Entering the European market for Islamic wear

This report describes the most important opportunities and requirements for exporting Islamic wear into Europe. You will learn about the relevant rules and regulations, the best channels to get your product on the market, the countries where your competitors are located, and the best ways to provide a quotation.

Contents of this page

1. What requirements must Islamic wear comply with to be allowed on the European market?

You can only successfully export Islamic wear into Europe if you understand all the requirements that European buyers of Islamic wear have. In addition to legal and company-specific requirements, the most obvious requirements for Islamic wear are religious and cultural.

What are mandatory requirements?

Legal requirements for exporting Islamic wear into Europe include legislation on product safety, the use of chemicals (REACH), quality and labelling. Check the EU Access2Markets online helpdesk for an overview. Additionally, many buyers have non-negotiable terms and conditions which their suppliers need to comply with.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Make sure that your product complies with the European Union's (EU) General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplies the product design, it is their responsibility to guarantee that it is legally safe for consumers to use.

- Make sure that you meet the EU’s REACH Regulation. This restricts and limits the use of chemicals in apparel and trims, including certain azo dyes, flame retardants, waterproofing and stain-repelling chemicals and nickel.

- Use a composition label to specify the material content of every Islamic wear item that you export to the EU, in accordance with EU Regulation 1007/2011. Check the EU Access2Markets online helpdesk on how to do it.

- Never violate Intellectual Property (IP) rights and never copy and share designs with other buyers. If your buyer provides the design, they will be liable if the item is found to violate any intellectual property rights.

Non-legal mandatory requirements

In addition to the legal requirements mentioned above, your buyer may have company-specific terms and conditions. These are not legal requirements, but are still essential to follow.

The buyer manual

When you do business with a European buyer for the first time, they will typically give you a contract and/or a manual to sign. By signing the contract, you are confirming that you will meet all the listed requirements. This means that you will be held accountable in case of a problem after the delivery of an order. Complying with the REACH Regulation can be particularly challenging. With small orders, most European buyers will not ask for expensive testing, but if illegal chemicals are discovered after delivery, you will be liable for all rectification costs.

Acceptable quality limit

To guarantee product quality, your buyer may set an acceptable quality limit (AQL). This refers to the minimum level of quality that can be accepted. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the whole order is defective.

Be prepared for the new EPR legislation (Extended Produced Responsibility), which states that the company importing the goods into the market is responsible for complying with the EPR legislation. If the buyer suggests changing delivery from FOB to DDP, this will have legal risks and consequences.

Restricted substances

Ask your buyer if they use a Restricted Substances List (RSL). These are often inspired by the guideline on safe chemicals use from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance here.

Packaging requirements

In most cases, your buyer will give you instructions on how to package the order. An important requirement for packaging Islamic wear is that packaging does not include any revealing pictures. If you agree to deliver Free on Board (FOB), which is the industry standard, your buyer will clear customs in the country of import. It is their responsibility to ensure that the instructions comply with EU import procedures. Always try to reduce the environmental impact (and financial cost) of the packaging materials you use.

Payment terms

For a first-time order, European buyers may agree to a down payment (for instance, 30%). They will pay the rest (70%) after the order has been completed. This will help you minimise the risk of taking on a new buyer. The safest payment method for you as a manufacturer is an LC (Letter of Credit). An LC requires the buyer’s bank to pay the supplier when both parties meet the conditions they have agreed upon. However, many buyers no longer favour LC payments, as they restrict their cash flow. Be aware that LC do not offer financial protection against bankruptcies!

When it comes to future orders, many European buyers typically request a TT (Telegraphic Transfer) payment method with payment terms of 30, 60, 90, or occasionally 120 days. Under this arrangement, as the manufacturer, you complete production and deliver the shipment to the buyer, along with the necessary original documents, prior to the payment due date. The actual payment is made by the buyer after the agreed-upon number of days. It is important to note that this payment agreement entails a certain level of risk for you as the supplier, because you assume all the financial risk until payment is received.

