Entering the European market for men’s shirts

The European market for men’s shirts has been somewhat in decline in recent years, but as a staple in European closets, this category still offers lots of opportunities. Any manufacturer wishing to enter the European market for men’s shirts must make circularity, recycling and sustainability an important part of their long-term strategy.

Contents of this page

1. What requirements must men’s shirts comply with, to be allowed on the European market?

There are several mandatory requirements you must comply with if you want to export men’s shirts to Europe. These include legal requirements concerning product safety, the use of chemicals and labelling. In addition to this, many buyers have created non-negotiable terms and conditions for all their suppliers. These generally include standards and certifications regarding raw materials testing, product performance, product safety, quality levels, quality control processes, labelling, sizing and environmental and/or social impact.

What are mandatory requirements?

There are several legal requirements for exporting men’s shirts to Europe, including requirements regarding product safety, the use of chemicals (REACH), quality and labelling. You can identify your product code to get a list of applicable legal requirements through the EU Access2Markets online helpdesk.

Follow these steps to ensure that your product complies with the relevant legal requirements:

- Product safety. Make sure that your product complies with the EU’s General Product Safety Directive (GPSD: 2001/95/EC). If your buyer supplied the product design, it is their responsibility to guarantee it is legally safe for consumers to use.

- Use of chemicals. Make sure you comply with the EU’s REACH Regulation. This legislation restricts the use of chemicals in apparel and trims, including certain Azo-dyes, flame retardants, waterproofing, stain-repelling chemicals and nickel.

- Use of restricted substances. Ask your buyer if they use a Restricted Substances List (RSL). These are often inspired by the guideline on safe chemicals use from the Zero Discharge of Hazardous Chemicals (ZDHC) foundation. Download the ZDHC Conformance Guidance here.

- Labelling. Specify the material content of every item that you export to the EU, in accordance with EU Regulation 1007/2011. Check the EU Access2Markets online helpdesk for information about how to do this.

- Intellectual property. Do not violate any Intellectual Property (IP) rights and do not copy designs or share designs with other buyers. If your buyer provides the design, they will be liable in case the item is found to violate a property right.

Figure 1: The most popular sub-category in Europe for men’s shirts is the casual shirt

Photo by Ben White on Unsplash

Non-legal mandatory requirements

In addition to the legal requirements mentioned above, buyers may have created non-negotiable terms and conditions for their suppliers. These may apply to sustainable production (and the certifications to prove this), quality control or payment terms.

Sustainable production

Most buyers in Europe are increasing their demands for sustainable production and social responsibility, in line with the new European Green Deal and with national regulations on sustainability. At the very least, buyers will expect you to open your factory doors for them, so that they can inspect your factory. Additionally, you may be requested to comply with certain independent standards for responsible production or sustainable materials.

Supply chain transparency is key for the European apparel industry, motivated by ever stricter laws at both the EU and national levels. For instance, the EU’s new Corporate Sustainability Reporting Directive (CSRD) will require all large European companies, from 2023 onwards, to disclose how they manage social and environmental challenges. Transparency means you should disclose information about your own operations to buyers, but also help them to gain as much insight as possible into their (and consequently your) entire supply chain.

Regarding harmful substances and organic production, European buyers may request standards such as the Standard 100 by Oekotex®, EU Ecolabel, BCI (Better Cotton Initiative), GOTS (Global Organic Textile Standard) or Bluesign®. The use of organic cotton, in particular, is fast becoming a standard for European brands and retailers of men’s shirts.

Furthermore, buyers in Europe are increasingly demanding recycled content in their items, in line with the new EU Regulation that aims to promote a ‘circular economy’. This includes new directives regarding the durability of textile products and a ‘right to repair’ for end consumers.

The ideal situation for European brands and retailers would be to close the loop in their own value chains. This means having end consumers return worn items. The items can then be:

- Processed into new input materials to produce new styles;

- Repurposed, remanufactured, refurbished or repaired to be resold as second-hand products (a fast-growing market in Europe).

Table 1 gives an overview of popular standards and certifications for recycled content, organic production and social compliance.

