Entering the European market for denim

This report explains the most important opportunities and requirements for exporting denim to Europe. You will learn about the relevant rules and regulations, the best channels to get your product onto the market, the countries where your competitors are located and the best ways to provide a quotation.

Contents of this page

1. What requirements and certification must denim comply with to be allowed on the European market?

In order to successfully export denim into the European Union (EU), it is important to possess a clear understanding of the various demands and expectations set by European buyers. The landscape of legal requirements is continuously changing and growing more stringent, paralleled by increased expectations for superior quality, competitive pricing, swift delivery, exceptional service, adaptability, and sustainability considerations. Applying to these combined requirements is crucial for establishing a strong foothold in the EU denim export market.

What are the legal requirements?

Legal requirements for exporting denim into Europe include legislation on product safety, the use of chemicals (REACH), quality and labelling. Check the EU Access2Markets online helpdesk for an overview. Additionally, many buyers have non-negotiable terms and conditions which their suppliers need to comply with.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Make sure that your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Make sure that you comply with the EU’s REACH Regulation. This restricts the use of chemicals in apparel and trims, including certain azo dyes, flame retardants, waterproofing and stain-repelling chemicals and nickel.

- Specify the material composition of every denim item that you export to the EU, in accordance with EU Regulation 1007/2011. Check the EU Access2Markets online helpdesk on how to do this.

- Never violate any Intellectual Property (IP) rights and never copy and share designs with other buyers. If your buyer provides the design, they will be liable if the item is found to violate any intellectual property rights.

- If you need help, always discuss compliance challenges and possible solutions with your buyer.

In addition to the legal requirements mentioned above, your buyer may have company-specific terms and conditions. These are non-legal requirements, but are still essential to follow.

The buyer manual

When you do business with a European buyer for the first time, they will typically give you a contract and/or a manual to sign. By signing the contract, you are confirming that you will comply with all the listed requirements. This means you will be held accountable in case of a problem after the delivery of an order. Complying with the REACH Regulation can be particularly challenging. With small orders, most European buyers will not ask for expensive testing, but if illegal chemicals are discovered after delivery, you will be liable for all rectification costs.

Acceptable quality limit

To guarantee product quality, your buyer may set an acceptable quality limit (AQL). This refers to the minimum level of quality that can be accepted. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the whole order is defective.

Packaging requirements

In most cases, your buyer will give you instructions on how to package the order. If you agree to deliver Free on Board (FOB), which is the industry standard, your buyer will clear customs in the country of import. It is their responsibility to ensure that the instructions comply with EU import procedures. Always try to reduce the environmental impact (and financial cost) of the packaging materials you use.

Be prepared for the new EPR legislation (Extended Produced Responsibility), which states that the company importing the goods into the market is responsible for complying with the EPR legislation. If the buyer suggests changing delivery from FOB to DDP, this will have legal risks and consequences.

Payment terms

For a first-time order, European buyers may agree to a down payment (for instance, 30%). They will pay the rest (70%) after the order has been completed. The safest payment method for you as a manufacturer is an LC (Letter of Credit). An LC requires the buyer’s bank to pay the supplier when both parties meet the conditions they have agreed upon. However, many buyers no longer favour LC payments, as they restrict their cash flow. Be aware that LC do not offer financial protection against bankruptcies!

When it comes to further orders, most European buyers typically request a TT (Telegraphic Transfer) with payment terms of 30, 60, 90 or sometimes even 120 days. This means that, as a manufacture, you complete production and deliver the shipment to the buyer, along with the necessary original documents, before payment is due. The payment will be made after the number of days that you have agreed with the buyer. This payment agreement entails a certain level of risk for you as the supplier, because you assume all the financial risk.

