to customise the dress to their taste by changing the shape or adding or removing parts (sleeves, for instance) and accessories.

Middle-market consumers

This segment represents the largest group of end consumers. Middle-market consumers are fashion and price conscious and expect value for money. That means their dresses may be made of medium-quality materials, but they still need to look fashionable. Dresses in this segment are often imported from production countries outside Europe, such as China, and may be finished in Europe.

Price-conscious consumers

Price-conscious consumers are looking for affordable wedding dresses that do not look cheap. Their expectations of material use may be lower, but they still expect their dress to look stylish. Dresses in this segment are almost always produced outside of Europe.

Tips:

- Build a community around your company, your product or your brand. A large and dedicated online community can convince a retail buyer to purchase your product.

- Focus on servicing your buyer by offering made-to-measure and customisation services.

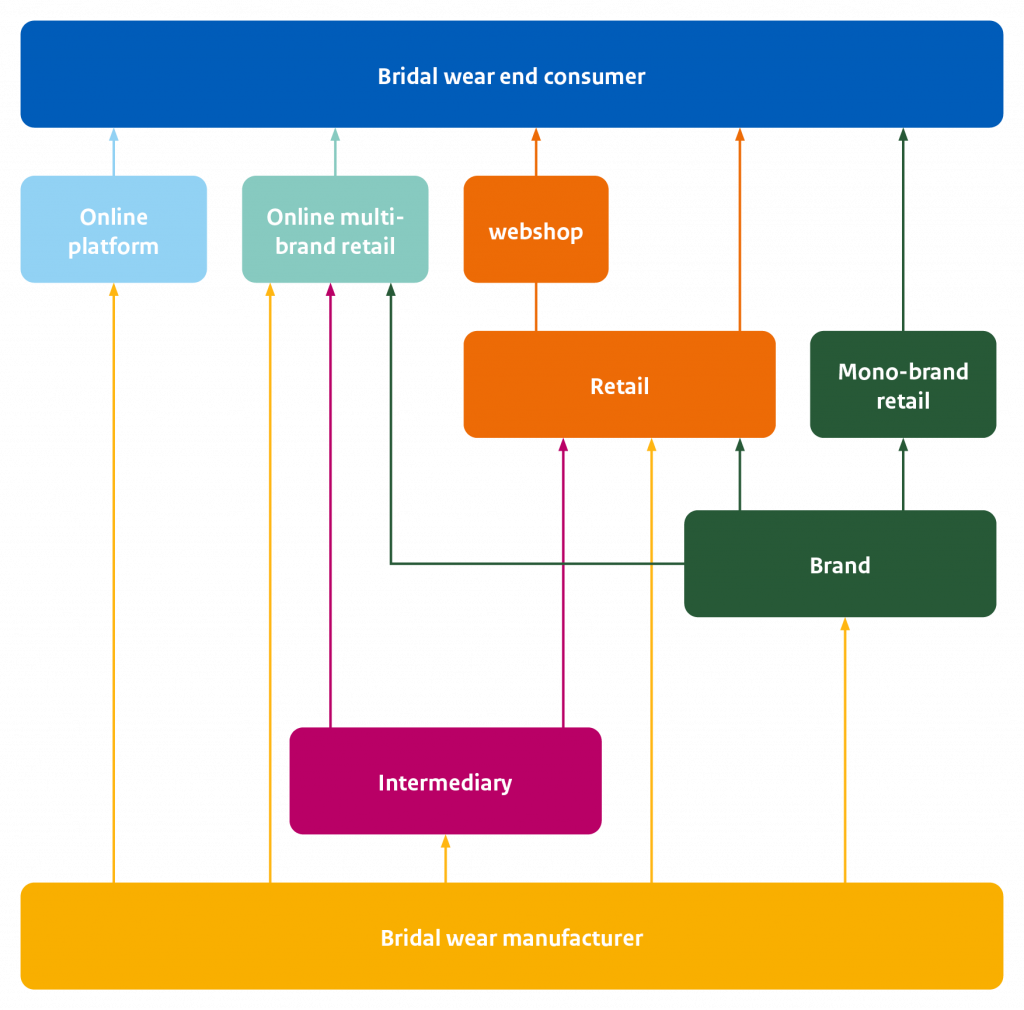

Through what channels does the product end up on the end-market?

The most marked difference among your potential buyers is their place up the value chain, because that will determine how they do business with you. Always try to find out in what part of the value chain your buyer is operating, what challenges they face in the market and how you can contribute to their sales strategy.

- If you want to target European end consumers directly, try selling via platforms such as Alibaba or Amazon. You will need to invest in a web shop, stock, order management and basic customer service. This channel is only suitable for manufacturers operating in the budget market, because it will be difficult to provide end consumers with personal services (no possibilities for fittings and alterations).

- Online multi-brand retailers such as Net-a-porter.com, Etsy, Zalando and Asos sell existing bridal wear brands in different price segments. Several platforms develop their own private collections: typically budget brands. They can detect market interest very fast and will immediately react upon sales data.

