Entering the European market for leather bags

Europe is one of the world’s most interesting markets for leather bags. It is large, but European buyers also have high expectations regarding quality, prices and service levels. On top of these, the European Union (EU) market is changing due to new legislations regarding social and environmental risks in international supply chains. For manufacturers that can adapt to these market requirements, change means opportunity.

Contents of this page

- What requirements and certifications must leather bags comply with to be allowed on the European market?

- Through which channels can you get leather bags on the European market?

- What competition do you face on the European leather bags market?

- What are the prices of leather bags on the European market?

1. What requirements and certifications must leather bags comply with to be allowed on the European market?

There are a range of requirements you need to comply with when exporting leather bags to Europe. Some are mandatory; both legal and non-legal. Others are voluntary. Meeting them can give you a competitive advantage. Some requirements only apply to niches in the leather bags market.

What are mandatory requirements?

There are many legal requirements for exporting leather bags to Europe, including ones that concern product safety, the use of chemicals (REACH), quality and labelling:

- Make sure your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Make sure you comply with the EU’s REACH Regulation, which restricts the use of chemicals and metals and with POP Regulation 2019/1021, which restricts the use of Persistent Organic Pollutants (POPs). See table 1 below.

- Specify the material composition of every item of leather bags that you export to the EU, in accordance with Regulation (EU) 1007/2011. Check the EU Access2Markets online helpdesk on how to do it.

- Do not use materials derived from endangered animals in your leather bags, in compliance with EU CITES legislation (EC 338/97). Check which animals and plants are restricted on the EU Access2Markets online help desk.

- Do not violate any Intellectual Property (IP) rights and do not copy or share designs with other buyers. If your buyer provides the design, they will be liable if the item is found to violate a property right.

Tips:

- The CBI study on buyer requirements offers an overview of the requirements (legal and non-legal) and commercial and cultural expectations for exporting to Europe. All legal requirements are also listed and updated on the EU Access2Markets online helpdesk.

- REACH is regularly updated to include more restricted substances. Keep yourself up to date with the candidate list here. Certain standards, such as the Oeko-Tex® Leather standard, guarantee compliance with both REACH and the substances on the candidate list (see below).

- Complying with REACH can be challenging. Most European buyers will not ask for testing with small orders, but you will bear all expenses involved if illegal chemicals are discovered after delivery. Make sure to test your materials if you want to be sure that your products are REACH compliant. Most laboratories use the competence standard ISO/IEC 17025.

Table 1: Explanation of the most common chemicals and metals in leather items restricted by the EU

| Chemical name | Common use |

|---|---|

| Biocides | Used to prevent the growth of bacteria that can damage the hides or skins during the soaking process. |

| Formaldehyde | Used in preservatives and tanning agents. |

| Chlorinated Paraffins/ Persistent Organic pollutants (POPs) | Used as fat-liquoring agents in the finishing stage of leather production. The fat-liquoring process improves softness, flexibility and water resistance. |

| Per- and PolyFluoroAlkyl Substances (PFAS) | Used in finishing to provide water and oil repellence and stain resistance. PFAS are often called ‘forever chemicals’ because they are highly persistent and do not break down in the environment or the human body. Recent changes to REACH regulation focus heavily on PFAS. |

| VOC-emitting substances | Carbon-based compounds that easily evaporate into the atmosphere. Emissions of VOCs in leather manufacturing primarily come from the use of organic solvents, adhesives, dyes and finishing agents. |

| Heavy metals such as Chromium III, Arsenic and Barium | Used in the tanning process. They can build up in the environment and cause health problems. Around 75% of leather is produced using chrome salts, which creates soft, supple leather that is durable and water resistant. Chromium III is not regulated by REACH, but processing can convert it to Chromium VI, which is. |

| Chromium VI | The formation of Chromium VI can occur during tanning, storage or transport via exposure to UV light, high temperatures, low humidity, oxidising gases, oxidising chemicals and high pH values. Exposure can cause skin irritation, respiratory problems and even cancer. |

| Nickel | May occur in trims. Exposure can cause health problems. |

| Phthalates | May occur in PVC parts. Exposure can cause health problems. |

Source: FT Journalistiek

Non-legal mandatory requirements

Buyers may confront you with additional, company-specific terms and conditions. These requirements are usually set out in a buyer manual. By signing a contract with your new buyer, you confirm that you will comply with all the requirements listed in the manual. You will be held accountable if there are any problems after the delivery of an order. The following topics may be included in a buyer manual.