Figure 1: The Muslim Shopping Festival in London is 1 of the biggest live events for Muslim fashion and lifestyle in Europe

Source: The Muslim Shopping Festival

Transparency

Supply chain transparency is key for the European apparel industry, motivated by ever stricter legislation at the EU and national levels. For instance, the EU’s new Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD) require all larger European companies to disclose and report on how they manage social and environmental risks.

Transparency means you should disclose information about your own operations to buyers, but also help them to gain as much insight as possible into the entire supply chain.

Restricted substances

Ask your buyer if they use a Restricted Substances List (RSL). These lists are often inspired by the guidelines on the safe use of chemicals from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. You can download the ZDHC Conformance Guidance here. Please note that the ZDHC guideline on safe chemicals goes beyond the legal requirements.

Carbon footprint

Many Western brands have committed to climate neutrality. To calculate the carbon footprint of a product, emissions are usually measured in units of carbon dioxide equivalent (CO2e) and the total emissions are then divided by the number of products. This calculation is complicated, but several organisations have set benchmarks for certain materials and/or products. Refer to the CBI study Tips to go green in the apparel sector for more information.

Recycling

The EU is introducing new legal measures to increase circularity in textiles, including new directives concerning the durability of textile products and a ‘right to repair’. The EU is also considering the introduction of an EU-wide EPR for apparel (extended producer responsibility). This would make companies responsible for the way their products are disposed of, recycled or repaired. Some countries have already implemented national EPR schemes. Recycling and repurposing materials will help your buyers reduce waste and conserve resources.

Certification

European Islamic wear companies may require suppliers to be certified for sustainable and/or fair production or the use of sustainable materials. The following standards and certifications are the most popular in Europe among (modest fashion) brands. Note that BSCI is almost a standard requirement for many European apparel companies.

Table 1: Europe’s most popular standards

|

Name of standard |

Logo |

Type of compliance |

Further information on getting certification |

|

Amfori BSCI |

|

Social |

On invitation from buyers. Amfori provides a list of organisations that can perform an audit |

|

SA8000® |

|

Social |

|

|

WRAP |

|

Social |

|

|

Sedex |

|

Social, environmental |

|

|

Fair Wear |

|

Social |

|

|

B-Corp |

|

Social, environmental |

|

|

OEKO-TEX® STeP |

|

Social, environmental |

|

|

BCI |

|

Environmental (sustainable cotton production) |

|

|

GOTS |

|

Social, environmental (organic production) |

GOTS provides a list of organisations that can perform an audit |

|

ZDHC |

|

Environmental (chemical use) |

The ZDHC provides a guide that outlines the requirements for indicating ZDHC MRSL conformance |

|

Bluesign |

|

Environmental (sustainable production) |

See the Bluesign services for manufacturers |

|

Global Recycled Standard |

|

Environmental (material recycling) |

|

|

Recycled Claim Standard |

|

Environmental (material recycling) |

In addition to these standards, many European buyers have developed their own codes of conduct. If you sell to several European buyers, you may have to comply with multiple standards. This can be costly and labour-intensive. To avoid the duplication of work, a group of 60 larger fashion brands and 7,000+ apparel factories have adopted the Social & Labor Convergence Program (SLCP). By adhering to this framework, you can ensure compliance with various social standards and regulations such as the CSDDD. The SLCP’s popularity is growing.

Tips:

- Read the CBI study on Buyer requirements for an extensive overview of the requirements for exporting Islamic wear to Europe.

- Check the EU Access2Markets online helpdesk for an overview of all the legal requirements that apply to your product. The Trade Assistant enables you to identify your product and get a list of applicable requirements.

- Read the CBI studies on Sustainable Materials, Recycled Fashion and The sustainable transition in apparel and home textiles for more information on sustainable apparel production. The CBI studies Tips to go green and Tips to become more socially responsible provide practical guidance to make your factory more fair and sustainable.

Figure 2: The jilbab refers to any long and loose-fitting over-garment or cloak worn by Muslim women when in public

Source: Forward in Fashion

What additional requirements and certifications do buyers often have?

In addition to mandatory requirements, there are many services that buyers may expect or value highly, if you want to do business with them. Firstly, Islamic wear should naturally meet the religious and cultural requirements for Islamic designs. There are also specific requirements on quality, machine washability and fit, which may be part of the buyer’s requirements.