- Most bridal wear retailers in Northern Europe are multi-brand boutiques that sell existing brands in the middle and luxury markets. Few develop their own styles. In Southern Europe, most bridal wear in the middle and luxury segments is sold via mono-brand retail (for instance, check Pronovias). Hybrid formulas in the budget market such as WED2B (online and physical stores) are more likely to buy directly from manufacturers.

- Bridal wear brands typically develop a collection 6/12 months in advance. Some brands will keep certain styles in their collections across seasons. You will need a large sample room, as brands require salesman samples (SMS) of each collection style. Every sample needs to be current, meaning it must look exactly like the product will in the shop, with branded hangtags and accessories.

- Intermediaries such as agents, traders, importers and private label companies will sell your product on to buyers up the value chain. Intermediaries are price focused and require flexibility in quantities and qualities.

Tips:

- For inspiration and news on styles, designs, brands and channels, check online media such as Bridal Musings or bride magazine.

- If you want to sell your bridal wear online, create styles that have an easy fit. Complicated fits will result in many items being returned. Also, invest in good product photography and well-written product descriptions, to manage end-consumer expectations.

- When you enter a new market, it is advisable to work with a local sales agent. An agent can help you find the right buyers and comply with their requirements. Check the CBI study ‘10 tips for finding buyers in the European apparel sector’ on how to do this.

Figure 2: Bridal wear market value chain

What is the most interesting channel for you?

Your best entry point into the European market is determined by your target price/quality segment and service level. If you operate in the budget market, intermediaries, budget brands and online or offline retail can be suitable channels. If you can provide high-level workmanship, customisation and/or low MOQs, European brands in the middle and luxury markets may be options. If you are a manufacturer with your own brand, you may be able to supply European retail or end consumers directly.

Intermediaries

Working with agents or traders/importers/private label companies can be a good entry point into the European market. They will give you access to many different buyers up the value chain, and you will learn how to service them by following their instructions.

Brands

The bridal wear budget market works similar to other apparel categories. However, the middle and luxury markets are very specialised. Most established European bridal wear brands are active in these segments, and they require impeccable workmanship, high-quality materials and a very high service level. Often, these brands have their own workshops (in Spain or Italy) where they make their dresses from scratch. In some cases, they may finish semi-finished dresses imported from outside Europe.

Retailers

If you are a manufacturer with your own brand, you may be able to supply European retailers (both physical shops and online multi-brand platforms). Your collection should match demand in your target market, and it helps if you already have a large online or offline following and can provide high-quality marketing (point-of-sale) materials. Several online multi-brand platforms develop their own collections, mostly in the budget market.

Tips:

- Find potential buyers on the exhibitor lists of bridal trade fairs, such as European Bridal Week, Interbride (Germany) or Barcelona Bridal Week (Spain). Due to COVID-19, most physical trade fairs are cancelled, but many have shifted to online matchmaking. If you do plan to meet a buyer or potential buyer at an online or offline fair, check what collections they have and prepare matching or even improved samples. Also, work out the costing before you introduce your company and your samples to a potential buyer.

- Be on top of new technical developments in the market. Be an advisor as well as a producer to create advantages over the competition. Create complete service proposals.

3. What competition do you face on the European bridal wear market?

Bridal wear is manufactured worldwide. The most important suppliers to the EU are China, Spain and Italy. If you want to create a competitive advantage over manufacturers in other countries, focus on design, quality and a high level of service and flexibility.

Which countries are you competing with?

| Country | Strengths | Challenges |

| China | China is the biggest exporter of bridal wear worldwide. The country manufactured 12.2 million units in 2018, of which more than 70% were exported. Technical innovation, high efficiency, excellent customer service, high flexibility and the local availability of high-quality yarns and trims are China’s strong points. | European bridal wear brands in the middle and luxury markets may be reluctant to admit their dresses are produced in China and not in Europe. Other challenges are: increasing labour, transport and production costs, human rights concerns and no General Scheme of Preferences (GSP) that removes import duties to the EU. |

| Vietnam | Vietnam’s bridal wear industry has developed a good level of workmanship and efficiency, thanks to investments from mainly Chinese factory owners. Vietnam exports most of its bridal wear to the US and Canada. | Lack of local spinning capacity, locally produced accessories and trims. Increasing transport costs. |

| Turkey | Turkey is close to Europe, which results in short lead times. The country produces high-quality dresses and has a European business culture. Turkish manufacturers accept payment in euros. | Turkish prices are relatively high compared to Asia. Unauthorised sub-contracting may occur. |

| Spain | In 2016, Spain manufactured 917,000 bridal gowns. 70% of their exports stayed in Europe. The label “Made in Spain” has a great acclaim throughout Europe. Being inside the EU, Spain benefits from the free movement of goods within the EU. | Because of high production costs, Spanish manufacturers almost exclusively work for Spanish brands in the middle and luxury markets. |

| Italy | Italy has a long history and a strong reputation in the manufacturing industry. The country has many local designers and workshops that produce super-high-quality handmade dresses. Being inside the EU, Italy benefits from the free movement of goods within the EU. | Because of high production costs, Italian manufacturers almost exclusively work for Italian brands in the middle and luxury markets. |

Tips:

- Study the countries you are competing with, compare their strengths and weaknesses to yours and advertise the competitive advantages of doing business with you. Besides the GSP, consider factors such as distance to Europe and local availability of high-quality fabrics and trims.