Quality requirements regarding tanning methods

Buyers will always search for the type of leather that best fits their product. Their first consideration will be about the tanning method, as this determines the look and feel of the leather, although a lot can be adjusted during the ‘finishing’ of the leather. Leather can be tanned using the following tanning methods:

- Vegetable tanned;

- Semi-veg;

- Chrome-tanned;

- Low-chrome; and

- Chrome-free.

Each type of leather is suitable for different products. For instance, vegetable tanned leather is relatively firm, thick and has deep, warm colours. It is mostly used for bags and belts. Vegetable tanned leather is especially popular in northern European countries, where consumers appreciate this type of leather for its ‘natural look’.

Chrome tanning may result in softer, thinner and suppler leathers, which can be used in many different bag styles and other leather products. Nowadays, certain vegetable and chrome-free tanned leathers are able to provide the same characteristics, with a lower environmental impact.

Sustainability and consumer safety are other reasons buyers require certain types of leather. Vegetable tanned leather is popular among European brands that promote themselves as ‘eco-friendly’, although the exact environmental impact of each tanning method is still under discussion. A lot depends on how tanneries manage their inputs and waste.

Ever more buyers require chrome-free tanned leathers for reasons of sustainability and consumer safety. This is to avoid the risk of formation of Chromium VI in leather (which is restricted by REACH). Between 2014 and 2020, the proportion of chrome-tanned leather fell from 85% to 75% and this trend is expected to continue. Chrome-free can be either vegetable tanned or wet-white tanned leather.

Figure 1: The growing popularity of chrome-free leather is shown by different exhibitors in the leather section at Première Vision trade fair in Paris

Source: FT Journalistiek

Quality requirements for finished leather

Finished leather is available in different qualities (high to low): full-grain aniline and semi-aniline, pigmented smooth leather, nubuck, suede, split leather and bonded leather. The number of scars, cuts and blemishes is expressed in grades: A (lowest number of defects, highest quality), B and C (highest number, lowest quality).

Most buyers will require a certain type of leather and leave the selection of grades up to you. Lower grade leathers are relatively cheap but using them will increase wastage because there are more blemishes you need to work around. Buyers will reject ready-made products with too many visible defects in the leather, unless the natural defects are part of the design.

Expect buyers to also set requirements regarding colour fastness, especially if you use suede-type leathers.

Acceptable quality limit

To guarantee product quality, your buyer may set an acceptable quality limit (AQL). This refers to the worst quality level that is still tolerable. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the items are defective.

Common quality defects in leather bags are:

- Uneven, wonky cut leather parts and patches;

- Uneven, wonky stitching lines;

- Visible material defects due to the use of lower grade leathers;

- Colour shadings;

- Pencil marks, presser foot marks;

- Edge paint spots, glue spots.

Packaging requirements

In most cases, buyers will give you instructions on how to package orders. This is specified in their vendor manual. These rules need to be respected and can lead to extra costs in case the final delivery does not comply with the instructions. Your buyer will also appreciate any efforts you make to reduce the environmental impact and financial cost of the use of packaging materials. For instance, you can use materials made from recycled cardboard or biodegradable plastics.

In case you have ordered bags made with chrome-tanned leather (which is legally allowed), make sure that the items are handled properly. Changes in temperature during transport can change chromium III into the forbidden chromium VI, which would lead to your product being non-compliant with REACH (see above).

A common requirement in the leather bags industry is to store, pack and ship your goods in dry, well-ventilated conditions. Leather tends to absorb moisture from the air, which can lead to a loss of sheen, bad smell, spots, stains and growth of mould or mildew. Packing your leather goods with silica gel packets is a common measure to reduce excess moisture during shipment. Wrap metal accessories separately to prevent them from damaging the leather.

Payment terms

For first-time orders, European buyers may agree to give you a down payment (30%, for example) and pay the rest (70%) once the order has been completed. The safest payment method for you as a manufacturer is the LC (Letter of Credit). An LC obligates a buyer’s bank to pay the supplier if both parties meet the conditions they have agreed upon. However, many buyers no longer favour LC payments, as this will block their cash flow. Be aware that LCs do not offer financial protection against bankruptcy.