Product design and development

Islamic wear should reflect the teachings of Islam. A more fashionable version of Islamic wear is often referred to as ‘modest’ fashion. The main characteristic of Islamic wear is its loose-fitting designs that hide the shape of the body. Body-hugging designs and flashy fabrics are therefore not consistent with this.

Islamic wear should generally meet the following criteria:

- Women should cover their body, and particularly their torso. Men should cover the area between their navel and knees.

- Garments should be loose and not reveal the shape of the body.

- See-through clothing is not considered appropriate. Fabrics should be thick enough to not show the colour of the skin.

- Flashy fabrics or styles are discouraged. The overall design of the garment should blend in rather than stand out.

- Designs should not imitate other faiths. Women should not dress like men and vice versa. Do not use gold or silk in men’s styles as these are materials considered suitable only for women.

The general idea among fashion brands and end consumers is that these criteria do not detract from a sense of style. Brands like Dolce & Gabbana, DKNY, Hilfiger, H&M, ASOS and Uniqlo have ventured into the Islamic wear market, designing garments that provide full coverage while also enabling women to explore the latest fashion trends. Islamic wear encompasses a range of styles that include hijabs, burqas, as well as tops, trousers, jackets, and dresses.

- Europe has several different climate zones, ranging from Mediterranean in the south to mild in the centre and cold in the north. Fabrics should be adapted to the climate and seasons.

- European Muslims often embrace the culture and fashion trends of their country of heritage. Colour and design choices will also depend on the occasion, such as festivals or celebrations, work, or everyday wear.

Tips:

- To stay updated on the latest trends in Islamic wear, follow websites such as Haute Hijab, Vogue Arabia, Elle Arabia, Harper’s Bazaar Arabia or Islamic wear retailers that cater to various markets, including Europe, such as The Modist or EastEssence.

- Social media platforms such as Instagram, Pinterest, and YouTube are popular platforms where influencers and fashion enthusiasts share trends in Islamic wear. Follow relevant hashtags such as #IslamicFashion, #ModestFashion, or #HijabStyle to discover the latest trends.

- Check international fashion events and exhibitions that showcase modest fashion and Islamic clothing designers such as the Muslim Shopping Festival in London.

Communication

Your success depends largely on the quality of your service. Smooth communication is an important aspect. Always reply to every e-mail within 24 hours, even if it is just to confirm that you have received it and will reply in detail later. If you encounter a problem with an order, notify your buyer immediately and try to offer a solution. Create a T&A (time and arrival) sheet of every order and share it with your buyer. This will help you to manage expectations and monitor progress and it is the best guarantee for timely delivery.

Since many European Islamic wear brands are Muslim-owned, there is a preference for doing business with manufacturers that share the same heritage and beliefs.

Flexibility

Many factories focus only on getting ‘convenient’ orders: simple styles, large quantities and long delivery times. If you want to embark on a business relationship with a European buyer, be prepared to accept more complicated orders first. Buyers will want to test your factory before giving you big, easy orders. However, make sure that a buyer will not continue only to place difficult orders with you and more convenient orders elsewhere.

For the first order, you can expect a European buyer to require:

- High-quality material and impeccable workmanship;

- Order quantities below your normal Minimum Order Quantity (MOQ);

- A price level that is lower than what you normally would accept for small quantity orders.

Tips:

- Don’t forget that 60% of doing business successfully is providing an excellent service.

- Buyers will want to receive deliveries before Ramadan as this is the time of year that most sales are made.

- Be proactive and prompt in your communication. Send short updates to your buyer via text, photo or video using WeChat, WhatsApp or Signal. To make free video (conference) calls you can also try Skype or Google Meet.

- Read more about voluntary standards including fair production in the ITC Standards Map database.

What are the requirements for niche markets?

The following niche categories, although relatively small, are experiencing growth and offer opportunities for Islamic wear manufacturers. The required qualities, styles, and quantities often differ from mainstream production.