Table 1: Popular standards among European buyers

| Recycled content | Harmful substances and organic production | Social compliance |

| The Recycled Claim Standard (RCS) tracks recycled raw materials through the supply chain using the chain of custody requirements of the Content Claim Standard. | Standard 100 by Oekotex® | Amfori BSCI (Business Social Compliance Initiative) is the most popular (and often only) certification that European buyers will require. |

| The Global Recycled Standard (GRS) is a product standard that incorporates recycled material verification, including social and environmental responsibility criteria, as well as chemical management. | EU Ecolabel | WRAP (Worldwide Responsible Accredited Production) |

| BCI (Better Cotton Initiative) | SEDEX | |

| GOTS (Global Organic Textile Standard) | ETI (Ethical Trade Initiative) | |

| Bluesign® | SA8000 | |

| ISO 26000 | ||

| FWF (Fair Wear Foundation) | ||

| Fair Trade |

Tips:

- Check the free CSR Risk Check database to discover the social and environmental risks associated with apparel production in your country and ways to manage them.

- Provide buyers with as much information about your product as possible. The more information you can give about the origin of your materials, the better.

- Read more about how to comply with transparency requirements on the websites of the Clean Clothes Campaign and Human Rights Watch. To see how European brands are doing, check Fashion Revolution’s Transparency Index.

- Check the Open Apparel Registry. Many European companies publish the names of their suppliers there.

- Read this article on the website of the Ellen MacArthur foundation for an overview of circular strategies and best practices.

- Discover how your factory scores on social performance by filling in the BSCI self-assessment.

- Read the CBI study Exporting sustainable cotton to Europe to learn more about the European market for sustainable cotton (and cotton products).

Acceptable Quality Limit (AQL)

To guarantee product quality, your buyer may set an AQL (acceptable quality limit). This is the lowest quality level that is still tolerated. For instance, AQL 2.5 means that your buyer will reject a batch if more than 2.5% of the whole order quantity is defective, measured over several production runs.

Packaging requirements

In most cases, your buyer will give you a manual with instructions on how to package the order. If you agree with your buyer that they will clear customs in the country of import (which is the norm in the apparel industry), it is their responsibility to make sure the instructions comply with EU import procedures. Your buyer will appreciate any efforts you make to reduce the environmental impact (and financial cost) of packaging materials.

Payment terms

For a first-time order, European buyers may agree to a down payment (e.g. 30%). They will pay the remainder (70%) after the order has been completed. The safest payment method for you as a manufacturer is the LC (Letter of Credit). An LC obligates a buyer’s bank to pay the supplier when both parties meet the conditions they have agreed upon. However, many buyers no longer favour LC payments because this blocks their cash flow. Be aware that LCs do not offer financial protection against bankruptcies!

For further orders, most European buyers will ask for a TT (Telegraphic Transfer) after 30, 60, 90 or sometimes even 120 days. This means you as a manufacturer finish the production and hand over the shipment to the buyer, including the original documents, before payment is due. The payment will be made after the number of days you have agreed with the buyer. This is a risky payment agreement because you bear the full financial risk.

The buyer manual

When you do business with a European buyer for the first time, they will typically give you a contract and/or a manual to sign. By signing the contract or manual, you confirm that you will comply with all the listed requirements. This means you will be held accountable in case of a problem after the delivery of an order. Complying with REACH can be especially challenging. For small orders, most European buyers will not ask for testing, but if illegal chemicals are discovered after delivery, you will bear all the costs involved.

Tips:

- Always ask buyers for their buyer manual, which should include all legal and non-legal requirements, including product performance standards, labelling, sizing, quality & safety assurance processes and terms of business.

- Read the CBI study on buyer requirements for an extensive overview of the legal, non-mandatory and niche requirements you will face as an exporter to Europe.

- The COVID-19 pandemic and its effects have shown the negative impact of extended payment conditions for manufacturers. Try to negotiate a down payment for every order and a balance payment before handover. This reduces the risk of cancellation.

- Do not take financial risks with new buyers. Insure your orders via an insurance company or insist on a Letter of Credit.

- Never agree to comply with requirements you cannot realistically meet. Always be ready to negotiate a workable solution with your (existing or potential) buyer.

What additional requirements do buyers often have?

There are many value-added services that European buyers either implicitly expect or highly appreciate from their preferred suppliers. The requirements will differ from buyer to buyer.

Product design and development

European buyers are always looking for special designs, materials or production methods that will help them stand out in the market. They increasingly expect preferred suppliers to showcase regular design collections with original designs and fabrications and to incorporate new techniques and technologies for garment construction into those collections.