For further orders, most European buyers will ask for a TT (Telegraphic Transfer) after 30, 60, 90 or sometimes even 120 days. This means you as a manufacturer finish the production and then hand over the shipment to the buyer before payment is due, including the original documents. The payment will be made after the number of days that you have agreed on with the buyer. This is a risky payment agreement because you are taking the full financial risk.

Transparency

Supply chain transparency is very important for European buyers because of ever stricter laws at EU and national levels. These include the EU’s CSDDD, CSRD and EUDR. This only applies to leather, not leather goods, but this may change. Transparency includes tracing back which suppliers produced the leather, but also measuring and disclosing the environmental impact of the materials, such as the carbon footprint. Always help buyers gain insight into their entire supply chain. Read the CBI study Tips to go green for more information.

Restricted substances

Your buyer’s manual may contain a Restricted Substances List (RSL). These lists are often inspired by industry platform AFIRM and the guideline on safe chemicals use from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance for more information.

Recycling

Recycling materials is ever more important for European buyers because the EU regularly introduces new legal measures, including the ‘right to repair’ and an EU-wide EPR scheme (extended producer responsibility), which makes companies responsible for how their products are disposed of, recycled or repaired. Some countries have national EPR schemes already.

Leather is notoriously difficult to recycle, but several initiatives can serve as best practices. Ideally, manufacturers should play a role in remanufacturing, refurbishing and repairing leather bags at the end of their lifecycle.

- Soruka creates sustainable, handcrafted, and responsibly-made recycled leather bags, wallets, and footwear using leftover leather clippings.

- Real man leather focusses on recycling and reusing leather (for example, old leather jackets) to create a variety of leather bags including bags, wallets, belts, tool belts, binders and book covers.

- Looptworks recycles leather seat covers from Southwest Airlines into handbags and leather bags.

Carbon footprint

Many European brands have committed to climate neutrality. Calculating the carbon footprint of a leather bag is a complicated process, but several organisations have set benchmarks for certain materials and products. Check the CBI study Tips to go green for more information.

Sustainable production and materials

Buyers of leather bags appreciate advise on the use of sustainable materials in leather bags.

- Buyers may require you to only use vegetable tanned or chrome-free leathers (see above).

- Suppliers of leather tanning chemicals and processes keep introducing sustainable solutions. Check, for instance, DriTan Technology by ECCO, Zeology by Neratanning, EasyWhite™ by Stahl, water-based finishing (instead of solvent-based chemical finishing) and plasma finishing (instead of PFAS)

- Another sustainability issue during tanning is the (excessive) use of salt. Many tanners and their suppliers are switching to techniques requiring less or no salt. For instance, look into Litehide.

- To prevent wastage, invest in computer-controlled cutting machines to optimise the use of leather skins, or discuss the option of using smaller patches in the designs with your buyer.

Equality

Your buyer may also have requirements regarding diversity and inclusion in your workforce. By ensuring that all individuals, regardless of gender, race, religion or other characteristics, have equal opportunities for employment, advancement and participation, your company can benefit from a wider range of talents. This can result in greater creativity, innovation and problem-solving capabilities.

Certification and standards

Many leather bag buyers require suppliers to get certified for sustainable and/or fair production or the use of sustainable materials. The following standards and certifications are the most popular in Europe. Note that BSCI is almost a standard requirement for many European apparel companies.

Table 2: Europe’s most popular standards for leather bags

| Name of standard | Logo | Type of compliance | Further information on getting certification |

| Leather Working Group |

| Environmental, social | Leather Working Group |

| Naturleder |

| Environmental, quality | Naturleder |

| Sustainable Leather Foundation | Environmental, social | Sustainable Leather Foundation | |

| Oeko-Tex® Leather standard |

| Environmental | Check here for more information |

| Amfori BSCI |

| Social | On invitation by buyers. Amfori provides a list of organisations that can perform an audit |

| SA8000® |

| Social | Check the SA8000 certification process here |

| WRAP |

| Social | Check the WRAP certification process here |

| Sedex |

| Social, environmental | Check the Sedex certification process here |

| B-Corp |

| Social, environmental | Check the B-corp certification process here |

| ZDHC | Environmental (chemical use) | The ZDHC provides a guide that outlines the requirements for indicating ZDHC MRSL conformance | |

| Bluesign | Environmental (sustainable production) | Check the Bluesign services for manufacturers | |

| Cradle to Cradle Certified™ |

| Environmental, social (material recycling, social responsibility, chemical management) | Check how to get certified |

Source: FT Journalistiek

Tips:

- Study your buyer’s market and their requirements before deciding on a specific standard. Getting and staying certified usually requires a lot of time and investment.