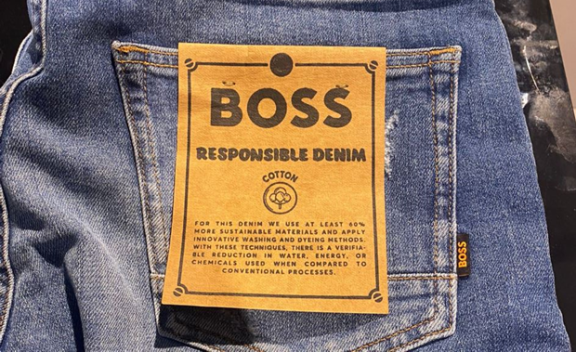

Figure 1: European brands advertise their sustainability claims directly with end customers

Source: Forward in Fashion

Transparency

Supply chain transparency is key for the European apparel industry, motivated by ever stricter legislation at the EU and national levels. For instance, the EU’s new Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD) require all larger European companies to disclose and report on how they manage social and environmental risks.

Transparency means you should disclose information about your own operations to buyers, but also help them to gain as much insight as possible into the entire supply chain.

Restricted substances

Ask your buyer if they use a Restricted Substances List (RSL). These lists are often inspired by the guidelines on the safe use of chemicals from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. You can download the ZDHC Conformance Guidance here. Please note that the ZDHC guideline on safe chemicals goes beyond the legal requirements.

Regenerative agriculture

The use of organic cotton is more popular than ever among European denim brands, but the efforts to make cotton production more sustainable have grown to ‘regenerative agriculture’: a concept focussed on phasing out harmful fertilisers and pesticides and ‘regenerating’ nature, including biodiversity, soil health and water. Several large European apparel retail groups have set goals in this area, including H&M, Inditex and Kering. Control Union has recently introduced the first certification for regenerative agriculture: regenagri.

Carbon footprint

Many Western brands have committed to climate neutrality. To calculate the carbon footprint of a product, emissions are usually measured in units of carbon dioxide equivalent (CO2e) and the total emissions are then divided by the number of products. This calculation is complicated, but several organisations have set benchmarks for certain materials and/or products. Refer to the CBI study Tips to go green for more information.

Recycling

The EU is introducing new legal measures to increase circularity in textiles, including new directives concerning the durability of textile products and a ‘right to repair’. The EU is also considering the introduction of an EU-wide EPR for apparel (extended producer responsibility). This would make companies responsible for the way their products are disposed of, recycled or repaired. Some countries have already implemented national EPR schemes. Recycling and repurposing materials will help your buyers reduce waste and conserve resources.

Certification

Many European fashion companies require suppliers to be certified for sustainable and/or fair production or the use of sustainable materials. The following standards and certifications are the most popular in Europe. Note that BSCI is almost a standard requirement for many European apparel companies.

Table 1: Europe’s most popular standards

|

Name of standard |

Logo |

Type of compliance |

Further information on getting certification |

|

Amfori BSCI |

|

Social |

On invitation from buyers. Amfori provides a list of organisations that can perform an audit |

|

SA8000® |

|

Social |

|

|

WRAP |

|

Social |

|

|

Sedex |

|

Social, environmental |

|

|

Fair Wear |

|

Social |

|

|

B-Corp |

|

Social, environmental |

|

|

OEKO-TEX® STeP |

|

Social, environmental |

|

|

BCI |

|

Environmental (sustainable cotton production) |

|

|

GOTS |

|

Social, environmental (organic production) |

GOTS provides a list of organisations that can perform an audit |

|

ZDHC |

|

Environmental (chemical use) |

The ZDHC provides a guide that outlines the requirements for indicating ZDHC MRSL conformance |

|

Bluesign |

|

Environmental (sustainable production) |

See the Bluesign services for manufacturers |

|

Global Recycled Standard |

|

Environmental (material recycling) |

|

|

Recycled Claim Standard |

|

Environmental (material recycling) |

In addition to these standards, many European buyers have developed their own codes of conduct. If you sell to a number of European buyers, you may have to comply with multiple standards. This can be costly and labour-intensive. To avoid the duplication of work, a group of 60 larger fashion brands and 7,000+ apparel factories have adopted the Social & Labor Convergence Program (SLCP). By adhering to this framework, you can ensure compliance with various social standards and regulations such as the CSDDD. The SLCP’s popularity is growing.