Seasonal and festive items

Ramadan, the end of which is marked by the festival of Eid-al-Fitr, is a time of prayer and fasting, but also of socialising with family, friends and the wider Muslim community. Muslims want to look their best during this period and will traditionally buy at least 1 new outfit. The dress code may vary from kaftans for European Muslims with an Arabian heritage to saris for Muslims with an Asian heritage. Ramadan garments should be smart but also comfortable and breathable, since fasting during Ramadan involves abstaining from food and water for long periods.

Islamic sportswear

Islamic sportswear should balance the need for modesty while also allowing for freedom of movement. It includes longer-length, loose-fitting garments, to ensure that the limbs and torso remain covered. For women, Islamic sportswear can include a hijab. Fabrics should be lightweight, breathable, and moisture-wicking to allow for easy movement and help regulate body temperature. These fabrics are designed to keep athletes cool and dry. Avoid loose or flowing fabrics that could get tangled during sports activities and pose a safety risk.

Sustainable Islamic wear

A growing number of Muslim-owned or Muslim-targeted fashion brands emphasise sustainability and ethical production practices. These brands offer modest fashion that is made from eco-friendly materials, promote fair trade practices, and prioritise reducing waste and carbon footprint. See, for instance, AAB, Nea Wear or Fayena.

Tips:

- If you decide to focus on a niche, investigate the specific requirements and make sure you can meet these. Be aware that order quantities in niche markets can be smaller than in mainstream markets.

- Check market research reports and studies that focus on Muslim consumer behaviour and trends, such as DinarStandard and the Pew Research Center. They occasionally publish reports on the Muslim consumer market.

- To stay updated on trends and innovations in Islamic wear, consult Islamic lifestyle magazines such as Muslim Vibe or Amaliah.

2. Through which channels can you get Islamic wear onto the European market?

Before you start to approach European Islamic wear buyers, you need to determine which market segment fits your company best and through which channel(s) you want to sell your product.

How is the end-market segmented?

In addition to the obvious segmentation based on gender, age and product type, segments in the Islamic wear market can best be distinguished by the price/quality level. The largest segments are the luxury market, the upper-middle and middle markets and the budget segment.

Table 2: Islamic wear market segmentation

|

Consumer type |

Price level |

Fashionability |

Material use |

|

Luxury consumer |

Very high |

Unique, original styles and designs |

Unique, high-quality materials and finishes |

|

The custom-made market |

High |

Unique, bespoke and original styles |

Unique, high-quality materials and finishes |

|

The middle market

|

Medium-high |

Wide range of basic to more detailed styles |

Often blends to improve fabric characteristics and durability |

|

The budget market

|

(very) low |

Basic styles with a focus on mainstream consumers |

Low-price materials that meet consumers’ quality expectations |

The luxury consumer

Islamic luxury brands such as Barjis London are rare. For mainstream luxury brands, such as Versace, Chanel or Balenciaga, Islamic wear is not their primary focus. These brands offer exclusive, custom-made or limited-edition designs (sometimes in collaboration with Muslim designers or influencers), sometimes at a very high retail price. Because buyers in this segment have extremely high standards regarding design, workmanship, material quality and brand image, production mostly takes place in and around Europe. Order quantities are low.

The custom-made market

The custom and bespoke segment offers individual tailoring and personalised Islamic wear items. Brands or designers in this segment work closely with end customers to create unique and made-to-measure pieces, often at higher price points due to the personalised service and attention to detail.

The middle market

The middle market caters to both practical and more fashion-conscious consumers. It is home to brands such as Haute Hijab, AAB Collection, Anna Hariri or IslamitischeKleding.nl, which sell both practical and creative designs, but in a less conspicuous way than in the luxury segment. The focus is on washability, fit, medium-quality materials and fashionable designs. Retail prices range from medium to high. Order quantities range from low to medium.

The budget market

Price-conscious consumers who are looking for mainstream but fashionable designs or more basic designs shop at large retail chains such as H&M (basic-fashionable) or Primark (basic-fashionable). Order quantities are high and retail prices are (very) low, so margins will be low too.

Tips:

- Investigate the preferences of the Muslim population in your target market. Djellabas, Kandoras or Abayas are worn mainly by people with North-African heritage in countries such as France, Belgium and the Netherlands. Members of Muslim communities with Asian origins (based in the UK, for example) prefer Asian styles such as Sharwals, Qamees, Chadors or Saris.