- For a complete list of certification schemes in the sector, consult the ITC Standards Map.

- Fill in the LWG’s Tannery of the Future – Are You Ready for an Audit?. This is a self-assessment questionnaire published by LWG, which is designed to support tanneries that may not yet be ready to undergo the LWG Environmental Audit.

- Check the freely accessible CSR Risk Check database to discover the social and environmental risks associated with leather bags production in your country and ways to manage them.

What additional requirements and certifications do buyers often have?

In addition to mandatory requirements like standards and certifications, there are many services that buyers implicitly expect or at least greatly appreciate. These requirements can differ from buyer to buyer.

Product design and development

Most buyers have their own design team and do not exclusively rely on the collections that factories present to them. Still, having your own ideas about product design and development will be highly appreciated. Buyers always look for special designs, materials, surprising colours, finishes, trims, types of embossing and production methods to help them stand out in the market. Consider, for instance:

- Classic styles like tote bags, crossbody bags and backpacks with minimal embellishments are popular choices for many European end-consumers. Minimising the use of difficult to obtain trims and focussing on easy styles will help you during production and will increase your competitiveness.

- Classic colours like black, brown and tan remain popular, but there is also a growing interest in bold and unconventional colour choices. Vibrant colours, pastel shades and metallic finishes add a modern twist to traditional leather bags.

- Customisation options have become more popular, allowing consumers to create unique bags that reflect their individual style. This trend includes monogramming, embossing and bespoke designs.

- Modular designs allow users to adapt bags to different needs, enhancing both utility and longevity. This includes designing bags to accommodate for electronic devices, such as phones and laptops of different sizes or other items commonly carried in leather bags.

- Smart features, like built-in trackers (air tags), RFID-blocking materials for security or solar panels for charging devices, add functionality to classic styles.

- The use of recycled or plant-based leather alternatives minimises environmental impact and appeals to eco-conscious end-consumers.

Figure 2: The weekender is one the most popular traveller bags in Europe

Source: Jan de Keijzer on Unsplash.

Communication

Always communicate with your buyers and manage expectations. Reply to every email, call and WhatsApp message within 24 hours, even if it is just to confirm that you have received the message and will reply more completely later. If you encounter a problem with a production order, immediately notify your buyer and try to offer a solution. Create a T&A (time and arrival) of every order and share it with your buyer. This file will help you to manage expectations, monitor progress and is the best way to guarantee on-time delivery.

Flexibility

If you want to start a business relationship with a European buyer, be prepared to accept small, complicated orders first. Buyers will test your factory before giving you large, easy orders. Make sure at the start that a buyer will not continue to place only difficult orders with you and convenient orders elsewhere.

In their first order, expect European buyers to require:

- Order quantities below your normal minimum order quantity (MOQ);

- A price level that is lower than you would normally accept for small quantity orders:

- High material quality and impeccable workmanship.

Tips:

- Check industry websites, such as Leatherbiz and International Leather Maker, or sign up for trend forecaster WGSN’s newsletter to get an idea of the latest trends in leather bags.

- Be proactive and prompt in your communication. Provide short, timely updates to your buyer via text, photo or video, using WeChat, WhatsApp or Signal. To make free video calls, try Google Meet, Zoom or Teams.

- When mapping your supply chain upstream, start by asking your supplier where they procure their materials and what certifications they have. Check, for instance, EcoVadis, Sourcemap and Ecochain for examples of supply chain mapping methods.

- Offering low MOQs will appeal to European buyers but beware that increased flexibility may eat away your profit margins. Always make sure to calculate your costs accurately. Check the CBI study on cost price calculation for tips.

What are the requirements for niche markets?