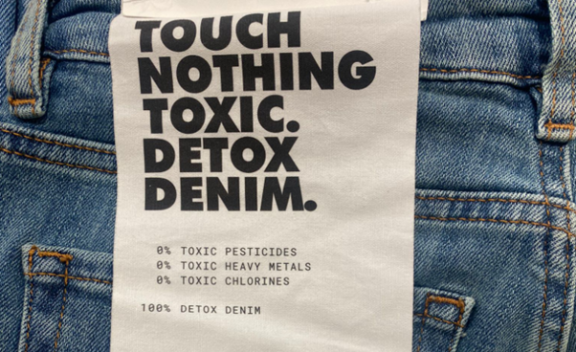

Figure 2: Armed Angels is a German brand with a sustainable profile that produces ‘detox denims’

Source: Forward in Fashion

Other sustainability requirements may be:

- Use of denim blended with eco-friendly fibres such as hemp, regenerated fibres such as REPREVE™, or Tencel®, Modal® and Refibra™ by Lenzing, or even with innovative bio-based polymer fibres such as PLA, milk, seaweed and soy.

- Saving water during production by dyeing fabrics with new techniques (using CO2 instead of water) such as Dyecoo or Kitotex®.

- Fabrics dyed with all-natural ingredients. Check out Rubia or Fibre Bio, for instance.

- Replacing fading techniques such as sandblasting, stone finishing and the use of potassium permanganate with sustainable alternatives like ozone washing, laser engraving and printing.

- Using vegan ‘Jacron paper’ patches instead of leather patches. See, for instance, Swedish denim brand Nudie.

- Phasing out the use of metal rivets to make it easier to recycle denim apparel, which fits in a circular economy strategy. See, for instance, the ‘Jeans Redesign pledge’ by The Ellen MacArthur Foundation and the launch of Tommy Hilfiger’s first circular jeans collection. The accompanying guideline with practical tips shows how to design jeans in a circular fashion.

- Refurbishing denim jeans. Several European companies do not recycle textile waste back to lint, but instead sell on post-consumer apparel as vintage, or cut it into pieces to remake it into new textile products. Check out MUD Jeans or Re/done, for instance.

Tips:

- Read the CBI study on Buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements you will face as an exporter of denim to Europe.

- Read the CBI studies on Sustainable Cotton, Recycled Fashion and The sustainable transition in apparel and home textiles for more information on sustainable (denim) apparel production. The CBI studies Tips to go green and Tips to become more socially responsible provide practical guidance to make your factory more fair and sustainable.

- Check the freely accessible CSR Risk Check database to discover the social and environmental risks associated with apparel production in your country and ways to manage them.

- For a complete overview of sustainability standards, check ITC’s standards map.

- Provide buyers with as much information on your product as possible. The more information you can give about the origin of your materials, the better.

Figure 3: Nudie Jeans is a Swedish denim brand that offers its customers a free repair service

Source: Forward in Fashion

What additional requirements and certifications do buyers often have?

In addition to legal and non-legal mandatory requirements, there are many services that buyers may expect or value highly, if you want to do business with them. These requirements may differ from buyer to buyer.

Product design and development

European buyers are always looking for special designs, materials or production methods that will help them stand out in the market. That is why they appreciate manufacturers who have their own ideas on product design and development.

Consider for instance:

- Fabrics in different colours than the popular blue, black and grey, such as white denim or other vibrant colours.

- Blended fabrics or different weaving and/or knitting techniques.

- Innovative finishes and prints, preferably using sustainable techniques (see above).

Tips:

- Follow market intelligence platforms such as Edited’s market analysis blog, Sourcing Journals’ Denim trends or WGSN for advice on the denim market, news and guidance on sales trends.

- Update yourself on innovations in the industry and expand your knowledge by researching companies such as: Jeonologia in Italy and Santanderina in Spain.