- Several European countries have banned face coverings. Check which countries allow for which styles of Islamic wear.

- Add value for higher segments that offer higher profit margins. Focus on design, quality and material use.

- All segments have 1 thing in common. The styles should be comfortable, practical and provide a great fit.

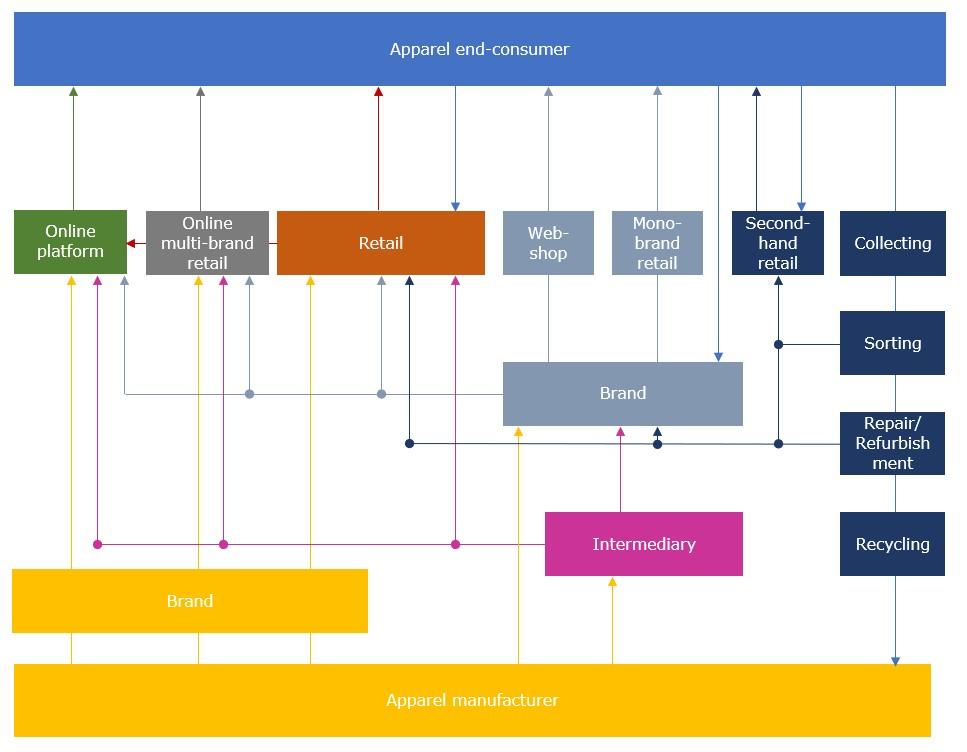

Through what channels does a product end up on the end-market?

How buyers will do business with you depends on their position in the value chain. Each buyer requires a specific approach. Always try to find out which part of the value chain your buyer is operating in, what challenges they face and how you can contribute to their sales strategy.

- End consumers for Islamic wear are used to shopping online. If you want to target them directly, try marketing your website through social media or platforms for independent brands such as Alibaba, Wish or Amazon. You will need to invest in a webshop, stock, order management, and customer service. Your biggest challenge will be transport costs and return policies.

- The growing second-hand market in Europe is served by online platforms such as vestiairecollective.com, vinted.com, depop.com, or national websites such as marktplaats.nl (in the Netherlands).

- Online multi-brand retailers, such as Zalando or Asos, sell existing brands and develop their own private collections, mainly value brands. They can detect market interest very quickly and will respond immediately based on sales data. Usually such companies will first place a small test order. If the item sells well, they will place the actual production order. Fast delivery is a must.

- Big retailers such as H&M or Primark cater to the European Muslim community with Islamic wear side collections and more general loose-fitting, lengthy styles. Retailers can place an order relatively easily as they only need 1 development sample for order confirmation. Order quantities are usually high, as is price sensitivity.

- Independent (online) brands typically develop their collection 12 months in advance. You will need a large sample room as brands require salesman samples (SMS) of each collection style. Every sample needs to be actual – meaning that it must look exactly like the product will look in the shop, including branded hangtags and accessories. It can take many months before orders are placed.