In recent years, a range of interesting innovations and functionalities have been applied to men’s shirts entering the European market. Many of these innovations are focused on increasing comfort and convenience as well as reducing the need for excessive washing. Here are some examples:

- Hydrophobic technology

- Antimicrobial/antibacterial technology

- Wicking technology

- Super non-iron technology

- Four-way stretch fabrics

- Dress shirts with activewear properties

- Recycled fibres (cotton and polyester)

- Aerocool performance mesh for work shirts wicks away moisture in sweat-prone areas

- Labfresh FreshCore technology – repels liquids, stains, odours and wrinkles in 100% cotton fabrics

Products that incorporate these technologies must go through rigorous testing (of both fabrics and garments) to ensure that claims are supported and valid. Some examples include:

- DP rating test for non-iron/wrinkle-resistance claims

- Physical testing including for stretch and elongation

- Fabric wicking test

- Water-repellence and breathability test

To ensure quality and/or environmentally respectful production methods, buyers may require you to source certain base materials from a preferred supplier. Examples include:

- DuPont for Lycra®

- ECONYL® for regenerated Nylon or Waste2Wear® for rPET (recycled PET)

- REFIBRA – pre- and post-consumer cotton waste and Lenzing Lyocell fibres (from wood pulp)

- COOLMAX – moisture-wicking and breathable polyester fibres (The Lycra Company)

- INDUO fabrics – stain resistant, sweat resistant, quick drying

- SORBTEK moisture-wicking fibres with soil release properties (Unifi, Inc.)

- REPREVE performance polyester fibre (Unifi, Inc.)

- ISKO R-TWO – denim fabrics made from reused and/or recycled materials

- ISKO Ultradry – denim fabrics with moisture management

Printing and embellishment

There are various printing techniques: lithography (using printing plates and rollers on fabric), digital printing (inkjet and laser, allows for small production runs) and screen printing (transferring images onto fabric or garments using a fine material or mesh/film). Printing can be outsourced, but having your own printing and embroidery machines increases your flexibility. Many men’s shirts buyers expect their suppliers to have in-house CAD design capabilities for yarn-dyed and printed fabrics.

Figure 2: Consumers in Northern Europe tend to appreciate minimalistic, simple designs, while styles in Southern Europe are usually flashier

Photo by Mohammad Faruque on Unsplash

Transparency and communication

Smooth communication is an implicit requirement of all buyers. Always reply to every email within 24 hours, even if it is just to confirm that you have received the email and will send a more elaborate reply later. If you have a problem with a production order, immediately notify the customer and try to offer a solution. Create a T&A (time and action) for every order and share it with your buyer. This will help you to manage expectations and monitor progress, and is the best guarantee for on-time delivery.

Tips:

- Be proactive and prompt in your communication. Provide your buyer with short text, photo or video updates using WeChat, WhatsApp or Signal. To make free video calls (you only need an Internet connection), try Skype or Google Meet. Register/document all confirmations to prevent any unclarity at a later stage.

- Your buyer may expect cost transparency for every product and order, including a full cost breakdown. Check the CBI study How to calculate the cost-price of an apparel item? for background information and tips about how to calculate costs.

Flexibility

Many factories focus on getting convenient orders: simple designs, large quantities and long delivery times. However, if you want to start a business relationship with a European buyer, be prepared to accept small and/or complicated orders first. There is only a limited group of European buyers that do big volume orders. Even those that do will want to test your factory before giving you large, easy orders. Beware that a buyer will not continue placing only difficult orders with you and convenient orders elsewhere.

Expect a European buyer to require in their first order:

- High material quality and impeccable workmanship;

- Order quantities below your normal minimum order quantity (MOQ);

- A price level that is lower than you would normally accept for small quantity orders.

Niche requirements

The European men’s shirts category includes several interesting sub-categories, the largest of which are dress shirts and casual shirts. In recent years, the lines between these two categories have blurred to some degree, following a wider apparel sector trend which emphasizes comfort and functionality for more active lifestyles.

Casual shirts

The largest sub-category in men’s shirts includes casual button-up shirts, work shirts, overshirts and shirt jackets. In addition to fabric quality and finish and design choice, there are a number of variations in finishing including printing, embroidery, sequinning, washing, bleaching, brushing, garment dyeing and water repellence. The upper-middle and higher fashion segments demand quality and sustainable options using materials such as hemp, organic cotton and recycled cotton.