- Source sustainable and certified materials that can help you to comply to the buyers expectations.

- Research the local industry and recycle initiatives. Cooperate with local innovators that can help you to develop a unique proposal.

Communication

Your success depends largely on the quality of your service. Smooth communication is an important aspect. Always reply to every e-mail within 24 hours, even if it is just to confirm that you have received it and will reply in detail later. If you encounter a problem with an order, notify your buyer immediately and try to offer a solution. Create a T&A (time and arrival) sheet of every order and share it with your buyer. This will help you to manage expectations and monitor progress and it is the best guarantee for timely delivery.

Flexibility

Many factories focus only on getting ‘convenient’ orders: simple styles, large quantities and long delivery times. However, if you want to embark on a business relationship with a European buyer, be prepared to accept more complicated orders first. Buyers will want to test your factory before giving you big, easy orders. However, make sure that a buyer will not continue only to place difficult orders with you and more convenient orders elsewhere.

For the first order, you can expect a European buyer to require:

- High-quality material and impeccable workmanship;

- Order quantities below your normal Minimum Order Quantity (MOQ);

- A price level that is lower than what you normally would accept for small quantity orders.

Tips:

- Find potential buyers on the exhibitor list of trade fairs such as the Bluezone at Munich Fabric Start (Germany), Kingpins (USA, the Netherlands) or Premiere Vision (France, Germany), even if you are not attending (or if shows are cancelled because of COVID-19). Search the Denimology trade show calendar for denim trade shows near you.

- Read more about voluntary standards including fair production in the ITC Standards Map database.

- Be proactive and prompt in your communication. Send short updates to your buyer via text, photo or video using WeChat, WhatsApp or Signal. To make free video (conference) calls you can also try Skype or Google Meet.

- Invest in your organisation and the personal development of your staff. Make sure they comply with your buyers’ expectations on service and communication.

What are the requirements for niche markets?

The following niche categories, although relatively small, are experiencing growth and offer opportunities for denim manufacturers. The required qualities, styles, and quantities, often differ from mainstream production. This means you need to adjust your manufacturing and sourcing setup if you want to be profitable.

Recycle

In the denim industry, a growing number of fabrics are produced using a combination of virgin materials and recycled denim. While making fabrics made entirely from 100% recycled post-consumer waste is not currently possible, the industry is consistently striving to increase the proportion of recycled materials used. As a manufacturer of denim styles, it is essential to establish a circular business model that enables buyers to both produce new styles and participate in the recycling process by returning used denim.

By implementing a circular business model, you facilitate the creation of a sustainable and environmentally conscious approach. This model not only allows for the production of innovative denim styles but also promotes the responsible management of resources by encouraging the recycling of used denim. By actively engaging in this circular economy, you contribute to the ongoing efforts within the industry to minimise waste and maximise the utilisation of recycled materials.

Re-done

Re-done jeans are a distinctive style of denim trousers crafted by stitching cut-out sections from second-hand denims items into new pairs. This design approach intentionally emphasises colour and shade variations, highlighting the fact that the garment is created from repurposed jeans. While this method has gained popularity, it is worth noting that certain brands have successfully developed new jeans that copy the appearance of re-done denim while using new fabrics.

Customised jeans

Some denim brands, including Levi’s, have started to offer end consumers the opportunity to customise their jeans. Italian denim brand Diesel launched something similar in 2020 with their ‘Unforgettable’ jeans campaign. Dutch retailer Atelier Munro offers a made-to-measure service for jeans. Such services require a highly flexible supply chain.

Denim accessories

Several denim and accessory brands offer bags, belts, shoes, espadrilles, wallets, bracelets and other fashion items made from denim fabrics. See Jacquemus, Chloé or Levi’s, for instance. Manufacturing accessories requires (an investment in) special skills and machinery, but also offers opportunities to expand into new product categories and to repurpose clippings, cutting waste and unsold stock (see Re-done above).