There are a lot of interesting niches in leather bags. Be aware that niche buyers usually offer smaller orders and require a relatively high service level. This means you need to adjust your manufacturing and sourcing setup if you want to be profitable.

Organic leather

There is no official definition of organic leather, and bag brands often use the term loosely. The term, however, suggests that the leather is tanned with organic tanning agents and dyes and made with skins from animals that are raised organically. Check, for instance, Meindl’s Identity line or Veja’s certified Organic Traced leather.

Deforestation-free leather

The Deforestation-Free Call to Action for Leather is an initiative led by Textile Exchange, the Leather Working Group and the World Wildlife Fund. Signatory brands commit to only sourcing their bovine leather from supply chains that are not associated with deforestation or land that has been converted from natural habitat by 2030. Adhere to your buyer’s requirements by mapping your supply chain, offering product lifecycle assessments and calculating your carbon footprint.

Recycled leather

A growing number of European fashion brands have started to use recycled leather. The term ‘recycled leather’ usually describes a composite material made from shredded cutting waste. For an example, take a look at Salamander’s collection of recycled leather fibre fabrics. Recycled leather can also refer to items made from leather patches cut out of used leather fashion items and upholstery. Beware that some recycled leathers are vulnerable to water. Watch this video on YouTube for an explanation of the basic steps involved in recycling leather.

Natural dyes

Some buyers may require leathers dyed using only natural ingredients. Natural dyes are typically used for finishing vegetable tanned leathers. Natural dyestuffs can include plants, such as berries, oils and coffee. Be careful with naturally dyed leathers because they tend to discolour quickly in sunlight.

Plant-based materials

European buyers are increasingly experimenting with plant-based materials as alternatives to leather. These leather-like materials are often branded as vegan, meaning no animals were used in the process of making the product. However, these products may be produced using synthetic binders, such as PU. Most of these materials have a specific look and feel, clearly different from real leather. For some examples, take a look at:

- Pelcor– made from cork

- Uashmama – made from paper

- Le Qara – made from micro-organisms

- Piñatex – uses fibres from pineapple leaves

- Mylo – made from mycelium

- Vegea – made from grape waste, vegetal oils and natural fibres

- Desserto – made from organically-grown prickly pear cacti

- Mirum – a recyclable, circular and 100% plastic-free leather alternative made from natural fibres

- Uppeal – made from apple waste

Figure 3: The range of alternative materials being introduced on the leather goods market is growing, including materials made from cactus fibres

Source: Forward in Fashion

2. Through which channels can you get leather bags on the European market?

Before you start to approach European buyers, you need to determine exactly what market segment your company fits into best and what channels you want to sell your product through. Each segment and channel has distinct requirements.

How is the end market segmented?

European buyers of leather bags can be classified by price-quality level.

Table 3: Leather bags market segmentation

| Consumer type | Description | Price level | Fashion | Material use | Functionality |

Luxury consumer segment (luxury market) | High-end leather bags for consumers who prioritise luxury, exclusivity and prestige. | Very high prices | Unique, creative, hand-made designs, high-level craftmanship | High-quality, (sometimes exotic) leathers and trims, nominated suppliers | Highly fashionable and functional |

Fashion-conscious consumer segment (middle market) | Leather bags that balance quality and affordability, targeting consumers seeking value for money. | Medium-high prices | Fashionable designs inspired by the luxury market but manufactured with more affordable materials | High-quality leathers, sometimes nominated suppliers, sustainable materials | Fashionable and functional |

Budget consumer segment (budget market) | Affordable leather bags for price-conscious consumers who prioritise cost-effectiveness and practicality. | Extremely low prices (volume production) | Focus on basic styles with trendy details | Low-medium quality, (PU) leather alternatives | Functional and sometimes fashionable |

Tips:

- The luxury market is extremely difficult to enter. Your competition will be based in countries like Italy and Portugal and can offer high-quality craftmanship. Single-piece manufacturing is recommended in this quality level.

- The middle-market segment offers high quality and marketing, almost matching the quality of the luxury market but at lower prices. Target this market if you have a production line for high-quality leather bags.

- The middle and lower markets are focussed on efficient manufacturing. These segments are price driven so manufacturing at high speeds is recommended. Sourcing your leather and trims in the international market is recommended to maximise competitiveness.