Dress/formal shirts

Dress shirts can be distinguished by a large (yet relatively fixed) number of design variations including:

- Fit (e.g. classic, slim, modern)

- Front placket (e.g. standard, French, concealed)

- Collar (e.g. spread, button-down, classic, cutaway, club, wing-tip)

- Cuff (e.g. French/double, single, barrel, mitred, square, rounded)

- Pockets (set-in, seam, plain, square, round, hemmed, flap)

- Hems

- Pleating

- Contrast stitching and other details

The quality of the fabric is key and generally a single fabrication will be offered in several colours and design variations. In recent years a travel shirt sub-category has emerged, particularly within the middle market, which uses easy-care fabrications and finishes (e.g. moisture management, temperature control, stain resistance, wrinkle resistance and anti-odour) as well as garment-technical features to provide more comfort and convenience. Knitted dress shirts have also become more popular.

Regional segmentation

End consumers in Scandinavia are focused on fabric quality and sustainability, particularly on the use of sustainable fabrics. Styles are minimalistic with clean lines. By contrast, consumers in Central and Northern Europe are more focused on value for money, so products tend to be more embellished and have a lower price point. In Southern Europe, with its long history of men’s shirts manufacturing, consumers require well-constructed, less embellished shirts produced with high-quality fabrics made from finer yarns.

Tips:

- Explore trends within a trend (e.g. shackets or padded shirts) and present seasonal colour palettes, design variations and fabric options to your buyers.

- Focus on comfortable, high-quality and/or sustainable fabrics to differentiate your offer, especially for the mid and higher segments.

- Position yourself as a sustainable, ethical supplier and reflect this in your own marketing and storytelling.

- All products in your collection should be tested before presentation to the buyer. Don’t present a product unless you are satisfied it will conform to their standards.

- Monitor trends and developments in technologies and manufacturing processes in your product areas by visiting trade shows and events.

- Establish an internal raw materials (yarn and fabric) function to ensure that your company is always at the forefront of new innovations.

- Depending on your product segment, consider investing in in-house washing and finishing, printing, embroidery equipment and/or design to better control quality and speed to market.

2. Through what channels can you get men’s shirts on the European market?

Advances in technology and communication have enabled manufacturers to supply directly to brands and retailers or even end consumers all over the world, rather than through intermediaries. This may result in higher profit margins for manufacturers, but it also requires a higher service level. For example, in terms of material sourcing and development, trends research and design, shorter lead times, flexible MOQs, sales forecasting and logistics. Always do your research and choose a sales channel that matches your capabilities.

How is the end market segmented?

The market is primarily segmented based on price/quality level. Distinctive regional segments also exist.

Table 2: Men’s shirts European market segmentation

| Consumer type | Price level | Fashionability | Material use | Functionality | Order Quantities |

| Luxury consumers | Very high retail prices | Highly fashionable designs | Highly innovative, luxury materials | Very high requirements regarding functionality and design | Low order quantities |

| Middle and upper- middle market consumers | Medium retail prices | On-trend styling | Good quality, often sustainable materials | Low to medium requirements regarding functionality | Medium to high order quantities |

Price-conscious consumers

| (Extremely) low retail prices | Basic styles | Medium to low-quality materials | Low functionality | High order quantities |

Source: FT Journalistiek

Luxury consumers

High-fashion consumers shop at luxury brands and retailers such as Luigi Borrelli, Charvet, Paul Smith and Acne Studios. These consumers expect their clothing to represent a strong brand image and the latest fashion trends in men’s shirting with a focus on maximum comfort. Men’s shirting brands in the luxury market require top-quality materials and manufacturing, the latest technical innovations and highly comfortable designs.

Middle and upper-middle market consumers

In this market segment, lifestyle brands sell collections created around a brand image and offer a good-quality product for a mid-level price. Products must have the look and feel of a high-end product, but retail prices are lower, sometimes even substantially lower. Increasingly, brand images centred around sustainability. This market is growing. Examples include Asket, Scotch & Soda, Profuomo, SuitSupply and Eton Shirts.

Price-conscious consumers

The budget market includes companies such as H&M, Jack & Jones, Only & Sons, Vero Moda, Pull & Bear, Primark, Decathlon, Monoprix and C&A, which cater to the price-conscious consumer. Volumes are high but prices are low and competition is fierce in this market segment, both with regard to retail and manufacturing. Supermarkets and hypermarkets in the 6 key EU markets offer a range of basics at very competitive prices.

Tip:

- Focus on adding value for higher segments. This offers more margin opportunities. If you are offering high-quality and sustainable products, make sure your products are fashionable and differentiated in some way.