Tips:

- If you decide to focus on a niche, investigate the specific requirements and make sure you can comply. Be aware that order quantities in niche markets are usually smaller than in mainstream markets.

- Try to think ahead in your product development if you service niche markets. New innovations are introduced almost daily. Try to find workable innovations that will not only give you the tools to diversify, but also to cut expenses.

- Try to cooperate with other manufacturers that are specialised in creating products made from cutting waste like denim belts or wallets. A product diversity in your factory will ultimately affects your product efficiency and therefore your profitability.

2. Through what channels can you get denim on the European market?

Before you start to approach European denim buyers, you need to determine what market segment fits your company best and through what channel(s) you want to sell your product.

How is the endmarket segmented?

The best way to divide up the denim market is according to price/quality level.

Table 1: Denim market segmentation

|

Consumer type |

Price level |

Fashionability |

Material use |

Functionality |

|

Luxury consumer |

Very high |

Unique, original styles and designs |

Unique, high-quality materials and finishes, Often sustainable fabrics |

Low functionality and often hand wash/dry clean only |

|

Fashion conscious consumer |

High |

Combination of fashionable styles and basic styles |

High-quality materials and finishes, Often sustainable fabrics are used |

Mix of sensitive materials and practical, user-friendly qualities |

|

The middle market

|

Medium |

Wide range of basic to fashionable styles |

Often blends to improve fabric characteristics and durability |

Functional and user friendly. Machine wash only |

|

The budget market

|

(Extremely) low |

Fashionable and basic styles with a focus on mainstream consumers |

Low-price materials meeting consumers’ quality expectations |

Machine wash only |

The luxury consumer

For many European luxury brands such as Dolce & Gabbana, denims are a side product. Such brands offer extremely fashionable, unique and luxurious designs with a very high retail price. Because buyers in this segment have extremely high standards regarding design, workmanship, material quality and brand image, production mostly takes place in Europe. Order quantities are low.

The fashion-conscious consumer

The upper-middle market caters to fashion-conscious consumers and is the biggest market for denim jeans. It is home to brands such as G-Star RAW, Diesel and Replay, selling creative designs, but in a less conspicuous way than in the luxury segment. Consumers appreciate brands for their brand image, original designs and high-quality materials. Smaller brands with a distinct sustainable profile such as Armed Angels or Nudie operate in this segment. Retail prices are high, order quantities are low to medium.

The middle market

Practical consumers shop in the middle market. Here, you will find brands and retailers such as Petrol or Tommy Hilfiger, selling both fashionable and basic styles. The focus is on washability, fit and medium-quality materials. Buyers will sometimes require organic fabrics. Order quantities are high, retail prices low to medium.

The budget market

Price-conscious consumers looking for both inconspicuous but fashionable and more basic designs shop for denim jeans at large retail chains such as H&M (basic-fashionable), Primark (basic-fashionable). Sustainable materials are in small demand, with notable exceptions such as C&A. Order quantities are high and retail prices are (very) low, so your margins are too.

Tips:

- For inspiration on denim styles check European online shopping platforms such as Yoox (brands in upper-middle to luxury market), Zalando (brands in all market segments) and Asos (brands in lower and middle market).

- Add value for higher segments that offer higher profit margins. Focus on design, quality and material use.

- Search the Material District database for hundreds of innovative and sustainable fibres and fabrics.

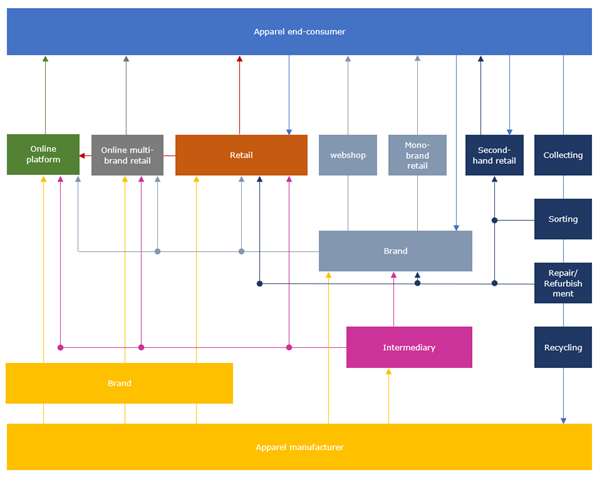

Through what channels does the product end up on the end-market?