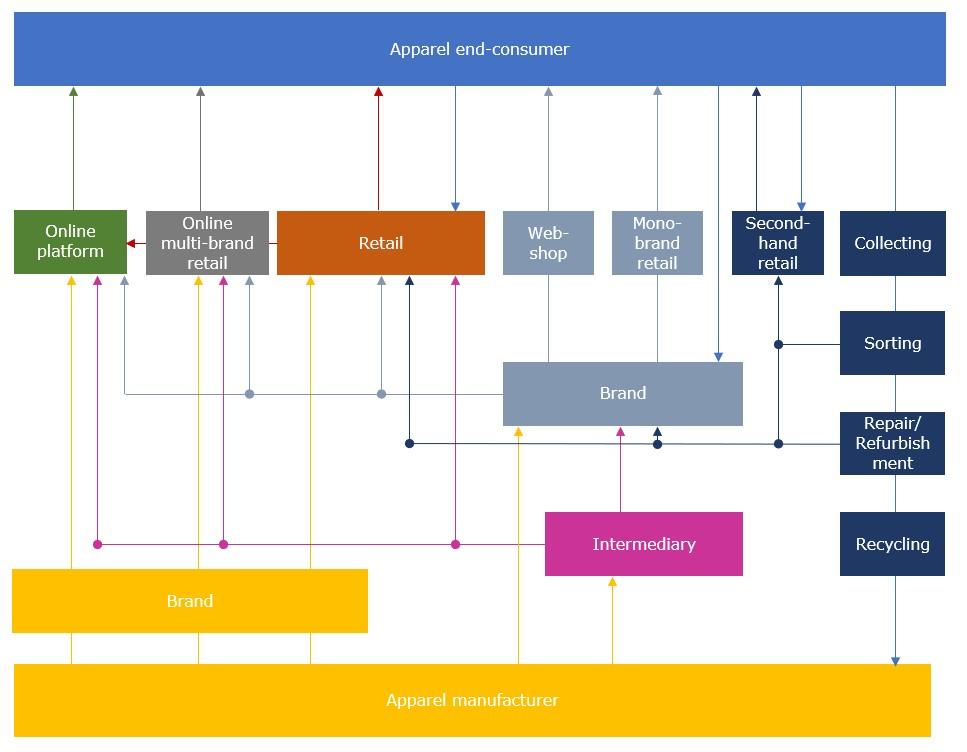

Through what channels does the product end up on the end-market?

Always try to find out if you are dealing with a brand, a retailer, an intermediary or some other type of buyer. Every buyer has a different sourcing and sales strategy and different challenges. Adapt your pitch accordingly.

| Sales channel | Who’s your buyer? | Requirements | Examples |

| 1 | European end-consumer | You will need to invest in a web shop, stock, order management and customer service. Your biggest challenges will be return policies and a lack of brand awareness. Note that online B2C-platforms may require a percentage of each sale and/or a monthly fee. | Alibaba, Wish, Amazon, ASOS marketplace, Rakuten (Spain and France), Allegro (Poland), Bol (the Netherlands, Belgium), Wolf & Badger |

| 2 | Online multi-brand platform | Online multi-brand platforms sell existing apparel and other brands and often develop their own private collections – mostly value brands. They can detect market trends very fast and will react to sales data immediately. Usually, these companies will place small test orders first. If the item sells well, they will place the actual production order. Fast delivery is a must. | Zalando, Asos, Farfetch, Boozt (Scandinavia), About you, La Redoute (France), Yoox |

| 3 | Retailer | Besides big chains, most leather bags are sold in boutique shops that can be found in almost every European city. These shops sell existing brands, but some also order products specially developed and manufactured for them. | H&M, Inditex, Primark, Next, M&S, C&A, Mango, KiK, Lancaster (France) Weidner (Austria), Van Os (the Netherlands) |

| 4 | Brand | Brands typically develop a collection 6 to 9 months in advance. You will need a sample room, as brands require salesman samples (SMS) of each collection style. Every salesman sample needs to be actual, meaning it should look exactly like the product will in the shop. It may take many months before orders are placed. | Hermès, Louis Vuitton, Bally, Montblanc, Ted Baker, French Connection, Picard, Burkely, Sandqvist, Royal Republic, Liebeskind |

| 5 | Intermediary | Agents, traders, importers and private label companies sell your product on to buyers up the value chain. They are extremely price focussed and require flexibility in terms of quantity and quality. Some are located near or in the production countries and primarily do sourcing and logistics. Others work from Europe and also do market research, design and stock keeping. Their service level determines the commission rate they charge. | Li & Fung, Miles Group, True Trident, Broadway, MTR, Dugros |

Tips:

- Check online shopping platforms for leather bags, such as Yoox (luxury and middle market segments), Zalando (all market segments) and Asos (middle and budget market), for inspiration. However, never copy styles.