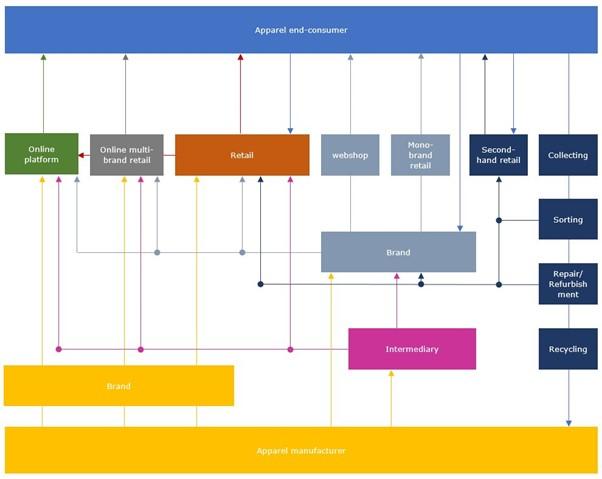

Through what channels does the product end up on the end-market?

There are various channels through which products end up on the European market. Each type of buyer requires a specific approach. Always try to find out in what part of the value chain your buyer is operating, what challenges they face in the market and how you can contribute to their sales strategy.

- Intermediaries such as agents, traders, importers, private label companies and full-service vendors sell your products to buyers higher up the value chain. They are price-focused and require flexibility in quantities and qualities. Some, such as Li & Fung, are located near or in the producing countries and primarily do sourcing and logistics. Others, such as Dewhirst, work from Europe and focus more on market research, design and stock keeping. Their service level determines the commission rate they charge.

- Independent brands typically develop a collection 12 months in advance. You will need a large sample room as brands require salesman samples (SMS) of each collection style. Every sample needs to be actual. This means that it must look exactly like the product will look in the shop, including branded hangtags and accessories. It may take many months before orders are placed. This sales process can cause delays in production as well as uncertainty in forecasting quantities, including for raw materials.

- If you want to sell to retailers, the biggest names in men’s shirts are retailers such as H&M and C&A. Retailers can place an order relatively easily as they only need one development sample for order confirmation. Order quantities are usually high, as is price pressure.

- Online multi-brand retailers, such as Zalando, Asos, Yoox and LYST, sell existing brands and develop their own private collections, mostly value brands. They can detect market interest very quickly and will immediately react based on sales data. Usually, such companies will first place a small test order. If the item sells well, they will place the actual production order. Fast delivery is a must.

- The growing second-hand market in Europe is serviced by online platforms such as vestiairecollective.com, vinted.com and depop.com, or national websites such as marktplaats.nl (the Netherlands). Some brands and retailers have launched their own second-hand platforms, such as Sellpy by H&M.

- If you want to target European end consumers, try selling via platforms for independent brands such as Alibaba, Wish, Amazon and Wolf & Badger. Most online consumers can be found in countries in Europe’s northwest. You will need to invest in a web shop, stock, order management and customer service. Your biggest challenges will be return policies and a lack of brand awareness, making it difficult to find buyers outside the budget market.

Tips:

- The following trade and fashion fairs are useful sources for researching the market and/or finding trading partners in Europe: Pitti Uomo (men’s fashion trade show in Florence, Italy), Premiere Vision (textile and fashion sourcing fair in Paris, France) and Texworld (fabric and apparel sourcing fair in Paris).

- If you plan to meet an existing or potential buyer at a fair, check what collections they have, buy 1 or 2 items and prepare matching or even improved samples. Also work out the costing before introducing your company and your samples to a potential buyer.

- You can find intermediaries specialised in men’s shirts by using an online search engine. Use keywords such as ‘full service’, ‘garment’ or ‘men’s shirts’ + ‘solution’. Trader’s websites usually show the brands they work with.

- Be on top of new technical developments in the market. In addition to being a producer, be an advisor to your buyers to create a competitive advantage.

Figure 3: Apparel market value chain

What is the most interesting channel for you?

Determining the best sales channel largely depends on your capabilities and the service level that you can provide.

Intermediaries

Intermediaries are the most adventurous type of buyer and are usually the first to investigate new sourcing destinations and factories. By working with this type of buyer, you will have access to many different buyers up the value chain and you can learn how to service them by following their instructions. There are 2 types of intermediaries.

- Agents are located near the production site and their traditional role is to act as a bridge between buyers and manufacturers. All responsibilities and risks are borne by the factory. The agent usually charges a commission (up to 10%) based on the total cost of goods purchased. The role of the agent is becoming less important as the industry moves towards more direct sourcing.