Always try to find out whether you are dealing with a brand, a retailer, an intermediary or some other type of buyer. Every buyer has a different sourcing and sales strategy and different challenges. By tailoring your approach to suit their requirements, you increase the chance of successful collaboration and business outcomes.

- If you want to target European end consumers, try selling via platforms such as Alibaba, Wish, Amazon or Wolf & Badger for independent brands. Most online consumers can be found in countries in Northwest Europe. You will need to invest in a web shop, stock, order management and customer service. Your biggest challenge will be return policies and a lack of brand awareness.

- The growing second-hand market in Europe is served by online platforms such as vestiairecollective.com, vinted.com, depop.com, or national websites such as marktplaats.nl (the Netherlands).

- Online multi-brand retailers such as Zalando, Asos, Lyst or Yoox sell apparel brands and develop their own private collections, mostly value brands. They can detect market interest very fast and will immediately react upon sales data. Usually such companies will place a small test order first. If the item is selling well, they will place the actual production order. Fast delivery is a must.

- If you want to sell to retailers, the biggest names in denim are H&M, Zara and Jack and Jones. Many large supermarket chains such as Lidl or Carrefour also sell basic denim. Retailers need only one development sample for order confirmation, but their buying behaviour can be unpredictable. Order quantities are high (if you service Europe’s large retail chains), but so is price pressure.

- Denim brands such as Nudie Jeans, Pepe Jeans or A.P.C. typically develop a collection 12 months in advance. You will need a large sample room, as brands require salesman samples (SMS) of each collection style. Every sample needs to look exactly like the product will in the shop, with branded hangtags and accessories. It may take many months before orders are placed. Brands sell to retailers, but also directly to consumers via their owned branded online store.

- Intermediaries (agents, or traders/importers/private label companies) sell your product on to buyers up the value chain. They are price focused and require flexibility in quantities and qualities. Some are located near or in the production countries and primarily do sourcing and logistics, such as Li & Fung. Others such as Fashionlinq or Dr. Rehfeld AG work from Europe and also do market research, design and stock keeping. Their service level determines the commission rate that intermediaries charge.

Figure 4: Denim market value chain

Tips:

- Read the CBI study on Finding buyers for an extensive overview of European fashion market segments, channels and requirements.

- Do a thorough study of the market your ideal buyer is operating in and adjust your proposition to his or her requirements and ambitions.

- Check the latest news and updates about denim on Denimology, Business of Fashion, FashionUnited, Fibre2Fashion and WWD.

What is the most interesting channel for you?

As you move higher up the value chain, your margin will increase, but the service level that buyers demand will also increase. If you have little experience with exporting to Europe, intermediaries and brands are likely the best starting point for you. Build your market experience by working with a trader before you develop your direct business.

Intermediaries

Intermediaries (agents, traders, importers and private label companies) are the most adventurous types of buyers and are usually the first to explore new sourcing destinations (from their perspective) and factories. By doing business with these types of buyers, you will have access to many different buyers further up the value chain and you can learn how to service them by following their instructions.

Brands

For many European fashion brands, denim is part of their concept. Others specialise in denim. There is usually more room for price negotiation with brands (especially in the higher market segments), but brands also demand a higher service level than intermediaries. Make sure you can supply low minimum order quantities (MOQs) and offer flexibility.

Retail

Most large European fashion retailers are used to doing business with manufacturers in developing countries. It can be very difficult to start a business relationship if you do not comply with all mandatory requirements. Besides delivering a good quality product for a competitive price, your service level needs to be very high. Retailers may lack professional expertise on denim, so advice on product quality and development is highly appreciated.