- Check the freely accessible CSR Risk Check database to discover the social and environmental risks associated with apparel production in different countries, including your own. Use this information to mitigate risks and to advertise the advantages of sourcing from your country.

- Check if and how other countries benefit from the Generalised Scheme of Preferences on the EU’s website on international trade.

- Most online search engines will let you create a news alert on a topic, so you can automatically follow the latest developments in the apparel industry in a specific country.

Which companies are you competing with?

Huameiyue weddingdress Co is a Chinese bridal wear manufacturer, supplying custom-made bridal dresses and accessories in-house from design to final product. Huameiyue’s major export market is the US and Canada, but it also exports to Europe. The company takes pride in being able to service its buyers with a high-quality product in the middle and luxury segments. Huameiyue’s website is a good example of a professional website featuring company info and visual media, including a video of the production process.

Nova Bella is a manufacturer of bridal wear based in Turkey. The company is not only focussed on manufacturing for brands and retailers but also delivers directly to end consumers in Europe. Nova Bella provides great flexibility in MOQs and can manufacture all types of wedding dresses, with a special focus on handcrafted designs.

Rosa Clara is a Spanish manufacturer of bridal wear that started in 1995 from a small shop in Barcelona and is now selling dresses worldwide. The company produces high-quality handmade dresses for the luxury market. 1 of Rosa Clara’s strengths is its collaboration with internationally famous designers such as Karl Lagerfeld and Zuhair Murad.

Tips:

- Watch short videos on YouTube about the dressmaking process by brands such as Pronovias, Oscar de la Renta or Elie Saab.

- For inspiration on styles and designs, check the bridal fashion shows by different brands and/or trade fairs. Many are published on YouTube, such as the 2021 collections by Pronovias or Jesus Peiro.

- Read the CBI study 10 Tips for Doing Business with European Buyers to learn how to approach and engage with buyers. This report also describes how you can get practical help with understanding European business culture, analysing your unique selling points (USPs) and doing business with European buyers.

Which products are you competing with?

Bridal wear faces little competition from other fashion categories or alternative products. However, there are several upcoming niches that have the possibility to shift market demand in the coming 5 years.

Vintage

Vintage, second-hand and rental bridal wear is an upcoming trend among younger generations in Europe that do not value the traditional “big wedding” including an expensive and high-quality bridal dress as much as older generations do. Other people may choose a second-hand wedding dress out of sustainability considerations. Brides shopping for second-hand or rental dresses may find a dress on websites such as Vinted or at physical retail stores such as The Dressing Club or boutiques such as Florence Bridal.

Micro weddings/haute couture

A growing group of European women prefer to celebrate their wedding day with a small group of family members and friends, typically in an informal setting, with a simple and relatively cheap dress to match. Restrictions on large gatherings due to the COVID-19 pandemic have furthered this trend. Brides that prefer such a wedding typically do not shop for a traditional wedding dress, but may opt for a dress or combination bought from an haute couture brand.

Low budget

In recent years, the demand for dresses in the budget market in Europe has grown, and so has supply. Brides that are looking for affordable bridal dresses can now shop for dresses priced as low as €100 at online or offline retailers such as Asos, Bonprix or H&M. Dutch textile discount chain Zeeman famously launched a wedding dress with a retail price of €29.99 in 2016. The launch was a publicity stunt, but the undertone was serious. The company wanted to prove it is possible to create a basic but stylish dress at an ultra-low price point.

4. What are the prices for bridal wear?

The price of your product, in fashion jargon often indicated as the free on board (FOB) price, is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin.

The following figure shows the average cost breakdown of a typical FOB price:

Note that these percentages depend on the market segment you work in and may vary per factory and per order. The percentages for labour versus fabrics and accessories may differ, depending on the efficiency and wage level of the workforce and the price of the materials.

Profit margin

The profit margin given in this pie chart is typical for manufacturers of bridal wear in the budget market supplying volume orders. In this market, profit margins are under continuous pressure. Wedding dresses in the middle and luxury markets are often customised and manufactured in single unique orders or very small quantities. The typical gross profit margin of such wedding dresses should be higher: up to 40-50%. Note that this is gross profit, pressured by the high service level you need to provide to your buyer.

This study was carried out on behalf of CBI by Frans Tilstra and Giovanni Beatrice for FT Journalistiek.

Please review our market information disclaimer.

Search

Enter search terms to find market research