Li & Fung is the garment industry’s largest and most dominant agent. Although it is a ‘middleman’, it continues to be successful because it puts customer service at the heart of everything it does. In addition to sourcing, it provides important supply chain support services including logistics, cost management, production monitoring and design support. Its size allows it to have greater influence over suppliers, enabling it to consistently deliver on its promises to the customer.

- Full-Service Vendors (FSVs) are usually located within Europe to be close to the market. Many also have offices in the producing regions to gain greater control over product development and guide the factories during production. The price paid by the buyer includes the FSV’s margin (up to 20%). The FSV bears most of the risk for the factory and is increasingly taking on responsibilities on behalf of the buyer, including sales forecasting and holding inventory.

Each season, the FSV designs collections for its buyers and sends tech packs to the factory. Once complete, the FSV designers and sales representatives will visit the buyer to present the collection. Some styles will be dropped, others ‘tweaked’, before creating fit samples ahead of bulk production. The factory is paid for all samples produced. As factories increase their skills, they are increasingly becoming FSVs themselves. Similarly, some FSVs have bought factories.

The FSV is the most attractive sales channel for small and medium-sized manufacturers in developing countries with little or no export experience. By working with an FSV, you can manufacture products for multiple brands and retailers. At the same time, you avoid the risk and investment associated with direct sourcing. Despite a lower margin compared to producing directly for a retailer or brand, this channel represents a very good learning opportunity for a factory wanting to start exporting to the EU.

Brands

Many brands develop special ‘outlet’ collections. This can be another good entry point for manufacturers to do business with European brands, because the items will have a relatively simple design and order quantities are large. If the buyer is satisfied with the quality of your product and your service, they may ask you to produce items for their mainstream collection.

Retailers

Larger, own-brand retailers and department stores have the biggest market share in Europe. They control all aspects of product design, development, labelling, distribution and marketing. All these factors make them another interesting channel. Many of these retailers have buying offices in producing regions to better monitor product development, production and quality. Usually offering high order quantities, they can demand very low prices, costing transparency and strict compliance with social and environmental standards.

Tips:

- Establish a relationship with your country’s trade associations, including garment industry support organisations. They can give you information about programmes and events designed to connect buyers and manufacturers.

- Search online for FSVs using keywords such as ‘full service’ + ‘garment’ + ‘solution’. FSV websites usually show the brands and retailers that they work with.

- Visit tradeshows and look out for suppliers marketing themselves as FSVs.

3. What competition do you face on the European men’s shirts market?

Men’s shirts are manufactured worldwide, so you will probably face stiff competition in this market. The most important factors in creating a competitive advantage over other manufacturers include technical knowledge, service level, flexibility to accept lower MOQs, efficiency and beneficial trade agreements.

Many leading men’s shirts brands have been around for many decades and have built up strong strategic partnerships with a small number of core suppliers along the value chain, increasing the entry barriers for new entrants. However, the emergence of new players on the European market, particularly digitally-native, premium brands focusing on quality and sustainable fabrics, offers opportunities for manufacturers in developing countries able to meet the required standards.

In addition to price, the 3 main factors that influence competitiveness in today’s men’s shirts market are as follows:

Raw materials availability

Factories located in countries or regions where there is significant local production of both cotton and man-made fabrics of export quality can offer their buyers lower fabric prices, flexible MOQs, shorter lead times and a wider range of fabrications used in manufacturing men’s shirts. Growing demand for organic cotton and sustainably produced fabrics means that manufacturers must source from reliable suppliers that provide total traceability along the supply chain.

Fabric sourcing and innovation

Being competitive within the men’s shirts segments requires constant innovation in fibres and fabrics. Manufacturers that invest in R&D and a fabric-sourcing function will be the most important strategic partners for brands in the upper, middle and higher segments.

Flexible MOQs

Manufacturers need to offer flexibility to their customers in terms of both raw materials and production MOQs. This is especially the case in the premium and luxury segments.

Which countries are you competing with?

Bangladesh is the single largest exporter of men’s woven shirts to the EU, followed by Turkey and China. In recent years, China has lost market share due to rising production costs. Men’s shirts are a good candidate for automation to increase production efficiency and reduce cost because they are less complex to produce than some other product categories. Many larger Chinese manufacturers invest in automated production lines, enabling them to maintain price competitiveness in the face of rising costs and competition from cheaper countries.