Online multi-brand retailers

Also promising are multi-brand online stores that produce private collections. This is a budget market with low profit margins, but potentially big volumes, mostly spread over many small orders. Check out ‘8’, for instance, by Yoox, Zalando’s private label brand ‘YOURTURN’, or ‘ASOS DESIGN’ by Asos.

Tips:

- You can find intermediaries specialised in denim by using an online search engine. Use keywords such as ‘full service’, ‘garment’ or ‘denim’ plus ‘solution’. Trader’s websites usually show the brands they are working with.

- Check the online Retail-Index, which contains profiles of major apparel (including denim) retailers in Europe.

3. What competition do you face on the European denim market?

Many European denim brands have been in business for decades. They usually work with a fixed selection of suppliers, making it difficult for newcomers to enter the market. It is very beneficial if you have local availability of export-quality cotton and synthetic fibres and materials, flexible MOQ’s and an innovative mindset regarding materials and construction techniques.

Which countries are you competing with?

‘Near sourcing’ manufacturing countries like Turkey, Morocco, Tunisia and Egypt focus on fast delivery and high fashion input, which enables buyers to respond quickly to market trends. The bulk of denim production used to be manufactured in China but has moved to countries like Bangladesh, Pakistan and Cambodia due to price pressure. These countries are increasingly investing in design and innovation to diversify.

Table 2: Competing countries

|

Country |

Strengths |

Challenges |

|

Bangladesh |

High-volume production, low production costs and a competitive price level. Bangladesh enjoys GSP status. |

Less flexibility than in China. Although yarns are increasingly spun locally, Bangladesh still imports many materials. |

|

Turkey |

Close to Europe, which results in very short lead and transport times. Produces low to high-quality apparel in many categories, offers high flexibility and has a European business culture. Manufacturers accept payment in euros. |

Turkish prices are structurally higher than many Asian countries. Currently they are rising still further due to inflation. |

|

Pakistan

|

Produces high-quality, relatively cheap denim jeans. The country grows its own high-quality long staple cotton and enjoys GSP status. |

Relatively high MOQs and security issues. Many buyers do not want to travel to Pakistan (or are prohibited from doing so by their company). |

|

China |

Technical innovation, high quality, high efficiency, excellent customer service, flexible MOQs and local availability of yarns and trims. |

Increasing labour, transport and production costs, human rights concerns and China lacks General Scheme of Preferences (GSP) status that removes import duties to the EU. |

|

Tunisia |

Located close to Europe, resulting in very short lead and transport times. Experienced in producing trousers and denim. |

Price levels are higher than Asia, but lower than Turkey. Limited availability of local fabrics. |

|

Cambodia |

Cambodia supplies high-quality products at a competitive price level. Many factories in Cambodia have been set up by foreign investors, who also supply their expertise. |

Cambodia’s challenges include having an inexperienced and relatively small workforce. Social compliance concerns and political repression have caused Cambodia to lose its duty-free GSP status in 2020. |

Tips:

- Most online search engines will let you create a ‘news alert’ on a topic. This way, you can automatically follow the latest developments in the apparel industry in a specific country.

- Before you approach any buyer, determine your USPs and define your ideal buyer. Note that selling your company is even more important than selling your product, so focus on certifications and CSR. For more information, read our report on trends in the European apparel market.

- Opportunities exist for lower cost manufacturers that can also offer value added services and smooth and consistent supply, particularly regarding quality and on-trend materials. Build up your knowledge of fabrics and create a reliable network of mills by visiting relevant trade shows.

- Study the countries you are competing with, compare their strengths and weaknesses to yours and advertise the advantages of doing business with you. Besides GSP, consider factors such as distance to Europe, ease of doing business, transparency and occurrence of CSR risks.

Which companies are you competing with?