- Find inspiration in the luxury segment but never copy the styles exactly.

- Study your prospective client’s collection to develop a product in a price range that meets their expectations.

Figure 4: Leather bags market value chain

Source: FT Journalistiek

What is the most interesting channel for you?

If you have little experience exporting to Europe, intermediaries, small brands and boutique shops are likely the best starting point. You should only consider big brands and retailers as potential buyers if you have the right certifications, production efficiency and can handle large volume orders. End-consumers are a difficult target group because of high service demands.

Intermediaries

Agents, traders, importers and private label companies are usually the first to explore new sourcing destinations and they can be a great way to get introduced to the European market and its many brands. Be aware that intermediaries are very focussed on price. They act as ‘middle-men’ between you and companies further up the value chain, which means they need to keep their prices close to your factory price. This leaves little negotiation room for you as a manufacturer.

Brands

Many European brands and retailers are trying to cut out intermediaries and source from manufacturers directly. Hence, these companies can be an interesting category of buyers, but beware: supplying major European brands and retailers as an SME may not be realistic due to their high requirements and high volumes. Small (niche) brands and retailers are more likely business partners unless you have the right certification and can produce volume orders.

Europe also has many startup brands and retailers (especially online) that search for small factories to support them with business development. The main risk with smaller companies and startups is that their business is risky and can end after a bad season or performance.

Online multi-brand retailers

Multi-brand online stores that produce private collections are also promising because this market is growing. This is a budget market with low profit margins but potentially big volumes, mostly spread over many small orders. Check, for instance, ‘8’ by Yoox, Zalando’s private label brand ‘YOURTURN’ and ‘ASOS DESIGN’ by Asos.

Tips:

- Find potential buyers at trade fairs for leather goods. Even if you don’t plan to attend, you can check the exhibitors list. Check for instance the following trade fairs: Linea pelle in Italy and ILM in Germany.

- Check the online Retail-Index, which offers profiles of major apparel retailers in Europe, including leather bags retailers.

- When working with online companies, study the requested service level as these differ from a regular retailer. Especially speed and low MOQ are required.ide you with company updates and news on their latest collections and travel schedules. They might also follow you in return.

3. What competition do you face on the European leather bags market?

Leather bags are manufactured worldwide so you will likely face stiff competition in this market. The best ways to create a competitive advantage over other countries and manufacturers are by providing technical knowledge, service level, flexibility (the willingness to accept lower MOQs), efficiency and beneficial trade agreements.

Which countries are you competing with?

Leather has been produced all over the world since ancient times. Many countries today still have at least rudimentary leather industries. This means you may expect competition from many sides.

Table 4: Competing countries

| Country | Strengths | Weaknesses | Image in Europe | Future developments |

| China | Design, innovation, local availability of leathers, faux leathers and trims | Increasing costs, no Generalised Scheme of Preferences (GSP) | Inconsistent quality standards, reputational decline | Buyers moving away to neighbouring countries |

| India | Price, flexibility, availability of leathers | Relatively low speed, low service level, compliancy concerns, no GSP | Reasonable quality-price ratio | Improving compliancy |

| Italy | Design, innovation | High prices | High quality | Growing industry, sustainable leather alternatives |

| Vietnam | Price, beneficial trade agreement with the EU | Low flexibility | Relatively unknown for leather goods | Increasing cost, growing business development led by export to the US |

| Ethiopia | Flexibility, General Scheme of Preferences (GSP), availability of hair sheep leathers | Political instability | Artisanal quality | Safety improvements |

Source: FT Journalistiek

Tips:

- Visit the trends section on UNIDO’s leatherpanel.org for an overview of global, regional and national trends in different leather-producing countries.