Table 3: Competing countries

| Country | Strengths | Challenges |

| Bangladesh | Bangladeshi producers specialise in cheap basic apparel, including dress and casual shirts. The country benefits from low production and labour costs and the GSP. | The biggest challenge for Bangladesh will be to increase technical expertise, facilitate smaller orders and get more factories to comply with international safety and sustainability standards. |

| Turkey | Turkey has the main advantage of being close to Europe, which results in very short lead times. It is a significant producer of cotton. The country produces high-quality apparel in small quantities, including men’s shirts, and it has a European business culture. Among other things, Turkish manufacturers will accept payment in euros. | Turkish prices are relatively high. |

China

| Technical innovation, high efficiency, increased automation, excellent customer service and the local availability of fabrics and trims give Chinese manufacturers an advantage over competitors in developing countries. | High MOQs, rising labour and production costs and no General Scheme of Preferences (GSP) that removes import duties to the EU all work against Chinese exporters. China is also facing claims about employing forced labour. |

| Italy | Italy has a long history of producing men’s shirts. Italian mills are renowned for making high-quality, fashionable and innovative shirting fabric, particularly for dress shirts. The Made in Italy label represents quality and excellence. | Labour costs, and therefore prices, are significantly higher than competitors’ prices, both regionally and globally. |

| India | India is a low-cost producer of apparel with a long history of garment and textile production and a large workforce. It enjoys a high level of English language literacy. The country is the world’s largest producer, and second-largest exporter, of cotton. Its largest product category is cotton casualwear. | India struggles to keep up with, and meet, increasing compliance requirements.

|

Vietnam

| Vietnam’s apparel industry has developed a large capacity and high efficiency levels, thanks to investments from mainly Chinese factory owners looking to benefit from low production costs and a new free trade agreement with the EU. | Vietnamese producers’ challenges include high MOQs, lack of local fabrics, accessories and trims and, in general, a lack of capacity (especially in the factories that operate in the North and South of the country). |

Tips:

- Study the countries you will be competing with, compare their strengths and weaknesses to yours and advertise the competitive advantages of doing business with you. In addition to the GSP, consider factors such as distance to Europe, ease of doing business and transparency.

- Check the free CSR Risk Check database to discover the social and environmental risks associated with apparel production in different countries, including your own. Use this information to mitigate risks and to advertise the advantages of sourcing in your country.

- Check if and how other countries benefit from the Generalised Scheme of Preferences on the EU’s website on international trade.

- Most online search engines will let you create a news alert on a topic, so you can automatically follow the latest developments in the apparel industry in a specific country.

Which companies are you competing with?

Many large Chinese manufacturing groups have shifted part of their supply chains to developing countries to take advantage of lower wage costs, capacity availability and duty-free access to the European market. These manufacturers have well-developed raw materials sourcing and supply networks that are often vertically integrated, including fabric and/or fibre production in China. They can deliver speed to market, flexibility in capacity and a high level of product development support to their buyers.

Many have invested heavily in automation to tackle the challenges associated with cost increases and the resulting loss of market share in this category.

Successful local manufacturers in competing countries have positioned themselves as highly ethical, compliant and customer-centric suppliers. They focus on providing value-added services to steadily grow their business and expand their production capacity, product scope and customer portfolios.

Some manufacturers have used their knowledge and experience to move up the value chain by opening retail stores or selling their own branded products. This gives them additional valuable insights into consumer purchasing behaviour and trends.

Leverstyle is a large manufacturing group whose history dates back to 1956 when it was founded as a shirt-making business in Hong Kong. The company now produces a broad range of apparel products including men’s shirts in various facilities in 7 countries (China, Vietnam, India, Indonesia, Cambodia, Bangladesh and Myanmar). It supports its clients with technical knowhow and product development capabilities that it has built up over decades of working with the most discerning designers and brands.

Founded in 2009 and based in Gazipur, Brothers Fashion Ltd is a highly compliant and certified factory specialising in the production of good-quality woven tops and bottoms (both denims and non-denims) for the lower and lower-middle markets. Customers include O’Neill, OVS, Next and Mango. The factory is a LEED-certified green garment factory. The company is also certified for ACCORD, WRAP Gold, BSCI, SEDEX, GOTS, C-TPAT, OEKO-TEX and GRS.

Founded in 2000 and headquartered in Istanbul, ShirtByShirt produces 15 million shirts per year. The company has a strong focus on research and development. ShirtByShirt can be defined as a hybrid between a shirt manufacturer and a design studio. Every season its showrooms are updated with a total of 3000 unique designs including dress, casual and denim styled shirts. ShirtByShirt services buyers across the lower and lower-middle segments including Tesco, Massimo Dutti, Zara Man, Esprit, Jack & Jones and Celio.