Denim Expert is one of the leading denim manufacturers in Bangladesh. The factory is ACCORD, BSCI, WRAP and Sedex certified. On its website, it first presents an elaborate story of its history, people and vision, before showing its facilities and product range. Denim Expert focuses heavily on product development and design (which it showcases on its website) and sustainable production.

Realkom in Turkey is a fully integrated manufacturer of high-quality denim jeans. The company invests heavily in research and development and has a big wash development centre. In addition to cut-make-trim, Realkom offers advice on trends, designs, fabrics and washings. The company publishes its own sustainability report, with scores on different Sustainable Development Goals.

Crossing in Morocco is a professional and flexible denim manufacturer that focuses on the sustainable manufacturing of denim products. With innovative in-house technology, they are able to manufacture denims with a minimum impact on the environment.

Tips:

- If you want to compete with the market leaders in denim production: be flexible in your minimum order quantity, even if the product has a high quality and finishing standard; innovate in product development and design and offer excellent customer service.

- Check the free online database Open Apparel Registry. This website lets you look up the suppliers of hundreds of European fashion brands, including buyers of denim.

- Read the CBI study 10 Tips for Doing Business with European Buyers to learn how to approach and engage with buyers. This report also describes how you can get practical help with understanding European business culture, analysing your USPs and doing business with European buyers.

Which products are you competing with?

Denim has long been a staple in European wardrobes, with many European consumers owning several pairs of denim jeans. Over the last five years, the value of Europe’s denim imports has increased at an average rate of 3.8% annually.

Non-denim trousers

The import of non-denims such as cotton chinos and woollen trousers, grew at an average rate of 3.6% during the last five years, only slightly less than the growth in imports of denim products. Demand is expected to continue to grow at a similar rate in the years to come. This category is becoming increasingly popular among European consumers. Items blended with elastane for stretch and comfort are doing relatively well.

Second-hand denims

The market for second-hand apparel is growing steadily in Europe, helped by convenient reselling, renting and swapping apps such as Vinted, United Wardrobe, Vestiaire Collective and By Rotation. This could in time threaten the import of denims into Europe.

Tips:

- Stay informed about the trends on the European denim market and try to adapt your product portfolio to new developments, even if it means also using non-denim materials.

- Develop a close cooperation with your fabric supplier. By combining your expertise on product development, you will increase your competitiveness.

4. What are the prices for denim on the European market?

The factory price of your product (in fashion industry jargon, your ‘FOB price’: Free On Board) is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin. For a step-by-step guide on how to calculate the FOB price of an apparel item, refer to this CBI study on cost-price calculation.

The average cost breakdown of your FOB price should look like this:

Note that these percentages may differ per factory and per order. Some factories accept lower profit margins during off-season periods, or when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of the materials. Efficiency goes up and material prices go down when producing large volume orders.

Retail pricing

The retail price of a denim item is on average 4-8 times the FOB price (this is called the ‘retail markup’). It follows that the FOB-price is on average 12,5-25% of the retail price of the product. Exceptions do occur. In the budget market, some large European retail chains may only double the FOB price mark up. Retailers mark up the FOB-price by 4-8 times because they need to account for (among other things) import duties, transport, rent, marketing, overhead, stock keeping, markdowns, VAT (15-27% in EU-countries).

Source: Eurostat

According to Eurostat’s 2022 comparison of retail prices for apparel in Europe, of the top-3 European importers of apparel and footwear, France has the highest price level at 105.4 points compared to the European average of 100, followed by Germany (98.7), and Spain (84.8). Denmark is the EU member state with the highest price point (134.4), and Switzerland is the most expensive European country for apparel (141.5).

Price development

Online commerce and a strong budget segment have made low prices the norm for European consumers. However, a stronger focus on sustainability and rising costs for materials, production (due to global political instability) and shipping have put manufacturers, suppliers and buyers under significant price pressure. Inflation in Europe has fallen slowly in 2023, but remains higher than normal.

Frans Tilstra and Giovanni Beatrice for FT Journalistiek carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research