- Intermediaries such as agents, traders, importers, private label companies, or full-service vendors sell your product to buyers higher up the value chain. They are price-focused and require flexibility in quantities and qualities. Some are located near or in the producing countries and focus primarily on sourcing and logistics, such as Li & Fung. Others work from Europe and focus more on market research, design and stock keeping. Their service level determines the commission rate they charge.

Figure 3: Islamic wear market value chain

Tips:

- Read the CBI study on Finding buyers for an extensive overview of European fashion market segments, channels and requirements.

- Do a thorough study of the market that your ideal buyer is operating in and tailor your proposition to their requirements and ambitions.

- Find trading partners at live events such as the Muslim Lifestyle Expo in London or Texworld in Paris.

What is the most interesting channel for you?

The market for Islamic wear is underserved in Europe. Online brands specialising in Islamic wear and small retailers are currently the two main options for European Muslim shoppers. Long, loose-fitting styles from large retail chains such as H&M, Zara or Primark are also popular with Muslim shoppers. Very few agents are active in Islamic wear export to Europe.

Small retailers

Many Muslim shoppers buy their Islamic wear in small shops around the corner that offer styles that have been bought off-the-shelf in Islamic countries such as Egypt or Turkey. These are often festive garments in relatively cheap materials such as polyester.

(Online) brands/retailers

For a growing number of European fashion brands, Islamic wear is part of their concept. Others specialise in Islamic wear. There is usually more room for price negotiation with brands (especially in the higher market segments), but your service level also needs to be higher than intermediaries require from you. Make sure you can provide low MOQs and flexibility.

Tips:

- You can find intermediaries specialising in Islamic wear by using an online search engine. Use keywords such as ‘full service’, ‘garment’ or ‘Islamic wear’ plus ‘solution’. Trader’s websites usually indicate which brands they work with.

- Check the online Retail-Index, which contains profiles of major apparel (including Islamic wear) retailers in Europe.

- Provide your buyers with a continuous collection of new materials and qualities.

Figure 4: A lot of Islamic wear in Europe originates from countries such as Egypt, Turkey and Morocco. These countries are close to the market and their manufacturers share the same Muslim background as buyers

Source: Forward in Fashion

3. What competition do you face on the European Islamic wear market?

If you want to be competitive, it is very beneficial to have local availability of export-quality cotton and synthetic fibres and materials, flexible MOQs (Minimum Order Quantity) and an innovative mindset regarding materials and construction techniques.

Which countries are you competing with?

‘Near sourcing’ manufacturing countries such as Turkey, Egypt, Morocco and Tunisia are well-positioned to service the European market for Islamic wear because of their location and religious and cultural heritage. The biggest overall exporters to Europe such as China offer excellent customer service and flexible MOQs.

Table 3: Competing countries

|

Country |

Strengths |

Challenges |

|

Turkey |

Close to Europe, resulting in very short lead and transport times. Produces low to high-quality apparel in many categories; offers high flexibility and has a European business culture. Manufacturers accept payment in euro. |

Turkish prices are structurally higher than many Asian countries. Currently, they are rising due to inflation. |

|

Egypt |

Local availability of high-quality long-staple cotton and fabrics which enables vertical manufacturing. High flexibility on order quantities. Benefits from the GSP. |

Relatively low service level and low level of compliancy. Design support lacking. |

|

China |

Technical innovation, high quality, high efficiency, excellent customer service, flexible MOQs and local availability of yarns and trims. |

Increasing labour, transport and production costs, human rights concerns and no General Scheme of Preferences (GSP) that removes import duties to the EU. |

|

Pakistan

|

Delivers good-quality, relatively cheap apparel. The country grows its own high-quality, long-staple cotton and benefits from the GSP. |

Relatively high MOQs and security issues. |

|

Morocco |

Close to Europe, resulting in short lead and transport times. The country is particularly popular with Spanish and French buyers. |

Price level higher than Asia, but lower than Turkey. No availability of local fabrics. |

|

Tunisia |

Specialises in fashionable casual wear. Close to Europe, resulting in short lead and transport times. |

Price level higher than Asia, but lower than Turkey. Minimum of local fabrics. |

Tips:

- Most online search engines will allow you to create a ‘news alert’ on a particular subject, so that you can automatically follow the latest developments in the apparel industry in a specific country.