- Check how other countries benefit from the Generalised Scheme of Preferences on the European Commission’s international trade website.

- Study the conditions in the countries where your competitors are, compare their strengths and weaknesses to yours and advertise the advantages of doing business with you. Besides GSP, consider factors like distance to Europe, ease of doing business, transparency and CSR risks.

Which companies are you competing with?

Crescent Tanners from India is a vertically integrated manufacturer of high-quality leather and leather goods, which offers bags, belts, shoes, gloves and wallets. The company presents itself as an innovative company with a long history of leather making, exporting high-quality products to the US and Europe. It features its ISO 9001 certification for quality management prominently on its website.

Leathertex from Pakistan is part of the vertically integrated Leathertex group, which also includes a tannery and produces bags, shoes, gloves, several other leather accessories and apparel. The company is known for its good-quality products at reasonable prices.

Meron is a relatively small leather goods factory located in Addis Ababa, Ethiopia. Meron works with local leathers and produces good-quality bags, leather accessories and home decoration products, with high flexibility and fashion input.

Tips:

- Check the free online database Open Apparel Registry, which lets you look up the suppliers of hundreds of European fashion brands, including leather bag buyers.

- Study your competitors and try to understand why European buyers are interested in placing orders with them. Understanding your competitor will help you to diversify and improve your best qualities.

- Read the CBI study 10 Tips for Doing Business with European Buyers to learn how to approach and engage with buyers.

Which products are you competing with?

Leather bags compete with various other types of bags, depending on the context and consumer preferences. Here are some product categories that can be considered as competitors to leather bags.

- Leather bags are increasingly being made from non-leather materials. Originally, artificial leathers (also called synthetic or ‘faux’ leathers) were made using PU (Polyurethane) or PVC (Polyvinyl chloride). These types of leather are cheaper than real leather and are therefore common in the budget market. They penetrated the middle market in recent years as their appearance and quality improved.

- If the composition of a style is not obligatory, factories may combine cheaper synthetic materials with real leather.

- Another competing material for leather fashion bags is textile – both artificial textiles and plant-based ones like cotton and jute. Bags made from sustainable plant-based materials are growing in popularity, in the slipstream of the rising demand for vegan food in Europe.

- If you are still using chrome-tanned leathers for your leather bags, expect competition from manufacturers that use chrome-free leathers (vegetable tanned and wet-white) in their products. The demand for chrome-free is increasing.

Tips:

- Create a company presentation that showcases the quality of your craftmanship and manufacturing. Positioning your product starts with positioning your company.

- After you have created a company presentation, focus on a product presentation that highlights your product’s unique character, quality and innovation.

4. What are the prices of leather bags on the European market?

The price of your product, often indicated as the FOB price (Free On Board) in fashion jargon, is influenced by many factors, including the cost of materials, your employees’ efficiency, your overheads and profit margins.

The average cost breakdown of your FOB price should look like this:

Source: FT Journalistiek

Percentages may differ per factory and per order. Some factories may accept lower profit margins during off-season periods or if order volumes are high. The percentages for labour versus materials may also differ depending on the efficiency and wage level of the workforce and the price of the materials. Efficiency increases, and material prices go down for producing large volume orders.

Retail pricing

The retail price of a leather bag is, on average, 4 to 8 times the FOB price. This is called the ‘retail markup’. It follows that the FOB price is, on average, 12.5–25% of the retail price of the product. This is why buyers may offer you an FOB price of €20 ]for an item sold in Europe for a retail price of €100 or more. However, exceptions do occur. In the budget market, some large European retail chains may only double the FOB price.

Retailers mark up the FOB price by 4 to 8 times because they need to account for a range of factors, including import duties, transport, rent, marketing, overhead, stock keeping, markdowns and VAT (17–27% in EU countries).

Source: Eurostat

According to Eurostat’s 2022 price level index for beverages, food, apparel and footwear in Europe, France has the highest price level at 105.4 points compared to the European average of 100, followed by Germany (98.7) and Spain (84.8). Denmark is the EU country with the highest price point (134.4), while Switzerland is the most expensive European country for apparel (141.5).

Tip:

- Check the CBI study on cost-price calculation for a step-by-step guide on how to calculate your FOB price.

Frans Tilstra and Giovanni Beatrice carried out this study for FT Journalistiek on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research