Tips:

- Explore possibilities for different types of collaborative partnerships that can offer market access opportunities and/or raise your knowledge and service levels.

- The ability to source a broad range of quality inputs offers competitive advantages. For manufacturers in countries that enjoy duty preferences to Europe, it is important to understand the rules of origin regarding raw materials and build up an appropriate network of regional and/or Chinese suppliers.

- A high level of quality and service alone will not necessarily lead to growth. A professional approach to marketing and sales is essential. Create a high-quality website in English and communicate your capabilities on a continuous basis. For example, by exhibiting at trade fairs and/or sales representation in Europe.

- Check the free online database Open Apparel Registry. On this website you can find the suppliers of hundreds of European fashion brands, including buyers of men’s shirts.

- Read the CBI study ‘10 Tips for Doing Business with European Buyers’ to learn how to approach and engage with buyers.

- Look for ways in which you can present your company as environmentally and socially aware, and communicate these aspects to buyers. Show them that you are different from your rivals.

Which products are you competing with?

Between 2016 and 2021, the value of the European Union’s men’s shirts imports has declined by an average compound annual rate of 4.8%. The COVID-19 pandemic and Europe-wide lockdowns, which resulted in work from home arrangements, can in part be blamed for this. Although exports are expected to bounce back in the coming years, men’s shirts do face some competition from other categories.

Fine gauge knitwear

While imports of men’s shirts are in decline, the market for knitwear in Europe shows steady growth. Especially fine-gauge knitwear pullovers in high-quality materials are a competitor for men’s shirts, as European consumers have come to appreciate more comfortable, informal styles, at home and at the office. Check, for instance, Joe Merino.

Shirt-jackets

Men’s shirts are also facing competition from new styles that blur the lines between shirts and other product categories, most notably jackets. These include padded shirts, sherpa-lined shirts, overshirts and shirt-jackets (shackets).

4. What are the prices for men’s shirts on the European market?

The price of your product, in fashion jargon often indicated as the FOB price (for free on board), is influenced by many factors, such as the cost of materials, the efficiency of your employees and your overhead and profit margin.

The following figure shows the average cost breakdown of a typical FOB price:

Note that these percentages may vary per factory and per order. Some factories accept lower profit margins during off-season periods, or when order volumes are high. In addition, the percentages for labour versus fabrics may differ, depending on the efficiency and wage level of the workforce and the price of the materials. Efficiency goes up and material prices go down when producing large volume orders.

Retail pricing

Depending on product complexity, materials used, quality levels and branding levels, current retail price ranges (in euros) for key product types in the different price segments are generally as shown below:

| Product | Budget / value segment* | Middle segment | Premium / upper-middle segment | Luxury segment |

| Dress shirts | 15-39 | 40-99 | 70-150 | 200-750 |

| Casual shirts | 15-39 | 40-70 | 70-150 | 150-400 |

| Overshirt/shacket | 30-60 | 40-80 | 70-200 | 250+ |

*Does not include the discount segment

Markup

The retail price of an apparel item is, on average, 4 to 8 times the FOB price. This multiplication is the ‘retail markup’. It follows that the FOB price is, on average, 12.5%–25% of the retail price of the product. Exceptions exist. In the budget market, some large European retail chains may sell products for a markup of just twice the FOB price. Retailers mark the FOB price up to account for import duties, transport, rent, marketing, overhead, stock keeping, markdowns and VAT (15%–27% in EU countries), among other costs.

According to Eurostat’s 2020 comparison of retail prices for apparel, of the top 6 European importers of apparel and footwear, France has the highest price level at 107.6 points compared to the European average of 100, followed by the Netherlands (106.1), Italy (101), Germany (98.2) and Spain (92.2). The UK, which is now out of the EU, had a score of 90.7 in 2019. Note that brands and retailers that sell in multiple European countries usually keep prices equal to or only deviate slightly from the standard retail price.

Price development

Online commerce and a strong budget segment have made consumers in Europe accustomed to low prices. However, a stronger focus on sustainability and rising costs of materials, production (due to the global COVID-19 pandemic and political instability) and shipping have put manufacturers, suppliers and buyers under enormous price pressure. In the first quarter of 2022, this has resulted in sharply rising European retail prices for many consumer goods. For up-to-date information on retail price inflation in the EU, check Eurostat.

This study was carried out on behalf of CBI by Frans Tilstra and Giovanni Beatrice for FT Journalistiek.

Please review our market information disclaimer.

Search

Enter search terms to find market research