- Study the countries you are competing with, compare their strengths and weaknesses to yours and advertise the advantages of doing business with you. Besides GSP, consider factors such as distance to Europe, ease of doing business, transparency and CSR risks.

- Research the Islamic wear brands that are sold locally. This will give you input on design, quality and manufacturing source.

Which companies are you competing with?

Abaya is an Egyptian wholesaler of Islamic wear, specialising in richly decorated abayas. The company was founded over 20 years ago and sells to the local, regional and international markets. In addition to wholesale, Abaya also runs an online retail platform.

MonaModda is a Turkish wholesaler of modest dresses, tunics, abayas and outerwear, founded in 1997. In 2009, it launched direct sales via an online shopping platform to customers worldwide.

Al Hour Al Ein in Jordan offers a diverse collection of clothing items, including hijabs, abayas, jilbabs, thobes, and other traditional Islamic wear. They combine traditional Islamic designs with contemporary fashion trends, creating stylish pieces that cater to a modern Muslim lifestyle. Their garments are available for purchase through their physical stores as well as their online platform.

Tips:

- Read the CBI study entitled 10 Tips for Doing Business with European Buyers to learn how to approach and engage with buyers. This report also describes how you can get practical help with understanding European business culture, analysing your USPs and doing business with European buyers.

- Explore the options for different types of partnerships that can offer market access opportunities, and enhance your knowledge and service level. In the highly competitive European market, companies are looking for a competitive edge to differentiate themselves from others. Co-creation and new ideas from partners are usually welcome.

Which products are you competing with?

Since Islamic wear caters to a very specific target group, few other products adhere to Islamic wear’s requirements. The only significant competition that you will currently face is from mainstream brands and retailers that are developing styles with looser fits and longer lengths but which are not specifically Islamic in nature.

Tips:

- Stay informed about the trends on the European Islamic wear market and try to adapt your product portfolio to new developments.

- Develop a close partnership with your fabric supplier. By combining your expertise on product development, you will increase your competitiveness.

4. What are the prices for Islamic wear on the European market?

The factory price of your product (in fashion industry jargon, your ‘FOB price’: Free On Board) is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overheads and profit margin. For a step-by-step guide on how to calculate the FOB-price of an apparel item, refer to this CBI-study on cost-price calculation.

Even though the demand for higher-quality Islamic wear is growing, there is still a large consumer base focusing on low-priced products.

The average cost breakdown of your FOB price should look something like this:

Note that these percentages may differ between factories and between orders. Some factories accept lower profit margins during off-season periods, or when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of materials. Efficiency rises and material prices decline when producing large-volume orders.

Retail pricing

The retail price of a fashion item is on average 4-8 times the FOB price (this is called the ‘retail markup’). It follows that the FOB price is on average 12.5-25% of the retail price of the product. There are exceptions, however. In the budget market, some large European retail chains may only double the FOB price mark-up. Retailers mark up the FOB price by 4-8 times because they need to account for extra costs such as import duties, transport, rent, marketing, overhead, stock keeping, markdowns, and VAT (15-27% in EU-countries).

However, in the Islamic wear market, there are also many small retailers that calculate a mark-up of 2 or 2.5.

Source: Eurostat

According to Eurostat’s 2022 comparison of retail prices for apparel in Europe, of the top-3 European importers of apparel and footwear, France has the highest price level at 105.4 points compared to the European average of 100, followed by Germany (98.7), and Spain (84.8). Denmark is the EU member state with the highest price point (134.4), and Switzerland is the most expensive European country for apparel (141.5).

Price development

Online commerce and a strong budget segment have made low prices the norm for European consumers. However, a stronger focus on sustainability and rising costs for materials, production (due to global political instability) and shipping have put manufacturers, suppliers and buyers under significant price pressure. Inflation in Europe has slowly fallen in 2023, but is still higher than normal.

Frans Tilstra and Giovanni Beatrice for FT Journalistiek carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research